Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

February 02 2024 - 4:53PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant x |

| |

| Filed by a Party other than the Registrant ¨ |

| |

| Check the appropriate box: |

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting Material under §240.14a-12 |

| |

| United States Steel Corporation |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The following information was posted on United States Steel Corporation’s

microsite on February 2, 2024.

| Legal Disclaimer

costs and improve operating efficiency; the possibility of not completing

planned alliances, acquisitions or investments, or such alliances.

acquisitions or investments not having the antlcipated results: natural

disasters and accidents or unpredictable events which may disrupt NSC's

supply chain as well as other events that may negatively impact NSC's

business activities: risks relating to CO2 emissions and NSCs challenge

for carbon neutrality: the economic, political, social and legal uncertainty

of doing business in emerging economies; the possibility of incurring

expenses r esulting from any defects in our products or incurring

additional costs and reputat iona1 harm due to product defects of other

steel manufacturers; the possibility that we may be unable to protect our

intellectual property rights or face intellectual property infringement

claims by third parties; changes in laws and regulations of countries

where we operate, including trade laws and tariffs, as well a tax,

environmental. health and safety laws; and the possibility of damage to

our reputation and business due to data breaches and data theft. All

information in this website is as of the date above. Neither the Company

nor NSC undertakes any duty to update any forward-looking statement

to conform the statement to actual results or changes In the Company's

or NSC's expectations whether as a result of new information, future

events or otherwise, except as required by law.

- |

| NIPPON STEEL CORPORATION [NSC]1

AND U.S. STEEL COMBINATION IS THE BEST DEAL FOR

AMERICAN STEEL --... NSIC--ln ... ,,_ ___ •-~------ -~-s.a,._,

I

,,_, ___________ _ ..,.,, __ ... __ .,_____ .,._.,,.,. __ .. __ , .. ,

---------

I

___

__________ ,, ,. __ , _____ _ I __ ,·----------- _____ .. ____ _ -------•ull,-

l

-----··------- <_.,..,

_ __ V5_ ... _..,_....,._

... _ ...

NSC HAS A PROVEN RECORD OF ACQUIRING, OPERATING AND INVESTING IN STEEL MILL

FACILITIES IN AMERICA

JISt"S.O.-'lW,_S[IC(.UIILUll'.u:tllNIASES,111111(t

_,._ .. __ ,._

----·----

---·---- __ .... __ _

NSC RECOGNIZES THAT THE COMBINED WORKFORCE IS CRITICAL TO OPERATIONS ANO IS

COMMITTED TO HONORING ALL USW COLLECTIVE BARGAINING AGREEMENTS

IOlflTSWIDEltEIMSGFTIICUMOOCIA

51 WA6E INCIIEASES

UNCAPPED PIIOITT SHAJIINS

S0.75/llOUR

---

Tll~ TlW1SICTION AEPIIESOOS A1111THER

EXAMPl.£0FTllEUIITlllSTATES'STRlTE61C

PARTNtRSHIPWITHJANJL

----~-URO- --•UOJ.-... --- --------- ------

·i _______ .............. ...,.

-.-:i--"'9"'f• ------t,ott.1,1, .. --..

___ ,.,.,,"""._ _ .. ---.. -~ ....... _ .... -----..----· -- STRENGTHENS U.S. STEffS MINED. MELTED ANO MADE IN AMERICA PORTFOLIO OF

PRODUCTS

l

ll,lr,g,..,....._.,._~--- -US-•---•--c--"""""""' _(_,._.._ ... ......... _,.,... ___ ..... ---.. ~

ENHANCING U. S. STEEL

I r-_.,,,_.....us-.-.-.,._"'11>-

....-.-.,.,.-.

1=-

---------·-- ·------'°'

TltETWSACTIIIIWITHNSCnLENIWICE I.S.STIRITltEFOl.L11¥1111G IIIA'rS:

Id(:,._., ________ ... _____ ..... _.,_.,

... __ i'l$0: ...... _,._.,s. ______ _ .., __ .,_, _ .... _ ..... -~ .. -OIIC'-____ ,. us.-..-•-•-.. •----"-" _", __ ., ... ____ .. __ ----·---

_, .. _., ___________ _ __ .. ____ UI)_

__..., ________ ..

=~=-=-==-=.. ..... .. _....,,, ______ .,_

-----------· __ .. _____ co,_ |

| , lfltBllUII.UU.•Nrtllla ___ ,_ Tlta.a:S l---~~ ••-- ___ ..._ __ ..,. __ .,t«: ... vl.____ .. ...,...,. ___ .,_N$C_,,.,_.....,. .,. ____ ...... _.. _____ .. _____ _ --... _ ... _.,._.,_...., __ _ -··---"'·----- ---•-------- ,._..,NISC-<AI.-----•--- ___ ... __ .,. __ -·--------- ...... ___ ___ ___ ., ____

"" __ _ _ .,. ____ _ UL_,, ______ ------ __ .. ____ .. __ __ _ --

--.------------

U.S. STEEL AND NIPPON STEEL CORPORATION (NSC)TRANSACTION IS THE CULMINATION OF A

COMPREHENSIVE AND THOROUGH STRATEGIC ALTERNATIVES REVIEW PROCESS

PmSSUO 8YIIIOEPIIIIIIIT 80AIIO ll!IIIOS

IJOIIOOTSIIIFIWIClll6U6.llAIMSIIIS

12

"TIAllSS!SSIIIII

------ ------

----

---·-- ~----- --------

3 2

s ,ii IIUl.£11U011li ElliAEIITlfflll ErnJSM:•&OTWIIISI.OINTI

llWllNID TWISACTIIIIAPPUAI.

------- ----- ------

......., _____ ...

--------

___________ .,.,. __ .. .........

___ _______ _ ...... _, ___ _ ------

KEYTIIANSACOON HliHUGtfTS ti onw

~11~.,.• aro

snnaM.f --

$55.00 _____ _.., 142% ... __ ,, __ _ _, ___ .,. _________ _ ------------

KEYTWISACTllNHl6HU6HTSfiOCJALS

$55.00 142% _.,us-----• _ .. _,.._

tll.llllS-..rNllfMI~ c---------

---------- ----... ---~-------- _ "

___ _ ---

COIIMITTmtolMllll:AllmEI.IIINO'IAllOII,

..QSANII COMMUNITIES

0 -v•---- _.,_,. 0 ___ 0 ......., ___ -..--- --- -=----,,..,. 0 .. 0 __ .. __ _ _ ..... u.1.-- |

| ::

TRANSACTION BENEFITS FOR EMPLOYEES

U.S. STEEL AND NIPPON STEEL CORPORATION (NSC1

) COMBINATION IS THE BEST DEAL FDR

AMERICAN STEEL

----·-

~-------

-------- --

,.,,

S15au:IIINZOZ3

$50111.lJ)N.2023

2Ull.l.OITWCS

(Z0.3Ttl'IIUI

'"

0

-----

·•------ W.----~i-......... - ---------

____ .,. __ _ __ ,, ____ __

·-------- ------

___ .. __ ·------- ------·-

0

0

0

0

1150

121,000-

12.1 .... ,r.ws [IITDIIJEJ4

1,993

20

0

·-----

~-------·-- -·-___ .,. __

-------

_.,,_

·-·---

____

_ ,. __ _ .. _ ... __ - - ·-------

___ ..., ___ _

0

0

0

0 |

| NIPPON STEEL TRANSACTION WITH U.S. STEEL SECURES LONG·TERM FUTURE OF UNION JOBS

"'"'SIIIIS wtwot ___ loo __ ~

·---- -------- --------- U$---•-----•- __ ,..., ____ IO<••---

DoM - USW--righ!IO-..IMtr_....,wkn

"''"

us-----•--•----•-- ----

us _______ ...,., ___ .,.,.

--------~--

... ______ _ Ut. __ ... ,_ _ __ .,. ___ ..

_,,. ___ ... ___ .. _,, ____ _ ------

KFl'TIIIISTtlOIM

Oo,H NSCrK<>gnin-USW-••-IIMnillin9

..... ....,., _____ .._ ___ ,.. ..

--------.. ---

_..,._ , __ .. __ ... ._ .. ..., .... a.... __ ......, ... ____ ..... ...,_ ..... ___ ...._ |

| 11111 -irra,. @ - --

MOVING FORWARD TOGETHER AS THE BEST STEELMAKER WITH WORLO·LEAOING

CAPABILITIES ... FOR OUR CUSTOMERS

STUTEICIOlflTS 3TIUG:$Tt~

cf ¢ .:~ .__,.CS!MII_IJl'lal m.n1t~sn.catM1• au111••S11B~-- ~--••--l'IJl'NI -----•-tlalllll ... ------- --,--~-"•--- __

-•- ,, ________ ... .,•--·-•-., -------- --u•--•-• .. _.,. ____ _

--------·· ---------· ---··----- ----- __ ... ____ _ ______ ,...

---

_________ _____ .. ·----- .,_ .. _ --·----- --------- __ ... ____ _ .,.

_,_.,.,. ___ _ ... ___ ,-~ ... --

IIITllRAIWT1l!IISCfllf'UT(,RISIUS»lSSASIISUAI.

06A

------------- __ .,, _________ _ ----- ------.. ------· -----·--- ----------- -· -- -·--- __ ---- .... ____ .. _ .. __ ---------- -----·

DELIVERS CERTAIN ANO IMMEDIATE VALUE FOR U. S. STEEL SHAREHOLDERS

mw&TUftSC"S ..-rMTOIElMIUIWICU,urrutJll .uala-fEIIIYAI.II flll llSCSIIAIIOaJIIS

,/ ---..... -..... ----·-------------------- |

| 00

~IJ.S.SIMh ~ -.Dr--~ __ ..

RESULT Of U. S. STEEL'S COMPREHENSIVE ANO THOROUGH STRATEGIC ALTERNATIVES PROCESS

~~

DrMnggioba,1----try

-dcer-neuo11111y-a.. --~ --•-byl'OSO |

| NIPPON STEEL @ United States Steel HOME BENEFITS OFT HE TRANSACTION v SUPPORT FOR THETRANSACTION NEWSROOM AND MATERIALS CONTACT

DOWNLOAD PDF .±.

HERE'S WHAT PEOPLE ARE SAYING ABOUT U. S. STEEL'S PROPOSED

TRANSACTION WITH NIPPON STEEL CORPORATION (NSC) 1 |

| FROM GOVERNMENT OFFICIALS ...

RAHM EMANUEL UNITID STATIS AMBASSADOR TO JAPAN DEC. 18, 2023

"Nippon Steel and U. S. Steel announce ahistoric

$14.9 billion transaction. These two iconic companies

are defining the future of the key steel industry and

forging a strong bond as they face a more

competitive environment.While the USA and Japan

have been the number one investors in each's

country for the past four years, today's

announcement will deepen those bonds."

8 FORMER US SEN. FOR PA PAT TOOMEY CARROU TOWNSHIP DEC. 21, 2023

[U. S. Steel) "shareholders consist of Americans of all

stripes. The teachers, firemen, truck drivers, who

have 401(k)s and pension plans invested in

companies including U. S. Steel. [ ... ) This is good for

the steel workers. This is good for steel production.

This is good for the United States. The fact of the

matter is that Nippon Steel would be obligated to

follow al of the labor laws that anyone else is

obligated to, including the negotiations over new

contracts, which is very heavily regulated by the

federal government...! think the union workers ought

to be glad that a larger parent company with greater

resources is going to be there to increase the

likelihood that they stay viable. I think it's a big

mistake for the unions to conclude somehow they're

worse off when it's not at all clear that that's the

case." |

| FROM THE ANALYST AND INVESTMENT COMMUNITY ...

BANK OF AMERICA q ~

Bank of America analysts said,"X stated

that NSC has committed to honor all

labor agreements and would maintain

X's iconic brand name. From an overall

industry perspective. t he deal would

increase competition in the domestic

market (especially auto/electrical steel)

with no material offset from

consolidation."

DECEMBER 18, 2023

INTHE MEDIA

FT

FIN"OiCIAL

T IMES

In the media ... "Japan reasonably

thinks of itself asAmerica·s closest ally

in Asia. It is the host nation of the

largest number of US military outside

t he US itself and a gargantuan

customer of American hardware. Japan

has also recently proved its friendship

many times over - most prominently

by joining t he US in imposing

restrictions on exports of high-end

semiconductor production equipment,

and by directly helpingWashington rally

sign-ups to the lndo-Pacific

EconomicFramework trade deal."

DECEMBER 19, 2023

II

Josh Spoores, steel analyst at CRU

Group, told Yahoo Finance the

announcement could be good news for

buyers. Further consolidation of the US

market would have increased prices and

pushed manufacturers elsewhere, he

said. The deal has the potential to keep

the domestic market competitive. which

could encourage manufacturers to keep

producing in the US and employing US

workers.

DECEMBER 18. 2023

Pl'IT SBURGI I

T RIBUNE-REVIEW

" ... shareholders are not the only

winners. The UnitedSteelworkers will

have their contract honored and a

good-faith bargaining partner in the

combined U. S.Steel-NSC. Pittsburgh

and Pennsylvania get to keep theU. S.

Steel jobs that already were here, and

our state will maintain its primacy in the

American steel industry. Finally, up and

down the steel supply chain. buyers

will have a competitive marketplace

that is not dominated by any one firm.

As inflation continues to be a problem,

a merger that will help keep prices

down is good for consumers."

DECEMBER 19, 2023

Morgan Stanley

Morgan Stanley analysts said, "Given

Nippon has stated it will honor all of

U. S. Steel's commitments with its

employees. including all collective

bargaining agreements in place with the

unions, we believe the requirements for

any transaction to take place will likely

be fulfilled."

DECEMBER 18, 2023

Jlittsburgb Jlost-'6ia..ette

"Jobs are staying in Pennsylvania

instead of leaving. The iconic U. S.

Steel brand will continue instead of

fading away. The United Steelworkers

will continue to represent the

hardworking men and women in a

combined U.S. Steel - Nippon Steel.

Our allied supply chain will be

strengthened and Chinese grip on the

international steel market will be

weakened. What's not to like?"

DECEMBER 20, 2023 |

| Jlittsburgb Jlosl-'6.udte

" ... this deal may be the best outcome

for what was once the world's largest

company, for the Pittsburgh region,

and for the United States ... Nippon has

few operations in the US, so there are

no serious antitrust concerns. For

southwest Pennsylvania, it's unlikely

Nippon just dropped$14 billion - a

huge 40% premium on the market

value - j ust to shut down the Mon

Valley Works. It is more likely that

Nippon values owning an American

integrated steel operation, maybe

even more than U. S. Steel did. Nippon

has also committed to making steel as

cleanly as possible"

DECEMBER 20, 2023

DOWNLOAD PDF .::!:.

"The proposed transaction should

easily pass muster. Large-scale capital

investment by a Japanese company

poses no danger to U.S. national or

economic security, as the relevant

agency - the Committee on Foreign

Investment in theUnited States (CFIUS),

chaired by Treasury Secretary Janet L.

Yellen - has every reason to

conclude ... Japan is a U.S. allyand party

to a mutual defense pact. The two

countries cooperate on the production

of microchips and other sensitive

technologies."

DECEMBER 22. 2023

HERE'S WHAT PEOPLE ARE SAYING ABOUT U. S. STEEL'S TRANSACTION WITH

NIPPON STEEL

There is broad agreement that the transaction with NSC will support customers, employees and communit ies

FROM GOVERNMENT OFFICIALS ...

WILBUR ROSS

FORMER UNITED STATES SECRETARY OF COMMERCE DEC_ 20. 2023

"Nippon Steel is a very high-tech steel company. If anything, they may have better technology than U. S.

Steel.They've pledged to honor the labor contracts, which go through 2026, and they have pledged O carbon by

2050.They're a very, very responsible company and it reminds me back some decades ago when I was at

Rothschild.WP rpprpspntPd !hp Rockpfpllpr 34 trust whpn thpy sold Rock CPntpr to thP .fap;mpsp to Mitsui ;md

everybody said, "Oh my God, the sky is falling. An American icon owned by the Japanese." Well, you know what

the consequences were? Nothing, no consequences, and I don't think there will be any consequences of this." |

| FROM THE ANALYST AND INVESTMENT COMMUNITY ...

II

John C. Tumazos, metals industry

analyst at Very Independent Research,

told Pittsburgh Tribune-Review the

transaction will not trigger mass layoffs

in southwestern Pennsylvania or

encourage new owners to id le mills;

instead, it will create new jobs, spark

investment and invest heavily in

upgrading existing facilities."

Josh Spoores, steel analyst at CRU

Group, said, "I do expect for them (NSC)

to come and invest in some production

lines in the U.S ... I don't think (those

opposing the sale) are seeing the whole

picture. I think they're seeing the old,

iconic image of U. S. Steel and not what

it is today."

James Pinkerton, political analyst, said,

"The news that Nippon Steel wants to

buy U. S. Steel is good news. If money

talks, then this offer from a Japanese

company speaks loudly. It's a vote of

confidence in American manufacturing,

in American workers, and in the United

States itself... Nippon Steel has pledged

to honor collective bargaining

agreements with the United

Steelworkers union. So that's good

news for workers across Pennsylvania

and other states."

DECEMBER 23. 2023

DECEMBER 23, 2023

FROM POLICY EXPERTS ...

SANJAY PATNAIK

DIRECTOR OF THE CENlIR ON REGULATION AND MARKETS AT THE

BROOKINGS INSTITUTION DEC 22. 2023

"I don't see a compelling national security reason to

block it because again, Japan is an ally. And

actually.I've seen some information that if the deal

goes through, the combined joint company could be

a pretty good play on the world market, which would

pose a counterweight to the Chinese steelmakers."

DECEMBER 22. 2023

WILLIAM CHOU

JAPAN FB.LOW AT HUDSON INSTITUTE DEC. 22, 2023

"The sale protects American consumers. Had U. S.

Steel merged with Cleveland-Cliffs, the new company

would have dominated steel supplies for the auto

industry and provided all the steel needed for

electric-vehicle motors.The lack of competition would

likely mean higher EV costs for consumers ... Nippon

Steel plans to maintain U.S.-based production, which

will provide Americans with greater economic

security." |

| INTHE MEDIA

THE

WALL S11U1,1'

JOURNAL

"The merger may enhance U.S.

competitiveness. The $15 billion deal

would create one of the world's top

three steel makers, and it's a direct

investment in U.S.

manufacturing ... Nippon Steel Is likely

to improve U.S. Steel's operations and

efficiency. The company headquarters

will remain in Pittsburgh. Foreign

capital investment in the U.S. is good

for the economy and workers."

DECEMBER 22, 2023

FT

"The acquisition of US Steel by Nippon

Steel is a symbolic deal (both

comp;mi<>s "'" Aftpr nll nnmPd nft<>r

their respective countries, ie "Nippon"

means Japan). It is also symbolic in

terms of competition in global capital

markets, and in the pursuit of scale and

efficiency in the steel industry, as well

as in terms of economic security

between Japan and the US and the

western world."

..IANUl,J ry 2. 2024

Bloomberg

"The upsides of the deal outweigh the

potential drawbacks. The acquisition

would lend US Steel the backing of a

financially stronger patron and create a

steel giant able to hold its own against

China's behemoth producers. It's

highly unlikely that the Pentagon's

needs, which currently account for

about 3%of total US steel shipments,

would be in any way compromised.

Even If Nippon Steel, a private

company, were somehow beholden to

the Japanese government, there's little

reason that Japan would want to

weaken the US military at a time when

it faces growing threats from China and

North Korea"

JAH.JAR'f2,202 |

| "U. S. Steel Merger

Objections Rooted In A

1970s-Era Perspective"

By Ike Brannon

Ike Brannon is a former senior economist for the

United States Treasury and U.S. Congress. He is

president of Capital Policy Analytics, d

consulting firm that does research on issues

related to public policy and financial markets.

Read Full 011-Ed on Forbes

"U. S. Steel and Nippon will

be Good Partners"

By Steve Forbes

Steve Forbes is chairman and editor~111-chief of

Forbes Media.

Read the Full 011-Ed on The WashingJQ!!

Examiner

"Economic illiteracy and

unseemly xenophobia hit

the U.S. Steel deal"

By George F. Will

George F. Will is a columnist at The Washington

Post who writes on politics and domestic and

foreign affairs since 1977. J../e won the Pulitzer

Prize for commenta,y In 1977 and is a regular

contributor to MSNC and NBC News.

Read the Full Column on The Washington

Post

"Nippon Steel's Purchase of

U. S. Steel Will Improve The

Economy"

By Wayne Winegarden

Wayne Winegarden is a Senior Fellow in

Business and Economics at the Pacific Research

Institute and the Director of PRl's Center for

Medical Economics and Innovation whose

research explores the connection between

macroeconomic policies and economic

outcomes, with a focus on the health care and

energy industries. Mr. Winegarden has 25 years

of experience advising Fortune 500 companies,

medium and small businesses. and trade

associations and received his Ph.D. in

economics from George Mason University.

Read Full Op-Ed on Forbes

"Let the watchdogs decide

if a foreign U. S. Steel sale

works for America"

By Marc L. Busch

Marc L. Busch is the Karl F. Landegger Professor

of International Business Diplomacy at the

Walsh School of Foreign Servfce. Georgetown

University, and a global fellow at the Wt/son

Center's Wahba Institute for Strategic

Competition.

Read Full OQ:Ed on The Hill

"Why there's no reason to

worry about the Japanese

takeover of U.S. Steel"

By The Editorial Board

Read Full Editorial on The Washington

Post

"Biden's Foolish Snub of

Nippon Steel"

By William Chou

Mr. Chou is a Japan Chair fellow at the Hudson

Institute.

Read Full 011-Ed on The Wall Street

Journal

"The U. S. Steel Acquisition

Is Good for America"

By Bruce Thompson

Bruce Thompson was a U.S. Senate aide,

assistant secretary of Treasury for legislative

affairs, and the director of government relations

for Merrill Lynch for 22 years.

Read Full OR-Ed on Real Clear Markets

"Biden Shouldn't Block the

Nippon Steel Deal"

By The Editorial Board

Read Full Editorial on Bloomberg |

| "Multinationals urge Janet

Yellen not to let politics stop

US Steel deal"

By Aime Williams

Aime Williams covers foreign policy. trade and

climate for the Financial Times.

Read the Full Article on Financial Times

"They've pledged to honor

the labor contracts, which

go through 2026, and they

have pledged 0 carbon by

2050. They're a very, very

responsible company ... "

Wilbur Ross

Former United States Secretary of

Commerce

Watch Video

"U. S. Steel-NSC Merger a

good deal for workers,

consumers and Pa."

By Ryan Costello

Ryan Costello is a former member of Congress

from Pennsylvania.

Read Full Op-Ed on Trib Live

t Nippon Steel North America (NSNA) is a wholly-owned subsidiary of Nippon Steel Corporation

"This is good for

steelworkers, this is good

for steel production, it's

good for the United States. I

don't get the argument

against it."

Pat Toomey

Former U.S. Senator for Pennsylvania

Watch Video

i,111111 NIPPON STEEL @ Umtell States Steel Privacy Pol icy |

| NIPPON STEEL @ United States Steel

PRESS RELEASE

HOME BENEFITS OF THE TRANSACTION v SUPPORT FOR TNE TRANSACTION NEWSROOM AND MATERIALS CONTACT

NIPPON STEEL CORPORATION INSCJ TO ACQUIRE U.S. STEEL, MOVING FORWARD

TOGETHER AS THE 'BEST STEELMAKER WITH WORLD-LEADING CAPABILITIES'

DECEMBER 18. 2023 |

| INVESTOR PRESENTATION +

TRANSCRIPTS

STAKEHOLDER RESOURCES

NSC INVESTOR CAU TRANSCRIPT

DECEMBER 19, 2023

NSC- U.S. STEEL TRANSACTION INVESTOR CALL TRANSCRIPT

DECEMBER 18. 2023

NSC -U.S. STEEL TRANSACTION INVESTOR PRESENTATION

DECEMBER 18. 2023

ENHANCING US STEEL FACT SHEET [1

OVERVIEW FACT SHEET [1

WHAT PEOPLE ARE SAYING FACT SHEET #1 [1

WHAT PEOPLE ARE SAYING FACT SHEET #2 [1

PROCESS FACT SHEET [1

UNITED STEELWORKERS FACT SHEET [1 |

| FILINGS U.S. STEEL SEC FILINGS ~

PRELIMINARY PROXY STATEMENT ~

JANUARY 24. 2024

DAVE BURRITT LITTER TO EMPLOYEES ~

JANUARY 15, 2024

MERGER AGREEMENT ~

DECEMBER 18, 2023

DAVE BURRITT LITTER TO EMPLOYEES ~

DECEMBER 18, 2023

8-K REGARDING A LETTER TO STOCKHOLDERS FROM DAVE BURRITT ~

AUGUST 29, 2023

LETTER TO STOCKHOLDERS ~

8-K OUTLINING BLA WITH USW ~

AUGUST 22. 2023

ASSOCIATED EMPLOYEE LETTER ~

"' NIPPON STEEL ~ Un1led Stales Steel Pnva Pol c, |

| NIPPON STEEL @ United States Steel HOME BENEFITS OF THE TRANSACTION v SUPPORTFOR THETRANSACTION NEWSROOM IND MATER

IALS CONTACT |

| NSC CONTACTS

MEDIA

Rf contact1ajMii:u~nstee1.com

Kayo Kikuchi

+81-3-6867-2977

kikuchi.26s.kayo_@jr.1.nir.1r.1ons1eel.com

Masato Suzuki

+81-3-6867-2135

suzuki.s4f.masato@jp.niRROnsteel.com

U.S.STEELCONTACTS

MEDIA INVESTORS

Tara Carrara Kevin Lewis

INVESTORS

i@jlW.iRQQnsteel.com

Yuichiro Kaneko

+81-80-9022-6867

kaneko.ys;l;/_uichiro@jr.1.nir.1r.1onsteel.com

Yohei Kato

+81-80-2131-0188

kato.rk5.ymi.ei@jr.i.nir.iRonsteel.com

+1 (412) 433 1300

media@uss.com

+1 (412) 433 6935

klewis@uss.com

Kelly Sullivan / Ed Trissel

+1 (212) 355 4449

GENERAL U.S. MEDIA CONTACTS

INQUIRIES NSCMedia@teneo.com

[U.S.) Robert Mead

Nippon +1 (917) 327 9828

Steel North Robert.Mead@leneo.com

America,

Inc. Monika Driscoll +1 (713) 654 +1 (929) 388 9442 7111 Monika.Driscoll@teneo.com

Tucker Elcock

+1 (917) 208 4652

Tucker.Elcock@teneo.com

" NIPPON STEEL ~ Un1led Slates Steel PllVa~ Pohg |

Additional Information and Where to Find It

This communication relates to the proposed transaction between the

United States Steel Corporation (the “Company”) and Nippon Steel Corporation (“NSC”). In connection

with the proposed transaction, the Company has filed and will file relevant materials with the United States Securities and Exchange Commission

(“SEC”), including the Company’s proxy statement on Schedule 14A (the “Proxy Statement”),

a preliminary version of which was filed with the SEC on January 24, 2024. The information in the preliminary Proxy Statement is not complete

and may be changed. The definitive Proxy Statement will be filed with the SEC and delivered to stockholders of the Company. The Company

may also file other documents with the SEC regarding the proposed transaction. This communication is not a substitute for the Proxy Statement

or for any other document that may be filed with the SEC in connection with the proposed transaction. The proposed transaction will be

submitted to the Company’s stockholders for their consideration. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS

ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT (A PRELIMINARY FILING OF WHICH

HAS BEEN MADE WITH THE SEC), AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN

THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, NSC AND THE PROPOSED TRANSACTION.

The Company’s stockholders will be able to obtain free copies

of the preliminary Proxy Statement and the definitive Proxy Statement (the latter if and when it is available), as well as other documents

containing important information about the Company, NSC and the proposed transaction once such documents are filed with the SEC, without

charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and the other documents filed with the SEC by

the Company can also be obtained, without charge, by directing a request to United States Steel Corporation, 600 Grant Street, Pittsburgh,

Pennsylvania 15219, Attention: Corporate Secretary; telephone 412-433-1121, or from the Company’s website www.ussteel.com.

Participants in the Solicitation

NSC, the Company and their directors, and certain of their executive

officers and employees may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in respect

of the proposed transaction. Information regarding the directors and executive officers of the Company who may, under the rules of the

SEC, be deemed participants in the solicitation of the Company’s stockholders in connection with the proposed transaction, including

a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement, a preliminary

version of which was filed with the SEC on January 24, 2024. Information about these persons is included in each company’s annual

proxy statement and in other documents subsequently filed with the SEC, and was included in the preliminary version of the Proxy Statement

filed with the SEC. Free copies of the Proxy Statement and such other materials may be obtained as described in the preceding paragraph.

Forward-Looking Statements

This communication contains information regarding the Company and NSC

that may constitute “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act

of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward-looking statements to be covered

by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements

by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,”

“project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,”

“future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion

of, among other things, statements expressing general views about future operating or financial results, operating or financial performance,

trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and

operational cash improvements and changes in the global economic environment, the construction or operation of new or existing facilities

or capabilities, statements regarding our greenhouse gas emissions reduction goals, as well as statements regarding the proposed transaction,

including the timing of the completion of the transaction. However, the absence of these words or similar expressions does not mean that

a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent

only the Company’s beliefs regarding future goals, plans and expectations about our prospects for the future and other events, many

of which, by their nature, are inherently uncertain and outside of the Company’s or NSC’s control. It is possible that the

Company’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and

financial condition indicated in these forward-looking statements. Management of the Company or NSC, as applicable, believes that these

forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such

forward-looking statements because such statements speak only as of the date when made. In addition, forward looking statements are subject

to certain risks and uncertainties that could cause actual results to differ materially from the Company’s or NSC’s historical

experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of the parties

to consummate the proposed transaction on a timely basis or at all; the timing, receipt and terms and conditions of any required governmental

and regulatory approvals of the proposed transaction; the occurrence of any event, change or other circumstances that could give rise

to the termination of the definitive agreement and plan of merger relating to the proposed transaction (the “Merger Agreement”);

the possibility that the Company’s stockholders may not approve the proposed transaction; the risks and uncertainties related to

securing the necessary stockholder approval; the risk that the parties to the Merger Agreement may not be able to satisfy the conditions

to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations

due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact the Company’s

ability to pursue certain business opportunities or strategic transactions; the risk that any announcements relating to the proposed transaction

could have adverse effects on the market price of the Company’s common stock or NSC’s common stock or American Depositary

Receipts; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to

the proposed transaction; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of the

Company or NSC to retain customers and retain and hire key personnel and maintain relationships with customers, suppliers, employees,

stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transaction

could distract management of the Company. The Company directs readers to its Quarterly Report on Form 10-Q for the quarter ended September

30, 2023 and Form 10-K for the year ended December 31, 2023, and the other documents it files with the SEC for other risks associated

with the Company’s future performance. These documents contain and identify important factors that could cause actual results to

differ materially from those contained in the forward-looking statements. Risks related to NSC’s forward-looking statements include,

but are not limited to, changes in regional and global macroeconomic conditions, particularly in Japan, China and the United States; excess

capacity and oversupply in the steel industry; unfair trade and pricing practices in NSC’s regional markets; the possibility of

low steel prices or excess iron ore supply; the possibility of significant increases in market prices of essential raw materials; the

possibility of depreciation of the value of the Japanese yen against the U.S. dollar and other major foreign currencies; the loss of market

share to substitute materials; NSC’s ability to reduce costs and improve operating efficiency; the possibility of not completing

planned alliances, acquisitions or investments, or such alliances, acquisitions or investments not having the anticipated results; natural

disasters and accidents or unpredictable events which may disrupt NSC’s supply chain as well as other events that may negatively

impact NSC’s business activities; risks relating to CO2 emissions and NSC’s challenge for carbon neutrality; the economic,

political, social and legal uncertainty of doing business in emerging economies; the possibility of incurring expenses resulting from

any defects in our products or incurring additional costs and reputational harm due to product defects of other steel manufacturers; the

possibility that we may be unable to protect our intellectual property rights or face intellectual property infringement claims by third

parties; changes in laws and regulations of countries where we operate, including trade laws and tariffs, as well as tax, environmental,

health and safety laws; and the possibility of damage to our reputation and business due to data breaches and data theft. All information

in this communication is as of the date above. Neither the Company nor NSC undertakes any duty to update any forward-looking statement

to conform the statement to actual results or changes in the Company’s or NSC’s expectations whether as a result of new information,

future events or otherwise, except as required by law.

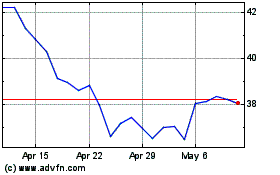

US Steel (NYSE:X)

Historical Stock Chart

From Apr 2024 to May 2024

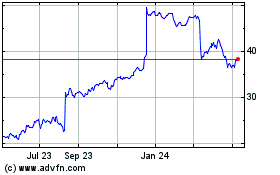

US Steel (NYSE:X)

Historical Stock Chart

From May 2023 to May 2024