- For Fourth Quarter 2019, Zoetis Reports Revenue of $1.7

Billion, Growing 7%, and Net Income of $384 Million, or $0.80 per

Diluted Share, on a Reported Basis

- Reports Adjusted Net Income of $440 Million, or Adjusted

Diluted EPS of $0.92, for Fourth Quarter 2019

- Delivers 9% Operational Growth in Revenue and 13%

Operational Growth in Adjusted Net Income for Fourth Quarter

2019

- For Full Year 2019, Zoetis Reports Revenue of $6.3 Billion,

Growing 7%, and Net Income of $1.5 Billion, or $3.11 per Diluted

Share, on a Reported Basis

- Reports Adjusted Net Income of $1.8 Billion, or Adjusted

Diluted EPS of $3.64, for Full Year 2019

- Delivers 10% Operational Growth in Revenue and 14%

Operational Growth in Adjusted Net Income for Full Year

2019

- Provides Full Year 2020 Revenue Guidance of $6.650 - $6.800

Billion, with Diluted EPS of $3.53 - $3.65 on a Reported Basis, or

$3.90 - $4.00 on an Adjusted Basis

Zoetis Inc. (NYSE: ZTS) today reported its financial results for

the fourth quarter and full year 2019 and provided full year

guidance for 2020.

The company reported revenue of $1.7 billion for the fourth

quarter of 2019, which was an increase of 7% compared with the

fourth quarter of 2018. Net income for the fourth quarter of 2019

was $384 million, or $0.80 per diluted share, compared with $345

million, or $0.71 per diluted share, in the fourth quarter of

2018.

Adjusted net income1 for the fourth quarter of 2019 was $440

million, or $0.92 per diluted share, an increase of 15% and 16%,

respectively. Adjusted net income for the fourth quarter of 2019

excludes the net impact of $56 million for purchase accounting

adjustments, acquisition-related costs and certain significant

items.

On an operational2 basis, revenue for the fourth quarter of

2019, excluding the impact of foreign exchange, increased 9%

compared with the fourth quarter of 2018. Adjusted net income for

the fourth quarter of 2019 increased 13% operationally, excluding

the impact of foreign exchange.

For full year 2019, the company reported revenue of $6.3

billion, an increase of 7% compared with full year 2018. Net income

for full year 2019 was $1.5 billion, or $3.11 per diluted share, an

increase of 5% and 6%, respectively.

Adjusted net income for full year 2019 was $1.8 billion, or

$3.64 per diluted share, an increase of 15% and 16%, respectively.

Adjusted net income for full year 2019 excludes the net impact of

$255 million for purchase accounting adjustments,

acquisition-related costs and certain significant items.

On an operational basis, revenue for full year 2019 increased

10%, excluding the impact of foreign exchange. Adjusted net income

for full year 2019 increased 14% operationally, excluding the

impact of foreign exchange.

EXECUTIVE COMMENTARY

“In 2019, Zoetis delivered another year of strong growth and

market leadership thanks to our diverse and durable portfolio and

commitment to continuous innovation,” said Kristin Peck, Chief

Executive Officer of Zoetis. “We grew revenue 10% operationally,

which is once again above market growth in a competitive, global

sector. We also grew our adjusted net income faster than revenue,

at 14% operationally, continuing to achieve our goal of growing

profitability faster than revenue over the long term.”

“Looking ahead in 2020, we are excited about the launch of

Simparica® Trio, our new triple combination parasiticide for dogs,

and we will be heavily focused on bringing this key innovation to

customers around the world,” said Peck. “Additionally, we will

continue to advance our pipeline with innovations in parasiticides,

monoclonal antibodies and vaccines; support our latest product

launches and lifecycle innovations across the portfolio; and invest

in newer growth areas for us such as diagnostics, digital and data

analytics. For full year 2020, we expect operational growth of 7%

to 9.5% in revenue and 8% to 11% in adjusted net income. As the new

CEO of Zoetis, I look forward to carrying on the company’s

successful formula of customer focus, innovation and execution, as

we continue to deliver on our long-term value proposition to

shareholders.”

QUARTERLY HIGHLIGHTS

Zoetis organizes and manages its commercial operations across

two regional segments: the United States (U.S.) and International.

Within these segments, the company delivers a diverse portfolio of

products for companion animals and livestock tailored to local

trends and customer needs. In the fourth quarter of 2019:

- Revenue in the U.S. segment was $861 million, an

increase of 6% compared with the fourth quarter of 2018. Sales of

companion animal products increased 15% driven primarily by growth

in our key dermatology portfolio across both the Apoquel® and

Cytopoint® brands. Additionally, companion animal sales benefited

from the recent acquisition of Platinum Performance and its

nutritional product formulas. Increased sales of parasiticides,

including ProHeart® 12 and Simparica®, also significantly

contributed to growth in the quarter. Sales of livestock products

declined 3% in the quarter. This decline was the result of

continued weakness in both the beef and dairy cattle sectors which

more than offset double digit growth in poultry and swine. Growth

in poultry was driven primarily by increased sales of Zoamix®, an

alternative to antibiotics in medicated feed additives, while

growth in swine was the result of increased sales of medicated feed

additives and vaccines.

- Revenue in the International segment was $791 million,

an increase of 9% on a reported basis and an increase of 12%

operationally compared with the fourth quarter of 2018. Sales of

companion animal products grew 23% on a reported basis and 26% on

an operational basis. Growth resulted primarily from increased

sales across our key dermatology portfolio and in certain

parasiticides, including Simparica and the Revolution®/Stronghold®

franchise, as well as growth across key markets in Western Europe

and in China. New diagnostics accounts in the UK and emerging

markets also contributed to growth. Sales of livestock products

grew 2% on a reported basis and 5% operationally. Growth in our

cattle portfolio was driven by favorable conditions in key markets,

including Australia, Germany and Mexico, as well as other smaller

developed markets. Alpha Flux®, a recently launched parasiticide

that controls sea lice in salmon, was the primary driver of growth

in fish, while promotional activities across Russia, India and

Brazil drove growth in poultry. Sales of swine products declined as

a result of the ongoing impact of African Swine Fever in China and

other smaller markets in Southeast Asia.

INVESTMENTS IN GROWTH

Zoetis diversifies and grows its business through the

introduction of new products, lifecycle innovations, business

development initiatives, and entries into new markets and

technologies. The company is increasingly focused on developing

integrated solutions for pet owners, veterinarians and farmers that

span the continuum of animal care - helping to predict, prevent,

detect and treat diseases.

Since our last quarterly earnings announcement, Zoetis has

continued to expand its reference laboratory capabilities in the

U.S. with the acquisitions of Phoenix Lab and ZNLabs

in November 2019 and Ethos Diagnostic Science this month.

This builds on the company’s strategy to develop a more

comprehensive diagnostics offering with enhanced value for

veterinarians.

Zoetis also received approval for Rimadyl® (carprofen)

for dogs in China, one of the fastest growing companion animal

markets in the world. This product, approved in both chewable and

injectable formulations, is indicated for the relief of pain and

inflammation associated with osteoarthritis (chewables), and for

the control of postoperative pain associated with soft tissue and

orthopedic surgeries (injectable). It was first approved in the UK

in 1993, and is an example of the product durability and longevity

generated by the company’s focus on lifecycle innovation and

geographic expansion.

FINANCIAL GUIDANCE

Zoetis is providing full year 2020 guidance, which includes:

- Revenue between $6.650 billion to $6.800 billion

- Reported diluted EPS between $3.53 to $3.65

- Adjusted diluted EPS between $3.90 to $4.00

This guidance reflects foreign exchange rates as of late

January. Additional details on guidance are included in the

financial tables and will be discussed on the company's conference

call this morning.

WEBCAST & CONFERENCE CALL

DETAILS

Zoetis will host a webcast and conference call at 8:30 a.m. (ET)

today, during which company executives will review fourth quarter

and full year 2019 results, discuss financial guidance and respond

to questions from financial analysts. Investors and the public may

access the live webcast by visiting the Zoetis website at

http://investor.zoetis.com/events-presentations. A

replay of the webcast will be archived and made available on Feb.

13, 2020.

About Zoetis

Zoetis is the leading animal health

company, dedicated to supporting its customers and their

businesses. Building on more than 65 years of experience in animal

health, Zoetis discovers, develops, manufactures and commercializes

medicines, vaccines and diagnostic products, which are complemented

by biodevices, genetic tests and precision livestock farming.

Zoetis serves veterinarians, livestock producers and people who

raise and care for farm and companion animals with sales of its

products in more than 100 countries. In 2019, the company generated

annual revenue of $6.3 billion with approximately 10,600 employees.

For more information, visit www.zoetis.com.

1 Adjusted net income and its components and adjusted diluted

earnings per share (non-GAAP financial measures) are defined as

reported net income attributable to Zoetis and reported diluted

earnings per share, excluding purchase accounting adjustments,

acquisition-related costs and certain significant items.

2 Operational revenue growth (a non-GAAP financial measure) is

defined as growth excluding the impact of foreign exchange.

DISCLOSURE NOTICES

Forward-Looking Statements: This

press release contains forward-looking statements, which reflect

the current views of Zoetis with respect to business plans or

prospects, future operating or financial performance, future

guidance, future operating models, expectations regarding products,

product approvals or products under development, expected timing of

product launches, expectations regarding the performance of

acquired companies and our ability to integrate new businesses,

expectations regarding the financial impact of acquisitions, future

use of cash and dividend payments, tax rate and tax regimes,

changes in the tax regimes and laws in other jurisdictions, and

other future events. These statements are not guarantees of future

performance or actions. Forward-looking statements are subject to

risks and uncertainties. If one or more of these risks or

uncertainties materialize, or if management's underlying

assumptions prove to be incorrect, actual results may differ

materially from those contemplated by a forward-looking statement.

Forward-looking statements speak only as of the date on which they

are made. Zoetis expressly disclaims any obligation to update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise. A further list and

description of risks, uncertainties and other matters can be found

in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2018, including in the sections thereof captioned

“Forward-Looking Statements and Factors That May Affect Future

Results” and “Item 1A. Risk Factors,” in our Quarterly Reports on

Form 10-Q and in our Current Reports on Form 8-K. These filings and

subsequent filings are available online at www.sec.gov, www.zoetis.com, or on request from Zoetis.

Use of Non-GAAP Financial Measures:

We use non-GAAP financial measures, such as adjusted net income,

adjusted diluted earnings per share and operational results (which

exclude the impact of foreign exchange), to assess and analyze our

results and trends and to make financial and operational decisions.

We believe these non-GAAP financial measures are also useful to

investors because they provide greater transparency regarding our

operating performance. The non-GAAP financial measures included in

this press release should not be considered alternatives to

measurements required by GAAP, such as net income, operating

income, and earnings per share, and should not be considered

measures of liquidity. These non-GAAP financial measures are

unlikely to be comparable with non-GAAP information provided by

other companies. Reconciliation of non-GAAP financial measures and

GAAP financial measures are included in the tables accompanying

this press release and are posted on our website at www.zoetis.com.

Internet Posting of Information: We

routinely post information that may be important to investors in

the 'Investors' section of our website at www.zoetis.com, on our Facebook page at

http://www.facebook.com/zoetis and on

Twitter@zoetis. We encourage investors

and potential investors to consult our website regularly and to

follow us on Facebook and Twitter for important information about

us.

ZOETIS INC.

CONDENSED CONSOLIDATED STATEMENTS

OF INCOME(a)

(UNAUDITED)

(millions of dollars, except per

share data)

Fourth Quarter

Full Year

2019

2018

% Change

2019

2018

% Change

Revenue

$

1,674

$

1,564

7

$

6,260

$

5,825

7

Costs and expenses:

Cost of sales

530

544

(3

)

1,992

1,911

4

Selling, general and administrative

expenses

472

420

12

1,638

1,484

10

Research and development expenses

132

125

6

457

432

6

Amortization of intangible assets

40

39

3

155

117

32

Restructuring charges and certain

acquisition-related costs

18

14

29

51

68

(25

)

Interest expense

56

59

(5

)

223

206

8

Other (income)/deductions–net

(11

)

(55

)

(80

)

(57

)

(83

)

(31

)

Income before provision for taxes on

income

437

418

5

1,801

1,690

7

Provision for taxes on income

53

73

(27

)

301

266

13

Net income before allocation to

noncontrolling interests

384

345

11

1,500

1,424

5

Less: Net loss attributable to

noncontrolling interests

—

—

—

—

(4

)

*

Net income attributable to Zoetis

$

384

$

345

11

$

1,500

$

1,428

5

Earnings per share—basic

$

0.81

$

0.72

13

$

3.14

$

2.96

6

Earnings per share—diluted

$

0.80

$

0.71

13

$

3.11

$

2.93

6

Weighted-average shares used to calculate

earnings per share

Basic

476.4

480.6

478.1

483.1

Diluted

480.2

484.5

481.8

486.9

(a)

The Condensed Consolidated Statements of

Income present the three and twelve months ended December 31, 2019

and 2018. Subsidiaries operating outside the U.S. are included for

the three and twelve months ended November 30, 2019 and 2018.

* Calculation not meaningful.

ZOETIS INC.

RECONCILIATION OF GAAP REPORTED

TO NON-GAAP ADJUSTED INFORMATION

CERTAIN LINE ITEMS

(UNAUDITED)

(millions of dollars, except per

share data)

Quarter Ended December 31,

2019

GAAP Reported(a)

Purchase Accounting

Adjustments

Acquisition- Related Costs(1)

Certain Significant Items(2)

Non-GAAP Adjusted(b)

Cost of sales

$

530

$

(2

)

$

—

$

(1

)

$

527

Gross profit

1,144

2

—

1

1,147

Selling, general and administrative

expenses

472

(18

)

—

(2

)

452

Research and development expenses

132

(1

)

—

—

131

Amortization of intangible assets

40

(34

)

—

—

6

Restructuring charges and certain

acquisition-related costs

18

—

(10

)

(8

)

—

Other (income)/deductions–net

(11

)

—

—

—

(11

)

Income before provision for taxes on

income

437

55

10

11

513

Provision for taxes on income

53

19

1

—

73

Net income attributable to Zoetis

384

36

9

11

440

Earnings per common share attributable to

Zoetis–diluted

0.80

0.08

0.02

0.02

0.92

Quarter Ended December 31,

2018

GAAP Reported(a)

Purchase Accounting

Adjustments

Acquisition- Related Costs(1)

Certain Significant Items(2)

Non-GAAP Adjusted(b)

Cost of sales

$

544

$

(14

)

$

—

$

(4

)

$

526

Gross profit

1,020

14

—

4

1,038

Selling, general and administrative

expenses

420

(18

)

—

(1

)

401

Research and development expenses

125

(1

)

—

—

124

Amortization of intangible assets

39

(34

)

—

—

5

Restructuring charges and certain

acquisition-related costs

14

—

(22

)

8

—

Other (income)/deductions–net

(55

)

—

—

42

(13

)

Income before provision for taxes on

income

418

67

22

(45

)

462

Provision for taxes on income

73

16

4

(13

)

80

Net income attributable to Zoetis

345

51

18

(32

)

382

Earnings per common share attributable to

Zoetis–diluted

0.71

0.11

0.04

(0.07

)

0.79

(a)

The Condensed Consolidated Statements of

Income present the quarter ended December 31, 2019 and 2018.

Subsidiaries operating outside the U.S. are included for the

quarter ended November 30, 2019 and 2018.

(b)

Non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS are not, and should

not be viewed as, substitutes for U.S. GAAP net income and its

components and diluted EPS. Despite the importance of these

measures to management in goal setting and performance measurement,

non-GAAP adjusted net income and its components and non-GAAP

adjusted diluted EPS are non-GAAP financial measures that have no

standardized meaning prescribed by U.S. GAAP and, therefore, have

limits in their usefulness to investors. Because of the non-

standardized definitions, non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS (unlike U.S. GAAP net

income and its components and diluted EPS) may not be comparable to

the calculation of similar measures of other companies. Non-GAAP

adjusted net income and its components, and non-GAAP adjusted

diluted EPS are presented solely to permit investors to more fully

understand how management assesses performance.

See Notes to Reconciliation of GAAP Reported to Non-GAAP Adjusted

Information for notes (1) and (2).

ZOETIS INC.

RECONCILIATION OF GAAP REPORTED

TO NON-GAAP ADJUSTED INFORMATION

CERTAIN LINE ITEMS

(UNAUDITED)

(millions of dollars, except per

share data)

Twelve Months Ended December 31,

2019

GAAP Reported(a)

Purchase Accounting

Adjustments

Acquisition- Related Costs(1)

Certain Significant Items(2)

Non-GAAP Adjusted(b)

Cost of sales

$

1,992

$

(24

)

$

—

$

(77

)

$

1,891

Gross profit

4,268

24

—

77

4,369

Selling, general and administrative

expenses

1,638

(72

)

—

(2

)

1,564

Research and development expenses

457

(2

)

—

—

455

Amortization of intangible assets

155

(136

)

—

—

19

Restructuring charges and certain

acquisition-related costs

51

—

(43

)

(8

)

—

Other (income)/deductions–net

(57

)

—

—

20

(37

)

Income before provision for taxes on

income

1,801

234

43

67

2,145

Provision for taxes on income

301

78

7

4

390

Net income attributable to Zoetis

1,500

156

36

63

1,755

Earnings per common share attributable to

Zoetis–diluted

3.11

0.32

0.08

0.13

3.64

Twelve Months Ended December 31,

2018

GAAP Reported(a)

Purchase Accounting

Adjustments

Acquisition- Related Costs(1)

Certain Significant Items(2)

Non-GAAP Adjusted(b)

Cost of sales

$

1,911

$

(27

)

$

—

$

(8

)

$

1,876

Gross profit

3,914

27

—

8

3,949

Selling, general and administrative

expenses

1,484

(32

)

—

(2

)

1,450

Research and development expenses

432

(2

)

—

—

430

Amortization of intangible assets

117

(101

)

—

—

16

Restructuring charges and certain

acquisition-related costs

68

—

(63

)

(5

)

—

Other (income)/deductions–net

(83

)

—

—

58

(25

)

Income before provision for taxes on

income

1,690

162

63

(43

)

1,872

Provision for taxes on income

266

43

13

29

351

Net income attributable to Zoetis

1,428

119

50

(72

)

1,525

Earnings per common share attributable to

Zoetis–diluted

2.93

0.24

0.10

(0.14

)

3.13

(a)

The Condensed Consolidated Statements of

Income present the twelve months ended December 31, 2019 and 2018.

Subsidiaries operating outside the U.S. are included for the twelve

months ended November 30, 2019 and 2018.

(b)

Non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS are not, and should

not be viewed as, substitutes for U.S. generally accepted

accounting principles (GAAP) net income and its components and

diluted EPS. Despite the importance of these measures to management

in goal setting and performance measurement, non-GAAP adjusted net

income and its components and non-GAAP adjusted diluted EPS are

non-GAAP financial measures that have no standardized meaning

prescribed by U.S. GAAP and, therefore, have limits in their

usefulness to investors. Because of the non-standardized

definitions, non-GAAP adjusted net income and its components and

non-GAAP adjusted diluted EPS (unlike U.S. GAAP net income and its

components and diluted EPS) may not be comparable to the

calculation of similar measures of other companies. Non-GAAP

adjusted net income and its components, and non-GAAP adjusted

diluted EPS are presented solely to permit investors to more fully

understand how management assesses performance.

See Notes to Reconciliation of GAAP

Reported to Non-GAAP Adjusted Information for notes (1) and

(2).

ZOETIS INC.

NOTES TO RECONCILIATION OF GAAP

REPORTED TO NON-GAAP ADJUSTED INFORMATION

CERTAIN LINE ITEMS

(UNAUDITED)

(millions of dollars)

(1) Acquisition-related costs include the

following:

Fourth Quarter

Full Year

2019

2018

2019

2018

Transaction costs(a)

$

—

$

—

$

—

$

21

Integration costs(b)

5

11

18

21

Restructuring charges(c)

5

11

25

21

Total acquisition-related

costs—pre-tax

10

22

43

63

Income taxes(d)

1

4

7

13

Total acquisition-related costs—net of

tax

$

9

$

18

$

36

$

50

(a)

Transaction costs represent external costs

directly related to acquiring businesses and primarily includes

expenditures for banking, legal, accounting and other similar

services. Included in Restructuring charges and certain

acquisition-related costs.

(b)

Integration costs represent external,

incremental costs directly related to integrating acquired

businesses and primarily includes expenditures for consulting and

the integration of systems and processes. Included in Restructuring

charges and certain acquisition-related costs.

(c)

Represents employee termination costs

related to the 2018 acquisition of Abaxis. Included in

Restructuring charges and certain acquisition-related costs.

(d)

Included in Provision for taxes on income.

Represents the tax effect of the associated pre-tax

acquisition-related amounts, calculated by determining the

jurisdictional location of the pre-tax amounts and applying that

jurisdiction's applicable tax rate. For the twelve months ended

December 31, 2018, also includes a tax charge related to the

non-deductibility of certain costs associated with the 2018

acquisition of Abaxis.

(2) Certain significant items

include the following:

Fourth Quarter

Full Year

2019

2018

2019

2018

Operational efficiency initiative(a)

$

—

$

(1

)

$

(20

)

$

(1

)

Supply network strategy(b)

—

2

7

10

Other restructuring charges and

cost-reduction/productivity initiatives(c)

8

(4

)

8

7

Net gain on sale of assets(d)

—

(42

)

—

(42

)

Other(e)

3

—

72

(17

)

Total certain significant

items—pre-tax

11

(45

)

67

(43

)

Income taxes(f)

—

(13

)

4

29

Total certain significant items—net of

tax

$

11

$

(32

)

$

63

$

(72

)

(a)

For 2019, represents income resulting from

a payment received pursuant to an agreement related to the 2016

sale of certain U.S. manufacturing sites.

(b)

Represents consulting fees and product

transfer costs, included in Cost of sales, and employee termination

costs and exit costs, included in Restructuring charges and certain

acquisition-related costs, related to cost-reduction and

productivity initiatives.

(c)

For 2019, represents employee termination

costs incurred as a result of the CEO transition, included in

Restructuring charges and certain acquisition-related costs. For

2018, represents employee termination costs/(reversals) in Europe

as a result of initiatives to better align our organizational

structure, included in Restructuring charges and certain

acquisition-related costs.

(d)

Represents a net gain related to the

divestiture of certain agribusiness products within our

International segment, included in Other

(income)/deductions—net.

(e)

For 2019, primarily represents a change in

estimate related to inventory costing, included in Cost of sales

and the modification of share-based compensation related to CEO

transition-related costs, included in Selling, general and

administrative expenses. For 2018, primarily represents a net gain

related to the relocation of a manufacturing site in China,

included in Other (income)/deductions—net.

(f)

Included in Provision for taxes on income.

Represents the tax effect of the associated pre-tax certain

significant items amounts, calculated by determining the

jurisdictional location of the pre-tax amounts and applying that

jurisdiction's applicable tax rate. For 2018, also includes (i) a

net tax benefit of $45 million related to a measurement period

adjustment to the one-time mandatory deemed repatriation tax on the

company's undistributed non-U.S. earnings, pursuant to the Tax Act

and (ii) a tax charge of approximately $17 million related to the

disposal of certain assets.

ZOETIS INC.

ADJUSTED SELECTED COSTS AND

EXPENSES(a)

(UNAUDITED)

(millions of dollars)

Fourth Quarter

% Change

2019

2018

Total

Foreign Exchange

Operational(b)

Adjusted cost of sales

$

527

$

526

—

%

(5

)%

5

%

As a percent of revenue

31.5

%

33.6

%

NA

NA

NA

Adjusted SG&A expenses

$

452

$

401

13

%

(1

)%

14

%

Adjusted R&D expenses

131

124

6

%

(1

)%

7

%

Adjusted net income attributable to

Zoetis

440

382

15

%

2

%

13

%

Full Year

% Change

2019

2018

Total

Foreign Exchange

Operational(b)

Adjusted cost of sales

$

1,891

$

1,876

1

%

(6

)%

7

%

As a percent of revenue

30.2

%

32.2

%

NA

NA

NA

Adjusted SG&A expenses

$

1,564

$

1,450

8

%

(3

)%

11

%

Adjusted R&D expenses

455

430

6

%

(1

)%

7

%

Adjusted net income attributable to

Zoetis

1,755

1,525

15

%

1

%

14

%

(a)

Adjusted cost of sales, adjusted selling,

general, and administrative (SG&A) expenses, adjusted research

and development (R&D) expenses, and adjusted net income

attributable to Zoetis (non-GAAP financial measures) are defined as

the corresponding reported U.S. GAAP income statement line items

excluding purchase accounting adjustments, acquisition-related

costs, and certain significant items. These adjusted income

statement line item measures are not, and should not be viewed as,

substitutes for the corresponding U.S. GAAP line items. The

corresponding U.S. GAAP line items and reconciliations of reported

to adjusted information are provided in Condensed Consolidated

Statements of Income and Reconciliation of GAAP Reported to

Non-GAAP Adjusted Information.

(b)

Operational growth (a non-GAAP financial

measure) is defined as growth excluding the impact of foreign

exchange.

ZOETIS INC.

2020 GUIDANCE

Selected Line Items (millions of dollars,

except per share amounts)

Full Year 2020

Revenue

$6,650 to $6,800

Operational growth(a)

7.0% to 9.5%

Adjusted cost of sales as a percentage of

revenue(b)

30% to 31%

Adjusted SG&A expenses(b)

$1,590 to $1,640

Adjusted R&D expenses(b)

$455 to $475

Adjusted interest expense and other

(income)/deductions(b)

Approximately $215

Effective tax rate on adjusted

income(b)

20% to 21%

Adjusted diluted EPS(b)

$3.90 to $4.00

Adjusted net income(b)

$1,865 to $1,915

Operational growth(a)(c)

8% to 11%

Certain significant items and

acquisition-related costs(d)

$20 to $30

The guidance reflects foreign exchange rates as of late January

2020.

Reconciliations of 2020 reported guidance to 2020 adjusted

guidance follows:

(millions of dollars, except per share

amounts)

Reported

Certain significant items and

acquisition-related costs(d)

Purchase accounting

Adjusted(b)

Cost of sales as a percentage of

revenue

30.3% to 31.3%

~ (0.2%)

~ (0.1%)

30% to 31%

SG&A expenses

$1,661 to $1,711

~ ($6)

~ ($65)

$1,590 to $1,640

R&D expenses

$457 to $477

~ ($2)

$455 to $475

Interest expense and other

(income)/deductions

~ $195

~ $20

~ $215

Effective tax rate

19.5% to 20.5%

~ 0.5%

20% to 21%

Diluted EPS

$3.53 to $3.65

$0.04 to $0.06

~ $0.31

$3.90 to $4.00

Net income attributable to Zoetis

$1,685 to $1,745

$20 to $30

~ $150

$1,865 to $1,915

(a)

Operational growth (a non-GAAP financial

measure) excludes the impact of foreign exchange.

(b)

Adjusted net income and its components and

adjusted diluted EPS are defined as reported U.S. GAAP net income

and its components and reported diluted EPS excluding purchase

accounting adjustments, acquisition-related costs and certain

significant items. Adjusted cost of sales, adjusted SG&A

expenses, adjusted R&D expenses, and adjusted interest expense

and other (income)/deductions are income statement line items

prepared on the same basis, and, therefore, components of the

overall adjusted income measure. Despite the importance of these

measures to management in goal setting and performance measurement,

adjusted net income and its components and adjusted diluted EPS are

non-GAAP financial measures that have no standardized meaning

prescribed by U.S. GAAP and, therefore, have limits in their

usefulness to investors. Because of the non-standardized

definitions, adjusted net income and its components and adjusted

diluted EPS (unlike U.S. GAAP net income and its components and

diluted EPS) may not be comparable to the calculation of similar

measures of other companies. Adjusted net income and its components

and adjusted diluted EPS are presented solely to permit investors

to more fully understand how management assesses performance.

Adjusted net income and its components and adjusted diluted EPS are

not, and should not be viewed as, substitutes for U.S. GAAP net

income and its components and diluted EPS.

(c)

We do not provide a reconciliation of

forward-looking non-GAAP adjusted net income operational growth to

the most directly comparable U.S. GAAP reported financial measure

because we are unable to calculate with reasonable certainty the

foreign exchange impact of unusual gains and losses,

acquisition-related expenses, potential future asset impairments

and other certain significant items, without unreasonable effort.

The foreign exchange impacts of these items are uncertain, depend

on various factors, and could have a material impact on U.S. GAAP

reported results for the guidance period.

(d)

Primarily includes certain nonrecurring

costs related to acquisitions and other charges.

ZOETIS INC.

CONSOLIDATED REVENUE BY

SEGMENT(a) AND SPECIES

(UNAUDITED)

(millions of dollars)

Fourth Quarter

% Change

2019

2018

Total

Foreign Exchange

Operational(b)

Revenue:

Livestock

$

868

$

872

—

%

(2

)%

2

%

Companion Animal

784

664

18

%

(1

)%

19

%

Contract Manufacturing & Human

Health

22

28

(21

)%

(2

)%

(19

)%

Total Revenue

$

1,674

$

1,564

7

%

(2

)%

9

%

U.S.

Livestock

$

372

$

384

(3

)%

—

%

(3

)%

Companion Animal

489

425

15

%

—

%

15

%

Total U.S. Revenue

$

861

$

809

6

%

—

%

6

%

International

Livestock

$

496

$

488

2

%

(3

)%

5

%

Companion Animal

295

239

23

%

(3

)%

26

%

Total International Revenue

$

791

$

727

9

%

(3

)%

12

%

Livestock:

Cattle

$

506

$

525

(4

)%

(2

)%

(2

)%

Swine

162

163

(1

)%

(2

)%

1

%

Poultry

142

127

12

%

(1

)%

13

%

Fish

44

40

10

%

(7

)%

17

%

Other

14

17

(18

)%

(7

)%

(11

)%

Total Livestock Revenue

$

868

$

872

—

%

(2

)%

2

%

Companion Animal:

Dogs and Cats

$

719

$

613

17

%

(2

)%

19

%

Horses

65

51

27

%

1

%

26

%

Total Companion Animal Revenue

$

784

$

664

18

%

(1

)%

19

%

(a)

For a description of each segment, see

Zoetis' most recent Annual Report on Form 10-K.

(b)

Operational revenue growth (a non-GAAP

financial measure) is defined as revenue growth excluding the

impact of foreign exchange.

ZOETIS INC.

CONSOLIDATED REVENUE BY

SEGMENT(a) AND SPECIES

(UNAUDITED)

(millions of dollars)

Full Year

% Change

2019

2018

Total

Foreign Exchange

Operational(b)

Revenue:

Livestock

$

3,030

$

3,154

(4

)%

(3

)%

(1

)%

Companion Animal

3,145

2,613

20

%

(3

)%

23

%

Contract Manufacturing & Human

Health

85

58

47

%

(1

)%

48

%

Total Revenue

$

6,260

$

5,825

7

%

(3

)%

10

%

U.S.

Livestock

$

1,219

$

1,269

(4

)%

—

%

(4

)%

Companion Animal

1,984

1,608

23

%

—

%

23

%

Total U.S. Revenue

$

3,203

$

2,877

11

%

—

%

11

%

International

Livestock

$

1,811

$

1,885

(4

)%

(6

)%

2

%

Companion Animal

1,161

1,005

16

%

(5

)%

21

%

Total International Revenue

$

2,972

$

2,890

3

%

(6

)%

9

%

Livestock:

Cattle

$

1,654

$

1,754

(6

)%

(4

)%

(2

)%

Swine

611

663

(8

)%

(3

)%

(5

)%

Poultry

559

522

7

%

(3

)%

10

%

Fish

134

132

2

%

(4

)%

6

%

Other

72

83

(13

)%

(6

)%

(7

)%

Total Livestock Revenue

$

3,030

$

3,154

(4

)%

(3

)%

(1

)%

Companion Animal:

Dogs and Cats

2,950

2,445

21

%

(2

)%

23

%

Horses

195

168

16

%

(3

)%

19

%

Total Companion Animal Revenue

$

3,145

$

2,613

20

%

(3

)%

23

%

(a)

For a description of each segment, see

Zoetis' most recent Annual Report on Form 10-K.

(b)

Operational revenue growth (a non-GAAP

financial measure) is defined as revenue growth excluding the

impact of foreign exchange.

ZOETIS INC.

CONSOLIDATED REVENUE BY KEY

INTERNATIONAL MARKETS

(UNAUDITED)

(millions of dollars)

Fourth Quarter

% Change

2019

2018

Total

Foreign Exchange

Operational(a)

Total International

$

791.6

$

727.2

9

%

(3

)%

12

%

Australia

46.4

36.8

26

%

(7

)%

33

%

Brazil

86.9

84.6

3

%

(7

)%

10

%

Canada

64.9

64.4

1

%

(1

)%

2

%

China

44.4

41.3

8

%

(2

)%

10

%

France

33.7

38.3

(12

)%

(4

)%

(8

)%

Germany

42.6

34.9

22

%

(5

)%

27

%

Italy

30.1

24.5

23

%

(4

)%

27

%

Japan

40.5

34.9

16

%

4

%

12

%

Mexico

29.4

26.2

12

%

—

%

12

%

Spain

28.2

26.8

5

%

(5

)%

10

%

United Kingdom

52.7

46.1

14

%

(3

)%

17

%

Other Developed

100.7

95.5

5

%

(5

)%

10

%

Other Emerging

191.1

172.9

11

%

(2

)%

13

%

Full Year

% Change

2019

2018

Total

Foreign Exchange

Operational(a)

Total International

$

2,972.2

$

2,889.8

3

%

(6

)%

9

%

Australia

195.9

188.6

4

%

(8

)%

12

%

Brazil

293.0

294.7

(1

)%

(10

)%

9

%

Canada

206.4

202.8

2

%

(3

)%

5

%

China

200.1

211.4

(5

)%

(4

)%

(1

)%

France

116.7

129.8

(10

)%

(5

)%

(5

)%

Germany

153.3

146.8

4

%

(6

)%

10

%

Italy

112.0

104.0

8

%

(5

)%

13

%

Japan

158.1

149.0

6

%

1

%

5

%

Mexico

116.6

100.0

17

%

(1

)%

18

%

Spain

114.4

109.9

4

%

(6

)%

10

%

United Kingdom

198.1

181.2

9

%

(6

)%

15

%

Other Developed

370.1

361.4

2

%

(6

)%

8

%

Other Emerging

737.5

710.2

4

%

(7

)%

11

%

(a)

Operational revenue growth (a non-GAAP

financial measure) is defined as revenue growth excluding the

impact of foreign exchange.

ZOETIS INC.

SEGMENT(a) EARNINGS

(UNAUDITED)

(millions of dollars)

Fourth Quarter

% Change

2019

2018

Total

Foreign Exchange

Operational(b)

U.S.:

Revenue

$

861

$

809

6

%

—

%

6

%

Cost of sales

187

175

7

%

—

%

7

%

Gross profit

674

634

6

%

—

%

6

%

Gross margin

78.3

%

78.4

%

Operating expenses

176

128

38

%

—

%

38

%

Other (income)/deductions

—

—

*

*

*

U.S. Earnings

$

498

$

506

(2

)%

—

%

(2

)%

International:

Revenue

$

791

$

727

9

%

(3

)%

12

%

Cost of sales

263

240

10

%

(3

)%

13

%

Gross profit

528

487

8

%

(4

)%

12

%

Gross margin

66.8

%

67.0

%

Operating expenses

148

148

—

%

(3

)%

3

%

Other (income)/deductions

—

1

*

*

*

International Earnings

$

380

$

338

12

%

(4

)%

16

%

Total Reportable Segments

$

878

$

844

4

%

(1

)%

5

%

Other business activities(c)

(102

)

(90

)

13

%

Reconciling Items:

Corporate(d)

(195

)

(196

)

(1

)%

Purchase accounting adjustments(e)

(55

)

(67

)

(18

)%

Acquisition-related costs(f)

(10

)

(22

)

(55

)%

Certain significant items(g)

(11

)

45

*

Other unallocated(h)

(68

)

(96

)

(29

)%

Total Earnings(i)

$

437

$

418

5

%

(a)

For a description of each segment, see

Zoetis' most recent Annual Report on Form 10-K.

(b)

Operational growth (a non-GAAP financial

measure) is defined as growth excluding the impact of foreign

exchange.

(c)

Other business activities reflect the

research and development costs managed by our Research and

Development organization as well as our contract manufacturing and

human health businesses.

(d)

Corporate includes, among other things,

administration expenses, interest expense, certain compensation

costs, certain procurement costs, and other costs not charged to

our operating segments.

(e)

Purchase accounting adjustments include

certain charges related to the amortization of fair value

adjustments to inventory, intangible assets and property, plant and

equipment not charged to our operating segments.

(f)

Acquisition-related costs include costs

associated with acquiring and integrating newly-acquired

businesses, such as transaction costs and integration costs.

(g)

Certain significant items includes

substantive, unusual items that, either as a result of their nature

or size, would not be expected to occur as part of our normal

business on a regular basis. Such items primarily include

restructuring charges and implementation costs associated with our

cost-reduction/productivity initiatives that are not associated

with an acquisition, costs associated with the operational

efficiency initiative and supply network strategy, and the impact

of divestiture- related gains and losses.

(h)

Includes overhead expenses associated with

our manufacturing and supply operations not directly attributable

to an operating segment, as well as certain procurement costs.

(i)

Defined as income before provision for

taxes on income.

* Calculation not meaningful.

ZOETIS INC.

SEGMENT(a) EARNINGS

(UNAUDITED)

(millions of dollars)

Full Year

% Change

2019

2018

Total

Foreign Exchange

Operational(b)

U.S.:

Revenue

$

3,203

$

2,877

11

%

—

%

11

%

Cost of sales

655

606

8

%

—

%

8

%

Gross profit

2,548

2,271

12

%

—

%

12

%

Gross margin

79.6

%

78.9

%

Operating expenses

543

456

19

%

—

%

19

%

Other (income)/deductions

—

—

*

*

*

U.S. Earnings

$

2,005

$

1,815

10

%

—

%

10

%

International:

Revenue

$

2,972

$

2,890

3

%

(6

)%

9

%

Cost of sales

925

929

—

%

(8

)%

8

%

Gross profit

2,047

1,961

4

%

(5

)%

9

%

Gross margin

68.9

%

67.9

%

Operating expenses

560

559

—

%

(6

)%

6

%

Other (income)/deductions

—

3

*

*

*

International Earnings

$

1,487

$

1,399

6

%

(4

)%

10

%

Total Reportable Segments

$

3,492

$

3,214

9

%

(1

)%

10

%

Other business activities(c)

(348

)

(337

)

3

%

Reconciling Items:

Corporate(d)

(707

)

(666

)

6

%

Purchase accounting adjustments(e)

(234

)

(162

)

44

%

Acquisition-related costs(f)

(43

)

(63

)

(32

)%

Certain significant items(g)

(67

)

43

*

Other unallocated(h)

(292

)

(339

)

(14

)%

Total Earnings(i)

$

1,801

$

1,690

7

%

(a)

For a description of each segment, see

Zoetis' most recent Annual Report on Form 10-K.

(b)

Operational growth (a non-GAAP financial

measure) is defined as growth excluding the impact of foreign

exchange.

(c)

Other business activities reflect the

research and development costs managed by our Research and

Development organization as well as our contract manufacturing and

human health businesses.

(d)

Corporate includes, among other things,

administration expenses, interest expense, certain compensation

costs, certain procurement costs, and other costs not charged to

our operating segments.

(e)

Purchase accounting adjustments include

certain charges related to the amortization of fair value

adjustments to inventory, intangible assets and property, plant and

equipment not charged to our operating segments.

(f)

Acquisition-related costs include costs

associated with acquiring and integrating newly- acquired

businesses, such as transaction costs and integration costs.

(g)

Certain significant items includes

substantive, unusual items that, either as a result of their nature

or size, would not be expected to occur as part of our normal

business on a regular basis. Such items primarily include

restructuring charges and implementation costs associated with our

cost-reduction/productivity initiatives that are not associated

with an acquisition, costs associated with the operational

efficiency initiative and supply network strategy, and the impact

of divestiture- related gains and losses.

(h)

Includes overhead expenses associated with

our manufacturing and supply operations not directly attributable

to an operating segment, as well as certain procurement costs.

(i)

Defined as income before provision for

taxes on income.

* Calculation not meaningful.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200213005399/en/

Media: Bill Price 1-973-443-2742

(o) william.price@zoetis.com

Kristen Seely 1-973-443-2777 (o) kristen.seely@zoetis.com

Investors: Steve Frank

1-973-822-7141 (o) steve.frank@zoetis.com

Marissa Patel 1-973-443-2996 (o) marissa.patel@zoetis.com

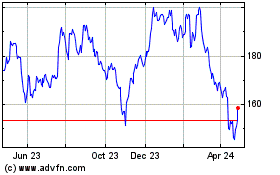

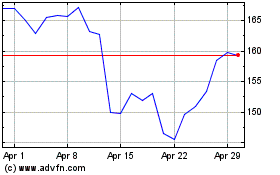

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jul 2023 to Jul 2024