Century Global Commodities Corporation

(“

Century” or the “

Company”)

(TSX:CNT) is pleased to provide an update about its plan to spin

out the Joyce Lake DSO Iron Ore Project (the “Project”, “Joyce” or

“Joyce Lake”) to raise the necessary funding to advance the Project

towards development.

After a careful study of the various options of

a spin out, the Company has determined that the best market to spin

Joyce to is the Australian Stock Exchange (“ASX” or the “Exchange”)

given the quality and the liquidity of the Exchange, particularly

in the iron ore sector. As such, it has signed a mandate with

Empire Capital Partners (“Empire”), a Perth based corporate

advisory and investment bank to execute the spin out.

The mandate authorizes Empire to identify a

pre-IPO investor or group of investors to raise initial seed

funding in a special purpose vehicle holding 100% of Joyce

(“Pre-IPO Financing”). After this successful Pre-IPO Financing,

Empire is then mandated to be the Lead Manager of the IPO

transaction on the ASX. Customary terms and fee structure are also

covered in the mandate, and listing will be subject to all

necessary board and regulatory approvals.

“We are very pleased with the completion of this

step of going to the ASX in the spin out plan as it is a market

that understands direct-shipping iron ore projects very well.

Joyce, being such a project in a tier one jurisdiction like Canada,

is expected to perform favorably in the ASX compared to other

capital markets.” Sandy Chim, CEO of the Company commented.

The Joyce Lake DSO Iron Ore

Project

Joyce Lake, our most advanced project, is a DSO

(direct shipping ore) project in Newfoundland and Labrador, close

to the town of Schefferville, Quebec which is serviced by a rail

link directly to ocean shipping iron ore ports at Sept-Iles. A new

43km dedicated haul road will be used from the Joyce Lake project

to the rail link. It has completed feasibility and permitting

studies and can be brought to production within approximately 30

months.

Following an expenditure of more than $40

million, the Project has total proven and probable reserves of

17.72 million tonnes at 59.71% Fe based on estimates included in

the 2015 NI 43-101 Feasibility Study dated April 14, 2015 (the

“Study”).

The NI 43-101 Study contemplates an open pit

mine of 2.5 million t/a over a 7-year life-of-mine producing both

lump and fines from crushing and screening with no tailings

generated. The Study financial analysis used a base case long term

price of US$95/t, a capital cost of $259.6M and operating costs of

$58.25 FOB the port at Sept- Iles, which generated an NPV8% of

$61.4M after tax and $130.8M before tax.

The Study (page 22-8) also provides a

sensitivity analysis range of iron ore selling prices CFR China. In

the context of higher prices, compared to the US$95/t life-of-mine

price assumed in the Study, the Study table extract below shows the

impact of higher prices on valuations and returns. At US$142.5/t

(which is 50% higher than the US$95/t Study base case but still

some US$27/t below the current April 2021 selling price of

US$170/t), Joyce Lake NPV8% is $888.8M before tax. This information

should be viewed in the context of the full information presented

in the Study. The Study is available on SEDAR and was published in

April 2015.

|

Selling Price Variation |

0 |

+10% |

+30% |

+50% |

|

Base Price for 62% Fe, CFR China (US$/DMT) |

$95.00 |

$104.50 |

$123.50 |

$142.50 |

|

IRR before tax |

18.7% |

30.4% |

52.4% |

73.7% |

|

NPV (8%) before tax in C$ |

$130.8M |

$282.4M |

$585.6M |

$888.8M |

|

Payback before tax (year) |

4.4 |

3.2 |

2.0 |

1.5 |

Joyce Lake Mineral Reserves

The following mineral reserves estimate for

Joyce Lake DSO Project was estimated during the Study effective as

of March 2, 2015.

|

|

Tonnage |

Grade |

Grade |

Grade |

Grade |

|

Mineral Reserves |

(t) |

(%Fe) |

(%SiO2) |

(%Al2O3) |

(%Mn) |

|

High Grade Proven (Above 55% Fe) |

11.63 M |

61.35 |

9.16 |

0.54 |

0.84 |

|

Low Grade Proven (52% - 55% Fe) |

2.89 M |

53.31 |

20.70 |

0.60 |

0.70 |

|

High Grade Probable (Above 55% Fe) |

2.45 M |

61.50 |

9.48 |

0.50 |

0.61 |

|

Low Grade Probable (52% - 55% Fe) |

0.75 M |

53.09 |

21.90 |

0.58 |

0.30 |

|

Total Reserve (Above 52% Fe) |

17.72 M |

59.71 |

11.62 |

0.55 |

0.76 |

The strip ratio is 4.09.

Mineral resources and mineral reserves are

reported in accordance with Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) definition standards for Mineral

Resources, Mineral Reserves and their Guidelines, and are compliant

with NI 43-101.

Allan (Wenlong) Gan, P. Geo, a Qualified Person

as defined by NI 43-101, has reviewed and approved the technical

information contained in this news release.

About Century

Century Global Commodities Corporation (TSX:CNT)

is primarily a resource exploration and development company with a

large portfolio of multi-billion tonne iron ore projects in Canada,

mostly discovered by its own exploration team. Century also owns

100% of the Joyce Lake Direct Shipping Ore project, its most

advanced project. It has other non-ferrous metals properties under

exploration as well as a well-established food distribution

business in Hong Kong (Century Food).

Century Food

Century Food is a subsidiary operation of the

Company which it started a few years ago and is a value-adding

marketing and distribution business of quality food products

sourced from such regions as Europe and Australia and sold in the

Hong Kong market.

For further information please

contact:

Sandy Chim, President & CEOCentury Global Commodities

Corporation416-977-3188IR@centuryglobal.ca

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

THIS PRESS RELEASE CONTAINS “FORWARD-LOOKING

INFORMATION” WITHIN THE MEANING OF CANADIAN SECURITIES LEGISLATION.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE

REPRESENTS THE EXPECTATIONS OF CENTURY AS OF THE DATE OF THIS PRESS

RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE.

FORWARD-LOOKING INFORMATION INCLUDES INFORMATION THAT RELATES TO,

AMONG OTHER THINGS, CENTURY’S OWNERSHIP AND PLANS FOR THE SPIN-0UT,

INCLUDING LISTING ON THE ASX, FINANCING AND DEVELOPMENT OF THE

JOYCE LAKE IRON ORE PROJECT, INCLUDING PROJECTIONS AS TO THE TIME

FRAME FOR DEVELOPMENT, CAPITAL COSTS, OPERATING COSTS AND THE

RELATED INTERNAL RATES OF RETURN, PAYBACK PERIODS AND PROJECT NET

PRESENT VALUES. FORWARD-LOOKING INFORMATION IS BASED ON, AMONG

OTHER THINGS, OPINIONS, ASSUMPTIONS, ESTIMATES AND ANALYSES THAT,

WHILE CONSIDERED REASONABLE BY CENTURY AT THE DATE THE

FORWARD-LOOKING INFORMATION IS PROVIDED, ARE INHERENTLY SUBJECT TO

SIGNIFICANT RISKS, UNCERTAINTIES, CONTINGENCIES AND OTHER FACTORS

THAT MAY CAUSE ACTUAL RESULTS AND EVENTS TO BE MATERIALLY DIFFERENT

FROM THOSE EXPRESSED OR IMPLIED BY THE FORWARD-LOOKING INFORMATION.

THE RISKS, UNCERTAINTIES, CONTINGENCIES AND OTHER FACTORS THAT MAY

CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED OR

IMPLIED BY THE FORWARD-LOOKING INFORMATION MAY INCLUDE, BUT ARE NOT

LIMITED TO, RISKS GENERALLY ASSOCIATED WITH CENTURY’S BUSINESS, AS

DESCRIBED IN CENTURY’S ANNUAL INFORMATION FORM FOR THE YEAR ENDED

MARCH 31, 2020. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON

FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS

INFORMATION AS OF ANY OTHER DATE. WHILE CENTURY MAY ELECT TO, IT

DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR

TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

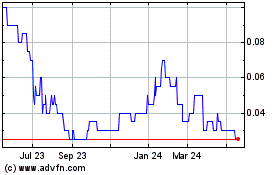

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Dec 2024 to Jan 2025

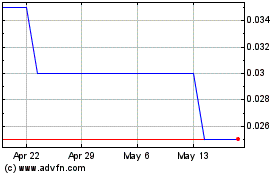

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Jan 2024 to Jan 2025