Europe Car Sales Dip on Weak Economy - Analyst Blog

May 16 2012 - 12:30PM

Zacks

The European Automobile Manufacturers’ Association or ACEA

reported a 6.5% fall in car sales to 1.06 million units in April as

consumers stayed away from showrooms in a weak

economy triggered by the sovereign-debt crisis in the Euro-zone.

Most of the major markets recorded a double-digit fall in new

car registrations in the continent during the month, except Germany

and U.K.

Sales in Italy dipped 18% to 129,663 vehicles, Spain plunged 22%

to 56,250 units and France slid 1.9% to 166,552 units. However,

sales in Germany scaled up 2.9% to 274,066 units and in U.K. rose

3.3% to 142,322 units.

All the major automakers except Daimler AG

(DDAIF) and Bayerische Motoren Werke AG (“BMW”), posted declines in

sales. Both Daimler and BMW benefited from higher sales of premium

brands in Germany.

Among the U.S. automakers, General Motors

Company (GM) posted an 11.1% fall in sales to 85,493

units, driven by lower Opel/Vauxhall (16.9%) and GM brand (50%)

sales while Ford Motor Co. (F) saw an 8.3% drop in

sales to 79,223 units.

Among the Japanese automakers, Toyota Motor

Corp.’s (TM) sales ebbed 13.2% to 41,259 units and

Nissan Motor Co. (NSANY) sales shrank 19.5% to

29,719 units. However, Korean automaker Hyundai Motor

Co. (HYMLF) saw a 1.3% rise in sales to 35,977 units.

In Europe, the top automaker Volkswagen AG

(VLKAY) reported a 5.2% decline in sales to 261,571 units driven by

lower sales of the namesake brand (8.4%) and Seat brand (22.4%).

However, both of its Audi and Skoda brands did well during the

month with 4.4% and 4% rise in sales, respectively.

The second biggest Paris-based carmaker PSA

Group (PEUGY) revealed a marginal 258 units fall in sales

to 132,466 units due to a 4% decrease in Peugeot brand sales.

Meanwhile, the third largest automaker, Renault Group, saw a

15.1% decline in sales to 89,724 units. The company’s CEO, Carlos

Ghosn, stated that automakers in Europe will continue to suffer if

the government doesn’t allow them to restructure and downsize

workforce. Sales at Fiat Group (FIATY) tumbled

11.3% to 75,462 units driven by lower sales of the namesake brand

(10.9%) and Alfa Romeo (31.3%).

However, sales at the world’s largest luxury carmaker BMW rose

2.6% to 68,334 units while sales at Daimler grew 1.1% to 56,677

vehicles. The improvement in sales was led by strong demand for

their premium luxury lineups such as BMW brand and

Mercedes-Benz.

Automakers are still concerned about car sales in Europe in the

near term due to the continuous negative impact (such as lower

consumer confidence) from the debt crisis. Some automakers have

projected that the European auto market will shrink 5% in

2012.

DAIMLER AG (DDAIF): Free Stock Analysis Report

FORD MOTOR CO (F): Free Stock Analysis Report

FIAT SPA (FIATY): Free Stock Analysis Report

GENERAL MOTORS (GM): Free Stock Analysis Report

NISSAN ADR (NSANY): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

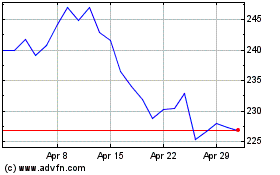

Toyota Motor (NYSE:TM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Toyota Motor (NYSE:TM)

Historical Stock Chart

From Nov 2023 to Nov 2024