0001465885FALSE00014658852023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 8, 2023

Western Asset Mortgage Capital Corporation

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

Delaware

(STATE OF INCORPORATION) | | | | | | | | |

| 001-35543 | | 27-0298092 |

| (COMMISSION FILE NUMBER) | | (IRS EMPLOYER ID. NUMBER) |

| | | | | | | | |

385 East Colorado Boulevard, | | 91101 |

Pasadena, California | | (ZIP CODE) |

| (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) | | |

(626) 844-9400

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

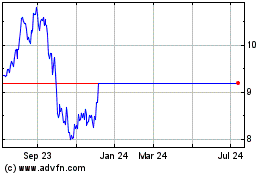

| Common Stock, $0.01 par value | | WMC | | New York Stock Exchange |

Item 2.02. Results of Operations and Financial Condition

On August 8, 2023, Western Asset Mortgage Capital Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2023. The text of the press release is furnished as exhibit 99.1 to this Form 8-K.

Item 7.01. Regulation FD Disclosure

On August 9, 2023, the Company will be holding its quarterly conference call in which it will discuss its financial results. The presentation for such call is furnished herewith as Exhibit 99.2 to this Form 8-K.

Pursuant to the rules and regulations of the Securities and Exchange Commission, Exhibits 99.1 and 99.2 and the information set forth therein and herein are being furnished and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall they be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | WESTERN ASSET MORTGAGE CAPITAL CORPORATION |

| | | |

| | | |

| | By: | /s/ Robert W. Lehman | |

| | | Name: | Robert W. Lehman | |

| | | Title: | Chief Financial Officer | |

Date: August 8, 2023

Exhibit 99.1

WESTERN ASSET MORTGAGE CAPITAL CORPORATION

ANNOUNCES SECOND QUARTER 2023 RESULTS

Conference Call and Webcast Scheduled for Tomorrow, August 9, 2023 at

12:00 p.m. Eastern Time/9:00 a.m. Pacific Time

Pasadena, CA, August 8, 2023 – Western Asset Mortgage Capital Corporation (the “Company,” “we,” or “WMC”) (NYSE: WMC) today reported its results for the second quarter ended June 30, 2023.

BUSINESS UPDATE

The Company continues to execute on its business strategy to take actions to strengthen its balance sheet:

•For the three months ended June 30, 2023:

◦the Company received $28.4 million from the sale or repayment of Residential Whole Loans and Non-Agency RMBS;

◦the Company received $1.1 million from the repayment or paydown of Commercial Whole Loans, Non-Agency CMBS, and Other Securities; and

◦the Company received $8.7 million in proceeds from the sale of Other Securities.

•Subsequent to quarter end, the Company replaced an existing short-term repurchase financing facility facing Credit Suisse AG (UBS) with a new two-year term, $65 million fixed rate, non-mark-to-market securitized funding vehicle. As a result, the Company no longer has any financing arrangements with Credit Suisse AG (UBS) as a counterparty.

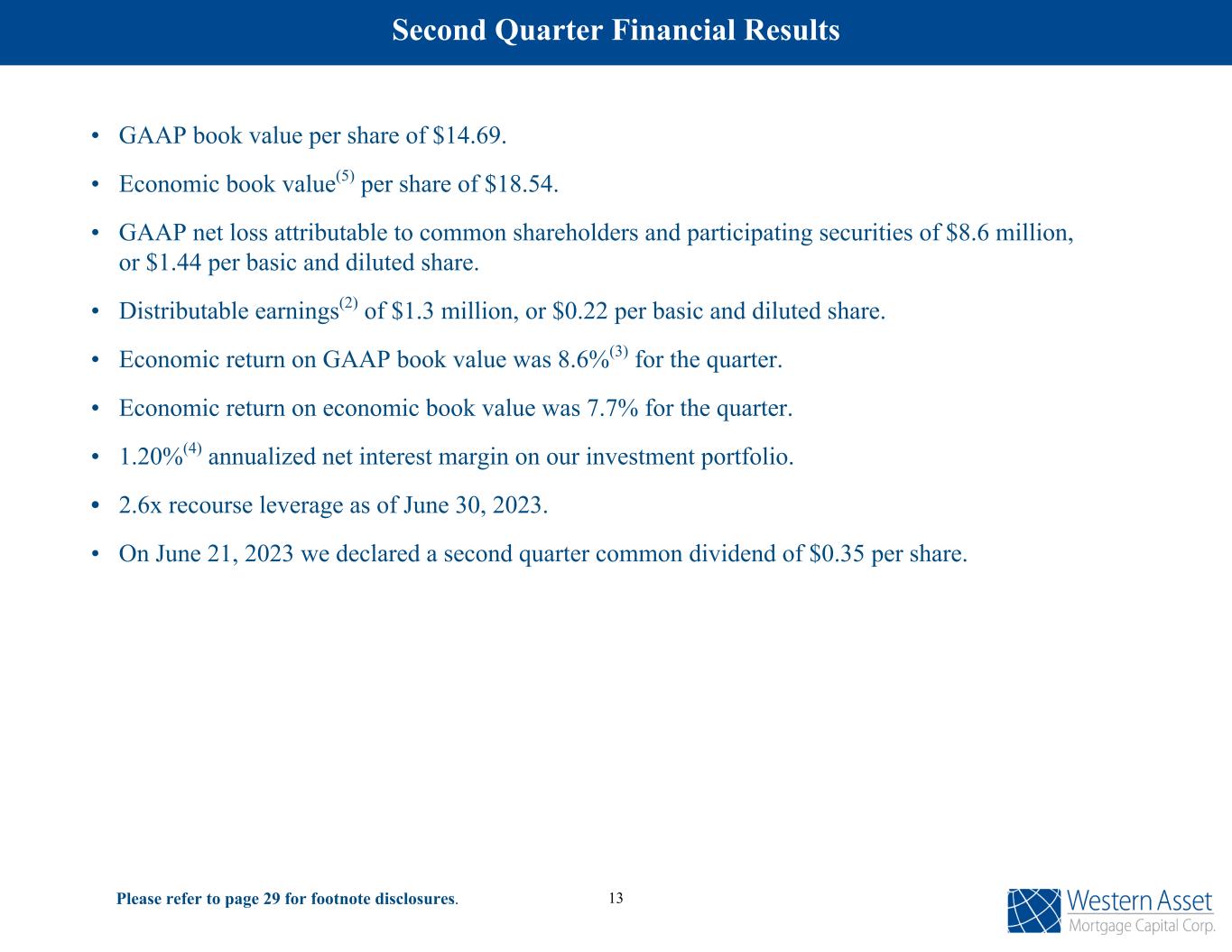

SECOND QUARTER 2023 FINANCIAL RESULTS

The rising and volatile interest rate environment negatively impacted our second quarter GAAP financial results. Key measures for the quarter were as follows:

▪GAAP book value per share was $14.69 at June 30, 2023.

▪Economic book value(1) per share of $18.54 at June 30, 2023.

▪GAAP net loss attributable to common shareholders and participating securities of $8.6 million, or $1.44 per share.

▪Distributable Earnings(1) of $1.3 million, or $0.22 per basic and diluted share.

▪Economic return(1)(2) on book value was negative 8.6% for the quarter.

▪Economic return(1)(2) on economic book value was 7.7% for the quarter.

▪1.2% annualized net interest margin(1)(3)(4) on our investment portfolio.

▪2.6x recourse leverage as of June 30, 2023.

▪On June 21, 2023, we declared a second quarter common dividend of $0.35 per share.

(1) Non-GAAP measure. Refer to pages 15 through 18 of this press release for reconciliations.

(2) Economic return is calculated by taking the sum of: (i) the total dividends declared and (ii) the change in book value during the period, divided

by beginning book value.

(3) Includes interest-only securities accounted for as derivatives.

(4) Excludes the consolidation of VIE trusts required under GAAP.

OPERATING RESULTS

The below table reflects a summary of our operating results:

| | | | | | | | | | | | | | | | |

| | | For the Three Months Ended | | |

| | June 30, 2023 | | March 31, 2023 | | |

| GAAP Results | | ($ in thousands) | | |

| Net Interest Income | | $ | 4,010 | | | $ | 4,355 | | | |

| Other Income (Loss): | | | | | | |

| Realized gain (loss), net | | (1,099) | | | (82,818) | | | |

| Unrealized gain (loss), net | | (6,854) | | | 90,316 | | | |

| Gain (loss) on derivative instruments, net | | 1,014 | | | (950) | | | |

| Other, net | | 186 | | | 57 | | | |

| Other Income (Loss) | | (6,753) | | | 6,605 | | | |

| Total Expenses | | 5,899 | | | 4,380 | | | |

| Income (loss) before income taxes | | (8,642) | | | 6,581 | | | |

| Income tax provision (benefit) | | (12) | | | 12 | | | |

| Net income (loss) | | $ | (8,630) | | | $ | 6,569 | | | |

| Net income (loss) attributable to non-controlling interest | | 3 | | | 1 | | | |

| Net income (loss) attributable to common stockholders and participating securities | | $ | (8,633) | | | $ | 6,568 | | | |

| | | | | | |

| Net income (loss) per Common Share – Basic/Diluted | | $ | (1.44) | | | $ | 1.07 | | | |

| Non-GAAP Results | | | | | | |

Distributable Earnings(1) | | $ | 1,328 | | | $ | 2,174 | | | |

| Distributable Earnings per Common Share – Basic/Diluted | | $ | 0.22 | | | $ | 0.36 | | | |

Weighted average yield(2)(3) | | 5.20 | % | | 5.29 | % | | |

Effective cost of funds(3) | | 4.58 | % | | 4.31 | % | | |

Annualized net interest margin(2)(3) | | 1.20 | % | | 1.39 | % | | |

| | | | | | |

(1) For a reconciliation of GAAP Income to Distributable Earnings, refer to page 15 of this press release.

(2) Includes interest-only securities accounted for as derivatives.

(3) Excludes the consolidation of VIE trusts required under GAAP.

MANAGEMENT COMMENTARY

“During the second quarter, we remained focused on strengthening our balance sheet and increasing our liquidity,” said Bonnie Wongtrakool, Chief Executive Officer of the Company. “Our second quarter results declined sequentially from the first quarter, driven by lower earnings and reduced prices across portions of our portfolio as rates rose. We also received approximately $38.1 million from the sale of, repayment or paydowns of investments and used the majority of these proceeds to further reduce recourse debt.”

“For the second quarter, our GAAP book value per share decreased 10.8% from the prior quarter, while economic book value per share increased 5.7%. We generated lower net interest income during the quarter, driven by a lower net interest margin and lower income from our interest rate swap positions, while our operating expenses increased sequentially from the prior quarter, primarily due to one-time expenses related to our strategic review process. Consequently, our distributable earnings of $1.3 million, or $0.22 per share, in the second quarter, were down $846 thousand, or 38.9%, from the first quarter.”

Greg Handler, Chief Investment Officer of the Company, added, “We remained focused on maximizing the value of our portfolio and increasing our total liquidity. During the quarter, we received payoffs in our residential whole loan and exited some of our non-agency investments. A combination of higher interest rates and spread widening in commercial mortgages put pressure on the GAAP value of our residential whole loan portfolio and some of our commercial assets. We continue to focus on monetizing our commercial holdings in a disciplined manner with the goal of strengthening our balance sheet and improving our liquidity.”

INVESTMENT PORTFOLIO

Investment Activity

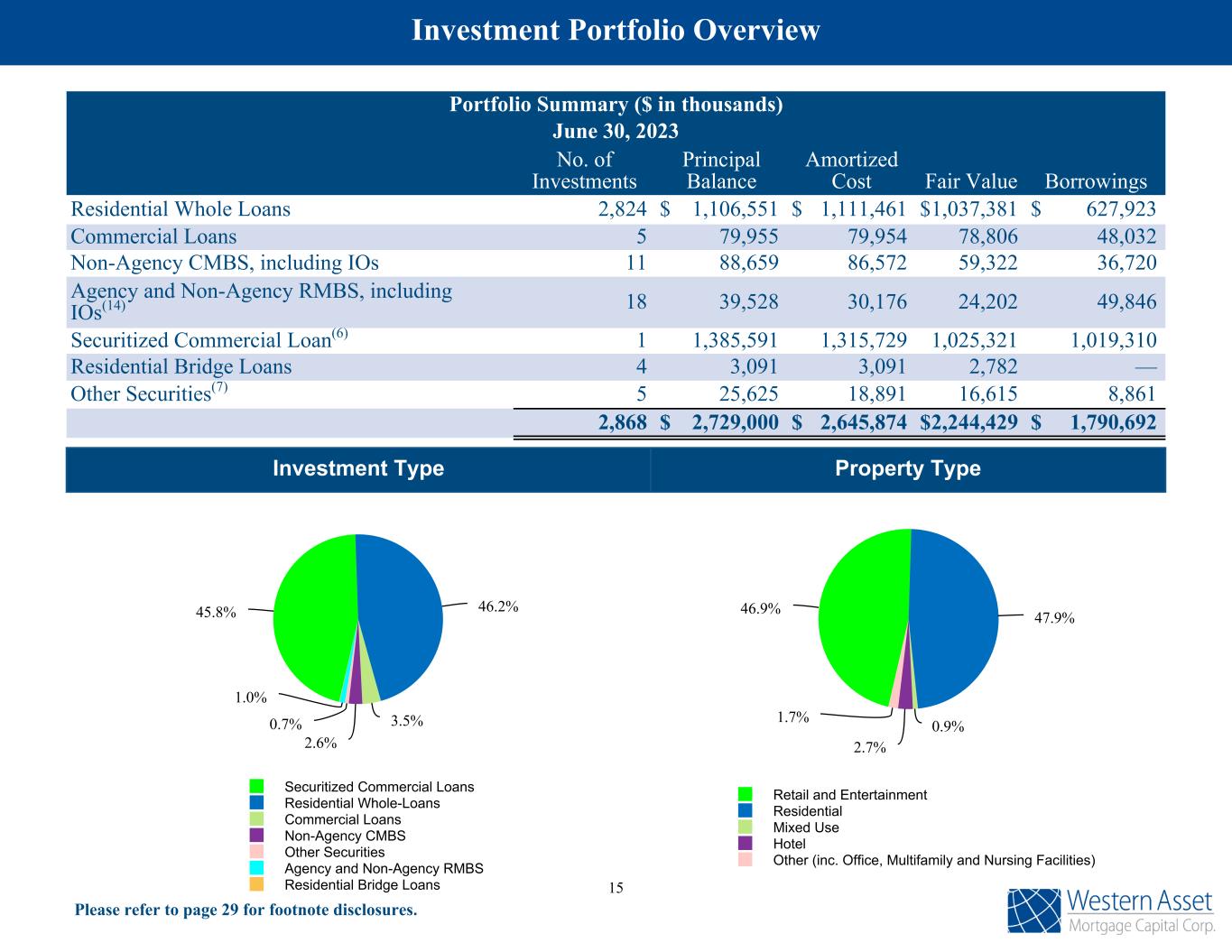

As of June 30, 2023, the Company owned an aggregate investment portfolio with a fair market value totaling $2.2 billion. The following table summarizes certain characteristics of our portfolio by investment category as of June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Balance at | | Loan Modification/Capitalized Interest | Principal Payments and Basis Recovery | Proceeds from

Sales | Transfers to REO | Realized Gain/(Loss) | Unrealized Gain/(loss) | Premium and discount amortization, net | | | Balance at |

| Investment Type | December 31, 2022 | Purchases | | June 30, 2023 |

| Agency RMBS and Agency RMBS IOs | $ | 767 | | $ | — | | N/A | $ | 4 | | $ | — | | N/A | $ | — | | $ | 67 | | $ | — | | | | $ | 838 | |

| Non-Agency RMBS | 23,687 | | — | | N/A | (264) | | — | | N/A | (48) | | 128 | | (139) | | | | 23,364 | |

| | | | | | | | | | | | |

| Non-Agency CMBS | 85,435 | | — | | N/A | (20,559) | | — | | N/A | (1,239) | | (4,970) | | 655 | | | | 59,322 | |

Other securities(1) | 27,262 | | 4,714 | | N/A | — | | (15,324) | | N/A | (1,379) | | 1,543 | | (201) | | | | 16,615 | |

| Total MBS and other securities | 137,151 | | 4,714 | | N/A | (20,819) | | (15,324) | | N/A | (2,666) | | (3,232) | | 315 | | | | 100,139 | |

| Residential Whole Loans | 1,091,145 | | — | | 41 | | (58,792) | | — | | — | | — | | 6,444 | | (1,457) | | | | 1,037,381 | |

| Residential Bridge Loans | 2,849 | | — | | — | | (75) | | — | | — | | — | | 8 | | — | | | | 2,782 | |

| Commercial Loans | 90,002 | | — | | — | | (1,680) | | (8,776) | | — | | (81,223) | | 80,417 | | 66 | | | | 78,806 | |

| Securitized commercial loans | 1,085,103 | | — | | — | | — | | — | | — | | — | | (74,050) | | 14,268 | | | | 1,025,321 | |

| Real Estate Owned | 2,255 | | — | | N/A | — | | 28 | | — | | (28) | | — | | N/A | | | 2,255 | |

| Total Investments | $ | 2,408,505 | | $ | 4,714 | | $ | 41 | | $ | (81,366) | | $ | (24,072) | | $ | — | | $ | (83,917) | | $ | 9,587 | | $ | 13,192 | | | | $ | 2,246,684 | |

(1) At June 30, 2023 other securities include GSE Credit Risk Transfer Securities with an estimated fair value of $15.4 million and Student Loan ABS with a fair value of $1.2 million.

Portfolio Characteristics

Residential Real Estate Investments

The Company's focus on residential real estate related investments includes but is not limited to non-qualified residential whole loans ("Non-QM Loans"), non-agency RMBS, and other related assets. The Company believes this focus allows it to address attractive market opportunities.

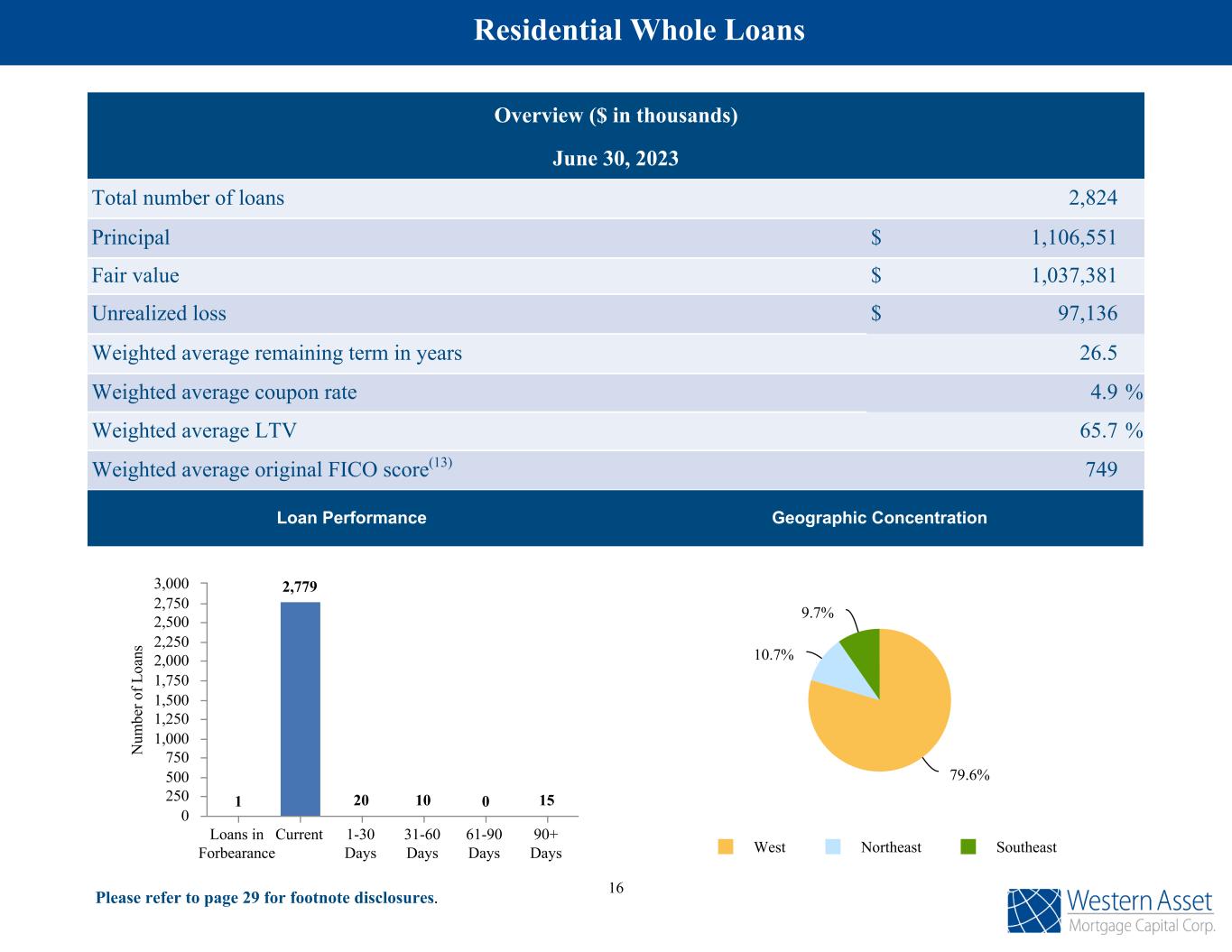

Residential Whole Loans

The Company's Residential Whole Loans have low LTV's and are comprised of 2,824 adjustable and fixed rate Non-QM and investor mortgages. The following table presents certain information about our Residential Whole Loans investment portfolio at June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Weighted Average |

| Current Coupon Rate | | Number of Loans | | Principal

Balance | | Original LTV | | Original FICO Score(1) | | Expected

Life (years) | | Contractual

Maturity

(years) | | Coupon

Rate |

2.01% – 3.00% | | 39 | | $ | 22,018 | | | 66.3 | % | | 758 | | | 8.9 | | 27.8 | | 2.9 | % |

3.01% – 4.00% | | 366 | | 200,548 | | | 66.9 | % | | 760 | | | 7.5 | | 28.3 | | 3.7 | % |

4.01% – 5.00% | | 1,236 | | 417,820 | | | 64.5 | % | | 750 | | | 5.7 | | 25.7 | | 4.6 | % |

5.01% – 6.00% | | 875 | | 347,001 | | | 65.5 | % | | 742 | | | 4.8 | | 26.2 | | 5.5 | % |

6.01% – 7.00% | | 282 | | 110,986 | | | 68.1 | % | | 742 | | | 3.6 | | 27.2 | | 6.4 | % |

7.01% - 8.00% | | 25 | | 8,173 | | | 68.3 | % | | 735 | | | 3.4 | | 26.5 | | 7.4 | % |

| | | | | | | | | | | | | | |

| Total | | 2,824 | | 1,106,551 | | 65.7 | % | | 749 | | | 5.5 | | 26.5 | | 4.9 | % |

(1) The original FICO score is not available for 219 loans with a principal balance of approximately $69.4 million at June 30, 2023. We have excluded these loans from the weighted average.

The following table presents the aging of the Residential Whole Loans as of June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | Residential Whole Loans |

| | No of Loans | | Principal | | Fair Value |

| Current | | 2,779 | | | $ | 1,082,536 | | | $ | 1,014,645 | |

| 1-30 days | | 20 | | | 10,339 | | | 9,984 | |

| 31-60 days | | 10 | | | 4,546 | | | 4,231 | |

| 61-90 days | | — | | | — | | | — | |

| 90+ days | | 15 | | | 9,130 | | | 8,521 | |

| Total | | 2,824 | | | $ | 1,106,551 | | | $ | 1,037,381 | |

Non-Agency RMBS

The following table presents the fair value and weighted average purchase price for each of our Non-agency RMBS categories, including IOs accounted for as derivatives, together with certain of their respective underlying loan collateral attributes and current performance metrics as of June 30, 2023 (fair value dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Weighted Average |

| Category | | Fair Value | | Purchase

Price | | Life (Years) | | Original LTV | | Original

FICO | | 60+ Day

Delinquent | | CPR |

| Prime | | $ | 11,770 | | | $ | 81.81 | | | 11.6 | | | 67.6 | % | | 747 | | | 1.0 | % | | 16.8 | % |

| Alt-A | | 11,594 | | | 48.30 | | | 18.5 | | | 81.3 | % | | 661 | | | 17.5 | % | | 6.0 | % |

| | | | | | | | | | | | | | |

| Total | | $ | 23,364 | | | $ | 65.18 | | | 15.0 | | | 74.4 | % | | 704 | | | 9.2 | % | | 11.4 | % |

Commercial Real Estate Investments

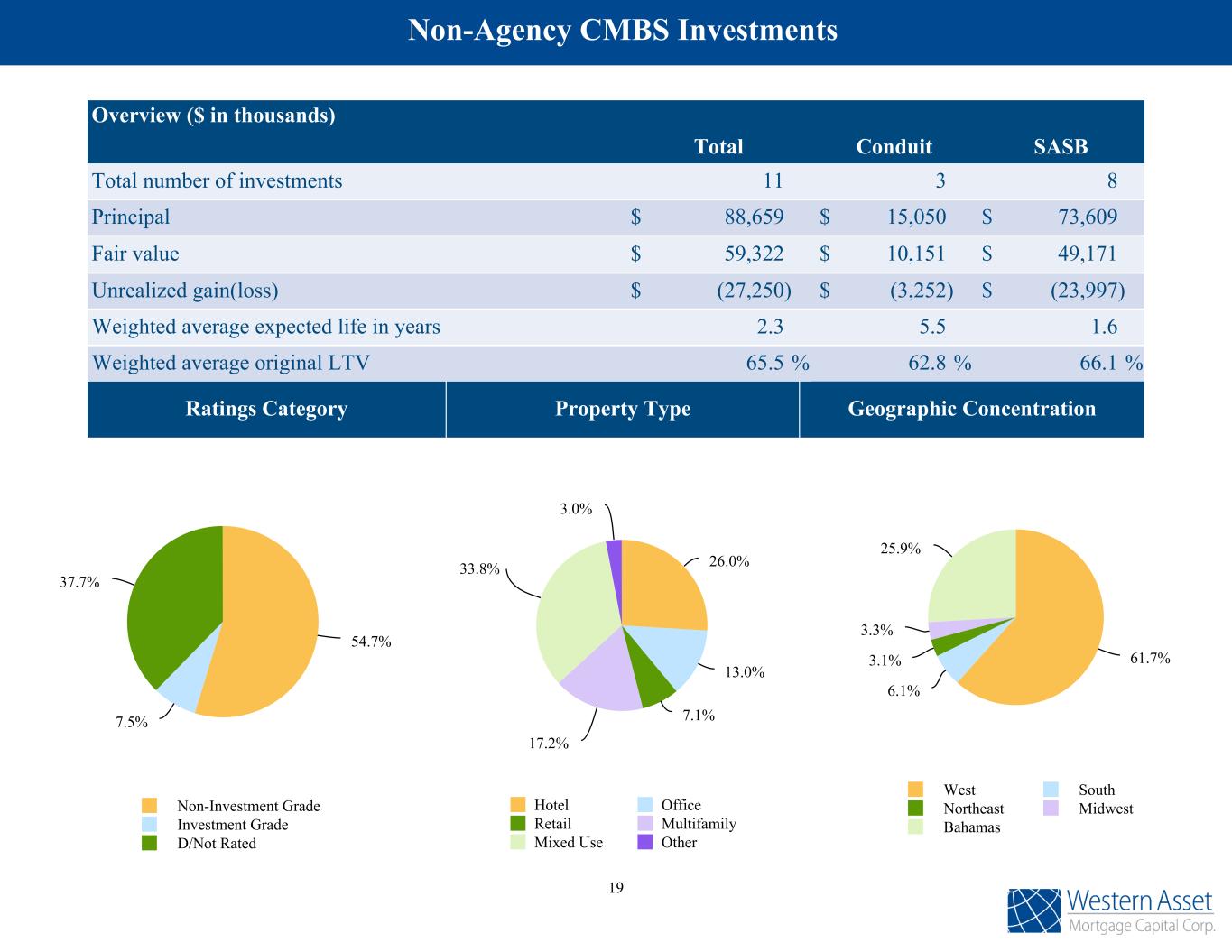

Non-Agency CMBS

The following table presents certain characteristics of our Non-Agency CMBS portfolio as of June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Principal | | | | Weighted Average |

| Type | | Vintage | | Balance | | Fair Value | | Life (Years) | | Original LTV |

| Conduit: | | | | | | | | | | |

| | | 2006-2009 | | $ | 68 | | | $ | 66 | | | 0.6 | | | 88.7 | % |

| | | 2010-2020 | | 14,982 | | | 10,085 | | | 5.6 | | | 62.6 | % |

| | | | | 15,050 | | | 10,151 | | | 5.5 | | | 62.8 | % |

| Single Asset: | | | | | | | | | | |

| | | 2010-2020 | | 73,609 | | | 49,171 | | | 1.6 | | | 66.1 | % |

| Total | | | | $ | 88,659 | | | $ | 59,322 | | | 2.3 | | | 65.5 | % |

Commercial Loans

The following table presents our commercial loan investments as of June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loan | Loan Type | Principal Balance | Fair Value | Original LTV | Interest Rate | Maturity Date | Extension Option | Collateral | Geographic Location |

| CRE 4 | Interest-Only First Mortgage | 22,204 | | 22,053 | | 63% | 1-Month SOFR plus 3.38% | 8/6/2025(1) | None | Retail | CT |

| CRE 5 | Interest-Only First Mortgage | 24,535 | | 23,993 | | 62% | 1-Month SOFR plus 4.95% | 11/6/2023(2) | One - 12 month extension | Hotel | NY |

| CRE 6 | Interest-Only First Mortgage | 13,207 | | 12,914 | | 62% | 1-Month SOFR plus 4.95% | 11/6/2023(2) | One - 12 month extension | Hotel | CA |

| CRE 7 | Interest-Only First Mortgage | 7,259 | | 7,099 | | 62% | 1-Month SOFR plus 4.95% | 11/6/2023(2) | One - 12 month extension | Hotel | IL, FL |

SBC 3(3) | Interest-Only First Mortgage | 12,750 | | 12,747 | | 49% | 1-Month SOFR plus 5.50% | 8/4/2023 | One - 3 month extension | Nursing Facilities | CT |

| | $ | 79,955 | | $ | 78,806 | | | | | | | |

| | | | | | | | | |

(1) In August 2022, CRE 4 was extended three years through August 6, 2025, with a principal pay down of $16.2 million.

(2) In November 2022, CRE 5, 6, and 7 were each extended for one year through November 6, 2023.

(3) In January 2023, the SBC 3 loan was partially paid down by $862 thousand to bring the unpaid principal balance to $13.5 million, the maturity date was extended through May 5, 2023 for a 50 bps extension fee and the margin was increased from 4.47% to 5.00%. In May 2023, the SBC 3 loan was partially paid down by $750 thousand to bring the unpaid principal to $12.8 million, the maturity date was extended through August 4, 2023, and the margin was increased from 5.00% to 5.50%. In July 2023, the SBC 3 loan was partially paid down by $250 thousand to bring the unpaid principal balance to $12.5 million, and the maturity date was extended to October 4, 2023 for a 25 bps extension fee. The borrower under this loan may, at its option, extend the October 4, 2023 maturity date for an additional period of three months through December 31, 2023, with an additional required paydown of $250 thousand and a 25 bps extension fee.

PORTFOLIO FINANCING AND HEDGING

Financing

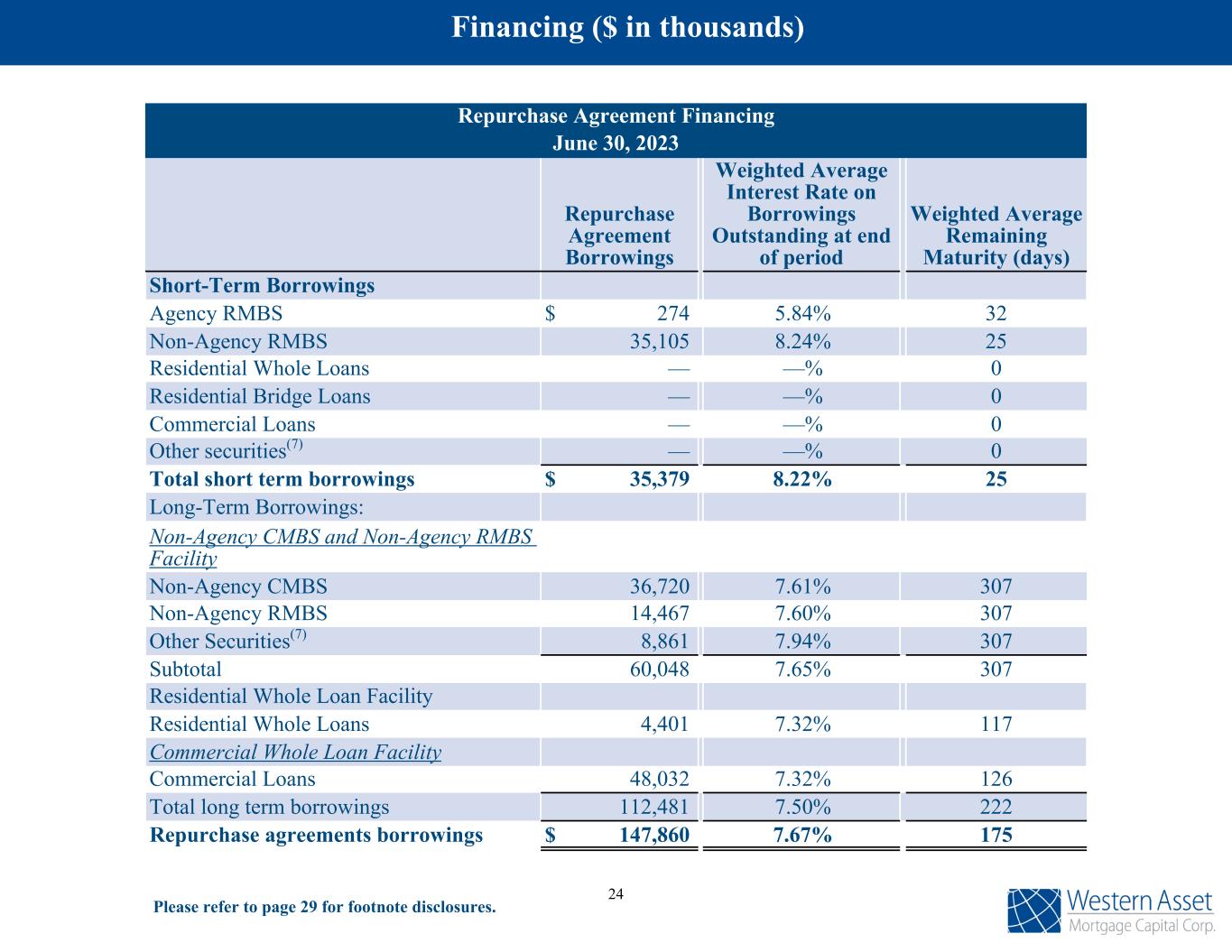

The following table sets forth additional information regarding the Company’s portfolio financing arrangements as of June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | |

| Securities Pledged | | Repurchase Agreement Borrowings | | Weighted Average Interest Rate on Borrowings Outstanding at end of period | | Weighted Average Remaining Maturity (days) |

| Short-Term Borrowings: | | | | | | |

| | | | | | |

| Agency RMBS | | $ | 274 | | | 5.84 | % | | 32 |

| | | | | | |

Non-Agency RMBS(1) | | 35,105 | | | 8.24 | % | | 25 |

Residential Whole Loans(2) | | — | | | — | % | | 0 |

Residential Bridge Loans(2) | | — | | | — | % | | 0 |

Commercial Loans(2) | | — | | | — | % | | 0 |

| | | | | | |

| Other Securities | | — | | | — | % | | 0 |

| Total short term borrowings | | 35,379 | | | 8.22 | % | | 25 |

| Long Term Borrowings: | | | | | | |

| Non-Agency CMBS and Non-Agency RMBS Facility | | | | | | |

Non-Agency CMBS(1) | | 36,720 | | | 7.61 | % | | 307 |

| Non-Agency RMBS | | 14,467 | | | 7.60 | % | | 307 |

| Other Securities | | 8,861 | | | 7.94 | % | | 307 |

| Subtotal | | 60,048 | | | 7.65 | % | | 307 |

| Residential Whole Loan Facility | | | | | | |

Residential Whole Loans(2) | | 4,401 | | | 7.32 | % | | 117 |

| Commercial Whole Loan Facility | | | | | | |

| Commercial Loans | | 48,032 | | | 7.32 | % | | 126 |

| Total long term borrowings | | 112,481 | | | 7.50 | % | | 222 |

| Repurchase agreements borrowings | | $ | 147,860 | | | 7.67 | % | | 175 |

| | | | | | |

| | | | | | |

(1) Includes repurchase agreement borrowings on securities eliminated upon VIE consolidation.

(2) Repurchase agreement borrowings on loans owned are through trust certificates. The trust certificates are eliminated in consolidation.

Residential Whole Loan Facility

The facility finances non-securitized, Non-QM Residential Whole Loans. It matures on October 25, 2023 and bears interest at a rate of SOFR plus 2.25%, with a SOFR floor of 0.25%. As of June 30, 2023, the Company had outstanding borrowings of $4.4 million. The borrowings are secured by $3.4 million in non-QM loans and one REO property with a carrying value of $2.3 million as of June 30, 2023.

Non-Agency CMBS and Non-Agency RMBS Facility

The facility started on May 2, 2023 and matures in May 2024. It bears interest at a weighted average rate of SOFR plus 2.5%. As of June 30, 2023, the outstanding balance under this facility was $60.0 million. The borrowings are secured by investments with an estimated fair market value of $95.0 million as of June 30, 2023.

Commercial Whole Loan Facility

The facility matures on November 3, 2023 and bears interest at a rate of SOFR plus 2.25%. As of June 30, 2023, the outstanding balance under this facility was $48.0 million. The borrowings are secured by performing commercial loans, with an estimated fair market value of $66.1 million as of June 30, 2023.

Convertible Senior Unsecured Notes

6.75% Convertible Senior Unsecured Notes due 2024 (the “2024 Notes”)

As of June 30, 2023, the Company had $86.3 million aggregate principal amount of the 2024 Notes outstanding. The 2024 Notes mature on September 15, 2024, unless earlier converted, redeemed or repurchased by the holders pursuant to their terms, and are not redeemable by us except during the final three months prior to maturity.

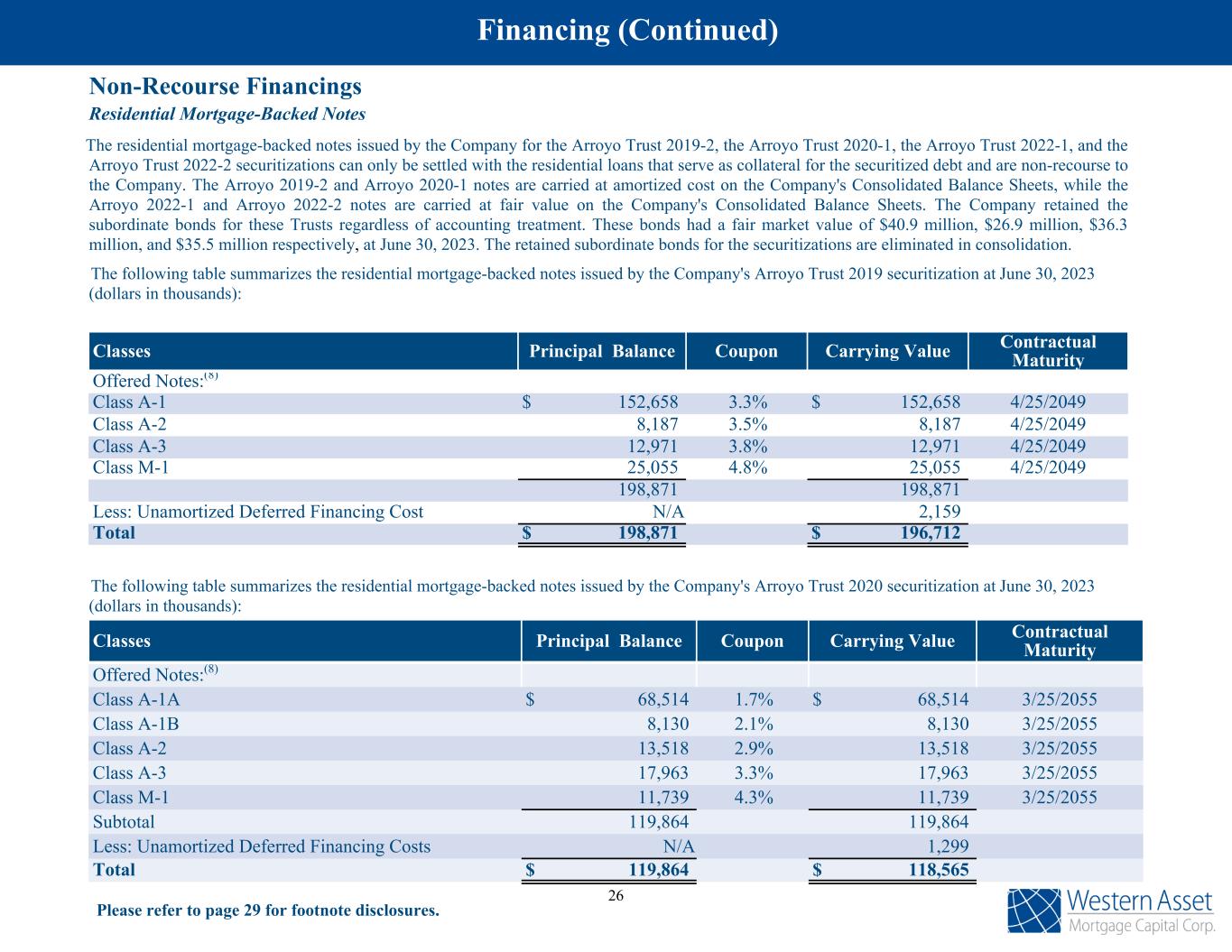

Residential Mortgage-Backed Notes

As of June 30, 2023, the Company has completed four Residential Whole Loan securitizations. The mortgage-backed notes issued are non-recourse to the Company and effectively finance $1.0 billion of Residential Whole Loans as of June 30, 2023.

Arroyo 2019-2

The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo 2019-2 securitization trust at June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | |

| Classes | Principal Balance | Coupon | Carrying Value | Contractual Maturity |

| Offered Notes: | | | | |

| Class A-1 | $ | 152,658 | | 3.3% | $ | 152,658 | | 4/25/2049 |

| Class A-2 | 8,187 | | 3.5% | 8,187 | | 4/25/2049 |

| Class A-3 | 12,971 | | 3.8% | 12,971 | | 4/25/2049 |

| Class M-1 | 25,055 | | 4.8% | 25,055 | | 4/25/2049 |

| 198,871 | | | 198,871 | | |

| Less: Unamortized Deferred Financing Cost | N/A | | 2,159 | | |

| Total | $ | 198,871 | | | $ | 196,712 | | |

The Company retained the subordinate bonds and these bonds had a fair market value of $40.9 million at June 30, 2023. The retained Arroyo 2019-2 subordinate bonds are eliminated in consolidation.

Arroyo 2020-1

The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo 2020-1 securitization trust at June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | |

| Classes | Principal Balance | Coupon | Carrying Value | Contractual Maturity |

| Offered Notes: | | | | |

| Class A-1A | $ | 68,514 | | 1.7% | $ | 68,514 | | 3/25/2055 |

| Class A-1B | 8,130 | | 2.1% | 8,130 | | 3/25/2055 |

| Class A-2 | 13,518 | | 2.9% | 13,518 | | 3/25/2055 |

| Class A-3 | 17,963 | | 3.3% | 17,963 | | 3/25/2055 |

| Class M-1 | 11,739 | | 4.3% | 11,739 | | 3/25/2055 |

| Subtotal | 119,864 | | | 119,864 | | |

| Less: Unamortized Deferred Financing Costs | N/A | | 1,299 | | |

| Total | $ | 119,864 | | | $ | 118,565 | | |

The Company retained the subordinate bonds and these bonds had a fair market value of $26.9 million at June 30, 2023. The retained Arroyo 2020-1 subordinate bonds are eliminated in consolidation.

Arroyo 2022-1

The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo 2022-1 securitization trust at June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | |

| Classes | Principal Balance | Coupon | Fair Value | Contractual Maturity |

| Offered Notes: | | | | |

| Class A-1A | $ | 202,556 | | 2.5% | $ | 182,262 | | 12/25/2056 |

| Class A-1B | 82,942 | | 3.3% | 73,725 | | 12/25/2056 |

| Class A-2 | 21,168 | | 3.6% | 17,292 | | 12/25/2056 |

| Class A-3 | 28,079 | | 3.7% | 22,186 | | 12/25/2056 |

| Class M-1 | 17,928 | | 3.7% | 12,780 | | 12/25/2056 |

| | | | |

| | | | |

| Total | $ | 352,673 | | | $ | 308,245 | | |

The Company retained the subordinate bonds and these bonds had a fair market value of $36.3 million at June 30, 2023. The retained Arroyo 2022-1 subordinate bonds are eliminated in consolidation.

Arroyo 2022-2

The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo 2022-2 securitization trust at June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | |

| Classes | Principal Balance | Coupon | Fair Value | Contractual Maturity |

| Offered Notes: | | | | |

| Class A-1 | $ | 250,394 | | 5.0% | $ | 242,542 | | 7/25/2057 |

| Class A-2 | 21,314 | | 5.0% | 20,239 | | 7/25/2057 |

| Class A-3 | 25,972 | | 5.0% | 24,613 | | 7/25/2057 |

| Class M-1 | 17,694 | | 5.0% | 14,680 | | 7/25/2057 |

| Subtotal | 315,374 | | | 302,074 | | |

| Less: Unamortized Deferred Financing Costs | N/A | | — | | |

| Total | $ | 315,374 | | | $ | 302,074 | | |

The Company retained the subordinate bonds and these bonds had a fair market value of $35.5 million at June 30, 2023. The retained Arroyo 2022-2 subordinate bonds are eliminated in consolidation.

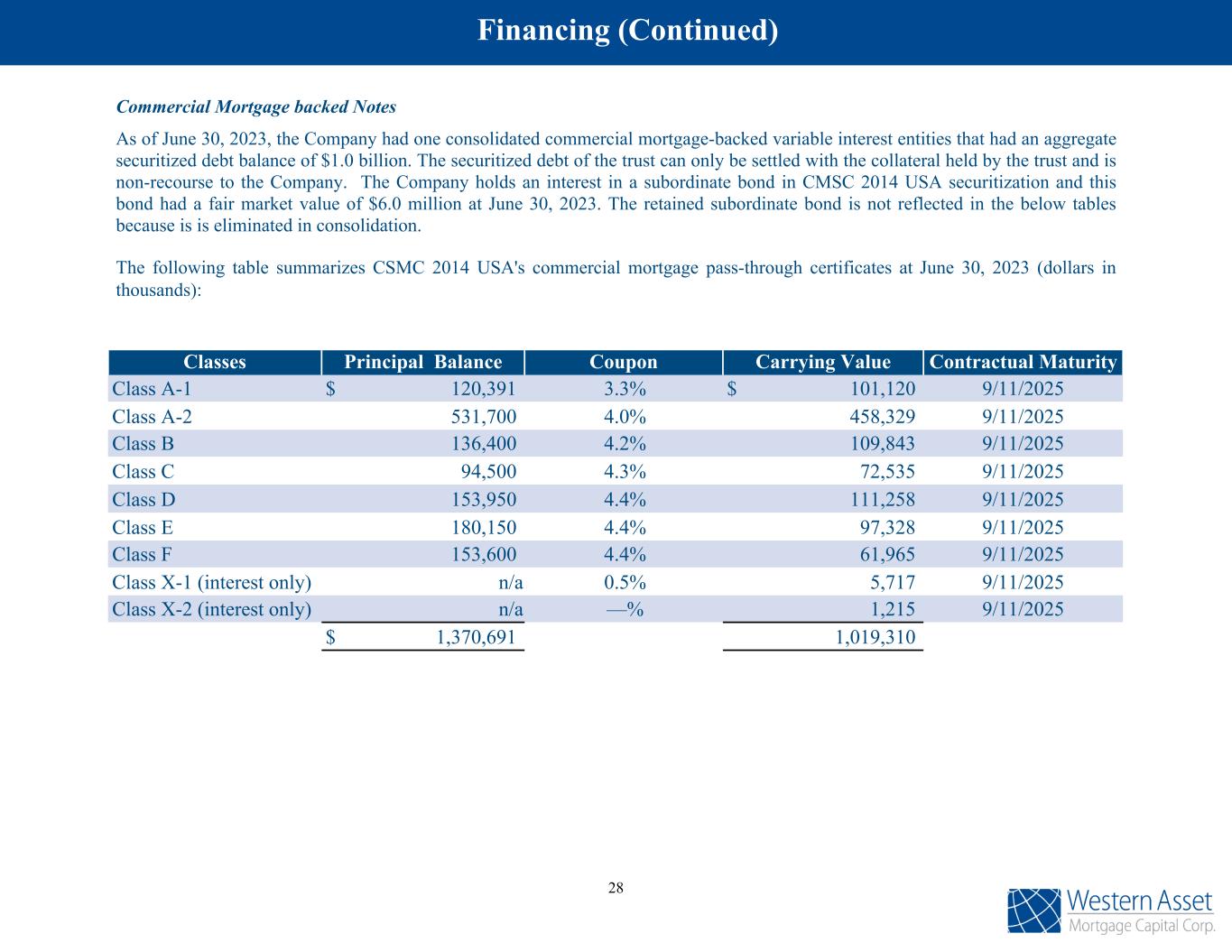

Commercial Mortgage-Backed Notes

CSMC 2014 USA

The following table summarizes CSMC 2014 USA's commercial mortgage pass-through certificates at June 30, 2023 (dollars in thousands), which is non-recourse to the Company:

| | | | | | | | | | | | | | |

| Classes | Principal Balance | Coupon | Fair Value | Contractual Maturity |

| Class A-1 | $ | 120,391 | | 3.3% | $ | 101,120 | | 9/11/2025 |

| Class A-2 | 531,700 | | 4.0% | 458,329 | | 9/11/2025 |

| Class B | 136,400 | | 4.2% | 109,843 | | 9/11/2025 |

| Class C | 94,500 | | 4.3% | 72,535 | | 9/11/2025 |

| Class D | 153,950 | | 4.4% | 111,258 | | 9/11/2025 |

| Class E | 180,150 | | 4.4% | 97,328 | | 9/11/2025 |

| Class F | 153,600 | | 4.4% | 61,965 | | 9/11/2025 |

Class X-1(1) | n/a | 0.5% | 5,717 | | 9/11/2025 |

Class X-2(1) | n/a | —% | 1,215 | | 9/11/2025 |

| $ | 1,370,691 | | | $ | 1,019,310 | | |

| | | | |

| | | | |

(1) Class X-1 and X-2 are interest-only classes with notional balances of $652.1 million and $733.5 million as of June 30, 2023, respectively.

The above table does not reflect the portion of the Class F bond held by the Company because the bond is eliminated in consolidation. The Company's ownership interest in the Class F bonds represents a controlling financial interest, which resulted in consolidation of the trust. The bond had a fair market value of $6.0 million at June 30, 2023. The securitized debt of the CSMC USA can only be settled with the commercial loan with an outstanding principal balance of approximately $1.4 billion at June 30, 2023, that serves as collateral for the securitized debt and is non-recourse to the Company.

Derivatives Activity

The following table summarizes the Company’s derivative instruments at June 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | | | |

| Other Derivative Instruments | | Notional Amount | | Fair Value | | |

| | | | | | |

| Interest rate swaps, asset | | $ | — | | | $ | — | | | |

| Credit default swaps, asset | | $ | — | | | $ | — | | | |

| TBA securities, asset | | — | | | — | | | |

| Other derivative instruments, assets | | | | — | | | |

| | | | | | |

| Interest rate swaps, liability | | $ | 82,000 | | | $ | (68) | | | |

| Credit default swaps, liability | | — | | | — | | | |

| TBA securities, liability | | — | | | — | | | |

| Total other derivative instruments, liabilities | | | | (68) | | | |

| Total other derivative instruments, net | | | | $ | (68) | | | |

DIVIDEND

For the quarter ended June 30, 2023, the Company declared a $0.35 dividend per share, generating a dividend yield of approximately 15.8% based on the closing price of the Company's common stock of $8.87 on June 30, 2023.

CONFERENCE CALL

The Company will host a conference call with a live webcast tomorrow, August 9, 2023 at 12:00 p.m. Eastern Time/9:00 a.m. Pacific Time, to discuss financial results for the second quarter 2023.

Individuals interested in listening to the conference call may do so by dialing (866) 235-9914 from the United States, or (412) 902-4115 from outside the United States and referencing “Western Asset Mortgage Capital Corporation.” Those interested in listening to the conference call live via the Internet may do so by visiting the Investor Relations section of the Company’s website at www.westernassetmcc.com.

The Company is enabling investors to pre-register for the earnings conference call so that they can expedite their entry into the call and avoid the need to wait for a live operator. In order to pre-register for the call, investors can visit https://dpregister.com/sreg/10181420/fa0f39cc68 and enter in their contact information. Investors will then be issued a personalized phone number and pin to dial into the live conference call. Individuals can pre-register any time prior to the start of the conference call tomorrow.

A telephone replay will be available through August 14, 2023 by dialing (877) 344-7529 from the United States, or (412) 317-0088 from outside the United States, and entering conference ID 5150535. A webcast replay will be available for 90 days.

ABOUT WESTERN ASSET MORTGAGE CAPITAL CORPORATION

Western Asset Mortgage Capital Corporation is a real estate investment trust that invests in, acquires and manages a diverse portfolio of assets consisting of Residential Whole Loans, Non-Agency RMBS and to a lesser extent GSE Risk Transfer Securities, Commercial Loans, Non-Agency CMBS, Agency RMBS, Agency CMBS and ABS. The Company’s investment strategy may change, subject to the Company’s stated investment guidelines, and is based on its manager Western Asset Management Company, LLC's perspective of which mix of portfolio assets it believes provide the Company with the best risk-reward opportunities at any given time. The Company is externally managed and advised by Western Asset Management Company, LLC, an investment advisor registered with the Securities and Exchange Commission and a wholly-owned subsidiary of Franklin Resources, Inc. Please visit the Company’s website at www.westernassetmcc.com.

FORWARD-LOOKING STATEMENTS

This press release contains statements that constitute “forward-looking statements.” For these statements, the Company claims the protections of the safe harbor for forward-looking statements contained in such sections. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company’s control.

Operating results are subject to numerous conditions, many of which are beyond the control of the Company, including, without limitation changes in interest rates, changes in the yield curve, changes in prepayment rates, the availability and terms of financing, general economic conditions, market conditions, conditions in the market for mortgage related investments, and legislative and regulatory changes that could adversely affect the business of the Company.

Other factors are described in Risk Factors section of the Company’s annual report on Form 10-K for the period ended December 31, 2022 filed with the Securities and Exchange Commission (“SEC”). The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

USE OF NON-GAAP FINANCIAL INFORMATION

In addition to the results presented in accordance with GAAP, this release includes certain non-GAAP financial information, including Distributable Earnings, Distributable Earnings per share, Economic return on book/economic value, and certain financial metrics derived from non-GAAP information, such as weighted average yield, including IO securities; weighted average effective cost of financing, including swaps; weighted average net interest margin, including IO securities and swaps, which constitute non-GAAP financial measures within the meaning of Regulation G promulgated by the SEC. We believe that these measures presented in this release, when considered together with GAAP financial measures, provide information that is useful to investors in understanding our borrowing costs and net interest income, as viewed by us. An analysis of any non-GAAP financial measure should be made in conjunction with results presented in accordance with GAAP.

| | | | | |

| Investor Relations Contact: | Media Contact: |

| Larry Clark | Tricia Ross |

| Financial Profiles, Inc. | Financial Profiles, Inc. |

| (310) 622-8223 | (310) 622-8226 |

| lclark@finprofiles.com | tross@finprofiles.com |

-Financial Tables to Follow-

Western Asset Mortgage Capital Corporation and Subsidiaries

Consolidated Balance Sheets

(in thousands—except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | |

| (dollars in thousands) | | June 30, 2023 | | March 31, 2023 | | |

| Assets: | | | | | | |

| Cash and cash equivalents | | $ | 17,375 | | | $ | 16,149 | | | |

| Restricted cash | | — | | | — | | | |

Agency mortgage-backed securities, at fair value ($278 and $271 pledged as collateral, at fair value, respectively) | | 838 | | | 837 | | | |

Non-Agency mortgage-backed securities, at fair value ($73,572 and $78,093 pledged as collateral, at fair value, respectively) | | 82,686 | | | 87,133 | | | |

Other securities, at fair value ($15,375 and $23,623 pledged as collateral, at fair value, respectively) | | 16,615 | | | 24,857 | | | |

Residential Whole Loans, at fair value ($1,036,385 and $1,073,257 pledged as collateral, at fair value, respectively) | | 1,037,381 | | | 1,074,417 | | | |

Residential Bridge Loans, at fair value (None and none pledged as collateral, at fair value, respectively) | | 2,782 | | | 2,782 | | | |

| Securitized commercial loans, at fair value | | 1,025,321 | | | 1,088,224 | | | |

Commercial Loans, at fair value ($66,059 and $65,692 pledged as collateral, at fair value, respectively) | | 78,806 | | | 79,182 | | | |

| Investment related receivable | | 8,806 | | | 8,980 | | | |

| Interest receivable | | 10,895 | | | 11,185 | | | |

| Due from counterparties | | 1,302 | | | 17,283 | | | |

| Derivative assets, at fair value | | — | | | — | | | |

| Other assets | | 4,542 | | | 3,366 | | | |

Total Assets (1) | | $ | 2,287,349 | | | $ | 2,414,395 | | | |

| | | | | | |

| Liabilities and Stockholders’ Equity: | | | | | | |

| Liabilities: | | | | | | |

| Repurchase agreements, net | | $ | 147,860 | | | $ | 171,290 | | | |

| Convertible senior unsecured notes, net | | 84,341 | | | 83,932 | | | |

Securitized debt, net ($1,629,629 and $1,713,455 at fair value and $115,793 and $126,313 held by affiliates, respectively) | | 1,944,906 | | | 2,039,353 | | | |

Interest payable (includes $635 and $652 on securitized debt held by affiliates, respectively) | | 10,216 | | | 12,139 | | | |

| | | | | | |

| Due to counterparties | | — | | | — | | | |

| Derivative liability, at fair value | | 68 | | | 121 | | | |

| Accounts payable and accrued expenses | | 5,246 | | | 3,140 | | | |

| Payable to affiliate | | 3,878 | | | 2,920 | | | |

| Dividend payable | | 2,113 | | | 2,113 | | | |

| Other liabilities | | — | | | 22 | | | |

Total Liabilities (2) | | 2,198,628 | | | 2,315,030 | | | |

| | | | | | |

| Commitments and contingencies | | | | | | |

| | | | | | |

| Stockholders’ Equity: | | | | | | |

Common stock: $0.01 par value, 50,000,000 shares authorized, 6,038,012 and 6,038,012 outstanding, respectively | | 60 | | | 60 | | | |

Preferred stock, $0.01 par value, 10,000,000 shares authorized and no shares outstanding | | — | | | — | | | |

Treasury stock, at cost, 57,981 and 57,981 shares held, respectively | | (1,665) | | | (1,665) | | | |

| Additional paid-in capital | | 919,511 | | | 919,368 | | | |

| Retained earnings (accumulated deficit) | | (829,193) | | | (818,405) | | | |

| Total Stockholders’ Equity | | 88,713 | | | 99,358 | | | |

| Non-controlling interest | | 8 | | | 7 | | | |

| Total Equity | | 88,721 | | | 99,365 | | | |

| Total Liabilities and Equity | | $ | 2,287,349 | | | $ | 2,414,395 | | | |

Western Asset Mortgage Capital Corporation and Subsidiaries

Consolidated Balance Sheets (Continued)

(in thousands—except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | |

| (dollars in thousands) | | June 30, 2023 | | March 31, 2023 | | |

(1) Assets of consolidated VIEs included in the total assets above: | | | | | | |

| Cash and cash equivalents | | $ | — | | | $ | — | | | |

| Restricted Cash | | — | | | — | | | |

Residential Whole Loans, at fair value ($1,036,385 and $1,073,257 pledged as collateral, at fair value, respectively) | | 1,037,381 | | | 1,074,417 | | | |

Residential Bridge Loans, at fair value ($0 and $0 pledged as collateral, at fair value, respectively) | | 2,782 | | | 2,782 | | | |

| Securitized commercial loans, at fair value | | 1,025,321 | | | 1,088,224 | | | |

Commercial Loans, at fair value (None and none pledged as collateral, at fair value, respectively) | | 12,747 | | | 13,490 | | | |

| Investment related receivable | | 8,760 | | | 8,934 | | | |

| Interest receivable | | 9,798 | | | 10,099 | | | |

| Other assets | | — | | | — | | | |

| Total assets of consolidated VIEs | | $ | 2,096,789 | | | $ | 2,197,946 | | | |

| | | | | | |

(2) Liabilities of consolidated VIEs included in the total liabilities above: | | | | | | |

Securitized debt, net ($1,629,629 and $1,713,455 at fair value and $115,793 and $126,313 held by affiliates, respectively) | | $ | 1,944,906 | | | $ | 2,039,353 | | | |

Interest payable (includes $635 and $652 on securitized debt held by affiliates, respectively) | | 7,971 | | | 8,227 | | | |

| Accounts payable and accrued expenses | | 60 | | | 60 | | | |

| Other liabilities | | — | | | — | | | |

| Total liabilities of consolidated VIEs | | $ | 1,952,937 | | | $ | 2,047,640 | | | |

Western Asset Mortgage Capital Corporation and Subsidiaries

Consolidated Statements of Operations

(in thousands—except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | |

| | Three months ended | | |

| (dollars in thousands) | | June 30, 2023 | | March 31, 2023 | | |

| Net Interest Income | | | | | | |

| Interest income | | $ | 40,222 | | | $ | 40,857 | | | |

| Interest expense | | 36,212 | | | 36,502 | | | |

| Net Interest Income | | 4,010 | | | 4,355 | | | |

| | | | | | |

| Other Income (Loss) | | | | | | |

| Realized gain (loss), net | | (1,099) | | | (82,818) | | | |

| Unrealized gain (loss), net | | (6,854) | | | 90,316 | | | |

| Gain (loss) on derivative instruments, net | | 1,014 | | | (950) | | | |

| Other, net | | 186 | | | 57 | | | |

| Other Income (Loss) | | (6,753) | | | 6,605 | | | |

| | | | | | |

| Expenses | | | | | | |

| Management fee to affiliate | | 958 | | | 976 | | | |

| Other operating expenses | | 293 | | | 286 | | | |

| Transaction costs | | 1,989 | | | 643 | | | |

| General and administrative expenses: | | | | | | |

| Compensation expense | | 504 | | | 511 | | | |

| Professional fees | | 1,550 | | | 1,415 | | | |

| Other general and administrative expenses | | 605 | | | 549 | | | |

| Total general and administrative expenses | | 2,659 | | | 2,475 | | | |

| Total Expenses | | 5,899 | | | 4,380 | | | |

| | | | | | |

| Income (loss) before income taxes | | (8,642) | | | 6,580 | | | |

| Income tax provision (benefit) | | (12) | | | 12 | | | |

| Net income (loss) | | (8,630) | | | 6,568 | | | |

| Net (loss) income attributable to non-controlling interest | | 3 | | | 1 | | | |

| Net income (loss) attributable to common stockholders and participating securities | | $ | (8,633) | | | $ | 6,567 | | | |

| | | | | | |

| Net income (loss) per Common Share – Basic | | $ | (1.44) | | | $ | 1.07 | | | |

| Net income (loss) per Common Share – Diluted | | $ | (1.44) | | | $ | 1.07 | | | |

Reconciliation of GAAP Net Income (Loss) to Non-GAAP Distributable Earnings

(in thousands—except share and per share data)

(Unaudited)

The table below reconciles Net Income (Loss) to Distributable Earnings for the three months ended June 30, 2023, and March 31, 2023:

| | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | |

| (dollars in thousands) | | June 30, 2023 | | March 31, 2023 | | | | |

| Net income (loss) attributable to common stockholders and participating securities | | $ | (8,633) | | | $ | 6,567 | | | | | |

| Income tax provision (benefit) | | (12) | | | 12 | | | | | |

| Net income (loss) before income taxes | | (8,645) | | | 6,579 | | | | | |

| | | | | | | | |

| Adjustments: | | | | | | | | |

| Investments: | | | | | | | | |

| Unrealized (gain) loss on investments, securitized debt and other liabilities | | 6,854 | | | (90,316) | | | | | |

| | | | | | | | |

| Realized (gain) loss on sale of investments | | 1,099 | | | 82,818 | | | | | |

| | | | | | | | |

| One-time transaction costs | | 1,987 | | | 640 | | | | | |

| | | | | | | | |

| Derivative Instruments: | | | | | | | | |

| Net realized (gain) loss on derivatives | | (184) | | | 2,184 | | | | | |

| Net unrealized (gain) loss on derivatives | | (54) | | | (3) | | | | | |

| | | | | | | | |

| Other: | | | | | | | | |

| Realized (gain) loss on extinguishment of convertible senior unsecured notes | | — | | | — | | | | | |

| Amortization of discount on convertible senior unsecured notes | | 171 | | | 172 | | | | | |

| | | | | | | | |

| Non-cash stock-based compensation | | 100 | | | 100 | | | | | |

| Total adjustments | | 9,973 | | | (4,405) | | | | | |

| Distributable earnings | | $ | 1,328 | | | $ | 2,174 | | | | | |

| Basic and diluted distributable earnings per common share and participating securities | | $ | 0.22 | | | $ | 0.36 | | | | | |

| | | | | | | | |

| Basic weighted average common shares and participating securities | | 6,038,012 | | | 6,038,012 | | | | | |

| Diluted weighted average common shares and participating securities | | 6,038,012 | | | 6,038,012 | | | | | |

Alternatively, our Distributable Earnings can also be derived as presented in the table below by starting net interest income adding interest income on Interest-Only Strips accounted for as derivatives and other derivatives, and net interest expense incurred on interest rate swaps and foreign currency swaps and forwards (a Non-GAAP financial measure) to arrive at adjusted net interest income. Then subtracting total expenses, adding non-cash stock based compensation, adding one-time transaction costs, adding amortization of discount on convertible senior notes and adding interest income on cash balances and other income (loss), net:

| | | | | | | | | | | | | | | | |

| | Three months ended | | |

| (dollars in thousands) | | June 30, 2023 | | March 31, 2023 | | |

| Net interest income | | $ | 4,010 | | | $ | 4,355 | | | |

| Interest income from IOs and IIOs accounted for as derivatives | | 10 | | | 11 | | | |

| Net interest income from interest rate swaps | | 766 | | | 1,220 | | | |

| Adjusted net interest income | | 4,786 | | | 5,586 | | | |

| Total expenses | | (5,899) | | | (4,380) | | | |

| | | | | | |

| Non-cash stock-based compensation | | 100 | | | 100 | | | |

| One-time transaction costs | | 1,987 | | | 640 | | | |

| Amortization of discount on convertible unsecured senior notes | | 171 | | | 172 | | | |

| Interest income on cash balances and other income (loss), net | | 186 | | | 57 | | | |

| Income attributable to non-controlling interest | | (3) | | | (1) | | | |

| Distributable Earnings | | $ | 1,328 | | | $ | 2,174 | | | |

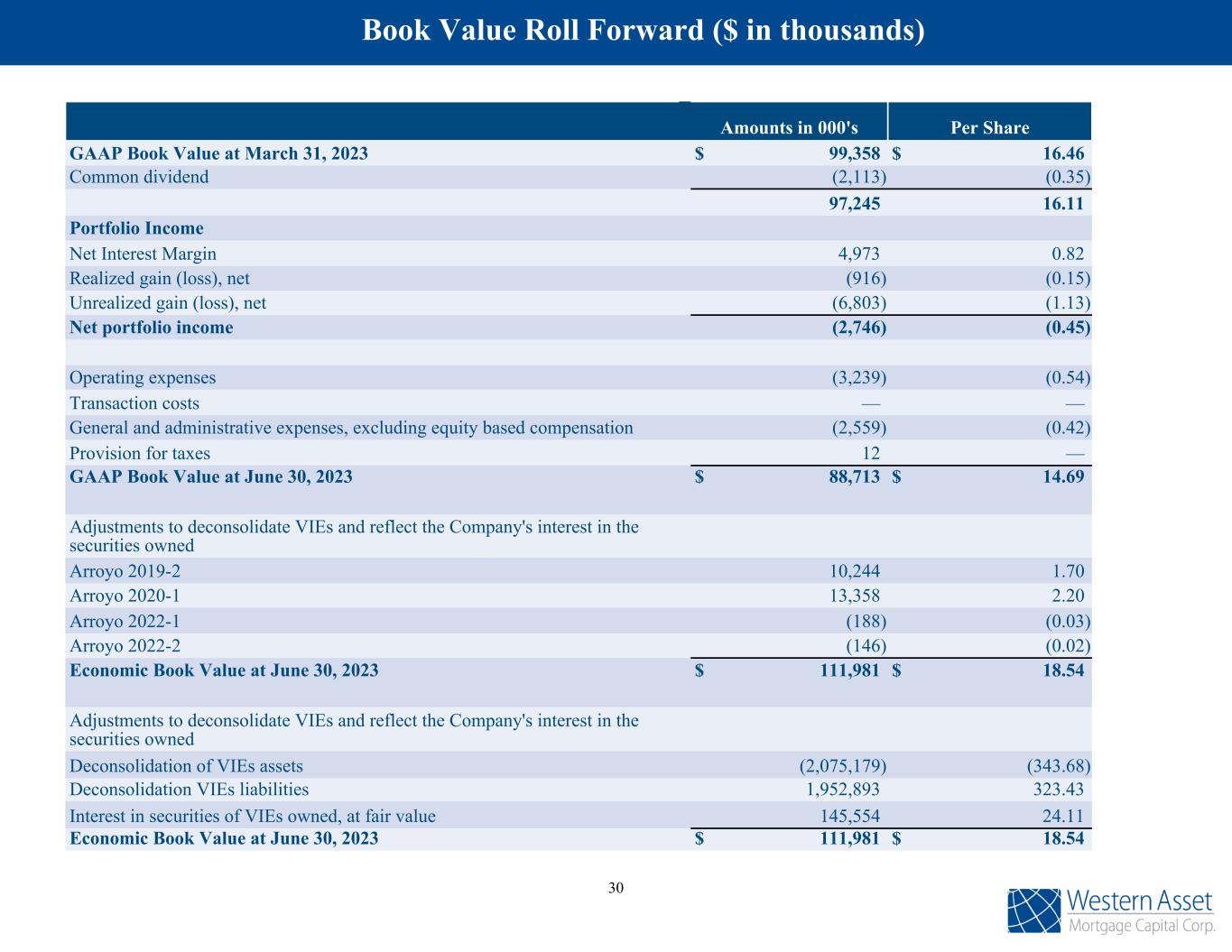

Reconciliation of GAAP Book Value to Non-GAAP Economic Book Value

(in thousands—except share and per share data)

(Unaudited)

| | | | | | | | | | | | |

| (dollars in thousands) | $ Amount | Per Share | | | | |

GAAP Book Value at March 31, 2023 | $ | 99,358 | | $ | 16.46 | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Common dividend | — | | (0.35) | | | | | |

| 99,358 | | 16.11 | | | | | |

| Portfolio Income (Loss) | | | | | | |

| Net Interest Margin | 4,973 | | 0.82 | | | | | |

| Realized gain (loss), net | (916) | | (0.15) | | | | | |

| Unrealized gain (loss), net | (6,803) | | (1.13) | | | | | |

| Net portfolio income (loss) | (2,746) | | (0.46) | | | | | |

| | | | | | |

| | | | | | |

| Operating expenses | (3,239) | | (0.54) | | | | | |

| Transaction costs | — | | — | | | | | |

| General and administrative expenses, excluding equity based compensation | (2,559) | | (0.42) | | | | | |

| Provision for taxes | 12 | | — | | | | | |

GAAP Book Value at June 30, 2023 | $ | 88,713 | | $ | 14.69 | | | | | |

| | | | | | |

| Adjustments to deconsolidate VIEs and reflect the Company's interest in the securities owned | | | | | | |

| Arroyo 2019-2 | 10,244 | | 1.70 | | | | | |

| Arroyo 2020-1 | 13,358 | | 2.20 | | | | | |

| Arroyo 2022-1 | (188) | | (0.03) | | | | | |

| Arroyo 2022-2 | (146) | | (0.02) | | | | | |

| Economic Book Value at June 30, 2023 | $ | 111,981 | | $ | 18.54 | | | | | |

| | | | | | |

| Adjustments to deconsolidate VIEs and reflect the Company's interest in the securities owned | | | | |

| Deconsolidation of VIEs assets | (2,075,179) | | (343.68) | | | | | |

| Deconsolidation VIEs liabilities | 1,952,893 | | 323.43 | | | | | |

| Interest in securities of VIEs owned, at fair value | 145,554 | | 24.11 | | | | | |

Economic Book Value at June 30, 2023 | $ | 111,981 | | $ | 18.54 | | | | | |

"Economic Book value" is a non-GAAP financial measure of our financial position on an unconsolidated basis. The Company owns certain securities that represent a controlling variable interest, which under GAAP requires consolidation, however, the Company's economic exposure to these variable interests is limited to the fair value of the individual investments. Economic book value is calculated by adjusting the GAAP book value by 1) adding the fair value of the retained interest or acquired security of the VIEs (CSMC USA, Arroyo 2019-2, Arroyo 2020-1, Arroyo 2022-1, and Arroyo 2022-2) held by the Company, which were priced by independent third party pricing services and 2) removing the asset and liabilities associated with each of consolidated trusts (CSMC USA, Arroyo 2019-2, Arroyo 2020-1, Arroyo 2022-1, and Arroyo 2022-2). Management believes that economic book value provides investors with a useful supplemental measure to evaluate our financial position as it reflects the actual financial interest of these investments irrespective of the variable interest consolidation model applied for GAAP reporting purposes. Economic book value does not represent and should not be considered as a substitute for Stockholders' Equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies.

Reconciliation of Effective Cost of Funds

(in thousands—except share and per share data)

(Unaudited)

The following table reconciles the Effective Cost of Funds (Non-GAAP financial measure) with interest expense for three months ended June 30, 2023, and March 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | | June 30, 2023 | | March 31, 2023 | | |

(dollars in thousands) | | Reconciliation | | Cost of Funds/Effective Borrowing Costs | | Reconciliation | | Cost of Funds/Effective Borrowing Costs | | | | |

| Interest expense | | $ | 36,212 | | | 5.80 | % | | $ | 36,502 | | | 5.73 | % | | | | |

| Adjustments: | | | | | | | | | | | | |

Interest expense on Securitized debt from consolidated VIEs(1) | | (21,601) | | | (6.72) | % | | (21,436) | | | (6.78) | % | | | | |

| Net interest (received) paid - interest rate swaps | | (766) | | | (0.12) | % | | (1,220) | | | (0.19) | % | | | | |

| Effective Cost of Funds | | $ | 13,845 | | | 4.58 | % | | $ | 13,846 | | | 4.31 | % | | | | |

| Weighted average borrowings | | $ | 1,213,384 | | | | | $ | 1,302,345 | | | | | | | |

| | | | | | | | | | | | |

Second Quarter 2023 Investor Presentation August 8, 2023

We make forward-looking statements in this presentation that are subject to risks and uncertainties, many of which are difficult to predict and are generally beyond the Company's control. These forward-looking statements include information about possible or assumed future results of our business, financial condition, liquidity, results of operations, plans and objectives. When we use the words "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions, we intend to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward- looking: our business and investment strategy; our projected operating results; our ability to obtain financing arrangements; financing and advance rates for mortgage loans, MBS and our potential target assets; our expected leverage; general volatility of the securities markets in which we invest and the market price of our common stock; our expected investments; interest rate mismatches between mortgage loans, MBS and our potential target assets and our borrowings used to fund such investments; changes in interest rates and the market value of MBS and our potential target assets; changes in prepayment rates on mortgage loans, Agency MBS and Non-Agency MBS; effects of hedging instruments on MBS and our potential target assets; rates of default or decreased recovery rates on our potential target assets; the degree to which any hedging strategies may or may not protect us from interest rate volatility; impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters; our ability to maintain our qualification as a REIT; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; availability of investment opportunities in mortgage-related, real estate- related and other securities; availability of qualified personnel; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; and the uncertainty and economic impact of pandemics, epidemics or other public health emergencies, such as the COVID-19 pandemic. The forward-looking statements in this presentation are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. You should not place undue reliance on these forward- looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these factors are described in our filings with the SEC under the headings "Summary," "Risk factors," "Management's discussion and analysis of financial condition and results of operations" and "Business." If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. This presentation is not an offer to sell securities nor a solicitation of an offer to buy securities in any jurisdiction where the offer and sale is not permitted. Safe Harbor Statement 1

Robert W. Lehman Chief Financial Officer Bonnie M. Wongtrakool Chief Executive Officer Sean Johnson Deputy Chief Investment Officer Second Quarter 2023 WMC Earnings Call Presenters Greg Handler Chief Investment Officer 2

Western Asset Mortgage Capital Corporation (“WMC”) is a public REIT that benefits from the leading fixed income management capabilities of Western Asset Management Company, LLC ("Western Asset") • One of the world’s leading global fixed income managers, known for team management, proprietary research, robust risk management and a long-term fundamental value approach. • AUM of $388.0 billion(1) ◦ AUM of the Mortgage and Consumer Credit Group is $68.7 billion(1) ◦ Extensive mortgage and consumer credit investing track record • Publicly traded mortgage REIT positioned to capture attractive current and long-term investment opportunities in the residential mortgage markets. • Completed Initial Public Offering in May 2012 Please refer to page 29 for footnote disclosures. Overview of Western Asset Mortgage Capital Corporation 3

2023 Outlook 4

Mortgage & Consumer Credit Outlook The aftershocks of the COVID experience have been uneven across parts of the economy, geographically, across demographics, and amongst different asset classes with certain segments of the economy operating above and others below the pre-Covid economy. Additionally, geopolitical risks have arisen, broad based inflationary pressures have persisted, and the Federal Reserve’s policy accommodation has been actively reduced, significantly tightening financial conditions. Caught in the crosshairs of this uncertain backdrop, the mortgage and consumer credit spreads and yields have repriced significantly and are well wide of the levels we saw pre-COVID and in December 2018, the last time interest rate increases by the Federal Reserve resulted in an economic slowdown. After booming during the pandemic, home prices have begun to stall and even decline in certain markets under the pressure of higher mortgage rates and lack of affordability. Credit standards have remained high during this cycle and we do not see the risk of higher rates hitting borrowers who already locked in ultra-low mortgage rates. While housing activity has slowed down dramatically with fewer willing sellers and buyers, we do not anticipate a wave of delinquencies and foreclosures or meaningful downside pressure on home prices. We see attractive opportunities in non-agency residential mortgages backed by high quality borrowers with significant built up equity that we believe offer attractive yields. While housing is expected to cool, we do not see a significant risk of widespread defaults or home price correction that current market pricing implies. As the clarity around the pace and timing of tapering by the Federal Reserve is expected to be more certain, and with inflation likely to continue to moderate through the end of 2023, the volatility in rates and spreads is expected to decline significantly. Therefore, we believe that spread normalization, combined with high carry, should provide upside value to our residential holdings. Our Manager's General Investment Outlook 5

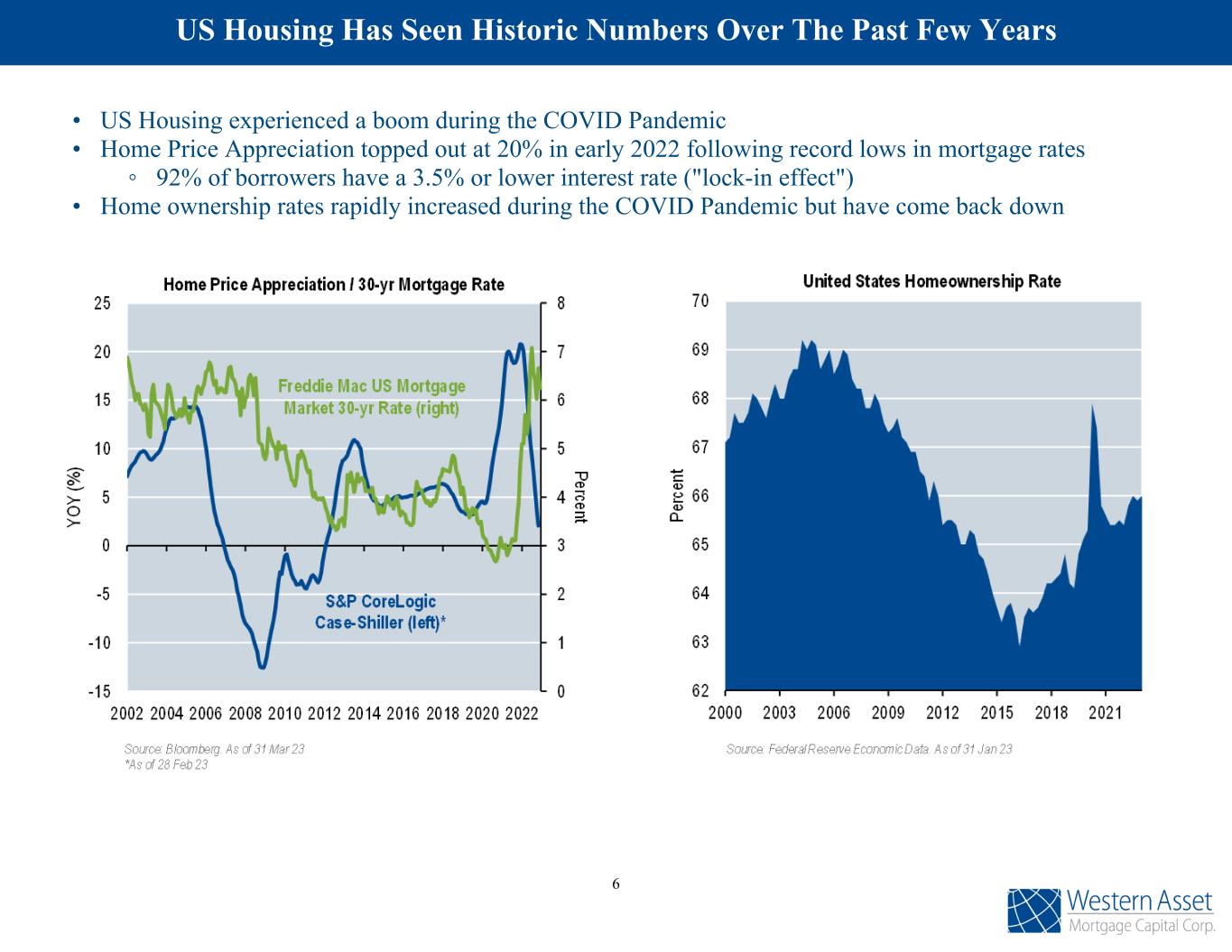

US Housing Has Seen Historic Numbers Over The Past Few Years 6 • US Housing experienced a boom during the COVID Pandemic • Home Price Appreciation topped out at 20% in early 2022 following record lows in mortgage rates ◦ 92% of borrowers have a 3.5% or lower interest rate ("lock-in effect") • Home ownership rates rapidly increased during the COVID Pandemic but have come back down

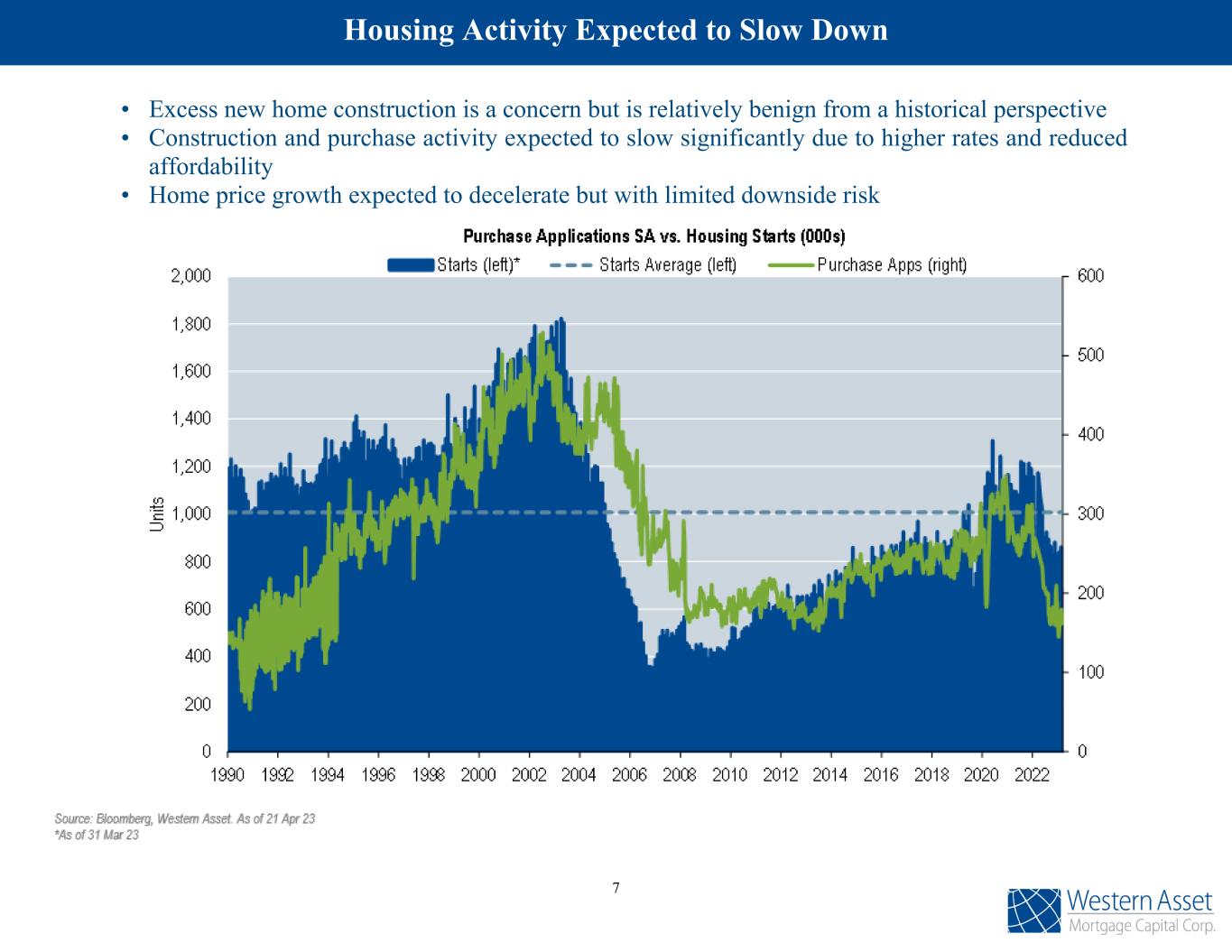

• Excess new home construction is a concern but is relatively benign from a historical perspective • Construction and purchase activity expected to slow significantly due to higher rates and reduced affordability • Home price growth expected to decelerate but with limited downside risk Housing Activity Expected to Slow Down 7

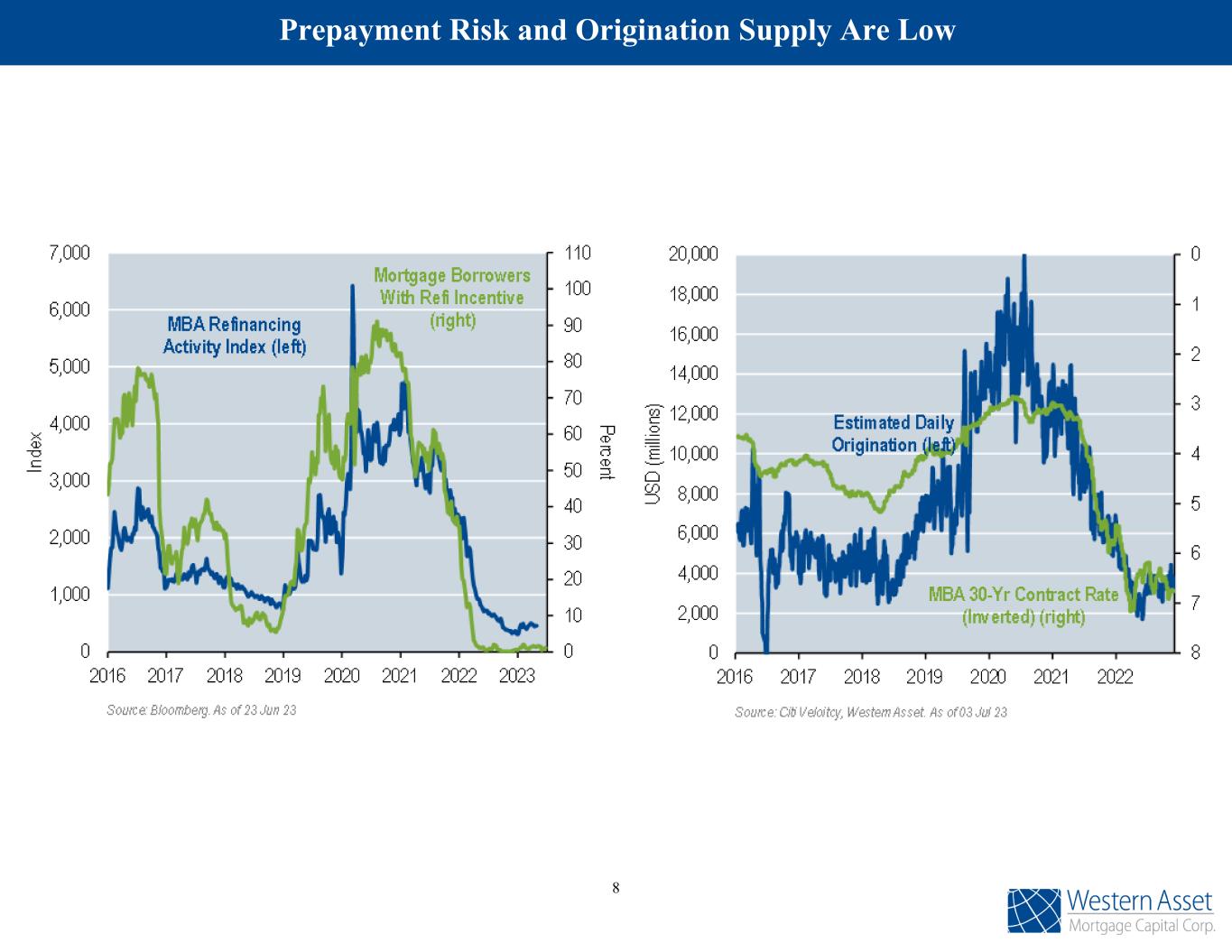

Prepayment Risk and Origination Supply Are Low 8

As pandemic excess savings are mostly depleted, consumer debt now growing at pre- pandemic levels Debt burden expected to grow modestly from here, but still below pre-GFC levels (below 11.0% average dating back to 1990) US Household Debt Burden Expected to Grow Modestly 9

CMBS OTR Relative Value vs. Investment-Grade Corp & High-Yield • CMBS spreads are cheap across the capital stock relative to both IG and HY corporates. 10

Investment Strategy Our primary goal is to generate attractive returns while preserving book value. We continue to find value in credit sensitive mortgages. Under current market conditions we expect to continue to focus investments in non-qualified residential mortgages and other mortgage credit investments that are accretive to portfolio earnings. Target Investments Residential Non-Qualified Mortgages ◦ Program initiated in 2014 ◦ No cumulative principal losses ◦ Strategic partnerships with seasoned originators ◦ Current target coupon in the 7.5%-8.5% range ◦ Average loan to value mid to high 60% at origination ◦ Non-recourse debt through securitization Other Mortgage Credit ◦ Assets with low leverage and strongly underwritten ◦ Residential securities ◦ Commercial loans and securities ◦ Yields between 6%-15% ◦ Favoring long-term financing utilizing structural leverage and low recourse leverage 11

Company Business Highlights The Company continues to execute on its business strategy to take actions to strengthen its balance sheet: • For the three months ended June 30, 2023: • the Company received $28.4 million from the sale or repayment of Residential Whole Loans, and Non-Agency RMBS. • the Company received $1.1 million from the repayment or paydown of Commercial Whole Loans, Non-Agency CMBS, and Other Securities. • the Company received $8.7 million in proceeds from the sale of Other Securities. • Subsequent to quarter end, the Company replaced an existing short-term repurchase financing facility facing Credit Suisse AG (UBS) with a new two-year term, $65 million fixed rate, non-mark-to-market securitized funding vehicle. As a result, the Company no longer has any financing arrangements with Credit Suisse AG (UBS) as a counterparty. 12

Please refer to page 29 for footnote disclosures. • GAAP book value per share of $14.69. • Economic book value(5) per share of $18.54. • GAAP net loss attributable to common shareholders and participating securities of $8.6 million, or $1.44 per basic and diluted share. • Distributable earnings(2) of $1.3 million, or $0.22 per basic and diluted share. • Economic return on GAAP book value was 8.6%(3) for the quarter. • Economic return on economic book value was 7.7% for the quarter. • 1.20%(4) annualized net interest margin on our investment portfolio. • 2.6x recourse leverage as of June 30, 2023. • On June 21, 2023 we declared a second quarter common dividend of $0.35 per share. Second Quarter Financial Results 13

The following are the Company's key metrics as of December 31, 2021; Share Price June 30, 2023 Market Cap (in millions) Q2 Dividend Q2 Dividend Yield Recourse Leverage Net Interest Margin(4) $8.87 $53.6 $0.35 15.7% 2.6x 1.20% Economic Book Value(5) June 30, 2023 Economic Book Value(5) March 31, 2023 Economic Book Value(5) Change Economic Book Value Change Q2 Economic Return(3) $18.54 $17.54 $1.00 5.7% 7.7% Please refer to page 29 for footnote disclosures. WMC Key Metrics as of June 30, 2023 GAAP Book Value June 30, 2023 GAAP Book Value March 31, 2023 GAAP Book Value Change GAAP Book Value Change Share Price to GAAP Book Value $14.69 $16.46 $(1.77) (10.8)% 60.4% 14

Portfolio Summary ($ in thousands) June 30, 2023 No. of Investments Principal Balance Amortized Cost Fair Value Borrowings Residential Whole Loans 2,824 $ 1,106,551 $ 1,111,461 $ 1,037,381 $ 627,923 Commercial Loans 5 79,955 79,954 78,806 48,032 Non-Agency CMBS, including IOs 11 88,659 86,572 59,322 36,720 Agency and Non-Agency RMBS, including IOs(14) 18 39,528 30,176 24,202 49,846 Securitized Commercial Loan(6) 1 1,385,591 1,315,729 1,025,321 1,019,310 Residential Bridge Loans 4 3,091 3,091 2,782 — Other Securities(7) 5 25,625 18,891 16,615 8,861 2,868 $ 2,729,000 $ 2,645,874 $ 2,244,429 $ 1,790,692 46.9% 47.9% 0.9% 2.7% 1.7% Retail and Entertainment Residential Mixed Use Hotel Other (inc. Office, Multifamily and Nursing Facilities) Property Type 45.8% 46.2% 3.5% 2.6% 0.7% 1.0% Securitized Commercial Loans Residential Whole-Loans Commercial Loans Non-Agency CMBS Other Securities Agency and Non-Agency RMBS Residential Bridge Loans Please refer to page 29 for footnote disclosures. Investment Portfolio Overview Investment Type 15

Overview ($ in thousands) June 30, 2023 Total number of loans 2,824 Principal $ 1,106,551 Fair value $ 1,037,381 Unrealized loss $ 97,136 Weighted average remaining term in years 26.5 Weighted average coupon rate 4.9 % Weighted average LTV 65.7 % Weighted average original FICO score(13) 749 Loan Performance Geographic Concentration 79.6% 10.7% 9.7% West Northeast Southeast N um be r o f L oa ns 1 2,779 20 10 0 15 Loans in Forbearance Current 1-30 Days 31-60 Days 61-90 Days 90+ Days 0 250 500 750 1,000 1,250 1,500 1,750 2,000 2,250 2,500 2,750 3,000 Residential Whole Loans Please refer to page 29 for footnote disclosures. 16

Overview ($ in thousands) June 30, 2023 Number of loans held 5 Principal balance $ 79,955 Fair value $ 78,806 Unrealized loss $ 1,148 Percentage of floating rate loans 100.0 % Percentage of senior loans 100.0 % Percentage of performing loans 100.0 % Weighted average extended life in years 1.88 Weighted average original LTV 60.2 % 16.2% 55.8% 28.0% Nursing Home/Assisted Living Facilities Hotel Retail Property Type Geographic Concentration 74.6% 4.5% 4.5% 16.4% Northeast Midwest Southeast West Unleveraged Weighted Average Effective Yield 2.6% 3.1% 4.3% 3.8% 10.7% 3/31/22 6/30/22 9/30/22 12/31/22 6/30/2023 0% 2% 4% 6% 8% 10% Commercial Loans 17

Loan Loan Type Principal Balance Fair Value Original LTV Interest Rate Maturity Date Extension Option Collateral Geographic Location CRE 4 Interest-Only First Mortgage 22,204 22,053 63.0% 1-Month SOFR plus 3.38% 8/6/2025(1) None Retail CT CRE 5 Interest-Only First Mortgage 24,535 23,993 62.0% 1-Month SOFR plus 4.95% 11/6/2023(2) One - 12 month extension Hotel NY CRE 6 Interest-Only First Mortgage 13,207 12,914 62.0% 1-Month SOFR plus 4.95% 11/6/2023(2) One - 12 month extension Hotel CA CRE 7 Interest-Only First Mortgage 7,259 7,099 62.0% 1-Month SOFR plus 4.95% 11/6/2023(2) One - 12 month extension Hotel IL, FL SBC 3(3) Interest-Only First Mortgage 12,750 12,747 49.0% One-Month SOFR plus 5.50% 8/4/2023 One - 3 month extension Nursing Facilities CT $ 79,955 $ 78,806 Commercial Loans as of June 30, 2023 ($ in thousands) (1) In August 2022, CRE 4 was extended three years through August 6, 2025, with a principal pay down of $16.2 million. (2) In November 2022, CRE 5, 6, and 7 were each extended for one year through November 6, 2023. (3) In January 2023, the SBC 3 loan was partially paid down by $862 thousand to bring the unpaid principal balance to $13.5 million, the maturity date was extended through May 5, 2023 for a 50 bps extension fee and the margin was increased from 4.47% to 5.00%. In May 2023, the SBC 3 loan was partially paid down by $750 thousand to bring the unpaid principal to $12.8 million, the maturity date was extended through August 4, 2023, and the margin was increased from 5.00% to 5.50%. In July 2023, the SBC 3 loan was partially paid down by $250 thousand to bring the unpaid principal balance to $12.5 million, and the maturity date was extended to October 4, 2023 for a 25 bps extension fee. The borrower under this loan may, at its option, extend the October 4, 2023 maturity date for an additional period of three months through December 31, 2023, with an additional required paydown of $250 thousand and a 25 bps extension fee. 18

Overview ($ in thousands) Total Conduit SASB Total number of investments 11 3 8 Principal $ 88,659 $ 15,050 $ 73,609 Fair value $ 59,322 $ 10,151 $ 49,171 Unrealized gain(loss) $ (27,250) $ (3,252) $ (23,997) Weighted average expected life in years 2.3 5.5 1.6 Weighted average original LTV 65.5 % 62.8 % 66.1 % 54.7% 7.5% 37.7% Non-Investment Grade Investment Grade D/Not Rated Ratings Category 26.0% 13.0% 7.1% 17.2% 33.8% 3.0% Hotel Office Retail Multifamily Mixed Use Other Property Type Geographic Concentration 61.7% 6.1% 3.1% 3.3% 25.9% West South Northeast Midwest Bahamas Non-Agency CMBS Investments 19

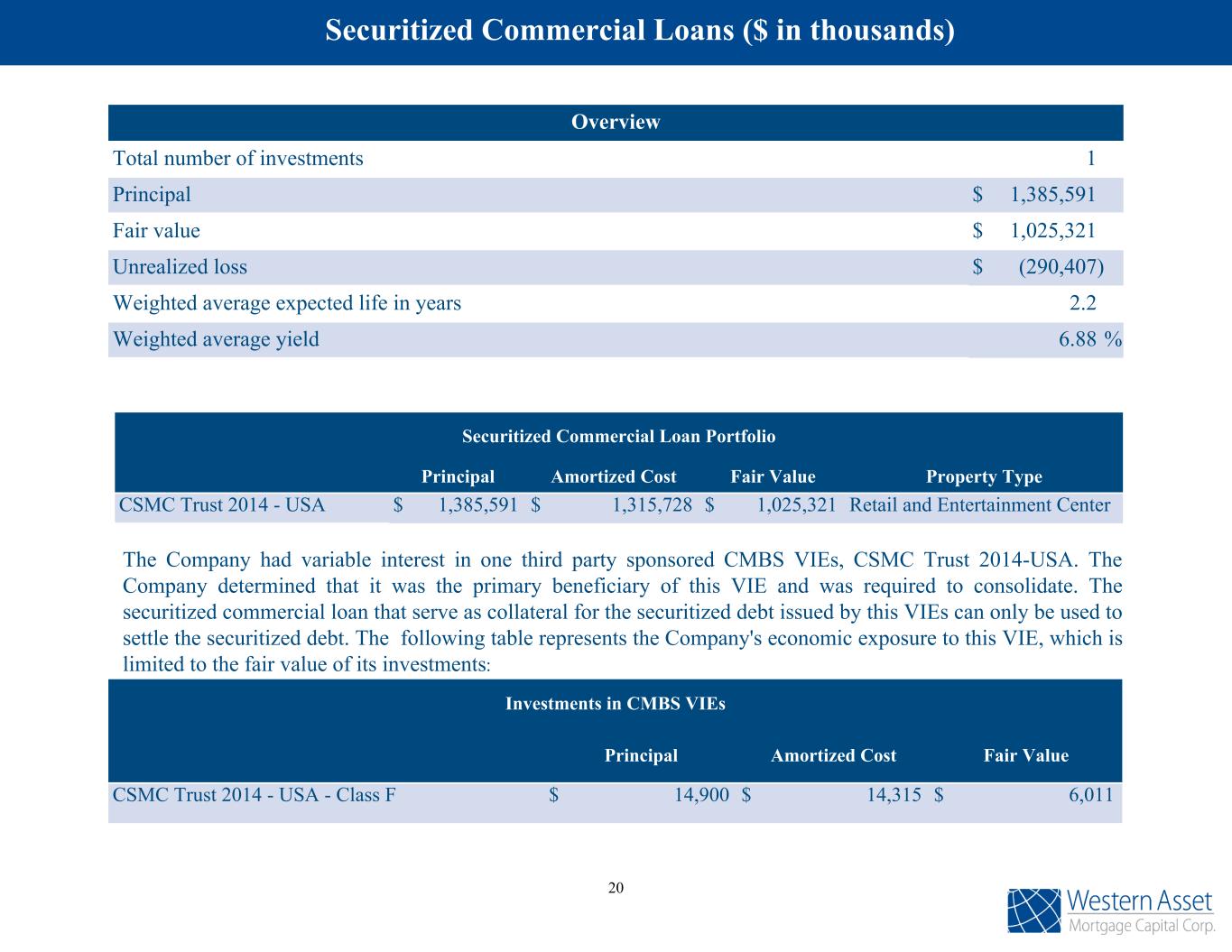

Overview Total number of investments 1 Principal $ 1,385,591 Fair value $ 1,025,321 Unrealized loss $ (290,407) Weighted average expected life in years 2.2 Weighted average yield 6.88 % Securitized Commercial Loan Portfolio Principal Amortized Cost Fair Value Property Type CSMC Trust 2014 - USA $ 1,385,591 $ 1,315,728 $ 1,025,321 Retail and Entertainment Center The Company had variable interest in one third party sponsored CMBS VIEs, CSMC Trust 2014-USA. The Company determined that it was the primary beneficiary of this VIE and was required to consolidate. The securitized commercial loan that serve as collateral for the securitized debt issued by this VIEs can only be used to settle the securitized debt. The following table represents the Company's economic exposure to this VIE, which is limited to the fair value of its investments: Investments in CMBS VIEs Principal Amortized Cost Fair Value CSMC Trust 2014 - USA - Class F $ 14,900 $ 14,315 $ 6,011 Securitized Commercial Loans ($ in thousands) 20

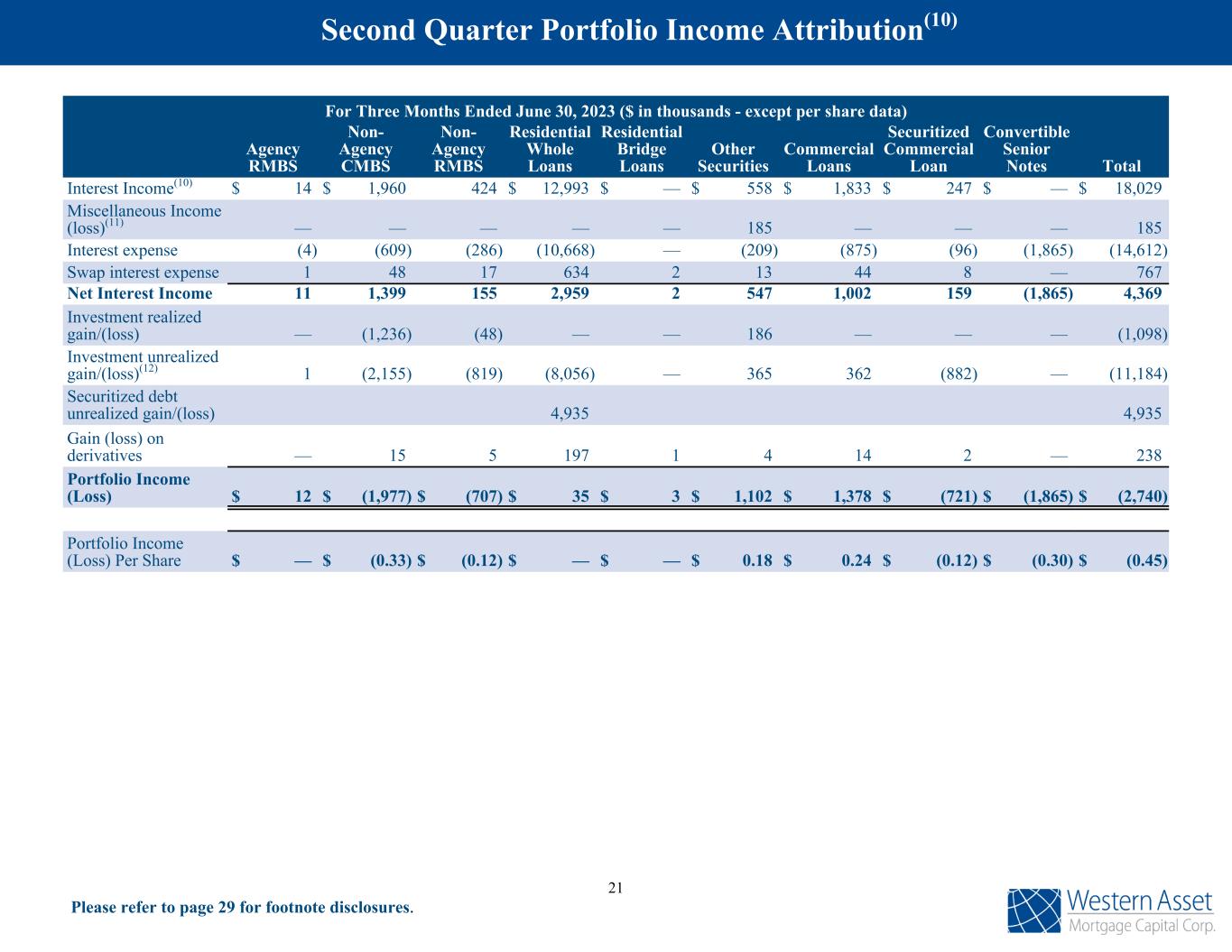

Please refer to page 29 for footnote disclosures. For Three Months Ended June 30, 2023 ($ in thousands - except per share data) Agency RMBS Non- Agency CMBS Non- Agency RMBS Residential Whole Loans Residential Bridge Loans Other Securities Commercial Loans Securitized Commercial Loan Convertible Senior Notes Total Interest Income(10) $ 14 $ 1,960 424 $ 12,993 $ — $ 558 $ 1,833 $ 247 $ — $ 18,029 Miscellaneous Income (loss)(11) — — — — — 185 — — — 185 Interest expense (4) (609) (286) (10,668) — (209) (875) (96) (1,865) (14,612) Swap interest expense 1 48 17 634 2 13 44 8 — 767 Net Interest Income 11 1,399 155 2,959 2 547 1,002 159 (1,865) 4,369 Investment realized gain/(loss) — (1,236) (48) — — 186 — — — (1,098) Investment unrealized gain/(loss)(12) 1 (2,155) (819) (8,056) — 365 362 (882) — (11,184) Securitized debt unrealized gain/(loss) 4,935 4,935 Gain (loss) on derivatives — 15 5 197 1 4 14 2 — 238 Portfolio Income (Loss) $ 12 $ (1,977) $ (707) $ 35 $ 3 $ 1,102 $ 1,378 $ (721) $ (1,865) $ (2,740) Portfolio Income (Loss) Per Share $ — $ (0.33) $ (0.12) $ — $ — $ 0.18 $ 0.24 $ (0.12) $ (0.30) $ (0.45) Second Quarter Portfolio Income Attribution(10) 21

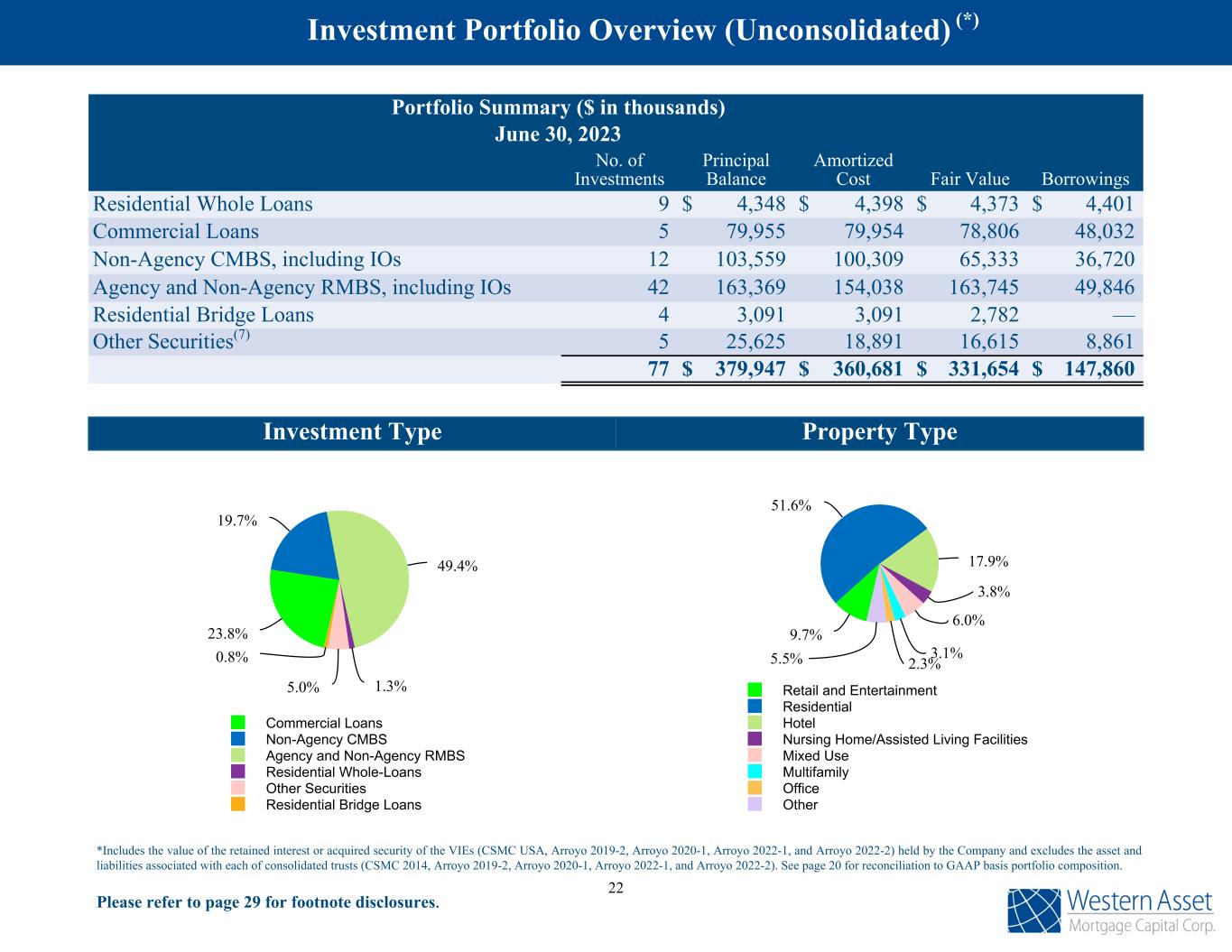

Investment Type 23.8% 19.7% 49.4% 1.3%5.0% 0.8% Commercial Loans Non-Agency CMBS Agency and Non-Agency RMBS Residential Whole-Loans Other Securities Residential Bridge Loans Portfolio Summary ($ in thousands) June 30, 2023 No. of Investments Principal Balance Amortized Cost Fair Value Borrowings Residential Whole Loans 9 $ 4,348 $ 4,398 $ 4,373 $ 4,401 Commercial Loans 5 79,955 79,954 78,806 48,032 Non-Agency CMBS, including IOs 12 103,559 100,309 65,333 36,720 Agency and Non-Agency RMBS, including IOs 42 163,369 154,038 163,745 49,846 Residential Bridge Loans 4 3,091 3,091 2,782 — Other Securities(7) 5 25,625 18,891 16,615 8,861 77 $ 379,947 $ 360,681 $ 331,654 $ 147,860 Property Type 9.7% 51.6% 17.9% 3.8% 6.0% 3.1% 2.3%5.5% Retail and Entertainment Residential Hotel Nursing Home/Assisted Living Facilities Mixed Use Multifamily Office Other *Includes the value of the retained interest or acquired security of the VIEs (CSMC USA, Arroyo 2019-2, Arroyo 2020-1, Arroyo 2022-1, and Arroyo 2022-2) held by the Company and excludes the asset and liabilities associated with each of consolidated trusts (CSMC 2014, Arroyo 2019-2, Arroyo 2020-1, Arroyo 2022-1, and Arroyo 2022-2). See page 20 for reconciliation to GAAP basis portfolio composition. Investment Portfolio Overview (Unconsolidated) (*) Please refer to page 29 for footnote disclosures. 22

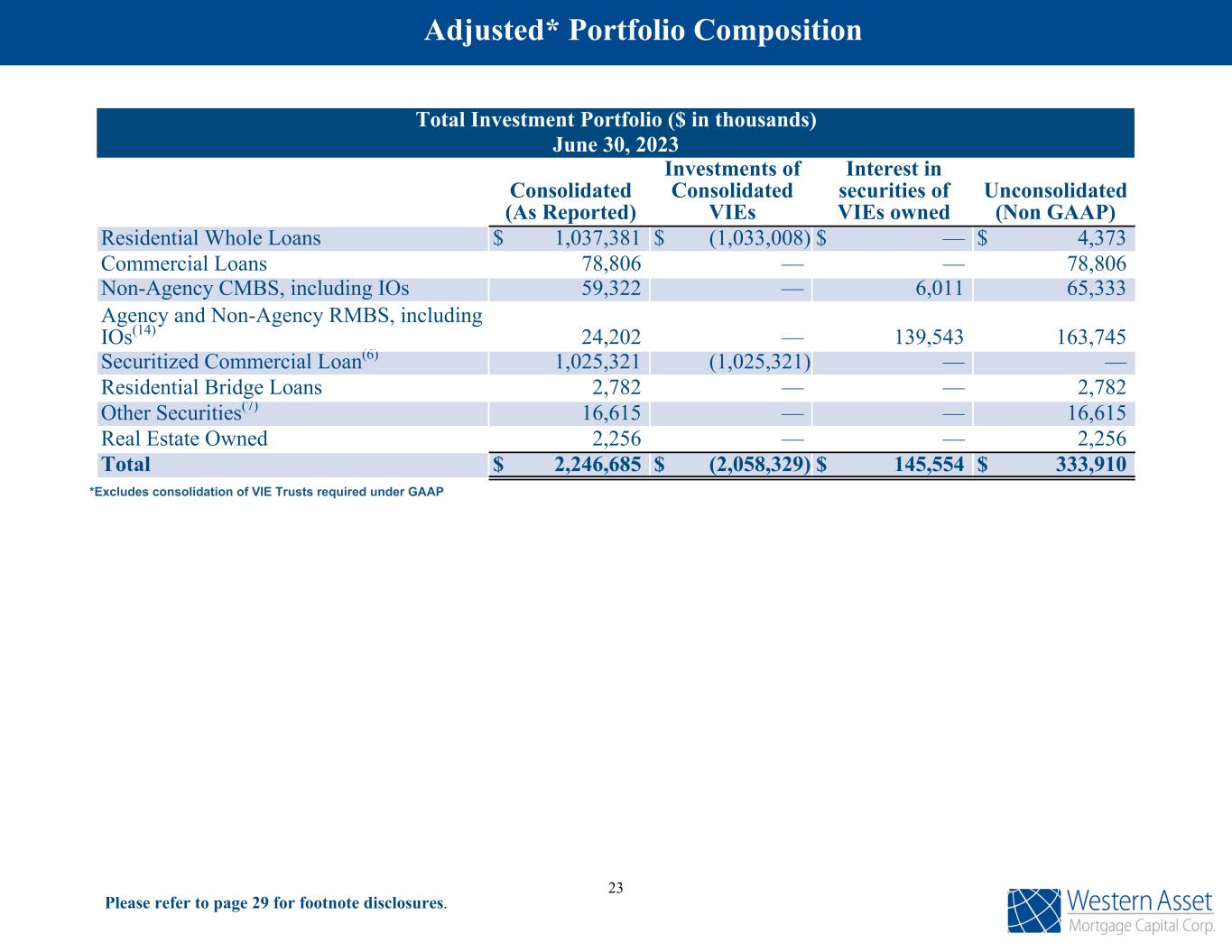

*Excludes consolidation of VIE Trusts required under GAAP Please refer to page 29 for footnote disclosures. Total Investment Portfolio ($ in thousands) June 30, 2023 Consolidated (As Reported) Investments of Consolidated VIEs Interest in securities of VIEs owned Unconsolidated (Non GAAP) Residential Whole Loans $ 1,037,381 $ (1,033,008) $ — $ 4,373 Commercial Loans 78,806 — — 78,806 Non-Agency CMBS, including IOs 59,322 — 6,011 65,333 Agency and Non-Agency RMBS, including IOs(14) 24,202 — 139,543 163,745 Securitized Commercial Loan(6) 1,025,321 (1,025,321) — — Residential Bridge Loans 2,782 — — 2,782 Other Securities(7) 16,615 — — 16,615 Real Estate Owned 2,256 — — 2,256 Total $ 2,246,685 $ (2,058,329) $ 145,554 $ 333,910 Adjusted* Portfolio Composition 23

Repurchase Agreement Financing June 30, 2023 Repurchase Agreement Borrowings Weighted Average Interest Rate on Borrowings Outstanding at end of period Weighted Average Remaining Maturity (days) Short-Term Borrowings Agency RMBS $ 274 5.84% 32 Non-Agency RMBS 35,105 8.24% 25 Residential Whole Loans — —% 0 Residential Bridge Loans — —% 0 Commercial Loans — —% 0 Other securities(7) — —% 0 Total short term borrowings $ 35,379 8.22% 25 Long-Term Borrowings: Non-Agency CMBS and Non-Agency RMBS Facility Non-Agency CMBS 36,720 7.61% 307 Non-Agency RMBS 14,467 7.60% 307 Other Securities(7) 8,861 7.94% 307 Subtotal 60,048 7.65% 307 Residential Whole Loan Facility Residential Whole Loans 4,401 7.32% 117 Commercial Whole Loan Facility Commercial Loans 48,032 7.32% 126 Total long term borrowings 112,481 7.50% 222 Repurchase agreements borrowings $ 147,860 7.67% 175 Please refer to page 29 for footnote disclosures. Financing ($ in thousands) 24

Long-Term Financing Facilities Residential Whole Loan Financing Facility • As of June 30, 2023, the outstanding borrowing under this facility was $4.4 million. The borrowings are secured by Non-QM residential whole loans with a fair value of $3.4 million and one REO property with a carrying value of $2.3 million. Commercial Whole Loan Facility • As of June 30, 2023, the Company had approximately $48.0 million in borrowings, with an interest rate of SOFR plus 2.25% under its commercial whole loan facility. The borrowings are secured by commercial loans with an estimated fair market value of $66.1 million. Non-Agency CMBS and Non-Agency RMBS Facility • As of June 30, 2023, the outstanding balance under this facility was $60.0 million. It bears an interest rate of SOFR plus 2.00%. The borrowings are secured by investments with a fair market value of $95.0 million as of June 30, 2023. Convertible Senior Unsecured Notes • As of June 30, 2023, the Company had $86.3 million aggregate principal amount outstanding of 6.75% convertible senior unsecured notes due in 2024. Financing (Continued) 25

Non-Recourse Financings Residential Mortgage-Backed Notes The residential mortgage-backed notes issued by the Company for the Arroyo Trust 2019-2, the Arroyo Trust 2020-1, the Arroyo Trust 2022-1, and the Arroyo Trust 2022-2 securitizations can only be settled with the residential loans that serve as collateral for the securitized debt and are non-recourse to the Company. The Arroyo 2019-2 and Arroyo 2020-1 notes are carried at amortized cost on the Company's Consolidated Balance Sheets, while the Arroyo 2022-1 and Arroyo 2022-2 notes are carried at fair value on the Company's Consolidated Balance Sheets. The Company retained the subordinate bonds for these Trusts regardless of accounting treatment. These bonds had a fair market value of $40.9 million, $26.9 million, $36.3 million, and $35.5 million respectively, at June 30, 2023. The retained subordinate bonds for the securitizations are eliminated in consolidation. The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2019 securitization at June 30, 2023 (dollars in thousands): The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2020 securitization at June 30, 2023 (dollars in thousands): Please refer to page 29 for footnote disclosures. Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1 $ 152,658 3.3% $ 152,658 4/25/2049 Class A-2 8,187 3.5% 8,187 4/25/2049 Class A-3 12,971 3.8% 12,971 4/25/2049 Class M-1 25,055 4.8% 25,055 4/25/2049 198,871 198,871 Less: Unamortized Deferred Financing Cost N/A 2,159 Total $ 198,871 $ 196,712 Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1A $ 68,514 1.7% $ 68,514 3/25/2055 Class A-1B 8,130 2.1% 8,130 3/25/2055 Class A-2 13,518 2.9% 13,518 3/25/2055 Class A-3 17,963 3.3% 17,963 3/25/2055 Class M-1 11,739 4.3% 11,739 3/25/2055 Subtotal 119,864 119,864 Less: Unamortized Deferred Financing Costs N/A 1,299 Total $ 119,864 $ 118,565 Financing (Continued) 26

Financing (Continued) The following table summarizes the residential mortgage-backed notes issued by the Company's Arroyo Trust 2022-1 securitization at June 30, 2023 (dollars in thousands): Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1A $ 202,556 2.5% $ 182,262 12/25/2056 Class A-1B 82,942 3.3% 73,725 12/25/2056 Class A-2 21,168 3.6% 17,292 12/25/2056 Class A-3 28,079 3.7% 22,186 12/25/2056 Class M-1 17,928 3.7% 12,780 12/25/2056 Subtotal 352,673 308,245 Less: Unamortized Deferred Financing Cost N/A — Total $ 352,673 $ 308,245 The following table summarizes the residential mortgage-backed notes by the Company's Arroyo Trust 2022-2 securitization at June 30, 2023 (dollars in thousands): Classes Principal Balance Coupon Carrying Value Contractual Maturity Offered Notes:(8) Class A-1 $ 250,394 5.0% $ 242,542 7/25/2057 Class A-2 21,314 5.0% 20,239 7/25/2057 Class A-3 25,972 5.0% 24,613 7/25/2057 Class M-1 17,694 5.0% 14,680 7/25/2057 Subtotal 315,374 302,074 Financing Cost N/A — Total $ 1,370,691 $ 1,019,310 27

Financing (Continued) Commercial Mortgage backed Notes As of June 30, 2023, the Company had one consolidated commercial mortgage-backed variable interest entities that had an aggregate securitized debt balance of $1.0 billion. The securitized debt of the trust can only be settled with the collateral held by the trust and is non-recourse to the Company. The Company holds an interest in a subordinate bond in CMSC 2014 USA securitization and this bond had a fair market value of $6.0 million at June 30, 2023. The retained subordinate bond is not reflected in the below tables because is is eliminated in consolidation. The following table summarizes CSMC 2014 USA's commercial mortgage pass-through certificates at June 30, 2023 (dollars in thousands): Classes Principal Balance Coupon Carrying Value Contractual Maturity Class A-1 $ 120,391 3.3% $ 101,120 9/11/2025 Class A-2 531,700 4.0% 458,329 9/11/2025 Class B 136,400 4.2% 109,843 9/11/2025 Class C 94,500 4.3% 72,535 9/11/2025 Class D 153,950 4.4% 111,258 9/11/2025 Class E 180,150 4.4% 97,328 9/11/2025 Class F 153,600 4.4% 61,965 9/11/2025 Class X-1 (interest only) n/a 0.5% 5,717 9/11/2025 Class X-2 (interest only) n/a —% 1,215 9/11/2025 $ 1,370,691 1,019,310 28