Standard General Sets the Record Straight Regarding Its Pending Acquisition of TEGNA

October 06 2022 - 1:40PM

Business Wire

Notes Misleading Assertions in

Congressional Letter

Transaction Will Create the Largest

Minority-Owned and Female-Led Broadcast Station Group in U.S.

History and Yield Significant Public Interest Benefits

Standard General Highlights Commitment to

Localism of TEGNA Stations

Standard General L.P. (“Standard General”) today issued the

following statement regarding its pending acquisition of TEGNA Inc.

(NYSE: TGNA):

Standard General’s proposed acquisition of TEGNA will yield

significant public interest benefits without any countervailing

public interest harms, including creating the largest

minority-owned and female-led broadcast station group in U.S.

history. We were therefore disappointed to see the FCC petitioners

enlist the involvement of Speaker Pelosi and Congressman Pallone by

misleading them with the same false statements they have been

making to the FCC.

- While the Pelosi-Pallone letter decries the UHF Discount, the

TEGNA transaction does not rely on the UHF Discount in any

way.

- While the Pelosi-Pallone letter complains of media

consolidation, TEGNA will actually be smaller after the proposed

transaction, creating the opposite of consolidation.

- While the Pelosi-Pallone letter repeats the petitioners’ claim

that Standard General will supplant local news content with news

produced in DC, there is utterly no support in the FCC record for

that claim and Standard General has made clear in the record that

it will not.

- The Pelosi-Pallone letter speculates that Standard General will

cut station jobs at TEGNA, when in fact Standard General made a

commitment in the FCC record that it was not planning any such

actions — a commitment no prior FCC broadcast station applicant has

ever made.

- The Pelosi-Pallone letter falsely claims that Standard General

stated several years ago that TEGNA has “too many employees,” when

in fact, Standard General publicly protested TEGNA’s furlough of

employees during the pandemic.

- The Pelosi-Pallone letter speculates about the influence of

foreign ownership, when 100% of the voting shares and the right to

appoint the entire TEGNA board is held by a U.S citizen.

- The Pelosi-Pallone letter speculates about “price increases on

American families” when TEGNA, as a broadcaster, makes its content

available to the public for free over-the-air. Only cable companies

decide what price their own subscribers pay.

We are therefore very disappointed to see the petitioners’

package of misstatements at the FCC being used to also mislead our

elected representatives into applying improper pressure upon the

FCC.

Soo Kim and Deb McDermott have a proven track record of

enhancing stations’ service to their local communities, increasing

local news output, and investing in the resources that stations

need to compete successfully. Standard General has increased

newsroom staffing at its current stations by 28% since acquiring

them in February 2021, while, in comparison, the employee headcount

at other major broadcasters, including TEGNA, dropped during the

pandemic. Soo Kim and Deb McDermott are committed to bringing that

same dedication to competition and localism to the TEGNA stations,

creating the largest minority-owned and female-led television

station group in U.S. history and dramatically increasing minority

broadcast ownership and viewpoint diversity.

The proposed TEGNA transaction complies with all FCC rules

without the need for any waivers, divestitures, or special

treatment. Standard General seeks nothing from the FCC other than

to be treated in the same fashion as other applicants whose

transactions were promptly approved in the past two years,

including Gray’s acquisition of Meredith, which unlike the TEGNA

transaction, involved a station divestiture to comply with FCC

local ownership rules, and Scripps’ acquisition of Ion, which

involved the divestiture of 23 stations to meet FCC ownership

limits. The Gray-Meredith transaction was approved in less than six

months, and the Scripps-Ion transaction was approved in less than

three months. The TEGNA transaction has been under review at the

FCC for almost nine months at this point, and the time has come to

approve the transaction and unleash an almost 300% increase in the

number of minority-owned TV stations in the U.S., bringing

badly-needed diversity to the nation’s broadcast station

ownership.

We continue to work collaboratively with FCC staff in their

review of the proposed transaction.

About Standard General

Standard General was founded in 2007 and manages capital for

public and private pension funds, endowments, foundations, and

high-net-worth individuals. Standard General is a

minority-controlled and operated organization. Mr. Kim is supported

by a diverse, highly experienced 17-person team, including seven

investment professionals with over 120 years of collective

investing experience.

Cautionary Statement Regarding Forward-Looking

Statements

This communication includes forward-looking statements within

the meaning of the “safe harbor” provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements are based on a number of assumptions about future events

and are subject to various risks, uncertainties and other factors

that may cause actual results to differ materially from the views,

beliefs, projections and estimates expressed in such statements.

These risks, uncertainties and other factors include, but are not

limited to, the following: (1) the timing, receipt and terms and

conditions of the required governmental or regulatory approvals of

the proposed transaction and the related transactions involving the

parties that could reduce the anticipated benefits of or cause the

parties to abandon the proposed transaction, (2) risks related to

the satisfaction of the conditions to closing the proposed

transaction (including the failure to obtain necessary regulatory

approvals), and the related transactions involving the parties, in

the anticipated timeframe or at all, (3) the risk that any

announcements relating to the proposed transaction could have

adverse effects on the market price of TEGNA’s common stock, (4)

disruption from the proposed transaction making it more difficult

to maintain business and operational relationships, including

retaining and hiring key personnel and maintaining relationships

with TEGNA’s customers, vendors and others with whom it does

business, (5) the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement entered into pursuant to the proposed transaction or of

the transactions involving the parties, (6) risks related to

disruption of management’s attention from TEGNA’s ongoing business

operations due to the proposed transaction, (7) significant

transaction costs, (8) the risk of litigation and/or regulatory

actions related to the proposed transaction or unfavorable results

from currently pending litigation and proceedings or litigation and

proceedings that could arise in the future, (9) other business

effects, including the effects of industry, market, economic,

political or regulatory conditions, (10) information technology

system failures, data security breaches, data privacy compliance,

network disruptions, and cybersecurity, malware or ransomware

attacks, and (11) changes resulting from the COVID-19 pandemic,

which could exacerbate any of the risks described above.

Readers are cautioned not to place undue reliance on

forward-looking statements made by or on behalf of Standard

General. Each such statement speaks only as of the day it was made.

Standard General undertakes no obligation to update or to revise

any forward-looking statements. The factors described above cannot

be controlled by Standard General. When used in this communication,

the words “believes,” “estimates,” “plans,” “expects,” “should,”

“could,” “outlook,” and “anticipates” and similar expressions as

they relate to Standard General or its management are intended to

identify forward looking statements. Forward-looking statements in

this communication may include, without limitation: statements

about the potential benefits of the proposed acquisition,

anticipated growth rates, Standard General’s plans, objectives,

expectations, and the anticipated timing of closing the proposed

transaction.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221006005870/en/

For media inquiries, contact: Standard General Andy

Brimmer / Jamie Moser / Jack Kelleher Joele Frank, Wilkinson

Brimmer Katcher 212-355-4449

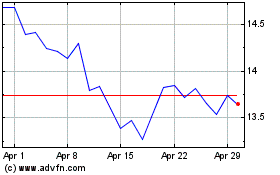

TEGNA (NYSE:TGNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

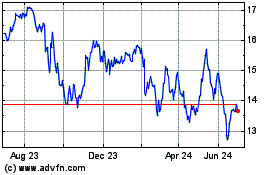

TEGNA (NYSE:TGNA)

Historical Stock Chart

From Apr 2023 to Apr 2024