Current Report Filing (8-k)

December 13 2021 - 10:33AM

Edgar (US Regulatory)

falseU S PHYSICAL THERAPY INC /NV000088597800008859782021-12-102021-12-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 10, 2021

U.S. PHYSICAL THERAPY, INC.

(Exact name of registrant as specified in its charter)

Registrant's telephone number, including area code: (713) 297-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions ( see General Instruction A.2. below):

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

ITEM 8.01 Other Event.

U.S. Physical Therapy, Inc. (the “Company”) reported today that the 3.75% reduction in the Medicare

physician fee schedule for therapy services, which was to be effective January 1, 2022, per the finalized rule by the Centers for Medicare and Medicaid Services (“CMS”), has been addressed in the Protecting Medicare and American Farmers from

Sequester Cuts Act (“Act”) signed into law on December 10, 2021. Based on various provisions in the Act, the Company now estimates that the

Medicare rate reduction for the full year of 2022 will be approximately 0.75%. In addition, the Act included a three-month extension of the 2% sequester relief applied to all Medicare payments through March 31, 2022, followed by 3 months of 1%

sequester relief through June 30, 2022. Sequester relief would then end on June 30, 2022. The Act did not address the 15% reduction in Medicare payments for services performed by a physical or occupational therapist assistant rather than a

physical or occupational therapist, which will begin on January 1, 2022.

Medicare represents approximately 30% of the Company’s physical therapy revenue. The Company estimates

that a total of approximately 35% of its physical therapy revenue, including certain of the Company’s commercial contracts, are tied to current year Medicare rates.

Summary of Risk Factors

Our business can be affected by certain risks, uncertainties and factors which include, but are not limited to:

See also Risk Factors in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2020 filed on March 1, 2021 and the additional Risk Factor noted

in Item 2 of our Quarterly Report on Form 10Q for the period ending September 30, 2021 filed on November 9, 2021.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

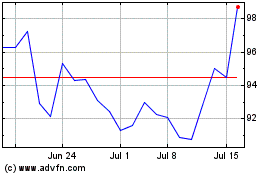

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

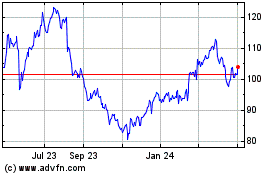

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

From Apr 2023 to Apr 2024