Zoetis Cuts Estimates After European Commission Tax Ruling

January 12 2016 - 9:07AM

Dow Jones News

By Chelsey Dulaney

Animal-health company Zoetis Inc. said a European Commission

order Monday to recover unpaid taxes from multinationals could cut

its profits this year and in 2017.

On Monday, European Union regulators ruled that about 35

multinationals benefited from an illegal tax break in Belgium and

ordered them to pay roughly EUR700 million ($765 million) in

additional taxes.

Zoetis, a New Jersey-based maker of animal-health products, said

it was "disappointed" with the European Commission's announcement

and hadn't expected "such a negative decision." The company said it

plans to appeal the decision.

If upheld, Zoetis said it would take a charge of up to $45

million in its current quarter to reevaluate its deferred tax

assets and liabilities for 2013 to 2015.

Zoetis said the ruling would lift its tax rate for this year to

33% from its prior expectations of a 28% rate.

As a result, Zoetis said it expects its adjusted earnings for

the year to come in about 13 cents a share lower. In November,

Zoetis had forecast $1.84 to $1.94 a share in earnings.

For 2017, Zoetis expects the decision to reduce its adjusted

earnings by six cents a share. The company had forecast $2.24 a

share to $2.38 a share in adjusted earnings.

Zoetis was spun off from Pfizer Inc. in 2013. Pfizer said it

won't be affected by the decision, but multinationals including

brewer Anheuser-Busch InBev NV and BP PLC are facing back-tax

demands as a result of the decision.

After an 11-month investigation, the European Commission

concluded Monday that a Belgian tax-discount plan for

multinationals amounted to "a very serious distortion of

competition within the EU's single market."

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

January 12, 2016 08:52 ET (13:52 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

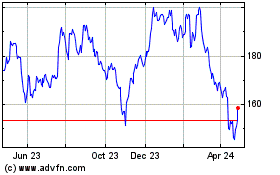

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jun 2024 to Jul 2024

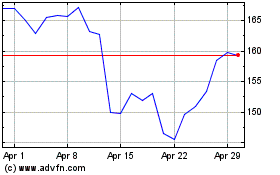

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jul 2023 to Jul 2024