- Second Quarter 2014 Revenue of $1.2

Billion Increased 4%, Compared to Second Quarter 2013

- Second Quarter 2014 Reported Net

Income of $136 Million, or Diluted EPS of $0.27, Increased 6% and

4%, respectively, Compared to Second Quarter 2013

- Second Quarter 2014 Adjusted Net

Income of $189 Million, or Adjusted Diluted EPS1 of

$0.38, Increased 6% Compared to Second Quarter 2013

- Company Narrows Full-Year 2014

Adjusted Diluted EPS1 Guidance to $1.50 -

$1.54

Zoetis Inc. (NYSE:ZTS) today reported its financial results for

the second quarter of 2014. The company reported revenue of $1.2

billion for the second quarter of 2014, an increase of 4% from the

second quarter of 2013. Revenue reflected an operational2 increase

of 6%, with foreign currency having a negative impact of 2

percentage points.

Net income for the second quarter of 2014 was $136 million, or

$0.27 per diluted share, an increase of 6% and 4%, respectively,

compared to the second quarter of 2013. Adjusted net income1 for

the second quarter of 2014 was $189 million, or $0.38 per diluted

share, an increase of 6% compared to the second quarter of 2013.

Adjusted net income for the second quarter of 2014 excludes the net

impact of $53 million, or $0.11 per diluted share, for purchase

accounting adjustments, acquisition-related costs and certain

significant items. On an operational2 basis, adjusted net income

for the second quarter of 2014 increased 11%, with foreign currency

having a negative impact of 5 percentage points.

EXECUTIVE COMMENTARY

"In the second quarter, we generated 6% operational growth in

revenue, based on the strong performance of our livestock

products,” said Zoetis Chief Executive Officer Juan Ramón Alaix.

“We benefited from positive economic conditions for livestock

producers versus the year-ago quarter, especially in the U.S.,

Canada and Brazil. This performance helped offset the impact of the

PED virus in swine and slower growth in companion animal products.

Sales of Apoquel, which continues to have limited supply,

contributed to our growth in companion animal revenue and were

somewhat offset by increased competition in other product

areas.”

“We also saw operational growth in revenue across all our

geographical segments in the quarter, reflecting the strength and

balance of our diverse portfolio," Alaix said. “Our continued focus

on building strong customer relationships, bringing new products to

market while managing product lifecycles, and producing

high-quality products with reliable supply, all remain fundamental

strengths of our business model.”

“In the second quarter, we grew adjusted earnings faster than

sales, while facing higher expense growth driven primarily by the

ramp-up of our corporate functions and timing of our promotional

activities,” said Glenn David, Senior Vice President of Finance

Operations and Acting Chief Financial Officer of Zoetis. “We

continue making progress on establishing our Zoetis systems and

infrastructure as we complete our stand-up programs. We remain

confident in our business model and outlook, and we are increasing

the lower end of the guidance range for revenue and adjusted EPS

for the full year 2014.”

QUARTERLY HIGHLIGHTS

Zoetis organizes and manages its business across four regional

operating segments: the United States (U.S.); Europe/Africa/Middle

East (EuAfME); Canada/Latin America (CLAR); and Asia/Pacific

(APAC). Within each of these regional segments, the company

delivers a diverse portfolio of products for livestock and

companion animals tailored to local trends and customer needs.

In the second quarter of 2014:

- Revenue in the U.S. was $459 million,

an increase of 5% compared to the second quarter of 2013. Sales of

livestock products grew 10% with contributions across cattle,

poultry and swine. Cattle products showed a significant increase

based on improved market conditions from the year-ago quarter.

Poultry product sales grew, benefiting from new vaccines and growth

in medicated feed additives. Swine products benefited from

continued growth in new products, tempered by the effect of Porcine

Epidemic Diarrhea virus (PEDv). Sales of companion animal products

grew 1% driven by APOQUEL®, but this was partially offset by

declines due to increased competition in vaccines and for

RIMADYL®.

- Revenue in EuAfME was $284 million, an

increase of 4% operationally compared to the second quarter of

2013. Sales of livestock products increased 5% operationally as the

region experienced more positive results in Germany, the UK and

Spain, but this was slightly offset by declines in France. The

livestock growth was primarily driven by increased sales in poultry

and cattle products, which were slightly offset by a decline in

swine products for the quarter. Sales of companion animal products

increased 2% operationally, primarily driven by sales of APOQUEL®

in the UK and Germany and growth in emerging markets; this growth

was somewhat offset by declines in France and southern Europe due

to increased competition in parasiticides.

- Revenue in CLAR was $214 million, an

increase of 11% operationally compared to the second quarter of

2013. Overall for the segment, sales of livestock products grew 13%

operationally and sales of companion animal products grew 6%

operationally. The CLAR segment results were largely driven by

growth in its two largest markets, Brazil and Canada, as well as

Venezuela and Argentina. In Brazil, there was significant growth

driven primarily by sales of cattle and poultry products as well as

companion animal products. Meanwhile, the company generated

increased sales of cattle products in Canada, as higher prices for

cattle led to increased treatments. Canada also saw an increase in

sales of swine products such as anti-infectives and vaccines, while

it posted a slight decline in poultry products. Finally, Venezuela

and Argentina grew sales of livestock products, reflecting price

increases in these high inflationary markets.

- Revenue in APAC was $185 million, an

increase of 5% operationally compared to the second quarter of

2013. Sales of livestock products grew 7% operationally, driven

primarily by sales of cattle products in New Zealand and Australia;

growth of swine products in China; and growth of poultry products

in Australia and India. This livestock growth was offset by

declines in Japan and Korea. Meanwhile, sales of companion animal

products increased 1% operationally largely due to an increase in

equine products in Australia, which was offset by declines in

companion animal products in Japan.

Zoetis continues to drive demand and strengthen its diverse

portfolio of products through product lifecycle development, strong

customer relationships and access to new markets and technologies.

The company is focused on improving the performance and delivery of

its current product lines; expanding product indications across

species; pursuing approvals in new geographies; and developing

innovative medicines, treatments and solutions for emerging

diseases and unmet customer needs.

One example of a new product introduction in the quarter was for

ACTOGAIN™ (ractopamine hydrochloride). The company launched

ACTOGAIN in the U.S. after receiving regulatory approvals to use it

in combination with other products. ACTOGAIN is the company’s

second branded generic ractopamine product and adds to its strong

portfolio for cattle. Ractopamine is an active ingredient in feed

additive products that help cattle and pigs direct their food

energy toward producing high-quality lean meat rather than fat.

FINANCIAL GUIDANCE AND

COMMENTARY

Zoetis's guidance for full-year 2014 reflects the company's

confidence in the diversity of its portfolio, the strength of its

business model, and its view of the evolving market conditions for

animal health products this year.

Zoetis narrowed its revenue and adjusted earnings guidance for

full year 2014, raising the lower end of previous ranges for both

items. The company also revised its reported diluted EPS guidance

to account for a one-time charge related to a commercial settlement

with customers in Mexico that impacted this quarter. Full-year 2014

guidance includes:

- Revenue of between $4.675 billion to

$4.750 billion

- Reported diluted EPS for the full year

of between $1.16 to $1.20 per share

- Adjusted diluted EPS1 for the full year

between $1.50 to $1.54 per share

Additional guidance on other items such as expenses and

effective tax rate is included in the financial tables and will be

discussed on the company's conference call this morning.

WEBCAST & CONFERENCE CALL

DETAILS

Zoetis will host a webcast and conference call at 8:30 a.m.

(EDT) today, during which company executives will review second

quarter financial results and respond to questions from financial

analysts. Investors and the public may access the live webcast by

visiting the Zoetis website at

http://www.zoetis.com/events-and-presentations. A replay of the

webcast will be archived and made available on Aug. 5, 2014.

About Zoetis

Zoetis (zô-EH-tis) is the leading animal health company,

dedicated to supporting its customers and their businesses.

Building on more than 60 years of experience in animal health,

Zoetis discovers, develops, manufactures and markets veterinary

vaccines and medicines, complemented by diagnostic products and

genetic tests and supported by a range of services. In 2013, the

company generated annual revenue of $4.6 billion. With

approximately 9,800 employees worldwide at the beginning of 2014,

Zoetis has a local presence in approximately 70 countries,

including 27 manufacturing facilities in 10 countries. Its products

serve veterinarians, livestock producers and people who raise and

care for farm and companion animals in 120 countries. For

more information, visit www.zoetis.com.

1 Adjusted net income and adjusted diluted earnings per share

(non-GAAP financial measures) are defined as reported net income

attributable to Zoetis and reported diluted earnings per share,

excluding purchase accounting adjustments, acquisition-related

costs and certain significant items.

2 Operational growth is defined as growth excluding the impact

of foreign exchange.

DISCLOSURE NOTICES

Forward-Looking Statements: This

press release contains forward-looking statements, which reflect

the current views of Zoetis with respect to business plans or

prospects, future operating or financial performance, expectations

regarding products, future use of cash and dividend payments, and

other future events. These statements are not guarantees of future

performance or actions. Forward-looking statements are subject to

risks and uncertainties. If one or more of these risks or

uncertainties materialize, or if management's underlying

assumptions prove to be incorrect, actual results may differ

materially from those contemplated by a forward-looking statement.

Forward-looking statements speak only as of the date on which they

are made. Zoetis expressly disclaims any obligation to update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise. A further list and

description of risks, uncertainties and other matters can be found

in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2013, including in the sections thereof captioned

“Forward-Looking Information and Factors That May Affect Future

Results” and “Item 1A. Risk Factors,” in our Quarterly Reports on

Form 10-Q and in our Current Reports on Form 8-K. These filings and

subsequent filings are available online at www.sec.gov,

www.zoetis.com, or on request from Zoetis.

Use of Non-GAAP Financial Measures:

We use non-GAAP financial measures, such as adjusted net income and

adjusted diluted earnings per share, to assess and analyze our

operational results and trends and to make financial and

operational decisions. We believe these non-GAAP financial measures

are also useful to investors because they provide greater

transparency regarding our operating performance. The non-GAAP

financial measures included in this press release should not be

considered alternatives to measurements required by GAAP, such as

net income, operating income, and earnings per share, and should

not be considered measures of liquidity. These non-GAAP financial

measures are unlikely to be comparable with non-GAAP information

provided by other companies. Reconciliation of non-GAAP financial

measures and GAAP financial measures are included in the tables

accompanying this press release and are posted on our website at

www.zoetis.com.

Internet Posting of Information: We

routinely post information that may be important to investors in

the 'Investors' section of our web site at www.zoetis.com, on our Facebook page at

http://www.facebook.com/zoetis and on Twitter @zoetis. We encourage

investors and potential investors to consult our website regularly

and to follow us on Facebook and Twitter for important information

about us.

ZOETIS INC.

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME(a)

(UNAUDITED)

(millions of dollars, except per share

data)

Second Quarter Six Months 2014 2013

% Change 2014 2013 % Change

Revenue $ 1,158 $ 1,114 4 $ 2,255 $ 2,204 2 Costs and

expenses: Cost of sales(b) 413 416 (1 ) 792 818 (3 ) Selling,

general and administrative expenses(b) 396 399 (1 ) 752 756 (1 )

Research and development expenses(b) 92 95 (3 ) 179 185 (3 )

Amortization of intangible assets(c) 15 15 — 30 30 — Restructuring

charges and certain acquisition-related costs 5 (20 ) * 8 (13 ) *

Interest expense 29 32 (9 ) 58 54 7 Other (income)/deductions–net 8

(10 ) * 9 (5 ) * Income before provision for taxes on

income 200 187 7 427 379 13 Provision for taxes on income 61

59 3 133 111 20 Net income before allocation

to noncontrolling interests 139 128 9 294 268 10 Less: Net income

attributable to noncontrolling interests 3 — * 3

— * Net income attributable to Zoetis $ 136 $

128 6 $ 291 $ 268 9 Earnings per

share—basic $ 0.27 $ 0.26 4 $ 0.58 $ 0.54

7 Earnings per share—diluted $ 0.27 $ 0.26

4 $ 0.58 $ 0.54 7 Weighted-average

shares used to calculate earnings per share (in thousands) Basic

500,975 500,000 500,603 500,000 Diluted

501,684 500,217 501,193 500,164

*Calculation not meaningful

(a)

The condensed consolidated statements of

income present the three and six months ended June 29, 2014 and

June 30, 2013. Subsidiaries operating outside the United States are

included for the three and six months ended May 25, 2014 and May

26, 2013.

(b)

Exclusive of amortization of intangible

assets, except as discussed in footnote (c) below.

(c)

Amortization expense related to

finite-lived acquired intangible assets that contribute to our

ability to sell, manufacture, research, market and distribute

products, compounds and intellectual property is included in

Amortization of intangible assets as these intangible assets

benefit multiple business functions. Amortization expense related

to acquired intangible assets that are associated with a single

function is included in Cost of sales, Selling, general and

administrative expenses or Research and development expenses, as

appropriate.

Certain amounts and percentages may reflect rounding

adjustments.

ZOETIS INC.

RECONCILIATION OF GAAP REPORTED TO

NON-GAAP ADJUSTED INFORMATION

CERTAIN LINE ITEMS

(UNAUDITED)

(millions of dollars, except per share

data)

Quarter ended June 29, 2014 Purchase

Acquisition- Certain

GAAP

Accounting Related Significant Non-GAAP

Reported(1)

Adjustments

Costs(2)

Items(3)

Adjusted(a)

Revenue

$ 1,158 $ — $ — $ — $ 1,158 Cost of sales(b)

413 — — (8 ) 405 Gross profit

745 — — 8 753 Selling,

general and administrative expenses(b)

396 (1 ) — (31 ) 364

Research and development expenses(b)

92 (1 ) — — 91

Amortization of intangible assets(c)

15 (11 ) — — 4

Restructuring charges and certain acquisition-related costs

5 — (2 ) (3 ) — Interest expense

29 — — — 29 Other

(income)/deductions–net

8 — — (11 ) (3 ) Income before

provision for taxes on income

200 13 2 53 268 Provision for

taxes on income

61 5 — 10 76 Income from continuing

operations

139 8 2 43 192 Net income attributable to

noncontrolling interests

3 — — — 3 Net income attributable

to Zoetis

136 8 2 43 189 Earnings per common share

attributable to Zoetis–diluted(d)

0.27 0.02 — 0.09 0.38

Quarter ended June 30, 2013

Purchase Acquisition- Certain

GAAP Accounting Related Significant Non-GAAP

Reported(1)

Adjustments

Costs(2)

Items(3)

Adjusted(a)

Revenue

$ 1,114 $ — $ — $ — $ 1,114 Cost of sales(b)

416 (1 ) (2 ) (13 ) 400 Gross profit

698 1 2 13 714

Selling, general and administrative expenses(b)

399 — — (60

) 339 Research and development expenses(b)

95 — — (4 ) 91

Amortization of intangible assets(c)

15 (12 ) — — 3

Restructuring charges and certain acquisition-related costs

(20 ) — (7 ) 27 — Interest expense

32 — — — 32

Other (income)/deductions–net

(10 ) — — 7 (3 ) Income

before provision for taxes on income

187 13 9 43 252

Provision for taxes on income

59 4 3 8 74 Net income

attributable to Zoetis

128 9 6 35 178 Earnings per common

share attributable to Zoetis–diluted(d)

0.26 0.02 0.01 0.07

0.36

(a)

Non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS are not, and should

not be viewed as, substitutes for U.S. GAAP net income and its

components and diluted EPS. Despite the importance of these

measures to management in goal setting and performance measurement,

non-GAAP adjusted net income and its components and non-GAAP

adjusted diluted EPS are non-GAAP financial measures that have no

standardized meaning prescribed by U.S. GAAP and, therefore, have

limits in their usefulness to investors. Because of the

non-standardized definitions, non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS (unlike U.S. GAAP net

income and its components and diluted EPS) may not be comparable to

the calculation of similar measures of other companies. Non-GAAP

adjusted net income and its components and non-GAAP adjusted

diluted EPS are presented solely to permit investors to more fully

understand how management assesses performance.

(b)

Exclusive of amortization of intangible

assets, except as discussed in footnote (c) below.

(c)

Amortization expense related to

finite-lived acquired intangible assets that contribute to our

ability to sell, manufacture, research, market and distribute

products, compounds and intellectual property is included in

Amortization of intangible assets as these intangible assets

benefit multiple business functions. Amortization expense related

to acquired intangible assets that are associated with a single

function is included in Cost of sales, Selling, general and

administrative expenses or Research and development expenses, as

appropriate.

(d)

EPS amounts may not add due to

rounding.

See Notes to Reconciliation of GAAP Reported to Non-GAAP

Adjusted Information for notes (1), (2) and (3). Certain

amounts may reflect rounding adjustments.

ZOETIS INC.

RECONCILIATION OF GAAP REPORTED TO

NON-GAAP ADJUSTED INFORMATION

CERTAIN LINE ITEMS

(UNAUDITED)

(millions of dollars, except per share

data)

Six Months ended June 29, 2014 Purchase

Acquisition- Certain

GAAP

Accounting Related Significant Non-GAAP

Reported(1)

Adjustments

Costs(2)

Items(3)

Adjusted(a)

Revenue

$ 2,255 $ — $ — $ — $ 2,255 Cost of sales(b)

792 (1 ) — (11 ) 780 Gross profit

1,463 1 — 11 1,475

Selling, general and administrative expenses(b)

752 — — (61

) 691 Research and development expenses(b)

179 (1 ) — — 178

Amortization of intangible assets(c)

30 (23 ) — — 7

Restructuring charges and certain acquisition-related costs

8 — (4 ) (4 ) — Interest expense

58 — — — 58 Other

(income)/deductions–net

9 — — (13 ) (4 ) Income before

provision for taxes on income

427 25 4 89 545 Provision for

taxes on income

133 9 1 19 162 Income from continuing

operations

294 16 3 70 383 Net income attributable to

noncontrolling interests

3 — — — 3 Net income attributable

to Zoetis

291 16 3 70 380 Earnings per common share

attributable to Zoetis–diluted(d)

0.58 0.03 0.01 0.14 0.76

Six Months ended June 30, 2013

Purchase Acquisition- Certain

GAAP Accounting Related Significant Non-GAAP

Reported(1)

Adjustments

Costs(2)

Items(3)

Adjusted(a)

Revenue

$ 2,204 $ — $ — $ — $ 2,204 Cost of sales(b)

818 (2 ) (2 ) (16 ) 798 Gross profit

1,386 2 2 16

1,406 Selling, general and administrative expenses(b)

756 —

— (95 ) 661 Research and development expenses(b)

185 — — (4

) 181 Amortization of intangible assets(c)

30 (23 ) — — 7

Restructuring charges and certain acquisition-related costs

(13 ) — (13 ) 26 — Interest expense

54 — — —

54 Other (income)/deductions–net

(5 ) — — 4 (1 )

Income before provision for taxes on income

379 25 15 85 504

Provision for taxes on income

111 8 5 23 147 Net income

attributable to Zoetis

268 17 10 62 357 Earnings per common

share attributable to Zoetis–diluted(d)

0.54 0.03 0.02 0.12

0.71

(a)

Non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS are not, and should

not be viewed as, substitutes for U.S. GAAP net income and its

components and diluted EPS. Despite the importance of these

measures to management in goal setting and performance measurement,

non-GAAP adjusted net income and its components and non-GAAP

adjusted diluted EPS are non-GAAP financial measures that have no

standardized meaning prescribed by U.S. GAAP and, therefore, have

limits in their usefulness to investors. Because of the

non-standardized definitions, non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS (unlike U.S. GAAP net

income and its components and diluted EPS) may not be comparable to

the calculation of similar measures of other companies. Non-GAAP

adjusted net income and its components and non-GAAP adjusted

diluted EPS are presented solely to permit investors to more fully

understand how management assesses performance.

(b)

Exclusive of amortization of intangible

assets, except as discussed in footnote (c) below.

(c)

Amortization expense related to

finite-lived acquired intangible assets that contribute to our

ability to sell, manufacture, research, market and distribute

products, compounds and intellectual property is included in

Amortization of intangible assets as these intangible assets

benefit multiple business functions. Amortization expense related

to acquired intangible assets that are associated with a single

function is included in Cost of sales, Selling, general and

administrative expenses or Research and development expenses, as

appropriate.

(d)

EPS amounts may not add due to

rounding.

See Notes to Reconciliation of GAAP Reported to Non-GAAP

Adjusted Information for notes (1), (2) and (3). Certain

amounts may reflect rounding adjustments.

ZOETIS INC.NOTES TO RECONCILIATION OF GAAP

REPORTED TO NON-GAAP ADJUSTED INFORMATIONCERTAIN LINE

ITEMS(UNAUDITED)(millions of dollars)

(1)

The condensed consolidated statements of

income present the three and six months ended June 29, 2014 and

June 30, 2013. Subsidiaries operating outside the United States are

included for the three and six months ended May 25, 2014 and May

26, 2013.

(2)

Acquisition-related costs include the

following:

Second Quarter Six Months 2014

2013 2014 2013

Integration costs(a) $ 2 $ 10 $ 4 $ 14 Restructuring

charges(b) — (1 ) — 1 Total acquisition-related

costs—pre-tax 2 9 4 15 Income taxes(c) — 3 1 5

Total acquisition-related costs—net of tax $ 2 $ 6 $

3 $ 10

(a)

Integration costs represent external,

incremental costs directly related to integrating acquired

businesses and primarily include expenditures for consulting and

the integration of systems and processes. Included in Restructuring

charges and certain acquisition-related costs for the three and six

months ended June 29, 2014. Included in Cost of sales ($2 million

and $2 million) and Restructuring charges and certain

acquisition-related costs ($8 million and $12 million) for the

three and six months ended June 30, 2013, respectively.

(b)

Restructuring charges are associated with

employees, assets and activities that will not continue with the

company. Included in Restructuring charges and certain

acquisition-related costs.

(c)

Included in Provision for taxes on income.

Income taxes include the tax effect of the associated pre-tax

amounts, calculated by determining the jurisdictional location of

the pre-tax amounts and applying that jurisdiction's applicable tax

rate.

(3)

Certain significant items include the

following:

Second Quarter Six Months 2014

2013 2014 2013

Restructuring charges(a) $ 3 $ (27 ) $ 3 $ (26 )

Implementation costs and additional depreciation—asset

restructuring(b) — 1 1 3 Certain asset impairment charges(c) — — —

1 Net gain on sale of assets(d) (3 ) (6 ) (3 ) (6 ) Stand-up

costs(e) 41 77 74 111 Other(f) 12 (2 ) 14 2

Total certain significant items—pre-tax 53 43 89 85 Income taxes(g)

10 8 19 23 Total certain significant

items—net of tax $ 43 $ 35 $ 70 $ 62

(a)

Represents restructuring charges incurred

for our cost-reduction/productivity initiatives. For the three and

six months ended June 30, 2013, includes a decrease in employee

termination expenses relating to the reversal of a previously

established termination reserve related to our operations in

Europe. Included in Restructuring charges and certain

acquisition-related costs.

(b)

Related to our cost-reduction/productivity

initiatives. Included in Restructuring charges and certain

acquisition-related costs for the six months ended June 29, 2014.

Included in Cost of sales for the three months ended June 30, 2013.

Included in Cost of sales ($1 million) and Selling, general and

administrative expenses ($2 million) for the six months ended June

30, 2013.

(c)

Included in Other

(income)/deductions—net.

(d)

For the three and six months ended June

29, 2014, represents the Zoetis portion of a net gain on the sale

of land in our Taiwan joint venture. For the three and six months

ended June 30, 2013, represents the net gain on the

government-mandated sale of certain product rights in Brazil that

were acquired with the FDAH acquisition in 2009. Included in Other

(income)/deductions—net.

(e)

Represents certain nonrecurring costs

related to becoming an independent public company, such as new

branding (including changes to the manufacturing process for

required new packaging), the creation of standalone systems and

infrastructure, site separation, and certain legal registration and

patent assignment costs, as well as, restructuring, certain legal

and commercial settlements, and other charges. Included in Cost of

sales ($8 million and $11 million), Selling, general and

administrative expenses ($31 million and $61 million), and Other

(income)/deductions—net ($2 million and $2 million) for the three

and six months ended June 29, 2014, respectively. Included in Cost

of sales ($13 million and $15 million), Selling, general and

administrative expenses ($60 million and $92 million), and Research

and development expenses ($4 million and $4 million) for the three

and six months ended June 30, 2013, respectively.

(f)

For the three and six months ended June

29, 2014, primarily includes a reserve associated with a commercial

settlement in Mexico ($13 million). The six months ended June 29,

2014 also includes a pension plan settlement charge related to the

divestiture of a manufacturing plant ($4 million), partially offset

by an insurance recovery of litigation related charges ($2 million

income).

(g)

Included in Provision for taxes on income.

Income taxes include the tax effect of the associated pre-tax

amounts, calculated by determining the jurisdictional location of

the pre-tax amounts and applying that jurisdiction's applicable tax

rate.

ZOETIS INC.

ADJUSTED SELECTED COSTS, EXPENSES AND

INCOME (a)

(UNAUDITED)

(millions of dollars)

% Change Second Quarter (Favorable)/Unfavorable 2014

2013 Total Foreign

Exchange Operational Adjusted cost of sales $ 405 $

400 1 % (3 )% 4 % as a percent of revenue 35.0 % 35.9 % NA NA NA

Adjusted SG&A expenses 364 339 7 % (2 )% 9 % Adjusted R&D

expenses 91 91 — % (1

)%

1 % Adjusted net income attributable to Zoetis 189 178 6 % (5 )% 11

% % Change Six Months (Favorable)/Unfavorable 2014

2013 Total Foreign Exchange Operational

Adjusted cost of sales $ 780 $ 798 (2

)%

(3 )% 1 % as a percent of revenue 34.6 % 36.2 % NA NA NA Adjusted

SG&A expenses 691 661 5 % (2 )% 7 % Adjusted R&D expenses

178 181 (2 )% (2 )% — % Adjusted net income attributable to Zoetis

380 357 6 % (4 )% 10 %

(a)

Adjusted cost of sales, adjusted selling,

general, and administrative (SG&A) expenses, adjusted research

and development (R&D) expenses, and adjusted net income are

defined as the corresponding reported U.S. generally accepted

accounting principles (GAAP) income statement line items excluding

purchase accounting adjustments, acquisition-related costs, and

certain significant items. Reconciliations of certain reported to

adjusted information for the three and six months ended June 29,

2014 and June 30, 2013 are provided in the materials accompanying

this report. These adjusted income statement line item measures are

not, and should not be viewed as, substitutes for the corresponding

U.S. GAAP line items.

ZOETIS INC.

2014 GUIDANCE

Selected Line Items Revenue $4,675 to $4,750 million

Adjusted cost of sales as a percentage of revenue(a) Approximately

35.5% Adjusted SG&A expenses(a) $1,440 to $1,480 million

Adjusted R&D expenses(a) $390 to $405 million Adjusted interest

expense and other (income)/deductions(a) Approximately $105 million

Effective tax rate on adjusted income(a) Approximately 29% Adjusted

diluted EPS(a) $1.50 to $1.54 Certain significant items(b) and

acquisition-related costs $175 to $195 million Reported diluted EPS

$1.16 to $1.20

In updating our guidance for full-year 2014, we have considered

current exchange rates and other factors.

A reconciliation of 2014 adjusted net income and adjusted

diluted EPS guidance to 2014 reported net income attributable to

Zoetis and reported diluted EPS attributable to Zoetis common

shareholders guidance follows:

Full-Year 2014 Guidance (millions of dollars,

except per share amounts) Net Income Diluted EPS

Adjusted net income/diluted EPS(a) guidance ~$750 - $770 ~$1.50 -

$1.54 Purchase accounting adjustments ~(30) ~(0.06) Certain

significant items(b) and acquisition-related costs ~(130 - 145)

~(0.26 - 0.29) Reported net income attributable to Zoetis/diluted

EPS guidance ~$580 - $600 ~$1.16 - $1.20

(a)

Adjusted net income and its components and

adjusted diluted EPS are defined as reported U.S. generally

accepted accounting principles (GAAP) net income and its components

and reported diluted EPS excluding purchase accounting adjustments,

acquisition-related costs and certain significant items. Adjusted

cost of sales, adjusted selling, general and administrative

(SG&A) expenses, adjusted research and development (R&D)

expenses, adjusted interest expense and adjusted other

(income)/deductions are income statement line items prepared on the

same basis, and, therefore, components of the overall adjusted

income measure. Despite the importance of these measures to

management in goal setting and performance measurement, adjusted

net income and its components and adjusted diluted EPS are non-GAAP

financial measures that have no standardized meaning prescribed by

U.S. GAAP and, therefore, have limits in their usefulness to

investors. Because of the non-standardized definitions, adjusted

net income and its components and adjusted diluted EPS (unlike U.S.

GAAP net income and its components and diluted EPS) may not be

comparable to the calculation of similar measures of other

companies. Adjusted net income and its components and adjusted

diluted EPS are presented solely to permit investors to more fully

understand how management assesses performance. Adjusted net income

and its components and adjusted diluted EPS are not, and should not

be viewed as, substitutes for U.S. GAAP net income and its

components and diluted EPS.

(b)

Primarily includes certain nonrecurring

costs related to becoming an independent public company, such as

new branding (including changes to the manufacturing process for

required new packaging), the creation of standalone systems and

infrastructure, site separation, certain legal registration and

patent assignment costs, as well as, restructuring, certain legal

and commercial settlements, and other charges.

ZOETIS INC.

CONSOLIDATED REVENUE BY SEGMENT(a) AND

SPECIES

(UNAUDITED)

(millions of dollars)

Second Quarter % Change 2014 2013

Total Foreign Exchange

Operational

Revenue: Livestock $ 703 $ 667 5 % (4 )%

9 % Companion Animal 439 435 1 % (1 )% 2 % Contract Manufacturing

16 12 33 % 6 % 27 %

Total Revenue $

1,158 $ 1,114 4 %

(2 )% 6 % U.S. Livestock

$ 224 $ 204 10 % — % 10 % Companion Animal 235 233 1

% — % 1 %

Total U.S. Revenue $ 459

$ 437 5 % — %

5 % EuAfME Livestock $ 193 $ 181 7 % 2

% 5 % Companion Animal 91 85 7 % 5 % 2 %

Total

EuAfME Revenue $ 284 $ 266

7 % 3 % 4 %

CLAR Livestock $ 156 $ 153 2 % (11 )% 13 % Companion Animal

58 60 (3 )% (9 )% 6 %

Total CLAR Revenue

$ 214 $ 213 —

% (11 )% 11 % APAC

Livestock $ 130 $ 129 1 % (6 )% 7 % Companion Animal 55 57

(4 )% (5 )% 1 %

Total APAC Revenue $

185 $ 186 (1 )%

(6 )% 5 % Livestock:

Cattle $ 379 $ 355 7 % (3 )% 10 % Swine 157 154 2 % (3 )% 5 %

Poultry 146 137 7 % (4 )% 11 % Other 21 21 — % — % —

%

Total Livestock Revenue $ 703

$ 667 5 % (4 )%

9 % Companion Animal: Horses $ 46 $ 45

2 % — % 2 % Dogs and Cats 393 390 1 % (1 )% 2 %

Total Companion Animal Revenue $ 439

$ 435 1 % (1 )%

2 %

(a)

For a description of each segment, see

Note 18A to Zoetis's consolidated and combined financial statements

included in Zoetis's Form 10-K for the year ended December 31,

2013. Beginning in the first quarter of 2014, contract

manufacturing is presented separately and we have revised our

segment results for the comparable 2013 period.

Certain amounts and percentages may reflect rounding

adjustments.

ZOETIS INC.

CONSOLIDATED REVENUE BY SEGMENT(a) AND

SPECIES

(UNAUDITED)

(millions of dollars)

Six Months % Change 2014 2013

Total Foreign Exchange

Operational

Revenue: Livestock $ 1,409 $ 1,370 3 % (3

)% 6 % Companion Animal 819 811 1 % (1 )% 2 % Contract

Manufacturing 27 23 17 % 7 % 10 %

Total

Revenue $ 2,255 $ 2,204

2 % (3 )% 5 %

U.S. Livestock $ 487 $ 449 8 % — % 8 % Companion

Animal 451 442 2 % — % 2 %

Total U.S. Revenue

$ 938 $ 891 5

% — % 5 % EuAfME

Livestock $ 374 $ 373 — % 1 % (1 )% Companion Animal 180 172

5 % 4 % 1 %

Total EuAfME Revenue $ 554

$ 545 2 % 2

% — % CLAR Livestock $ 291 $ 292

— % (11 )% 11 % Companion Animal 91 92 (1 )% (10 )% 9

%

Total CLAR Revenue $ 382 $

384 (1 )% (11 )%

10 % APAC Livestock $ 257 $ 256 — % (7

)% 7 % Companion Animal 97 105 (8 )% (7 )% (1 )%

Total APAC Revenue $ 354 $

361 (2 )% (7 )% 5

% Livestock: Cattle $ 770 $ 745 3 % (3 )% 6 %

Swine 317 314 1 % (3 )% 4 % Poultry 281 270 4 % (5 )% 9 % Other 41

41 — % (4 )% 4 %

Total Livestock Revenue

$ 1,409 $ 1,370 3

% (3 )% 6 % Companion

Animal: Horses $ 89 $ 87 2 % (3 )% 5 % Dogs and Cats 730

724 1 % (1 )% 2 %

Total Companion Animal Revenue

$ 819 $ 811 1

% (1 )% 2 %

(a)

For a description of each segment, see

Note 18A to Zoetis's consolidated and combined financial statements

included in Zoetis's Form 10-K for the year ended December 31,

2013. Beginning in the first quarter of 2014, contract

manufacturing is presented separately and we have revised our

segment results for the comparable 2013 period.

Certain amounts and percentages may reflect rounding

adjustments.

ZOETIS INC.

SEGMENT EARNINGS(a)

(UNAUDITED)

(millions of dollars)

Second Quarter % Change 2014 2013

Total Foreign Exchange

Operational U.S. $ 258 $ 254 2 % — % 2 % EuAfME 103 93 11 % 2 % 9 %

CLAR 88 78 13 % (3 )% 16 % APAC 72 71 1 % (10 )% 11 %

Total Reportable Segments 521 496 5 % (2 )% 7 % Other

business activities(b) (74 ) (76 ) (3 )% Reconciling Items:

Corporate(c) (128 ) (137 ) (7 )% Purchase accounting adjustments(d)

(13 ) (13 ) — % Acquisition-related costs(e) (2 ) (9 ) (78 )%

Certain significant items(f) (53 ) (43 ) 23 % Other unallocated(g)

(51 ) (31 ) 65 %

Total Earnings(h) $

200 $ 187 7 %

Six Months % Change 2014 2013 Total Foreign

Exchange Operational U.S. $ 536 $ 488 10 % — % 10 % EuAfME 215 207

4 % 1 % 3 % CLAR 152 130 17 % 3 % 14 % APAC 138 146

(5 )% (9 )% 4 % Total Reportable Segments 1,041 971 7 % (1 )% 8 %

Other business activities(b) (146 ) (147 ) (1 )% Reconciling

Items: Corporate(c) (253 ) (253 ) — % Purchase accounting

adjustments(d) (25 ) (25 ) — % Acquisition-related costs(e) (4 )

(15 ) (73 )% Certain significant items(f) (89 ) (85 ) 5 % Other

unallocated(g) (97 ) (67 ) 45 %

Total Earnings(h)

$ 427 $ 379 13

%

(a)

For a description of each segment, see

Note 18A to Zoetis's consolidated and combined financial statements

included in Zoetis's Form 10-K for the year ended December 31,

2013. Beginning in the first quarter of 2014, contract

manufacturing is included in other business activities and we have

revised our segment results for the comparable 2013 period.

(b)

Other business activities reflect the

research and development costs managed by our Research and

Development organization as well as our contract manufacturing

business.

(c)

Corporate includes, among other things,

administration expenses, interest expense, certain compensation and

other costs not charged to our operating segments.

(d)

Purchase accounting adjustments include

certain charges related to intangible assets and property, plant

and equipment not charged to our operating segments.

(e)

Acquisition-related costs can include

costs associated with acquiring, integrating and restructuring

newly acquired businesses, such as transaction costs, integration

costs, restructuring charges and additional depreciation associated

with asset restructuring.

(f)

Certain significant items are substantive,

unusual items that, either as a result of their nature or size,

would not be expected to occur as part of our normal business on a

regular basis. Such items primarily include certain costs related

to becoming an independent public company, restructuring charges

and implementation costs associated with our

cost-reduction/productivity initiatives that are not associated

with an acquisition, certain legal and commercial settlements, and

the impact of divestiture-related gains and losses.

(g)

Includes overhead expenses associated with

our manufacturing operations not directly attributable to an

operating segment.

(h)

Defined as income before provision for

taxes on income.

Certain amounts and percentages may reflect rounding

adjustments.

Zoetis Inc.Media:Bill Price,

1-973-443-2742 (o)william.price@zoetis.comElinore White,

1-973-443-2835 (o)elinore.y.white@zoetis.comorInvestors:John O'Connor, 1-973-822-7088 (o)

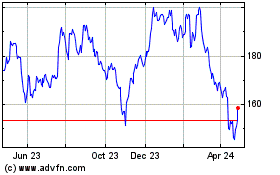

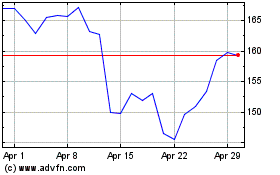

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Jul 2023 to Jul 2024