Dundee Precious Metals to Provide Incentive for Early Exercise of Warrants

March 25 2013 - 8:00AM

Marketwired Canada

This news release is not for distribution in the United States or over United

States wire services

Dundee Precious Metals Inc. (TSX:DPM)(TSX:DPM.WT.A) ("DPM" or the "Company") is

pleased to announce that the Toronto Stock Exchange ("TSX") has conditionally

approved a warrant incentive program designed to encourage the early exercise of

its 20,439,500 listed warrants that otherwise expire on November 20, 2015 (the

"Warrants").

The proposal is to be effected by way of an amendment to the indenture governing

the Warrants (the "Warrant Amendment") to provide holders of Warrants (the

"Warrantholders") an opportunity to receive a premium to the intrinsic or

"in-the-money" value of their Warrants and the trading price of the Warrants

upon the early exercise of their Warrants. Each Warrant currently entitles a

Warrantholder to acquire one common share of the Company (an "Underlying Share")

at a price of Cdn.$3.25 (the "Current Exercise Price") at any time prior to 5:00

p.m. (Toronto time) on November 20, 2015.

Pursuant to the proposed Warrant Amendment, each Warrant would entitle the

holder thereof to a Cdn.$0.40 reduction in the Current Exercise Price of the

Warrants (the "Exercise Price Reduction"), in the event that the Warrantholder

exercises his or her Warrants during a period of 30 days (the "Early Exercise

Period") expected to commence on or about May 10, 2013. A Warrantholder who

chooses to exercise his or her Warrants during the Early Exercise Period will

pay an exercise price of Cdn.$2.85 per common share rather than the Current

Exercise Price. Each Warrant that is not exercised during the Early Exercise

Period will continue to entitle the holder to acquire one Underlying Share at

the Current Exercise Price until November 20, 2015. The Warrants will continue

to trade on the TSX during the Early Exercise Period.

Illustrative Early Exercise of 100 Warrants

Warrants Owned What is Paid on Exercise What is Received

Cdn.$285 (Cdn.$2.85 per

100 Warrant)(1) 100 common shares

(1) Instead of Cdn.$325 or Cdn.$3.25 per Warrant

In the event that all of the Warrants are exercised during the Early Exercise

Period, the Company would:

i. receive net proceeds of approximately Cdn.$58.3 million, on or before

June 9, 2013; and

ii. issue 20,439,500 common shares.

The proceeds raised from the early exercise of the Warrants will further

strengthen the Company's balance sheet and support its planned growth capital

expenditures.

The Company believes that the trading pattern of the Warrants is currently

substantially the same as the trading pattern of the common shares of the

Company, and that the trading price of the Warrants does not include a

significant option value component in addition to the intrinsic or the

"in-the-money" value of the Warrants. Management of the Company is therefore

proposing to provide an incentive to Warrantholders to encourage the exercise of

the Warrants during the Early Exercise Period. The Company has entered into

support agreements with certain Warrantholders who hold approximately 32% of the

issued and outstanding Warrants, and have thereby agreed to vote their

securities of DPM in favour of the Warrant Amendment and to exercise their

Warrants during the Early Exercise Period.

The following table compares the trading value and the intrinsic value of the

Warrants for the 10 trading days prior to March 22, 2013, the last trading day

prior to the date of this news release.

10 Trading Day Premium

(March 11, 2013 to March 22, 2013)

Percentage of

Premium to Trading

Stock Symbol Trading Price Intrinsic Value Price

----------------------------------------------------------------------------

TSX: DPM.WT.A Cdn.$5.10 Cdn.$4.92 4.2%

The independent members of the board of directors of the Company approved the

submission of the Warrant Amendment to Warrantholders and shareholders of the

Company for their approval at meetings scheduled to be held on May 9, 2013. In

connection with the proposed Warrant Amendment, the Company has engaged Dundee

Securities Ltd. ("Dundee Securities") and GMP Securities L.P. ("GMP") to act as

financial advisors (the "Financial Advisors") to the Company and the directors

of the Company in connection with the Exercise Price Reduction. GMP has provided

a fairness opinion to the board of directors indicating that the Exercise Price

Reduction is fair, from a financial point of view, to Warrantholders and

shareholders (in both cases excluding insiders of the Company).

The Warrant Amendment requires final approval of the TSX, approval by holders of

66 2/3% of the Warrants, voting in person or by proxy at the meeting of holders

of Warrants, and approval by a simple majority of those holders of Warrants that

are not insiders of the Company. The transaction also requires approval of a

simple majority of the votes cast by shareholders, excluding insiders, at the

meeting of shareholders.

The Underlying Shares to be issued upon exercise of the Warrants have not been

and will not be registered under the U.S. Securities Act of 1933, as amended

(the "U.S. Securities Act") or any state securities laws and may not be offered

or sold within the United States or to, or for the account or benefit of, U.S.

persons unless registered under the U.S. Securities Act and applicable state

securities laws or an exemption therefrom is available.

About DPM

Dundee Precious Metals Inc. is a Canadian based, international gold mining

company engaged in the acquisition, exploration, development, mining and

processing of precious metals. The Company's principal operating assets include

the Chelopech operation, which produces a gold, copper and silver concentrate,

located east of Sofia, Bulgaria; the Deno Gold operation, which produces gold,

copper, zinc and silver concentrate, located in southern Armenia; and the Tsumeb

smelter, a concentrate processing facility located in Namibia. DPM also holds

interests in a number of developing gold properties located in Bulgaria, Serbia,

and northern Canada, including interests held through its 53.1% owned

subsidiary, Avala Resources Ltd., its 47.3% interest in Dunav Resources Ltd. and

its 10.7% interest in Sabina Gold & Silver Corp.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" that involve a number of

risks and uncertainties. Forward-looking statements include, but are not limited

to, statements with respect to the Warrant Amendment, receipt of all necessary

approval thereof, future growth opportunities, the future price of gold and

silver, the estimation of mineral reserves and resources, the realization of

mineral estimates, the timing and amount of estimated future production and

output, costs of production, capital expenditures, costs and timing of the

development of new deposits, success of exploration activities, permitting time

lines, currency fluctuations, requirements for additional capital, government

regulation of mining operations, environmental risks, unanticipated reclamation

expenses, title disputes or claims, limitations on insurance coverage and timing

and possible outcome of pending litigation. Often, but not always,

forward-looking statements can be identified by the use of words such as

"plans", "expects", or "does not expect", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or

"believes", or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or "will" be taken,

occur or be achieved. Forward-looking statements are based on the opinions and

estimates of management as of the date such statements are made, and they

involve known and unknown risks, uncertainties and other factors which may cause

the actual results, performance or achievements of the Company to be materially

different from any other future results, performance or achievements expressed

or implied by the forward-looking statements. Such factors include, among

others: the uncertainties inherent to receiving all necessary approvals for the

Warrant Amendment, the availability of future growth opportunities, the actual

results of current exploration activities; actual results of current reclamation

activities; conclusions of economic evaluations; changes in project parameters

as plans continue to be refined; future prices of gold, copper, zinc and silver;

possible variations in ore grade or recovery rates; failure of plant, equipment

or processes to operate as anticipated; accidents, labour disputes and other

risks of the mining industry; delays in obtaining governmental approvals or

financing or in the completion of development or construction activities,

fluctuations in metal prices, as well as those risk factors discussed or

referred to in documents filed from time to time with the securities regulatory

authorities in all provinces and territories of Canada and available at

www.sedar.com.

Although the Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors that cause

actions, events or results not to be anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to be accurate,

as actual results and future events could differ materially from those

anticipated in such statements. Unless required by securities laws, the Company

undertakes no obligation to update forward-looking statements if circumstances

or management's estimates or opinions should change. Accordingly, readers are

cautioned not to place undue reliance on forward-looking statements.

This press release is not an offer of securities for sale in the United States.

The securities have not been and will not be registered under the U.S.

Securities Act of 1933. Securities may not be offered or sold in the United

States absent registration or an exemption from registration. Any public

offering of securities that may be made in the United States will be made by

means of a prospectus that may be obtained from the issuer and that will contain

detailed information about the Company and management, as well as financial

statements.

IF YOU HAVE ANY QUESTIONS OR REQUIRE ASSISTANCE CONCERNING THE

EARLY EXERCISE WARRANT TRANSACTION, PLEASE CONTACT:

Kingsdale Shareholder Services Inc.

North America Toll-Free Phone: 1-866-581-0512

Outside North America Call Collect: 416-867-2272

E-mail: contactus@kingsdaleshareholder.com

FOR FURTHER INFORMATION PLEASE CONTACT:

Dundee Precious Metals Inc.

Jonathan Goodman

President & Chief Executive Officer

(416) 365-2408

Dundee Precious Metals Inc.

Lori Beak

Senior Vice President, Investor & Regulatory Affairs and

Corporate Secretary

(416) 365-5165

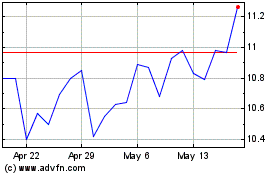

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

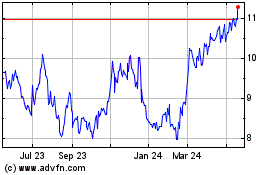

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024