(All monetary figures are expressed in Canadian Dollars unless otherwise stated)

Dundee Precious Metals Inc. ("DPM" or the "Company")

(TSX:DPM)(TSX:DPM.WT)(TSX:DPM.WT.A) today announced its unaudited results for

the third quarter ended September 30, 2009. DPM reported third quarter net

earnings of $4.1 million (basic and diluted net earnings per share of $0.04).

This compares with third quarter 2008 net earnings of $6.5 million (basic and

diluted net earnings per share of $0.11).

"I am very pleased to report our third quarter 2009 results, noted Jonathan

Goodman, President and CEO of DPM. At Chelopech, we continue to experience

steady and consistent operating performance - contributing to solid financial

gains. The Chelopech mine and mill expansion plans are now finalized and

construction has begun with completion expected in the second quarter of 2011.

Operational and productivity improvements at Deno Gold translated into positive

gross profit from mining operations - a recent first for this facility."

The following table summarizes the Company's financial and operating results for

the periods indicated:

----------------------------------------------------------------------------

$ millions, except per share amounts

Ended September 30, Three Months Nine Months

----------------- -----------------

2009 2008 2009 2008

----------------------------------------------------------------------------

Net Revenue $ 50.3 $ 16.7 $ 110.0 $ 89.2

Cost of Sales 31.5 23.8 78.1 74.5

------------------------------------------------ -------- -------- --------

Gross Profit (Loss) from Mining

Operations 18.8 (7.1) 31.9 14.7

------------------------------------------------ -------- -------- --------

Investment and Other Income (Expense) (3.7) 27.9 (3.5) 28.9

Net Earnings 4.1 6.5 1.3 0.8

Basic Net Earnings Per Share $ 0.04 $ 0.11 $ 0.01 $ 0.01

Diluted Net Earnings Per Share $ 0.04 $ 0.11 $ 0.01 $ 0.01

Net Cash Provided By (Used in) Operating

Activities 11.7 (10.4) (3.3) 3.9

Capital Expenditures (9.8) (19.3) (25.9) (66.7)

Proceeds on Sale (Purchase) of Short-term

Investments (15.1) - 14.0 -

Proceeds on Sale of Exploration Property - - 7.0 -

Other Investing Activities (1.8) 41.0 (4.2) 61.0

Financing Activities (1.0) 15.2 (3.6) 13.3

------------------------------------------------ -------- -------- --------

Net Increase (Decrease) in Cash $ (16.0) $ 26.5 $ (16.0) $ 11.5

------------------------------------------------ -------- -------- --------

Concentrate Produced (mt)

Chelopech 20,816 13,567 56,023 39,738

Deno Gold 2,972 4,608 6,145 9,197

Cash Cost per tonne Ore Processed

(US$/t)(1)

Chelopech (excluding royalties) $ 59.31 $ 60.69 $ 51.98 $ 60.39

Deno Gold $ 78.31 $ 110.75 $ 72.43 $ 109.62

------------------------------------------------ -------- -------- --------

Third Quarter 2009 - Financial Highlights

Net earnings in the third quarter of 2009 were $4.1 million compared to

net earnings of $6.5 million in the corresponding prior year period. The

decrease in net earnings, period over period, was primarily due to lower

investment and other income partially offset by higher gross profit from

mining operations and reductions in exploration and administrative

expenses. The increase in gross profit from mining operations, period

over period, was primarily due to higher deliveries of concentrates

produced at Chelopech and Deno Gold, lower production costs at Deno Gold

and Chelopech, and a 10% increase in gold price. These positive

variances were partially offset by a 24% decrease in copper price in the

third quarter of 2009 relative to the corresponding prior year period.

Included in the third quarter of 2008 results was a gain of $27.2

million on the sale of the Company's holdings in Eldorado Gold

Corporation.

Chelopech recorded a gross profit from mining operations of $17.5

million in the third quarter of 2009 compared to a gross loss from

mining operations of $1.5 million in the third quarter of 2008.

Chelopech operations reported net revenue of $41.9 million on

corresponding concentrate deliveries of 23,493 tonnes. Chelopech cash

cost per tonne of ore processed(1), excluding royalties, in the period

was 2% lower than the corresponding prior year period due to the

favourable impact of a 5% devaluation of the average Euro to U.S.

foreign exchange rate, lower input cost for backfill as the slurry

needed for the backfill in the period was produced on site whereas, in

the third quarter of 2008, it was purchased from a third party and

reduced spending on services as a result of cost savings initiatives.

These positive variances were partially offset by higher maintenance

costs resulting from planned maintenance on mobile equipment and the

planned maintenance shutdown at the mill and higher employment expenses.

Cash cost per tonne of ore processed(1), including royalties, in the

third quarter of 2009 of US$62.41 was 3% lower than the third quarter of

2008 cash cost per tonne of ore processed(1), including royalties, of

US$64.52.

Deno Gold recorded a gross profit from mining operations of $1.3 million

in the third quarter of 2009 compared to a gross loss from mining

operations of $5.6 million in the corresponding prior year period.

Continued operating improvements at Deno Gold during the quarter,

including reductions in headcount and external contractors and tighter

inventory and cost controls, and a 23% devaluation of the Armenian dram

to U.S. dollar exchange rate contributed to a 29%, period over period,

reduction in cash cost per tonne of ore processed(1), to US$78.31.

Deliveries of concentrate in the period of 4,510 tonnes were 153% higher

than the corresponding prior year period due to a drawdown of

concentrate inventory. It is currently anticipated that the positive

performance will continue into the future given improved operating

processes and controls, particularly in the areas of mine dilution and

productivity.

Net cash provided by operating activities was $11.7 million in the third

quarter of 2009 compared to cash used in operating activities of $10.4

million in the corresponding prior year period. The increase in cash

provided by operating activities was primarily due to higher gross

profit from mining operations.

As at September 30, 2009, DPM had cash, cash equivalents and short-term

investments of $74.0 million compared to $104.0 million at December 31,

2008.

Significant Items

A comprehensive review of the mine and mill expansion plans at Chelopech

resulted in certain scope changes being made to optimize the planned

investment. Such changes include the installation of an underground

crushing and conveying system in lieu of a shaft upgrade to facilitate

the increase in mine output to two million tonnes of ore per year. The

scope changes increased total expansion capital by US$42.5 million and

decreased projected unit operating cost by US$6 per tonne (US$12.0

million per year). The estimated capital cost to complete the mine and

mill expansion project, including the installation of an underground

crushing and conveying system but excluding capital spending required to

complete the metals processing facility ("MPF"), special projects

associated with on-going operations and sustaining capital, is US$102.0

million. This amount includes approximately US$19.0 million that is

forecast to be spent in the year 2009. Completion of the mine and mill

expansion is planned for the second quarter of 2011. Following

commissioning, unit operating cost for the expanded facility is expected

to decrease to approximately US$34 per tonne of ore processed.

In September 2009, the Bulgarian Ministry of Environment and Waters

("MoEW") issued the Integrated Pollution Prevention and Control ("IPPC")

permit for the MPF to be constructed in Chelopech, Bulgaria. The IPPC

and the Seveso (working with hazardous substances) permits are

prerequisites for the issuance of the MPF construction permit. The

application for the Seveso permit has been made. The MPF incorporates

pressure oxidation, solvent extraction and electrowinning and carbon in

leach cyanidation to treat the Chelopech copper/gold concentrates and

produce copper cathode and gold dore.

Following DPM's announcement on July 31, 2009 regarding the subscription

of shares of Weatherly International plc ("WTI"), the Company purchased

40.5 million ordinary shares of WTI for US$2.0 million ($2.2 million)

representing approximately 9.1% of WTI issued and outstanding shares. If

required by WTI on or before July 31, 2010, the Company will subscribe

for up to an additional US$5.0 million worth of WTI ordinary shares

based on the then prevailing market price but in no event, except in

certain circumstances, less than GBP0.03 per share. The Company also

completed an agreement with WTI's subsidiary, Namibia Custom Smelters

(Pty) Limited ("NCS"), to extend the Chelopech concentrate purchase and

sales contract to and including the year 2020.

In September 2009, the MoEW issued a Commercial Discovery Certificate

(the "Certificate") for the Krumovgrad gold deposit to DPM's Bulgarian

subsidiary, Balkan Mineral and Mining EAD. The Certificate is the final

requirement for conversion of the property to a mining concession, the

application for which has already been filed with the Bulgarian

government.

The Company continues to evaluate value enhancing strategic

opportunities available to it in respect of its Serbian assets. As part

of a limited program undertaken during the third quarter of 2009 to

delineate several key anomalies, drilling on the western margin of the

Timok Magmatic Complex in Serbia has confirmed two gold discoveries with

bulk tonnage potential.

A complete set of DPM's Consolidated Financial Statements, Notes to the

Consolidated Financial Statements and Management's Discussion and Analysis for

the third quarter ended September 30, 2009 will be posted on the Company's

website at www.dundeeprecious.com and will be filed on Sedar at www.sedar.com.

Conference Call

DPM will be holding an analyst call to present its Third Quarter 2009 Financial

Results on Thursday, November 5, 2009 at 8.30 a.m. (EST).

The call will be webcast live (audio only) at:

http://events.digitalmedia.telus.com/dundee/110509/index.php.

The audio webcast for this conference call will be archived and available on the

Company's website at www.dundeeprecious.com.

Overview

DPM is a Canadian-based, international mining company engaged in the

acquisition, exploration, development and mining of precious metal properties.

Its common shares and share purchase warrants (symbols: DPM; DPM.WT; DPM.WT.A)

are traded on the Toronto Stock Exchange ("TSX"). DPM's business objectives are

to identify, acquire, finance, develop and operate low-cost, long-life mining

properties.

The Company's operating interests include its 100% ownership of Chelopech Mining

EAD ("Chelopech"), a gold, copper, silver concentrates producer, owner of the

Chelopech mine located approximately 70 kilometres east of Sofia, Bulgaria, and

a 95% interest in Vatrin Investment Limited ("Vatrin"), a private entity which

holds 100% of Deno Gold Mining Company CJSC ("Deno Gold"), its principal asset

being the Kapan mine, a gold, copper, zinc, silver concentrates producer located

about 320 kilometres south east of the capital city of Yerevan in Southern

Armenia. DPM's interests also include a 100% interest in the Krumovgrad

development stage gold property located in south eastern Bulgaria, near the town

of Krumovgrad, and numerous exploration properties in one of the larger

gold-copper-silver mining regions in Serbia.

Summarized Financial Results

Net revenue

Net revenue from the sale of concentrates of $50.3 million in the third quarter

of 2009 was $33.6 million higher than the corresponding prior year period net

revenue due to a significant increase in deliveries of concentrates produced at

Chelopech and Deno Gold, net favourable mark-to-market adjustments, a 10%

increase in gold price and the favourable impact of a weaker Canadian to U.S.

dollar exchange rate partially offset by a 24% decrease in copper price. The

weakening of the Canadian dollar relative to the U.S. dollar, period over

period, increased revenue by $3.9 million in the period.

Deliveries of concentrates produced at Chelopech of 23,493 tonnes in the third

quarter of 2009 were 126% higher than third quarter of 2008 deliveries of 10,376

tonnes. Deliveries of concentrates produced at Deno Gold of 4,510 tonnes in the

third quarter of 2009 were 153% higher than third quarter of 2008 deliveries of

1,785 tonnes. Net favourable mark-to-market adjustments and final settlements of

$1.5 million, related to the open positions of provisionally priced concentrate

sales, were recorded in the third quarter of 2009 compared to net unfavourable

mark-to-market adjustments and final settlements of $4.4 million in the third

quarter of 2008. In the third quarter of 2009, DPM recorded realized losses on

its copper derivatives of $0.4 million and unrealized gains of $0.03 million.

The copper derivative contracts were entered into to mitigate substantially all

the copper price exposure and associated earnings volatility the Company is

exposed to as a result of the time lag between the receipt of provisional sales

revenue of concentrate deliveries and its specified final pricing period.

Net revenue from the sale of concentrates of $110.0 million in the first nine

months of 2009 was $20.8 million or 23% higher than the corresponding prior year

period due primarily to a 34% increase in deliveries, net favourable

mark-to-market adjustments, the favourable impact of a weaker Canadian to U.S.

dollar exchange rate and a 4% increase in gold price partially offset by a 42%

decrease in copper price. The weakening of the Canadian dollar relative to the

U.S. dollar, period over period, increased revenue by $13.6 million in 2009.

Deliveries of concentrates produced at Chelopech of 57,751 tonnes in the first

nine months of 2009 were 42% higher than the corresponding prior year period

deliveries of 40,796 tonnes due to increased production in 2009. Deliveries of

concentrates produced at Deno Gold of 5,415 tonnes in the first nine months of

2009 were 13% lower than the corresponding prior year period deliveries of 6,249

tonnes. Deno Gold was on care and maintenance in the first quarter of 2009. Net

favourable mark-to-market adjustments and final settlements of $7.4 million,

related to the open positions of provisionally priced concentrate sales, were

recorded in the first nine months of 2009 compared to net unfavourable

mark-to-market adjustments and final settlements of $3.1 million recorded in the

corresponding prior year period. In the first nine months of 2009, DPM recorded

realized losses on its copper derivatives of $4.5 million and unrealized gains

of $0.03 million.

The average London Bullion gold price(2) in the third quarter of 2009 of US$960

per ounce was 10% higher than the third quarter of 2008 average price of US$869

per ounce. The average London Metal Exchange ("LME") cash copper price(2) in the

third quarter of 2009 of US$2.66 per pound was 24% lower than the third quarter

of 2008 average price of US$3.48 per pound. The average LME cash zinc price(2)

in the third quarter of 2009 of US$0.80 per pound was comparable to the third

quarter of 2008 average price of US$0.80 per pound.

The average London Bullion gold price(2) in the first nine months of 2009 of

US$930 per ounce was 4% higher than the corresponding prior year period average

price of US$898 per ounce. The average LME cash copper price(2) in the first

nine months of 2009 of US$2.11 per pound was 42% lower than the corresponding

prior year period average price of US$3.62 per pound. The average LME cash zinc

price(2) in the first nine months of 2009 of US$0.67 per pound was 30% lower

than the first nine months of 2008 average price of US$0.96 per pound.

Cost of sales

Cost of sales of $31.5 million in the third quarter of 2009 was $7.7 million or

32% higher than the corresponding prior year period due to a significant

increase in deliveries and the unfavourable impact of a weaker Canadian dollar

to U.S. dollar exchange rate partially offset by lower production costs at Deno

Gold and Chelopech. Deliveries of concentrates produced at Chelopech and Deno

Gold totalled 28,003 tonnes compared to 12,161 tonnes in the corresponding prior

year period. A weaker Canadian dollar to U.S. dollar exchange rate in the third

quarter of 2009, compared to the corresponding prior year period, increased cost

of sales by $2.7 million in the period.

Cost of sales of $78.1 million in the first nine months of 2009 was $3.6 million

or 5% higher than the corresponding prior year period due primarily to higher

deliveries of concentrates produced at Chelopech and the unfavourable impact of

a weaker Canadian to U.S. dollar exchange rate partially offset by lower

production costs at Chelopech and Deno Gold. A weaker Canadian dollar to U.S.

dollar exchange rate in the first nine months of 2009, compared to the

corresponding prior year period, increased cost of sales by $9.4 million in

2009.

Cash cost per tonne of ore processed(1), excluding royalties, at Chelopech in

the third quarter of 2009 of US$59.31 was 2% lower than the corresponding prior

year period cash cost per tonne of ore processed(1), excluding royalties, of

US$60.69 due to the favourable impact of a 5% devaluation of the average Euro to

U.S. foreign exchange rate, lower input cost for backfill as the slurry needed

for the backfill in the period was produced on site whereas, in the third

quarter of 2008, it was purchased from a third party and reduced spending on

services as a result of cost savings initiatives. These positive variances were

partially offset by higher maintenance costs resulting from planned maintenance

on mobile equipment and the planned maintenance shutdown at the mill and higher

employment expenses. Cash cost per tonne of ore processed(1), including

royalties, in the third quarter of 2009 of US$62.41 was 3% lower than third

quarter of 2008 cash cost per tonne of ore processed(1), including royalties, of

US$64.52.

Cash cost per tonne of ore processed(1), excluding royalties, at Chelopech in

the first nine months of 2009 of US$51.98 was 14% lower than the corresponding

prior year period cash cost per tonne of ore processed(1), excluding royalties,

of US$60.39 due to the favourable impact of a weaker Euro relative to the U.S.

dollar, higher volumes of material processed and reduced spending on services

partially offset by higher spending on backfill due to higher volumes of

backfill placed in stopes. Cash cost per tonne of ore processed(1), including

royalties, in the first nine months of 2009 of US$57.56 was 10% lower than first

nine months of 2008 cash cost per tonne of ore processed(1), including

royalties, of US$63.88.

Cash cost per tonne of ore processed(1) at Deno Gold in the third quarter and

first nine months of 2009 of US$78.31 and US$72.43 were, respectively, 29% and

34% lower than the corresponding prior year periods due to the favourable impact

of a weaker Armenian dram relative to the U.S. dollar, improved operating

performance, tighter inventory and cost controls and reductions in headcount and

external contractors.

Gross profit (loss)

Chelopech recorded a gross profit from mining operations of $17.5 million in the

third quarter of 2009 compared to a gross loss from mining operations of $1.5

million in the third quarter of 2008. The increase in gross profit from mining

operations, period over period, of $19.0 million was due to a 126% increase in

deliveries of concentrates, higher gold and copper contained in concentrate

produced due to higher metal grades and recovery rates, lower production costs

and a 10% increase in gold price partially offset by a 24% decrease in copper

price. Net favourable mark-to-market adjustments and final settlements of $0.6

million, related to the open positions of provisionally priced concentrate

sales, were recorded in the third quarter of 2009 compared to net unfavourable

mark-to-market adjustments and final settlements of $2.9 million in the third

quarter of 2008. Net losses of $0.4 million related to the copper derivatives

were recorded in the third quarter of 2009.

Chelopech recorded a gross profit from mining operations of $36.7 million in the

first nine months of 2009 compared to a gross profit from mining operations of

$28.1 million in the corresponding prior year period. The increase in gross

profit from mining operations, period over period, of $8.6 million was due to a

42% increase in deliveries, higher gold and copper contained in concentrate

produced due to higher metal grades and recovery rates, lower production costs

and a 4% increase in gold price partially offset by a 42% decrease in copper

price. Net favourable mark-to-market adjustments and final settlements of $6.9

million, related to the open positions of provisionally priced concentrate

sales, were recorded in the first nine months of 2009 compared to net

unfavourable mark-to-market adjustments and final settlements of $1.7 million in

the first nine months of 2008. Offsetting the net favourable mark-to-market

adjustments and final settlements recorded in the first nine months of 2009 were

net losses related to the copper derivatives of $4.5 million.

Deno Gold recorded a gross profit from mining operations of $1.3 million in the

third quarter of 2009 compared to a gross loss from mining operations of $5.6

million in the corresponding prior year period due to a 153% increase in

deliveries and lower production costs. Net favourable mark-to-market adjustments

and final settlements of $0.9 million, related to the open positions of

provisionally priced concentrate sales, were recorded in the third quarter of

2009 compared to net unfavourable mark-to-market adjustments and final

settlements of $1.5 million in the third quarter of 2008.

Deno Gold recorded a gross loss from mining operations of $4.7 million in the

first nine months of 2009 compared to a gross loss from mining operations of

$13.5 million in the first nine months of 2008. The operations were on care and

maintenance in the first quarter of 2009. Net favourable mark-to-market

adjustments and final settlements of $0.5 million, related to the open positions

of provisionally priced concentrate sales, were recorded in the first nine

months of 2009 compared to net unfavourable adjustments and final settlements of

$1.4 million in the corresponding prior year period.

Investment and other income (expense)

Investment and other expense were $3.7 million and $3.5 million in the third

quarter and first nine months of 2009, respectively, compared to investment and

other income of $27.9 million and $28.9 million in the corresponding prior year

periods. Scope changes following a comprehensive review of the Chelopech mine

and mill expansion project resulted in a write-down of fixed assets of $4.1

million (US$3.5 million) in the third quarter of 2009. Included in the third

quarter of 2008 results was a gain of $27.2 million on the sale of the Company's

holdings in Eldorado Gold Corporation.

Administrative and other expenses

Administrative and other expenses were $4.6 million and $12.6 million in the

third quarter and first nine months of 2009, respectively, compared to $5.5

million and $15.5 million in the corresponding prior year periods. The decrease

in both periods was primarily due to lower employment costs and associated

expenses and lower spending on outside services as a result of the cost savings

initiatives introduced in the first quarter of 2009 partially offset by a

provision for royalties and other taxes.

Exploration expense

Exploration expense was $1.3 million and $4.1 million in the third quarter and

first nine months of 2009 compared to $7.5 million and $21.5 million in the

corresponding prior year periods, respectively, due to a decrease in the level

of exploration activities in Serbia following the suspension of activities in

the fourth quarter of 2008.

Foreign exchange

Monetary assets and liabilities denominated in foreign currencies are translated

into Canadian dollars at the period end exchange rates, whereas non-monetary

assets and liabilities and related expenses denominated in foreign currencies

are translated at the exchange rate in effect at the transaction date. Income

and expense items are translated at the exchange rate in effect on the date of

the transaction. Exchange gains and losses resulting from the translation of

these amounts are included in the consolidated statement of earnings. In the

third quarter and first nine months of 2009, DPM recorded foreign exchange

losses of $1.5 million and $4.5 million, respectively, compared with foreign

exchange losses of $0.9 million and $1.6 million in the corresponding prior year

periods.

Income tax expense

DPM's effective tax rate of 27% for the third quarter of 2009 was lower than the

statutory rate of 33.0% due primarily to an increase in the benefit of profits

earned in jurisdictions having a lower tax rate.

DPM's effective tax rate of 48% for the first nine months of 2009 was higher

than the statutory rate of 33.0% due primarily to an increase in the valuation

allowance on investments and property and the unrecognized tax benefit relating

to foreign losses partially offset by the benefit of profits earned in

jurisdictions having a lower tax rate and the reversal of the flow-through

shares liability of $6.0 million, which was recognized as a recovery following

the sale of the Back River project.

Operating cash flow (shortfall)

The following table summarizes the Company's cash flow (shortfall) from

operating activities for the periods indicated:

----------------------------------------------------------------------------

$ thousands

Ended September 30, Three Months Nine Months

------------------- -------------------

2009 2008 2009 2008

-------------------------------------------- --------- ---------- ---------

Net earnings $ 4,101 $ 6,537 $ 1,317 $ 847

Non-cash charges (credits) to

earnings:

Amortization of property, plant

and equipment 4,858 4,314 14,175 11,456

Net gains on sale of investments (207) (27,509) (160) (28,005)

Impairment of property, plant and

equipment 4,211 62 4,520 75

Write-downs of investments to

market value - 572 1,130 1,523

Other (268) 696 (2,283) 618

-------------------------------------------- --------- ---------- ---------

Total non-cash charges (credits) to

earnings 8,594 (21,865) 17,382 (14,333)

Decrease (increase) in non-cash

working capital (1,025) 4,887 (21,959) 17,368

-------------------------------------------- --------- ---------- ---------

Net cash provided by (used in)

operating activities $ 11,670 $ (10,441) $ (3,260)$ 3,882

-------------------------------------------- --------- ---------- ---------

-------------------------------------------- --------- ---------- ---------

Cash provided by operating activities in the third quarter of 2009 was $11.7

million compared with cash used in operating activities of $10.4 million in the

third quarter of 2008. The increase in cash provided by operating activities in

the third quarter of 2009, relative to the corresponding prior year period, was

primarily due to higher gross profit from mining operations.

Cash used in operating activities in the first nine months of 2009 was $3.3

million compared with cash provided by operating activities of $3.9 million in

the first nine months of 2008. The increase in cash used in operating activities

in the first nine months of 2009, relative to the corresponding prior year

period, was primarily due to an increase in working capital requirements

partially offset by higher gross profit from mining operations. The non-cash

working capital requirements of $22.0 million in the first nine months of 2009

was primarily due to a decrease in accounts payable, a decrease in deferred

revenue and an increase in accounts receivable.

The following table summarizes the Company's investing activities for the

periods indicated:

----------------------------------------------------------------------------

$ thousands

Ended September 30, Three Months Nine Months

--------------------- ---------------------

2009 2008 2009 2008

----------------------------------------- ---------- ----------- ----------

Proceeds on sale of exploration

property $ - $ - $ 7,000 $ -

Proceeds on sale of investments

at fair value 308 41,047 2,612 60,238

Proceeds on sale (purchase) of

short-term investments (15,101) - 14,036 -

Loan advances - - (4,887) -

Purchases of investments at

fair value (2,152) - (2,152) -

Capital expenditures (9,766) (19,321) (25,934) (66,681)

Proceeds on sale of property,

plant and equipment 30 5 167 714

----------------------------------------- ---------- ----------- ----------

Net cash provided by (used in)

investing activities $ (26,681)$ 21,731 $ (9,158)$ (5,729)

----------------------------------------- ---------- ----------- ----------

----------------------------------------- ---------- ----------- ----------

Capital expenditures at Chelopech in the third quarter and first nine months of

2009 of $8.6 million and $20.6 million were, respectively, 5% and 38% lower than

the corresponding prior year periods. The decrease in spending in the nine

months ended September 2009, relative to the corresponding prior year period,

was due to a reduction in non-critical expenditures, including those related to

the expansion project. Capital expenditures at Deno Gold in the third quarter

and first nine months of 2009 of $1.2 million and $5.0 million were,

respectively, 82% and 75% lower than the corresponding prior year periods due

primarily to the suspension of exploration activities in the fourth quarter of

2008.

In August 2009, DPM purchased 40.5 million ordinary shares of WTI for US$2.0

million ($2.2 million), which by agreement, was advanced by WTI to its

subsidiary, NCS, to cover the costs of certain capital improvements being made

to its Tsumeb copper smelter and for working capital purposes.

In 2009, DPM advanced $4.9 million (US$4.0 million) to NCS, a subsidiary of WTI,

as per the agreement DPM signed with NCS in December 2008 to advance up to

US$7.0 million of loans to NCS. The total commitment of US$7.0 million had been

advanced as at June 30, 2009.

Financing Activities

The following table summarizes the Company's financing activities for the

periods indicated:

----------------------------------------------------------------------------

$ thousands

Ended September 30, Three Months Nine Months

------------------- -------------------

2009 2008 2009 2008

-------------------------------------------- --------- ---------- ---------

Redemption of deferred share units $ - $ - $ - $ (58)

Repayment of leases (430) - (846) -

Proceeds of debt financing - 15,821 - 15,821

Repayment of debt (609) (595) (2,729) (2,429)

-------------------------------------------- --------- ---------- ---------

Net cash provided by (used in)

financing activities $ (1,039) $ 15,226 $ (3,575) $ 13,334

-------------------------------------------- --------- ---------- ---------

-------------------------------------------- --------- ---------- ---------

Average Metal Prices

The following table, summarizing the average metal prices for the London Bullion

Market Association ("LBM") gold, LME copper Grade A, LME special high grade

("SHG") zinc and LBM silver prices, is used to illustrate the Company's average

metal price exposures based on its key reference prices for the periods

indicated.

----------------------------------------------------------------------------

US$ Average

Ended September 30, Three Months Nine Months

--------------------- ---------------------

2009 2008 2009 2008

----------------------------------------------------------------------------

London Bullion gold ($/oz) $ 960 $ 869 $ 930 $ 898

LME settlement copper ($/lb) 2.66 3.48 2.11 3.62

LME settlement SHG zinc ($/lb) 0.80 0.80 0.67 0.96

LBM spot silver ($/oz) $ 14.70 $ 15.03 $ 13.68 $ 16.63

----------------------------------------------------------------------------

Non-GAAP Financial Measures

We have referred to cash cost per tonne of ore processed because we understand

that certain investors use this information to assess the Company's performance

and also determine the Company's ability to generate cash flow for investing

activities. This measurement captures all of the important components of the

Company's production and related costs. In addition, management utilizes this

metric as an important management tool to monitor cost performance of the

Company's operations. This measurement has no standardized meaning under

Canadian GAAP and is therefore unlikely to be comparable to similar measures

presented by other companies. This measurement is intended to provide additional

information and should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with Canadian GAAP.

The following table provides, for the periods indicated, a reconciliation of the

Company's cash cost measure and Canadian GAAP cost of sales:

-------------------------------------------------------------------------

$ thousands, unless otherwise indicated

For the quarter ended September 30, 2009 Chelopech Deno Gold Total

-------------------------------------------------------------------------

Ore processed (mt) 239,803 66,466

Cost of sales (Cdn$) $ 24,015 $ 7,488 $ 31,503

Cost of sales (US$) $ 21,159 $ 6,699 $ 27,858

Add (deduct):

Amortization (3,007) (705)

Reclamation costs and other (444) (241)

Change in concentrate inventory (2,742) (548)

-------------------------------------------------- ---------- -----------

Total cash cost of production (US$) $ 14,966 $ 5,205

-------------------------------------------------- ---------- -----------

-------------------------------------------------- ---------- -----------

Cash cost per tonne of ore processed

(US$), including royalties $ 62.41 $ 78.31

Cash cost per tonne of ore processed

(US$), excluding royalties $ 59.31 $ 78.31

-------------------------------------------------- ---------- -----------

-------------------------------------------------------------------------

$ thousands, unless otherwise indicated

For the quarter ended September 30, 2008 Chelopech Deno Gold Total

-------------------------------------------------------------------------

Ore processed (mt) 238,820 78,191

Cost of sales (Cdn$) $ 16,674 $ 7,155 $ 23,829

Cost of sales (US$) $ 15,853 $ 6,889 $ 22,742

Add/(Deduct):

Amortization and other (3,283) (977)

Change in concentrate inventory 2,837 2,748

-------------------------------------------------- ---------- -----------

Total cash cost of production (US$) $ 15,407 $ 8,660

-------------------------------------------------- ---------- -----------

-------------------------------------------------- ---------- -----------

Cash cost per tonne of ore processed

(US$), including royalties $ 64.52 $ 110.75

Cash cost per tonne of ore processed

(US$), excluding royalties $ 60.69 $ 110.75

-------------------------------------------------- ---------- -----------

(1) A reconciliation of the Company's cash cost per tonne ore processed to

cost of sales under Canadian GAAP for the third quarters of 2009 and

2008 is shown in the table entitled "Non-GAAP Financial Measures."

(2) Refer to the quarterly information section for the average metal prices

used to illustrate the Company's average metal price exposure based on

its key reference prices.

To view the Financial Statements, please click the following link:

http://media3.marketwire.com/docs/dpm1104.pdf

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" that involve a number

of risks and uncertainties. Forward-looking statements include, but are not

limited to, statements with respect to the future price of gold, copper, zinc

and silver the estimation of mineral reserves and resources, the realization of

mineral estimates, the timing and amount of estimated future production, costs

of production, capital expenditures, costs and timing of the development of new

deposits, success of exploration activities, permitting time lines, currency

fluctuations, requirements for additional capital, government regulation of

mining operations, environmental risks, unanticipated reclamation expenses,

title disputes or claims, limitations on insurance coverage and timing and

possible outcome of pending litigation. Often, but not always, forward-looking

statements can be identified by the use of words such as "plans", "expects", or

"does not expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "does not anticipate", or "believes",

or variations of such words and phrases or state that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur or be

achieved.

Forward-looking statements are based on the opinions and estimates of management

as of the date such statements are made, and they involve known and unknown

risks, uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially different from any

other future results, performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others: the actual

results of current exploration activities; actual results of current reclamation

activities; conclusions of economic evaluations; changes in project parameters

as plans continue to be refined; future prices of gold, copper, zinc and silver;

possible variations in ore grade or recovery rates; failure of plant, equipment

or processes to operate as anticipated; accidents, labour disputes and other

risks of the mining industry; delays in obtaining governmental approvals or

financing or in the completion of development or construction activities,

fluctuations in metal prices, as well as those risk factors discussed or

referred to in Management's Discussion and Analysis under the heading "Risks and

Uncertainties" and other documents filed from time to time with the securities

regulatory authorities in all provinces and territories of Canada and available

at www.sedar.com. Although the Company has attempted to identify important

factors that could cause actual actions, events or results to differ materially

from those described in forward-looking statements, there may be other factors

that cause actions, events or results not to be anticipated, estimated or

intended. There can be no assurance that forward-looking statements will prove

to be accurate, as actual results and future events could differ materially from

those anticipated in such statements. Unless required by securities laws, the

Company undertakes no obligation to update forward-looking statements if

circumstances or management's estimates or opinions should change. Accordingly,

readers are cautioned not to place undue reliance on forward-looking statements.

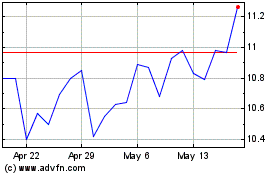

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

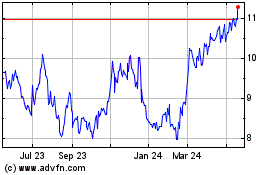

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024