0001522727false00015227272024-10-292024-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 29, 2024

USA Compression Partners, LP

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

| Delaware | | 1-35779 | | 75-2771546 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

111 Congress Avenue, Suite 2400

Austin, Texas 78701

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (512) 473-2662

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Common units representing limited partner interests | | USAC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On October 29, 2024, the board of directors of USA Compression GP, LLC (the “Company”), the general partner of USA Compression Partners, LP (the “Partnership”), appointed Christopher M. Paulsen to the position of Vice President, Chief Financial Officer and Treasurer of the Company, effective November 18, 2024. Mr. Paulsen will replace G. Tracy Owens as the principal financial officer of the Company, effective November 18, 2024. Mr. Paulsen, 47, was the Senior Vice President of Business Development and Strategy for Pioneer Natural Resources Company (“Pioneer”), a large independent oil and gas exploration and production company, from March 2023 through Pioneer’s merger with ExxonMobil in May 2024. Prior to that, he was the Vice President of Business Development and Strategy at Pioneer beginning in January 2013. Mr. Paulsen joined Pioneer in 2002 and served in various areas including investor relations, mergers and acquisitions, and operations and subsurface. In 2011, Mr. Paulsen took over leadership of the business development team responsible for shale technology, divestitures, and mergers and acquisitions. Transactions generally concentrated on upstream, midstream, oilfield service, and renewable sectors in the Permian Basin, Mid-Continent, Gulf Coast, Alaska, and Rockies. Additionally, his team was responsible for corporate strategy, scenario planning, and energy transition investments transactions. Prior to joining Pioneer, Mr. Paulsen worked for SBC Communications in planning as well as treasury. Mr. Paulsen received his BBA from Baylor University and his MBA from the McCombs School of Business at the University of Texas. Mr. Paulsen is a board member of Ralph Lowe Energy Institute at Texas Christian University. He also serves as a board member of the Maguire Energy Institute at Southern Methodist University, focusing his efforts with the student-directed Spindletop Energy Investment Fund.

In connection with his appointment as Vice President, Chief Financial Officer and Treasurer, Mr. Paulsen will receive an annual base salary of $425,000 and a sign-on bonus payment of $125,000, which bonus is expected to be paid at the same time as bonus payments under the Bonus Plan (defined below). Mr. Paulsen will also participate in the Partnership’s Amended and Restated Annual Cash Incentive Plan (the “Bonus Plan”), under which awards are determined annually, with reference to an initial target bonus amount of 105% of his annual base salary, or $446,250. Mr. Paulsen will also participate in the Partnership’s long-term equity incentive plan (“LTIP”), with an initial equity award of 75,000 phantom units, consisting of (i) approximately 45,000 units representing his initial target value of 250% of his base salary and (ii) a sign-on bonus of approximately 30,000 phantom units. Descriptions of the LTIP and the Bonus Plan are included in the Partnership’s Annual Report on Form 10-K for the year ended December 31, 2023. Mr. Paulsen is also eligible to receive other benefits generally available to all employees.

There are no arrangements or understandings between Mr. Paulsen and any other persons pursuant to which he was selected to serve as the Company’s Vice President, Chief Financial Officer and Treasurer. There are no family relationships between Mr. Paulsen and any of the Company’s directors or executive officers, and Mr. Paulsen has no reportable transactions under Item 404(a) of Regulation S-K.

Item 7.01. Regulation FD Disclosure.

On October 29, 2024, the Partnership issued a press release in connection with the management change described above, a copy of which is furnished as Exhibit 99.1 to this Current Report.

The information furnished pursuant to this Item 7.01 (including the exhibit) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | USA COMPRESSION PARTNERS, LP |

| | | |

| | By: | USA Compression GP, LLC, |

| | | its General Partner |

| | | |

| Date: | October 29, 2024 | By: | /s/ Christopher W. Porter |

| | | Christopher W. Porter |

| | | Vice President, General Counsel and Secretary |

USA Compression Partners Announces Appointment of New Chief Financial Officer

AUSTIN, Texas, October 29, 2024 – USA Compression Partners, LP (NYSE: USAC) (“USA Compression”) today announced that Christopher M. Paulsen will join the company on November 18, 2024 as its new Chief Financial Officer. Chris comes to USA Compression with over 20 years in the energy industry, most recently serving as the Senior Vice President of Business Development and Strategy at Pioneer Natural Resources. Chris received his BBA from Baylor University and his MBA from the McCombs School of Business at the University of Texas. Chris is a board member of Ralph Lowe Energy Institute at Texas Christian University. He also serves as a board member of the Maguire Energy Institute at Southern Methodist University, focusing his efforts with the student-directed Spindletop Energy Investment Fund.

“I am thrilled to welcome Chris to the USA Compression team and look forward to his contributions,” said Clint Green, USA Compression’s President and Chief Executive Officer. “Chris brings a valuable combination of experiences to his role, encompassing financial acumen, strategy, business development and industry knowledge. I look forward to working with Chris and continuing to drive value for our stakeholders.”

ABOUT USA COMPRESSION PARTNERS, LP

USA Compression Partners, LP is one of the nation’s largest independent providers of natural gas compression services in terms of total compression fleet horsepower. USA Compression partners with a broad customer base composed of producers, processors, gatherers, and transporters of natural gas and crude oil. USA Compression focuses on providing midstream natural gas compression services to infrastructure applications primarily in high-volume gathering systems, processing facilities, and transportation applications. More information is available at usacompression.com.

Contact:

USA Compression Partners, LP

Investor Relations

ir@usacompression.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

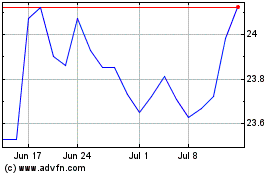

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

From Nov 2023 to Nov 2024