(All monetary figures are expressed in U.S. dollars unless otherwise stated)

Dundee Precious Metals Inc. ("DPM" or the "Company")

(TSX:DPM)(TSX:DPM.WT)(TSX:DPM.WT.A) today reported third quarter 2011 net

earnings attributable to common shareholders of $40.3 million ($0.32 per share)

compared to $35.6 million ($0.28 per share) for the same period in 2010.

Adjusted net earnings(1) in the third quarter of 2011 were $32.4 million ($0.26

per share) compared to $14.8 million ($0.12 per share) for the same period in

2010.

The quarter over quarter increase in adjusted net earnings was driven by

stronger metal prices and higher concentrate sales. Higher metal pricing was led

by gold and copper, which increased by 39% and 24%, respectively, compared with

the third quarter of 2010. The increase in concentrate sales reflects increased

production at Chelopech following the commissioning of the semi-autogenous

grinding ("SAG") mill in the first quarter of 2011 and at Deno Gold following

the completion of the mine and mill expansion in the fourth quarter of 2010.

Unrealized net gains of $7.9 million ($9.3 million before income taxes) added to

reported net earnings attributable to common shareholders during the quarter.

These gains were comprised of unrealized mark-to-market gains of $46.9 million

(2010 - $nil) related to copper hedges entered into earlier this year, partially

offset by unrealized mark-to-market losses in respect of the Company's Sabina

Gold & Silver Corp. ("Sabina") special warrants of $37.6 million (2010 - $24.1

million gain).

For the first nine months of 2011, adjusted net earnings increased to $48.2

million compared with $15.9 million in the corresponding period in 2010. This

increase was due primarily to favourable metal prices and higher concentrate

sales. Relative to the first nine months of 2010, quoted prices for gold

increased by 30%, copper increased by 29% and silver prices doubled while

concentrate sales increased by 28%. Net earnings attributable to common

shareholders of $63.4 million ($0.51 per share) compared to $1.5 million ($0.01

per share) in the corresponding period in 2010 were also impacted by several

items, including unrealized gains on copper hedges of $42.5 million (2010 -

$nil), unrealized losses related to the Company's Sabina special warrants of

$30.8 million (2010 - $38.1 million gain), and an impairment charge of $50.6

million taken in 2010 against the planned construction of a metals processing

facility.

"We fully expect production to continue to increase over the balance of the year

and the first half of 2012 as Chelopech and NCS finish their expansion projects"

said Jonathan Goodman, the Company's President and CEO. "This increasing

production, combined with strong metal pricing, delivered record cash flow and

earnings this quarter and further strengthened our financial position. Today,

with our operating cash flow and significant cash position, we are well

positioned to fund our current capital expansion programs, exploration drilling

activities and our planned Krumovgrad gold project, which continues to advance

through the approval process."

Adjusted EBITDA(1) in the third quarter and first nine months of 2011 was $46.7

million and $80.5 million, respectively, compared to $16.7 million and $29.7

million in the corresponding periods in 2010. These increases were driven by the

same factors affecting adjusted net earnings.

Concentrate production for the three and nine months ended September 30, 2011

was 34,704 tonnes and 82,102 tonnes, respectively, representing a 41% and 19%

increase relative to the corresponding periods in 2010. These increases reflect

the ramp up of production at Chelopech and higher Deno Gold production as a

result of the mine and mill expansion completed in the fourth quarter of 2010.

In the third quarter of 2011, Deno mine production was lower than anticipated

due to disruptions in equipment availability and a greater proportion of ore

mined coming from development ore instead of production ore which resulted in

higher dilution and lower grades. This was partially offset by processing higher

volumes of oxidized ore through the mill but resulted in lower recoveries.

Deliveries of concentrates for the three and nine months ended September 30,

2011 were 38,142 tonnes and 86,925 tonnes, respectively, representing a 47% and

28% increase relative to the corresponding periods in 2010 due to increased

production. Relative to the third quarter of 2010, payable gold in concentrate

sold increased by 58%, payable copper in concentrate sold increased by 51% and

payable silver in concentrate sold increased by 37%. Payable zinc in concentrate

sold decreased by 6% due to lower grades and recoveries. Relative to the first

nine months of 2010, payable gold in concentrate sold increased by 31%, payable

copper in concentrate sold increased by 25%, payable zinc in concentrate sold

increased by 39% and payable silver in concentrate sold increased by 49%.

Cash provided from operating activities before changes in non-cash working

capital during the third quarter and first nine months of 2011 of $42.4 million

and $81.3 million, respectively, was $21.9 million and $44.9 million higher than

the corresponding periods in 2010 due primarily to stronger metal prices and

higher payable metals in concentrate sold.

Capital expenditures during the third quarter and first nine months of 2011 of

$38.6 million and $87.4 million increased by 64% and 66%, respectively, over the

corresponding periods in 2010 due to the mine and mill expansion project at

Chelopech and the expansion and environmental capital being incurred at NCS to

increase its capacity and efficiency.

As at September 30, 2011, DPM maintained a strong financial position with

consolidated cash and cash equivalents of $159.3 million and investments valued

at $81.3 million.

On September 1, 2011, Dunav (previously Queensland Minerals Ltd.) exercised its

option agreement with DPM, wherein DPM received, amongst other consideration, a

47.5% ownership interest in Dunav in exchange for DPM's remaining Serbian

properties, namely its Surdulica molybdenum, Tulare copper and gold and other

early stage projects in Serbia directly held by Dundee Moly Company d.o.o. As a

result, DPM now holds 47,257,922 common shares and 36,790,009 warrants to

purchase common shares of Dunav at a unit price of $0.40 (Cdn$0.42) which are

exercisable for a period of 24 months from issuance, subject to acceleration

under certain circumstances.

Exploration programs at and around the Company's existing mine sites in Bulgaria

and Armenia as well as in Serbia, through its interests in Avala and Dunav, and

Nunavut, through Sabina, are progressing well and continue to show potential to

add significant value to the Company over the longer term.

(1) Adjusted earnings, adjusted basic earnings per share and adjusted earnings

before interest, taxes, depreciation and amortization ("EBITDA") are not defined

under International Financial Reporting Standards ("IFRS"). Presenting these

measures from period to period helps management and investors evaluate earnings

trends more readily in comparison with results from prior periods. Refer to the

Non-IFRS Measures section of management's discussion and analysis for the three

and nine months ended September 30, 2011 (the "MD&A") for further discussion of

these items, including reconciliations to net earnings attributable to common

shareholders.

Key Financial and Operational Highlights

----------------------------------------------------------------------------

$ millions, except where noted Three Months Nine Months

Ended September 30, 2011 2010 2011 2010

----------------------------------------------------------------------------

Revenue 112.5 59.1 250.0 140.5

Gross profit 51.7 17.8 93.7 35.0

Net earnings attributable to

common shareholders 40.3 35.6 63.4 1.5

Basic earnings per share 0.32 0.28 0.51 0.01

Adjusted EBITDA(1) 46.7 16.7 80.5 29.7

Adjusted net earnings(1) 32.4 14.8 48.2 15.9

Adjusted basic earnings per

share(1) 0.26 0.12 0.39 0.14

Cash flow from operations,

before changes in working

capital 42.4 20.5 81.3 36.4

Concentrate produced (mt) 34,704 24,583 82,102 68,807

Metals in concentrate produced:

Gold (ounces) 32,221 22,032 79,713 67,698

Copper ('000s pounds) 11,140 7,831 25,866 22,023

Zinc ('000s pounds) 4,692 4,850 14,455 12,710

Silver (ounces) 152,865 176,071 492,949 437,293

NCS - concentrate smelted (mt) 55,009 36,041 132,815 81,922

Deliveries of concentrates (mt) 38,142 26,029 86,925 67,811

Payable metals in concentrate

sold:

Gold (ounces) 34,125 21,648 78,592 59,883

Copper ('000s pounds) 11,410 7,577 25,514 20,459

Zinc ('000s pounds) 4,918 5,222 14,072 10,138

Silver (ounces) 198,894 145,019 478,660 320,179

Cash cost of sales per ounce of

gold sold, net of by-

product credits(1)

Chelopech (34) 47 (3) 292

Deno Gold 106 478 119 441

Consolidated 3 192 31 329

----------------------------------------------------------------------------

(1) Adjusted EBITDA; adjusted net earnings; adjusted basic earnings per

share; and cash cost of sales per ounce of gold sold, net of by-product

credits are not defined measures under IFRS. Refer to the MD&A for

reconciliations to IFRS measures.

DPM's third quarter reports, including its condensed interim unaudited

consolidated financial statements and MD&A for the three and nine months ended

September 30, 2011, are posted on the Company's website at

www.dundeeprecious.com and have been filed on Sedar at www.sedar.com.

An analyst conference call to discuss these results is scheduled for Thursday,

November 3, 2011, at 9:00 a.m. (EST). The call will be webcast live (audio only)

at: http://www.gowebcasting.com/2882. Listen only telephone option at

416-340-2218 or North America Toll Free at 1-866-226-1793. Replay available at

905-694-9451 or North America Toll Free at 1-800-408-3053, passcode 3547687. The

audio webcast for this conference call will be archived and available on the

Company's website at www.dundeeprecious.com.

Dundee Precious Metals Inc. is a well-financed, Canadian based, international

gold mining company engaged in the acquisition, exploration, development, mining

and processing of precious metals. The Company's principal operating assets

include the Chelopech operation, which produces a gold, copper and silver

concentrate, located east of Sofia, Bulgaria; the Kapan operation, which

produces a gold, copper, zinc and silver concentrate, located in southern

Armenia; and the Tsumeb smelter, a concentrate processing facility located in

Namibia. DPM also holds interests in a number of developing gold properties

located in Bulgaria, Serbia, and northern Canada, including interests held

through its 51.4% owned subsidiary, Avala Resources Ltd., its 47.7% interest in

Dunav Resources Ltd. ("Dunav") and its 11.6% interest in Sabina Gold & Silver

Corp.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" that involve a number

of risks and uncertainties. Forward-looking statements include, but are not

limited to, statements with respect to the future price of gold, copper, zinc

and silver, the estimation of mineral reserves and resources, the realization of

mineral estimates, the timing and amount of estimated future production and

output, costs of production, capital expenditures, costs and timing of the

development of new deposits, success of exploration activities, permitting time

lines, currency fluctuations, requirements for additional capital, government

regulation of mining operations, environmental risks, unanticipated reclamation

expenses, title disputes or claims, limitations on insurance coverage and timing

and possible outcome of pending litigation. Often, but not always,

forward-looking statements can be identified by the use of words such as

"plans", "expects", or "does not expect", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or

"believes", or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or "will" be taken,

occur or be achieved. Forward-looking statements are based on the opinions and

estimates of management as of the date such statements are made, and they

involve known and unknown risks, uncertainties and other factors which may cause

the actual results, performance or achievements of the Company to be materially

different from any other future results, performance or achievements expressed

or implied by the forward-looking statements. Such factors include, among

others: the actual results of current exploration activities; actual results of

current reclamation activities; conclusions of economic evaluations; changes in

project parameters as plans continue to be refined; future prices of gold,

copper, zinc and silver; possible variations in ore grade or recovery rates;

failure of plant, equipment or processes to operate as anticipated; accidents,

labour disputes and other risks of the mining industry; delays in obtaining

governmental approvals or financing or in the completion of development or

construction activities, fluctuations in metal prices, as well as those risk

factors discussed or referred to in Management's Discussion and Analysis under

the heading "Risks and Uncertainties" and other documents filed from time to

time with the securities regulatory authorities in all provinces and territories

of Canada and available at www.sedar.com.

Although the Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors that cause

actions, events or results not to be anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to be accurate,

as actual results and future events could differ materially from those

anticipated in such statements. Unless required by securities laws, the Company

undertakes no obligation to update forward-looking statements if circumstances

or management's estimates or opinions should change. Accordingly, readers are

cautioned not to place undue reliance on forward-looking statements.

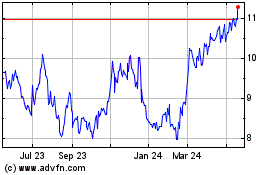

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

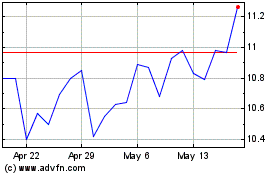

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024