Struggling Shares of Denison Mines and USEC Look for Near Term Catalyst

December 16 2011 - 8:16AM

Marketwired

The uranium sector has faced considerable price uncertainty in the

second half of 2011 as the aftermath of Japan's tragic nuclear

crisis continues to drive the industry's outlook. As Resources

Capital Research (RCR) said in its December quarter note uranium

majors have significantly underperformed the broader share market

over the past 12 months, largely due to set backs following

Fukushima.The Paragon Report examines investing opportunities in

the Uranium Industry and provides equity research on Denison Mines

Corporation (NYSE Amex: DNN) (TSX: DML) and USEC Inc. (NYSE: USU).

Access to the full company reports can be found at:

www.paragonreport.com/DNN

www.paragonreport.com/USU

As industry leader Cameco Corporation explains in its "Uranium

101" article, "demand for uranium is directly linked to the level

of electricity generated by nuclear power plants. Reactor capacity

is growing slowly, and at the same time the reactors are being run

more productively, with higher capacity factors, and reactor power

levels."

While a few countries -- Germany most notably -- abandoned

nuclear programs in the aftermath of the crisis at Fukushima, the

United States as well as emerging economies such as China continue

to embrace nuclear energy. Earlier this week the Associated Press

reported that Federal regulators are leaning towards approving a

nuclear reactor designed by Westinghouse Electric Co. that could

power the first nuclear plants built from scratch in a

generation.

The Paragon Report provides investors with an excellent first

step in their due diligence by providing daily trading ideas, and

consolidating the public information available on them. For more

investment research on the Uranium Industry register with us free

at www.paragonreport.com and get exclusive access to our numerous

stock reports and industry newsletters.

Denison Mines Corp. engages in the exploration, development,

mining, and milling of uranium primarily in the United States and

Canada. It also produces vanadium as a co-product from its mines

located in Colorado and Utah. Last month the company announced the

successful completion of Phase 2 of the two-phased 2011 drilling

program on its 100% owned Mutanga uranium project in Zambia. Based

on internal estimates, Denison believes that the results from the

2011 drill program could potentially lead to an increase in

Denison's mineral resource estimates on the Mutanga project by 16

to 24 million pounds U3O8.

USEC Inc., together with its subsidiaries, supplies low enriched

uranium (LEU) to commercial nuclear power plants in the United

States and internationally. The company reported a net loss of $6.9

million or 6 cents per share for the quarter ended September 30,

2011, compared to net income of $1.0 million or 1 cent per share

for the third quarter of 2010.

The Paragon Report has not been compensated by any of the

above-mentioned publicly traded companies. Paragon Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.paragonreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

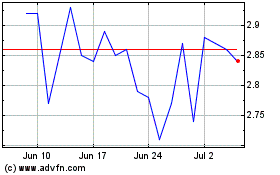

Denison Mines (TSX:DML)

Historical Stock Chart

From Jun 2024 to Jul 2024

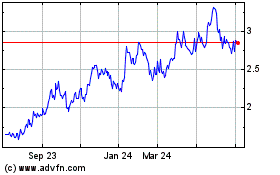

Denison Mines (TSX:DML)

Historical Stock Chart

From Jul 2023 to Jul 2024