Bull of the Day: Yelp (YELP) - Bull of the Day

October 22 2013 - 3:19AM

Zacks

Yelp (YELP) has been getting a series of good reviews from

Wall Street. Those good reviews come in the form os higher earnings

estimates and that has helped make the stock the Bull of the Day as

a Zacks Rank #1 (Strong Buy).

Steady Increases In Revenue

One critical factor in a stock beating earnings is to have

strong topline growth. YELP has been able to produce consistent

beats on top and that has translated into a recent beat on the

bottom line as well.

The last three quarters saw the company hit positive revenue

surprises of 2.2%, 3.4% and 3.2% respectively. The most recent

quarter also saw a bottom line surprise of 75% as the company came

in three cents ahead of the Zacks Consensus Estimate.

Company Description

Yelp operates an online urban city guide that helps people find

places to eat, shop, drink, relax, and play based on the informed

opinions of a community of locals in the know. It offers

information relating to restaurants, shopping, food, nightlife,

arts and entertainment. The company serves customers in the United

States, Canada, the United Kingdom, Ireland, France, Germany,

Austria, the Netherlands, Spain, Italy, Switzerland, Finland, and

Belgium. Yelp was founded in 2004 and is headquartered in San

Francisco, California.

Earnings History

Of the last five reports, the company has posted two earnings

beats, two misses and reported in line one time. That isn't exactly

a stellar record, but as the company moves towards profitability,

investors would be wise to take a deeper look at the stock.

While they are in quite different industries, Telsa (TSLA) saw

its stock jolt higher as it reached its expected first quarter of

profitability. The move higher in the automaker was also assisted

by a very large short position in the stock. YELP has seen the

number of shares sold short increase from 4.7M at the end of June

to 6.6M at the end of July and 7.5M at the end of September. So

there is potential for a very large short squeeze should the

company reach profitability sooner than expected.

The Next Earnings Report

The company is expected to report earnings on October 29 after

the market closes. The Zacks Consensus Estimate is calling for $59M

in revenue and a loss of a penny per share. Given that the last

quarter was expected to see a loss of four cents a share and the

company reported a loss of only one cent a share, this could very

well be the quarter that helps push shares higher.

Each of the last two quarterly reports helped the stock move

higher. The March 2013 report was a miss on the bottom line of two

cents, but the beat on top was more to Wall Street's liking. The

stock moved higher by 23.8% in the session following the report.

Similarly, the June 2013 quarter saw a move of 23.2% after beating

on both the top and bottom lines.

Earnings Estimates Moving Higher

In May the Zacks Consensus Estimate for 2013 was calling for a

loss of $0.14 per share. That number ticked higher to a loss of

$0.13 per share in July and then to loss of $0.10 per share where

the consensus resides today.

Over the same time period the earnings estimates for 2014 have

increased from a gain of $0.19 in May to a gain of $0.23 where the

consensus sits right now.

Valuation

The more common metric investors lean on (PE) is not relevant

for YELP as the company still has negative trailing and forward

earnings. That will change soon as the calendar year 2014 is

expected to be profitable. Price to book and price to sales metrics

are more relevant, but they show some inflated numbers as investors

still struggle to properly value the company that has negative

earnings and tremendous growth. Speaking of growth, this should be

the focus of most valuation arguments. The company is expected grow

revenues 46% in 2014 compared to 7.3% for the industry average.

Earnings growth is even better, with 332% growth in 2014 vs. the

14% industry average.

The Chart

A quick look at the chart shows a stock that is moving higher in

a rapid fashion. With earnings right around the corner and

potential profitability there to push the stock higher, there could

be a massive short squeeze. Average daily volume of 3.4M shares

means that there is a little over two days volume of stock that is

sold short. Of course earnings days tend to get more liquid than

most, but don't be surprised if a sizeable amount of short covering

pushes this stock higher into the earnings report.

Brian Bolan is a Stock Strategist for Zacks.com. He is the

Editor in charge of the Zacks Home Run Investor service, a Buy and

Hold service where he recommends the stocks in the portfolio.

Brian is also the editor of Breakout Growth Trader a trading

service that focuses on small cap stocks and also carries a risk

limiting strategy. Subscribers get daily emails along with buy, and

sell alerts.

Follow Brian Bolan on twitter at @BBolan1

Like Brian Bolan on Facebook

TESLA MOTORS (TSLA): Free Stock Analysis Report

YELP INC (YELP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

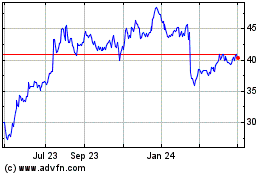

Yelp (NYSE:YELP)

Historical Stock Chart

From Jun 2024 to Jul 2024

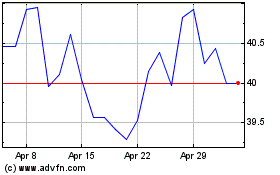

Yelp (NYSE:YELP)

Historical Stock Chart

From Jul 2023 to Jul 2024