Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 08 2024 - 4:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of August 2024

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

| (FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |

|

|

| ITR – Interim Financial Information – June 30,2024 – SENDAS DISTRIBUIDORA S.A. |

|

|

| |

|

|

| Contents |

|

|

| |

|

|

| Corporate Information / Capital Composition |

|

|

| Interim financial information |

|

2 |

| Individual Statements |

|

|

| Balance Sheet - Assets |

|

3 |

| Balance Sheet - Liabilities |

|

4 |

| Statements of Operations |

|

5 |

| Statements of Comprehensive Income |

|

6 |

| Statements of Cash Flows |

|

7 |

| Statements of Changes in Shareholders’ Equity |

|

8 |

| |

|

|

| Notes to the Interim Financial Information |

|

9 |

| (FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |

| ITR – Interim Financial Information – June 30,2024 – SENDAS DISTRIBUIDORA S.A. |

| |

|

|

|

|

| Corporate information / Capital composition |

|

|

| |

|

|

|

|

| Number of Shares |

|

Current quarter |

|

|

| (Thousands) |

|

6/30/2024 |

|

|

| Share Capital |

|

|

|

|

| Common |

|

1,351,833 |

|

|

| Preferred |

|

- |

|

|

| Total |

|

1,351,833 |

|

|

| Treasury Shares |

|

|

|

|

| Common |

|

- |

|

|

| Preferred |

|

- |

|

|

| Total |

|

- |

|

|

| (FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |

|

|

| Interim Financial Information - 6/30/2024 - SENDAS DISTRIBUIDORA S.A. |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| Individual Financial Statements / Balance Sheet - Assets |

|

|

|

| R$ (in thousands) |

|

|

|

| |

|

|

|

|

| |

|

Current Quarter |

|

Prior year |

| Account code |

Account description |

6/30/2024 |

|

12/31/2023 |

| 1 |

Total Assets |

44,074,000 |

|

43,177,000 |

| 1.01 |

Current Assets |

15,641,000 |

|

14,616,000 |

| 1.01.01 |

Cash and cash equivalents |

5,104,000 |

|

5,459,000 |

| 1.01.03 |

Acoounts Receivables |

1,929,000 |

|

1,199,000 |

| 1.01.03.01 |

Trade Receivables |

1,929,000 |

|

1,199,000 |

| 1.01.04 |

Inventories |

7,242,000 |

|

6,664,000 |

| 1.01.06 |

Recoverable Taxes |

1,085,000 |

|

1,100,000 |

| 1.01.08 |

Other Current Assets |

281,000 |

|

194,000 |

| 1.01.08.03 |

Others |

281,000 |

|

194,000 |

| 1.01.08.03.01 |

Derivative Financial Instruments |

52,000 |

|

48,000 |

| 1.01.08.03.03 |

Other Accounts Receivable |

229,000 |

|

146,000 |

| 1.02 |

Non-current Assets |

28,433,000 |

|

28,561,000 |

| 1.02.01 |

Long-Term Assets |

1,147,000 |

|

1,155,000 |

| 1.02.01.07 |

Deferred Taxes |

216,000 |

|

171,000 |

| 1.02.01.09 |

Receivable From Related Parties |

19,000 |

|

23,000 |

| 1.02.01.09.04 |

Receivable from Others Related Parties |

19,000 |

|

23,000 |

| 1.02.01.10 |

Other Non-current Assets |

912,000 |

|

961,000 |

| 1.02.01.10.04 |

Recoverable Taxes |

539,000 |

|

573,000 |

| 1.02.01.10.05 |

Restricted Deposits for Legal Proceedings |

37,000 |

|

44,000 |

| 1.02.01.10.06 |

Derivative Financial Instruments |

220,000 |

|

226,000 |

| 1.02.01.10.07 |

Other Accounts Receivable |

116,000 |

|

118,000 |

| 1.02.02 |

Investments |

802,000 |

|

864,000 |

| 1.02.02.01 |

Investments in Associates |

802,000 |

|

864,000 |

| 1.02.02.01.03 |

Joint Venture Participation |

802,000 |

|

864,000 |

| 1.02.03 |

Property, Plant and Equipment |

21,309,000 |

|

21,370,000 |

| 1.02.03.01 |

Property, Plant and Equipment in Use |

13,183,000 |

|

13,148,000 |

| 1.02.03.02 |

Right of Use on Leases |

8,126,000 |

|

8,222,000 |

| 1.02.04 |

Intangible Assets |

5,175,000 |

|

5,172,000 |

| (FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |

|

|

| Interim Financial Information - 6/30/2024 - SENDAS DISTRIBUIDORA S.A. |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| Individual Financial Statements / Balance Sheet - Liabilities |

|

|

| R$ (in thousands) |

|

|

|

| |

|

|

|

|

| |

|

Current Quarter |

|

Prior year |

| Account code |

Account description |

6/30/2024 |

|

12/31/2023 |

| 2 |

Total Liabilities |

44,074,000 |

|

43,177,000 |

| 2.01 |

Current Liabilities |

18,727,000 |

|

16,425,000 |

| 2.01.01 |

Payroll and Related Taxes |

640,000 |

|

624,000 |

| 2.01.01.01 |

Social Taxes |

81,000 |

|

84,000 |

| 2.01.01.02 |

Payroll Taxes |

559,000 |

|

540,000 |

| 2.01.02 |

Trade Payables |

10,374,000 |

|

12,110,000 |

| 2.01.02.01 |

National Trade Payables |

10,374,000 |

|

12,110,000 |

| 2.01.02.01.01 |

Trade Payables |

9,715,000 |

|

9,759,000 |

| 2.01.02.01.02 |

Trade Payables - Agreements |

659,000 |

|

1,459,000 |

| 2.01.02.01.03 |

Trade payables - Agreements - Acquisition of hypermarkets |

- |

|

892,000 |

| 2.01.03 |

Taxes and Contributions Payable |

336,000 |

|

298,000 |

| 2.01.04 |

Borrowings and Financing |

6,414,000 |

|

2,115,000 |

| 2.01.04.01 |

Borrowings and Financing |

949,000 |

|

36,000 |

| 2.01.04.02 |

Debentures |

5,465,000 |

|

2,079,000 |

| 2.01.05 |

Other Liabilities |

963,000 |

|

1,278,000 |

| 2.01.05.02 |

Others |

963,000 |

|

1,278,000 |

| 2.01.05.02.09 |

Deferred Revenue |

288,000 |

|

418,000 |

| 2.01.05.02.17 |

Lease Liability |

374,000 |

|

532,000 |

| 2.01.05.02.19 |

Other Accounts Payable |

301,000 |

|

328,000 |

| 2.02 |

Non-current Liabilities |

20,520,000 |

|

22,122,000 |

| 2.02.01 |

Borrowings and Financing |

11,318,000 |

|

13,069,000 |

| 2.02.01.01 |

Borrowings and Financing |

926,000 |

|

1,947,000 |

| 2.02.01.02 |

Debentures |

10,392,000 |

|

11,122,000 |

| 2.02.02 |

Other Liabilities |

8,928,000 |

|

8,753,000 |

| 2.02.02.02 |

Others |

8,928,000 |

|

8,753,000 |

| 2.02.02.02.05 |

Trade payables |

25,000 |

|

38,000 |

| 2.02.02.02.09 |

Lease Liability |

8,840,000 |

|

8,652,000 |

| 2.02.02.02.11 |

Other Accounts Payable |

63,000 |

|

63,000 |

| 2.02.04 |

Provision |

242,000 |

|

263,000 |

| 2.02.06 |

Deferred Earnings and Revenue |

32,000 |

|

37,000 |

| 2.02.06.02 |

Deferred Revenue |

32,000 |

|

37,000 |

| 2.03 |

Shareholders’ Equity |

4,827,000 |

|

4,630,000 |

| 2.03.01 |

Share Capital |

1,272,000 |

|

1,272,000 |

| 2.03.02 |

Capital Reserves |

72,000 |

|

56,000 |

| 2.03.04 |

Earnings Reserves |

3,492,000 |

|

3,309,000 |

| 2.03.08 |

Other Comprehensive Income |

(9,000) |

|

(7,000) |

| (FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |

| Interim Financial Information - 6/30/2024 - SENDAS DISTRIBUIDORA S.A. |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Individual Financial Statements / Statements of Operations |

| R$ (in thousands) |

|

|

|

|

| |

|

|

|

| |

|

Current quarter |

Year to date current year |

Same quarter of previous year |

Year to date prior year |

| Account code |

Account description |

4/1/2024 to 6/30/2024 |

1/1/2024 to 6/30/2024 |

4/1/2023 to 6/30/2023 |

1/1/2023 to 6/30/2023 |

| 3.01 |

Net Operating Revenue |

17,871,000 |

35,093,000 |

15,984,000 |

31,080,000 |

| 3.02 |

Cost of Sales |

(14,923,000) |

(29,343,000) |

(13,420,000) |

(26,088,000) |

| 3.03 |

Gross Profit |

2,948,000 |

5,750,000 |

2,564,000 |

4,992,000 |

| 3.04 |

Operating Expense/Income |

(2,071,000) |

(4,059,000) |

(1,827,000) |

(3,636,000) |

| 3.04.01 |

Selling Expenses |

(1,504,000) |

(2,920,000) |

(1,303,000) |

(2,609,000) |

| 3.04.02 |

General and Administrative Expenses |

(194,000) |

(399,000) |

(177,000) |

(383,000) |

| 3.04.05 |

Other Operating Expenses |

(389,000) |

(772,000) |

(359,000) |

(668,000) |

| 3.04.05.01 |

Depreciation/ Amortization |

(385,000) |

(764,000) |

(341,000) |

(654,000) |

| 3.04.05.03 |

Other Expenses Operating |

(4,000) |

(8,000) |

(18,000) |

(14,000) |

| 3.04.06 |

Share of Profit of Associates |

16,000 |

32,000 |

12,000 |

24,000 |

| 3.05 |

Profit from Operations Before Net Financial Expenses and Taxes |

877,000 |

1,691,000 |

737,000 |

1,356,000 |

| 3.06 |

Net Financial Result |

(719,000) |

(1,479,000) |

(628,000) |

(1,258,000) |

| 3.06.01 |

Financial Revenues |

54,000 |

97,000 |

59,000 |

129,000 |

| 3.06.02 |

Financial Expenses |

(773,000) |

(1,576,000) |

(687,000) |

(1,387,000) |

| 3.07 |

Income Before Income Tax and Social Contribution |

158,000 |

212,000 |

109,000 |

98,000 |

| 3.08 |

Income Tax and Social Contribution |

(35,000) |

(29,000) |

47,000 |

130,000 |

| 3.08.01 |

Current |

(55,000) |

(82,000) |

2,000 |

2,000 |

| 3.08.02 |

Deferred |

20,000 |

53,000 |

45,000 |

128,000 |

| 3.09 |

Net Income from Continued Operations |

123,000 |

183,000 |

156,000 |

228,000 |

| 3.11 |

Net Income for the Period |

123,000 |

183,000 |

156,000 |

228,000 |

| 3.99 |

Earnings per Share - (Reais/Share) |

|

|

|

|

| 3.99.01 |

Basic Earnings Per Share |

|

|

|

|

| 3.99.01.01 |

Common |

0.09032 |

0.13507 |

0.11535 |

0.16867 |

| 3.99.02 |

Diluted Earnings Per Share |

|

|

|

|

| 3.99.02.01 |

Common |

0.09005 |

0.13472 |

0.11489 |

0.16815 |

| (FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |

|

|

|

| Interim Financial Information - 6/30/2024 - SENDAS DISTRIBUIDORA S.A. |

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Individual Financial Statements / Statements of Comprehensive Income |

|

|

| R$ (in thousands) |

|

|

|

|

| |

|

|

|

|

|

| |

|

Current quarter |

Year to date current year |

Same quarter of previous year |

Year to date prior year |

| Account code |

Account description |

4/1/2024 to 6/30/2024 |

1/1/2024 to 6/30/2024 |

4/1/2023 to 6/30/2023 |

1/1/2023 to 6/30/2023 |

| 4.01 |

Net Income for the period |

123,000 |

183,000 |

156,000 |

228,000 |

| 4.02 |

Other Comprehensive Income |

(5,000) |

(2,000) |

(5,000) |

(4,000) |

| 4.02.04 |

Fair value of receivables |

(8,000) |

(3,000) |

(8,000) |

(6,000) |

| 4.02.06 |

Income Tax Effect |

3,000 |

1,000 |

3,000 |

2,000 |

| 4.03 |

Total Comprehensive Income for the period |

118,000 |

181,000 |

151,000 |

224,000 |

| (FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |

|

|

| Interim Financial Information - 6/30/2024 - SENDAS DISTRIBUIDORA S.A. |

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| Individual Financial Statements / Statements of Cash Flows - Indirect method |

|

| R$ (in thousands) |

|

|

| |

|

|

|

| |

|

Year to date current year |

Year to date prior year |

| Account code |

Account description |

1/1/2024 to 6/30/2024 |

1/1/2023 to 6/30/2023 |

| 6.01 |

Net Cash Operating Activities |

549,000 |

2,634,000 |

| 6.01.01 |

Cash Provided by the Operations |

2,793,000 |

2,510,000 |

| 6.01.01.01 |

Net profit for the period |

183,000 |

228,000 |

| 6.01.01.02 |

Deferred Income Tax and Social Contribution |

(44,000) |

(128,000) |

| 6.01.01.03 |

Loss of Disposal of Property, Plant and Equipment and Leasing |

9,000 |

7,000 |

| 6.01.01.04 |

Depreciation and Amortization |

806,000 |

694,000 |

| 6.01.01.05 |

Financial Charges |

1,536,000 |

1,389,000 |

| 6.01.01.07 |

Share of Profit of Associates |

(32,000) |

(24,000) |

| 6.01.01.08 |

Provision for Legal Proceedings |

34,000 |

90,000 |

| 6.01.01.10 |

Provision for Stock Option |

16,000 |

9,000 |

| 6.01.01.11 |

(Reverse) Allowance for Doubtful Accounts |

(3,000) |

3,000 |

| 6.01.01.13 |

Provision for Allowance for Inventory Losses and Damages |

288,000 |

242,000 |

| 6.01.02 |

Variations in Assets and Liabilities |

(2,244,000) |

124,000 |

| 6.01.02.01 |

Trade Receivables |

(730,000) |

(139,000) |

| 6.01.02.02 |

Inventories |

(866,000) |

(149,000) |

| 6.01.02.03 |

Recoverable Taxes |

49,000 |

271,000 |

| 6.01.02.04 |

Other Assets |

(98,000) |

(108,000) |

| 6.01.02.05 |

Related Parties |

4,000 |

(1,000) |

| 6.01.02.06 |

Restricted Deposits for Legal Proceedings |

7,000 |

8,000 |

| 6.01.02.07 |

Trade Payables |

(536,000) |

526,000 |

| 6.01.02.08 |

Payroll and Related Taxes |

16,000 |

(42,000) |

| 6.01.02.09 |

Taxes and Social Contributions Payable |

38,000 |

(26,000) |

| 6.01.02.10 |

Payment for Legal Proceedings |

(60,000) |

(34,000) |

| 6.01.02.11 |

Deferred Revenue |

(135,000) |

(118,000) |

| 6.01.02.12 |

Other Liabilities |

(27,000) |

(84,000) |

| 6.01.02.15 |

Dividends Received |

94,000 |

20,000 |

| 6.02 |

Net Cash of Investing Activities |

(853,000) |

(1,366,000) |

| 6.02.02 |

Purchase of Property, Plant and Equipment |

(852,000) |

(1,362,000) |

| 6.02.03 |

Purchase of Intangible Assets |

(19,000) |

(29,000) |

| 6.02.04 |

Receipt of Property, Plant and Equipment |

2,000 |

16,000 |

| 6.02.09 |

Receipt of Sale of Assets Held for Sale |

16,000 |

9,000 |

| 6.03 |

Net Cash of Financing Activities |

(51,000) |

(2,514,000) |

| 6.03.01 |

Capital Contribution |

- |

2,000 |

| 6.03.02 |

Proceeds from Borrowings |

2,300,000 |

300,000 |

| 6.03.03 |

Payment of Borrowings |

(199,000) |

(104,000) |

| 6.03.04 |

Payment of Interest on Borrowings |

(567,000) |

(502,000) |

| 6.03.05 |

Dividends and interest on own equity, paid |

- |

(118,000) |

| 6.03.09 |

Payment of Lease Liabilities |

(148,000) |

(169,000) |

| 6.03.10 |

Payment of Interest on Lease Liabilities |

(529,000) |

(476,000) |

| 6.03.11 |

Borrowing costs from borrowings |

(12,000) |

(51,000) |

| 6.03.12 |

Payment Points of Sales Acquisition |

(896,000) |

(1,396,000) |

| 6.05 |

Increase (Decrease) in Cash and Equivalents |

(355,000) |

(1,246,000) |

| 6.05.01 |

Cash and Cash Equivalents at the beginning of the Period |

5,459,000 |

5,842,000 |

| 6.05.02 |

Cash and Cash Equivalents at the end of the Period |

5,104,000 |

4,596,000 |

| (FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL PREVIOUSLY ISSUED IN PORTUGUESE) |

|

|

|

|

|

| Interim Financial Information - 6/30/2024 - SENDAS DISTRIBUIDORA S.A. |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Individual Financial Statements / Statements of Changes in Shareholders' Equity 1/1/2024 to 6/30/2024 R$ (in thousands) |

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Account code |

Account description |

Capital stock |

Capital reserves, granted options and treasury shares |

Profit reserves |

Retained earnings

/Accumulated losses |

Other comprehensive income |

Shareholders' equity |

| 5.01 |

Opening Balance |

1,272,000 |

56,000 |

3,309,000 |

- |

(7,000) |

4,630,000 |

| 5.03 |

Adjusted Opening Balance |

1,272,000 |

56,000 |

3,309,000 |

- |

(7,000) |

4,630,000 |

| 5.04 |

Capital Transactions with Shareholders |

- |

16,000 |

- |

- |

- |

16,000 |

| 5.04.03 |

Stock Options Granted |

- |

16,000 |

- |

- |

- |

16,000 |

| 5.05 |

Total Comprehensive Income |

- |

- |

- |

183,000 |

(2,000) |

181,000 |

| 5.05.01 |

Net Income for the Period |

- |

- |

- |

183,000 |

- |

183,000 |

| 5.05.02 |

Other Comprehensive Income |

- |

- |

- |

- |

(2,000) |

(2,000) |

| 5.05.02.07 |

Fair Value of Receivables |

- |

- |

- |

- |

(3,000) |

(3,000) |

| 5.05.02.09 |

Income Tax Effect |

- |

- |

- |

- |

1,000 |

1,000 |

| 5.06 |

Internal Changes of Shareholders' Equity |

- |

- |

183,000 |

(183,000) |

- |

- |

| 5.06.05 |

Tax Incentive Reserve |

- |

- |

183,000 |

(183,000) |

- |

- |

| 5.07 |

Closing Balance |

1,272,000 |

72,000 |

3,492,000 |

- |

(9,000) |

4,827,000 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Individual Financial Statements / Statements of Changes in Shareholders' Equity 1/1/2023 to 6/30/2023 R$ (in thousands) |

|

|

| |

|

|

|

|

|

|

|

| Account code |

Account description |

Capital stock |

Capital reserves, granted options and treasury shares |

Profit reserves |

Retained earnings

/Accumulated losses |

Other comprehensive income |

Shareholders' equity |

| 5.01 |

Opening Balance |

1,263,000 |

36,000 |

2,599,000 |

- |

(2,000) |

3,896,000 |

| 5.03 |

Adjusted Opening Balance |

1,263,000 |

36,000 |

2,599,000 |

- |

(2,000) |

3,896,000 |

| 5.04 |

Capital Transactions with Shareholders |

2,000 |

9,000 |

- |

- |

- |

11,000 |

| 5.04.01 |

Capital Contribution |

2,000 |

- |

- |

- |

- |

2,000 |

| 5.04.03 |

Stock Options Granted |

- |

9,000 |

- |

- |

- |

9,000 |

| 5.05 |

Total Comprehensive Income |

- |

- |

- |

228,000 |

(4,000) |

224,000 |

| 5.05.01 |

Net Income for the Period |

- |

- |

- |

228,000 |

- |

228,000 |

| 5.05.02 |

Other comprehensive income |

- |

- |

- |

- |

(4,000) |

(4,000) |

| 5.05.02.07 |

Fair Value of Receivables |

- |

- |

- |

- |

(6,000) |

(6,000) |

| 5.05.02.09 |

Income Tax Effect |

- |

- |

- |

- |

2,000 |

2,000 |

| 5.06 |

Internal Changes of Shareholders' Equity |

- |

- |

228,000 |

(228,000) |

- |

- |

| 5.06.05 |

Tax Incentive Reserve |

- |

- |

228,000 |

(228,000) |

- |

- |

| 5.07 |

Closing Balance |

1,265,000 |

45,000 |

2,827,000 |

- |

(6,000) |

4,131,000 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

CORPORATE INFORMATION |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

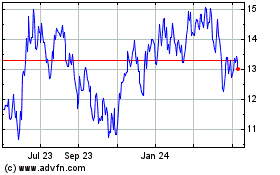

Sendas Distribuidora S.A. (“Company” or “Sendas”) is a publicly held company listed in the Novo Mercado segment of B3 S.A. - Brasil, Bolsa, Balcão (B3), under ticker symbol "ASAI3" and on the New York Stock Exchange (NYSE), under ticker symbol "ASAI". The Company is primarily engaged in the retail and wholesale of food products, bazaar items and other products through its chain of stores, operated under “ASSAÍ” brand, since this is the only disclosed segment. The Company's registered office is at Avenida Ayrton Senna, 6.000, Lote 2 - Anexo A, Jacarepaguá, in the State of Rio de Janeiro. As of June 30, 2024, the Company operated 293 stores (288 stores as of December 31, 2023) and 11 distribution centers (11 distribution centers as of December 31, 2023) in the five regions of the country, with operations in 24 states and in the Federal District. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.1 |

New matters |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Ninth and tenth issue of debentures, see note 15.6. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Long-term benefit plans, see notes 19.3.4 and 19.3.5. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Buy-back program of shares, see note 19.4. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2 |

BASIS OF PREPARATION AND DISCLOSURE OF THE INTERIM FINANCIAL INFORMATION |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The interim financial information has been prepared in accordance with IAS 34 – Interim Financial Reporting issued by the International Accounting Standards Board (“IASB”) and accounting standard CPC 21 (R1) – Interim Financial Report and disclosed aligned with the standards approved by the Brazilian Securities and Exchange Commission (“CVM”), applicable to the preparation of the Interim Financial Information. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The interim financial information has been prepared based on the historical cost basis, except for: (i) certain financial instruments; and (ii) assets and liabilities arising from business combinations measured at their fair values, when applicable. In accordance with OCPC 07 - Presentation and Disclosures in General Purpose - Financial Statements, all significant information related to the interim financial information, and only them, is being disclosed and is consistent with the information used by Management in managing of the Company's activities. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The interim financial information is presented in millions of Brazilian Reais (R$), which is the Company's functional currency. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The interim financial information for the period ended June 30, 2024 were approved by the Board of Directors on August 8, 2024. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3 |

MATERIAL ACCOUNTING POLICIES |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The material accounting policies and practices applied by the Company to the preparation of the interim financial information are in accordance with those adopted and disclosed in note 3 and in each explanatory note corresponding to the financial statements for the year ended December 31, 2023, approved on February 21, 2024 and, therefore, it should be read together. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.1 |

Standards, amendments and interpretations |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

In the period ended June 30, 2024, the new current standards, include the review of CPC 09 (R1) – Statements of Value Added, were evaluated and produced no effect on the interim financial information disclosed, additionally the Company did not adopt in advance the IFRS issued and not yet current. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4 |

SIGNIFICANT ACCOUNTING JUDGMENTS, ESTIMATES AND ASSUMPTIONS |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The preparation of the interim financial information requires Management to makes judgments and estimates and adopt assumptions that affect the reported amounts of revenues, expenses, assets and liabilities, and the disclosure of contingent liabilities at the end of the reporting period, however, the uncertainties about these assumptions and estimates may generate results that require substantial adjustments to the carrying amount of the asset or liability in future periods. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The significant assumptions and estimates applied on the preparation of the interim financial information for the period ended June 30, 2024, were the same as those adopted in the financial statements for the year ended December 31, 2023, approved on February 21, 2024, disclosed in note 5. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5 |

CASH AND CASH EQUIVALENTS |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

6/30/2024 |

|

12/31/2023 |

|

|

|

|

|

|

|

|

|

| |

Cash and bank accounts |

|

|

|

292 |

|

352 |

|

|

|

|

|

|

|

|

|

| |

Cash and bank accounts - Abroad (i) |

|

25 |

|

|

|

22 |

|

|

|

|

|

|

|

|

|

| |

Financial investments (ii) |

|

|

|

4,787 |

|

|

|

5,085 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

5,104 |

|

5,459 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(i) As of June 30, 2024, the Company had funds held abroad, of which R$25 in US dollars (R$22 in US dollars as of December 31, 2023). |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(ii) As of June 30, 2024, the financial investments refer to the repurchase and resale agreements and Bank Deposit Certificates - CDB, with a weighted average interest rate of 97.72% of the CDI - Interbank Deposit Certificate (95.92% of the CDI as of December 31, 2023). |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The Company's exposure to interest rate indexes and the sensitivity analysis for these financial assets are disclosed in note 15.3. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6 |

TRADE

RECEIVABLES |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Note |

|

6/30/2024 |

|

12/31/2023 |

|

| |

From sales with: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Credit

card |

|

|

|

|

|

|

|

|

|

6.1 |

|

1,300 |

|

589 |

|

| |

Credit

card - related parties (FIC) |

|

|

|

|

|

9.1 |

|

289 |

|

211 |

|

| |

Ticket |

|

|

|

|

|

|

|

|

|

|

|

6.1 |

|

183 |

|

185 |

|

| |

Total of credit

card and ticket |

|

|

|

|

|

|

|

|

|

|

|

1,772 |

|

985 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Slips |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

109 |

|

148 |

|

| |

Suppliers

and others |

|

|

|

|

|

|

|

|

|

|

|

60 |

|

81 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,941 |

|

1,214 |

|

| |

Expected credit

loss for doubtful accounts |

|

|

|

6.2 |

|

(12) |

|

(15) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,929 |

|

1,199 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The breakdown of trade

receivables by their gross amount by maturity period is presented below: |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Overdue |

|

| |

|

|

|

|

|

|

|

|

|

Total |

|

Due |

|

Less

than 30 days |

|

Over

30 days |

|

| |

June 30, 2024 |

|

|

|

|

|

|

|

1,941 |

|

|

|

1,930 |

|

5 |

|

6 |

|

| |

December 31, 2023 |

|

|

|

|

|

|

|

1,214 |

|

|

|

1,202 |

|

5 |

|

7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6.1 |

Assignment

of receivables |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The Company assigned

part of its receivables referring to credit cards and ticket with operators, without any right of recourse, aiming to anticipate

its cash flow. As of June 30, 2024, the amount of these operations is R$1,650 (R$2,757 as of December 31, 2023). The amount was derecognized

from the balance of trade receivables, since all risks related to the receivables were substantially transferred. The cost to advance

these credit card receivables is classified as “Cost and discount of receivables” in note 23. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of June 30, 2024,

the amount of receivables, currently, discountable (credit cards and ticket) is R$1,772 (R$985 as of December 31,2023). |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6.2 |

Expected

credit loss for doubtful accounts |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

6/30/2024 |

|

6/30/2023 |

|

|

|

|

|

|

|

|

|

| |

At the beginning of the period |

|

|

|

(15) |

|

(11) |

|

|

|

|

|

|

|

|

|

| |

Additions |

|

|

|

|

|

|

|

(37) |

|

(20) |

|

|

|

|

|

|

|

|

|

| |

Reversals |

|

|

|

|

|

|

40 |

|

18 |

|

|

|

|

|

|

|

|

|

| |

At the end of the period |

|

|

|

(12) |

|

(13) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7 |

INVENTORIES |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Note |

|

6/30/2024 |

|

12/31/2023 |

|

|

|

|

|

|

|

|

|

| |

Stores |

|

|

|

|

|

|

|

6,402 |

|

6,033 |

|

|

|

|

|

|

|

|

|

| |

Distribution centers |

|

|

|

|

|

1,462 |

|

1,237 |

|

|

|

|

|

|

|

|

|

| |

Commercial agreements |

|

7.1 |

|

(575) |

|

(525) |

|

|

|

|

|

|

|

|

|

| |

Inventory losses |

|

|

|

7.2 |

|

(47) |

|

(81) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

7,242 |

|

6,664 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7.1 |

Commercial

agreements |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As

of June 30, 2024, the amount of unrealized commercial agreements, presented as a reduction of inventory balance, totaled R$575 (R$525

as of December 31, 2023). |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7.2 |

Inventory

losses |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

6/30/2024 |

|

6/30/2023 |

|

|

|

|

|

|

|

|

|

| |

At the beginning of the period |

|

|

|

(81) |

|

(68) |

|

|

|

|

|

|

|

|

|

| |

Additions |

|

|

|

|

|

|

(298) |

|

(259) |

|

|

|

|

|

|

|

|

|

| |

Reversals |

|

|

|

|

|

|

10 |

|

17 |

|

|

|

|

|

|

|

|

|

| |

Write-offs |

|

|

|

|

|

|

322 |

|

266 |

|

|

|

|

|

|

|

|

|

| |

At the end of the period |

|

|

|

(47) |

|

(44) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8 |

RECOVERABLE

TAXES |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Note |

|

6/30/2024 |

|

12/31/2023 |

|

|

|

|

|

|

|

| |

ICMS |

|

|

|

|

|

|

|

8.1 |

|

953 |

|

1,085 |

|

|

|

|

|

|

|

| |

PIS and COFINS |

|

|

|

|

|

8.2 |

|

381 |

|

287 |

|

|

|

|

|

|

|

| |

Social Security Contribution

- INSS |

|

|

|

148 |

|

169 |

|

|

|

|

|

|

|

| |

Whithholding taxes to

be recovered |

|

|

|

138 |

|

105 |

|

|

|

|

|

|

|

| |

Others |

|

|

|

|

|

|

|

|

|

4 |

|

27 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

1,624 |

|

1,673 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Current |

|

|

|

|

|

|

|

|

|

1,085 |

|

1,100 |

|

|

|

|

|

|

|

| |

Non-current |

|

|

|

|

|

|

|

539 |

|

573 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8.1 |

State

VAT tax credits - ICMS |

| |

The Brazilian States

have been substantially amending their local laws aiming at implementing and broadening the ICMS tax replacement system. This system

entails the prepayment of ICMS of the whole commercial chain, upon goods outflow from an industrial establishment or importer or

their inflow into each State. The expansion of this system to an increasingly wider range of products sold in the retail generates

the prepayment of the tax and consequently a refund in certain operations. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

With respect to credits

that cannot yet be immediately offset, the Company's management, according to a technical recovery study, based on the future expectation

of growth and consequent offset against taxes payable from its operations, believes that its future offset is viable. The mentioned

studies are prepared and periodically reviewed based on information obtained from the strategic planning previously approved by the

Company's Board of Directors. For the interim financial information as of June 30, 2024, the Company's management has monitoring

controls over the adherence to the annually established plan, reassessing and including new elements that contribute to the realization

of the recoverable ICMS balance, as shown in the table below: |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Year |

|

Amount |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Within

1 year |

|

|

|

455 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

From

1 to 2 years |

|

|

|

116 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

From

2 to 3 years |

|

|

|

103 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

From

3 to 4 years |

|

|

|

83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

From

4 to 5 years |

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

More

than 5 years |

|

|

|

146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

953 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 8.2 |

PIS and

COFINS credit |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

On March 15, 2017, the

Federal Supreme Court ("STF”) recognized the unconstitutionality of the inclusion of ICMS in the PIS and COFINS

calculation base. On May 13, 2021, the STF judged the Declaration Embargoes in relation to the amount to be excluded from the calculation

basis of the contributions, which should only be the ICMS paid, or if the entire ICMS, as shown in the respective invoices. The STF

rendered a favorable decision to the taxpayers, concluding that all ICMS highlighted should be excluded from the calculation basis. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Currently the Company,

with the favorable judgment of the Supreme Court, has recognized the exclusion of ICMS from the PIS and COFINS calculation basis. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

In addition to the recorded

credits, the Company has contingent tax assets in the amount of R$54 related to PIS and COFINS credits. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

•

Expected realization of PIS and COFINS credits |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

In relation to the recoverable

PIS and COFINS credits, the Company's management, based on a technical recovery study considering future growth expectations and

consequent offset against debts from its operations, projects its future realization. The mentioned studies are prepared and periodically

reviewed based on information obtained from the strategic planning previously approved by the Company's Board of Directors. For the

interim financial information as of June 30, 2024, the Company's management has monitoring controls over the adherence to the annually

established plan, reassessing and including new elements that contribute to the realization of the recoverable PIS and COFINS balance,

in the amount of R$381, and expected realization is within one year. |

|

| 9 |

RELATED

PARTIES |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 9.1 |

Balances

and related party transactions |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Assets |

|

Liabilities |

|

Transactions |

| |

|

|

|

|

|

|

|

Trade

receivables |

|

Other

assets |

|

Suppliers |

|

Revenue

(expenses) |

| |

|

|

|

|

|

|

|

6/30/2024 |

|

12/31/2023 |

|

6/30/2024 |

|

12/31/2023 |

|

6/30/2024 |

|

12/31/2023 |

|

6/30/2024 |

|

6/30/2023 |

| |

Joint venture |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Financeira

Itaú CBD S.A. Crédito, Financiamento e Investimento (“FIC”) |

|

289 |

|

211 |

|

19 |

|

23 |

|

23 |

|

28 |

|

15 |

|

12 |

| |

|

|

|

|

|

|

|

289 |

|

211 |

|

19 |

|

23 |

|

23 |

|

28 |

|

15 |

|

12 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Current |

|

|

|

|

|

289 |

|

211 |

|

- |

|

- |

|

23 |

|

28 |

|

|

|

|

| |

Non-current |

|

|

|

|

|

- |

|

- |

|

19 |

|

23 |

|

- |

|

- |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Transactions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Revenue

(expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

6/30/2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Associates (i) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Casino

Guichard Perrachon |

|

|

|

(20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Euris |

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Grupo

Pão de Açúcar ("GPA") |

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Wilkes

Participações S.A. |

|

|

|

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

(7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(i)

On June 23, 2023, as per the Notice to the Market published on the same date, Casino, through its subsidiaries Wilkes, Geant International

BV ("GIBV") and Segisor S.A.S ("Segisor"), sold 157,582,850 common shares issued by the Company, representing

11.67% of its share capital, through a block trade operation carried out on the same date. As a result, the Casino Group now holds

an ownership interest of less than 0.01% of Sendas' share capital, no longer being considered a related party of the Company. The

balances with these companies and their subsidiaries are presented under the line items Other accounts receivable and Other accounts

payable in the balance sheet in the interim financial information for the period ended June 30, 2024. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Additionally,

after the completion of the spin-off between the Company and GPA on December 31, 2020, both undertook to put forth commercially reasonable

efforts, within up to 18 months, to release, replace and/or otherwise remove the counterparty from the position of guarantor of liabilities

or obligations, which after such term would be subject to the payment of a fee, net, as remuneration for the guarantees provided

by both parties. If the Company and GPA cease to be submitted to common control, the parties would be required to release, replace

and/or otherwise remove the guarantees until then not replaced or provided, observing the terms established in the Separation Agreement. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

Company and GPA ceased to be related parties in fiscal year 2023 and are taking the necessary measures to replace the cross guarantees

on the contractual obligations of: i) rental of stores; ii) borrowing agreement; and iii) purchase of electricity. The fee paid to

GPA as remuneration for the guarantees provided as of June 30, 2024 and December 31, 2023 was less than R$1. |

| 9.2 |

Management

compensation |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Expenses

referring to the executive board compensation recorded in the Company’s statement of operations in the period ended June 30,

2024 and 2023 as follows (amounts expressed in thousands reais): |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Base

salary |

|

Variable

compensation |

|

Stock

option plan and shared-based payment plan (i) |

|

Total |

|

| |

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

| |

Board of directors |

|

|

|

6,124 |

|

5,452 |

|

- |

|

- |

|

- |

|

5,250 |

|

6,124 |

|

10,702 |

|

| |

Statutory officers |

|

|

|

|

|

|

8,543 |

|

5,466 |

|

10,198 |

|

7,444 |

|

14,170 |

|

5,691 |

|

32,911 |

|

18,601 |

|

| |

Executives excluding statutory officers |

17,286 |

|

15,500 |

|

23,646 |

|

19,158 |

|

9,104 |

|

5,845 |

|

50,036 |

|

40,503 |

|

| |

Fiscal council |

|

|

|

|

|

|

282 |

|

267 |

|

- |

|

- |

|

- |

|

- |

|

282 |

|

267 |

|

| |

|

|

|

|

|

|

|

|

|

32,235 |

|

26,685 |

|

33,844 |

|

26,602 |

|

23,274 |

|

16,786 |

|

89,353 |

|

70,073 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(i) More details about

shared-based payment plan for the Statutory officers, see note 19.3.3. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The stock option plan,

fully convertible into shares, refers to the Company's and this plan has been treated in the Company's statement of operations. The

corresponding expenses are allocated to the Company and recorded in the statement of operations against capital reserve - stock options

in shareholders' equity. There are no other short-term benefits granted to members of the Company's management. The new long-term

benefit plans are disclosed in notes 19.3.4 and 19.3.5. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 10 |

INVESTMENTS |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The details of the Company's

investments at the end of the period are as follows: |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Participation

in investments - % |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct

participation |

|

| |

Investment

type |

|

Company |

|

Country |

|

6/30/2024 |

|

12/31/2023 |

|

| |

Joint venture |

|

Bellamar Empreendimento

e Participações S.A. |

|

Brazil |

|

50.00 |

|

50.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Summary

of financial information of Joint Venture |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

6/30/2024 |

|

12/31/2023 |

|

|

|

|

|

|

|

|

|

| |

Current assets |

|

|

|

|

|

1 |

|

1 |

|

|

|

|

|

|

|

|

|

| |

Non-current assets |

|

|

|

|

|

458 |

|

581 |

|

|

|

|

|

|

|

|

|

| |

Shareholders´

equity |

|

|

|

|

459 |

|

582 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

6/30/2024 |

|

6/30/2023 |

|

|

|

|

|

|

|

|

|

| |

Net income for the

period |

|

|

|

64 |

|

47 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Investments

composition and breakdown |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Bellamar |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of December 31,

2022 |

|

|

|

833 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Share

of profit of associates |

|

|

|

24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Dividends

received |

|

|

|

|

|

(20) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of June 30, 2023 |

|

|

|

|

837 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of December 31, 2023 |

|

|

|

864 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Share

of profit of associates |

|

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Dividends

received |

|

|

|

|

|

(94) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

As of June 30, 2024 |

|

|

|

|

802 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 11 |

PROPERTY,

PLANT AND EQUIPMENT |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 11.1 |

Breakdown

and composition of property, plant and equipment |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

As

of 12/31/2023 |

|

Additions

(i) |

|

Write-off |

|

Depreciation |

|

Transfers

and others |

|

As

of

6/30/2024 |

|

|

Historical

cost |

|

Accumulated

depreciation |

| |

Lands |

|

|

|

|

|

|

|

|

|

|

559 |

|

- |

|

- |

|

- |

|

- |

|

559 |

|

= |

559 |

|

- |

| |

Buildings |

|

|

|

|

|

|

|

|

|

|

777 |

|

37 |

|

- |

|

(11) |

|

98 |

|

901 |

|

1,069 |

|

(168) |

| |

Improvements |

|

|

|

|

|

|

|

8,099 |

|

287 |

|

(4) |

|

(248) |

|

(82) |

|

8,052 |

|

9,783 |

|

(1,731) |

| |

Machinery and equipment |

|

|

|

2,310 |

|

149 |

|

(2) |

|

(133) |

|

15 |

|

2,339 |

|

3,443 |

|

(1,104) |

| |

Facilities |

|

|

|

|

|

|

|

|

|

|

270 |

|

7 |

|

- |

|

(19) |

|

- |

|

258 |

|

437 |

|

(179) |

| |

Furniture and appliances |

|

|

|

903 |

|

49 |

|

(3) |

|

(78) |

|

12 |

|

883 |

|

1,367 |

|

(484) |

| |

Constructions in progress |

|

|

|

111 |

|

13 |

|

- |

|

- |

|

(45) |

|

79 |

|

79 |

|

- |

| |

Others |

|

|

|

|

|

|

|

|

|

|

119 |

|

14 |

|

- |

|

(26) |

|

5 |