UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 18, 2014

|

|

Zoetis Inc. |

(Exact name of registrant as specified in its charter) |

|

| | | | |

Delaware | | 001-35797 | | 46-0696167 |

(State or other jurisdiction | | (Commission File | | (I.R.S. Employer |

of incorporation) | | Number) | | Identification No.) |

|

| | |

100 Campus Drive, Florham Park, NJ | | 07932 |

(Address of principal executive offices) | | (Zip Code) |

|

|

(973) 822-7000 |

(Registrant's telephone number, including area code) |

|

|

Not Applicable |

(Former Name or Former Address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b))

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

The information set forth under Item 7.01 of this Current Report on Form 8-K is incorporated into this Item 2.02 by reference.

Item 7.01. Regulation FD Disclosure.

On November 18, 2014, Zoetis Inc. issued a press release announcing guidance for its full-year 2015 financial results and outlining its longer-term financial goals through 2017. A copy of the press release is attached hereto as Exhibit No. 99.1 and is incorporated by reference into this Item 7.01.

The information set forth under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing under the Securities Act of 1933, as amended, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibit:

99.1 Press Release of Zoetis Inc. dated November 18, 2014.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

ZOETIS INC. |

| |

By: | | /s/ Heidi C. Chen |

Name: | | Heidi C. Chen |

Title: | | Executive Vice President, |

| | General Counsel and Corporate Secretary |

Dated: November 18, 2014

INDEX OF EXHIBITS

|

| | |

|

Exhibit | | |

Number | | Description |

| | |

99.1 | | Press Release of Zoetis Inc. dated November 18, 2014. |

Exhibit 99.1

For immediate release:

November 18, 2014

|

| | |

Media Contacts: | | Investor Contact: |

Bill Price | | John O'Connor |

1-973-443-2742 (o) | | 1-973-822-7088 (o) |

william.price@zoetis.com | | john.oconnor@zoetis.com |

| | |

Elinore White | |

|

1-973-443-2835 (o) | |

|

elinore.y.white@zoetis.com | | |

| | |

Zoetis Outlines Strategy and Initiatives Underway to Drive Growth and

Create Shareholder Value at Investor Day Meeting

| |

• | Highlights Attractive Investment Opportunity in Animal Health Industry |

| |

• | Describes Zoetis' Competitive Advantage and Market Leadership Position |

| |

• | Announces Full-Year 2015 Guidance of $1.61 to $1.68 for Adjusted Diluted Earnings Per Share1 and Longer Term Financial Goals Through 2017 |

FLORHAM PARK, N.J. - Nov. 18, 2014 - Zoetis Inc. (NYSE: ZTS), the world’s leading animal health company, today hosted its first-ever Investor Day, discussing with investors and analysts the company’s leadership position in the animal health industry and the strategy and initiatives underway that will drive growth and create value for shareholders. The company also provided full-year 2015 financial guidance and outlined its longer term financial goals through 2017.

“Zoetis has become the world leader in the $23 billion market for animal health medicines and vaccines based on our unique combination of capabilities, our diverse portfolio of more than 300 product lines, our global presence in 120 countries and critical investments that we have made in our operations,” said Zoetis Chief Executive Officer Juan Ramón Alaix. “Our financial strength, strong performance as a fully independent company, and prospects for growth as the market leader position Zoetis to continue delivering sustained value to shareholders.”

“Steady and growing demand for meat and milk proteins and pets for companionship represent an attractive market opportunity for Zoetis to help keep animals healthy and productive. Our singular focus on animal health makes a difference in how we serve our customers, create innovative new products for their needs, and deliver a reliable, high-quality supply of medicines and vaccines, putting us in a strong position to continue growing in line with or faster than the market.”

Combining Three Interconnected Capabilities for Market Success

During the meeting, Alaix and the Zoetis executive team provided an in-depth review of the Zoetis business model and the unique characteristics that have established the company as the world leader in animal health, growing revenue faster than the market for the last three years (5.1% for Zoetis2 vs. 4.6% for the Animal Health Market).

| |

• | The company’s four regional presidents - Clint Lewis, Joyce Lee, Dr. Stefan Weiskopf and Dr. Alejandro Bernal - each described how they are gaining market share through the company’s direct selling model, with approximately 3,500 customer-facing colleagues on the ground in 70 countries. The executives emphasized the unique growth drivers and distinct needs in each of the regions, which are addressed with local-market approaches and strategies. |

| |

• | Dr. Catherine Knupp, Executive Vice President and President of Research & Development (R&D), described the company’s approach to R&D and building enduring brands, including Zoetis’ focus on customer needs, speed to market, its ability to leverage its global capabilities, and drivers of future revenue growth. Knupp highlighted examples of the company’s innovation with its recent dermatology breakthrough for dogs, APOQUEL®, and its continuous enhancement of the ceftiofur franchise over the last 25 years. Knupp also outlined the company’s areas of focus for future livestock and companion animal product innovations. |

| |

• | Kristin Peck, Executive Vice President and Group President, discussed the company’s Manufacturing and Supply Network and how it enables Zoetis to deliver high-quality, reliable supply at competitive costs through a mix of internal and external supply sources. Peck described the company’s ongoing emphasis on productivity improvements and the high value customers place on Zoetis’ reliable, high-quality supply, its record of maintaining its manufacturing excellence, and its ability to integrate acquisitions seamlessly. She also outlined the company’s plan to further optimize its network for growth and gross margin improvement. |

Future Outlook and Commitment to Generating Value for Shareholders

The company concluded its event with a discussion of its financial dynamics and expectations over a three-year horizon, including announcing guidance for full-year 2015.

“Zoetis participates in an industry where revenues are expected to grow in the mid-single digits - 5% to 6% on an operational basis3 - over the long-term,” said Zoetis Executive Vice President and Chief Financial Officer Paul Herendeen. “And, we expect to grow our revenue in line with or faster than the market based on the combination of our industry-leading field-based resources, R&D and high quality supply.

“Below the revenue line, we expect to generate modest improvements in gross margin in the near term before accelerating after 2017. After 2015, we expect to keep our operating expense growth in the range of the inflation rate,” said Herendeen. “Considering all of these factors, we believe Zoetis is a company that can grow adjusted net income1 in the low, double-digits over the long term.”

In his remarks, Herendeen indicated the company could grow revenue in the range of 5% to 7% on an operational basis3 for 2016 and 2017, and grow adjusted net income in the range of 11% to 16% on an operational basis3 for 2016 and 2017.

For full-year 2015, the company offered the following financial guidance:

| |

• | Revenue of between $4.850 billion to $4.950 billion (6.5% to 8.5% growth on an operational basis3) |

| |

• | Reported diluted EPS for the full year of between $1.36 to $1.43 per share |

| |

• | Adjusted diluted EPS1 for the full year between $1.61 to $1.68 per share |

Additional guidance on other items such as expenses and effective tax rate is included in the financial tables accompanying this press release and on the company’s website.

Herendeen also outlined the company’s priorities for capital allocation at the meeting:

| |

• | The company will aggressively manage its operating costs to drive revenue and support a complex growing business. |

| |

• | It will use capital for value-creating business development activities that add to or complement its existing business base such as the purchase of assets of Abbott Animal Health, which the company announced yesterday, to generate additional shareholder value. |

| |

• | It will return capital to shareholders through continued dividend payments and the utilization of a $500 million share repurchase authorization, which was announced separately today. |

A full replay of the company’s webcast and copies of today’s presentations will be made available on http://www.zoetis.com/events-and-presentations.

About Zoetis

Zoetis (zô-EH-tis) is the leading animal health company, dedicated to supporting its customers and their businesses. Building on more than 60 years of experience in animal health, Zoetis discovers, develops, manufactures and markets veterinary vaccines and medicines, complemented by diagnostic products and genetic tests and supported by a range of services. In 2013, the company generated annual revenue of $4.6 billion. With approximately 9,800 employees worldwide at the beginning of 2014, Zoetis has a local presence in approximately 70 countries, including 27 manufacturing facilities in 10 countries. Its products serve veterinarians, livestock producers and people who raise and care for farm and companion animals in 120 countries. For more information, visit www.zoetis.com.

1 Adjusted net income and adjusted diluted earnings per share (non-GAAP financial measures) are defined as reported net income attributable to Zoetis and reported diluted earnings per share, excluding purchase accounting adjustments, acquisition-related costs and certain significant items.

2Sales of animal health products (as defined by Vetnosis), which excludes Poultry Devices, Agribusiness, Nutritional Feed Additives. Company sales prior to February 1, 2013 refer to Pfizer Animal Health. Company sales from February 1, 2013 refer to Zoetis.

3Operational growth is defined as growth excluding the impact of foreign exchange.

DISCLOSURE NOTICES

Forward-Looking Statements: This press release contains forward-looking statements, which reflect the current views of Zoetis with respect to business plans or prospects, future operating or financial performance, expectations regarding products, future use of cash and dividend payments, and other future events. These statements are not guarantees of future performance or actions. Forward-looking statements are subject to risks and uncertainties. If one or more of these risks or uncertainties materialize, or if management's underlying assumptions prove to be incorrect, actual results may differ materially from those contemplated by a forward-looking statement. Forward-looking statements speak only as of the date on which they are made. Zoetis expressly disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. A further list and description of risks, uncertainties and other matters can be found in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, including in the sections thereof captioned “Forward-Looking Information and Factors That May Affect Future Results” and “Item 1A. Risk Factors,” in our Quarterly Reports on Form 10-Q and in our Current Reports on Form 8-K. These filings and subsequent filings are available online at www.sec.gov, www.zoetis.com, or on request from Zoetis.

###

ZOETIS INC.

2015 GUIDANCE

|

| | |

Selected Line Items | | |

Revenue | | $4,850 to $4,950 million |

Operational growth1 | | 6.5% to 8.5% |

Adjusted cost of sales as a percentage of revenue2 | | Approximately 35.5% |

Adjusted SG&A expenses2 | | $1,470 to $1,520 million |

Adjusted R&D expenses2 | | $385 to $405 million |

Adjusted interest expense and other (income)/deductions2 | | Approximately $110 million |

Effective tax rate on adjusted income2 | | Approximately 29% |

Adjusted diluted EPS2 | | $1.61 to $1.68 |

Adjusted net income2 | | $810 million to $845 million |

Operational growth1 | | 12% to 16% |

Certain significant items3 and acquisition-related costs | | $130 to $150 million |

Reported diluted EPS | | $1.36 to $1.43 |

| | |

Full-year 2015 guidance reflects current exchange rates and other factors. This excludes any impact of the recently announced acquisition of assets of Abbott Animal Health.

A reconciliation of 2015 adjusted net income and adjusted diluted EPS guidance to 2015 reported net income attributable to Zoetis and reported diluted EPS attributable to Zoetis common shareholders guidance follows: |

| | | | |

| | Full-Year 2015 Guidance |

(millions of dollars, except per share amounts) | | Net Income | | Diluted EPS |

Adjusted net income/diluted EPS2 guidance | | ~$810 - $845 | | ~$1.61 - $1.68 |

Purchase accounting adjustments | | ~(30) | | ~(0.06) |

Certain significant items3 and acquisition-related costs | | ~(90 - 105) | | ~(0.18 - 0.21) |

Reported net income attributable to Zoetis/diluted EPS guidance | | ~$685 - $720 | | ~$1.36 - $1.43 |

1Growth excluding the impact of foreign exchange.

2Adjusted net income and its components and adjusted diluted EPS are defined as reported U.S. generally accepted accounting principles (GAAP) net income and its components and reported diluted EPS excluding purchase accounting adjustments, acquisition-related costs and certain significant items. Adjusted cost of sales, adjusted selling, general and administrative (SG&A) expenses, adjusted research and development (R&D) expenses, adjusted interest expense and adjusted other (income)/deductions are income statement line items prepared on the same basis, and, therefore, components of the overall adjusted income measure. Despite the importance of these measures to management in goal setting and performance measurement, adjusted net income and its components and adjusted diluted EPS are non-GAAP financial measures that have no standardized meaning prescribed by U.S. GAAP and, therefore, have limits in their usefulness to investors. Because of the non-standardized definitions, adjusted net income and its components and adjusted diluted EPS (unlike U.S. GAAP net income and its components and diluted EPS) may not be comparable to the calculation of similar measures of other companies. Adjusted net income and its components and adjusted diluted EPS are presented solely to permit investors to more fully understand how management assesses performance. Adjusted net income and its components and adjusted diluted EPS are not, and should not be viewed as, substitutes for U.S. GAAP net income and its components and diluted EPS.

3Primarily includes certain nonrecurring costs related to becoming an independent public company, such as new branding (including changes to the manufacturing process for required new packaging), the creation of standalone systems and infrastructure, site separation, certain legal registration and patent assignment costs, as well as other charges.

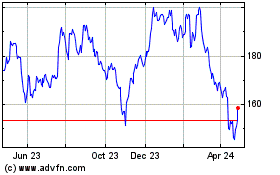

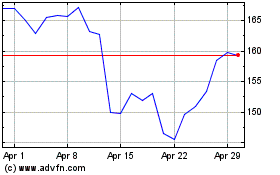

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jul 2023 to Jul 2024