Scotiabank Fined $127 Million for Price Manipulation, False Statements -- Update

August 19 2020 - 7:14PM

Dow Jones News

By Dylan Tokar

The Bank of Nova Scotia agreed to pay more than $127 million to

settle civil and criminal allegations in connection with its role

in what authorities described as a massive price-manipulation

scheme.

The fine is the result of multiple agreements reached Wednesday

with the U.S. Justice Department and the U.S. Commodity Futures

Trading Commission. The settlements stem in part from thousands of

manipulative orders for precious metals futures contracts placed on

U.S. exchanges over an eight-year period by four traders at the

bank, known as Scotiabank, the agencies said.

The settlements also resolve claims by the CFTC that Scotiabank

made false statements and incomplete disclosures about alleged

price manipulation by its traders in connection with a prior

investigation by the derivatives market regulator. Scotiabank also

agreed to resolve further claims by the CFTC related to its conduct

as a swap dealer. Under the agreements with both agencies, the bank

will be required to retain an independent compliance monitor for

three years.

The steep fine and imposition of a monitor reflected the

seriousness of Scotiabank's offense and the state of its compliance

program, Robert Zink, chief of the Justice Department's criminal

fraud section, said in a statement.

Scotiabank said Wednesday that it had set aside money for the

fines in earlier quarters.

"We understand that in order to maintain the trust of our

stakeholders, we must adhere to trading-related regulatory

requirements and compliance policies," the bank said. "We are

committed to adhering to these standards."

The price-manipulation scheme was compounded by several

compliance failures, federal prosecutors said. In one case, in

2013, one of the traders involved in the unlawful trading contacted

a compliance officer to seek clarification on the CFTC's guidance

on disruptive trading practices, they said.

The trader's email detailed how the trader was engaging in

problematic activity by placing groups of one-contract orders on

one side of the market to facilitate execution on the other,

prosecutors said. The compliance officer forwarded the note to a

colleague but made no effort to investigate the trader's practices,

they said.

The manipulation caused other market participants to lose about

$6.6 million, according to the Justice Department.

The department on Wednesday filed its agreement, which defers

criminal charges of wire fraud and attempted price manipulation, in

federal court in New Jersey.

The agreement requires Scotiabank to pay more than $60.4 million

in criminal penalties, disgorgement and victim compensation.

Prosecutors said half of the criminal penalty would be credited

against fines by the CFTC.

The CFTC agreement settled two separate enforcement actions

against Scotiabank, the regulator said -- one related to the

price-manipulation scheme, known as spoofing, and another related

to the bank's conduct as a swaps dealer, the regulator said.

Spoofing is designed to trick other investors into buying and

selling at artificially high or low prices.

In both actions, as well as in the agreement with the Justice

Department, Scotiabank was accused of misleading regulators at the

CFTC, and making incomplete disclosures, at times due to

inconsistent record-keeping.

Scotiabank was fined $800,000 by the CFTC in 2018 for spoofing

in the gold and silver futures markets. Statements the company made

to the regulator during the course of the investigation that led to

the earlier settlement had later proved to be false, the CFTC

said.

With regards to its swap dealer business, Scotiabank had failed

to meet certain disclosure, supervision and compliance

requirements, the CFTC said. It also made false or misleading

statements to CFTC staff about audio recordings used to supervise

its swaps business, the regulator said.

In the order settling the CFTC's claims, Scotiabank neither

admitted nor denied the regulator's findings.

Corey Flaum, one of the Scotiabank traders described in the

settlement, pleaded guilty to attempted price manipulation in 2019.

The former Scotiabank trader is scheduled to be sentenced early

next year, according to the Justice Department.

--Stephen Nakrosis contributed to this article.

Write to Dylan Tokar at dylan.tokar@wsj.com

(END) Dow Jones Newswires

August 19, 2020 18:59 ET (22:59 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

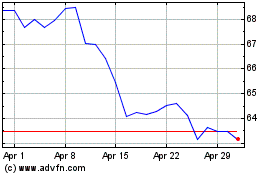

Bank of Nova Scotia (TSX:BNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of Nova Scotia (TSX:BNS)

Historical Stock Chart

From Apr 2023 to Apr 2024