Fortuna Silver Mines Inc. (NYSE: FSM)

(TSX: FVI) provides an update on the evaluation work of

the Mineral Reserves and Mineral Resources and the brownfields

exploration program at the Yaramoko Mine complex in Burkina

Faso.

Following the completion of Fortuna’s

acquisition of Roxgold Inc. on July 2, 2021, the Company updated

the technical report previously filed by Roxgold in 2017 and filed

a new technical report on March 30, 2022 (the “2022 Technical

Report”) to describe the proposed open pit mining operation at the

55 Zone as disclosed by Roxgold on November 10, 2020. During the

first half of 2022, the Company carried out additional exploration

drilling and a re-evaluation of the modeling and estimation

techniques to improve the definition of the mineralization. A

summary of the drilling and evaluation programs completed at

Yaramoko during 2022 are summarized below, together with the

highlights of its brownfields exploration program.

2022 Drilling Programs and

Studies

55 Zone underground

drilling

Underground drilling of the 55 Zone concentrated

on grade control drilling within the Mineral Resource and Mineral

Reserve boundaries to provide increased confidence in the mine

plans. Step-out drilling associated with the 2022 grade control

drilling program returned encouraging results, incrementally

extending the western limit of the drill defined mineralization a

further 20 to 50 meters, where it remains open. Additional step-out

drilling is planned for the first half of 2023.

In addition, four holes totaling 1,490 meters

were drilled to test the area between the 4900 and 5100 meters

above Relative Level (mRL) on the eastern side of the 55 Zone,

which confirmed an up-dip extension of a high-grade shoot

previously intersected in the development drives between the 4800

and 4900 mRL.

109 Zone open pit exploration drilling

and first-time estimate of Mineral Reserves

A total of 60 reverse circulation and diamond

core drill holes totaling 4,922 meters were completed at the 109

Zone during 2022, including 13 holes drilled for geotechnical

purposes. Drilling was designed to infill and upgrade the

geological confidence to support the estimation of Mineral

Resources and Mineral Reserves.

55 Zone open pit drilling

Reverse circulation drilling to test projections

of near surface structural splays identified from mapping of the

underground openings was completed during 2022, with 25 holes

completed for a total of 1,500 meters. Historic resource

drilling had intersected several isolated high-grade intervals

related to sub-parallel mineralized veins associated with the main

55 Zone and which coincided with structures identified from

detailed mapping of the near surface 55 Zone underground

workings.

The drilling was successful in identifying the

mineralized structures and veins although continuity of economic

intervals and strike lengths resulted in downgrading of the

potential.

55 Zone open pit

re-evaluation

Roxgold´s proposal to build an open pit at the

55 Zone was based on extracting high-grade near surface material

that formed the crown pillar by mining both remnant mineralization

identified as being adjacent to existing mine workings and

additional sub-parallel structures related to the main 55 Zone

structure. Based on recommendations in the 2022 Technical Report,

Fortuna completed an evaluation of the mineralization that was

identified as potentially recoverable from surface, which was to

include an underground transition study and the preparation of a

void management plan.

During this evaluation process, the Company

identified a spatial discrepancy attributed to a surveying error

which occurred prior to August 2020. This resulted in horizontal

differences averaging from 2 to 3 meters between the drill holes

used to define the 55 Zone main mineralized structure and the

underground face channel samples collected during underground

development. The updated estimate, having corrected for this

inconsistency, results in a reduction of 120,000 ounces of gold

previously identified as modelled remnant mineralized material.

Subsequently, an economic evaluation of the open pit resulted in a

reduction of a further 46,000 ounces of mineralized material which

the Company determined cannot be economically extracted from

surface or underground due to its isolated location and low-grade

nature.

The updated estimate of the 55 Zone crown pillar

decreases the life of mine from 5 years to 3 years and results in a

reduction in pit size that reduces risk associated with the plan by

lowering the strip ratio from 55:1 to 19:1; optimising throughput

during the last three years; no longer requiring the relocation of

infrastructure; removing the need for significant pre-stripping;

and eliminating the requirement to expand the tailings storage

facility as a result of processing fewer tonnes.

Bagassi South QV Prime Underground

re-evaluation

An evaluation was conducted to assess the

optimal mining method proposed for the QV Prime structure at

Bagassi South. Changing the method from the originally proposed

long hole stoping to shrinkage stoping resulted in lower dilution

levels and an increase in estimated gold content in the updated

Mineral Reserve.

Yaramoko Mineral Reserves and Mineral

Resources as of June 30, 2022

|

Mineral Reserves – Proven and Probable as of June 30, 2022 |

|

Property |

Classification |

Tonnes (000) |

Au (g/t) |

Contained Au (koz) |

|

55 Zone underground |

Proven |

29 |

4.83 |

4 |

|

Probable |

743 |

7.42 |

177 |

|

Proven + Probable |

772 |

7.32 |

182 |

|

55 Zone open pit |

Proven |

72 |

5.79 |

13 |

|

Probable |

73 |

4.69 |

11 |

|

Proven + Probable |

145 |

5.23 |

24 |

|

109 Zone open pit |

Proven |

|

|

|

|

Probable |

160 |

1.77 |

9 |

|

Proven + Probable |

160 |

1.77 |

9 |

|

Bagassi South QV Prime underground |

Proven |

|

|

|

|

Probable |

142 |

6.75 |

31 |

|

Proven + Probable |

142 |

6.75 |

31 |

|

Bagassi South underground |

Proven |

|

|

|

|

Probable |

10 |

4.44 |

1.4 |

|

Proven + Probable |

10 |

4.44 |

1.4 |

|

Stockpiles |

Proven |

180 |

2.59 |

15 |

|

Probable |

|

|

|

|

Proven + Probable |

180 |

2.59 |

15 |

|

TOTAL |

Proven |

281 |

3.64 |

33 |

|

Probable |

1,128 |

6.33 |

230 |

|

Proven + Probable |

1,409 |

5.80 |

263 |

|

Mineral Resources– Measured and Indicated (exclusive of Reserves)

as of June 30, 2022 |

|

Property |

Classification |

Tonnes (000) |

Au (g/t) |

Contained Au (koz) |

|

55 Zone underground |

Measured |

81 |

6.35 |

17 |

|

Indicated |

199 |

6.42 |

41 |

|

Measured + Indicated |

280 |

6.40 |

58 |

|

55 Zone open pit |

Measured |

|

|

|

|

Indicated |

46 |

4.18 |

6 |

|

Measured + Indicated |

46 |

4.18 |

6 |

|

109 Zone open pit |

Measured |

|

|

|

|

Indicated |

32 |

1.63 |

2 |

|

Measured + Indicated |

32 |

1.63 |

2 |

|

Bagassi South QV Prime underground |

Measured |

|

|

|

|

Indicated |

74 |

7.27 |

17 |

|

Measured + Indicated |

74 |

7.27 |

17 |

|

Bagassi South underground |

Measured |

|

|

|

|

Indicated |

54 |

7.07 |

12 |

|

Measured + Indicated |

54 |

7.07 |

12 |

|

TOTAL |

Measured |

81 |

6.35 |

17 |

|

Indicated |

404 |

6.02 |

78 |

|

Measured + Indicated |

485 |

6.08 |

95 |

|

Mineral Resources– Inferred (exclusive of Reserves) as of June 30,

2022 |

|

Property |

Classification |

Tonnes(000) |

Au(g/t) |

Contained Au (koz) |

|

55 Zone underground |

Inferred |

26 |

6.74 |

6 |

|

55 Zone open pit |

Inferred |

41 |

3.62 |

5 |

|

109 Zone open pit |

Inferred |

3 |

1.35 |

0 |

|

Bagassi South QV Prime underground |

Inferred |

22 |

6.12 |

4 |

|

Bagassi South underground |

Inferred |

49 |

6.07 |

10 |

|

TOTAL |

Inferred |

141 |

5.39 |

25 |

Notes:

- Mineral Reserves and Mineral

Resources are as defined by the 2014 CIM Definition Standards for

Mineral Resources and Mineral Reserves

- Mineral Resources are exclusive of

Mineral Reserves

- Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability

- Factors that could materially

affect the reported Mineral Resources or Mineral Reserves include:

changes in metal price and exchange rate assumptions; changes in

local interpretations of mineralization; changes to assumed

metallurgical recoveries, mining dilution and recovery; and

assumptions as to the continued ability to access the site, retain

mineral and surface rights titles, maintain environmental and other

regulatory permits, and maintain the social license to operate

- Mineral Resources and Reserves for

the Yaramoko Mine are estimated and reported as of June 30,

2022

- Mineral Reserves for Yaramoko are

reported at a cut-off grade of 1.26 g/t Au for the 55 Zone open

pit, 0.73 g/t Au for the 109 Zone open pit, 4.1 g/t Au for 55

Zone and Bagassi South underground (SLS), 3.1 g/t Au for Bagassi

South QV Prime (shrinkage) based on an assumed gold price of

US$1,600/oz, metallurgical recovery rates of 98.0%, underground

mining costs of US$135/t, processing cost of US$31/t and G&A

costs of US$28/t, surface mining costs of US$3.44/t, processing

cost of US$27/t and G&A costs of US$25/t. Underground average

mining recovery is estimated at 86% (SLS) and 90% (shrinkage) for

Bagassi South, 92% (SLS) for 55 Zone stopes and 100% for sill

drifts. A mining dilution factor of 10% has been applied for sill

drifts, 0.6 meter and 0.4 meter dilution skin has been applied for

SLS and shrinkage mining respectively. Surface mining recovery is

estimated to average 100% and mining dilution 0% having been

accounted for during block regularization to 5 meters x 5

meters x 5 meters size within an optimized pit shell and only

Proven and Probable categories reported within the final pit

designs. Yaramoko Mineral Resources are reported in situ at a gold

grade cut-off grade of 0.9 g/t Au for the 55 Zone open pit,

0.5 g/t Au for the 109 Zone open pit, and 2.9 g/t Au for

underground (Zone 55 and Bagassi South), based on an assumed gold

price of US$1,700/oz and the same costs, metallurgical recovery and

constrained within an optimised pit shell. The Yaramoko Mine is

subject to a 10% carried interest held by the government of Burkina

Faso.

- Matthew Cobb, (MAIG #5486) is the

Qualified Person responsible for Mineral Resources being an

employee of Roxgold Inc. (a wholly-owned subsidiary of Fortuna),

Raul Espinoza (FAUSIMM (CP) #309581) is the Qualified Person

responsible for Mineral Reserves, being an employee of Fortuna

- Totals may not add due to rounding

procedures

Changes to the Yaramoko Mine Mineral

Reserves and Mineral Resources since December 31, 2021

Proven and Probable Reserves decreased from 2.1

million tonnes averaging 6.78 g/t Au containing 464,000 ounces of

gold to 1.4 million tonnes averaging 5.80 g/t Au containing 263,000

ounces of gold in the first six months of 2022 representing a 34

percent decrease in tonnes and 43 percent decrease in gold ounces.

Reasons for the changes include:

-

55 Zone underground and Bagassi South underground: decrease of 12

percent or 53,000 ounces due to production related depletion

and sterilization

-

55 Zone open pit: decrease of 26 percent or 120,000 ounces due to a

reduction of remnant mineralized material related to a survey

discrepancy identified in the historical model that was corrected

in the updated resource model evaluation

-

55 Zone open pit: decrease of 10 percent or 46,000 ounces due to

changes in pit size as material at depth cannot be economically

extracted from surface due to increased strip ratios as a result of

the depletion of the aforementioned remnant material

-

55 Zone underground and Bagassi South underground: increase of 1

percent or 5,000 ounces due to updated geological

interpretation as a result of brownfields drilling counteracting

marginal increases in cut-off grades

-

109 Zone open pit: gain of 2 percent or 9,000 ounces due to infill

drilling and first time estimation of resources and reserves

-

Bagassi South QV Prime: gain of 2 percent or 8,000 ounces in the

Bagassi South underground mine due to a change in the proposed

mining method to shrinkage stoping and subsequent re-evaluation of

the Mineral Reserves

Measured and Indicated Resources excluding

reserves remain relatively unchanged at 0.5 million tonnes

averaging 6.10 g/t Au containing 95,000 ounces of gold.

Inferred Resources decreased slightly from 0.25

million tonnes averaging 4.41 g/t Au containing 35,000 ounces

of gold to 0.14 million tonnes averaging 5.39 g/t Au containing

25,000 ounces of gold in the first 6 months of 2022. Reasons for

the changes are related to geological reinterpretation and

upgrading based on the exploration and infill drilling.

The aforementioned updated Mineral Resources and

Mineral Reserves for the Yaramoko Mine will be included in the

Company’s consolidated Mineral Resource and Mineral Reserve update

to be released prior to the end of the first quarter of 2023,

subject to the completion of depletion for the period from June 30,

2022 to December 31, 2022. The Company will also prepare an updated

technical report for the Yaramoko Mine to be filed together with

its annual continuous disclosure filings prior to the end of the

first quarter. The aforementioned changes in the Mineral Resources

and Mineral Reserves are not material to the Company´s consolidated

Mineral Resources and Mineral Reserves.

Brownfields Exploration

Highlights

A program of 11 reverse circulation holes

totaling 1,182 meters was completed in 2022 as part of a scout

drilling program to test the projected northwest extension of the

QV and QV Prime veins approximately 300 to 400 meters along strike

from Bagassi South.

Hosted in similar variably sheared granite and

mafic volcanic lithologies to the Bagassi South mineralization

(refer to Figure 1), drilling intersected quartz vein hosted

mineralization interpreted as a continuation of the Bagassi South

vein system. At Bagassi South this system comprises

several veins including the QV, QV Prime, QV1 to QV3 veins and is

characterized by anastomosing and steeply plunging high-grade

shoots within the vein system. Refer to Appendix 1 for full

results.

Highlight intervals include:

- YRM-22-RC-BGR-006:

7.36 g/t Au over an estimated true width of 5.5 meters from 119

meters downhole, including 17.43 g/t Au over an estimated true

width of 2.2 meters from 123 meters

- YRM-22-RC-BGR-004:

1.92 g/t Au over an estimated true width of 7.3 meters from 22

meters

Figure 1. Plan view of scout

drilling testing strike projections of the QV and QV Prime veins at

Bagassi South.

Quality Assurance & Quality Control

(QA-QC)

All drilling data completed by the Company

utilized the following procedures and methodologies. All drilling

was carried out under the supervision of the Company’s

personnel.

All RC drilling used a 5.25-inch face sampling

pneumatic hammer with samples collected into 60-liter plastic bags.

Samples were kept dry by maintaining enough air pressure to exclude

groundwater inflow. If water ingress exceeded the air pressure, RC

drilling was stopped, and drilling converted to diamond core tails.

Once collected, RC samples were riffle split through a three-tier

splitter to yield a 12.5% representative sample for submission

to the analytical laboratory. The residual 87.5% sample were stored

at the drill site until assay results were received and validated.

Coarse reject samples for all mineralized samples corresponding to

significant intervals are retained and stored on-site at the

company-controlled core yard.

All DD drill holes at Yaramoko were drilled with

HQ sized diamond drill bits. The core was logged, marked up for

sampling using standard lengths of one meter or to a geological

boundary. Samples were then cut into equal halves using a diamond

saw. One half of the core was left in the original core box and

stored in a secure location at the company core yard at the project

site. The other half was sampled, catalogued, and placed into

sealed bags and securely stored at the site until shipment.

All Yaramoko RC and DD core samples were

transported to ALS Laboratories in Ouagadougou for preparation.

Routine gold analysis using a 50-gram charge and fire assay with an

atomic absorption finish was completed for all samples. Quality

control procedures included the systematic insertion of blanks,

duplicates and sample standards into the sample stream. In

addition, the ALS laboratory inserted its own quality control

samples.

Qualified Persons

Eric Chapman, Senior Vice President of Technical

Services at Fortuna, is a Professional Geoscientist of the

Association of Professional Engineers and Geoscientists of the

Province of British Columbia (Registration Number 36328) and a

Qualified Person as defined by National Instrument 43-101-

Standards of Disclosure for Mineral Projects (“NI 43-101”). Mr.

Chapman has reviewed and approved the scientific and technical

information contained in this news release related to the Mineral

Resources and Mineral Reserves at the Yaramoko Mine and has

verified the underlying data.

Paul Weedon, Senior Vice President of

Exploration at Fortuna, is a member of the Australian Institute of

Geoscientists (Membership #6001) and a Qualified Person as defined

by NI 43-101. Mr. Weedon has reviewed and approved the scientific

and technical information contained in this news release related to

the exploration programs at the Yaramoko Mine. Mr. Weedon has

verified the data disclosed, and the sampling, analytical and test

data underlying the information or opinions contained herein by

reviewing geochemical and geological databases and reviewing

diamond drill core. There were no limitations to the verification

process.

About Fortuna Silver Mines

Inc.

Fortuna Silver Mines Inc. is a Canadian precious

metals mining company with four operating mines in Argentina,

Burkina Faso, Mexico and Peru, and a fifth mine under construction

in Côte d'Ivoire. Sustainability is integral to all our operations

and relationships. We produce gold and silver and generate shared

value over the long-term for our stakeholders through efficient

production, environmental protection, and social responsibility.

For more information, please visit our website.

ON BEHALF OF THE BOARD

Jorge A. Ganoza President, CEO,

and DirectorFortuna Silver Mines Inc.

Investor Relations:

Carlos Baca |

info@fortunasilver.com | Twitter: @Fortuna_Silver

| LinkedIn: fortunasilvermines |

YouTube: Fortuna Silver Mines

Forward looking Statements

This news release contains forward-looking

statements which constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995 (collectively, “Forward-looking Statements”). All

statements included herein, other than statements of historical

fact, are Forward-looking Statements and are subject to a variety

of known and unknown risks and uncertainties which could cause

actual events or results to differ materially from those reflected

in the Forward-looking Statements. The Forward-looking Statements

in this news release may include, without limitation, statements

about the Company’s plans for its mines and mineral properties; the

Company’s business strategy, plans and outlook; the merit of the

Company’s mines and mineral properties; the Yaramoko Mine Mineral

Resource and Mineral Reserve estimates; expected metallurgical

recoveries; the Company’s ability to convert Inferred Mineral

Resources to Indicated Mineral Resources and to convert Mineral

Resources to Mineral Reserves; timelines; production at the

Yaramoko Mine; the future financial or operating performance of the

Company; the effects of laws, regulations and government policies

affecting our operations or potential future operations; future

successful development of the Yaramoko Mine; the estimates of

expected or anticipated economic returns from the Company’s mining

operations including future sales of metals, doré and concentrate

or other products produced by the Company and the Company’s ability

to achieve its production and cost guidance; capital expenditures

at the Company’s operations; estimated brownfields and greenfields

expenditures in 2023; the success of the Company’s exploration

activities, including infill drill programs at its mines and

development projects; the duration and impacts of COVID-19 on the

Company’s production, workforce, business, operations and financial

condition; metal price estimates, estimated metal grades in 2023;

approvals and other matters. Often, but not always, these

Forward-looking Statements can be identified by the use of words

such as “estimated”, “potential”, “open”, “future”, “assumed”,

“projected”, “used”, “detailed”, “has been”, “gain”, “planned”,

“reflecting”, “will”, “anticipated”, “estimated” “containing”,

“remaining”, “to be”, or statements that events, “could” or

“should” occur or be achieved and similar expressions, including

negative variations.

Forward-looking Statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any results, performance or achievements

expressed or implied by the Forward-looking Statements. Such

uncertainties and factors include, among others, operational risks

associated with mining and mineral processing; uncertainty relating

to Mineral Resource and Mineral Reserve estimates; uncertainty

relating to capital and operating costs, production schedules and

economic returns; risks relating to the Company’s ability to

replace its Mineral Reserves; risks associated with mineral

exploration and project development; uncertainty relating to the

repatriation of funds as a result of currency controls;

environmental matters including obtaining or renewing environmental

permits and potential liability claims; uncertainty relating to

nature and climate conditions; risks associated with political

instability and changes to the regulations governing the Company’s

business operations; changes in national and local government

legislation, taxation, controls, regulations and political or

economic developments in countries in which the Company does or may

carry on business; risks associated with war, hostilities or other

conflicts, such as the Ukrainian – Russian conflict, and the impact

it may have on global economic activity; risks relating to the

termination of the Company’s mining concessions in certain

circumstances; developing and maintaining relationships with local

communities and stakeholders; risks associated with losing control

of public perception as a result of social media and other

web-based applications; potential opposition to the Company’s

exploration, development and operational activities; risks related

to the Company’s ability to obtain adequate financing for planned

exploration and development activities; property title matters;

risks relating to the integration of businesses and assets acquired

by the Company; impairments; risks associated with climate change

legislation; reliance on key personnel; adequacy of insurance

coverage; operational safety and security risks; legal proceedings

and potential legal proceedings; the ability of the Company to

successfully contest and revoke the resolution issued by SEMARNAT

which annuls the extension of the environmental impact

authorization for the San Jose mine; uncertainties relating to

general economic conditions; risks relating to a global pandemic,

including COVID-19, which could impact the Company’s business,

operations, financial condition and share price; competition;

fluctuations in metal prices; risks associated with entering into

commodity forward and option contracts for base metals production;

fluctuations in currency exchange rates and interest rates; tax

audits and reassessments; risks related to hedging; uncertainty

relating to concentrate treatment charges and transportation costs;

sufficiency of monies allotted by the Company for land reclamation;

risks associated with dependence upon information technology

systems, which are subject to disruption, damage, failure and risks

with implementation and integration; risks associated with climate

change legislation; labor relations issues; as well as those

factors discussed under “Risk Factors” in the Company's Annual

Information Form. Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

Forward-looking Statements, there may be other factors that cause

actions, events or results to differ from those anticipated,

estimated or intended.

Forward-looking Statements contained herein are

based on the assumptions, beliefs, expectations and opinions of

management, including but not limited to the accuracy of the

Company’s current mineral resource and reserve estimates; that the

Company’s activities will be conducted in accordance with the

Company’s public statements and stated goals; that there will be no

material adverse change affecting the Company, its properties or

its production estimates (which assume accuracy of projected ore

grade, mining rates, recovery timing, and recovery rate estimates

and may be impacted by unscheduled maintenance, labour and

contractor availability and other operating or technical

difficulties); the duration and effect of global and local

inflation; the duration and impacts of COVID-19 and geo-political

uncertainties on the Company’s production, workforce, business,

operations and financial condition; the expected trends in mineral

prices, inflation and currency exchange rates; that the Company

will be successful in challenging the annulment of the extension to

the San Jose environmental impact authorization; that all required

approvals and permits will be obtained for the Company’s business

and operations on acceptable terms; that there will be no

significant disruptions affecting the Company's operations and such

other assumptions as set out herein. Forward-looking Statements are

made as of the date hereof and the Company disclaims any obligation

to update any Forward-looking Statements, whether as a result of

new information, future events or results or otherwise, except as

required by law. There can be no assurance that these

Forward-looking Statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, investors should not

place undue reliance on Forward-looking Statements.

Cautionary Note to United States Investors

Concerning Estimates of Reserves and Resources

Reserve and resource estimates included in this

news release have been prepared in accordance with National

Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI

43-101") and the Canadian Institute of Mining, Metallurgy, and

Petroleum Definition Standards on Mineral Resources and Mineral

Reserves. NI 43-101 is a rule developed by the Canadian Securities

Administrators that establishes standards for public disclosure by

a Canadian company of scientific and technical information

concerning mineral projects. Unless otherwise indicated, all

mineral reserve and mineral resource estimates contained in the

technical disclosure have been prepared in accordance with NI

43-101 and the Canadian Institute of Mining, Metallurgy and

Petroleum Definition Standards on Mineral Resources and

Reserves.

Canadian standards, including NI 43-101, differ

significantly from the requirements of the Securities and Exchange

Commission, and mineral reserve and resource information included

in this news release may not be comparable to similar information

disclosed by U.S. companies.

APPENDIX 1. Yaramoko Mine, Burkina Faso:

Bagassi South QV and QV Prime drill results

|

HoleID |

Easting(ADINDAN_30N) |

Northing(ADINDAN_30N) |

Elevation (m) |

EOHDepth (m) |

UTM Azimuth |

Dip |

DepthFrom(m) |

DepthTo (m) |

Width (m) |

EST1 (m) |

Au(ppm) |

HoleType2 |

|

YRM-22-RC-BGR-001 |

469543 |

1297805 |

309 |

121 |

210 |

48 |

99 |

100 |

1 |

0.84 |

0.42 |

RC |

|

YRM-22-RC-BGR-002 |

469520 |

1297754 |

310 |

80 |

210 |

50 |

NSR3 |

|

|

|

|

RC |

|

YRM-22-RC-BGR-003A |

469575 |

1297752 |

311 |

110 |

210 |

50 |

71 |

75 |

4 |

3.36 |

3.02 |

RC |

|

YRM-22-RC-BGR-004 |

469596 |

1297689 |

316 |

80 |

210 |

50 |

22 |

31 |

9 |

7.3 |

1.92 |

RC |

|

YRM-22-RC-BGR-005 |

469615 |

1297723 |

312 |

115 |

210 |

50 |

NSR3 |

|

|

|

|

RC |

|

YRM-22-RC-BGR-006 |

469626 |

1297748 |

313 |

144 |

212 |

56 |

119 |

129 |

10 |

5.5 |

7.36 |

RC |

|

|

|

|

|

|

|

incl |

123 |

127 |

4 |

2.2 |

17.43 |

RC |

|

YRM-22-RC-BGR-007 |

469559 |

1297716 |

311 |

46 |

210 |

50 |

30 |

31 |

1 |

0.84 |

3.22 |

RC |

|

YRM-22-RC-BGR-008 |

469601 |

1297797 |

318 |

170 |

210 |

50 |

158 |

159 |

1 |

0.84 |

0.37 |

RC |

|

YRM-22-RC-BGR-009 |

469673 |

1297617 |

319 |

44 |

210 |

50 |

NSR3 |

|

|

|

|

RC |

|

YRM-22-RC-BGR-010 |

469705 |

1297660 |

321 |

105 |

210 |

50 |

NSR3 |

|

|

|

|

RC |

|

YRM-22-RC-BGR-011 |

469768 |

1297668 |

323 |

167 |

210 |

50 |

146 |

150 |

4 |

3.1 |

1.27 |

RC |

|

YRM-22-RC-BGR-001 |

469543 |

1297805 |

309 |

121 |

210 |

48 |

99 |

100 |

1 |

0.84 |

0.42 |

RC |

|

YRM-22-RC-BGR-002 |

469520 |

1297754 |

310 |

80 |

210 |

50 |

NSR3 |

|

|

|

|

RC |

|

YRM-22-RC-BGR-003A |

469575 |

1297752 |

311 |

110 |

210 |

50 |

71 |

75 |

4 |

3.36 |

3.02 |

RC |

Notes:

- EST:

Estimated true width

- RC:

Reverse

circulation

- NSR: No

significant result

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/213adcb0-a016-4411-bc6e-3c005affdf76

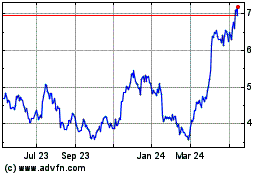

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Dec 2024 to Jan 2025

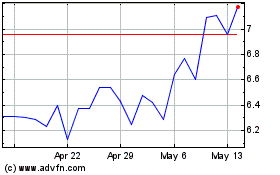

Fortuna Mining (TSX:FVI)

Historical Stock Chart

From Jan 2024 to Jan 2025