– Company Reports Record Revenue and

Profitability for Second Quarter 2015 –

– Declares Third Quarter Dividend of $0.70 Per

Common Share, an Increase of 7.7% Over Second Quarter Dividend

–

Ryman Hospitality Properties, Inc. (NYSE:RHP), a lodging

real estate investment trust ("REIT") specializing in

group-oriented, destination hotel assets in urban and resort

markets, today reported financial results for the second quarter

ended June 30, 2015.

Colin Reed, chairman and chief executive officer of Ryman

Hospitality Properties, said, “We are delighted with our record

second quarter performance from both a revenue and profitability

perspective. Our Hospitality segment capitalized on strong demand

from group and transient customers to drive higher levels of

occupancy and outside-the-room spending, which, combined with

effective margin management, contributed to same-store Hospitality

Adjusted EBITDA Margin growth of 160 basis points to 34.5 percent

compared to second quarter 2014. This quarter’s Hospitality

Adjusted EBITDA margin is the best our Company has achieved for any

quarter since the opening of Gaylord National.

“Second quarter 2014 was a record for sales production, and

despite this tough comparison, our second quarter 2015 sales

production exceeded our four-year, five-year and seven-year second

quarter bookings average and is on pace with our production

expectations for the year.

“Based on our strong performance to date and our expectations

for the remainder of the year—and taking into consideration our

dividend policy—we are increasing our third quarter dividend to

$0.70 per common share. We plan to pay a total 2015 annual dividend

of $2.70 per common share, which is an increase of approximately 23

percent over 2014.”

The Company’s results include the following:

Three Months Ended Six Months Ended ($

in thousands, except per share amounts, RevPAR and Total RevPAR)

June 30, June 30, As Reported

Pro Forma As Reported Pro

Forma 2015 2014 % ∆

2014 (1) % ∆ 2015 2014 %

∆ 2014 (1) % ∆

Same-Store RevPAR (2)

$139.07 $134.85 3.1% $134.54 $129.94 3.5%

Same-Store Total RevPAR (2)

$330.46 $316.09 4.5% $314.16 5.2% $327.46 $317.34 3.2% $315.51 3.8%

Total Revenue $274,036 $257,913 6.3% $256,490 6.8% $527,184

$504,364 4.5% $501,685 5.1% Adjusted EBITDA $91,751 $81,562

12.5% $165,577 $148,044 11.8% Adjusted EBITDA Margin 33.5% 31.6%

1.9pt 31.8% 1.7pt 31.4% 29.4% 2.0pt 29.5% 1.9pt

Same-Store Hospitality Revenue (2)

$243,522 $232,930 4.5% $231,507 5.2% $479,976 $465,133 3.2%

$462,454 3.8%

Same-Store Hospitality Adjusted EBITDA

(2)

$84,035 $76,591 9.7% $159,879 $146,522 9.1%

Same-Store Hospitality Adjusted EBITDA

Margin (2)

34.5% 32.9% 1.6pt 33.1% 1.4pt 33.3% 31.5% 1.8pt 31.7% 1.6pt

Adjusted FFO $74,802 $68,408 9.3% $133,717 $123,128 8.6% Adjusted

FFO per diluted share $1.45 $1.13 28.3% $2.59 $2.05 26.3%

Operating income $57,015 $47,486 20.1% $92,905 $80,283 15.7%

Net income available to common shareholders $41,389 $23,039 79.6%

$45,921 (3) $43,692 5.1% Net income per diluted share available to

common shareholders $0.80 $0.38 110.5% $0.89 (3) $0.73 21.9%

(1) Shown pro forma to present 2014

results with an accounting change related to parking fees as

stipulated by the hospitality industry's Uniform System of Accounts

for the Lodging Industry, Eleventh Revised Edition, which became

effective in January 2015. Prior to 2015, all revenue and expense

associated with managed parking services at our hotels were

reported on a gross basis. Beginning in 2015, only the net fee

received from the parking manager is recorded as revenue.

(2) Same-Store excludes the AC Hotel at National Harbor, which

opened in April 2015. (3) 2015 net income impacted by a

$20.2 million loss on warrant settlements in the first quarter of

2015.

For the Company’s definitions of RevPAR, Total RevPAR, Adjusted

EBITDA and Adjusted FFO, as well as a reconciliation of the

non-GAAP financial measure Adjusted EBITDA to Net Income and a

reconciliation of the non-GAAP financial measure Adjusted FFO to

Net Income, see “Calculation of RevPAR and Total RevPAR,” “Non-GAAP

Financial Measures,” “Adjusted FFO Definition” and “Supplemental

Financial Results” below.

Operating Results

Hospitality Segment

For the three months and six months ended June 30, 2015 and

2014, the Company reported the following:

Three Months Ended Six Months

Ended ($ in thousands, except for ADR, RevPAR and Total RevPAR)

June 30, June 30, As Reported

Pro Forma As Reported Pro

Forma 2015 2014 % ∆

2014 (1) % ∆ 2015 2014

% ∆ 2014 (1) % ∆

Hospitality

Results

Hospitality Revenue (2) $245,835 $232,930 5.5% $231,507 6.2%

$482,289 $465,133 3.7% $462,454 4.3% Hospitality Adjusted

EBITDA $85,066 $ 76,591 11.1% $160,910 $ 146,522 9.8% Hospitality

Adjusted EBITDA Margin 34.6% 32.9% 1.7pt 33.1% 1.5pt 33.4% 31.5%

1.9pt 31.7% 1.7pt Hospitality Performance Metrics (2)

Occupancy 75.2% 74.3% 0.9pt 73.1% 72.4% 0.7pt Average Daily Rate

(ADR) $184.32 $181.44 1.6% $183.75 $179.50 2.4% RevPAR $138.61

$134.85 2.8% $134.36 $129.94 3.4% Total RevPAR $325.96 $316.09 3.1%

$314.16 3.8% $325.21 $317.34 2.5% $315.51 3.1% Gross

Definite Rooms Nights Booked 532,270 639,739 (16.8%) 875,535

1,012,387 (13.5%) Net Definite Rooms Nights Booked 402,433 475,580

(15.4%) 665,488 725,894 (8.3%) Group Attrition (as % of contracted

block) 13.4% 11.1% (2.3pt) 12.4% 10.7% (1.7pt) Cancellations ITYFTY

(3) 6,057 9,155 33.8% 18,076 16,531 (9.3%)

Same-Store

Hospitality Results (4)

Same-Store Hospitality Revenue (2) $243,522 $232,930 4.5% $231,507

5.2% $479,976 $465,133 3.2% $462,454 3.8% Same-Store

Hospitality Adjusted EBITDA $84,035 $76,591 9.7% $159,879 $ 146,522

9.1% Same-Store Hospitality Adjusted EBITDA Margin 34.5% 32.9%

1.6pt 33.1% 1.4pt 33.3% 31.5% 1.8pt 31.7% 1.6pt Same-Store

Hospitality Performance Metrics (2) Occupancy 75.6% 74.3% 1.3pt

73.3% 72.4% 0.9pt Average Daily Rate (ADR) $183.83 $181.44 1.3%

$183.49 $179.50 2.2% RevPAR $139.07 $134.85 3.1% $134.54 $129.94

3.5% Total RevPAR $330.46 $316.09 4.5% $314.16 5.2% $327.46 $317.34

3.2% $315.51 3.8%

(1) Shown pro forma to present 2014

results with an accounting change related to parking fees as

stipulated by the hospitality industry's Uniform System of Accounts

for the Lodging Industry, Eleventh Revised Edition, which became

effective in January 2015. Prior to 2015, all revenue and expense

associated with managed parking services at our hotels were

reported on a gross basis. Beginning in 2015, only the net fee

received from the parking manager is recorded as revenue.

(2) During Q2 2014, Gaylord Texan had

15,700 room nights out of service due to a room renovation project

that was completed in August 2014. Out of service rooms do not

impact total available room count for calculating hotel metrics

(e.g., Occupancy, RevPAR, and Total RevPAR).

(3) "ITYFTY" represents In The Year For The Year. (4)

Same-Store excludes the AC Hotel at National Harbor, which opened

in April 2015.

Property-level results and operating metrics for second quarter

2015 are presented in greater detail below and under “Supplemental

Financial Results.” Highlights for second quarter 2015 for the

Hospitality segment and at each property include:

- Hospitality Segment

(Same-Store): Total revenue increased 4.5 percent to $243.5

million in second quarter 2015 compared to second quarter 2014, and

RevPAR increased 3.1 percent, driven mainly by an increase in

occupancy of 1.3 percentage points. Adjusted EBITDA increased 9.7

percent, as compared to second quarter 2014, to $84.0 million.

Adjusted EBITDA margin grew by 160 basis points compared to the

prior-year quarter, driven by continued margin management and

higher system-wide occupancy levels.

- Gaylord Opryland: Total revenue

for second quarter 2015 was $78.4 million, a 9.3 percent increase

from the 2014 period, driven by a favorable shift to corporate

group rooms, which drove higher outside-the-room spending in food

and beverage. In addition, an overall increase in group rooms was

the primary driver of a 3.1 percentage point increase in occupancy.

Adjusted EBITDA increased 19.2 percent, as compared to second

quarter 2014, to $29.7 million, which was a record second quarter

for the property. Adjusted EBITDA Margin grew by 320 basis points

over the same period in 2014 to 37.9 percent.

- Gaylord Palms: Total revenue for

second quarter 2015 was $40.9 million, a 1.1 percent increase from

the 2014 period, driven primarily by an increase in banquet revenue

due to a favorable shift to corporate room nights. Adjusted EBITDA

increased 4.7 percent, as compared to second quarter 2014, to $11.1

million as a result of effective margin management, and Adjusted

EBITDA margin grew by 90 basis points over the same period in 2014

to 27.2 percent.

- Gaylord Texan: Total revenue for

second quarter 2015 was $50.0 million, a 14.6 percent increase from

the 2014 period, due primarily to a total occupancy increase of 8.6

percentage points. This occupancy increase included a favorable

shift to corporate group room nights, which also drove strong

banquet revenue. During the second quarter of 2014, the hotel had

15,700 room nights out of service due to the room renovation

project that was completed in August 2014. Adjusted EBITDA

increased 24.5 percent, as compared to second quarter 2014, to

$17.1 million, which was a record second quarter for the property.

Adjusted EBITDA margin grew by 270 basis points over the same

period in 2014 to 34.2 percent.

- Gaylord National: Total revenue

for second quarter 2015 was $70.5 million, a 4.5 percent decrease

from the 2014 period, primarily due to a large association group

cancellation in June and a few corporate groups underperforming.

Although Adjusted EBITDA decreased 5.1 percent, as compared to

second quarter 2014, to $24.9 million, the property maintained

Adjusted EBITDA margin year over year.

Reed continued, “Overall, our Hospitality segment had a very

good second quarter, with Gaylord Texan and Gaylord Opryland on

pace to have their best-ever years in 2015 in terms of revenue and

profitability. While Gaylord National had a challenging second

quarter, we believe it will outperform the D.C. market for the

remainder of this year. In April, we added the AC Hotel at National

Harbor to our portfolio, which further enhances our ability to

capitalize on National Harbor’s continued rise as a premier leisure

destination and provides a natural overflow option for Gaylord

National.”

Entertainment Segment

For the three months and six months ended June 30, 2015 and

2014, the Company reported the following:

Three Months Ended

Six Months Ended ($ in thousands)

June 30, June

30,

2015

2014

%

∆

2015

2014

%

∆

Revenue $28,201 $24,983 12.9% $44,895 $39,231 14.4%

Operating Income $10,158 $8,341 21.8% $12,278 $8,893 38.1% Adjusted

EBITDA $11,674 $9,698 20.4% $15,417 $11,806 30.6% Adjusted EBITDA

Margin 41.4% 38.8% 2.6pt 34.3% 30.1% 4.2pt

Reed continued, “Our Entertainment segment had another superb

quarter with double-digit increases in both revenue and Adjusted

EBITDA compared to the prior-year quarter. Our Ryman Auditorium

expansion opened in June to rave reviews, and early indicators are

that the capital we deployed there is delivering the desired

outcome.”

Corporate and Other Segment Results

For the three months and six months ended June 30, 2015 and

2014, the Company reported the following:

Three Months Ended

Six Months Ended ($ in thousands)

June 30, June

30,

2015

2014

%

∆

2015

2014

%

∆

Operating Loss ($6,970) ($7,046) 1.1% ($14,779) ($14,817)

0.3% Adjusted EBITDA ($4,989) ($4,727) (5.5%) ($10,750) ($10,284)

(4.5%)

Development Update

In April, the Company announced a $20 million meeting facility

expansion at Gaylord National. The new facility will include a

24,000-square-foot ballroom building offering 16,000 square feet of

meeting space overlooking the Potomac River, the Woodrow Wilson

Bridge and Old Town Alexandria. The investment will also include an

expansion of an open-air events space to be used for group and

social events, catering and the hotel’s holiday programming. The

new ballroom facility is scheduled to open in fall 2016, while the

open-air events space is scheduled to open in September 2015.

Dividend Update

The Company paid its second quarter 2015 cash dividend

of $0.65 per share of common stock on July 15,

2015 to stockholders of record on June 30, 2015. Today,

the Company announced a third quarter cash dividend of $0.70 per

share of common stock payable on October 15, 2015 to stockholders

of record on September 30, 2015. It is the Company’s current plan

to distribute total annual dividends of

approximately $2.70 per share for 2015, with the

remaining fourth quarter payment of $0.70 per share of common stock

occurring in January 2016. If expected regular quarterly dividends

for 2015 do not satisfy the Company’s annual distribution

requirements, the Company would satisfy the annual distribution

requirement by paying a “catch up” dividend in January 2016. Any

future dividend is subject to the board’s future determinations as

to the amount of quarterly distributions and the timing

thereof.

Balance Sheet/Liquidity Update

As of June 30, 2015, the Company had total debt outstanding of

$1,493.2 million and unrestricted cash of $41.3 million. As of

June 30, 2015, $340.5 million of borrowings were drawn under the

revolving credit line of the Company’s credit facility, and the

lending banks had issued $2.0 million in letters of credit, which

left $357.5 million of availability for borrowing under the credit

facility.

Credit Facility Amendment and Senior Unsecured Notes

Update

On June 5, 2015, the Company successfully extended the maturity

of the revolving line of credit under its senior secured credit

facility. The revolving line of credit was scheduled to mature in

April 2017.

The extended $700 million revolver will mature in June 2019 and

at June 30, 2015 had an outstanding borrowing of $340.5 million.

The Company also amended certain covenants under the facility. The

revolver's interest rate is based upon a leverage-based pricing

grid ranging from 160 to 240 basis points over LIBOR, representing

an improvement in pricing of 15 to 35 basis points compared to the

terms of the credit facility prior to the amendment. The initial

interest rate under the amended revolver is the sum of LIBOR plus a

margin of 160 basis points per annum.

With the credit facility amendment and recently completed

private placement of $400 million in principal amount of 5% senior

notes due 2023, the Company has no debt with a maturity date prior

to 2019.

Guidance

The Company is updating its 2015 guidance provided on May 6,

2015 to reflect its expectations for Hospitality revenue for the

full year. The following business performance outlook is based on

current information as of August 4, 2015. The Company does not

expect to update the guidance provided below before next quarter’s

earnings release. However, the Company may update its full business

outlook or any portion thereof at any time for any reason.

Reed continued, “Our Hospitality segment is on pace to have its

best year ever in terms of profitability, and we are encouraged by

the strength of our business in the fourth quarter and our business

on the books for 2016. However, our third quarter outlook for

top-line revenue growth in our Hospitality segment has moderated

due to a challenging holiday calendar and our accelerated room

renovation project at Gaylord Opryland. Therefore, we are revising

our Hospitality RevPAR and Total RevPAR guidance ranges. Our

outlook for Adjusted EBITDA remains unchanged.”

$ in millions, except per share figures

Prior Guidance Updated Guidance Full

Year 2015 Full Year 2015 Low

High Low High Hospitality

RevPAR 1,2 4.0% 6.0% 3.5% 4.5% Hospitality Total RevPAR 1,2 3.0%

5.0% 3.0% 4.5% Hospitality Adjusted EBITDA Margin Change + 150 bps

+ 240 bps + 150 bps + 260 bps

Adjusted

EBITDA

Hospitality 3,4 $ 310.0 $ 325.0 $ 310.0 $ 325.0 AC Hotel 2.0 3.0

2.0 3.0 Entertainment (Opry and Attractions) 29.0 32.0 29.0 32.0

Corporate and Other (23.0) (22.0) (23.0) (22.0) Consolidated

Adjusted EBITDA $ 318.0 $ 338.0 $ 318.0 $ 338.0 Adjusted FFO

$ 250.5 $ 270.5 $ 250.5 $ 270.5 Adjusted FFO per Diluted Share $

4.86 $ 5.25 $ 4.86 $ 5.25 Estimated Diluted Shares

Outstanding 51.5 51.5 51.5 51.5 1. Hospitality

segment guidance for RevPAR and Total RevPAR does not include the

AC Hotel. 2.

Includes impact of various accounting

changes as stipulated by the industry’s Uniform System of Accounts

for the Lodging Industry, Eleventh Revised Edition, which became

effective January 2015.

3. Estimated interest income of $12.0 million from Gaylord National

bonds reported in Hospitality segment guidance in 2015 and

historical results in 2014. 4. Hospitality segment guidance assumes

approximately 18,100 room nights out of service in 2015 due to the

renovation of rooms at Gaylord Opryland. The out of service rooms

do not impact total available room count for calculating hotel

metrics (e.g., RevPAR and Total RevPAR).

Earnings Call Information

Ryman Hospitality Properties will hold a conference call to

discuss this release today at 10 a.m. ET. Investors can listen to

the conference call over the Internet at www.rymanhp.com. To listen

to the live call, please go to the Investor Relations section of

the website (Investor Relations/Presentations, Earnings and

Webcasts) at least 15 minutes prior to the call to register and

download any necessary audio software. For those who cannot listen

to the live broadcast, a replay will be available shortly after the

call and will be available for at least 30 days.

About Ryman Hospitality Properties, Inc.

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a REIT for

federal income tax purposes, specializing in group-oriented,

destination hotel assets in urban and resort markets. The Company’s

owned assets include a network of four upscale, meetings-focused

resorts totaling 7,795 rooms that are managed by lodging operator

Marriott International, Inc. under the Gaylord Hotels brand. Other

owned assets managed by Marriott International, Inc. include

Gaylord Springs Golf Links, the Wildhorse Saloon, the General

Jackson Showboat, The Inn at Opryland, a 303-room overflow hotel

adjacent to Gaylord Opryland and AC Hotel Washington, DC at

National Harbor, a 192-room hotel near Gaylord National. The

Company also owns and operates media and entertainment assets,

including the Grand Ole Opry (opry.com), the legendary weekly

showcase of country music’s finest performers for nearly 90 years;

the Ryman Auditorium, the storied former home of the Grand Ole Opry

located in downtown Nashville; and 650 AM WSM, the Opry’s radio

home. For additional information about Ryman Hospitality

Properties, visit www.rymanhp.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements as to the Company’s

beliefs and expectations of the outcome of future events that are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. You can identify these statements by

the fact that they do not relate strictly to historical or current

facts. Examples of these statements include, but are not limited

to, statements regarding the future performance of our business,

estimated capital expenditures, out-of-service rooms, the expected

approach to making dividend payments, the board’s ability to alter

the dividend policy at any time and other business or operational

issues. These forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ materially

from the statements made. These include the risks and uncertainties

associated with economic conditions affecting the hospitality

business generally, the geographic concentration of the Company’s

hotel properties, business levels at the Company’s hotels, the

effect of the Company’s election to be taxed as a REIT for federal

income tax purposes commencing with the year ended December 31,

2013, the Company’s ability to remain qualified as a REIT, the

Company’s ability to execute its strategic goals as a REIT, the

Company’s ability to generate cash flows to support dividends,

future board determinations regarding the timing and amount of

dividends and changes to the dividend policy, which could be made

at any time, the determination of Adjusted FFO and REIT taxable

income, and the Company’s ability to borrow funds pursuant to its

credit agreement. Other factors that could cause operating and

financial results to differ are described in the filings made from

time to time by the Company with the U.S. Securities and Exchange

Commission (SEC) and include the risk factors and other risks and

uncertainties described in the Company’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2014 and its Quarterly

Reports on Form 10-Q. The Company does not undertake any obligation

to release publicly any revisions to forward-looking statements

made by it to reflect events or circumstances occurring after the

date hereof or the occurrence of unanticipated events.

Additional Information

This release should be read in conjunction with the consolidated

financial statements and notes thereto included in our most recent

report on Form 10-K. Copies of our reports are available on our

website at no expense at www.rymanhp.com and through the SEC’s

Electronic Data Gathering Analysis and Retrieval System (“EDGAR”)

at www.sec.gov.

Calculation of RevPAR and Total RevPAR

We calculate revenue per available room (“RevPAR”) for our

hotels by dividing room revenue by room nights available to guests

for the period. We calculate total revenue per available room

(“Total RevPAR”) for our hotels by dividing the sum of room

revenue, food & beverage and other ancillary services revenue

by room nights available to guests for the period.

Non-GAAP Financial Measures

We present the following non-GAAP financial measures we believe

are useful to investors as key measures of our operating

performance:

To calculate Adjusted EBITDA, we determine EBITDA, which

represents net income (loss) determined in accordance with GAAP,

plus loss (income) from discontinued operations, net; provision

(benefit) for income taxes; other (gains) and losses, net; loss on

extinguishment of debt; (income) loss from unconsolidated entities;

interest expense; and depreciation and amortization, less interest

income. Adjusted EBITDA is calculated as EBITDA plus preopening

costs; non-cash ground lease expense; equity-based compensation

expense; impairment charges; any closing costs of completed

acquisitions; interest income on Gaylord National bonds; other

gains and (losses); (gains) and losses on warrant settlements; and

any other adjustments we have identified in this release. We

believe Adjusted EBITDA is useful to investors in evaluating our

operating performance because this measure helps investors evaluate

and compare the results of our operations from period to period by

removing the impact of our capital structure (primarily interest

expense) and our asset base (primarily depreciation and

amortization) from our operating results. A reconciliation of net

income (loss) to EBITDA and Adjusted EBITDA and a reconciliation of

segment operating income to segment Adjusted EBITDA are set forth

below under “Supplemental Financial Results.” The losses on the

call spread and warrant modifications related to our convertible

notes and warrant repurchases do not result in a charge to net

income; therefore, Adjusted EBITDA does not reflect the impact of

these losses. Hospitality Adjusted EBITDA—Same Store excludes the

AC Hotel at National Harbor.

Adjusted FFO Definition

We calculate Adjusted FFO to mean net income (loss) (computed in

accordance with GAAP), excluding non-controlling interests, and

gains and losses from sales of property; plus depreciation and

amortization (excluding amortization of deferred financing costs

and debt discounts) and impairment losses; we also exclude

written-off deferred financing costs, non-cash ground lease

expense, amortization of debt discounts and amortization of

deferred financing cost, and gains (losses) on extinguishment of

debt and warrant settlements. For periods prior to 2015, we also

deducted certain capital expenditures. We believe that the

presentation of Adjusted FFO provides useful information to

investors regarding our operating performance because it is a

measure of our operations without regard to specified non-cash

items such as real estate depreciation and amortization, gain or

loss on sale of assets and certain other items which we believe are

not indicative of the performance of our underlying hotel

properties. We believe that these items are more representative of

our asset base than our ongoing operations. We also use Adjusted

FFO as one measure in determining our results after taking into

account the impact of our capital structure. A reconciliation of

net income (loss) to Adjusted FFO is set forth below under

“Supplemental Financial Results.” The losses on the call spread and

warrant modifications related to our convertible notes and warrant

repurchases do not result in a charge to net income; therefore,

Adjusted FFO does not reflect the impact of these losses.

We caution investors that amounts presented in accordance with

our definitions of Adjusted EBITDA and Adjusted FFO may not be

comparable to similar measures disclosed by other companies,

because not all companies calculate these non-GAAP measures in the

same manner. Adjusted EBITDA and Adjusted FFO, and any related per

share measures, should not be considered as alternative measures of

our net income (loss), operating performance, cash flow or

liquidity. Adjusted EBITDA and Adjusted FFO may include funds that

may not be available for our discretionary use due to functional

requirements to conserve funds for capital expenditures and

property acquisitions and other commitments and uncertainties.

Although we believe that Adjusted EBITDA and Adjusted FFO can

enhance an investor’s understanding of our results of operations,

these non-GAAP financial measures, when viewed individually, are

not necessarily better indicators of any trend as compared to GAAP

measures such as net income (loss) or cash flow from operations. In

addition, you should be aware that adverse economic and market and

other conditions may harm our cash flow.

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited (In thousands, except per share data)

Three Months Ended Six Months

Ended Jun. 30, Jun. 30, 2015 2014

2015 2014

Revenues:

Rooms $ 104,540 $ 99,376 $ 199,261 $ 190,458 Food and beverage

119,042 109,959 237,373 227,203 Other hotel revenue 22,253 23,595

45,655 47,472 Entertainment (previously Opry and Attractions)

28,201 24,983 44,895

39,231 Total revenues 274,036

257,913 527,184

504,364 Operating expenses: Rooms 26,802

26,903 52,869 54,381 Food and beverage 64,789 61,058 129,864

124,240 Other hotel expenses 70,109 68,823 140,405 140,925

Management fees 3,791 3,952

7,303 7,863 Total hotel

operating expenses 165,491 160,736 330,441 327,409 Entertainment

(previously Opry and Attractions) 16,659 15,411 29,821 27,682

Corporate 6,273 6,048 13,367 12,755 Preopening costs 199 - 791 -

Impairment and other charges - - 2,890 - Depreciation and

amortization 28,399 28,232

56,969 56,235 Total operating

expenses 217,021 210,427

434,279 424,081 Operating income

57,015 47,486 92,905 80,283 Interest expense, net of amounts

capitalized (17,814 ) (15,472 ) (31,627 ) (31,142 ) Interest income

3,393 3,038 6,401 6,069 Loss on extinguishment of debt - (2,148 ) -

(2,148 ) Other gains and (losses), net (339 )

(4,337 ) (20,571 ) (4,326 ) Income before

income taxes 42,255 28,567 47,108 48,736 Provision for

income taxes (866 ) (576 ) (1,187 )

(92 ) Net income 41,389 27,991 45,921 48,644

Loss on call spread and warrant modifications related to

convertible notes - (4,952 ) -

(4,952 ) Net income available to common

shareholders $ 41,389 $ 23,039 $ 45,921

$ 43,692

Basic net income per share available to common shareholders $ 0.81

$ 0.45 $ 0.90 $ 0.86

Fully diluted net income per share available to common shareholders

$ 0.80 $ 0.38 $ 0.89 $ 0.73

Weighted average

common shares for the period:

Basic 51,269 50,814 51,196 50,719 Diluted (1) 51,601 60,535 51,562

60,078 (1)

Represents GAAP calculation of diluted

shares and does not consider anti-dilutive effect of the Company's

purchased call options associated with its previously outstanding

convertible notes. For the three months and six months ended June

30, 2014, the purchased call options effectively reduce dilution by

approximately 6.0 million and 5.8 million shares of common stock,

respectively.

RYMAN HOSPITALITY PROPERTIES, INC. AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS Unaudited (In thousands)

Jun. 30, Dec. 31, 2015 2014

ASSETS: Property and equipment, net of accumulated

depreciation $ 2,015,099 $ 2,036,261 Cash and cash equivalents -

unrestricted 41,319 76,408 Cash and cash equivalents - restricted

25,270 17,410 Notes receivable 152,615 149,612 Trade receivables,

net 68,512 45,188 Deferred financing costs 27,587 21,646 Prepaid

expenses and other assets 59,141 66,621 Total assets

$ 2,389,543 $ 2,413,146 LIABILITIES AND STOCKHOLDERS'

EQUITY: Debt and capital lease obligations $ 1,493,239 $ 1,341,555

Accounts payable and accrued liabilities 137,647 166,848 Deferred

income taxes 14,626 14,284 Deferred management rights proceeds

184,635 183,423 Dividends payable 33,931 29,133 Derivative

liabilities - 134,477 Other liabilities 143,939 142,019

Stockholders' equity 381,526 401,407 Total

liabilities and stockholders' equity $ 2,389,543 $ 2,413,146

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

SUPPLEMENTAL FINANCIAL RESULTS ADJUSTED EBITDA

RECONCILIATION Unaudited (in thousands)

Three Months Ended Jun. 30, Six Months Ended Jun.

30, 2015 2014 2015

2014 $ Margin $

Margin $ Margin $

Margin

Consolidated

Revenue $ 274,036 $ 257,913 $

527,184 $ 504,364

Net income $ 41,389 $ 27,991 $ 45,921 $

48,644 Provision for income taxes 866 576 1,187 92 Other (gains)

and losses, net 339 4,337 20,571 4,326 Net loss on the

extinguishment of debt - 2,148 - 2,148 Interest expense, net 14,421

12,434 25,226 25,073 Depreciation & amortization 28,399

28,232 56,969 56,235

EBITDA 85,414 31.2 % 75,718 29.4 % 149,874 28.4 %

136,518 27.1 % Preopening costs 199 - 791 - Non-cash lease expense

1,341 1,371 2,682 2,741 Equity-based compensation 1,467 1,447 3,057

2,728 Impairment charges - - 2,890 - Interest income on Gaylord

National bonds 3,381 3,031 6,380 6,062 Other gains and (losses),

net (339 ) (4,337 ) (20,571 ) (4,326 ) Loss on warrant settlements

60 4,496 20,246 4,496 (Gain) loss on disposal of assets 228

(164 ) 228

(175 )

Adjusted EBITDA $

91,751 33.5 % $ 81,562 31.6 % $ 165,577

31.4 % $ 148,044 29.4 %

Hospitality

segment

Revenue $ 245,835 $ 232,930 $ 482,289 $ 465,133

Operating

income $ 53,827 $ 46,191 $ 95,406 $ 86,207 Depreciation &

amortization 26,349 26,003 52,792 51,517 Preopening costs 168 - 760

- Non-cash lease expense 1,341 1,371 2,682 2,741 Impairment charges

- - 2,890 - Interest income on Gaylord National bonds 3,381 3,031

6,380 6,062 Other gains and (losses), net (222 ) (5 ) (222 ) (5 )

Loss on disposal of assets 222 -

222 -

Adjusted EBITDA $ 85,066

34.6 % $ 76,591 32.9 % $ 160,910 33.4 %

$ 146,522 31.5 %

Entertainment

segment (previously Opry and Attractions)

Revenue $ 28,201 $ 24,983 $ 44,895 $ 39,231

Operating

income $ 10,158 $ 8,341 $ 12,278 $ 8,893 Depreciation &

amortization 1,353 1,231 2,765 2,656 Preopening costs 31 - 31 -

Equity-based compensation 132 126 343 257 Other gains and (losses),

net - 152 - 152 Gain on disposal of assets -

(152 ) -

(152 )

Adjusted EBITDA $ 11,674

41.4 % $ 9,698 38.8 % $ 15,417

34.3 % $ 11,806 30.1 %

Corporate and Other

segment

Operating loss $ (6,970 ) $ (7,046 ) $ (14,779 ) $ (14,817 )

Depreciation & amortization 697 998 1,412 2,062 Equity-based

compensation 1,335 1,321 2,714 2,471 Other gains and (losses), net

(117 ) (4,484 ) (20,349 ) (4,473 ) Loss on warrant settlements 60

4,496 20,246 4,496 (Gain) loss on disposal of assets 6

(12 ) 6 (23 )

Adjusted

EBITDA $ (4,989 ) $ (4,727 ) $ (10,750 ) $ (10,284 )

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

SUPPLEMENTAL FINANCIAL RESULTS FUNDS FROM OPERATIONS

("FFO") AND ADJUSTED FFO RECONCILIATION Unaudited (in

thousands, except per share data)

Three Months Ended Jun. 30, Six Months Ended Jun.

30, 2015 2014 2015 2014

Consolidated

Net income $ 41,389 $ 27,991 $ 45,921 $ 48,644 Depreciation

& amortization 28,399 28,232

56,969 56,235

FFO 69,788 56,223 102,890

104,879 Non-cash lease expense 1,341 1,371 2,682 2,741

Impairment charges - - 2,890 - Loss on extinguishment of debt -

2,148 - 2,148 Loss on warrant settlements 60 4,496 20,246 4,496

(Gain) loss on other assets 228 - 228 - Write-off of deferred

financing costs 1,926 - 1,926 - Amortization of deferred financing

costs 1,459 1,415 2,855 2,836 Amortization of debt discounts

- 2,755 - 6,028

Adjusted FFO $ 74,802 $ 68,408 $ 133,717

$ 123,128 Capital expenditures (1) (12,357 )

(9,604 ) (24,792 ) (19,393 )

Adjusted FFO

less maintenance capital expenditures $ 62,445 $ 58,804

$ 108,925 $ 103,735 FFO per

basic share $ 1.36 $ 1.11 $ 2.01 $ 2.07 Adjusted FFO per basic

share $ 1.46 $ 1.35 $ 2.61 $ 2.43 FFO per diluted share (2)

$ 1.35 $ 0.93 $ 2.00 $ 1.75 Adjusted FFO per diluted share (2) $

1.45 $ 1.13 $ 2.59 $ 2.05 (1) Represents FF&E

reserve for managed properties and maintenance capital expenditures

for non-managed properties. (2) The GAAP calculation of

diluted shares does not consider anti-dilutive effect of the

Company's purchased call options associated with its previously

outstanding convertible notes. For the three months and six months

ended June 30, 2014, the purchased call options effectively reduce

dilution by approximately 6.0 million and 5.8 million shares of

common stock, respectively.

RYMAN HOSPITALITY

PROPERTIES, INC. AND SUBSIDIARIES SUPPLEMENTAL FINANCIAL

RESULTS Unaudited (in thousands, except operating metrics)

Three Months Ended Jun. 30,

Six Months Ended Jun. 30, 2015 2014

2014 (1)

2015 2014

2014 (1)

HOSPITALITY OPERATING METRICS:

Hospitality

Segment

Occupancy 75.2 % 74.3 % 74.3 % 73.1 % 72.4 % 72.4 % Average

daily rate (ADR) $ 184.32 $ 181.44 $ 181.44 $ 183.75 $ 179.50 $

179.50 RevPAR $ 138.61 $ 134.85 $ 134.85 $ 134.36 $ 129.94 $ 129.94

OtherPAR $ 187.35 $ 181.24 $ 179.31 $ 190.85 $ 187.40 $ 185.57

Total RevPAR $ 325.96 $ 316.09 $ 314.16 $ 325.21 $ 317.34 $ 315.51

Revenue $ 245,835 $ 232,930 $ 231,507 $ 482,289 $ 465,133 $

462,454 Adjusted EBITDA $ 85,066 $ 76,591 $ 76,591 $ 160,910 $

146,522 $ 146,522 Adjusted EBITDA Margin 34.6 % 32.9 % 33.1 % 33.4

% 31.5 % 31.7 %

Same-Store

Hospitality Segment (2)

Occupancy 75.6 % 74.3 % 74.3 % 73.3 % 72.4 % 72.4 % Average

daily rate (ADR) $ 183.83 $ 181.44 $ 181.44 $ 183.49 $ 179.50 $

179.50 RevPAR $ 139.07 $ 134.85 $ 134.85 $ 134.54 $ 129.94 $ 129.94

OtherPAR $ 191.39 $ 181.24 $ 179.31 $ 192.92 $ 187.40 $ 185.57

Total RevPAR $ 330.46 $ 316.09 $ 314.16 $ 327.46 $ 317.34 $ 315.51

Revenue $ 243,522 $ 232,930 $ 231,507 $ 479,976 $ 465,133 $

462,454 Adjusted EBITDA $ 84,035 $ 76,591 $ 76,591 $ 159,879 $

146,522 $ 146,522 Adjusted EBITDA Margin 34.5 % 32.9 % 33.1 % 33.3

% 31.5 % 31.7 %

Gaylord

Opryland

Occupancy

79.5 % 76.4 % 76.4 % 72.3 % 72.5 % 72.5 % Average daily rate (ADR)

$ 170.83 $ 166.71 $ 166.71 $ 167.59 $ 168.05 $ 168.05 RevPAR $

135.76 $ 127.34 $ 127.34 $ 121.21 $ 121.79 $ 121.79 OtherPAR $

163.11 $ 146.08 $ 144.19 $ 158.54 $ 154.68 $ 152.93 Total RevPAR $

298.87 $ 273.42 $ 271.53 $ 279.75 $ 276.47 $ 274.72 Revenue

$ 78,382 $ 71,710 $ 71,214 $ 145,929 $ 144,220 $ 143,304 Adjusted

EBITDA $ 29,701 $ 24,909 $ 24,909 $ 51,467 $ 48,293 $ 48,293

Adjusted EBITDA Margin 37.9 % 34.7 % 35.0 % 35.3 % 33.5 % 33.7 %

Gaylord

Palms

Occupancy 71.8 % 72.3 % 72.3 % 77.3 % 78.1 % 78.1 % Average

daily rate (ADR) $ 164.72 $ 169.35 $ 169.35 $ 180.63 $ 176.57 $

176.57 RevPAR $ 118.22 $ 122.41 $ 122.41 $ 139.59 $ 137.86 $ 137.86

OtherPAR $ 201.73 $ 194.03 $ 191.55 $ 231.02 $ 226.83 $ 224.37

Total RevPAR $ 319.95 $ 316.44 $ 313.96 $ 370.61 $ 364.69 $ 362.23

Revenue $ 40,936 $ 40,487 $ 40,170 $ 94,316 $ 92,809 $

92,183 Adjusted EBITDA $ 11,132 $ 10,628 $ 10,628 $ 31,206 $ 28,948

$ 28,948 Adjusted EBITDA Margin 27.2 % 26.3 % 26.5 % 33.1 % 31.2 %

31.4 %

Gaylord

Texan

Occupancy 73.7 % 65.1 % 65.1 % 74.9 % 68.1 % 68.1 % Average

daily rate (ADR) $ 187.03 $ 184.35 $ 184.35 $ 191.53 $ 182.88 $

182.88 RevPAR $ 137.75 $ 120.03 $ 120.03 $ 143.39 $ 124.53 $ 124.53

OtherPAR $ 225.51 $ 196.96 $ 195.20 $ 241.50 $ 222.10 $ 220.44

Total RevPAR $ 363.26 $ 316.99 $ 315.23 $ 384.89 $ 346.63 $ 344.97

Revenue $ 49,950 $ 43,587 $ 43,344 $ 105,265 $ 94,799 $

94,345 Adjusted EBITDA $ 17,103 $ 13,739 $ 13,739 $ 37,984 $ 29,038

$ 29,038 Adjusted EBITDA Margin 34.2 % 31.5 % 31.7 % 36.1 % 30.6 %

30.8 %

Gaylord

National

Occupancy 73.8 % 79.5 % 79.5 % 71.1 % 71.8 % 71.8 % Average

daily rate (ADR) $ 223.74 $ 217.43 $ 217.43 $ 211.85 $ 206.23 $

206.23 RevPAR $ 165.13 $ 172.91 $ 172.91 $ 150.69 $ 147.99 $ 147.99

OtherPAR $ 223.07 $ 233.56 $ 231.54 $ 203.81 $ 204.34 $ 202.45

Total RevPAR $ 388.20 $ 406.47 $ 404.45 $ 354.50 $ 352.33 $ 350.44

Revenue $ 70,510 $ 73,829 $ 73,462 $ 128,072 $ 127,288 $

126,605 Adjusted EBITDA $ 24,868 $ 26,202 $ 26,202 $ 37,474 $

38,593 $ 38,593 Adjusted EBITDA Margin 35.3 % 35.5 % 35.7 % 29.3 %

30.3 % 30.5 %

The AC Hotel at

National Harbor (3)

Occupancy 56.2 % n/a n/a 56.2 % n/a n/a Average daily rate

(ADR) $ 211.94 n/a n/a $ 211.94 n/a n/a RevPAR $ 119.17 n/a n/a $

119.17 n/a n/a OtherPAR $ 14.67 n/a n/a $ 14.67 n/a n/a Total

RevPAR $ 133.84 n/a n/a $ 133.84 n/a n/a Revenue $ 2,313 n/a

n/a $ 2,313 n/a n/a Adjusted EBITDA $ 1,031 n/a n/a $ 1,031 n/a n/a

Adjusted EBITDA Margin 44.6 % n/a n/a 44.6 % n/a n/a

The Inn at

Opryland (4)

Occupancy 79.4 % 75.9 % 75.9 % 71.2 % 70.8 % 70.8 % Average

daily rate (ADR) $ 128.65 $ 114.94 $ 114.94 $ 122.73 $ 111.28 $

111.28 RevPAR $ 102.13 $ 87.25 $ 87.25 $ 87.34 $ 78.76 $ 78.76

OtherPAR $ 33.69 $ 33.09 $ 33.09 $ 29.24 $ 30.94 $ 30.94 Total

RevPAR $ 135.82 $ 120.34 $ 120.34 $ 116.58 $ 109.70 $ 109.70

Revenue $ 3,744 $ 3,317 $ 3,317 $ 6,394 $ 6,017 $ 6,017 Adjusted

EBITDA $ 1,231 $ 1,113 $ 1,113 $ 1,748 $ 1,650 $ 1,650 Adjusted

EBITDA Margin 32.9 % 33.6 % 33.6 % 27.3 % 27.4 % 27.4 % (1)

Shown pro forma to present 2014 results

with an accounting change related to parking fees as stipulated by

the hospitality industry's Uniform System of Accounts for the

Lodging Industry, Eleventh Revised Edition, which became effective

in January 2015. Prior to 2015, all revenue and expense associated

with managed parking services at our hotels were reported on a

gross basis. Beginning in 2015, only the net fee received from the

parking manager is recorded as revenue.

(2) Same-store excludes the AC Hotel at National Harbor. (3) The AC

Hotel at National Harbor opened in April 2015. (4) Includes other

hospitality revenue and expense.

Ryman Hospitality

Properties, Inc. and Subsidiaries Reconciliation of

Forward-Looking Statements Unaudited (in

thousands) Adjusted Earnings Before Interest, Taxes,

Depreciation and Amortization ("Adjusted EBITDA") and

Adjusted Funds From Operations ("AFFO") reconciliation:

GUIDANCE RANGE FOR

FULL YEAR 2015 Low High

Ryman Hospitality

Properties, Inc.

Net Income $ 99,100 $ 119,100

Provision (benefit) for income taxes 6,500 6,500 Other (gains) and

losses, net (2,500 ) (2,500 ) Loss on warrant settlements 20,000

20,000 Interest expense 60,000 60,000 Interest income

(12,000 ) (12,000 )

Operating Income 171,100

191,100 Depreciation and amortization 117,000

117,000

EBITDA 288,100 308,100

Non-cash lease expense 5,500 5,500 Preopening expense 1,000 1,000

Equity based compensation 6,000 6,000 Other gains and (losses), net

2,500 2,500 Impairment charges 2,900 2,900 Interest income

12,000 12,000

Adjusted EBITDA $

318,000 $ 338,000

Hospitality

Segment 1

Operating Income $ 180,600 $

196,600 Depreciation and amortization 107,500

107,500

EBITDA 288,100 304,100

Non-cash lease expense 5,500 5,500 Preopening expense 1,000 1,000

Equity based compensation - -

Other gains and (losses), net

2,500 2,500 Impairment charges 2,900 2,900 Interest income

12,000 12,000

Adjusted EBITDA $

312,000 $ 328,000

Entertainment

(Opry and Attractions) Segment

Operating Income $ 23,000 $

26,000 Depreciation and amortization 5,500

5,500

EBITDA 28,500 31,500

Equity based compensation 500 500

Adjusted EBITDA $ 29,000 $

32,000

Corporate and

Other Segment

Operating Income $ (32,500 ) $

(31,500 ) Depreciation and amortization 4,000

4,000

EBITDA (28,500 )

(27,500 ) Other gains and (losses), net (20,000 )

(20,000 ) Loss on warrant settlements 20,000 20,000 Equity based

compensation 5,500 5,500

Adjusted

EBITDA $ (23,000 ) $ (22,000

)

Ryman Hospitality

Properties, Inc.

Net income $ 99,100 $ 119,100

Depreciation & amortization 117,000 117,000 Non-cash lease

expense 5,500 5,500 Impairment charges 2,900 2,900 Amortization of

DFC 6,000 6,000 Loss on warrant settlements 20,000

20,000

Adjusted FFO $

250,500 $ 270,500

1 Hospitality includes AC Hotel

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150804005913/en/

Investor Relations:Ryman Hospitality Properties, Inc.Mark

Fioravanti, 615-316-6588President and Chief Financial

Officermfioravanti@rymanhp.comorRyman Hospitality Properties,

Inc.Todd Siefert, 615-316-6344Vice President of Corporate Finance

& Treasurertsiefert@rymanhp.comorMedia:Ryman Hospitality

Properties, Inc.Brian Abrahamson, 615-316-6302Vice President of

Corporate Communicationsbabrahamson@rymanhp.comorSloane &

CompanyJosh Hochberg or Dan Zacchei212-446-1892 or

212-446-1882jhochberg@sloanepr.com; dzacchei@sloanepr.com

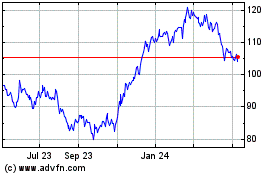

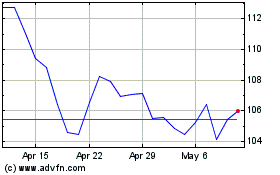

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024