(All monetary figures are expressed in U.S. dollars unless

otherwise stated)

Dundee Precious Metals announces strong first quarter

results

-- Strong operating performance at Chelopech and favourable market prices

delivered solid results

-- Expansion project at Chelopech is progressing well and remains on track

-- Exploration drilling continues to produce favourable results

-- Solid financial position with $168.9 million in cash

Dundee Precious Metals Inc. ("DPM" or the "Company")

(TSX:DPM)(TSX:DPM.WT)(TSX:DPM.WT.A) today reported 2012 first

quarter adjusted net earnings(1) of $31.3 million ($0.25 per share)

compared to $9.8 million ($0.08 per share) for the same period in

2011. Reported 2012 first quarter net earnings attributable to

common shareholders were $8.2 million ($0.07 per share) compared to

$14.0 million ($0.11 per share) for the same period in 2011.

The quarter over quarter increase in adjusted net earnings was

driven primarily by higher concentrate sales, higher volumes of

payable metals in concentrate sold, higher gold market prices and a

lower cash cost per tonne at Chelopech. These favourable variances

were partially offset by lower copper market prices, and higher

administrative and exploration expenses. Relative to the

corresponding period in 2011, average market prices for gold in the

first quarter of 2012 increased by 22% while average market prices

for copper decreased by 14%. Unrealized net losses of $23.1 million

($26.0 million before income taxes) reduced net earnings

attributable to common shareholders in the first quarter of 2012.

These losses were comprised of unrealized mark-to-market losses of

$16.3 million (Q1 2011 - $4.7 million losses) related to commodity

price hedges and unrealized mark-to-market losses in respect of the

Company's Sabina Gold & Silver Corp. ("Sabina") special

warrants of $9.7 million (Q1 2011 - $4.5 million gains).

"We delivered another quarter of strong results as we benefitted

from increased concentrate and metals production at Chelopech" said

Jonathan Goodman, the Company's President and CEO. "Despite lower

production and sales in the quarter, we still expect that Deno Gold

will meet its 2012 targets. Our expansion project at Chelopech is

progressing well and remains on track to be completed in the third

quarter. We are also making good progress on our planned Krumovgrad

gold project as well as our exploration programs at Deno Gold,

Avala and Dunav."

Adjusted EBITDA(1) for the first quarter of 2012 was $40.8

million compared to $19.2 million in the corresponding period in

2011. This increase was driven by the same factors affecting

adjusted net earnings.

Concentrate production for the first quarter of 2012 was 36,978

tonnes, representing a 93% increase relative to the corresponding

period in 2011. This increase reflects the ramp up of production at

Chelopech. In the first quarter of 2011, ore processed at Chelopech

was negatively impacted by the planned commissioning of the

semi-autogenous grinding mill and the upgraded flotation system.

Concentrate smelted at NCS in the first quarter of 2012 of 41,924

tonnes was 9% higher than the corresponding period in 2011 due

primarily to improved performance of the Ausmelt furnace.

Deliveries of concentrate in the first quarter of 2012 totalled

34,169 tonnes, representing a 44% increase relative to the

corresponding period in 2011 due to increased concentrate

production at Chelopech partially offset by the delay of a copper

shipment at Deno Gold. Relative to the first quarter of 2011,

payable gold in concentrate sold increased by 56% in the first

quarter of 2012, payable copper in concentrate sold increased by

55%, payable zinc in concentrate sold decreased by 24% and payable

silver in concentrate sold decreased by 15%. The increases in

payable gold and copper in concentrate sold were due primarily to

higher production, grades and recoveries at Chelopech.

Cash provided from operating activities, before changes in

non-cash working capital, during the first quarter of 2012 of $48.1

million was $26.2 million higher than the corresponding period in

2011 due primarily to higher volumes of payable metals in

concentrate sold and higher gold market prices.

Capital expenditures during the first quarter of 2012 of $25.8

million increased by 11% relative to the corresponding period in

2011 due primarily to increased construction activities in

connection with NCS' capital program to increase capacity and

improve environmental performance and operational efficiency.

As at March 31, 2012, DPM maintained a strong financial position

with consolidated cash and cash equivalents of $168.9 million and

investments valued at $79.6 million.

Exploration programs at and around the Company's existing mine

sites in Bulgaria and Armenia as well as in Serbia, through its

interests in Avala and Dunav, and in Nunavut, through its interest

in Sabina, are progressing well and continue to show potential to

add significant value to the Company over the longer term.

On April 30, 2012, the Namibian Minister of Environment and

Tourism ("Minister") issued a letter to the Company relating to the

operation of its Tsumeb smelter owned by NCS. "We are currently

assessing the implications of the Minister's directives and are not

able to provide definitive guidance at this time" said Jonathan

Goodman. "We are committed to completing the operational

improvements we identified when we acquired NCS and to working with

the Government to ensure the right steps are being taken to avoid

any unnecessary impacts." NCS is currently planning to advance the

30 day maintenance on the Ausmelt furnace to mid-May and is

evaluating its ability to advance the fugitive portion of Project

2012, currently scheduled to be completed by the end of the year.

In the event NCS production is curtailed by 50%, the Company

currently estimates the cost will be in the region of $2 million

per month. The Company is endeavoring to minimize the impacts on

NCS and its employees, however, temporary lay-offs may be

unavoidable. At this time, the Company does not expect Chelopech

production to be impacted and is working with NCS' customers and

suppliers to help mitigate the impact of the curtailment extending

to the end of the year. The Company remains optimistic that NCS'

production can be restored before year end and will provide further

updates when available.

(1) Adjusted earnings, adjusted basic earnings per share and

adjusted earnings before interest, taxes, depreciation and

amortization ("EBITDA") are not defined under generally accepted

accounting principles ("GAAP"). Presenting these measures from

period to period helps management and investors evaluate earnings

trends more readily in comparison with results from prior periods.

Refer to the Non-GAAP Measures section of management's discussion

and analysis for the three months ended March 31, 2012 (the

"MD&A") for further discussion of these items, including

reconciliations to applicable International Financial Reporting

Standards ("IFRS") measures.

Key Financial and Operational Highlights

----------------------------------------------------------------------------

$ millions, except where otherwise noted Three Months

---------------------

Ended March 31, 2012 2011

----------------------------------------------------------------------------

Revenue 100.0 68.4

Gross profit 48.2 22.0

Earnings before income taxes 4.3 15.7

Net earnings attributable to common shareholders 8.2 14.0

Basic earnings per share ($) 0.07 0.11

Adjusted EBITDA(1) 40.8 19.2

Adjusted net earnings(1) 31.3 9.8

Adjusted basic earnings per share ($)(1) 0.25 0.08

Cash provided from operating activities, before changes

in working capital 48.1 21.9

Copper and zinc concentrates produced (mt) 36,978 19,135

Metals in concentrate produced:

Gold (ounces) 41,910 19,585

Copper ('000s pounds) 12,234 5,782

Zinc ('000s pounds) 4,443 4,761

Silver (ounces) 187,526 157,666

NCS - concentrate smelted (mt) 41,924 38,532

Deliveries of concentrate (mt) 34,169 23,724

Payable metals in concentrate sold:

Gold (ounces) 33,585 21,582

Copper ('000s pounds) 10,413 6,724

Zinc ('000s pounds) 3,845 5,031

Silver (ounces) 114,399 135,136

Cash cost of sales per ounce of gold sold, net of by-

product credits ($)(1)

Chelopech (213) (54)

Deno Gold 703 247

Consolidated (110) 34

----------------------------------------------------------------------------

(1) Adjusted EBITDA; adjusted net earnings; adjusted basic earnings per

share; and cash cost of sales per ounce of gold sold, net of by-product

credits, are non-GAAP measures. Refer to the MD&A for reconciliations to

applicable IFRS measures.

DPM's first quarter reports, including its condensed interim

unaudited consolidated financial statements and MD&A for the

three months ended March 31, 2012, are posted on the Company's

website at www.dundeeprecious.com and have been filed on SEDAR at

www.sedar.com.

An analyst conference call to review these results is scheduled

for Wednesday, May 9, 2012 at 9:00 a.m. (E.S.T). The call will be

webcast live, audio only, at: http://www.gowebcasting.com/3302.

Listen only dial-in numbers are 416-340-8061 or North American Toll

Free at 1-866-225-0198. The audio webcast for this conference call

will be archived and available on the Company's website at

www.dundeeprecious.com.

Dundee Precious Metals Inc. is a well-financed, Canadian based,

international gold mining company engaged in the acquisition,

exploration, development, mining and processing of precious metals.

The Company's principal operating assets include the Chelopech

operation, which produces a gold, copper and silver concentrate,

located east of Sofia, Bulgaria; the Kapan operation, which

produces a gold, copper, zinc and silver concentrate, located in

southern Armenia; and the Tsumeb smelter, a concentrate processing

facility located in Namibia. DPM also holds interests in a number

of developing gold properties located in Bulgaria, Serbia, and

northern Canada, including interests held through its 51.4% owned

subsidiary, Avala Resources Ltd., its 47.3% interest in Dunav

Resources Ltd. ("Dunav") and its 11.5% interest in Sabina Gold

& Silver Corp.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" that

involve a number of risks and uncertainties. Forward-looking

statements include, but are not limited to, statements with respect

to the future price of gold, copper, zinc and silver, the

estimation of mineral reserves and resources, the realization of

mineral estimates, the timing and amount of estimated future

production and output, costs of production, capital expenditures,

costs and timing of the development of new deposits, success of

exploration activities, permitting time lines, currency

fluctuations, requirements for additional capital, government

regulation of mining operations, environmental risks, unanticipated

reclamation expenses, title disputes or claims, limitations on

insurance coverage and timing and possible outcome of pending

litigation. Often, but not always, forward-looking statements can

be identified by the use of words such as "plans", "expects", or

"does not expect", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "does not

anticipate", or "believes", or variations of such words and phrases

or state that certain actions, events or results "may", "could",

"would", "might" or "will" be taken, occur or be achieved.

Forward-looking statements are based on the opinions and

estimates of management as of the date such statements are made,

and they involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

other future results, performance or achievements expressed or

implied by the forward-looking statements. Such factors include,

among others: the actual results of current exploration activities;

actual results of current reclamation activities; conclusions of

economic evaluations; changes in project parameters as plans

continue to be refined; future prices of gold, copper, zinc and

silver; possible variations in ore grade or recovery rates; failure

of plant, equipment or processes to operate as anticipated;

accidents, labour disputes and other risks of the mining industry;

delays in obtaining governmental approvals or financing or in the

completion of development or construction activities, fluctuations

in metal prices, as well as those risk factors discussed or

referred to in Management's Discussion and Analysis under the

heading "Risks and Uncertainties" and other documents filed from

time to time with the securities regulatory authorities in all

provinces and territories of Canada and available at www.sedar.com.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Unless

required by securities laws, the Company undertakes no obligation

to update forward-looking statements if circumstances or

management's estimates or opinions should change. Accordingly,

readers are cautioned not to place undue reliance on

forward-looking statements.

Contacts: Dundee Precious Metals Inc. Jonathan Goodman President

and Chief Executive Officer (416)

365-2408jgoodman@dundeeprecious.com Dundee Precious Metals Inc.

Hume Kyle Executive Vice President and Chief Financial Officer

(416) 365-5091hkyle@dundeeprecious.com Dundee Precious Metals Inc.

Lori Beak Senior Vice President, Investor & Regulatory Affairs

and Corporate Secretary (416) 365-5165lbeak@dundeeprecious.com

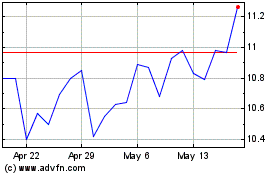

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

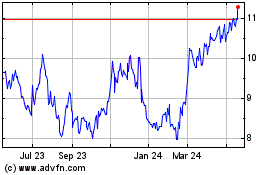

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024