Maersk Posts Record Profit, Steps Up Buyback Program -- Update

May 05 2021 - 12:50PM

Dow Jones News

By Costas Paris and Dominic Chopping

A.P. Moller-Maersk A/S said it would launch a roughly $5 billion

share-buyback program as unrelenting demand for manufactured goods

helped the Danish shipping company post a record profit for the

first quarter.

Maersk said net profit surged to $2.7 billion, up from $197

million in the first quarter of last year, boosted by big retailers

such as Walmart Inc. and Amazon.com Inc. restocking inventories

that were depleted early last year after the coronavirus pandemic

hit.

The result came in above the average forecast of $2.38 billion

of 10 analysts surveyed by FactSet.

Maersk is the world's No. 1 containership operator, moving

nearly 17% of all container capacity, according to data provider

Alphaliner, and its performance is considered a barometer of global

trade.

"It's been our best quarter ever," said Maersk CEO Soren Skou.

He said demand is driven by a race to replenish low U.S.

inventories with consumers spending Covid-19 related stimulus

checks mostly for online shopping. "That won't change anytime soon

as the American and other major economies are recovering fast," he

said.

Revenue rose 30% to $12.44 billion, in line with guidance

provided by the company last week.

Maersk said shipping volumes rose 5.7% year-over-year in the

quarter and that average freight rates were 36% higher.

The company's shares surged 6.4% on the Copenhagen Stock

Exchange to 15,945 kroner after the strong earnings report.

Maersk last month concluded the 3.3 billion kroner, equivalent

to $533.6 million, first phase of its current 10 billion kroner

share-buyback program, and plans to buy back the remaining 6.7

billion kroner between by the end of September. A new program of up

to 31 billion kroner, worth approximately $5 billion, will be

executed over two years when the current one is finalized, the

company said.

The expanded share buyback is "supported by the strong earnings

and free cash flow generation seen in both 2020 and 2021," the

company said.

Mr. Skou said he expects the boom for container ships that began

late last summer to continue until the end of the year.

"Demand from our customers for space on ships is very high up in

the third quarter. The freight rates will normalize at some point,

but we expect the current strong market to continue into the fourth

quarter," Mr. Skou said. "The pandemic continues to impact the

industry with a temporary economic upside, along with significant

operational challenges."

The cost of shipping a container from China to Los Angeles

surged to $4,140 in April from $1,579 a year earlier, and the cost

of moving one from Asia to Europe rose to $3,934 from $741,

according to the Shanghai Containerized Freight Index.

Maersk last week increased its forecast for container demand

growth to between 5% and 7% this year from a February forecast of

3% to 5%.

Mr. Skou said container ships still face long delays to unload

at congested ports around the world, including the U.S. West Coast

gateways of Los Angeles and Long Beach, and that the capacity

crunch will continue after 50 of Maersk's ships were stranded in

the Suez Canal for almost a week in March when a giant boxship,

operated by a competitor, ran aground.

Unlike many smaller carriers, Maersk has been focusing on

long-term contracts, rather than relying on spot rates. Operators

that agree to prices in the spot market can benefit from short-term

spikes, but also lose out when rates fall, often below operational

costs.

The company said it already has completed roughly 80% of its

contract deals for this year, with the remainder to be settled by

the end of this month. Long-term contract coverage will increase

20% compared with 2020, the company said.

The earnings boost will accelerate Maersk's investment into its

inland logistics business. Since 2016, when Maersk set out to

become an integrated logistics operator, the conglomerate has sold

its oil-and-tanker businesses and invested tens of millions of

dollars in warehousing and customs-clearing services globally.

Revenue from the company's logistics and services division rose

42% year-over-year in the first quarter to $2 billion.

"The benefits from the extraordinary freight market will

disappear at some point," Mr Skou said. "What is the growth we've

seen in our logistics business. Our strategy to offer inland

logistics to our ocean customers is playing out and wie are

supercharging that part of the business."

Write to Costas Paris at costas.paris@wsj.com and Dominic

Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

May 05, 2021 12:35 ET (16:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

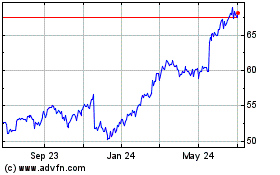

Walmart (NYSE:WMT)

Historical Stock Chart

From Jun 2024 to Jul 2024

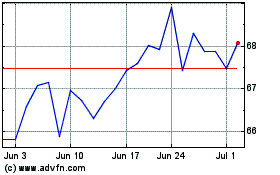

Walmart (NYSE:WMT)

Historical Stock Chart

From Jul 2023 to Jul 2024