Clairvest Reports Fiscal 2023 Second Quarter Results

November 14 2022 - 5:00PM

Clairvest Group Inc. (TSX: CVG) today reported results for the

fiscal 2023 second quarter and six months ended September 30, 2022

and material events subsequent to quarter end. (All figures are in

Canadian dollars unless otherwise stated)

Highlights

- September 30, 2022 book value was

$1,194.2 million or $79.48 per share compared with $1,156.0 million

or $76.80 per share as at June 30, 2022

- Net income for the quarter ended

September 30, 2022 was $40.1 million or $2.66 per share

- Clairvest and Clairvest Equity

Partners VI (“CEP VI”) made an equity investment in Star Waste (dba

Boston Carting Services)

- Clairvest and Clairvest Equity

Partners V (“CEP V”) completed the partial realization of Meriplex

Communications

- Clairvest and CEP VI portfolio

company NovaSource Power Services completed the previously

announced $100 million equity raise

- Clairvest and CEP VI made an equity

investment in Acera Insurance

- Subsequent to quarter end,

Clairvest and Clairvest Equity Partners IV (“CEP IV”) portfolio

company Top Aces completed an equity raise

Clairvest’s book value was $1,194.2 million or

$79.48 per share as at September 30, 2022, compared with $1,156.0

million or $76.80 per share as at June 30, 2022. The increase in

book value for the quarter was attributable to net income for the

quarter of $40.1 million, or $2.66 per share. The net increase

arose from an increase in the valuation of Clairvest’s private

equity investment portfolio.

In July 2022, Clairvest together with CEP VI

made a US$40.0 million equity investment in Star Waste, which was

previously announced in the first quarter press release.

Clairvest’s portion of the investment was US$10.8 million (C$14.2

million).

In July 2022, and as previously announced in the

first quarter press release, Clairvest and CEP V completed the

partial realization of Meriplex. At closing, Clairvest and CEP V

received cash proceeds totaling US$169.1 million while continuing

to own approximately 18% of Meriplex. Clairvest’s portion of the

cash proceeds was US$56.7 million and it retained a 5.5% ownership

interest in Meriplex.

In August 2022, and as previously announced in

the first quarter press release, NovaSource Power Services

completed a US$100 million equity raise where a third-party

investor acquired a minority ownership in the company. Subsequent

to the transaction, NovaSource Power Services repaid the bridge

loans previously advanced by Clairvest and CEP VI.

In September 2022, Clairvest and CEP VI made a

$100 million minority equity investment to support the merger and

recapitalization of Alberta-based Roger Insurance and British

Columbia-based CapriCMW forming a combined entity operating as

Acera Insurance. Clairvest’s portion of the investment was $27.1

million.

Subsequent to quarter end, Top Aces completed an

equity raise from new and existing investors. As part of this

transaction, Clairvest made an incremental $17.9 million equity

investment in Top Aces. As at September 30, 2022, Clairvest had

US$27.6 million in loans advanced to Top Aces which was repaid in

full in conjunction with the equity raise.

“Over the quarter, there have been positive

developments both in our portfolio and on the capital deployment

front. Most notably, we are thrilled to partner with over 350

employee owners and support Acera Insurance on its path to become

the largest independent Canadian insurance brokerage of choice,”

said Ken Rotman, CEO of Clairvest. “Despite the macroeconomic

backdrop, our portfolio companies in aggregate continue to

demonstrate strong financial performance. We will continue to stay

disciplined in our underwriting process and capitalize on unique

opportunities to back owner-operators.”

| Summary of

Financial Results – Unaudited |

|

|

|

|

|

|

|

|

|

Financial Results |

Quarter ended |

|

Six months ended |

|

|

September 30 |

|

September 30 |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

($000’s, except per share amounts) |

$ |

|

$ |

|

$ |

|

$ |

|

|

Net investment gain (loss) |

(12,488 |

) |

12,982 |

|

(23,509 |

) |

41,933 |

|

|

Net carried interest from Clairvest Equity Partners III and IV |

5,588 |

|

1,632 |

|

5,003 |

|

1,298 |

|

|

Distributions, interest income, dividends and fees |

78,657 |

|

17,050 |

|

87,260 |

|

24,350 |

|

|

Total expenses, excluding income taxes |

22,953 |

|

152 |

|

33,529 |

|

11,902 |

|

|

Net income and comprehensive income |

40,084 |

|

28,560 |

|

28,746 |

|

46,659 |

|

|

Basic and fully diluted net income per share |

2.66 |

|

1.89 |

|

1.91 |

|

3.10 |

|

|

Financial Position |

September 30 |

|

March 31, |

|

|

2022 |

|

2022 |

|

|

($000’s, except share information and per share amounts) |

$ |

|

$ |

|

|

Total assets |

1,386,625 |

|

1,353,143 |

|

|

Total cash, cash equivalents, temporary investments and restricted

cash |

349,105 |

|

348,795 |

|

|

Carried interest from Clairvest Equity Partners III and IV |

40,249 |

|

35,496 |

|

|

Corporate investments(1) |

885,088 |

|

849,073 |

|

|

Total liabilities |

192,410 |

|

174,056 |

|

|

Management participation from Clairvest Equity Partners III and

IV |

30,426 |

|

26,997 |

|

|

Book value(2) |

1,194,215 |

|

1,179,087 |

|

|

Common shares outstanding |

15,025,601 |

|

15,052,301 |

|

|

Book value per share(2) |

79.48 |

|

78.33 |

|

(1) Includes carried interest of $190,963 (March

31: $201,852) and management participation of $136,861 (March 31:

$141,328) from Clairvest Equity Partners V and VI, and $91,661

(March 31, 2021: $80,504) in cash, cash equivalents and temporary

investments held by Clairvest’s acquisition entities.(2) Book value

is a Non-IFRS measure calculated as the value of total assets less

the value of total liabilities.

Clairvest’s second quarter fiscal 2023 financial

statements and MD&A are available on the SEDAR website at

www.sedar.com and the Clairvest website at

www.clairvest.com.

About Clairvest Clairvest’s

mission is to partner with entrepreneurs to help them build

strategically significant businesses. Founded in 1987 by a group of

successful Canadian entrepreneurs, Clairvest is a top performing

private equity management firm with over CAD $3.3 billion of

capital under management. Clairvest invests its own capital and

that of third parties through the Clairvest Equity Partners limited

partnerships in owner-led businesses. Under the current management

team, Clairvest has initiated investments in 59 different platform

companies and generated top quartile performance over an extended

period.

Contact InformationStephanie LoManager,

Investor Relations and MarketingClairvest Group Inc. Tel: (416)

925-9270Fax: (416) 925-5753stephaniel@clairvest.com

Forward-looking Statements This

news release contains forward-looking statements with respect to

Clairvest Group Inc., its subsidiaries, its CEP limited

partnerships and their investments. These statements are based on

current expectations and are subject to known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Clairvest, its subsidiaries, its CEP

limited partnerships and their investments to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. Such

factors include general and economic business conditions and

regulatory risks. Clairvest is under no obligation to update any

forward-looking statements contained herein should material facts

change due to new information, future events or otherwise.

www.clairvest.com

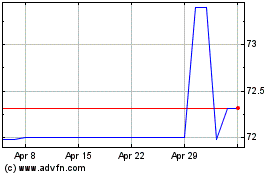

Clairvest (TSX:CVG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Clairvest (TSX:CVG)

Historical Stock Chart

From Apr 2023 to Apr 2024