Alamos Gold Inc. (“Alamos”) (TSX:AGI; NYSE:AGI) and

Argonaut Gold Inc. (“Argonaut”) (TSX:AR) today announced

the closing of their previously announced non-brokered private

placement, pursuant to which Alamos subscribed (the “Private

Placement”) for 174,825,175 common shares of Argonaut (the

“Acquired Shares”), representing approximately 13.8% of Argonaut’s

total outstanding common shares (the “Common Shares”) after giving

effect to the Private Placement. The Acquired Shares were acquired

at a price of C$0.286 per share, for total gross proceeds to

Argonaut of C$50,000,000.

The Private Placement was conducted pursuant to

the terms of the arrangement agreement between Alamos and Argonaut

entered into on March 27, 2024 (the “Arrangement Agreement”)

pursuant to which Alamos will acquire all of the issued and

outstanding shares of Argonaut pursuant to a court approved plan of

arrangement (the “Transaction”). The net proceeds from the Private

Placement will be used by Argonaut to fund its immediate liquidity

needs related to its loan facilities and operations, including the

advancement of the Magino Gold mine and for general working

capital. Argonaut will allocate no more than C$10,000,000 of the

proceeds, directly or indirectly, to the advancement and working

capital of its United States and Mexican assets.

The Acquired Shares are subject to the Canadian

resale rules which include a four-month restricted period before

the Acquired Shares may become freely tradeable within Canada.

Early Warning Disclosure

Immediately prior to the closing of the Private

Placement, Alamos did not have beneficial ownership of, or control

or direction over, any Common Shares. After giving effect to the

Private Placement, Alamos has beneficial ownership of, or control

or direction over, 174,825,175 Common Shares, or approximately

13.8% of the issued and outstanding Common Shares.

Alamos acquired the Acquired Shares in

connection with the Transaction, and for investment purposes.

Pursuant to the Arrangement Agreement, Alamos agreed to acquire all

of the issued and outstanding Common Shares that it does not

already own at the closing of the Transaction.

An early warning report in respect of the

Private Placement will be filed in accordance with applicable

securities laws and will be available on Argonaut’s SEDAR+ profile

at www.sedarplus.ca.To obtain a copy of the early warning report,

once filed, please contact Alamos at Brookfield Place, 181 Bay

Street, Suite 3910, Toronto, Ontario, M5J 2T3, Attention: Scott K.

Parsons, 416-368-9932 x 5439.

Argonaut’s head office address is 200 Bay

Street, Suite 1302, Toronto, Ontario, M5J 2J3.

About Alamos Gold Inc.

Alamos is a Canadian-based intermediate gold

producer with diversified production from three operating mines in

North America. This includes the Young-Davidson and Island Gold

mines in northern Ontario, Canada and the Mulatos mine in Sonora

State, Mexico. Additionally, Alamos has a strong portfolio of

growth projects, including the Phase 3+ Expansion at Island Gold,

and the Lynn Lake project in Manitoba, Canada. Alamos employs more

than 1,900 people and is committed to the highest standards of

sustainable development. Alamos’ shares are traded on the TSX and

NYSE under the symbol “AGI”.

Argonaut Gold Inc.

Argonaut is a Canadian-based gold producer with

a portfolio of operations in North America. Focused on becoming a

low-cost, mid-tier gold producer, the Company’s flagship asset,

Magino Mine, is expected to become Argonaut’s largest and lowest

cost mine. Argonaut is pursuing potential for re-development and

additional growth at the Florida Canyon Mine in Nevada, USA.

Together, the Magino and Florida Canyon mines are Argonaut’s

cornerstone assets that will drive Argonaut through this pivotal

growth stage. The Company also has one additional operating mine in

Mexico, the San Agustin Mine in Durango. Argonaut Gold trades on

the TSX under the ticker symbol “AR”.

For further information please visit the Alamos

and Argonaut websites at www.alamosgold.com or www.argonautgold.com

or contact:

|

Scott K. ParsonsSenior Vice-President, Investor

RelationsAlamos Gold Inc.416-368-9932 x

5439sparsons@alamosgold.com |

Joanna LongoInvestor Relations Argonaut Gold

Inc.416-575-6965 joanna.longo@argonautgold.com |

|

|

|

Alamos Cautionary Statement

This News Release contains “forward-looking

information” and “forward-looking statements” as those terms are

defined under applicable Canadian and U.S. securities laws. All

statements in this News Release other than statements of historical

fact, which address results, outcomes, or developments that Alamos

and Argonaut expect to occur are, or may be deemed to be,

“forward-looking statements” and are based on expectations as at

the date of this News Release. Forward-looking statements are

generally, but not always, identified by the use of forward-looking

terminology such as “expect”, “anticipate”, “intend” or variations

of such words and phrases and similar expressions or statements

that certain actions, events or results “may”, “could”, “would”,

“might” or “will” be taken, occur or be achieved or the negative

connotation of such terms.

Such statements in this News Release include

(without limitation) information, statements and expectations

pertaining to: the receipt of court and regulatory approvals for

the Transaction; completion of the acquisition of Argonaut by

Alamos; Argonaut’s use of the proceeds from the Private Placement;

and other statements that express management’s expectations or

estimates of future plans and performance, operational, geological

or financial results, estimates of amounts not yet determinable and

assumptions of management.

Alamos cautions that forward looking statements

are necessarily based upon a number of factors that, while

considered reasonable by management at the time of making such

statements, are inherently subject to significant business,

economic, technical, legal, political, and competitive

uncertainties, and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward-looking statements and undue reliance should not be

placed on such statements and information.

Risk factors that may affect the ability to

achieve the expectations set forth in the forward-looking

statements in this News Release include, but are not limited to not

receiving the requisite approvals for completion of the

Transaction. Although Alamos has attempted to identify important

factors that could cause actual results to differ materially, there

may be other factors that cause results not to be as anticipated,

estimated or intended.

For a more detailed discussion of other risk

factors that may affect Alamos’ ability to achieve the expectations

set forth in the forward-looking statements in this News Release,

see Alamos’ latest 40-F/Annual Information Form and Management’s

Discussion and Analysis, each under the heading “Risk Factors”,

available on the SEDAR+ website at www.sedarplus.ca or on EDGAR at

www.sec.gov, which should be reviewed in conjunction with the

information, risk factors and assumptions found in this News

Release.

Alamos disclaims any intention or obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise, except as required

by applicable law.

Argonaut Cautionary

Statement

Certain information contained or incorporated by

reference in this press release, including any information as to

our strategy, projects or future financial or operating

performance, constitutes “forward-looking statements”.

Forward-looking statements are frequently characterized by words

such as “estimate”, “plan”, “anticipate”, “expect”, “intend”,

“believe(s)”, “potential”, or statements that certain events or

conditions “may”, “should” or “will” occur, and similar

expressions. This press release contains forward-looking statements

and forward-looking information including, but not limited to:

information with respect to the completion of the Transaction and

the use of proceeds from the Private Placement.

Forward-looking statements are based on a number

of assumptions, opinions and estimates, including estimates and

assumptions in regards to the factors listed below that, while

considered reasonable by Argonaut as at the date of this press

release based on management’s experience and assessment of current

conditions and anticipated developments, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies. Many of these assumptions are based on factors and

events that are not within the control of Argonaut and there is no

assurance they will prove to be correct. Known and unknown factors

could cause actual results to differ materially from those

projected in the forward-looking statements and undue reliance

should not be placed on such statements and information. Such

factors include, but are not limited to: receipt of final approval

of the Private Placement from the Toronto Stock Exchange, ability

to complete the Transaction, the receipt of necessary approvals,

the ability to satisfy conditions to the Transaction, Argonaut’s

ability to continue as a going concern, satisfying the conditions

precedent for further draws on Argonaut’s loan facilities,

satisfying ongoing covenants under its loan facilities, results of

independent engineer technical reviews, the availability and change

in terms of financing, the possibility of cost overruns and

unanticipated costs and expenses, the ability of the Magino mine to

be one of the largest and lowest cost gold mines, the winding down

of the Mexican mines, the impact of inflation on costs of

exploration, development and production, risk of employee and/or

contractor strike actions, the future price of gold and silver, the

estimation of the Mineral Reserves and Resources, the realization

of Mineral Reserve and Resource estimates, the timing and amount of

estimated future production at the Magino mine, Florida Canyon

mine, La Colorada mine, San Agustin mine and El Castillo mine, mine

closure plans for the La Colorada mine and El Castillo mine, costs

of production (including cash cost per gold ounce sold), expected

capital expenditures, costs and timing of development of new

deposits, success of exploration activities, permitting

requirements, currency fluctuations, the ability to take advantage

of forward sales agreements profitably, the ability to recover

property potentially impaired by third party insolvency

proceedings, requirements for additional capital, government

regulation of mining operations, environmental risks and hazards,

title disputes or claims, limitations on insurance coverage, the

use of proceeds from financings, the potential sale of Argonaut’s

non-core Mexican assets, and the timing and ability to refinance

its existing term loan.

These factors are discussed in greater detail in

the Argonaut’s most recent Annual Information Form dated March 28,

2024, and in the most recent Management’s Discussion and Analysis

for the three and twelve months ended December 31, 2023, both filed

under Argonaut’s issuer profile on SEDAR+. Argonaut cautions that

the foregoing list of important factors is not exhaustive.

Investors and others who base themselves on forward-looking

statements should carefully consider the above factors as well as

the uncertainties they represent and the risk they entail.

Forward-looking statements included in this

press release speak only as of the date of this press release.

Although Argonaut has attempted to identify important factors that

could cause actual actions, events or results to differ materially

from those described in forward-looking statements, there may be

other factors that cause actions, events or results not to be

anticipated, estimated or intended. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Argonaut undertakes no obligation

to update forward-looking statements if circumstances or

management’s estimates or opinions should change except as required

by applicable securities laws.

The TSX and NYSE have not reviewed and do not

accept responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained

herein.

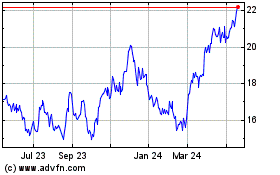

Alamos Gold (TSX:AGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

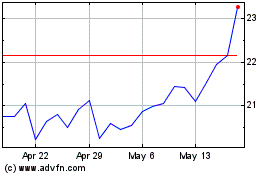

Alamos Gold (TSX:AGI)

Historical Stock Chart

From Dec 2023 to Dec 2024