12A P6 production ramp lifts 22/28nm revenue

contribution to 32% 2023 Year to Date EPS totaled

NT$3.87

Third Quarter 2023 Overview1:

- Revenue: NT$57.07 billion (US$1.77 billion)

- Gross margin: 35.9%; Operating margin: 26.8%

- Revenue from 22/28nm: 32%

- Capacity utilization rate: 67%

- Net income attributable to shareholders of the parent:

NT$15.97 billion (US$495 million)

- Earnings per share: NT$1.29; earnings per ADS:

US$0.200

United Microelectronics Corporation (NYSE: UMC; TWSE:

2303) (“UMC” or “The Company”), a leading global semiconductor

foundry, today announced its consolidated operating results for the

third quarter of 2023.

Third quarter consolidated revenue was NT$57.07 billion,

increasing 1.4% QoQ from NT$56.30 billion in 2Q23. Compared to a

year ago, 3Q23 revenue declined 24.3% YoY from NT$75.39 billion in

3Q22. Consolidated gross margin for 3Q23 was 35.9%. Net income

attributable to the shareholders of the parent was NT$15.97

billion, with earnings per ordinary share of NT$1.29.

Jason Wang, co-president of UMC, said, “During the third

quarter, despite a 2.3% decrease in wafer shipments, quarterly

revenue and gross margin remained firm QoQ which primarily

attributed to the demand strength in computing and communication

segments, continuous product mix enhancement as well as favorable

currency movement. From end markets perspective, strength in

computing applications were propelled by LCD controller, WiFi,

codec and touch IC controllers while shipments in communication

segments increased due to demand for RF front end IC and networking

chips. Looking back at 2023, although foundry industry experienced

a significant decline in market demand, UMC maintained solid

structural profitability supported by firmness in blended ASP due

to continuous product mix optimization efforts and the increasing

contribution from specialty technologies. As UMC continues to

introduce new specialty technologies to solidify our

differentiation, we will strengthen the competitiveness of our

customers and enhance their respective market position.”

Co-president Wang said, “For the fourth quarter, with the recent

rush orders from PC and smartphones, we expect demand has gradually

stabilized. However, customers still employ a cautious and

conservative approach in maintaining lean inventory levels while

automotive business conditions appear challenging. For 2024, we

anticipate the production ramp of our 12A Phase 6 fab will further

enhance revenue contribution from 22/28nm continuing the robust

business traction for UMC. In addition, through our technology

leadership, we will ramp up our offering on 22nm derivative

products which will further our specialty technology product

pipeline.”

Co-president Wang continued, “Talent is UMC's most important and

highly valued asset. We respect the uniqueness of every employee

and are committed to creating a diverse, equal, and inclusive

workplace environment. Receiving the ‘HR Asia’ award for the ‘Best

Employer in Asia’ in July is a recognition of our years of effort.

Our goal is to create a culture of diversity and inclusivity in our

workplace that enables employees to leverage their strengths,

thereby playing a pivotal role in the Company's sustained growth

and enduring success.”

Summary of Operating Results

Operating Results

(Amount: NT$ million)

3Q23

2Q23

QoQ %

change

3Q22

YoY %

change

Operating Revenues

57,069

56,296

1.4

75,392

(24.3)

Gross Profit

20,461

20,252

1.0

35,664

(42.6)

Operating Expenses

(5,722)

(5,718)

0.1

(6,794)

(15.8)

Net Other Operating Income and

Expenses

573

1,141

(49.8)

1,287

(55.5)

Operating Income

15,312

15,675

(2.3)

30,157

(49.2)

Net Non-Operating Income and Expenses

3,336

2,810

18.7

2,189

52.5

Net Income Attributable to Shareholders of

the Parent

15,971

15,641

2.1

26,996

(40.8)

EPS (NT$ per share)

1.29

1.27

2.19

(US$ per ADS)

0.200

0.197

0.339

Third quarter operating revenues slightly grew by 1.4%

sequentially to NT$57.07 billion mainly lifted by a favorable

exchange rate and a better product mix from wafer shipments.

Revenue contribution from 40nm and below technologies increased to

45% of wafer revenue. Gross profit grew 1.0% QoQ to NT$20.46

billion, or 35.9% of revenue. Operating expenses remained flat QoQ

to NT$5.72 billion. Net other operating income declined to NT$573

million. Net non-operating income reached NT$3.34 billion mainly

reflecting the mark to market securities. Net income attributable

to shareholders of the parent amounted to NT$15.97 billion.

Earnings per ordinary share for the quarter was NT$1.29.

Earnings per ADS was US$0.200. The basic weighted average number of

shares outstanding in 3Q23 was 12,371,129,866, compared with

12,348,986,144 shares in 2Q23 and 12,305,516,644 shares in 3Q22.

The diluted weighted average number of shares outstanding was

12,566,773,628 in 3Q23, compared with 12,526,182,161 shares in 2Q23

and 12,635,661,561 shares in 3Q22. The fully diluted shares counted

on September 30, 2023 were approximately 12,609,732,000.

Detailed Financials Section

Operating revenues grew slightly to NT$57.07 billion. COGS

increased 1.6% to NT$36.61 billion. Gross profit grew 1.0% QoQ to

NT$20.46 billion partly due to a better product mix. Operating

expenses remained flat at NT$5.72 billion, as Sales & Marketing

and G&A increased 2.7% and 0.9% respectively, while R&D

declined 1.9% sequentially to NT$3.26 billion, representing 5.7% of

revenue. Net other operating income was NT$573 million. In 3Q23,

operating income decreased 2.3% QoQ to NT$15.31 billion.

COGS & Expenses

(Amount: NT$ million)

3Q23

2Q23

QoQ % change

3Q22

YoY % change

Operating Revenues

57,069

56,296

1.4

75,392

(24.3)

COGS

(36,608)

(36,044)

1.6

(39,728)

(7.9)

Depreciation

(8,485)

(8,467)

0.2

(9,622)

(11.8)

Other Mfg. Costs

(28,123)

(27,577)

2.0

(30,106)

(6.6)

Gross Profit

20,461

20,252

1.0

35,664

(42.6)

Gross Margin (%)

35.9%

36.0%

47.3%

Operating Expenses

(5,722)

(5,718)

0.1

(6,794)

(15.8)

Sales & Marketing

(735)

(716)

2.7

(1,061)

(30.7)

G&A

(1,731)

(1,715)

0.9

(2,428)

(28.8)

R&D

(3,255)

(3,317)

(1.9)

(3,304)

(1.5)

Expected Credit

Impairment gain (loss)

(1)

30

-

(1)

129.2

Net Other Operating

Income & Expenses

573

1,141

(49.8)

1,287

(55.5)

Operating Income

15,312

15,675

(2.3)

30,157

(49.2)

Net non-operating income in 3Q23 increased to NT$3.34 billion,

mainly from the NT$1.89 billion in net investment gain, the NT$0.62

billion in net interest income and the NT$0.51 billion in other

gain.

Non-Operating Income and

Expenses

(Amount: NT$ million)

3Q23

2Q23

3Q22

Non-Operating Income and Expenses

3,336

2,810

2,189

Net Interest Income and Expenses

617

974

139

Net Investment Gain and Loss

1,885

1,042

780

Exchange Gain and Loss

324

799

1,293

Other Gain and Loss

510

(5)

(23)

In 3Q23, cash inflow from operating activities was NT$19.06

billion. Cash outflow from investing activities amounted to

NT$17.72 billion, which included NT$17.91 billion in capital

expenditure, resulting in free cash inflow of NT$1.15 billion. Cash

outflow from financing was NT$27.60 billion, primarily the NT$45.02

billion in cash dividend distribution and the NT$21.21 billion in

other financial liabilities offset, the NT$21.37 billion in bank

loans, the NT$10.00 billion in bond issuance and the NT$7.43

billion increase in deposits-in. Net cash outflow in 3Q23 totaled

NT$22.46 billion. Over the next 12 months, the company expects to

repay NT$2.15 billion in bank loans.

Cash Flow Summary

(Amount: NT$ million)

For the 3-Month

Period Ended

Sep. 30, 2023

For the 3-Month

Period Ended

Jun. 30, 2023

Cash Flow from Operating Activities

19,059

13,760

Net income before tax

18,648

18,485

Depreciation & Amortization

9,928

9,931

Share of profit of associates and

joint ventures

(1,022)

(726)

Income tax paid

(1,216)

(11,845)

Changes in working capital &

others

(7,279)

(2,085)

Cash Flow from Investing Activities

(17,720)

(23,667)

Acquisition of PP&E

(17,245)

(24,139)

Acquisition of intangible assets

(560)

(684)

Others

85

1,156

Cash Flow from Financing Activities

(27,602)

1,061

Bank loans

21,369

939

Bonds Issued

10,000

-

Increase in deposits-in

7,425

287

Decrease in other financial

liabilities

(21,209)

-

Cash dividends

(45,018)

-

Others

(169)

(165)

Effect of Exchange Rate

3,808

109

Net Cash Flow

(22,455)

(8,737)

Beginning balance

163,097

171,834

Ending balance

140,642

163,097

Cash and cash equivalents decreased to NT$140.64 billion. Days

of inventory increased by 4 days to 89 days.

Current Assets

(Amount: NT$ billion)

3Q23

2Q23

3Q22

Cash and Cash Equivalents

140.64

163.10

180.65

Notes & Accounts Receivable

31.11

30.62

44.84

Days Sales Outstanding

49

47

53

Inventories, net

36.56

34.55

30.10

Days of Inventory

89

85

66

Total Current Assets

219.28

239.03

266.95

Current liabilities decreased to NT$92.07 billion. Long-term

credit/bonds increased to NT$49.38 billion. Total liabilities

declined to NT$197.26 billion, leading to a debt to equity ratio of

56%.

Liabilities

(Amount: NT$ billion)

3Q23

2Q23

3Q22

Total Current Liabilities

92.07

142.98

108.01

Accounts Payable

8.37

8.83

10.04

Short-Term Credit / Bonds

30.07

11.59

12.19

Payables on Equipment

15.95

13.01

19.40

Dividends Payable

-

45.02

-

Other

37.68

64.53

66.38

Long-Term Credit / Bonds

49.38

36.06

46.15

Long-Term Investment Liabilities

-

-

4.26

Total Liabilities

197.26

226.31

204.21

Debt to Equity

56%

69%

65%

Analysis of Revenue2

Revenue from Asia-Pacific grew to 58% while business from North

America remain unchanged at 27% of sales. Business from Europe

stayed firm at 12% while contribution from Japan decreased to

3%.

Revenue Breakdown by

Region

Region

3Q23

2Q23

1Q23

4Q22

3Q22

North America

27%

27%

31%

30%

23%

Asia Pacific

58%

56%

50%

54%

62%

Europe

12%

12%

11%

9%

9%

Japan

3%

5%

8%

7%

6%

Revenue contribution from 22/28nm grew to 32% of the wafer

revenue, while 40nm contribution was 13% of sales.

Revenue Breakdown by

Geometry

Geometry

3Q23

2Q23

1Q23

4Q22

3Q22

14nm and below

0%

0%

0%

0%

0%

14nm<x<=28nm

32%

29%

26%

28%

25%

28nm<x<=40nm

13%

12%

15%

17%

17%

40nm<x<=65nm

19%

23%

19%

17%

18%

65nm<x<=90nm

8%

10%

10%

9%

8%

90nm<x<=0.13um

12%

10%

12%

12%

12%

0.13um<x<=0.18um

9%

9%

10%

10%

10%

0.18um<x<=0.35um

5%

5%

6%

5%

8%

0.5um and above

2%

2%

2%

2%

2%

Revenue from fabless customers accounted for 79% of revenue.

Revenue Breakdown by Customer

Type

Customer Type

3Q23

2Q23

1Q23

4Q22

3Q22

Fabless

79%

79%

77%

81%

83%

IDM

21%

21%

23%

19%

17%

Revenue from the communication segment accounted for 46%, while

business from consumer represented 23%. Business from computing

applications grew to 13% as other segments declined to 18% of

revenue.

Revenue Breakdown by

Application (1)

Application

3Q23

2Q23

1Q23

4Q22

3Q22

Computer

13%

9%

9%

12%

14%

Communication

46%

44%

44%

45%

45%

Consumer

23%

26%

24%

25%

27%

Others

18%

21%

23%

18%

14%

(1) Computer consists of ICs such as CPU, GPU, HDD

controllers, DVD/CD-RW control ICs, PC chipset, audio codec,

keyboard controller, monitor scaler, USB, I/O chipset, WLAN.

Communication consists of handset components, broadband,

bluetooth, Ethernet, LAN, DSP, etc. Consumer consists of ICs

used for DVD players, DTV, STB, MP3/MP4, flash controller, game

consoles, DSC, smart cards, toys, etc.

Blended ASP Trend

Blended average selling price (ASP) grew slightly in 3Q23.

(To view blended ASP trend, please click here for 3Q23 ASP)

Shipment and Utilization Rate3

Wafer shipments declined by 2.3% QoQ to 1,788K in the third

quarter, while quarterly capacity was 2,659K. Overall utilization

rate in 3Q23 was 67%.

Wafer Shipments

3Q23

2Q23

1Q23

4Q22

3Q22

Wafer Shipments (8” K equivalents)

1,788

1,831

1,826

2,213

2,597

Quarterly Capacity Utilization

Rate

3Q23

2Q23

1Q23

4Q22

3Q22

Utilization Rate

67%

71%

70%

90%

100%+

Total Capacity (8” K equivalents)

2,659

2,626

2,522

2,543

2,539

Capacity4

Total capacity in the third quarter increased to 2,659K 8-inch

equivalent wafers. Capacity will grow in the fourth quarter of 2023

to 2,710K 8-inch equivalent wafers, primarily reflecting the

22/28nm capacity expansion at 12A Phase 6.

Annual Capacity in

thousands of wafers

Quarterly Capacity in

thousands of wafers

FAB

Geometry (um)

2022

2021

2020

2019

FAB

4Q23E

3Q23

2Q23

1Q23

WTK

6"

5 – 0.15

335

329

371

370

WTK

6"

83

83

82

80

8A

8"

3 – 0.11

765

755

802

825

8A

8"

207

207

207

189

8C

8"

0.35 – 0.11

459

459

452

436

8C

8"

119

120

120

113

8D

8"

0.18 – 0.09

410

380

371

359

8D

8"

118

111

109

101

8E

8"

0.6 – 0.14

469

457

449

426

8E

8"

131

122

122

116

8F

8"

0.18 – 0.11

550

514

485

434

8F

8"

145

145

145

136

8S

8"

0.18 – 0.11

443

408

373

372

8S

8"

114

112

112

109

8N

8"

0.5 – 0.11

952

917

917

831

8N

8"

254

250

248

244

12A

12"

0.13 – 0.014

1,170

1,070

1,044

997

12A

12"

346

333

321

305

12i

12"

0.13 – 0.040

655

641

628

595

12i

12"

164

164

164

162

12X

12"

0.080 – 0.022

314

284

217

203

12X

12"

80

80

80

78

12M

12"

0.13 – 0.040

436

395

391

98

12M

12"

110

110

110

108

Total(1)

10,031

9,453

9,188

8,148

Total

2,710

2,659

2,626

2,522

YoY Growth Rate

6%

3%

13%

6%

(1) One 6-inch wafer is converted into 0.5625 (62/82) 8-inch

equivalent wafer; one 12-inch wafer is converted into 2.25 (122/82)

8-inch equivalent wafers. Total capacity figures are expressed in

8-inch equivalent wafers.

CAPEX

CAPEX spending in 3Q23 totaled US$0.57 billion, as total

expenditure year to date reached US$2.4 billion. 2023 cash-based

CAPEX budget will be US$3.0 billion.

Capital Expenditure by Year - in

US$ billion

Year

2022

2021

2020

2019

2018

CAPEX

$ 2.7

$ 1.8

$ 1.0

$ 0.6

$ 0.7

2023 CAPEX Plan

8"

12"

Total

10%

90%

US$3.0 billion

Fourth Quarter 2023 Outlook & Guidance

Quarter-over-Quarter Guidance:

- Wafer Shipments: Will decline by approximately 5%

- ASP in USD: Will remain flat

- Gross Profit Margin: Will be in the low-30% range

- Capacity Utilization: low-60% range

- 2023 CAPEX: US$3.0 billion

Recent Developments / Announcements

Aug. 17, 2023

Faraday Announces Infineon’s SONOS eFlash

Qualified on UMC’s 40nm ULP Process

Please visit UMC’s website for further details

regarding the above announcements

Conference Call / Webcast Announcement

Wednesday, October 25, 2023

Time: 5:00 PM (Taipei) / 5:00 AM (New York) / 10:00 AM

(London)

Dial-in numbers and Access Codes:

Taiwan Number:

02 3396 1191

Taiwan Toll Free:

0080 185 4007

USA Toll Free:

1 866 212 5567

Other Areas:

+886 2 3396 1191

Access Code:

9517025#

A live webcast and replay of the 3Q23 results

announcement will be available at www.umc.com under the “Investors

/ Events” section.

About UMC

UMC (NYSE: UMC, TWSE: 2303) is a leading global semiconductor

foundry company. The company provides high quality IC fabrication

services, focusing on logic and various specialty technologies to

serve all major sectors of the electronics industry. UMC’s

comprehensive IC processing technologies and manufacturing

solutions include logic/mixed-signal, embedded high-voltage,

embedded non-volatile-memory, RFSOI and BCD. UMC has total 12 fabs

in production with combined capacity of more than 850,000 8-inch

equivalent wafers per month, and all of them are certified with

IATF 16949 automotive quality standard. Most of UMC's 12-inch and

8-inch fabs with its core R&D are located in Taiwan, with

additional ones throughout Asia. UMC is headquartered in Hsinchu,

Taiwan, plus local offices in China, United States, Europe, Japan,

Korea and Singapore, with worldwide total 20,000 employees. For

more information, please visit: https://www.umc.com.

Safe Harbor Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the United States Securities Act of

1933, as amended, and Section 21E of the United States Securities

Exchange Act of 1934, as amended, and as defined in the United

States Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to,

statements regarding anticipated financial results for the third

quarter of 2023; the expected wafer shipment and ASP; the

anticipated annual budget; capex strategies; environmental

protection goals and water management strategies; impact of foreign

currency exchange rates; expected foundry capacities; the ability

to obtain new business opportunities; and information under the

heading “Fourth Quarter of 2023 Outlook and Guidance.”

These forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause the actual

performance, financial condition or results of operations of UMC to

be materially different from what is stated or may be implied in

such forward-looking statements. Investors are cautioned that

actual events and results could differ materially from those

statements as a result of a number of factors including, but not

limited to: (i) dependence upon the frequent introduction of new

services and technologies based on the latest developments in the

industry in which UMC operates; (ii) the intensely competitive

semiconductor, communications, consumer electronics and computer

industries and markets; (iii) the risks associated with

international business activities; (iv) dependence upon key

personnel; (v) general economic and political conditions; (vi)

possible disruptions in commercial activities caused by natural and

human-induced events and disasters, including natural disasters,

terrorist activity, armed conflict and highly contagious diseases;

(vii) reduced end-user purchases relative to expectations and

orders; and (viii) fluctuations in foreign currency exchange rates.

Further information regarding these and other risk factors is

included in UMC’s filings with the United States Securities and

Exchange Commission, including its Annual Report on Form 20-F. All

information provided in this release is as of the date of this

release and are based on assumptions that UMC believes to be

reasonable as of this date, and UMC does not undertake any

obligation to update any forward-looking statement as a result of

new information, future events or otherwise, except as required

under applicable law.

The financial statements included in this release are prepared

and published in accordance with Taiwan International Financial

Reporting Standards, or TIFRSs, recognized by the Financial

Supervisory Commission in the ROC, which is different from

International Financial Reporting Standards, or IFRSs, issued by

the International Accounting Standards Board. Investors are

cautioned that there may be significant differences between TIFRSs

and IFRSs. In addition, TIFRSs and IFRSs differ in certain

significant respects from generally accepted accounting principles

in the ROC and generally accepted accounting principles in the

United States.

- FINANCIAL TABLES TO FOLLOW -

UNITED MICROELECTRONICS

CORPORATION AND SUBSIDIARIES

Consolidated Condensed Balance

Sheet

As of September 30, 2023 Figures in Millions of New Taiwan Dollars

(NT$) and U.S. Dollars (US$) September 30, 2023 US$

NT$ % Assets Current assets Cash and cash equivalents

4,360

140,642

25.7%

Notes & Accounts receivable, net

964

31,105

5.7%

Inventories, net

1,133

36,561

6.7%

Other current assets

340

10,972

2.0%

Total current assets

6,797

219,280

40.1%

Non-current assets Funds and investments

2,197

70,890

13.0%

Property, plant and equipment

6,583

212,367

38.8%

Right-of-use assets

226

7,279

1.3%

Other non-current assets

1,161

37,455

6.8%

Total non-current assets

10,167

327,991

59.9%

Total assets

16,964

547,271

100.0%

Liabilities Current liabilities Short-term loans

545

17,590

3.2%

Payables

1,646

53,108

9.7%

Current portion of long-term liabilities

387

12,484

2.3%

Other current liabilities

276

8,888

1.6%

Total current liabilities

2,854

92,070

16.8%

Non-current liabilities Bonds payable

867

27,977

5.1%

Long-term loans

663

21,403

3.9%

Lease liabilities, noncurrent

155

5,009

0.9%

Other non-current liabilities

1,575

50,796

9.3%

Total non-current liabilities

3,260

105,185

19.2%

Total liabilities

6,114

197,255

36.0%

Equity Equity attributable to the parent company Capital

3,876

125,031

22.9%

Additional paid-in capital

416

13,423

2.4%

Retained earnings and other components of equity

6,547

211,223

38.6%

Total equity attributable to the parent company

10,839

349,677

63.9%

Non-controlling interests

11

339

0.1%

Total equity

10,850

350,016

64.0%

Total liabilities and equity

16,964

547,271

100.0%

Note: New Taiwan Dollars have been translated into

U.S. Dollars at the September 30, 2023 exchange rate of NT $32.26

per U.S. Dollar.

UNITED MICROELECTRONICS

CORPORATION AND SUBSIDIARIES

Consolidated Condensed

Statements of Comprehensive Income

Figures in Millions of New Taiwan

Dollars (NT$) and U.S. Dollars (US$)

Except Per Share and Per ADS

Data

Year over Year

Comparison

Quarter over Quarter

Comparison

Three-Month Period Ended

Three-Month Period Ended

September 30, 2023

September 30, 2022

Chg.

September 30, 2023

June 30, 2023

Chg.

US$

NT$

US$

NT$

%

US$

NT$

US$

NT$

%

Operating revenues

1,769

57,069

2,337

75,392

(24.3%)

1,769

57,069

1,745

56,296

1.4%

Operating costs

(1,135)

(36,608)

(1,231)

(39,728)

(7.9%)

(1,135)

(36,608)

(1,117)

(36,044)

1.6%

Gross profit

634

20,461

1,106

35,664

(42.6%)

634

20,461

628

20,252

1.0%

35.9%

35.9%

47.3%

47.3%

35.9%

35.9%

36.0%

36.0%

Operating expenses

- Sales and marketing

expenses

(23)

(735)

(33)

(1,061)

(30.7%)

(23)

(735)

(22)

(716)

2.7%

- General and administrative

expenses

(53)

(1,731)

(76)

(2,428)

(28.8%)

(53)

(1,731)

(53)

(1,715)

0.9%

- Research and development

expenses

(101)

(3,255)

(102)

(3,304)

(1.5%)

(101)

(3,255)

(103)

(3,317)

(1.9%)

- Expected credit impairment gain

(loss)

(0)

(1)

(0)

(1)

129.2%

(0)

(1)

1

30

-

Subtotal

(177)

(5,722)

(211)

(6,794)

(15.8%)

(177)

(5,722)

(177)

(5,718)

0.1%

Net other operating income and

expenses

18

573

40

1,287

(55.5%)

18

573

35

1,141

(49.8%)

Operating income

475

15,312

935

30,157

(49.2%)

475

15,312

486

15,675

(2.3%)

26.8%

26.8%

40.0%

40.0%

26.8%

26.8%

27.8%

27.8%

Net non-operating income and

expenses

103

3,336

68

2,189

52.5%

103

3,336

87

2,810

18.7%

Income from continuing

operations

before income tax

578

18,648

1,003

32,346

(42.3%)

578

18,648

573

18,485

0.9%

32.7%

32.7%

42.9%

42.9%

32.7%

32.7%

32.8%

32.8%

Income tax expense

(83)

(2,682)

(155)

(5,004)

(46.4%)

(83)

(2,682)

(80)

(2,588)

3.6%

Net income

495

15,966

848

27,342

(41.6%)

495

15,966

493

15,897

0.4%

28.0%

28.0%

36.3%

36.3%

28.0%

28.0%

28.2%

28.2%

Other comprehensive income

(loss)

221

7,138

134

4,336

64.6%

221

7,138

(8)

(238)

-

Total comprehensive income

(loss)

716

23,104

982

31,678

(27.1%)

716

23,104

485

15,659

47.5%

Net income attributable to:

Shareholders of the parent

495

15,971

837

26,996

(40.8%)

495

15,971

485

15,641

2.1%

Non-controlling interests

(0)

(5)

11

346

-

(0)

(5)

8

256

-

Comprehensive income (loss)

attributable to:

Shareholders of the parent

716

23,109

971

31,332

(26.2%)

716

23,109

477

15,403

50.0%

Non-controlling interests

(0)

(5)

11

346

-

(0)

(5)

8

256

-

Earnings per share-basic

0.040

1.29

0.068

2.19

0.040

1.29

0.039

1.27

Earnings per ADS (2)

0.200

6.45

0.339

10.95

0.200

6.45

0.197

6.35

Weighted average number of

shares

outstanding (in millions)

12,371

12,306

12,371

12,349

Notes:

(1) New Taiwan Dollars have been

translated into U.S. Dollars at the September 30, 2023 exchange

rate of NT $32.26 per U.S. Dollar.

(2) 1 ADS equals 5 common

shares.

UNITED MICROELECTRONICS

CORPORATION AND SUBSIDIARIES

Consolidated Condensed Balance

Sheet

Figures in Millions of New Taiwan Dollars (NT$) and U.S. Dollars

(US$) Except Per Share and Per ADS Data For the Three-Month

Period Ended For the Nine-Month Period Ended September 30, 2023

September 30, 2023 US$ NT$ % US$ NT$ % Operating revenues

1,769

57,069

100.0%

5,195

167,575

100.0%

Operating costs

(1,135)

(36,608)

(64.1%)

(3,337)

(107,637)

(64.2%)

Gross profit

634

20,461

35.9%

1,858

59,938

35.8%

Operating expenses - Sales and marketing expenses

(23)

(735)

(1.3%)

(74)

(2,402)

(1.4%)

- General and administrative expenses

(53)

(1,731)

(3.1%)

(173)

(5,547)

(3.3%)

- Research and development expenses

(101)

(3,255)

(5.7%)

(289)

(9,339)

(5.6%)

- Expected credit impairment gain (loss)

(0)

(1)

(0.0%)

2

67

0.0%

Subtotal

(177)

(5,722)

(10.1%)

(534)

(17,221)

(10.3%)

Net other operating income and expenses

18

573

1.0%

85

2,750

1.6%

Operating income

475

15,312

26.8%

1,409

45,467

27.1%

Net non-operating income and expenses

103

3,336

5.9%

335

10,795

6.5%

Income from continuing operations

578

18,648

32.7%

1,744

56,262

33.6%

before income tax Income tax expense

(83)

(2,682)

(4.7%)

(248)

(8,015)

(4.8%)

Net income

495

15,966

28.0%

1,496

48,247

28.8%

Other comprehensive income (loss)

221

7,138

12.5%

317

10,225

6.1%

Total comprehensive income (loss)

716

23,104

40.5%

1,813

58,472

34.9%

Net income attributable to: Shareholders of the parent

495

15,971

28.0%

1,482

47,795

28.5%

Non-controlling interests

(0)

(5)

(0.0%)

14

452

0.3%

Comprehensive income (loss) attributable to: Shareholders

of the parent

716

23,109

40.5%

1,799

58,020

34.6%

Non-controlling interests

(0)

(5)

(0.0%)

14

452

0.3%

Earnings per share-basic

0.040

1.29

0.120

3.87

Earnings per ADS (2)

0.200

6.45

0.600

19.35

Weighted average number of shares outstanding (in millions)

12,371

12,356

Notes: (1) New Taiwan Dollars have been translated into U.S.

Dollars at the September 30, 2023 exchange rate of NT $32.26 per

U.S. Dollar. (2) 1 ADS equals 5 common shares.

UNITED MICROELECTRONICS

CORPORATION AND SUBSIDIARIES

Consolidated Condensed

Statement of Cash Flows

For The Nine-Month Period Ended September 30, 2023 Figures in

Millions of New Taiwan Dollars (NT$) and U.S. Dollars (US$)

US$ NT$

Cash flows from operating activities : Net income

before tax

1,744

56,262

Depreciation & Amortization

923

29,763

Share of profit of associates and joint ventures

(155)

(4,996)

Income tax paid

(496)

(15,997)

Changes in working capital & others

(163)

(5,249)

Net cash provided by operating activities

1,853

59,783

Cash flows from investing activities : Acquisition of

property, plant and equipment

(2,205)

(71,140)

Acquisition of intangible assets

(55)

(1,772)

Others

60

1,939

Net cash used in investing activities

(2,200)

(70,973)

Cash flows from financing activities : Increase in

short-term loans

545

17,590

Proceeds from bonds issued

310

10,000

Proceeds from long-term loans

477

15,382

Repayments of long-term loans

(346)

(11,149)

Increase in guarantee deposits

301

9,703

Decrease in other financial liabilities

(657)

(21,209)

Cash dividends

(1,395)

(45,018)

Others

(16)

(493)

Net cash used in financing activities

(781)

(25,194)

Effect of exchange rate changes on cash and cash equivalents

100

3,207

Net decrease in cash and cash equivalents

(1,028)

(33,177)

Cash and cash equivalents at beginning of period

5,388

173,819

Cash and cash equivalents at end of period

4,360

140,642

Note: New Taiwan Dollars have been translated

into U.S. Dollars at the September 30, 2023 exchange rate of NT

$32.26 per U.S. Dollar.

1Unless otherwise stated, all financial figures discussed in

this announcement are prepared in accordance with TIFRSs recognized

by Financial Supervisory Commission in the ROC, which is different

from IFRSs issued by the International Accounting Standards Board.

They represent comparisons among the three-month period ending

September 30, 2023, the three-month period ending June 30, 2023,

and the equivalent three-month period that ended September 30,

2022. For all 3Q23 results, New Taiwan Dollar (NT$) amounts have

been converted into U.S. Dollars at the September 30, 2023 exchange

rate of NT$ 32.26 per U.S. Dollar.

2Revenue in this section represents wafer sales

3Utilization Rate = Quarterly Wafer Out / Quarterly Capacity

4Estimated capacity numbers are based on calculated maximum

output rather than designed capacity. The actual capacity numbers

may differ depending upon equipment delivery schedules, pace of

migration to more advanced process technologies, and other factors

affecting production ramp-up.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231025926162/en/

Michael Lin / David Wong UMC, Investor Relations +

886-2-2658-9168, ext. 16900 jinhong_lin@umc.com

david_wong@umc.com

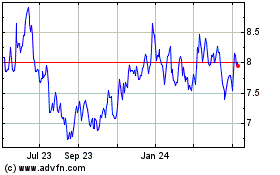

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Oct 2024 to Nov 2024

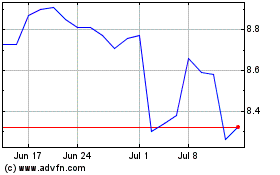

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Nov 2023 to Nov 2024