Current Report Filing (8-k)

September 12 2019 - 8:17AM

Edgar (US Regulatory)

0001040829

false

0001040829

2019-09-11

2019-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 12, 2019 (September 12, 2019)

RYMAN HOSPITALITY PROPERTIES, INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

1-13079

|

|

73-0664379

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

One Gaylord Drive

Nashville, Tennessee

|

37214

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number,

including area code: (615) 316-6000

(Former name or former address, if changed

since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on

Which Registered

|

|

Common Stock, par value $.01

|

|

RHP

|

|

New York Stock Exchange

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a)

of the Exchange Act. ¨

|

Item 7.01

|

Regulation FD Disclosure.

|

Hospitality Segment Preliminary Update

Ryman Hospitality Properties, Inc., a Delaware corporation (the “Company”),

disclosed that estimated preliminary results for third quarter 2019 through the end of August are consistent with the Company’s

previously disclosed expectation that Same-Store Hospitality RevPAR and Same-Store Hospitality Total RevPAR would increase by mid-single

digits in third quarter 2019, as compared to third quarter 2018. In addition, the Gaylord Rockies Resort & Convention Center

(“Gaylord Rockies”) continues to generate strong bookings and occupancy, and the Company expects third quarter 2019

to be Gaylord Rockies’ strongest quarter of 2019.

The Company calculates

revenue per available room (“RevPAR”) for its hotels by dividing room revenue by room nights available to guests for

the period. The Company calculates total revenue per available room (“Total RevPAR”) for its hotels by dividing the

sum of room revenue, food & beverage and other ancillary services revenue by room nights available to guests for the period.

Rooms out of service for renovation are included in room nights available. Same-Store Hospitality RevPAR and Same-Store Hospitality

Total RevPAR do not include the Gaylord Rockies. The Company’s expectations with respect to Same-Store Hospitality RevPAR,

Same-Store Hospitality Total RevPAR and Gaylord Rockies performance are based on preliminary results including estimates, which

are based on the most current information available to the Company as of the date of this Current Report on Form 8-K (this “Current

Report”), and such preliminary results and estimates are subject to the completion of the Company’s quarter-end financial

closing procedures. Accordingly, these results may change and those changes may be material.

Credit Facility Amendment

The Company and certain

of its subsidiaries, are currently in the process of amending the Company’s senior secured credit facility (the “Credit

Facility”) to extend the revolving portion of the Credit Facility and $200 million term loan A under the Credit Facility

beyond their current maturity dates of May 23, 2021 and May 23, 2022, respectively. The amendment and extension may also include

amending the pricing, size (including, potentially, an increase) and other terms for our revolver and term loan A. No change in

the combined principal amount of the term loan A and term loan B is expected.

The Company currently

anticipates completing the amendment and extension of the revolver and term loan A during the fourth quarter of 2019, although

there can be no assurance that such extension or amendments can be completed on favorable terms or at all.

The information furnished

pursuant to this Item 7.01 of Form 8-K shall not be deemed to be “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, and Section 11 of the Securities Act of 1933, as amended (the “Securities Act”) and

shall not be otherwise subject to the liabilities of those sections. This Current Report will not be deemed an admission by the

Company as to the materiality of any information in this Current Report that is required to be disclosed solely by Item 7.01. The

Company does not undertake a duty to update the information in this Current Report and cautions that the information included in

this Current Report under Item 7.01 is current only as of September 12, 2019 and may change thereafter.

On September

12, 2019, the Company announced that RHP Hotel Properties, LP (the “Operating Partnership”) and RHP

Finance Corporation (together, with the Operating Partnership, the “Issuers”), its indirect wholly owned

subsidiaries, intend to offer, in a private placement, subject to market and other conditions, up to $500 million aggregate

principal amount of senior unsecured notes due 2027 (the “2027 Notes”). The 2027 Notes will be offered to persons

reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act, and non-U.S.

persons outside of the United States pursuant to Regulation S under the Securities Act. The 2027 Notes have not been

registered under the Securities Act and will not be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements of the Securities Act.

A copy of the press

release announcing the intention of the Issuers to offer the 2027 Notes is attached hereto as Exhibit 99.1 and is incorporated

herein by reference.

In addition, on September

12, 2019, the Company issued a separate press release announcing that the Issuers have commenced a cash tender offer for any and

all of their outstanding 5.00% senior unsecured notes due 2021 (the “2021 Notes”), which were jointly issued by the

Issuers and are jointly and severally guaranteed, on an unsecured subordinated basis by the Company and the Operating Partnership’s

subsidiaries that guarantee the Credit Facility.

A copy of the press

release announcing the tender offer is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

This Current Report

is not an offer to sell or a solicitation of an offer to buy any security and does not constitute a redemption notice for the 2021

Notes.

Cautionary Statement Regarding Forward-Looking

Statements

This Current Report

contains forward-looking statements (as defined within the meaning of the Private Securities Litigation Reform Act of 1995) concerning

the intention of the Company to amend and extend its Credit Facility, the intention of the Issuers to offer the 2027 Notes, the

Company’s expectation of the aggregate principal amount of 2027 Notes to be sold and the Company’s expectations with

respect to performance of its hospitality segment, including with respect to anticipated Same-Store Hospitality RevPAR and Same-Store

Hospitality Total RevPAR and Gaylord Rockies performance. These forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from the statements made. Important factors that could cause actual results

to differ are described in the filings made from time to time by the Company with the U.S. Securities and Exchange Commission and

include the risk factors described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31,

2018. The Company does not undertake any obligation to release publicly any revisions to forward-looking statements made by it

to reflect events or circumstances occurring after the date hereof or the occurrence of unanticipated events.

|

ITEM 9.01.

|

financial statements and exhibits.

|

|

|

104

|

Cover Page Interactive Date File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

Ryman Hospitality Properties, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

Date: September 12, 2019

|

|

By:

|

/s/ Scott J. Lynn

|

|

|

|

Name:

|

Scott J. Lynn

|

|

|

|

Title:

|

Executive Vice President, General Counsel and Secretary

|

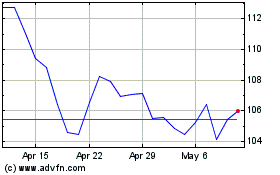

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

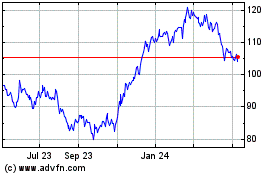

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024