- Declared quarterly distribution of $0.4714 per unit; 42nd

consecutive quarterly distribution

Westlake Chemical Partners LP (NYSE: WLKP) (the "Partnership")

today reported net income attributable to the Partnership in the

fourth quarter of 2024 of $15.0 million, or $0.43 per limited

partner unit, which was relatively in line with fourth quarter 2023

net income of $14.3 million. Cash flows from operating activities

in the fourth quarter of 2024 were $132.5 million, an increase of

$24.8 million compared to fourth quarter 2023 cash flows from

operating activities of $107.7 million, due to higher net income

and more favorable working capital changes. For the three months

ended December 31, 2024, MLP distributable cash flow was $15.0

million, a decrease of $1.4 million compared to fourth quarter 2023

MLP distributable cash flow of $16.4 million. The decrease in MLP

distributable cash flow was primarily due to higher turnaround

reserve contributions and maintenance capital contributions to

support the planned Petro 1 turnaround.

Fourth quarter 2024 net income attributable to the Partnership

of $15.0 million decreased by $3.1 million compared to third

quarter 2024 net income of $18.1 million, primarily due to the

impact of excess quantities on OpCo's ethylene sales price to

Westlake in the fourth quarter of 2024, which was related to the

decision to push the Petro 1 turnaround to 2025. The excess

quantities impact on fourth quarter 2024 sales price, in and of

itself, had no effect on full year 2024 net income, MLP

distributable cash flow or coverage ratio. Fourth quarter 2024 cash

flows from operating activities of $132.5 million increased by $6.4

million compared to third quarter 2024 cash flows from operating

activities of $126.1 million primarily due to more favorable

working capital changes. Fourth quarter 2024 MLP distributable cash

flow of $15.0 million decreased by $2.9 million compared to third

quarter 2024 MLP distributable cash flow of $17.9 million,

primarily due to lower OpCo net income.

For the full year 2024, net income attributable to the

Partnership of $62.4 million, or $1.77 per limited partner unit,

increased by $8.1 million compared to full year 2023 net income

attributable to the Partnership of $54.3 million. The increase in

net income attributable to the Partnership was primarily due to

higher third-party ethylene sales prices and margins. Cash flows

from operating activities for the full year 2024 were $485.0

million, an increase of $33.0 million compared to the full year

2023 cash flows from operating activities of $452.0 million. This

increase in cash flows from operating activities was primarily due

to higher net income. For the year ended December 31, 2024, MLP

distributable cash flow was $66.9 million, an increase of $4.3

million compared to MLP distributable cash flow of $62.6 million

for the year ended December 31, 2023.

"The Partnership performed well in 2024 as we exceeded our

annual production plan, in part due to the decision to defer the

planned turnaround at our Petro 1 ethylene unit to 2025. By

postponing the Petro 1 turnaround we were able to better capture

attractive third-party ethylene prices and margins in the second

half of 2024, which supported an improvement in the Partnership's

distributable cash flow and coverage ratio for the full year 2024,"

said Jean-Marc Gilson, President and Chief Executive Officer. "At

the end of January 2025, we began our planned maintenance

turnaround at our Petro 1 ethylene unit, which is expected to last

approximately 60 days. As is typically the case during turnaround

years, the lost production during the Petro 1 turnaround may cause

the Partnership's coverage ratio to dip below 1.00x this year. As

has been the case in previous turnaround years when the

Partnership's coverage ratio dipped below 1.00x, we estimate that

the Partnership will have ample cash and operating surplus to fund

distributions in excess of distributable cash flow in 2025. Looking

beyond 2025, we believe recent improvement in third-party ethylene

prices and margins should position the Partnership for improved

cash flows once production returns to expected levels."

On January 27, 2025, the Partnership announced that the Board of

Directors of Westlake Chemical Partners GP LLC had approved a

quarterly distribution for the fourth quarter of 2024 of $0.4714

per unit to be payable on February 25, 2025 to unitholders of

record as of February 7, 2025, representing the 42nd consecutive

quarterly distribution to the Partnership's unitholders. MLP

distributable cash flow provided trailing twelve-month coverage of

1.01x the declared distributions for the fourth quarter of 2024,

which was a decrease from the trailing twelve-month coverage ratio

of 1.03x at the end of the third quarter of 2024.

OpCo's Ethylene Sales Agreement with Westlake is designed to

provide for stable and predictable cash flows. The agreement

provides that 95% of OpCo's ethylene production is sold to Westlake

for a cash margin of $0.10 per pound, net of operating costs,

maintenance capital expenditures and reserves for future turnaround

expenditures.

The statements in this release and the related teleconference

relating to matters that are not historical facts, such as those

with respect to the timing and results of our turnaround

activities, including the Petro 1 turnaround, our future coverage

ratio, our ability to fund distributions in excess of distributable

cash flow, our outlook for third-party ethylene margins, our

expectations regarding future interest rates, the ability to

deliver value and returns to unitholders, our outlook for improved

cash flows, and the nature of the sales agreement with Westlake,

are forward-looking statements. These forward-looking statements

are subject to significant risks and uncertainties. Actual results

could differ materially, based on factors including, but not

limited to, pandemic infectious diseases and the response thereto;

operating difficulties; the volume of ethylene that we are able to

sell; the price at which we are able to sell ethylene; changes in

the price and availability of feedstocks; changes in prevailing

economic conditions; actions and commitments of Westlake

Corporation; actions of third parties; inclement or hazardous

weather conditions, including flooding, and the physical impacts of

climate change; environmental hazards; changes in laws and

regulations (or the interpretation thereof); inability to acquire

or maintain necessary permits; inability to obtain necessary

production equipment or replacement parts; technical difficulties

or failures; labor disputes; difficulty collecting receivables;

inability of our customers to take delivery; fires, explosions or

other industrial accidents; our ability to borrow funds and access

capital markets; and other risk factors. For more detailed

information about the factors that could cause actual results to

differ materially, please refer to the Partnership's Annual Report

on Form 10-K for the year ended December 31, 2023, which was filed

with the SEC in February 2024, and Quarterly Report on Form 10-Q

for the quarter ended September 30, 2024, which was filed with the

SEC in November 2024.

This release is intended to be a qualified notice under Treasury

Regulation Section 1.1446-4(b). Brokers and nominees should treat

one hundred percent (100.0%) of the Partnership's distributions to

non-U.S. investors as being attributable to income that is

effectively connected with a United States trade or business.

Accordingly, the Partnership's distributions to non-U.S. investors

are subject to federal income tax withholding at the highest

applicable effective tax rate.

Use of Non-GAAP Financial Measures

This release makes reference to certain "non-GAAP" financial

measures, such as MLP distributable cash flow and EBITDA. For this

purpose, a non-GAAP financial measure is generally defined by the

Securities and Exchange Commission ("SEC") as a numerical measure

of a registrant's historical or future financial performance,

financial position or cash flows that (1) excludes amounts, or is

subject to adjustments that have the effect of excluding amounts,

that are included in the most directly comparable measure

calculated and presented in accordance with U.S. generally accepted

accounting principles ("U.S. GAAP") in the statement of income,

balance sheet or statement of cash flows (or equivalent statements)

of the registrant; or (2) includes amounts, or is subject to

adjustments that have the effect of including amounts, that are

excluded from the most directly comparable measure so calculated

and presented. We report our financial results in accordance with

U.S. GAAP, but believe that certain non-GAAP financial measures,

such as MLP distributable cash flow and EBITDA, provide useful

supplemental information to investors regarding the underlying

business trends and performance of our ongoing operations and are

useful for period-over-period comparisons of such operations. These

non-GAAP financial measures should be considered as a supplement

to, and not as a substitute for, or superior to, the financial

measures prepared in accordance with U.S. GAAP. We define MLP

distributable cash flow as distributable cash flow less

distributable cash flow attributable to Westlake Corporation's

noncontrolling interest in OpCo and distributions attributable to

the incentive distribution rights holder. MLP distributable cash

flow does not reflect changes in working capital balances. We

define EBITDA as net income before interest expense, income taxes,

depreciation and amortization. MLP distributable cash flow and

EBITDA are non-GAAP supplemental financial measures that management

and external users of our consolidated financial statements, such

as industry analysts, investors, lenders and rating agencies, may

use to assess our operating performance as compared to other

publicly traded partnerships, our ability to incur and service debt

and fund capital expenditures and the viability of acquisitions and

other capital expenditure projects and the returns on investment of

various investment opportunities. Reconciliations of MLP

distributable cash flow to net income and to net cash provided by

operating activities and of EBITDA to net income, income from

operations and net cash provided by operating activities can be

found in the financial schedules at the end of this press

release.

Westlake Chemical Partners LP

Westlake Chemical Partners is a limited partnership formed by

Westlake Corporation to operate, acquire and develop ethylene

production facilities and other qualified assets. Headquartered in

Houston, the Partnership owns a 22.8% interest in Westlake Chemical

OpCo LP. Westlake Chemical OpCo LP's assets consist of three

ethylene production facilities in Calvert City, Kentucky, and Lake

Charles, Louisiana, and an ethylene pipeline. For more information

about Westlake Chemical Partners LP, please visit

http://www.wlkpartners.com.

Westlake Chemical Partners LP Conference Call Information:

A conference call to discuss Westlake Chemical Partners' fourth

quarter and full year 2024 results will be held Monday, February

24th, 2025 at 1:00 PM Eastern Time (12:00 PM Central Time). To

access the conference call, please register at:

https://register.vevent.com/register/BI294ab16856704d199e4792cc3d8bb4b0.

A dial-in will be provided upon registration.

The conference call will also be available via webcast at:

https://edge.media-server.com/mmc/p/s2462hyq and the earnings

release can be obtained via the Partnership web page at:

https://investors.wlkpartners.com/corporate-profile/default.aspx.

WESTLAKE CHEMICAL PARTNERS LP

("WESTLAKE PARTNERS")

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

2024

2023

(In thousands of dollars,

except per unit data)

Revenue

Net sales—Westlake Corporation

("Westlake")

$

260,266

$

255,306

$

950,801

$

1,026,655

Net co-products, ethylene and other

sales—third parties

29,794

41,967

185,095

164,136

Total net sales

290,060

297,273

1,135,896

1,190,791

Cost of sales

191,476

196,590

716,957

803,332

Gross profit

98,584

100,683

418,939

387,459

Selling, general and administrative

expenses

6,559

7,867

28,495

29,751

Income from operations

92,025

92,816

390,444

357,708

Other income (expense)

Interest expense—Westlake

(5,771

)

(6,632

)

(25,701

)

(26,501

)

Other income, net

1,335

1,079

5,251

4,232

Income before income taxes

87,589

87,263

369,994

335,439

Provision for income taxes

202

206

835

813

Net income

87,387

87,057

369,159

334,626

Less: Net income attributable to

noncontrolling interest in Westlake Chemical OpCo LP ("OpCo")

72,391

72,758

306,767

280,343

Net income attributable to Westlake

Partners

$

14,996

$

14,299

$

62,392

$

54,283

Net income per limited partner unit

attributable to Westlake Partners (basic and diluted)

Common units

$

0.43

$

0.41

$

1.77

$

1.54

Distributions declared per unit

$

0.4714

$

0.4714

$

1.8856

$

1.8856

MLP distributable cash flow

$

14,958

$

16,418

$

66,864

$

62,574

Distributions declared

Limited partner units—publicly and

privately held

$

9,954

$

9,949

$

39,809

$

39,790

Limited partner units—Westlake

6,657

6,658

26,628

26,631

Total distributions declared

$

16,611

$

16,607

$

66,437

$

66,421

EBITDA

$

120,838

$

122,196

$

507,594

$

472,143

WESTLAKE CHEMICAL PARTNERS

LP

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

December 31,

2024

2023

(In thousands of

dollars)

ASSETS

Current assets

Cash and cash equivalents

$

58,316

$

58,619

Receivable under the Investment Management

Agreement—Westlake

134,557

94,444

Accounts receivable, net—Westlake

31,975

49,565

Accounts receivable, net—third parties

11,576

18,701

Inventories

4,058

4,432

Prepaid expenses and other current

assets

444

442

Total current assets

240,926

226,203

Property, plant and equipment, net

903,588

943,843

Other assets, net

143,442

146,796

Total assets

$

1,287,956

$

1,316,842

LIABILITIES AND EQUITY

Current liabilities (accounts payable and

accrued and other liabilities)

$

55,372

$

56,335

Long-term debt payable to Westlake

399,674

399,674

Other liabilities

3,596

4,583

Total liabilities

458,642

460,592

Common unitholders—publicly and privately

held

471,328

473,513

Common unitholder—Westlake

47,373

48,993

General partner—Westlake

(242,572

)

(242,572

)

Total Westlake Partners partners'

capital

276,129

279,934

Noncontrolling interest in OpCo

553,185

576,316

Total equity

829,314

856,250

Total liabilities and equity

$

1,287,956

$

1,316,842

WESTLAKE CHEMICAL PARTNERS

LP

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

Twelve Months Ended December

31,

2024

2023

(In thousands of

dollars)

Cash flows from operating

activities

Net income

$

369,159

$

334,626

Adjustments to reconcile net income to net

cash provided by operating activities

Depreciation and amortization

111,899

110,203

Net loss on disposition and other

2,163

4,906

Other balance sheet changes

1,780

2,264

Net cash provided by operating

activities

485,001

451,999

Cash flows from investing

activities

Additions to property, plant and

equipment

(48,971

)

(46,821

)

Investments with Westlake under the

Investment Management Agreement

(40,000

)

(174,116

)

Maturities of investments with Westlake

under the Investment Management Agreement

—

145,000

Net cash used for investing activities

(88,971

)

(75,937

)

Cash flows from financing

activities

Proceeds from debt payable to Westlake

219,000

209,250

Repayment of debt payable to Westlake

(219,000

)

(209,250

)

Distributions to noncontrolling interest

retained in OpCo by Westlake

(329,898

)

(315,805

)

Distributions to unitholders

(66,435

)

(66,420

)

Net cash used for financing activities

(396,333

)

(382,225

)

Net decrease in cash and cash

equivalents

(303

)

(6,163

)

Cash and cash equivalents at beginning of

the year

58,619

64,782

Cash and cash equivalents at end of the

year

$

58,316

$

58,619

WESTLAKE CHEMICAL PARTNERS

LP

RECONCILIATION OF MLP

DISTRIBUTABLE CASH FLOW TO NET INCOME

AND NET CASH PROVIDED BY

OPERATING ACTIVITIES

(Unaudited)

Three Months Ended September

30,

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2024

2023

2024

2023

(In thousands of

dollars)

Net cash provided by operating

activities

$

126,071

$

132,469

$

107,671

$

485,001

$

451,999

Changes in operating assets and

liabilities and other

(21,971

)

(45,082

)

(20,614

)

(115,842

)

(117,373

)

Net income

104,100

87,387

87,057

369,159

334,626

Add:

Depreciation, amortization and disposition

of property, plant and equipment

28,528

27,582

28,796

114,244

115,136

Less:

Contribution to turnaround reserves

(11,903

)

(11,829

)

(7,682

)

(43,880

)

(29,520

)

Maintenance capital expenditures

(17,753

)

(15,923

)

(11,805

)

(50,731

)

(49,212

)

Distributable cash flow attributable to

noncontrolling interest in OpCo

(85,093

)

(72,259

)

(79,948

)

(321,928

)

(308,456

)

MLP distributable cash flow

$

17,879

$

14,958

$

16,418

$

66,864

$

62,574

WESTLAKE CHEMICAL PARTNERS

LP

RECONCILIATION OF EBITDA TO

NET INCOME, INCOME FROM OPERATIONS AND

NET CASH PROVIDED BY OPERATING

ACTIVITIES

(Unaudited)

Three Months Ended September

30,

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2024

2023

2024

2023

(In thousands of

dollars)

Net cash provided by operating

activities

$

126,071

$

132,469

$

107,671

$

485,001

$

451,999

Changes in operating assets and

liabilities and other

(21,971

)

(45,082

)

(20,614

)

(115,842

)

(117,373

)

Net income

104,100

87,387

87,057

369,159

334,626

Less:

Other income, net

1,325

1,335

1,079

5,251

4,232

Interest expense—Westlake

(6,698

)

(5,771

)

(6,632

)

(25,701

)

(26,501

)

Provision for income taxes

(216

)

(202

)

(206

)

(835

)

(813

)

Income from operations

109,689

92,025

92,816

390,444

357,708

Add:

Depreciation and amortization

28,112

27,478

28,301

111,899

110,203

Other income, net

1,325

1,335

1,079

5,251

4,232

EBITDA

$

139,126

$

120,838

$

122,196

$

507,594

$

472,143

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218475847/en/

Contact—(713) 585-2900 Investors—Steve Bender Media—L. Benjamin

Ederington

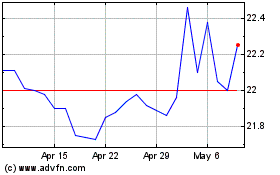

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Feb 2025 to Mar 2025

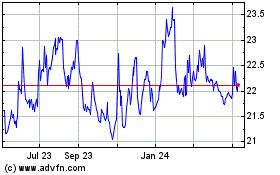

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Mar 2024 to Mar 2025