Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

July 26 2021 - 4:35PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-252868

PROSPECTUS SUPPLEMENT NO. 5

(to prospectus dated March 18, 2021)

SKILLZ INC.

Up to 38,616,576 Shares of Class A Common

Stock

Up to 5,016,666 Warrants

This prospectus supplement is being filed to update

and supplement the information contained in the prospectus dated March 18, 2021 (and as may be further supplemented or amended from time

to time, the “Prospectus”), with the information contained in our Current Report on Form 8-K (the “Current Report”),

which we have filed with the Securities and Exchange Commission on July 19, 2021. Accordingly, we have attached the Current Report to

this prospectus supplement.

The Prospectus and this prospectus supplement

relates to: (a) the issuance by us of up to an aggregate of up to 22,266,643 shares of our Class A common stock, par value $0.0001

per share (“Class A common stock”), which consists of (i) up to 5,016,666 shares of Class A common stock that

are issuable upon the exercise of private placement warrants (the “Private Placement Warrants”) originally issued in a private

placement in connection with the IPO (as defined below) of Flying Eagle Acquisition Corp., a Delaware corporation (“FEAC”),

at an exercise price of $11.50 per share of Class A common stock, and (ii) up to 17,249,977 shares of Class A common stock

that are issuable upon the exercise of 17,249,977 warrants issued in connection with the IPO (the “Public Warrants,” and together

with the Private Placement Warrants, the “Warrants”) and (b) the resale from time to time by the Selling Securityholders named

in this prospectus (the “Selling Securityholders”) of (i) 5,016,666 Private Placement Warrants, (ii) up to 5,016,666

shares of Class A common stock that may be issued upon exercise of the Private Placement Warrants, (iii) 6,350,203 shares of

Class A common stock held by the Sponsor and certain of its transferees (the “Sponsor Shares”) and (iv) 9,999,730

shares of Class A common stock (including 1,427,112 shares of Class A common stock issuable upon conversion of Class B

common stock, par value $0.0001 per share ) that were released from escrow on March 5, 2021 based upon the achievement of certain stock

price targets (the “Earnout Shares”).

This prospectus supplement updates and supplements

the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus,

including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there

is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this

prospectus supplement.

Our Class A common stock is traded on the New

York Stock Exchange under the symbol “SKLZ.” On July 23, 2021, the closing price of our Class A common stock was $15.29 per

share.

Investing in our securities involves risks

that are described in the “Risk Factors” section beginning on page 6 of the Prospectus. Neither the SEC nor any state securities

commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is July 26, 2021.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 16, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SKILLZ INC.

(Exact name of registrant as specified in its charter)

|

|

Delaware

(State or other jurisdiction

of incorporation)

|

001-39243

(Commission

File Number)

|

46-2682070

(IRS Employer

Identification No.)

|

|

PO Box 445

San Francisco, California 94104

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (415) 762-0511

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A common stock, par value $0.0001 per share

|

SKLZ

|

NYSE

|

|

Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share

|

SKLZ.WS

|

NYSE

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.01 Completion of Acquisition or Disposition of Assets.

As previously disclosed, on June 1, 2021, Skillz Inc. (“Skillz” or the “Company”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Aarki, Inc., a Delaware corporation (“Aarki”) and certain other parties named thereto whereby Skillz would acquire all the equity interests of Aarki (the “Acquisition”).

The Acquisition closed on July 16, 2021 and Aarki became a direct and wholly owned subsidiary of Skillz Inc., with such subsidiary renamed as Aarki, LLC. The aggregate consideration paid by Skillz in the Acquisition pursuant to the Merger Agreement (after taking into account certain estimated purchase price adjustments as of closing) was approximately $157 million, which consisted of approximately $90 million in cash with the remaining approximately $67 million comprised of 4.4 million shares of Skillz Class A common stock.

Skillz intends to file a resale shelf registration statement on Form S-1 to register for resale under the Securities Act, the shares of Skillz Class A common stock issued to Aarki stockholders in connection with the Acquisition.

Skillz has determined that it is not required to file historical financial statements of, or pro forma financial information relating to, the Acquisition.

The foregoing description of the Agreement is qualified in its entirety by the full text of the Agreement, which is attached to Skillz’s Current Report filed on Form 8-K with the Securities Exchange Commission on June 2, 2021 as Exhibit 2.1 and is incorporated by reference herein. The Agreement has been included to provide investors with information regarding its terms. It is not intended to provide any other factual information about Skillz, Aarki, or their respective subsidiaries or affiliates. The representations, warranties, and covenants contained in the Agreement were made only for purposes of the Agreement and as of specific dates, were solely for the benefit of the parties to the Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors are not third-party beneficiaries under the Agreement and should not rely on the representations, warranties, and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties thereto or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of representations and warranties may change after the date of the Agreement, which subsequent information may or may not be fully reflected in Skillz’s public disclosures.

Item 3.02. Unregistered Sales of Equity Securities.

The information contained in Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference. The shares of Skillz Class A common stock issued in connection with the Acquisition were issued in reliance upon exemptions from the registration requirements of the Securities Act, pursuant to Section 4(a)(2) thereof and/or Regulation D promulgated thereunder, based upon appropriate representations and certifications that Skillz has received or expects to obtain from Aarki and each Aarki stockholder receiving Skillz Class A common stock. The issuance of any additional shares of Skillz Class A common stock in connection with the payment of any contingent merger consideration described above is also expected to be exempt from the registration requirements of the Securities Act, pursuant to Section 4(a)(2) thereof and/or Regulation D promulgated thereunder. Skillz has agreed to file a resale shelf registration statement on Form S-1 (or if then ineligible to use such form, then any other available

form of registration statement) to register for resale under the Securities Act the shares of Skillz Class A common stock issued to Aarki equity holders in connection with the Acquisition.

Forward-Looking Statements

Certain statements contained in this Form 8-K and its exhibits may be characterized as forward-looking under the Private Securities Litigation Reform Act of 1995. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially. Additional information concerning these factors is contained in Skillz’s filings with the U.S. Securities and Exchange Commission (SEC). Copies are available from the SEC or from the Skillz web site (www.investors.skillz.com).

Statements in this communication regarding Skillz that are forward-looking may include projections as to closing date for the transaction, the extent of, and the time necessary to obtain, the regulatory approvals required for the transaction, the anticipated benefits of the transaction, the impact of the transaction on Skillz’s business, the synergies from the transaction, the combined company’s future operating results, and other statements identified by words such as “will”, “expect”, “believe”, “anticipate”, “estimate”, “should”, “intend”, “plan”, “potential”, “predict” “project”, “aim”, and similar words, phrases or expressions. These forward-looking statements are based on current expectations and beliefs of the management of Skillz, as well as assumptions made by, and information currently available to, management, current market trends and market conditions and involve risks and uncertainties, many of which are outside of Skillz’s and Aarki’s management’s control.

Important risk factors related to the transaction could cause actual future results and other future events to differ materially from those currently estimated by management, including, but not limited to: the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect Skillz’s business and the price of the Class A common stock of Skillz; the failure to satisfy any of the conditions to the consummation of the proposed transaction; the timing to consummate the proposed transaction; the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated; the occurrence of any event, change or other circumstance that could give rise to the termination of the Agreement; the effect of the announcement or pendency of the proposed transaction on Skillz’s business relationships, operating results and business generally; the risk that the proposed transaction may disrupt current plans and operations and the potential difficulties in employee retention as a result of the proposed transaction; the ability to achieve the synergies and value creation contemplated; Skillz’s ability to promptly and effectively integrate Aarki’s businesses; the risk that revenues following the transaction may be lower than expected; the risk that operating costs, customer loss, and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, and suppliers) may be greater than expected; the assumption of unexpected risks and liabilities; the outcome of any legal proceedings that may be instituted related to the Agreement or the proposed transaction; the diversion of and attention of management of Skillz on transaction-related issues; and the other factors discussed in “Risk Factors” in Skillz’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, as amended, and subsequent filings with the SEC, which are available at http://www.sec.gov. Skillz assumes no obligation to update the information in the communication, except as otherwise required by law. Accordingly, you should not place undue reliance on these forward looking statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SKILLZ INC.

By: /s/ Charlotte Edelman

Name: Charlotte Edelman

Title: VP of Legal

Date: July 19, 2021

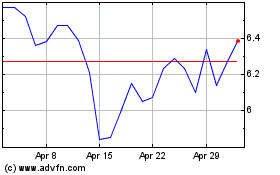

Skillz (NYSE:SKLZ)

Historical Stock Chart

From Aug 2024 to Sep 2024

Skillz (NYSE:SKLZ)

Historical Stock Chart

From Sep 2023 to Sep 2024