Ryman Hospitality Properties, Inc.'s 3.75% Convertible Senior Notes Remain Convertible

October 01 2012 - 11:28AM

Business Wire

Ryman Hospitality Properties, Inc. (the successor in interest by

merger to Gaylord Entertainment Company) (NYSE: RHP) today

announced that its 3.75% Convertible Senior Notes due October 1,

2014, remain convertible at the option of the holders through

December 31, 2012, the last business day of the current fiscal

quarter. The company issued the notes in September 2009.

The notes remain convertible because the last reported sale

price of the company’s common stock for at least 20 trading days

during the 30 consecutive trading-day period ending on September

28, 2012, was greater than 120 percent of the conversion price in

effect on such day.

The company will deliver shares of its common stock or pay cash

upon conversion of any notes surrendered through December 31, 2012.

If shares are delivered, cash will be paid in lieu of fractional

shares only. The notes are currently convertible at a rate of

36.6972 shares of common stock per $1,000 principal amount of

notes, which is equal to a conversion price of $27.25 per

share.

There is approximately $360 million in aggregate principal

amount of notes outstanding.

If all outstanding notes are surrendered for conversion and the

company elects to deliver shares of its common stock, the aggregate

number of shares of common stock issued would be approximately 13.2

million. The notes could be convertible after December 31, 2012, if

the sale price condition described above is met in any future

fiscal quarter or if any of the other conditions to conversion set

forth in the indenture governing the notes are met.

About Ryman Hospitality Properties,

Inc.

Ryman Hospitality Properties (NYSE: RHP), formerly known as

Gaylord Entertainment Company, a leading hospitality and

entertainment company based in Nashville Tennessee, is in the

process of restructuring its assets and operations in order to

elect to be taxed as a real estate investment trust (REIT) for

federal income tax purposes effective as of January 1, 2013, at

which time, Ryman Properties intends to specialize in

group-oriented, destination hotel assets in urban and resort

markets. Ryman Properties’ owned assets include a network of four

upscale, meetings-focused resorts totaling 7,795 rooms that are

managed by world-class lodging operator Marriott International

under the Gaylord Hotels brand (gaylordhotels.com). Other owned

assets, managed or to be managed by an independent third-party

manager prior to the REIT election, include Gaylord Springs Golf

Links, the Wildhorse Saloon, the General Jackson Showboat and the

Radisson Hotel Opryland, a 303-room overflow hotel adjacent to

Gaylord Opryland. Ryman Properties also owns and operates a number

of media and entertainment assets including the Grand Ole Opry

(opry.com), the legendary weekly showcase of country music’s finest

performers for nearly 90 years; the Ryman Auditorium, the storied

former home of the Grand Ole Opry located in downtown Nashville;

and WSM-AM, the Opry’s radio home and the only clear-channel

station in the U.S. broadcasting music. For additional information

about Ryman Properties, visit www.rymanhp.com.

This press release contains “forward-looking statements”

concerning Ryman Properties’ goals, beliefs, expectations,

strategies, objectives, plans, future operating results and

underlying assumptions, and other statements that are not

necessarily based on historical facts. Examples of these statements

include, but are not limited to, Ryman Properties’ expectation to

elect REIT status and the timing and effect of that election.

Actual results may differ materially from those indicated in

forward-looking statements as a result of various important

factors, including: completing the management transfer of the

Radisson Hotel to Marriott; Ryman Properties’ ability to realize

cost savings and revenue enhancements from the Marriott transaction

and REIT conversion; the expected form, timing and amount of the

special dividend; and Ryman Properties’ ability to qualify as a

REIT effective as of January 1, 2013 or at all, and, if it does

qualify as a REIT, it may be unable to maintain that

qualification.

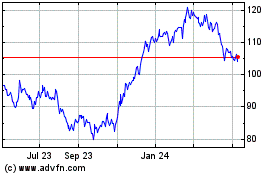

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

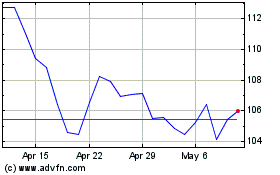

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024