Current Report Filing (8-k)

May 05 2023 - 4:17PM

Edgar (US Regulatory)

Allison Transmission Holdings Inc false 0001411207 --12-31 0001411207 2023-05-03 2023-05-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 3, 2023

ALLISON TRANSMISSION HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-35456 |

|

26-0414014 |

| (State or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| One Allison Way, Indianapolis, Indiana |

|

|

|

46222 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (317) 242-5000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

ALSN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On May 4, 2023, the Board of Directors (the “Board”) of Allison Transmission Holdings, Inc. (the “Company”), acting upon the recommendation of the Nominating and Corporate Governance Committee of the Board, approved and adopted an amendment and restatement of the Company’s Sixth Amended and Restated Bylaws (as so amended, the “Amended and Restated Bylaws”).

The amendments address the universal proxy rules adopted by the U.S. Securities and Exchange Commission by clarifying that no person may solicit proxies in support of a director nominee other than the Board’s nominees, unless such person has complied with Rule 14a-19 under the Securities Exchange Act of 1934, as amended, including applicable notice and solicitation requirements. Further, any stockholder directly or indirectly soliciting proxies from other stockholders must use a proxy card color other than white, with the white proxy card being reserved for exclusive use by the Board.

The amendments also revise the advance notice disclosure requirements contained in the Amended and Restated Bylaws to require the stockholder proposing business or nominating directors to provide additional information about the stockholder’s ownership of securities in the Company and permit the Board to request that such stockholder, or such proposed candidate for nomination as a director, if applicable, furnish additional information that is reasonably requested by the Board, including such candidate’s intent to serve the full term. Further, the Amended and Restated Bylaws update the majority vote standard for proposals other than director elections to a majority of votes cast, which provides that both abstentions and broker non-votes will have no effect on the outcome of such proposals. Additionally, the Amended and Restated Bylaws adopt a federal forum provision requiring all claims under the Securities Act of 1933, as amended, to be brought in federal courts. The amendments also update provisions regarding notice of an adjournment of any meeting of stockholders and the availability of the list of stockholders entitled to vote at a meeting of stockholders, each to align with recent amendments to the Delaware General Corporation Law, as amended.

The amendments also include certain technical, conforming, modernizing or clarifying changes to the Amended and Restated Bylaws.

The foregoing description of the changes contained in the Amended and Restated Bylaws does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended and Restated Bylaws, a copy of which is attached hereto as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 5.07 |

Submission of Matters to a Vote of Security Holders. |

On May 3, 2023, the Company held its annual meeting of stockholders. At the meeting, stockholders took the following actions:

| |

• |

|

elected ten directors for one-year terms ending at the 2024 annual meeting of stockholders (Proposal 1); |

| |

• |

|

ratified the appointment of PricewaterhouseCoopers LLP (“PwC”) as the Company’s independent registered public accounting firm for 2023 (Proposal 2); and |

| |

• |

|

approved, in an advisory, non-binding vote, the compensation paid to the Company’s named executive officers (Proposal 3). |

The vote tabulation for each proposal follows:

Proposal 1 – Election of Directors.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NOMINEES |

|

FOR |

|

|

AGAINST |

|

|

ABSTAIN |

|

|

BROKER NON-VOTES |

|

| Judy L. Altmaier |

|

|

77,392,979 |

|

|

|

2,490,185 |

|

|

|

35,009 |

|

|

|

4,854,619 |

|

| D. Scott Barbour |

|

|

78,809,189 |

|

|

|

1,078,005 |

|

|

|

30,979 |

|

|

|

4,854,619 |

|

| Philip J. Christman |

|

|

79,065,116 |

|

|

|

822,616 |

|

|

|

30,441 |

|

|

|

4,854,619 |

|

| David C. Everitt |

|

|

75,984,575 |

|

|

|

3,903,089 |

|

|

|

30,509 |

|

|

|

4,854,619 |

|

| David S. Graziosi |

|

|

75,238,746 |

|

|

|

4,506,588 |

|

|

|

172,839 |

|

|

|

4,854,619 |

|

| Carolann I. Haznedar |

|

|

77,751,927 |

|

|

|

2,130,509 |

|

|

|

35,737 |

|

|

|

4,854,619 |

|

| Richard P. Lavin |

|

|

67,222,059 |

|

|

|

12,665,151 |

|

|

|

30,963 |

|

|

|

4,854,619 |

|

| Sasha Ostojic |

|

|

79,512,082 |

|

|

|

369,902 |

|

|

|

36,189 |

|

|

|

4,854,619 |

|

| Gustave F. Perna |

|

|

78,671,970 |

|

|

|

1,215,277 |

|

|

|

30,926 |

|

|

|

4,854,619 |

|

| Krishna Shivram |

|

|

78,575,586 |

|

|

|

1,311,284 |

|

|

|

31,303 |

|

|

|

4,854,619 |

|

Proposal 2 – Ratification of Appointment of PwC.

|

|

|

|

|

| FOR |

|

AGAINST |

|

ABSTAIN |

| 82,952,856 |

|

1,798,198 |

|

21,738 |

Proposal 3 – Advisory Vote on Executive Compensation.

|

|

|

|

|

|

|

| FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

| 74,848,658 |

|

4,936,199 |

|

133,316 |

|

4,854,619 |

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Allison Transmission Holdings, Inc. |

|

|

|

|

| Date: May 5, 2023 |

|

|

|

By: |

|

/s/ Eric C. Scroggins |

|

|

|

|

Name: |

|

Eric C. Scroggins |

|

|

|

|

Title: |

|

Vice President, General Counsel and Secretary |

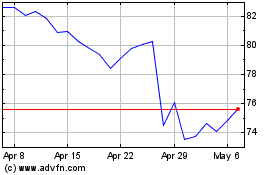

Transmission (NYSE:ALSN)

Historical Stock Chart

From Aug 2024 to Sep 2024

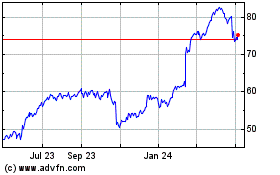

Transmission (NYSE:ALSN)

Historical Stock Chart

From Sep 2023 to Sep 2024