Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 14 2024 - 6:01AM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number 001-34919

SUMITOMO MITSUI FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

1-2, Marunouchi 1-chome, Chiyoda-ku, Tokyo 100-0005, Japan

(Address of principal executive offices)

|

|

|

|

|

| Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: |

|

Form 20-F ☒ |

|

Form 40-F ☐ |

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE INTO THE

PROSPECTUS FORMING A PART OF SUMITOMO MITSUI FINANCIAL GROUP, INC.’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-276219) AND TO BE A PART OF SUCH PROSPECTUS FROM THE DATE ON WHICH THIS REPORT IS

FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED, EXCEPT FOR THE STATEMENTS REGARDING OUR EARNINGS FORECAST UNDER THE CAPTION “3. EARNINGS FORECAST ON A CONSOLIDATED BASIS (FOR THE FISCAL YEAR

ENDING MARCH 31, 2025).”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

| Sumitomo Mitsui Financial Group, Inc. |

|

|

| By: |

|

/s/ Jun Okahashi |

|

|

Name: Jun Okahashi |

|

|

Title: Executive Officer & General Manager,

Financial Accounting Dept |

Date: November 14, 2024

|

|

|

|

|

|

|

November 14, 2024 |

|

|

|

Sumitomo Mitsui Financial Group,

Inc. Consolidated Financial Results for the six months ended September 30, 2024

<Under Japanese GAAP> |

|

|

|

|

|

| Head Office: 1-2, Marunouchi 1-chome, Chiyoda-ku, Tokyo, Japan |

| Stock Exchange Listings: Tokyo Stock Exchange, Nagoya Stock Exchange, New York Stock Exchange |

| URL: https://www.smfg.co.jp/english/ |

| President: Toru Nakashima |

| Interim Securities Report (Hanki hokokusho) issuing date: November 29, 2024 |

| Dividend payment date: December 3, 2024 |

| Investors meeting presentation for financial results: Scheduled |

|

| Note: Amounts less than one million yen have been

rounded down. |

| 1. Consolidated financial results (for the six months ended September 30, 2024) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Operating results |

|

(Millions of yen, except per share data and percentages) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Ordinary income

|

|

|

Ordinary profit |

|

|

Profit attributable to

owners of parent |

|

| Six months ended September 30, 2024 |

|

¥ |

5,276,938 |

|

|

|

17.7 |

% |

|

¥ |

1,030,472 |

|

|

|

45.3 |

% |

|

¥ |

725,172 |

|

|

|

37.7 |

% |

| Six

months ended September 30, 2023 |

|

|

4,482,985 |

|

|

|

53.7 |

|

|

|

709,232 |

|

|

|

(2.3 |

) |

|

|

526,465 |

|

|

|

0.2 |

|

|

|

|

|

|

| Notes: |

|

1. |

|

Comprehensive income: |

|

|

|

|

(a) for the six months ended September 30, 2024 ¥373,994 million [(70.3)%]

(b) for the six months ended September 30, 2023 ¥1,257,766 million [78.3%] |

|

|

2. |

|

Percentages shown in ordinary income, ordinary profit, profit attributable to owners of parent and comprehensive income are the increase (decrease) from the same period in the previous fiscal year. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Earnings per share

|

|

|

Earnings per share

(Diluted) |

|

|

|

|

|

| Six months ended September 30, 2024 |

|

|

¥ 184.77 |

|

|

|

|

|

|

|

¥ 184.72 |

|

|

|

|

|

|

|

|

|

| Six

months ended September 30, 2023 |

|

|

131.47 |

|

|

|

|

|

|

|

131.43 |

|

|

|

|

|

|

|

|

|

Note: On October 1, 2024, Sumitomo Mitsui Financial Group, Inc. (“the Company”) effected a

three for one split of its common stock on the record date of September 30, 2024. Earnings per share and Earnings per share (Diluted) take into account the stock split.

|

|

|

|

|

|

|

|

|

| (2) Financial position |

|

(Millions of yen, except percentages) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total assets |

|

|

Net assets |

|

|

Net assets

ratio |

|

| As of September 30, 2024 |

|

¥ |

290,022,585 |

|

|

|

|

|

|

¥ |

14,892,743 |

|

|

|

|

|

|

|

5.1 |

% |

|

|

|

|

| As

of March 31, 2024 |

|

|

295,236,701 |

|

|

|

|

|

|

|

14,799,967 |

|

|

|

|

|

|

|

5.0 |

|

|

|

|

|

|

|

|

|

|

| Notes: |

|

1. |

|

Stockholders’ equity: |

|

|

|

|

(a) as of September 30, 2024: ¥ 14,755,242 million (b) as of March 31, 2024: ¥ 14,660,110 million |

|

|

2. |

|

Net assets ratio = {(Net assets – stock acquisition rights – non-controlling interests) / total assets} X 100 |

|

|

|

|

|

|

|

|

|

|

|

| 2. Dividends on common stock |

|

(Yen) |

| |

|

Cash dividends per share |

| |

|

1st quarter |

|

2nd quarter |

|

3rd quarter |

|

4th quarter |

|

Annual |

| Fiscal year ended March 31, 2024 |

|

¥ — |

|

¥ 135.00 |

|

¥ — |

|

¥ 135.00 |

|

¥ 270.00 |

| Fiscal year ending March 31, 2025

Before considering the stock split |

|

— |

|

180.00 |

|

|

|

|

|

|

|

(After considering the stock split) |

|

— |

|

180.00 |

|

|

|

|

|

|

| Fiscal year ending March 31, 2025

Forecast/Before considering the stock split |

|

|

|

|

|

— |

|

180.00 |

|

360.00 |

|

(Forecast/After considering the stock split) |

|

|

|

|

|

— |

|

60.00 |

|

— |

|

|

|

|

|

| Notes: |

|

1. |

|

Dividend forecast which was announced in May 2024 was revised. |

|

|

2. |

|

On October 1, 2024, the Company effected a three for one split of its common stock on the record date of September 30, 2024. |

3. Earnings forecast on a consolidated basis (for the fiscal year ending March 31, 2025)

|

|

|

|

|

|

|

|

|

| |

|

(Millions of yen, except per share data and percentage) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Profit attributable to owners

of parent |

|

|

Earnings per share |

|

| Fiscal

year ending March 31, 2025 |

|

|

¥ 1,160,000 |

|

|

|

|

|

|

20.5 % |

|

|

|

|

|

|

¥ 299.94 |

|

|

|

|

|

|

|

|

|

|

| Notes: |

|

1. |

|

Earnings forecast which was announced in May 2024 was revised. |

|

|

2. |

|

Percentage shown in profit attributable to owners of parent is the increase (decrease) from the previous fiscal year. |

|

|

3. |

|

On October 1, 2024, the Company effected a three for one split of its common stock on the record date of September 30, 2024. At the Board of Directors held on November 14, 2024, the Company resolved to repurchase its own shares.

Forecasted earnings per share are calculated by dividing forecasted profit attributable to owners of parent by the number of issued common stocks (excluding treasury stocks) as of September 30, 2024 which takes into account the stock split and the

repurchase of own shares. |

[Notes]

(1) There were changes in material consolidated subsidiaries during the period.

Newly consolidated: 1 company (JRI Holdings, Limited)

Excluded: 1 company (SMBC Finance Service Co., Ltd.)

(2) Changes in accounting policies, changes in accounting estimates and restatements

|

|

|

|

|

|

|

|

|

| (a) Changes in accounting policies due to application of new or revised accounting standards |

|

: |

|

Yes |

|

|

|

|

| (b) Changes in accounting policies due to reasons other than above (a) |

|

: |

|

No |

|

|

|

|

| (c) Changes in accounting estimates |

|

: |

|

No |

|

|

|

|

| (d) Restatements |

|

: |

|

No |

|

|

|

|

|

| Note: For more details, see page 7 “IV. Notes to interim consolidated financial statements.” |

(3) Number of shares issued (common stocks)

|

|

|

|

|

| |

|

As of September 30, 2024 |

|

As of March 31, 2024 |

| (a) Number of shares issued (including treasury stocks) |

|

3,924,531,558 shares |

|

4,012,587,252 shares |

| (b) Number of treasury stocks |

|

10,672,350 shares |

|

70,763,598 shares |

|

|

|

| |

|

Six months ended |

|

Six months ended |

| |

|

September 30, 2024 |

|

September 30, 2023 |

| (c) Average number of shares issued during the period |

|

3,924,762,726 shares |

|

4,004,538,607 shares |

|

|

|

|

|

| Notes: |

|

1. |

|

The Company has introduced a “Stock grant trust for employees.” The shares of the Company held by the trust are included in the number of treasury stocks to be deducted when calculating both the number of treasury stocks

and the average number of shares issued during the period. |

|

|

2. |

|

On October 1, 2024, the Company effected a three for one split of its common stock on the record date of September 30, 2024. The number of shares issued (including treasury stocks), the number of treasury stocks and the average

number of shares issued during the period take into account the stock split. |

(Summary of financial information on a non-consolidated basis)

Non-consolidated financial results (for the six months ended September 30, 2024)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Operating results |

|

|

|

|

|

|

|

|

|

(Millions of yen, except per share data and percentages) |

| |

|

|

|

Operating income |

|

Operating profit |

|

Ordinary profit |

|

Net income |

| |

|

Six months

ended

September 30, 2024 |

|

¥ 806,087 |

|

187.7 % |

|

¥ 593,915 |

|

504.9 % |

|

¥ 584,119 |

|

536.8 % |

|

¥ 589,967 |

|

526.6 % |

| |

|

September 30,

2023 |

|

280,170 |

|

54.8 |

|

98,180 |

|

105.1 |

|

91,720 |

|

106.3 |

|

94,155 |

|

98.6 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended

September 30, 2024 |

|

¥ 150.32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

23.51 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Notes: |

|

1. |

|

Percentages shown in operating income, operating profit, ordinary profit and net income are the increase (decrease) from the same period in the previous fiscal year. |

|

|

|

|

2. |

|

On October 1, 2024, the Company effected a three for one split of its common stock on the record date of September 30, 2024. Earnings per share takes into account the stock split. |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) Financial position |

|

(Millions of yen, except percentages) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Total

assets |

|

Net

assets |

|

Net assets

ratio |

|

|

As of September 30,

2024 |

|

¥ 19,675,606 |

|

¥ 6,376,568 |

|

32.4% |

|

|

As of March 31,

2024 |

|

19,745,893 |

|

6,075,333 |

|

30.8 |

Note: Stockholders’ equity:

|

| (a) as of September 30, 2024: ¥6,375,777 million (b) as of March 31, 2024: ¥6,074,401 million |

[Note on interim audit procedures]

This report is out of the scope of the interim audit procedures.

This document contains “forward-looking

statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995), regarding the intent, belief or current expectations of Sumitomo Mitsui Financial Group, Inc. (“the Company”) and its management with respect to

the Company’s future financial condition and results of operations. In many cases but not all, these statements contain words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “plan,” “probability,” “risk,” “project,” “should,” “seek,” “target,” “will” and similar expressions. Such forward-looking statements are not guarantees

of future performance and involve risks and uncertainties, and actual results may differ from those expressed in or implied by such forward-looking statements contained or deemed to be contained herein. The

risks and uncertainties which may affect future performance include: deterioration of Japanese and global economic conditions and financial markets; declines in the value of the Company’s securities portfolio; incurrence of significant

credit-related costs; the Company’s ability to successfully implement its business strategy through its subsidiaries, affiliates and alliance partners; and exposure to new risks as the Company expands the scope of its business. Given these and

other risks and uncertainties, you should not place undue reliance on forward-looking statements, which speak only as of the date of this document. The Company undertakes no obligation to update or revise any

forward-looking statements. Please refer to the Company’s most recent disclosure documents such as its annual report on Form 20-F and other documents submitted to the U.S. Securities and Exchange

Commission, as well as its earnings press releases, for a more detailed description of the risks and uncertainties that may affect its financial conditions, its operating results, and investors’ decisions.

Table of contents

* Appendix: Financial results for the six months ended September 30, 2024 supplementary information

- 1 -

Interim consolidated financial statements and main notes

I. Interim consolidated balance sheets

|

|

|

|

|

|

|

|

|

| |

|

Millions of yen |

|

| |

|

March 31, 2024 |

|

|

September 30, 2024 |

|

| Assets: |

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

¥ |

78,143,100 |

|

|

¥ |

73,612,647 |

|

| Call loans and bills bought |

|

|

5,333,883 |

|

|

|

4,330,213 |

|

| Receivables under resale agreements |

|

|

8,525,688 |

|

|

|

13,430,028 |

|

| Receivables under securities borrowing transactions |

|

|

6,799,541 |

|

|

|

5,933,711 |

|

| Monetary claims bought |

|

|

6,103,091 |

|

|

|

5,545,605 |

|

| Trading assets |

|

|

11,540,063 |

|

|

|

10,614,415 |

|

| Money held in trust |

|

|

23,751 |

|

|

|

32,903 |

|

| Securities |

|

|

37,142,808 |

|

|

|

38,834,511 |

|

| Loans and bills discounted |

|

|

107,013,907 |

|

|

|

105,037,170 |

|

| Foreign exchanges |

|

|

2,068,885 |

|

|

|

2,379,382 |

|

| Lease receivables and investment assets |

|

|

207,645 |

|

|

|

250,180 |

|

| Other assets |

|

|

15,313,546 |

|

|

|

13,593,179 |

|

| Tangible fixed assets |

|

|

1,006,883 |

|

|

|

996,006 |

|

| Intangible fixed assets |

|

|

976,706 |

|

|

|

991,104 |

|

| Net defined benefit asset |

|

|

913,791 |

|

|

|

936,006 |

|

| Deferred tax assets |

|

|

71,427 |

|

|

|

57,248 |

|

| Customers’ liabilities for acceptances and guarantees |

|

|

14,869,558 |

|

|

|

14,244,674 |

|

| Reserve for possible loan losses |

|

|

(817,578) |

|

|

|

(796,404) |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

¥ |

295,236,701 |

|

|

¥ |

290,022,585 |

|

|

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

| Deposits |

|

¥ |

164,839,357 |

|

|

¥ |

163,541,943 |

|

| Negotiable certificates of deposit |

|

|

14,672,275 |

|

|

|

13,336,652 |

|

| Call money and bills sold |

|

|

3,138,049 |

|

|

|

4,221,905 |

|

| Payables under repurchase agreements |

|

|

19,625,877 |

|

|

|

20,662,981 |

|

| Payables under securities lending transactions |

|

|

1,736,935 |

|

|

|

1,424,469 |

|

| Commercial paper |

|

|

2,429,179 |

|

|

|

1,981,332 |

|

| Trading liabilities |

|

|

9,689,434 |

|

|

|

8,526,459 |

|

| Borrowed money |

|

|

14,705,266 |

|

|

|

14,889,132 |

|

| Foreign exchanges |

|

|

2,872,560 |

|

|

|

2,199,495 |

|

| Short-term bonds |

|

|

863,000 |

|

|

|

1,011,500 |

|

| Bonds |

|

|

13,120,274 |

|

|

|

12,511,245 |

|

| Due to trust account |

|

|

1,246,198 |

|

|

|

1,095,100 |

|

| Other liabilities |

|

|

15,573,044 |

|

|

|

14,509,112 |

|

| Reserve for employee bonuses |

|

|

115,488 |

|

|

|

83,930 |

|

| Reserve for executive bonuses |

|

|

4,411 |

|

|

|

— |

|

| Net defined benefit liability |

|

|

37,263 |

|

|

|

36,517 |

|

| Reserve for executive retirement benefits |

|

|

1,179 |

|

|

|

891 |

|

| Reserve for point service program |

|

|

35,622 |

|

|

|

30,040 |

|

| Reserve for reimbursement of deposits |

|

|

9,228 |

|

|

|

7,048 |

|

| Reserve for losses on interest repayment |

|

|

121,947 |

|

|

|

209,887 |

|

| Reserves under the special laws |

|

|

4,631 |

|

|

|

5,296 |

|

| Deferred tax liabilities |

|

|

698,632 |

|

|

|

573,200 |

|

| Deferred tax liabilities for land revaluation |

|

|

27,316 |

|

|

|

27,025 |

|

| Acceptances and guarantees |

|

|

14,869,558 |

|

|

|

14,244,674 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

280,436,734 |

|

|

|

275,129,842 |

|

|

|

|

|

|

|

|

|

|

| Net assets: |

|

|

|

|

|

|

|

|

| Capital stock |

|

|

2,344,038 |

|

|

|

2,345,960 |

|

| Capital surplus |

|

|

610,143 |

|

|

|

611,833 |

|

| Retained earnings |

|

|

7,843,470 |

|

|

|

8,216,457 |

|

| Treasury stock |

|

|

(167,671) |

|

|

|

(34,101) |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

10,629,980 |

|

|

|

11,140,149 |

|

|

|

|

|

|

|

|

|

|

| Net unrealized gains (losses) on other securities |

|

|

2,406,883 |

|

|

|

2,095,703 |

|

| Net deferred gains (losses) on hedges |

|

|

(65,073) |

|

|

|

(135,196) |

|

| Land revaluation excess |

|

|

34,936 |

|

|

|

34,110 |

|

| Foreign currency translation adjustments |

|

|

1,362,647 |

|

|

|

1,345,023 |

|

| Accumulated remeasurements of defined benefit plans |

|

|

290,735 |

|

|

|

275,451 |

|

|

|

|

|

|

|

|

|

|

| Total accumulated other comprehensive income |

|

|

4,030,129 |

|

|

|

3,615,092 |

|

|

|

|

|

|

|

|

|

|

| Stock acquisition rights |

|

|

931 |

|

|

|

790 |

|

| Non-controlling interests |

|

|

138,925 |

|

|

|

136,710 |

|

|

|

|

|

|

|

|

|

|

| Total net assets |

|

|

14,799,967 |

|

|

|

14,892,743 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and net assets |

|

¥ |

295,236,701 |

|

|

¥ |

290,022,585 |

|

|

|

|

|

|

|

|

|

|

- 2 -

II. Interim consolidated statements of income and interim consolidated

statements of comprehensive income

(Interim consolidated statements of income)

|

|

|

|

|

|

|

|

|

| |

|

Millions of yen |

|

| Six months ended September 30 |

|

2023 |

|

|

2024 |

|

| Ordinary income |

|

¥ |

4,482,985 |

|

|

¥ |

5,276,938 |

|

| Interest income |

|

|

2,923,705 |

|

|

|

3,450,738 |

|

| Interest on loans and discounts |

|

|

1,751,125 |

|

|

|

1,992,942 |

|

| Interest and dividends on securities |

|

|

305,920 |

|

|

|

468,838 |

|

| Trust fees |

|

|

3,784 |

|

|

|

4,499 |

|

| Fees and commissions |

|

|

804,513 |

|

|

|

905,938 |

|

| Trading income |

|

|

164,795 |

|

|

|

436,753 |

|

| Other operating income |

|

|

439,872 |

|

|

|

79,744 |

|

| Other income |

|

|

146,313 |

|

|

|

399,264 |

|

| Ordinary expenses |

|

|

3,773,752 |

|

|

|

4,246,466 |

|

| Interest expenses |

|

|

2,035,952 |

|

|

|

2,324,340 |

|

| Interest on deposits |

|

|

800,847 |

|

|

|

829,337 |

|

| Fees and commissions payments |

|

|

119,549 |

|

|

|

151,321 |

|

| Trading losses |

|

|

229,906 |

|

|

|

132,106 |

|

| Other operating expenses |

|

|

133,937 |

|

|

|

224,648 |

|

| General and administrative expenses |

|

|

1,082,198 |

|

|

|

1,172,747 |

|

| Other expenses |

|

|

172,207 |

|

|

|

241,302 |

|

|

|

|

|

|

|

|

|

|

| Ordinary profit |

|

|

709,232 |

|

|

|

1,030,472 |

|

|

|

|

|

|

|

|

|

|

| Extraordinary gains |

|

|

168 |

|

|

|

1,527 |

|

| Extraordinary losses |

|

|

3,014 |

|

|

|

4,599 |

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

706,386 |

|

|

|

1,027,400 |

|

|

|

|

|

|

|

|

|

|

| Income taxes-current |

|

|

176,906 |

|

|

|

264,819 |

|

| Income taxes-deferred |

|

|

837 |

|

|

|

32,753 |

|

|

|

|

|

|

|

|

|

|

| Income taxes |

|

|

177,743 |

|

|

|

297,572 |

|

|

|

|

|

|

|

|

|

|

| Profit |

|

|

528,642 |

|

|

|

729,827 |

|

|

|

|

|

|

|

|

|

|

| Profit attributable to non-controlling

interests |

|

|

2,176 |

|

|

|

4,655 |

|

|

|

|

|

|

|

|

|

|

| Profit attributable to owners of parent |

|

¥ |

526,465 |

|

|

¥ |

725,172 |

|

|

|

|

|

|

|

|

|

|

|

| (Interim consolidated statements of comprehensive income) |

|

|

|

| |

|

Millions of yen |

|

| Six months ended September 30 |

|

2023 |

|

|

2024 |

|

| Profit |

|

¥ |

528,642 |

|

|

¥ |

729,827 |

|

| Other comprehensive income (losses) |

|

|

729,123 |

|

|

|

(355,833) |

|

| Net unrealized gains (losses) on other securities |

|

|

126,098 |

|

|

|

(255,139) |

|

| Net deferred gains (losses) on hedges |

|

|

71,528 |

|

|

|

(63,775) |

|

| Foreign currency translation adjustments |

|

|

476,785 |

|

|

|

(98,034) |

|

| Remeasurements of defined benefit plans |

|

|

(9,683) |

|

|

|

(14,408) |

|

| Share of other comprehensive income of affiliates |

|

|

64,394 |

|

|

|

75,523 |

|

|

|

|

|

|

|

|

|

|

| Total comprehensive income |

|

|

1,257,766 |

|

|

|

373,994 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive income attributable to owners of parent |

|

|

1,250,368 |

|

|

|

370,291 |

|

| Comprehensive income attributable to non-controlling

interests |

|

|

7,397 |

|

|

|

3,702 |

|

- 3 -

III. Interim consolidated statements of changes in net assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Millions of yen |

|

|

|

|

| |

|

Stockholders’ equity |

|

|

|

|

| Six months ended September 30, 2023 |

|

Capital

stock |

|

|

Capital

surplus |

|

|

Retained

earnings |

|

|

Treasury stock |

|

|

Total |

|

|

|

|

| Balance at the beginning of the period |

|

¥ |

2,342,537 |

|

|

¥ |

694,052 |

|

|

¥ |

7,423,600 |

|

|

¥ |

(151,798) |

|

|

¥ |

10,308,391 |

|

|

|

|

|

| Changes in the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of new stock |

|

|

1,501 |

|

|

|

1,500 |

|

|

|

|

|

|

|

|

|

|

|

3,001 |

|

|

|

|

|

| Cash dividends |

|

|

|

|

|

|

|

|

|

|

(168,077) |

|

|

|

|

|

|

|

(168,077) |

|

|

|

|

|

| Profit attributable to owners of parent |

|

|

|

|

|

|

|

|

|

|

526,465 |

|

|

|

|

|

|

|

526,465 |

|

|

|

|

|

| Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(61,326) |

|

|

|

(61,326) |

|

|

|

|

|

| Disposal of treasury stock |

|

|

|

|

|

|

(99) |

|

|

|

|

|

|

|

242 |

|

|

|

143 |

|

|

|

|

|

| Cancellation of treasury stock |

|

|

|

|

|

|

(195,160) |

|

|

|

|

|

|

|

195,160 |

|

|

|

— |

|

|

|

|

|

| Changes in shareholders’ interest due to transaction with

non-controlling interests |

|

|

|

|

|

|

(9,892) |

|

|

|

|

|

|

|

|

|

|

|

(9,892) |

|

|

|

|

|

| Reversal of land revaluation excess |

|

|

|

|

|

|

|

|

|

|

(35) |

|

|

|

|

|

|

|

(35) |

|

|

|

|

|

| Transfer from retained earnings to capital surplus |

|

|

|

|

|

|

195,259 |

|

|

|

(195,259) |

|

|

|

|

|

|

|

— |

|

|

|

|

|

| Net changes in items other than stockholders’ equity in the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in the period |

|

|

1,501 |

|

|

|

(8,391) |

|

|

|

163,092 |

|

|

|

134,076 |

|

|

|

290,278 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at the end of the period |

|

¥ |

2,344,038 |

|

|

¥ |

685,660 |

|

|

¥ |

7,586,692 |

|

|

¥ |

(17,721) |

|

|

¥ |

10,598,670 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Millions of yen |

|

| |

|

Accumulated other comprehensive income |

|

| Six months ended September 30, 2023 |

|

Net unrealized

gains (losses)

on other

securities |

|

|

Net deferred

gains

(losses)

on hedges |

|

|

Land

revaluation

excess |

|

|

Foreign

currency

translation

adjustments |

|

|

Accumulated

remeasurements

of defined

benefit plans |

|

|

Total |

|

| Balance at the beginning of the period |

|

¥ |

1,373,521 |

|

|

¥ |

(13,293) |

|

|

¥ |

35,005 |

|

|

¥ |

843,614 |

|

|

¥ |

133,226 |

|

|

¥ |

2,372,074 |

|

| Changes in the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of new stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit attributable to owners of parent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Disposal of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cancellation of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in shareholders’ interest due to transaction with

non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reversal of land revaluation excess |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transfer from retained earnings to capital surplus |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in items other than stockholders’ equity in the period |

|

|

132,347 |

|

|

|

75,289 |

|

|

|

35 |

|

|

|

525,903 |

|

|

|

(9,638) |

|

|

|

723,938 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in the period |

|

|

132,347 |

|

|

|

75,289 |

|

|

|

35 |

|

|

|

525,903 |

|

|

|

(9,638) |

|

|

|

723,938 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at the end of the period |

|

¥ |

1,505,869 |

|

|

¥ |

61,996 |

|

|

¥ |

35,041 |

|

|

¥ |

1,369,518 |

|

|

¥ |

123,588 |

|

|

¥ |

3,096,013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 4 -

(Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Millions of yen |

|

|

|

|

|

|

|

|

|

|

| Six months ended September 30, 2023 |

|

Stock

acquisition

rights |

|

|

Non-

controlling

interests |

|

|

Total

net assets |

|

|

|

|

|

|

|

|

|

|

| Balance at the beginning of the period |

|

¥ |

1,145 |

|

|

¥ |

109,495 |

|

|

¥ |

12,791,106 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of new stock |

|

|

|

|

|

|

|

|

|

|

3,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends |

|

|

|

|

|

|

|

|

|

|

(168,077) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit attributable to owners of parent |

|

|

|

|

|

|

|

|

|

|

526,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

(61,326) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Disposal of treasury stock |

|

|

|

|

|

|

|

|

|

|

143 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cancellation of treasury stock |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in shareholders’ interest due to transaction with

non-controlling interests |

|

|

|

|

|

|

|

|

|

|

(9,892) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reversal of land revaluation excess |

|

|

|

|

|

|

|

|

|

|

(35) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transfer from retained earnings to capital surplus |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in items other than stockholders’ equity in the period |

|

|

(142) |

|

|

|

15,905 |

|

|

|

739,701 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in the period |

|

|

(142) |

|

|

|

15,905 |

|

|

|

1,029,980 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at the end of the period |

|

¥ |

1,002 |

|

|

¥ |

125,400 |

|

|

¥ |

13,821,086 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Six months ended September 30, 2024 |

|

Millions of yen |

|

|

|

|

| |

Stockholders’ equity |

|

|

|

|

| |

Capital

stock |

|

|

Capital

surplus |

|

|

Retained

earnings |

|

|

Treasury

stock |

|

|

Total |

|

|

|

|

| Balance at the beginning of the period |

|

¥ |

2,344,038 |

|

|

¥ |

610,143 |

|

|

¥ |

7,843,470 |

|

|

¥ |

(167,671) |

|

|

¥ |

10,629,980 |

|

|

|

|

|

| Cumulative effects of changes in accounting policies |

|

|

|

|

|

|

|

|

|

|

59,330 |

|

|

|

|

|

|

|

59,330 |

|

|

|

|

|

| Restated balance |

|

|

2,344,038 |

|

|

|

610,143 |

|

|

|

7,902,800 |

|

|

|

(167,671) |

|

|

|

10,689,311 |

|

|

|

|

|

| Changes in the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of new stock |

|

|

1,922 |

|

|

|

1,922 |

|

|

|

|

|

|

|

|

|

|

|

3,844 |

|

|

|

|

|

| Cash dividends |

|

|

|

|

|

|

|

|

|

|

(177,382) |

|

|

|

|

|

|

|

(177,382) |

|

|

|

|

|

| Profit attributable to owners of parent |

|

|

|

|

|

|

|

|

|

|

725,172 |

|

|

|

|

|

|

|

725,172 |

|

|

|

|

|

| Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(101,576) |

|

|

|

(101,576) |

|

|

|

|

|

| Disposal of treasury stock |

|

|

|

|

|

|

(339) |

|

|

|

|

|

|

|

486 |

|

|

|

147 |

|

|

|

|

|

| Cancellation of treasury stock |

|

|

|

|

|

|

(234,659) |

|

|

|

|

|

|

|

234,659 |

|

|

|

— |

|

|

|

|

|

| Changes in shareholders’ interest due to transaction with

non-controlling interests |

|

|

|

|

|

|

(232) |

|

|

|

|

|

|

|

|

|

|

|

(232) |

|

|

|

|

|

| Increase due to decrease in subsidiaries |

|

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

|

39 |

|

|

|

|

|

| Reversal of land revaluation excess |

|

|

|

|

|

|

|

|

|

|

825 |

|

|

|

|

|

|

|

825 |

|

|

|

|

|

| Transfer from retained earnings to capital surplus |

|

|

|

|

|

|

234,999 |

|

|

|

(234,999) |

|

|

|

|

|

|

|

— |

|

|

|

|

|

| Net changes in items other than stockholders’ equity in the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in the period |

|

|

1,922 |

|

|

|

1,689 |

|

|

|

313,656 |

|

|

|

133,569 |

|

|

|

450,838 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at the end of the period |

|

¥ |

2,345,960 |

|

|

¥ |

611,833 |

|

|

¥ |

8,216,457 |

|

|

¥ |

(34,101) |

|

|

¥ |

11,140,149 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 5 -

(Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Millions of yen |

|

| |

|

Accumulated other comprehensive income |

|

| Six months ended September 30, 2024 |

|

Net unrealized

gains (losses)

on other

securities |

|

|

Net deferred

gains (losses)

on hedges |

|

|

Land

revaluation

excess |

|

|

Foreign

currency

translation

adjustments |

|

|

Accumulated

remeasurements

of defined

benefit plans |

|

|

Total |

|

| Balance at the beginning of the period |

|

¥ |

2,406,883 |

|

|

¥ |

(65,073) |

|

|

¥ |

34,936 |

|

|

¥ |

1,362,647 |

|

|

¥ |

290,735 |

|

|

¥ |

4,030,129 |

|

| Cumulative effects of changes in accounting policies |

|

|

(59,330) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(59,330) |

|

| Restated balance |

|

|

2,347,553 |

|

|

|

(65,073) |

|

|

|

34,936 |

|

|

|

1,362,647 |

|

|

|

290,735 |

|

|

|

3,970,798 |

|

| Changes in the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of new stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit attributable to owners of parent |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Disposal of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cancellation of treasury stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in shareholders’ interest due to transaction with

non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase due to decrease in subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reversal of land revaluation excess |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transfer from retained earnings to capital surplus |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in items other than stockholders’ equity in the period |

|

|

(251,849) |

|

|

|

(70,122) |

|

|

|

(825) |

|

|

|

(17,624) |

|

|

|

(15,283) |

|

|

|

(355,706) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in the period |

|

|

(251,849) |

|

|

|

(70,122) |

|

|

|

(825) |

|

|

|

(17,624) |

|

|

|

(15,283) |

|

|

|

(355,706) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at the end of the period |

|

¥ |

2,095,703 |

|

|

¥ |

(135,196) |

|

|

¥ |

34,110 |

|

|

¥ |

1,345,023 |

|

|

¥ |

275,451 |

|

|

¥ |

3,615,092 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Millions of yen |

|

|

|

|

|

|

|

|

|

|

| Six months ended September 30, 2024 |

|

Stock

acquisition

rights |

|

|

Non-

controlling

interests |

|

|

Total

net assets |

|

|

|

|

|

|

|

|

|

|

| Balance at the beginning of the period |

|

¥ |

931 |

|

|

¥ |

138,925 |

|

|

¥ |

14,799,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cumulative effects of changes in accounting policies |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restated balance |

|

|

931 |

|

|

|

138,925 |

|

|

|

14,799,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in the period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of new stock |

|

|

|

|

|

|

|

|

|

|

3,844 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends |

|

|

|

|

|

|

|

|

|

|

(177,382) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit attributable to owners of parent |

|

|

|

|

|

|

|

|

|

|

725,172 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase of treasury stock |

|

|

|

|

|

|

|

|

|

|

(101,576) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Disposal of treasury stock |

|

|

|

|

|

|

|

|

|

|

147 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cancellation of treasury stock |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in shareholders’ interest due to transaction with

non-controlling interests |

|

|

|

|

|

|

|

|

|

|

(232) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase due to decrease in subsidiaries |

|

|

|

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reversal of land revaluation excess |

|

|

|

|

|

|

|

|

|

|

825 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transfer from retained earnings to capital surplus |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in items other than stockholders’ equity in the period |

|

|

(141) |

|

|

|

(2,215) |

|

|

|

(358,062) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net changes in the period |

|

|

(141) |

|

|

|

(2,215) |

|

|

|

92,775 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at the end of the period |

|

¥ |

790 |

|

|

¥ |

136,710 |

|

|

¥ |

14,892,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 6 -

IV. Notes to interim consolidated financial statements

(Note on going concern)

Not applicable.

(Changes in

accounting policies)

Application of Accounting Standard for Current Income Taxes, etc.

The Company applied the “Accounting Standard for Current Income Taxes” (ASBJ Statement No.27,

October 28, 2022), the “Accounting Standard for Presentation of Comprehensive Income” (ASBJ Statement No.25, October 28, 2022) and the “Implementation Guidance on Tax Effect Accounting” (ASBJ Guidance No.28,

October 28, 2022) from the beginning of the six months ended September 30, 2024.

As for the

revision of accounting classification of current income taxes (imposed on Other comprehensive income) in accordance with the transitional treatment stipulated in the proviso of Paragraph 20-3 of the Accounting

Standard for Current Income Taxes and Paragraph 65-2, Item 2 of the Implementation Guidance on Tax Effect Accounting, the cumulative effects by the retroactive application of the new accounting policies prior

to the beginning of the six months ended September 30, 2024, were adjusted to “Retained earnings” at the beginning of the six months ended September 30, 2024. Furthermore, the corresponding amounts were appropriately allocated

among “Capital surplus”, “Valuation and translation adjustments” and “Total accumulated other comprehensive income,” and new accounting standards were applied from the beginning balance of the six months ended

September 30, 2024. As a result, “Retained earnings” increased by ¥59,330 million and “Net unrealized gains on other securities” decreased by ¥59,330 million at the beginning of the six months ended

September 30, 2024.

As for the revision to review the treatment of gains or losses on sales arising

from the sale of subsidiaries’ stocks and others between consolidated companies in the consolidated financial statements, in cases where the gains or losses on sales is deferred for tax purposes, the Company applied the Implementation Guidance

on Tax Effect Accounting from the beginning of the six months ended September 30, 2024. There were no significant effects on the consolidated financial statements due to the application of the Implementation Guidance.

- 7 -

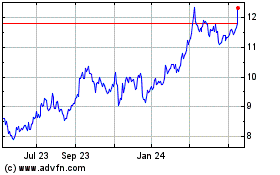

Sumitomo Mitsui Financial (NYSE:SMFG)

Historical Stock Chart

From Oct 2024 to Nov 2024

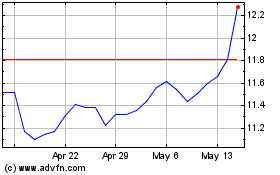

Sumitomo Mitsui Financial (NYSE:SMFG)

Historical Stock Chart

From Nov 2023 to Nov 2024