0001498710false00014987102024-10-182024-10-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): October 24, 2024 (October 18, 2024)

Spirit Airlines, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 001-35186 | 38-1747023 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

| | | |

1731 Radiant Drive

Dania Beach, Florida 33004

(Address of principal executive offices, including zip code)

(954) 447-7920

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | SAVE | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Aircraft Sale

On October 18, 2024, Spirit Airlines, Inc. (the “Company”) entered into a binding term sheet with GA Telesis, LLC (“GAT”) for the sale of 23 A320ceo/A321ceo aircraft (the “Aircraft”) to GAT for an expected total purchase price of approximately $519 million (the “Sale”). The Aircraft are planned for delivery beginning in October 2024 through February 2025. The Sale is subject to, among other things, the execution of definitive documentation and other customary conditions precedent.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the term sheet, a copy of which will be filed with the Company’s Annual Report on Form 10-K.

Item 2.02. Results of Operations and Financial Condition.

On October 24, 2024, Spirit Airlines, Inc. (the "Company" or "Spirit") provided an update to investors announcing certain preliminary estimates for the third quarter 2024. The Company’s unaudited interim consolidated financial statements for the third quarter 2024 are not yet complete and results may vary from these preliminary estimates upon completion of closing procedures.

Item 7.01. Regulation FD Disclosure.

The Company estimates the net proceeds of the Sale, combined with discharging the Aircraft-related debt from its balance sheet, will benefit its liquidity by approximately $225 million through year-end 2025.

The Company estimates its third quarter 2024 adjusted operating margin will come in approximately three hundred basis points better than the mid-point of its previous guidance range, primarily due to stronger-than-expected revenue with early results from its transformation plan exceeding initial expectations.

The Company’s third quarter 2024 capacity was down 1.2 percent year over year, and the Company estimates its fourth quarter 2024 capacity will be down approximately 20 percent year over year.

The Company plans to provide additional details regarding its third quarter 2024 performance in conjunction with reporting its third quarter results which it plans to release in mid-November.

For the full year 2025, the Company estimates its capacity will be down mid-teens year over year. This decrease takes into account the sale and removal from scheduled service of the Aircraft, a year-over-year increase in the estimated number of neo aircraft removed from scheduled service due to the reduced availability of Pratt & Whitney geared turbofan engines, the retirement of the Company’s remaining A319ceo aircraft and the addition of six new A321neo aircraft scheduled for delivery in 2025.

As part of its continued strategy to return to profitability, the Company has identified approximately $80 million of annualized cost reductions that it plans to begin implementing in early 2025. These cost reductions are driven primarily by a reduction in workforce commensurate with the Company’s expected flight volume.

As previously disclosed, the Company remains in active and constructive discussions with holders of its senior secured notes due 2025 and convertible senior notes due 2026 with respect to their respective maturities.

Consistent with its previously provided guidance, the Company expects to end the year 2024 with over $1.0 billion of liquidity, including unrestricted cash and cash equivalents, short-term investment securities and additional liquidity initiatives, assuming that the Company is able to consummate those initiatives that are currently in process.

Forward Looking Statements

Forward-looking statements in this report and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”) which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts are “forward-looking statements” for purposes of these provisions. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential,” and similar expressions intended to identify forward-looking statements. Forward-looking statements include, without limitation, guidance for 2024 and 2025 and statements regarding the Company's intentions and expectations regarding cash levels, capacity, adjusted operating margin, the availability of aircraft and other changes to the Company’s fleet, additional financing and resolving outstanding indebtedness. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors include, among others, results of operations and financial condition, the competitive environment in our industry, our ability to keep costs low and the impact of worldwide economic conditions, including the impact of economic cycles or downturns on customer travel behavior and other factors, as described in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including the detailed factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as supplemented in the Company’s Quarterly Report on Form 10-Q for the fiscal quarters ended March 31, 2024 and June 30, 2024. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. Risks or uncertainties (i) that are not currently known to us, (ii) that we currently deem to be immaterial, or (iii) that could apply to any company, could also materially adversely affect our business, financial condition, or future results. Additional information concerning certain factors is contained in the Company’s SEC filings, including but not limited to the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

Non-GAAP Financial Measures

The Company evaluates its financial performance utilizing various accounting principles generally accepted in the United States of America (“GAAP”) and non-GAAP financial measures, including adjusted operating margin. These non-GAAP financial measures are provided as supplemental information to the financial information presented in this report that is calculated and presented in accordance with GAAP and these non-GAAP financial measures are presented because management believes that they supplement or enhance management’s, analysts’ and investors’ overall understanding of the Company’s underlying financial performance and trends and facilitate comparisons among current, past and future periods.

Because the non-GAAP financial measures are not calculated in accordance with GAAP, they should not be considered superior to and are not intended to be considered in isolation or as a substitute for the related GAAP financial measures presented in the report and may not be the same as or comparable to similarly titled measures presented by other companies due to possible differences in the method of calculation and in the items being adjusted. We encourage investors to review our financial statements and other filings with the SEC in their entirety and not to rely on any single financial measure.

The information below provides an explanation of certain adjustments reflected in the non-GAAP financial measure and shows a reconciliation of the non-GAAP financial measure in this report to the most directly comparable GAAP financial measure.

Reconciliation of Estimated Adjusted Operating Margin to Estimated GAAP Operating Margin

| | | | | | | | | | |

| | | | |

| 3Q24E | Prior 3Q24E | | |

| Operating margin | Approx (24.8)% | N/A | | |

| Impact of special items (1) | Approx. 0.3% | N/A | | |

| Adj. operating margin | Approx. (24.5)% | (29)% - (26)% | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

1.Includes furlough expenses related to furloughed pilots, net losses on the sale of A319 airframes and engines and losses related to the write-off of obsolete assets and other adjustments.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Date: October 24, 2024 | SPIRIT AIRLINES, INC. |

| |

| By: /s/ Thomas Canfield |

| Name: Thomas Canfield |

| Title: Senior Vice President and General Counsel |

| |

| |

| |

| |

| |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

save_Coverpage.Abstract |

| Namespace Prefix: |

save_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

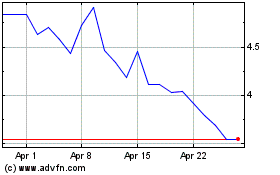

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Oct 2024 to Nov 2024

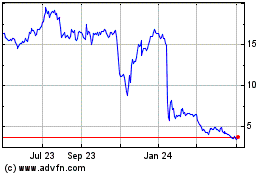

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Nov 2023 to Nov 2024