0001610682false00016106822023-07-262023-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 26, 2023

USD Partners LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-36674 | | 30-0831007 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

811 Main Street, Suite 2800

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(281) 291-0510

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Units Representing Limited Partner Interests | | USDP | | New York Stock Exchange |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 3.01 | Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing. |

On July 26, 2023, USD Partners LP (the “Partnership”) received a notice from the New York Stock Exchange (“NYSE”) that it is not in compliance with the continued listing criteria under Section 802.01C of the NYSE's Listed Company Manual, because the average closing price of the Partnership's common units was less than $1.00 over a consecutive 30 trading-day period.

Under the applicable rules of the NYSE, the Partnership will respond to the NYSE within ten business days of receipt of the non-compliance notice with respect to its intent to cure the deficiency to regain compliance with the average closing price criteria. The rules allow the Partnership to potentially submit a plan to regain compliance within a six-month grace period. The Partnership would then have six months from its receipt of the non-compliance notice to cure the deficiency and regain compliance by having a closing price of at least $1.00 per unit on the last trading day of any calendar month during the six-month cure period and an average closing unit price of at least $1.00 over the 30 trading-day period ending on the last trading day of that month or by the Partnership meeting such standards on the last trading day of the cure period.

At this time, the notice does not result in delisting of the Partnership's common units, which will continue to be listed and traded on the NYSE under the ticker “USDP” with an added designation of “.BC” to indicate “below compliance,” subject to the Partnership's continued compliance with the NYSE's other applicable listing rules.

The NYSE notification does not affect the Partnership’s business operations or its Securities and Exchange Commission reporting requirements, nor does it conflict with or cause an event of default under the Partnership’s credit agreement or other agreements.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On July 26, 2023, the Partnership issued a press release announcing the receipt of the notice of noncompliance from the NYSE, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

The information furnished in this Item 7.01 and in Exhibit 99.1 to this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Cautionary Note Regarding Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of U.S. federal securities laws, including statements regarding whether the Partnership will seek to regain, or regain compliance with, the NYSE’s listing standards; the ability of the Partnership to remain in compliance with the NYSE’s other listing standards; and the timing of any process involving the continued listing or any delisting of the common units. Words and phrases such as “expect,” “plan,” “intent,” “believes,” “projects,” “anticipates,” “subject to” and similar expressions are used to identify such forward-looking statements. However, the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements relating to the Partnership are based on management’s expectations, estimates and projections about the Partnership, its interests, market conditions, and the energy industry in general on the date this press release was issued. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Factors that could cause actual results or events to differ materially from those described in the forward-looking statements include the Partnership’s pursuit of and ability to develop a plan to regain compliance with NYSE listing standards, equity market conditions and those factors set forth under the heading “Risk Factors” and elsewhere in the Partnership’s most recent Annual Report on Form 10-K and in the Partnership’s subsequent filings with the Securities and Exchange Commission. The Partnership is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | | |

Exhibit Number | | Description | | | |

| 99.1 | | | | | | |

| 104 | | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | USD Partners LP

(Registrant) |

| | |

| | By: | | USD Partners GP LLC, |

| | | | its general partner |

| | |

| Date: July 26, 2023 | | By: | | /s/ Adam Altsuler |

| | Name: | | Adam Altsuler |

| | Title: | | Executive Vice President, Chief Financial Officer |

July 26, 2023

USD Partners LP Receives Continued Listing Standard Notice from the NYSE

Houston, TX –USD Partners LP (NYSE: USDP) (the “Partnership”) announced today that it received notification from the New York Stock Exchange (“NYSE”) on July 26, 2023 that the Partnership is no longer in compliance with the NYSE’s continued minimum price criteria set forth in section 802.01C of the NYSE’s Listed Company Manual, which provides that the Partnership will be considered to be below compliance standards if the average closing price of the Common Units is less than $1.00 over a consecutive 30 trading-day period.

The Partnership’s Common Units will continue to be listed and traded on the NYSE, subject to its compliance with other NYSE continued listing requirements. The NYSE notification does not affect the Partnership’s business operations or its Securities and Exchange Commission reporting requirements, nor does it conflict with or cause an event of default under the Partnership’s Credit Agreement or other agreements.

In accordance with NYSE rules, the Partnership will respond to the NYSE within 10 business days of receipt of the non-compliance notification to notify the NYSE of the Partnership’s intention to cure the deficiency. The Partnership will have a period of six months from receipt of the notification to regain compliance with the NYSE’s minimum closing price requirement, also referred to as the cure period. Under the NYSE rules, the Partnership can regain compliance if on the last trading day of any calendar month during the cure period (or the last trading day of the cure period) the Partnership’s Common Units have a closing price of at least $1.00 and an average closing price of at least $1.00 over the prior 30 trading-day period.

About USD Partners LP

USD Partners LP is a fee-based, growth-oriented master limited partnership formed in 2014 by US Development Group, LLC (“USD”) to acquire, develop and operate midstream infrastructure and complementary logistics solutions for crude oil, biofuels and other energy-related products. The Partnership generates substantially all of its operating cash flows from multi-year, take-or-pay contracts with primarily investment grade customers, including major integrated oil companies, refiners and marketers. The Partnership’s principal assets include a network of crude oil terminals that facilitate the transportation of heavy crude oil from Western Canada to key demand centers across North America. The Partnership’s operations include railcar loading and unloading, storage and blending in on-site tanks, inbound and outbound pipeline connectivity, truck transloading, as well as other related logistics services. In addition, the Partnership provides customers with leased railcars and fleet services to facilitate the transportation of liquid hydrocarbons and biofuels by rail.

USD, which owns the general partner of USD Partners LP, is engaged in designing, developing, owning, and managing large-scale multi-modal logistics centers and energy-related infrastructure across North America. USD’s solutions create flexible market access for customers in significant growth areas and key demand centers, including Western Canada, the U.S. Gulf Coast and Mexico. Among other projects, USD is currently pursuing the development of a premier energy logistics terminal on the Houston Ship Channel with capacity for substantial tank storage, multiple docks (including barge and deepwater), inbound and

outbound pipeline connectivity, as well as a rail terminal with unit train capabilities. For additional information, please visit texasdeepwater.com. Information on websites referenced in this release is not part of this release.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of U.S. federal securities laws, including statements regarding whether the Partnership will seek to regain, or regain compliance with, the NYSE’s listing standards; the ability of the Partnership to remain in compliance with the NYSE’s other listing standards; and the timing of any process involving the continued listing or any delisting of the Common Units. Words and phrases such as “expect,” “plan,” “intent,” “believes,” “projects,” “anticipates,” “subject to” and similar expressions are used to identify such forward-looking statements. However, the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements relating to the Partnership are based on management’s expectations, estimates and projections about the Partnership, its interests, market conditions, and the energy industry in general on the date this press release was issued. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecast in such forward-looking statements. Factors that could cause actual results or events to differ materially from those described in the forward-looking statements include the Partnership’s pursuit of and ability to develop a plan to regain compliance with NYSE listing standards, equity market conditions and those factors set forth under the heading “Risk Factors” and elsewhere in the Partnership’s most recent Annual Report on Form 10-K and in the Partnership’s subsequent filings with the Securities and Exchange Commission. The Partnership is under no obligation (and expressly disclaims any such obligation) to update or alter its forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Investor Relations Contacts:

Adam Altsuler, (281) 291-3995

Executive Vice President and Chief Financial Officer

Jennifer Waller, (832) 991-8383

Senior Director, Financial Reporting and Investor Relations

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

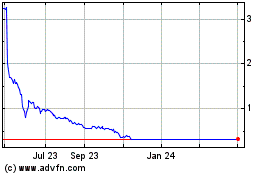

USD Partners (NYSE:USDP)

Historical Stock Chart

From Nov 2024 to Dec 2024

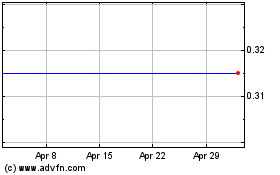

USD Partners (NYSE:USDP)

Historical Stock Chart

From Dec 2023 to Dec 2024