Stock Market News for October 23, 2012 - Market News

October 23 2012 - 5:06AM

Zacks

Benchmarks rebounded from a heavy

slump in the final hour of trading and finished with paltry gains

on Monday. The Dow and S&P 500 ended almost flat, whereas the

Nasdaq had a decent run. With investors worried about how sluggish

global economic conditions are affecting corporates, benchmarks are

spending most of their days in the red. Meanwhile, Caterpillar

managed to beat analysts’ estimates on its bottom line, but its top

line fell short. The technology sector was the leading gainer among

the S&P 500 industry groups.

The Dow Jones Industrial Average

(DJI) rose 0.02% to close the day at 13,345.89. The Standard &

Poor 500 (S&P 500) climbed 0.04% to finish yesterday’s trading

session at 1,433.82. The tech-laden Nasdaq Composite Index added

0.4% to end at 3,016.96. The fear-gauge CBOE Volatility Index (VIX)

lost 2.6% to settle at 16.62. Consolidated volumes on the New York

Stock Exchange, American Stock Exchange and Nasdaq were roughly 5.8

billion shares, lower than the year-to-date daily average of 6.52

billion shares. The decliners on the New York Stock Exchange

outpaced advancing stocks; as for 46% stocks that gained, 50%

stocks closed lower.

Benchmarks struggled to find a

specific direction on Monday. During mid-afternoon, the blue-chip

index had fallen by as much as 108 points before rallying in the

final hour. Benchmarks rallied in the final session, despite the

absence of any major news that could affect them. Investors were

worried about corporate revenues and macroeconomic headwinds have

already had a negative impact on certain industry heavyweights.

Last Friday, markets were battered

following weak corporate results. Microsoft Corporation, McDonald's

Corporation and General Electric Company had reported discouraging

results and almost all of them blamed certain macroeconomic

headwinds. Shares of Microsoft, McDonald's and General Electric had

slumped 2.9%, 4.5% and 3.4%, respectively last Friday. Also,

Advanced Micro Devices, Inc. (NYSE:AMD) had announced late on

Thursday that its revenue slumped 10.2% sequentially and 24.9% year

over year. The negative sentiment spilled on to Monday as well and

affected the markets.

On Monday, corporate results

continued to be weak. Hasbro, Inc. (NASDAQ:HAS), V.F. Corporation

(NYSE:VFC) and SunTrust Banks, Inc. (NYSE:STI) posted their

quarterly results which came in below analysts’ estimates. The

stocks tumbled 1.7%, 4.4% and 3.5%, respectively.

Meanwhile, Caterpillar Inc.

(NYSE:CAT) posted quarterly earnings that surpassed analysts’

estimates. However, the industry bellwether’s revenue fell short of

expectations. Also, Caterpillar slashed its 2012 forecasts, citing

weak global demand. It was the second time that Caterpillar slashed

estimates this year. Nonetheless, Caterpillar’s stock surged 1.5%,

recovering from its initial losses.

Meanwhile, technology bellwether

Apple Inc. (NASDAQ:AAPL) jumped 4.0% after announcing that the

company will release a smaller iPad on Tuesday. The smaller iPad

will compete with Amazon.com, Inc’s. (NASDAQ:AMZN) Kindle Fire and

Google Inc’s (NASDAQ:GOOG) Nexus 7. This was Apple’s biggest gain

in almost five months. The company is schedule to report its

earnings on Thursday. Meanwhile, investors awaited results from

Yahoo! Inc. (NASDAQ:YHOO) and Texas Instruments Incorporated

(NASDAQ:TXN).

The 4% jump in Apple also helped

Nasdaq finish in the green. Also, the technology sector was guided

back to the positive zone after three days of consecutive losses.

The Technology SPDR (ETF) jumped 0.7%. Stocks such as

Hewlett-Packard Company (NYSE:HPQ), Dell Inc. (NASDAQ:DELL), Digi

International Inc., Synaptics, Incorporated and EMC Corporation

(NYSE:EMC) surged 1.6%, 0.4%, 3.0%, 1.9% and 1.9%,

respectively.

The Energy Select Sector SPDR was

the major loser, slipping 0.3%. Stocks such as Chevron Corporation

(NYSE:CVX), BP plc (NYSE:BP), Marathon Oil Corporation, Suncor

Energy Inc. and ConocoPhillips lost 0.6%, 1.0%, 1.6%, 1.3% and

0.7%, respectively.

APPLE INC (AAPL): Free Stock Analysis Report

ADV MICRO DEV (AMD): Free Stock Analysis Report

AMAZON.COM INC (AMZN): Free Stock Analysis Report

BP PLC (BP): Free Stock Analysis Report

CATERPILLAR INC (CAT): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

DELL INC (DELL): Free Stock Analysis Report

EMC CORP -MASS (EMC): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

HASBRO INC (HAS): Free Stock Analysis Report

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

SUNTRUST BKS (STI): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

V F CORP (VFC): Free Stock Analysis Report

YAHOO! INC (YHOO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

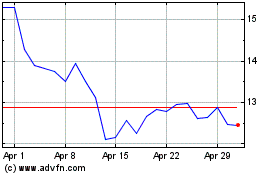

VF (NYSE:VFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

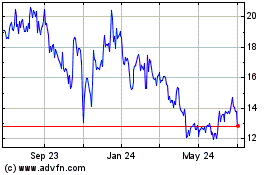

VF (NYSE:VFC)

Historical Stock Chart

From Jul 2023 to Jul 2024