Extendicare Inc. (“Extendicare” or the “Company”) (TSX: EXE) today

reported results for the three and nine months ended September 30,

2020. Results are presented in Canadian dollars unless otherwise

noted.

“Combatting the recent surge in COVID-19 cases is the top

priority for our organization,” said President and Chief Executive

Officer, Dr. Michael Guerriere. “We have learned a lot from our

experience with COVID-19 and have applied these learnings to

enhance our processes to mitigate the risk posed by the pandemic.

From routine testing for staff, to the creation of rapid response

teams that can assist locations that are experiencing COVID-19

challenges, we remain steadfast in our efforts to protect our

residents, clients and staff.”

“While we focus on safety in our day-to-day operations, we are

also making significant investments in people and infrastructure to

build a better future for seniors,” added Dr. Guerriere. “In the

face of an increasing shortage of personal support workers, we have

established a caregiver training program where Extendicare provides

tuition and paid, on-the-job training for qualified applicants and

a guaranteed job upon graduation. We aim to expand this program to

train more than 600 new hires per year to help address what is a

critical, industry-wide need. We are also pleased to announce the

start of construction on a 256-bed long-term care home in Sudbury

to replace one of our older homes. These important long-term

investments in people and infrastructure will improve conditions

for residents and employees, while also adding value for all

stakeholders.”

COVID-19 Update

During the second quarter, Extendicare took decisive steps to

prepare for the “second wave” of COVID-19 now underway across

Canada. These actions included routine testing of staff in

cooperation with local public health authorities, increased

staffing in long-term care (LTC) homes, bolstering inventory of

personal protective equipment (PPE) and the introduction of an

experienced rapid response team to assist homes in outbreak, among

other initiatives. While these actions have helped mitigate the

impact of COVID-19 in our homes, the sharp rise in cases in

surrounding communities has caused a resurgence of outbreaks.

As of today, of our 69 long-term care homes and retirement

communities, 12 LTC homes are in outbreak, with the majority

limited to three or fewer active cases of COVID-19 among residents

and staff. We are also working closely with our Extendicare Assist

clients to help them manage outbreaks in their homes.

We continue to believe that routine testing, effective use of

PPE and frequent sanitizing are the best preventative measures

currently available to stop the spread of the virus in

Extendicare’s network of LTC homes and retirement communities until

vaccines are widely available. Extendicare is working closely with

government, health authorities, industry partners and advocacy

groups on initiatives to help ensure our collective response to the

crisis is optimized for the protection and care of our residents,

clients and staff.

To combat the pandemic, we have spent an estimated $42.5 million

in operating and administrative expenses, partially offset by $22.7

million from various provincial government pandemic programs,

resulting in a reduction of our consolidated net operating income

(NOI) and Adjusted EBITDA of approximately $17.0 million and $19.8

million, respectively. We have dispensed a further estimated $33.6

million in pandemic pay, fully funded by programs announced by the

Ontario and Alberta governments, to temporarily increase hourly

wages for certain eligible front-line employees. In addition, we

have an additional $9.7 million in PPE inventory to ensure that we

continue to have sufficient supply.

Our operations continue to be affected by COVID-19, with lower

occupancy levels in our LTC homes and retirement communities and

costs in excess of funding levels. Home health care volumes

continue to recover as referrals have returned to pre-pandemic

levels. However, volumes are taking longer to recover due to

COVID-19 related shortfalls in our workforce capacity.

Executive Appointment

Dr. Matthew Morgan joined Extendicare in the newly-created role

of Chief Medical Officer on October 19, 2020. His focus is on

developing and coordinating the implementation of clinical

strategies that result in better outcomes for residents, clients

and their families. Dr. Morgan is a practicing General Internal

Medicine physician with a Masters in Clinical Epidemiology, and an

Assistant Professor in the Faculty of Medicine at the University of

Toronto.

Factors Impacting Comparability of Financial Results for

2020

For purposes of the Financial Highlights and Business Update

sections, revenue, NOI and NOI margins exclude the year-over-year

decline in revenue resulting from the expiration of ParaMed’s B.C.

home health care contracts in Q1 2020, the incremental

funding related to Bill-148 received by ParaMed in Q2 2019, and the

increase in NOI from the $50.8 million received by ParaMed

under the Canada Emergency Wage Subsidy (CEWS) program in Q3 2020

(recorded as an offset to operating expenses of the home health

care segment), as discussed under the Home Health Care business

update below.

In addition, the recognition of pandemic-related costs and the

timing of the recognition and receipt of related government funding

and subsidies has resulted in volatility in our quarterly results

which is expected to continue throughout the remainder of the

pandemic.

Financial Highlights

Q3 2020 (all comparisons with Q3 2019)

- Revenue up 10.1% or $27.2 million to $296.8 million; driven by

COVID-19 funding of $28.7 million, LTC funding enhancements and

growth in retirement living and other operations, partially offset

by a 9.9% decline in home health care average daily volumes

(ADV).

- Net operating income (NOI)(1) of $25.2 million, down 27.6% or

$9.6 million; reflecting COVID-19 costs in excess of funding of

$7.2 million, costs of resident care in excess of funding in LTC

and lower ADV and increased workers compensation and benefits costs

in home health care, partially offset by growth in the retirement

living and other operations segments.

- Adjusted EBITDA(1) up $39.9 million to $63.8 million;

reflecting the underlying decline in NOI noted above and increase

in administrative costs, offset by CEWS.

- Earnings from continuing operations up $29.3 million to $34.6

million; primarily driven by CEWS, as noted above for ParaMed

($37.3 million net of tax), partially offset by estimated COVID-19

costs in excess of funding ($6.4 million net of tax) and the volume

driven decline in NOI of the home health care segment.

- AFFO(1) of $42.8 million ($0.48 per basic share), up $29.1

million; reflecting the increase in earnings from continuing

operations (including impact of CEWS and estimated costs of

COVID-19 in excess of funding, net of tax, of $30.9 million or

$0.35 per basic share).

- Earnings from discontinued operations included a release of the

Company’s captive’s reserves of $2.0 million in the prior

year.

Nine Months 2020 (all comparisons with Nine

Months 2019)

Excluding the factors impacting comparability noted above,

results for the nine months ended September 30, 2020 reflect growth

in the retirement living and other operations segments and LTC

funding enhancements, partially offset by COVID-19 costs in excess

of funding, a 11.3% decline in home health care ADV, higher home

health care operating costs and increased administrative costs.

- Revenue up 5.7% or $46.0 million to $847.6 million.

- NOI(1) of $75.5 million, down 23.7% or $23.4 million.

- Adjusted EBITDA(1) up $23.3 million to $92.1 million;

reflecting the underlying decline in NOI noted above and increase

in administrative costs related to COVID-19, offset by CEWS.

- Earnings from continuing operations up $16.7 million to $27.0

million; primarily driven by CEWS ($37.3 million net of tax) and

largely offset by estimated COVID-19 costs in excess of funding

($14.5 million net of tax) and the volume driven decline in NOI of

home health care operations.

- AFFO(1) of $57.4 million ($0.64 per basic share), up $16.1

million; reflecting the increase in earnings from continuing

operations (including impact of CEWS and estimated costs of

COVID-19 in excess of funding, net of tax, of $22.8 million or

$0.26 per basic share).

- Earnings from discontinued operations up $1.5 million to $9.7

million; reflecting releases of the Company’s captive’s reserves of

$9.5 million compared to $6.4 million in the prior year, and a $1.9

million reduction in foreign exchange and fair value

adjustments.

- Dividends declared of $32.2 million in 2020, representing

approximately 56% of AFFO.

Business Updates

The following is a summary of the Company’s revenue, NOI and NOI

margins by business segment for the three and nine months ended

September 30, 2020 and 2019.

|

(unaudited) |

Three months ended September 30 |

|

Nine months ended September 30 |

|

(millions of dollars, unless otherwise noted) |

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

| Long-term care |

184.7 |

|

161.0 |

|

|

523.4 |

|

477.1 |

|

| Retirement living |

12.0 |

|

10.4 |

|

|

35.8 |

|

29.9 |

|

| Home health care |

93.2 |

|

92.3 |

|

|

268.8 |

|

276.8 |

|

|

Other |

6.8 |

|

5.9 |

|

|

19.6 |

|

17.7 |

|

|

Total revenue |

296.8 |

|

269.6 |

|

|

847.6 |

|

801.6 |

|

| NOI and NOI

margin (1) |

|

|

|

|

|

|

|

|

|

|

Long-term care |

13.0 |

7.0 |

% |

20.6 |

12.8 |

% |

|

42.5 |

8.1 |

% |

56.9 |

11.9 |

% |

| Retirement living |

3.2 |

26.9 |

% |

2.9 |

28.3 |

% |

|

10.4 |

29.2 |

% |

8.4 |

28.2 |

% |

| Home health care |

4.7 |

5.1 |

% |

8.0 |

8.7 |

% |

|

10.4 |

3.9 |

% |

23.7 |

8.6 |

% |

|

Other |

4.3 |

62.7 |

% |

3.2 |

53.9 |

% |

|

12.1 |

61.9 |

% |

9.8 |

55.4 |

% |

|

Total NOI and NOI margin (1) |

25.2 |

8.5 |

% |

34.8 |

12.9 |

% |

|

75.5 |

8.9 |

% |

98.9 |

12.3 |

% |

|

Note: Totals may not sum due to rounding. |

Long-term Care

Long-term care operations continue to be impacted by increased

costs associated with COVID-19. In Q3 2020, the increased operating

expenses resulted in lower NOI compared to the same period last

year.

NOI and NOI margin in Q3 2020 were $13.0 million and 7.0%,

respectively, down from $20.6 million and 12.8% respectively in Q3

2019. NOI and NOI margin decreased in the quarter largely as a

result of increased costs of resident care, including costs

associated with COVID-19 and pandemic pay programs, estimated to be

$27.7 million and $6.6 million in excess of government funding

received.

Average occupancy dropped to 90.0% in Q3 2020, down 790 bps from

Q3 2019 and 350 bps from Q2 2020, mainly driven by reduced

admissions as a result of COVID-19. Despite lower occupancy levels,

our revenue base is largely protected as full funding is preserved

in Ontario for the remainder of the year, and each of the western

provinces in which we operate have introduced additional funding to

offset the impact of COVID-19.

During the third quarter, the Ontario Ministry of Long-Term Care

provided updates to its Long-Term Care Home Capital Development

Funding program for the development of new and replacement LTC

beds. The program includes a $1.75 billion investment to redevelop

12,000 beds and add an additional 8,000 beds over the next five

years.

We have submitted applications to the Ontario Ministry of

Long-Term Care in respect of 22 projects to build over 4,200 beds

to replace all of our existing 3,287 C-class beds and to add new

LTC beds, in keeping with the Ontario government’s focus on

replacing aging infrastructure and increasing the number of LTC

beds in the province. We continue to work closely with our industry

partners and government to further enhance the new capital

development funding program, in particular, to address certain

geographic areas and streamline the related approval and licensing

processes to expedite those projects that are currently

feasible.

In October 2020, we received all of the necessary approvals to

commence construction of a new 256-bed LTC home in Sudbury, Ontario

that will replace our 234-bed Extendicare Falconbridge C-class bed

home. Construction will commence in Q4 2020, with completion

anticipated in Q4 2022, and the redevelopment represents an

investment of $62.3 million in our LTC segment.

Home Health Care

In Q3 2020, revenue was largely unchanged at $93.2 million, up

1.0% from Q3 2019, as the impact of COVID-19 and pandemic pay

funding of $7.6 million was largely offset by lower ADV, down 9.9%

compared to same quarter last year.

NOI and NOI margin decreased to $4.7 million and 5.1%,

respectively, in Q3 2020, down from $8.0 million and 8.7%,

respectively, in Q3 2019. NOI declined largely as a result of lower

business volumes and workers compensation and benefits costs. In

addition, NOI was impacted by costs associated with COVID-19 and

pandemic pay in excess of funding.

The peak impact of COVID-19 on ADV occurred in April 2020. Since

that time, we have seen a gradual recovery in ADV with Q3 2020

showing an 11.6% increase from Q2 2020 and a further increase of

5.2%, to 23,934, in ADV for the four weeks ended November 8, 2020.

While referrals have recently returned to pre-COVID levels our

business volumes have been slower to recover due to COVID-19

related shortfalls in our workforce capacity.

The volume declines and resultant revenue decreases experienced

in our home health care operating subsidiary, ParaMed Inc.,

resulted in ParaMed applying for, and receiving, a payment under

the CEWS program in Q3 2020. The CEWS program was established by

the Federal Government to help Canadian employers that have

experienced revenue declines to re-hire workers laid off as a

result of COVID-19, to prevent further job losses and to

better position the employers to resume normal operations after the

COVID-19 pandemic. ParaMed received a payment of $50.8 million

under the CEWS program in Q3 2020 for claim periods from March 15,

2020 to July 4, 2020. Subsequent to September 30, 2020, ParaMed

applied for and received an additional $31.4 million in CEWS for

the claims periods from July 5, 2020 to September 26, 2020. ParaMed

anticipates filing for additional CEWS funding contingent on

changes to the CEWS program and the rate of volume recovery in

subsequent periods. The CEWS is recorded as an offset to operating

expenses, positively impacting the NOI of the home health care

segment for the three and nine months ended September 30,

2020.

Throughout this period, we have remained focused on maintaining

our workforce capacity to ensure we are able to respond quickly to

increases in demand for home health care services and resume

operating at normalized levels as the pandemic recedes. In

addition, we are making long-term investments to address the

shortage of personal support workers that has challenged our

industry for years, and has been more recently exacerbated by the

pandemic. We have developed in-house programs and partnered with

colleges to create a new supply of skilled caregivers. For example,

under a program launched earlier this year, ParaMed is covering

college tuition and providing paid on-the-job training, followed by

full employment to new entrants to the home health care sector. To

date, we have graduated approximately 200 new caregivers through

the program, and we expect the capacity to increase to more than

600 students per year as we partner with additional colleges.

As the stream of graduates from our training programs increases

and remaining staff return to the workforce, we anticipate

continued improvement in ADV. While we cannot predict the ultimate

impact nor the duration of the pandemic, we are focused on managing

our operations through this challenge so we are well positioned to

continue to provide high quality care and expand our operations

when the pandemic recedes.

Retirement Living

Our retirement living operations continued to deliver solid

financial results as contributions from non same-store operations

and lease-up communities more than offset the negative impact of

COVID-19 on occupancy and cost levels.

In Q3 2020, revenue increased to $12.0 million, up 15.1% from

the same quarter last year, largely driven by the opening of The

Barrieview in October 2019 and partially offset by the impact of

COVID-19 on occupancy levels at our stabilized communities. NOI in

the third quarter increased by 9.5% to $3.2 million, reflecting the

increase in revenue; however, lower same-store occupancy levels and

increased costs associated with COVID-19 led to lower NOI margin of

26.9%, down from 28.3% from the same quarter last year.

As a result of the recommencement of in-person tours in Ontario

in Q3 2020, average occupancy of our stabilized portfolio improved

to 91.9% in Q3 2020, up from 91.5% in Q2 2020. Despite this rebound

from the prior quarter, levels remain below Q3 2019 of 94.0% as a

result of the impacts of COVID-19.

Stabilized occupancy improved through the third quarter,

increasing by 180bps from Q2 2020 to 93.1% as at September 30,

2020. Subsequent to quarter end, in-person tour restrictions were

re-introduced in certain regions in Ontario and stabilized

occupancy decreased to 91.7% as at October 31, 2020. We continue to

actively market our properties and conduct virtual tours in place

of in-person visits.

Other Operations

Financial performance in our other operations remained strong as

revenue increased 15.2% to $6.8 million, largely driven by growth

in our SGP Purchasing Partner Network (SGP). NOI also increased in

the quarter, up 34.0% to $4.3 million, as our growing SGP client

base and lower travel and business promotion costs offset increased

staff costs. The number of third-party residents served by SGP

increased to approximately 79,400 at the end of the third quarter,

up 23.5% from September 30, 2019, and 5.6% from June 30,

2020.

Financial Position

Extendicare maintained its strong financial flexibility and

liquidity in Q3 2020, with cash and cash equivalents on hand of

$170.1 million and access to a further $71.3 million in undrawn

demand credit facilities as at September 30, 2020. Following

financing activities in the first half of 2020 to extend and renew

existing mortgages on LTC homes and to finalize new mortgages on

retirement communities, the Company does not have any scheduled

debt maturities until Q1 2022.

Select Financial Information

The following is a summary of the Company’s consolidated

financial information for the three and nine months ended September

30, 2020 and 2019.

|

(unaudited) |

Three months ended September 30

(2) |

|

Nine months ended September 30

(2) |

|

(thousands of dollars unless otherwise noted) |

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

| Revenue |

296,786 |

|

282,733 |

|

|

850,551 |

|

841,055 |

|

|

Operating expenses |

220,810 |

|

247,866 |

|

|

724,258 |

|

740,482 |

|

| NOI (1) |

75,976 |

|

34,867 |

|

|

126,293 |

|

100,573 |

|

|

NOI margin (1) |

25.6 |

% |

12.3 |

% |

|

14.8 |

% |

12.0 |

% |

|

Administrative costs |

12,182 |

|

11,021 |

|

|

34,201 |

|

31,801 |

|

| Adjusted

EBITDA (1) |

63,794 |

|

23,846 |

|

|

92,092 |

|

68,772 |

|

|

Adjusted EBITDA margin (1) |

21.5 |

% |

8.4 |

% |

|

10.8 |

% |

8.2 |

% |

| Other

expense |

— |

|

— |

|

|

2,780 |

|

2,404 |

|

| Earnings from

continuing operations |

34,644 |

|

5,353 |

|

|

26,992 |

|

10,332 |

|

| per basic share ($) |

0.39 |

|

0.06 |

|

|

0.30 |

|

0.12 |

|

| per

diluted share ($) |

0.36 |

|

0.06 |

|

|

0.30 |

|

0.12 |

|

|

Earnings from discontinued operations, net of

tax |

(178 |

) |

1,906 |

|

|

9,721 |

|

8,210 |

|

|

Net earnings (loss) |

34,466 |

|

7,259 |

|

|

36,713 |

|

18,542 |

|

| per basic share ($) |

0.38 |

|

0.08 |

|

|

0.41 |

|

0.21 |

|

| per

diluted share ($) |

0.36 |

|

0.08 |

|

|

0.41 |

|

0.21 |

|

| AFFO (1) |

42,787 |

|

13,693 |

|

|

57,363 |

|

41,235 |

|

| per basic share ($) |

0.48 |

|

0.15 |

|

|

0.64 |

|

0.46 |

|

| per

diluted share ($) |

0.44 |

|

0.15 |

|

|

0.61 |

|

0.45 |

|

| Current income tax

expense (recovery) included in FFO |

14,118 |

|

2,666 |

|

|

14,343 |

|

7,477 |

|

|

FFO effective tax rate |

25.9 |

% |

17.9 |

% |

|

22.3 |

% |

17.6 |

% |

|

Maintenance capex |

2,381 |

|

3,056 |

|

|

6,293 |

|

6,284 |

|

| Cash dividends

declared per share |

0.12 |

|

0.12 |

|

|

0.36 |

|

0.36 |

|

|

Payout ratio (1) |

25 |

% |

78 |

% |

|

56 |

% |

78 |

% |

| Weighted average

number of shares (thousands) |

|

|

|

|

|

|

|

|

|

| Basic |

89,864 |

|

89,253 |

|

|

89,778 |

|

89,040 |

|

|

Diluted |

100,223 |

|

99,614 |

|

|

100,145 |

|

99,412 |

|

|

(1) Non-GAAP Measures:

Extendicare assesses and measures operating results and financial

position based on performance measures referred to as “net

operating income”, “NOI”, “NOI margin”, “Adjusted EBITDA”,

“Adjusted EBITDA margin”, “AFFO”, “AFFO per share”, and “payout

ratio”. In addition, the Company assesses its return on investment

in development activities using the non-GAAP financial measure “NOI

Yield”. These are not measures recognized under GAAP and do not

have standardized meanings prescribed by GAAP. These non-GAAP

measures are presented in this document because either: (i)

management believes that they are a relevant measure of the ability

of Extendicare to make cash distributions; or (ii) certain ongoing

rights and obligations of Extendicare may be calculated using these

measures. Such non-GAAP measures may differ from similar

computations as reported by other issuers and, accordingly, may not

be comparable to similarly titled measures as reported by such

issuers. They are not intended to replace earnings (loss) from

continuing operations, net earnings (loss), cash flow, or other

measures of financial performance and liquidity reported in

accordance with GAAP. Detailed descriptions of these terms can be

found in Extendicare’s disclosure documents, including its

Management’s Discussion and Analysis, filed with the securities

regulatory authorities; these documents are available at

www.sedar.com and on Extendicare’s website at

www.extendicare.com. |

|

(2) Comparative figures have been re-presented to

reflect discontinued operations. |

Extendicare’s financial reports, including its Management’s

Discussion and Analysis are available on its website at

www.extendicare.com under the “Investors/Financial Reports”

section.

November Dividend Declared

The Board of Directors of Extendicare today declared a cash

dividend of $0.04 per share for the month of November 2020, which

is payable on December 15, 2020, to shareholders of record at the

close of business on November 30, 2020. This dividend is designated

as an “eligible dividend” within the meaning of the Income Tax Act

(Canada).

Conference Call and Webcast

On November 13, 2020, at 11:30 a.m. (ET), Extendicare will hold

a conference call to discuss its 2020 third quarter results. The

call will be webcast live and archived online at

www.extendicare.com under the “Investors/Events &

Presentations” section. Alternatively, the call-in number is

1-800-319-4610 or 416-915-3239. A replay of the call will be

available approximately two hours after completion of the live call

until midnight on November 27, 2020. To access the rebroadcast dial

1-800-319-6413 followed by the passcode 5368#.

About Extendicare

Extendicare is a leading provider of care and services for

seniors across Canada, operating under the Extendicare, Esprit

Lifestyle, ParaMed, Extendicare Assist, and SGP Purchasing Partner

Network brands. We are committed to delivering quality care

throughout the health continuum to meet the needs of a growing

seniors population. We operate or provide contract services to a

network of 122 long-term care homes and retirement communities (69

owned/53 contract services), provide approximately 8.5 million

hours of home health care services annually, and provide group

purchasing services to third parties representing approximately

79,400 senior residents across Canada. Our qualified and highly

trained workforce of approximately 23,000 individuals is passionate

about providing high quality services to help people live

better.

Forward-looking Statements

This press release contains forward-looking statements

concerning anticipated financial events, results, circumstances,

economic performance or expectations with respect to Extendicare

and its subsidiaries, including, without limitation, statements

regarding its business operations, business strategy, and financial

condition, including anticipated timelines, costs and financial

returns in respect of development projects, and in particular

statements in respect of the impact of measures taken to mitigate

the impact of COVID-19, the availability of various government

programs and financial assistance announced in respect of COVID-19,

the impact of COVID-19 on the Company’s operating costs, staffing,

procurement, occupancy levels (primarily in its retirement

communities) and volumes in its home health care business, the

impact on the capital and credit markets and the Company’s ability

to access the credit markets as a result of COVID-19, increased

litigation and regulatory exposure and the outcome of any

litigation and regulatory proceedings. Forward-looking statements

can be identified because they generally contain the words

“anticipate”, “believe”, “estimate”, “expect”, “intend”,

“objective”, “plan”, “project”, “will” or other similar expressions

or the negative thereof. Forward-looking statements reflect

management’s beliefs and assumptions and are based on information

currently available, and Extendicare assumes no obligation to

update or revise any forward-looking statement, except as required

by applicable securities laws. These statements are not guarantees

of future performance and involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance or achievements of Extendicare to differ materially

from those expressed or implied in the statements. Risks and

uncertainties related to the effects of COVID-19 on Extendicare

include the length, spread and severity of the pandemic; the nature

and extent of the measures taken by all levels of governments and

public health officials, both short and long term, in response to

COVID-19; domestic and global credit and capital markets; the

Company’s ability to access capital on favourable terms or at all

due to the potential for reduced revenue and increased operating

expenses as a result of COVID-19; the availability of insurance on

favourable terms; litigation and/or regulatory proceedings against

or involving the Company, regardless of merit; the health and

safety of the Company’s employees and its residents and clients;

and domestic and global supply chains, particularly in respect of

personal protective equipment. Given the evolving circumstances

surrounding COVID-19, it is difficult to predict how significant

the adverse impact will be on the global and domestic economy and

the business operations and financial position of Extendicare. For

further information on the risks, uncertainties and assumptions

that could cause Extendicare’s actual results to differ from

current expectations, refer to “Risk Factors” in Extendicare’s

Annual Information Form and “Forward Looking-Statements” in

Extendicare’s Q2 2020 Management’s Discussion and Analysis filed by

Extendicare with the securities regulatory authorities, available

at www.sedar.com and on Extendicare’s website at

www.extendicare.com. Given these risks and uncertainties, readers

are cautioned not to place undue reliance on Extendicare’s

forward-looking statements.

Extendicare contact:David BaconSenior Vice

President and Chief Financial OfficerPhone: (905) 470-4000; Fax:

(905) 470-4003Email:

david.bacon@extendicare.comwww.extendicare.com

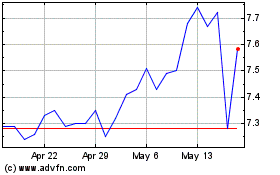

Extendicare (TSX:EXE)

Historical Stock Chart

From Oct 2024 to Nov 2024

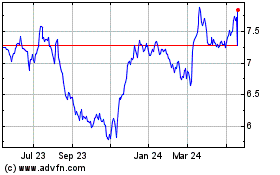

Extendicare (TSX:EXE)

Historical Stock Chart

From Nov 2023 to Nov 2024