This news release contains forward-looking information that is

based upon assumptions and is subject to risks and uncertainties as

indicated in the cautionary note contained elsewhere in this news

release.

Andrew Peller Limited (TSX: ADW.A)(TSX: ADW.B) (the "Company")

announced today its results for the three months and fiscal year

ended March 31, 2011 ("fiscal 2011").

FISCAL 2011 HIGHLIGHTS:

-- Common share dividend to increase 9% on annualized basis

-- Company purchases and cancels 594,412 Class A Non-Voting Shares for

approximately $5.2 million

-- Sales up on solid growth through liquor boards and estate wineries

-- Strong Canadian dollar and increased sales of high margin products

generate improved profitability

-- Gross profit margin improves to 39.1% of sales from 36.6% last year

-- EBITA rises to $32.0 million from $27.4 million in prior year

-- Cash flow from operating activities increases to $23.0 million from

$17.6 million in fiscal 2010

"Our successful sales and marketing initiatives, combined with

the increasing global recognition of the quality of our premium and

ultra-premium wines, generated increased sales through the majority

of our trade channels in fiscal 2011 and a solid improvement in

profitability," commented John Peller, President and CEO. "Looking

ahead, we are confident we will continue this trend of positive

growth."

"We are very proud to be celebrating the Company's 50th

Anniversary this year. Our growth and achievements over the last

half-century are considerable, a testament to the hard work and

dedication of all our people. We look forward to continued progress

in the years ahead," Mr. Peller added.

For fiscal 2011, sales rose to $265.4 million, up from $263.2

million in fiscal 2010. Ongoing initiatives to grow sales of the

Company's blended varietal table and premium wines through

provincial liquor boards and the introduction of new products and

improved performance at the Company's estate wineries were

partially offset by a discriminatory levy introduced by the

Province of Ontario on July 1, 2010 on sales of blended wines sold

through the Company's retail stores. The annual impact on sales and

EBITA of this levy amounts to approximately $3.0 million. Sales of

personal winemaking products declined over the past year. Sales for

the fourth quarter of fiscal 2011 were $56.9 million compared to

$59.3 million in the prior year period. The decline is due

primarily to the above-mentioned special levy in Ontario and the

timing of sales in the key Easter selling season.

For fiscal 2011, gross profit rose to 39.1% of sales from 36.6%

in the prior fiscal year, and to 38.9% of sales for the three

months ended March 31, 2011 from 37.6% in the same period last

year. The increase in gross profit in fiscal 2011 was due to the

lower cost to the Company of purchasing United States dollars and

Euros, increased sales volumes of higher margin products, and the

Company's successful cost control initiatives which served to

reduce operating and packaging expenses. Gross profit was

negatively impacted by the above-mentioned special levy in the

Province of Ontario. Management remains focused on efforts to

enhance production efficiency and productivity to further improve

overall profitability.

Selling and administrative expenses rose in the fourth quarter

and year ended March 31, 2011 due primarily to increased sales and

marketing expenses compared with the prior year. Management expects

the level of sales and administrative expenses will increase

slightly in fiscal 2012.

Interest expense in fiscal 2011 declined compared to last year

due primarily to the reduction in debt from regularly scheduled

long-term debt repayments, proceeds from the sale of certain

non-core vineyards during the first quarter of fiscal 2011, and to

lower interest rates on both short and long-term debt.

The Company incurred a non-cash gain in fiscal 2011 related to

the mark-to-market adjustments on an interest rate swap and foreign

exchange contracts aggregating approximately $0.1 million compared

to a gain of $3.2 million in the prior year. The Company has

elected not to apply hedge accounting and these financial

instruments are reflected in the Company's financial statements at

fair value each reporting period. These instruments are considered

to be effective economic hedges and have enabled management to

mitigate the volatility of changing costs and interest rates during

the year.

Other expenses incurred in fiscal 2011 relate to a net $1.3

million write-down, after proceeds from an insurance claim, in the

value of a BC vineyard where vines were damaged by an early and

severe frost in the fall of 2009, as well as carrying costs in the

amount of $0.2 million related to the Company's Port Moody facility

which was closed effective December 31, 2005. These costs were

partially offset by other income of $0.3 million related to a gain

on the sale of a portion of an Okanagan vineyard. The damage to the

BC vineyard was realized when the vines were not able to support

the growth of grapes during hot weather that occurred during August

2010. Other expenses incurred in fiscal 2010 primarily related to

impairment charges on certain investments made by the Company.

Earnings before interest, taxes, amortization and gains on the

above mentioned derivative financial instruments ("EBITA") were

$32.0 million and $4.0 million for the year and three months ended

March 31, 2011 respectively compared to $27.4 million and $4.1

million in the respective prior year periods.

Net and comprehensive earnings from continuing operations,

excluding gains on derivative financial instruments and other

expenses for the year ended March 31, 2011, were $11.5 million

compared to $8.4 million for the prior year. Net and comprehensive

earnings were $11.0 million or $0.76 per Class A share in fiscal

2011 compared to $21.7 million or $1.49 per Class A share in fiscal

2010. The results for fiscal 2010 included an after-tax gain of

approximately $11.9 million related to the sale of the Company's

beer business.

Strong Financial Position

On March 10, 2011 the Company announced that it had filed a

Notice of Intention to make a normal course issuer bid to purchase

for cancellation up to a maximum of 594,412 of its Class A

Non-Voting Shares ("Class A Shares") through the facilities of the

Toronto Stock Exchange representing 5% of the Company's issued and

outstanding Class A shares. The normal course issuer bid was to

remain in effect until the earlier of March 13, 2012 or the date on

which the Company has purchased the maximum number of Class A

shares permitted. As of March 31, 2011, the Company had acquired

594,412 Class A common Shares for total consideration of

approximately $5.2 million, or an average price of $8.75 per Class

A Share.

Working capital as at March 31, 2011 was $28.3 million compared

to $29.4 million at March 31, 2010. The decline at March 31, 2011

was due primarily to the use of funds for the Company's normal

course issuer bid, higher levels of capital spending, and cash flow

from operating activities used to reduce bank indebtedness.

The Company's debt to equity ratio declined to 0.84:1 at March

31, 2011 compared to 0.90:1 at the end of fiscal 2010.

Shareholders' equity as at March 31, 2011 rose to $114.7 million or

$8.02 per common share compared to $113.7 million or $7.63 per

common share as at March 31, 2010. The increase in shareholders'

equity is primarily due to higher net earnings from continuing

operations, partially offset by the decrease in Capital Stock

arising from the cancellation of 594,412 Class A Shares resulting

from the Company's normal course issuer bid.

During fiscal 2011, the Company generated cash flow from

operating activities, after changes in non-cash working capital

items, of $23.0 million compared to $17.6 million in the prior

year. Cash flow from operating activities increased primarily due

to stronger earnings performance.

Common Share Dividend Increase

As a result of the Company's continued strong performance, the

Board of Directors is pleased to announce today a 9% increase in

common share dividends for shareholders of record on June 30, 2011

payable on July 8, 2011. The annual dividend on Class A shares will

be increased to $0.360 per share from $0.330 per share and the

Class B shares increased to $.0314 per share from $0.288 per

share.

"We are very pleased to be implementing our fourth increase in

commons share dividends over the last six years," Mr. Peller

commented. "With our record performance this year, and our positive

outlook for the future, we are proud to be enhancing value for our

shareholders."

Conference Call

A conference call hosted by the Company will be held Thursday

June 9, 2011 at 10:00 a.m. (ET). The call-in numbers for

participants are local /international (416) 340-2216 or North

American Toll-Free at (866) 226-1792. Please connect with the

conference call at least five minutes before the start time. An

audio replay of the call will be available after the live call by

dialing (416) 695-5800 or (800) 408-3053 and entering access code

4802885#

Financial Highlights (Unaudited)

(Complete consolidated financial statements to follow)

----------------------------------------------------------------------------

(in $000 except as otherwise

stated) Three Months Year

----------------------------------------------------------------------------

For the Period Ended March 31, 2011 2010 2011 2010

----------------------------------------------------------------------------

Sales 56,940 59,295 265,420 263,151

Gross profit 22,165 22,281 103,662 96,324

-------------------------------------------

Gross profit (% of sales) 38.9% 37.6% 39.1% 36.6%

-------------------------------------------

Selling general and

administrative expenses 18,196 18,152 71,703 68,970

Earnings before interest, taxes,

amortization, unrealized loss

(gain) and

other expenses 3,969 4,129 31,959 27,354

Unrealized gain on derivative

financial instruments (291) (781) (117) (3,224)

Other expenses (155) 380 921 1,627

Net and comprehensive earnings

from continuing operations 339 838 10,989 9,526

Net and comprehensive earnings

from a discontinued operation - (200) - 12,135

-------------------------------------------

Net and comprehensive earnings 339 638 10,989 21,661

-------------------------------------------

Earnings per share from

continuing operations - Class A $ 0.03 $ 0.06 $ 0.76 $ 0.66

Earnings per share - basic and

diluted - Class A $ 0.03 $ 0.04 $ 0.76 $ 1.49

Dividend per share - Class A

(annual) $ 0.330 $ 0.330 $ 0.330 $ 0.330

Dividend per share - Class B

(annual) $ 0.288 $ 0.288 $ 0.288 $ 0.288

-------------------------------------------

Class A Common Shares

outstanding (000 shares) 11,294 11,888 11,294 11,888

-------------------------------------------

Cash provided by operations

(after changes in non-cash

working capital items) 12,181 10,411 23,019 17,615

-------------------------------------------

Working capital 28,277 29,357

Shareholders' equity per share $ 8.02 $ 7.63

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Andrew Peller Limited ('APL' or the 'Company') is a leading

producer and marketer of quality wines in Canada. With wineries in

British Columbia, Ontario and Nova Scotia, the Company markets

wines produced from grapes grown in Ontario's Niagara Peninsula,

British Columbia's Okanagan and Similkameen Valleys and from

vineyards around the world. The Company's award-winning premium and

ultra-premium VQA brands include Peller Estates, Trius, Hillebrand,

Thirty Bench, Crush, Sandhill, Calona Vineyards Artist Series and

Red Rooster. Complementing these premium brands are a number of

popularly priced varietal wine brands including Peller Estates

French Cross in the East, Peller Estates Proprietors Reserve in the

West, Copper Moon, XOXO and Croc Crossing. Hochtaler, Domaine D'Or,

Schloss Laderheim, Royal and Sommet are our key value priced wine

blends. The Company imports wines from major wine regions around

the world to blend with domestic wine to craft these popularly

priced and value priced wine brands. With a focus on serving the

needs of all wine consumers, the Company produces and markets

premium personal winemaking products through its wholly-owned

subsidiary, Global Vintners Inc., the recognized world leader in

personal winemaking products. Global Vintners distributes products

through over 250 Winexpert and Wine Kitz authorized retailers and

franchisees and more than 600 independent retailers across Canada,

United States, United Kingdom, New Zealand and Australia. Global

Vintners award-winning premium and ultra-premium winemaking brands

include Selection, Vintners Reserve, Island Mist, Kenridge, Cheeky

Monkey, Ultimate Estate Reserve, Traditional Vintage and Artful

Winemaker. The Company owns and operates more than 100

well-positioned independent retail locations in Ontario under the

Vineyards Estate Wines, Aisle 43 and WineCountry Vintners store

names. The Company also owns Grady Wine Marketing Inc. based in

Vancouver, and The Small Winemaker's Collection Inc. based in

Ontario; both of these wine agencies are importers of premium wines

from around the world and are marketing agents for these fine

wines. The Company's products are sold predominantly in Canada with

a focus on export sales for our icewine products.

Net earnings from continuing operations before other expenses is

defined as net earnings before the net unrealized gain on financial

instruments, other expenses and net earnings from a discontinued

operation, all adjusted by income tax rates as calculated

below:

(in $000) Three Months Year

----------------------------------------------------------------------------

Period ended March 31, 2011 2010 2011 2010

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net and comprehensive earnings 339 638 10,989 21,661

----------------------------------------------------------------------------

Unrealized gain on financial

instruments (291) (781) (117) (3,224)

----------------------------------------------------------------------------

Other expenses (155) 380 921 1,627

----------------------------------------------------------------------------

Income tax effect on the above 138 120 (249) 479

----------------------------------------------------------------------------

Net (earnings) loss from a discontinued

operation - 200 - (12,135)

----------------------------------------------------------------------------

Net earnings from continuing operations

before other expenses 31 557 11,544 8,408

----------------------------------------------------------------------------

The Company utilizes EBITA (defined as earnings before interest,

amortization, unrealized derivative (gain) loss, other expenses,

income taxes and net earnings from a discontinued operation). EBITA

is not a recognized measure under GAAP. Management believes that

EBITA is a useful supplemental measure to net earnings, as it

provides readers with an indication of cash available for

investment prior to debt service, capital expenditures and income

taxes. Readers are cautioned that EBITA should not be construed as

an alternative to net earnings determined in accordance with GAAP

as an indicator of the Company's performance or to cash flows from

operating, investing and financing activities as a measure of

liquidity and cash flows. In addition, the Company's method of

calculating EBITA may differ from the methods used by other

companies and, accordingly, may not be comparable to measures used

by other companies.

Andrew Peller Limited common shares trade on the Toronto Stock

Exchange (symbols ADW.A and ADW.B).

FORWARD-LOOKING INFORMATION

Certain statements in this news release may contain

"forward-looking statements" within the meaning of applicable

securities laws, including the "safe harbour provision" of the

Securities Act (Ontario) with respect to Andrew Peller Limited (

the "Company") and its subsidiaries. Such statements include, but

are not limited to, statements about the growth of the business in

light of the Company's recent acquisitions; its launch of new

premium wines; sales trends in foreign markets; its supply of

domestically grown grapes; and current economic conditions. These

statements are subject to certain risks, assumptions and

uncertainties that could cause actual results to differ materially

from those included in the forward-looking statements. The words

"believe", "plan", "intend", "estimate", "expect" or "anticipate"

and similar expressions, as well as future or conditional verbs

such as "will", "should", "would" and "could" often identify

forward-looking statements. We have based these forward-looking

statements on our current views with respect to future events and

financial performance. With respect to forward-looking statements

contained in this news release, the Company has made assumptions

and applied certain factors regarding, among other things: future

grape, glass bottle and wine prices; its ability to obtain grapes,

imported wine, glass and its ability to obtain other raw materials;

fluctuations in the U.S./Canadian dollar exchange rates; its

ability to market products successfully to its anticipated

customers; the trade balance within the domestic Canadian wine

market; market trends; reliance on key personnel; protection of its

intellectual property rights; the economic environment; the

regulatory requirements regarding producing, marketing, advertising

and labelling its products; the regulation of liquor distribution

and retailing in Ontario; and the impact of increasing

competition.

These forward-looking statements are also subject to the risks

and uncertainties discussed in this news release, in the "Risk

Factors" section and elsewhere in the Company's MD&A and other

risks detailed from time to time in the publicly filed disclosure

documents of Andrew Peller Limited which are available at

www.sedar.com. Forward-looking statements are not guarantees of

future performance and involve risks, uncertainties and assumptions

which could cause actual results to differ materially from those

conclusions, forecasts or projections anticipated in these

forward-looking statements. Because of these risks, uncertainties

and assumptions, you should not place undue reliance on these

forward-looking statements. The Company's forward-looking

statements are made only as of the date of this news release, and

except as required by applicable law, the Company undertakes no

obligation to update or revise these forward-looking statements to

reflect new information, future events or circumstances or

otherwise.

ANDREW PELLER LIMITED

CONSOLIDATED BALANCE SHEETS

As at March 31, 2011 and 2010

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2011 2010

$ $

----------------------------------------------------------------------------

Assets

Current Assets

Accounts receivable 23,390 22,902

Inventories 96,085 89,693

Prepaid expenses and other assets 818 1,818

Income taxes recoverable - 1,327

-------------------

120,293 115,740

Property, plant and equipment 94,154 95,728

Intangibles and other assets 14,170 14,775

Goodwill 38,073 37,473

-------------------

266,690 263,716

-------------------

-------------------

Liabilities

Current Liabilities

Bank indebtedness 48,758 48,877

Accounts payable and accrued liabilities 33,883 28,229

Dividends payable 1,148 1,197

Income taxes payable 1,000 -

Current portion of derivative financial instruments 1,894 1,922

Current portion of long-term debt 5,333 6,158

-------------------

92,016 86,383

Long-term debt 42,720 47,633

Long-term derivative financial instruments 1,578 1,667

Employee future benefits 3,803 4,530

Future income taxes 11,906 9,838

-------------------

152,023 150,051

-------------------

Shareholders' Equity

Capital Stock 7,026 7,375

Retained Earnings 107,641 106,290

-------------------

114,667 113,665

-------------------

266,690 263,716

-------------------

-------------------

The accompanying notes are an integral part of these consolidated financial

statements

ANDREW PELLER LIMITED

Consolidated Statements of Earnings, Comprehensive Earnings and Retained

Earnings

For the Three For the Twelve

Months Ended Months Ended

March 31 March 31

2011 2010 2011 2010

$ $ $ $

-------------------------------------------------------- -------------------

Sales 56,940 59,295 265,420 263,151

Cost of goods sold, excluding

amortization 34,775 37,014 161,758 166,827

--------- --------- --------- ---------

Gross profit 22,165 22,281 103,662 96,324

Selling and administration 18,196 18,152 71,703 68,970

--------- --------- --------- ---------

Earnings before interest and

amortization 3,969 4,129 31,959 27,354

Interest 1,241 1,926 6,673 7,873

Amortization of plant, equipment and

intangible assets 2,098 1,817 8,202 7,991

--------- --------- --------- ---------

Earnings before other items 630 386 17,084 11,490

Net unrealized gains on derivative

financial instruments (291) (781) (117) (3,224)

Other expenses (155) 380 921 1,627

--------- --------- --------- ---------

Earnings before income taxes 1,076 787 16,280 13,087

--------- --------- --------- ---------

Provision for (recovery of) income

taxes

Current (1,748) 172 3,223 3,503

Future 2,485 (223) 2,068 58

--------- --------- --------- ---------

737 (51) 5,291 3,561

--------- --------- --------- ---------

Net and comprehensive earnings for

the year from continuing operations 339 838 10,989 9,526

Net and comprehensive earnings for

the year from a discontinued

operation - (200) - 12,135

--------- --------- --------- ---------

Net and comprehensive earnings for

the year 339 638 10,989 21,661

Retained earnings- Beginning of year 113,349 106,848 106,290 89,416

Purchase and cancellation of Class A

shares (4,900) - (4,900) -

Dividends:

Class A and Class B (1,147) (1,196) (4,738) (4,787)

--------- --------- --------- ---------

Retained earnings - End of year 107,641 106,290 107,641 106,290

--------- --------- --------- ---------

--------- --------- --------- ---------

Net earnings per share from

continuing operations

Basic and diluted

Class A shares 0.03 0.06 0.76 0.66

--------- --------- --------- ---------

--------- --------- --------- ---------

Class B shares 0.02 0.05 0.66 0.57

--------- --------- --------- ---------

--------- --------- --------- ---------

Net earnings (loss) per share from

discontinued operation

Basic and diluted

Class A shares 0.00 (0.02) 0.00 0.83

--------- --------- --------- ---------

--------- --------- --------- ---------

Class B shares 0.00 (0.01) 0.00 0.73

--------- --------- --------- ---------

--------- --------- --------- ---------

Net earnings per share

Basic and diluted

Class A shares 0.03 0.04 0.76 1.49

--------- --------- --------- ---------

--------- --------- --------- ---------

Class B shares 0.02 0.04 0.66 1.30

--------- --------- --------- ---------

--------- --------- --------- ---------

The accompanying notes are an integral part of these consolidated financial

statements

ANDREW PELLER LIMITED

Consolidated Statements of Cash Flows

For the three months ended March 31, 2011 and 2010

For the three For the twelve

months ended months ended

March 31 March 31

2011 2010 2011 2010

$ $ $ $

---------------------------------------------- ------------------- ---------

Cash provided by (used in)

Operating activities

Net earnings for the period 339 838 10,989 9,526

Items not affecting cash:

Loss on disposal of property,

plant and equipment 187 175 865 175

Amortization of plant, equipment

and intangible assets 2,098 1,817 8,202 7,991

Employee future benefits (189) (300) (727) (866)

Net unrealized gains on derivative

financial instruments (291) (781) (117) (3,224)

Future income taxes 2,485 (223) 2,068 58

Amortization of deferred financing

costs 16 294 420 371

Write-off of deferred financing

costs - 267 - 267

Impairment charges - 0 - 1,247

--------- --------- --------- ---------

4,645 2,087 21,700 15,545

Changes in non-cash working capital

items related to operations 7,536 8,324 1,319 2,070

--------- --------- --------- ---------

12,181 10,411 23,019 17,615

--------- --------- --------- ---------

Investing activities

Purchase of other assets (101) (165) (101) (165)

Proceeds from disposal of property,

plant and equipment 722 34 1,488 34

Purchase of property, plant and

equipment (3,424) (613) (8,093) (5,047)

Acquisition of businesses - - (825) (825)

--------- --------- --------- ---------

(2,803) (744) (7,531) (6,003)

--------- --------- --------- ---------

Financing activities

Repurchase of Class A shares (5,249) - (5,249) -

Increase in deferred financing costs - (68) - (979)

Decrease in bank indebtedness (1,600) (7,726) (119) (3,315)

Payment to partially unwind a

derivative financial instrument - - - (1,600)

Repayment of long-term debt (1,333) (1,333) (5,333) (22,750)

Dividends paid (1,196) (1,196) (4,787) (4,787)

--------- --------- --------- ---------

(9,378) (10,323) (15,488) (33,431)

--------- --------- --------- ---------

Cash used in continuing operations - (656) - (21,819)

Cash provided from discontinued

operation - 656 - 21,819

--------- --------- --------- ---------

Cash at beginning and end of year - - - -

--------- --------- --------- ---------

--------- --------- --------- ---------

Supplemental disclosure of cash flow

information

Cash paid (received) during the year

from continuing operations for

Interest 1,175 1,747 6,601 7,819

Income taxes (2,009) 3,557 896 38

Cash paid (received) during the year

from discontinued operation for

Income taxes - (155) - 602

Cash paid (received) during the year

for

Interest 1,175 1,747 6,601 7,819

Income taxes (2,009) 3,402 896 640

The accompanying notes are an integral part of these consolidated financial

statements

Contacts: Andrew Peller Limited Mr. Peter Patchet CFO and EVP

Human Resources (905) 643-4131 Ext. 2210

peter.patchet@andrewpeller.com

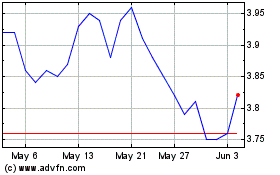

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

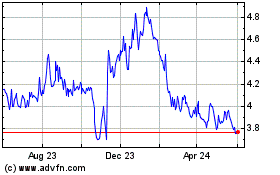

Andrew Peller (TSX:ADW.A)

Historical Stock Chart

From Jul 2023 to Jul 2024