false000148158200014815822024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): July 30, 2024 |

Ryerson Holding Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-34735 |

26-1251524 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

227 W. Monroe St. 27th Floor |

|

Chicago, Illinois |

|

60606 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (312) 292-5000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value, 100,000,000 shares authorized |

|

RYI |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The information contained within Item 2.02 of this Form 8-K and Exhibit 99.1 and Exhibit 99.2 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

On July 30, 2024, Ryerson Holding Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The Company also provided a presentation as a supplement to its press release. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers.

(b) On July 30, 2024, Michael J. Burbach, age 63, notified the Company of his intent to retire from his position as our Chief Operating Officer, effective December 31, 2024. Mr. Burbach plans to remain with the Company through the end of the calendar year. In connection with Mr. Burbach's retirement at the end of the year, the Company intends to (i) grant Mr. Burbach a one-time special grant of 10,000 long-term incentive shares pursuant to the Company’s Second Amended and Restated Omnibus Incentive Plan and (ii) waive the continued service requirement for any outstanding long-term incentive shares at the time of retirement.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits

The following exhibits are being furnished or filed, as applicable, with this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

RYERSON HOLDING CORPORATION |

|

|

|

|

Date: |

July 30, 2024 |

By: |

/s/ James J. Claussen |

|

|

|

James. J. Claussen

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Ryerson Reports Second Quarter 2024 Results

Quarterly business highlights include ramp-up of operations at University Park, IL service center, expansion and modernization of the Shelbyville, KY service center, and progress on cost savings across the network

CHICAGO – July 30, 2024 – Ryerson Holding Corporation (NYSE: RYI), a leading value-added processor and distributor of industrial metals, today reported results for the second quarter ended June 30, 2024.

Highlights:

•Delivered Net Income attributable to Ryerson Holding Corporation of $9.9 million and Adjusted EBITDA1, excluding LIFO of $42.6 million

•Earned diluted EPS2 of $0.29 on $1.23 billion of revenue from 508,000 tons shipped and average selling price of $2,412 per ton

•Reduced operating expenses3 by $17.8 million, compared to the first quarter of 2024, as part of previously announced cost reductions. Annualized cost reduction expectations updated to savings of approximately $60 million from previously announced $40 million

•Reduced inventory by $107.1 million on a FIFO cost basis4, compared to the first quarter of 2024

•Returned $20.4 million to shareholders during the quarter, comprised of $14.0 million in share repurchases and $6.4 million in dividends

•Ended the quarter with debt of $525 million and net debt5 of $497 million as of June 30, 2024, compared to $497 million and $455 million, respectively, on March 31, 2024

•Increased share repurchase authorization by $50 million and extended maturity of authorization to April 2026

•Announced third quarter 2024 dividend of $0.1875 per share

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included below in this news release.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in millions, except tons (in thousands), average selling prices, and earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Highlights: |

|

Q2 2024 |

|

Q1 2024 |

|

Q2 2023 |

|

QoQ |

|

YoY |

|

1H 2024 |

|

1H 2023 |

|

YoY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$1,225.5 |

|

$1,239.2 |

|

$1,343.5 |

|

(1.1)% |

|

(8.8)% |

|

$2,464.7 |

|

$2,749.6 |

|

(10.4)% |

Tons shipped |

|

508 |

|

497 |

|

496 |

|

2.2% |

|

2.4% |

|

1,005 |

|

1,015 |

|

(1.0)% |

Average selling price/ton |

|

$2,412 |

|

$2,493 |

|

$2,709 |

|

(3.2)% |

|

(11.0)% |

|

$2,452 |

|

$2,709 |

|

(9.5)% |

Gross margin |

|

18.2% |

|

17.6% |

|

19.4% |

|

60 bps |

|

-120 bps |

|

17.9% |

|

19.1% |

|

-120 bps |

Gross margin, excl. LIFO |

|

17.4% |

|

17.6% |

|

18.7% |

|

-20 bps |

|

-130 bps |

|

17.5% |

|

18.9% |

|

-140 bps |

Warehousing, delivery, selling, general, and administrative expenses |

|

$199.0 |

|

$216.8 |

|

$202.6 |

|

(8.2)% |

|

(1.8)% |

|

$415.8 |

|

$396.8 |

|

4.8% |

As a percentage of revenue |

|

16.2% |

|

17.5% |

|

15.1% |

|

-130 bps |

|

110 bps |

|

16.9% |

|

14.4% |

|

250 bps |

Net income (loss) attributable to Ryerson Holding Corporation |

|

$9.9 |

|

$(7.6) |

|

$37.6 |

|

230.3% |

|

(73.7)% |

|

$2.3 |

|

$84.9 |

|

(97.3)% |

Diluted earnings (loss) per share |

|

$0.29 |

|

$(0.22) |

|

$1.06 |

|

$0.51 |

|

$(0.77) |

|

$0.07 |

|

$2.33 |

|

$(2.26) |

Adjusted diluted earnings (loss) per share |

|

$0.33 |

|

$(0.18) |

|

$1.06 |

|

$0.51 |

|

$(0.73) |

|

$0.14 |

|

$2.33 |

|

$(2.19) |

Adj. EBITDA, excl. LIFO |

|

$42.6 |

|

$40.2 |

|

$70.1 |

|

6.0% |

|

(39.2)% |

|

$82.8 |

|

$160.2 |

|

(48.3)% |

Adj. EBITDA, excl. LIFO margin |

|

3.5% |

|

3.2% |

|

5.2% |

|

30 bps |

|

-170 bps |

|

3.4% |

|

5.8% |

|

-240 bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet and Cash Flow Highlights: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total debt |

|

$525.4 |

|

$497.3 |

|

$396.1 |

|

5.7% |

|

32.6% |

|

$525.4 |

|

$396.1 |

|

32.6% |

Cash and cash equivalents |

|

$28.0 |

|

$41.9 |

|

$30.0 |

|

(33.2)% |

|

(6.7)% |

|

$28.0 |

|

$30.0 |

|

(6.7)% |

Net debt |

|

$497.4 |

|

$455.4 |

|

$366.1 |

|

9.2% |

|

35.9% |

|

$497.4 |

|

$366.1 |

|

35.9% |

Net debt / LTM Adj. EBITDA, excl. LIFO |

|

3.2x |

|

2.5x |

|

1.4x |

|

0.7x |

|

1.8x |

|

3.2x |

|

1.4x |

|

1.8x |

Cash conversion cycle (days) |

|

77.6 |

|

75.6 |

|

76.1 |

|

2.0 |

|

1.5 |

|

76.5 |

|

77.2 |

|

(0.7) |

Net cash provided by (used in) operating activities |

|

$25.9 |

|

$(47.8) |

|

$115.3 |

|

$73.7 |

|

$(89.4) |

|

$(21.9) |

|

$195.7 |

|

$(217.6) |

Management Commentary

Eddie Lehner, Ryerson’s President, Chief Executive Officer, and Director, said, “I want to thank all of my Ryerson teammates for striving to create a better Ryerson that delivers the industry’s best customer experience safely, enjoyably, and productively. Over the second quarter we managed through a compressed pricing and declining industry demand environment that intensified in late-May through the end of the quarter marked by a continued slowdown in various industrial manufacturing and consumer end-markets as well as notable declines in aluminum, nickel, and carbon steel commodity indexes. Despite these challenges, our overall business performance improved as we saw an increase in tons sold, reduced variable and structural expenses, reduced our inventory levels, and returned to generating operating cash flow and free cash flow. We did this while transitioning to an optimization phase as we complete a record three-year investment cycle, highlighted this quarter by the start-up of our state-of-the-art 900,000 square foot University Park, IL service center, ongoing assimilation of the ERP-conversion in our southern network of service centers, our launch of Ryerson’s redesigned e-commerce platform at www.ryerson.com, as well as nearing the final stage of equipment installation for our Shelbyville, KY processing center modernization and expansion that is slated to start-up in the first quarter of 2025. During the quarter, we grew our book value per share, repurchased 647,330 shares of Ryerson common stock, and paid a quarterly dividend of $0.1875. For the remainder of 2024, we are targeting approximately $60 million in annualized cost savings, updated from our previous $40 million target, primarily through the realization of greater efficiencies within our network. As we navigate through the second half of 2024, Ryerson is planning, preparing, and executing on the strategic growth plan for our business through the optimization of our operating model despite the persistence of what has turned out to be an extended industry counter-cycle. Looking at the bigger picture, it has been just about ten-years since Ryerson closed its Initial Public Offering (“IPO”) on August 13, 2014. I would kindly ask interested stakeholders to view the first page of this quarter’s investor presentation deck. When we stack up all the days since our IPO and look at all we have accomplished over the past ten years, it is an important reminder that there is no sustainable progress without some pain and discomfort. As I look at the strength of our company, the significant investments made to our next-gen operating model, the value of our assets, and the culture of our people and organization, I couldn’t be more optimistic about the next ten years.”

Announcement – Ryerson’s Chief Operating Officer, Mike Burbach to retire at year-end of 2024

After more than 40 years of driving excellence, Mike Burbach will retire from his position as Chief Operating Officer (“COO”), effective December 31, 2024. Mike has served as COO since April 2, 2021, and has been pivotal to the company’s operational and financial success. Eddie Lehner, Ryerson’s President, Chief Executive Officer, and Director, said, “Mike has been a tremendous asset to our organization and will be missed by all those who know him and have had the pleasure to work him throughout his remarkable career – he is truly a pillar of the metals service industry and is well respected not just within Ryerson, but the entire industry. He has always been a steady hand and partner at the till, helping navigate the ebbs, flows, highs, and lows of this dynamic industry.” Mr. Lehner continued, “Mike has been a mentor, leader, partner, role model, friend, and Ryerson “All-Time Great.” I am delighted that Mike is spending some more time with us in transition, and I wish Mike, Anne, and their 5 grandkids the best of everything in retirement!”

Second Quarter Results

Ryerson generated net sales of $1.23 billion in the second quarter of 2024, a decrease of 1.1%, compared to the first quarter of 2024. Revenue performance during the quarter benefitted from seasonal volume demand which increased 2.2%, but was offset by average selling prices decreasing 3.2%, which was below our guidance expectations.

Gross margin expanded sequentially by 60 basis points to 18.2% in the second quarter of 2024, compared to 17.6% in the first quarter of 2024, primarily driven by $10 million in LIFO income recorded in the second quarter of 2024 compared to LIFO expense of $1 million recorded in the first quarter of 2024. Due to a decline in metals futures prices, in the second quarter of 2024, LIFO income of $10 million was greater than our guidance expectations of a LIFO expense of $1 million. Excluding the impact of LIFO, gross margin contracted 20 basis points to 17.4% in the second quarter of 2024, compared to 17.6% in the first quarter. Gross margins for our product mix experienced compression in the second quarter of 2024 due to average selling prices for our carbon, aluminum, and stainless-steel products declining at a greater rate than our costs of goods sold.

Warehousing, delivery, selling, general and administrative expenses decreased 8.2%, or $17.8 million, to $199.0 million in the second quarter of 2024, compared to $216.8 million in the first quarter of 2024. Decreases in expenses were strongest in personnel-related expenses, operating expenses, and the reduction in start-up costs related to our University Park, IL service center, as well as a reduction in the costs related to our network ERP integration.

Net Income Attributable to Ryerson Holding Corporation for the second quarter of 2024 was $9.9 million, or $0.29 per diluted share, compared to a net loss of $7.6 million, or $0.22 per diluted share in the previous quarter. Ryerson generated Adjusted EBITDA, excluding LIFO, of $42.6 million in the second quarter of 2024, compared to the first quarter of 2024 Adjusted EBITDA, excluding LIFO of $40.2 million.

Liquidity & Debt Management

Ryerson generated $25.9 million of operating cash flow in the second quarter of 2024 due to net income of $10.3 million. The Company ended the second quarter of 2024 with $525 million of debt and $497 million of net debt, sequential increases of $28 million and $42 million, respectively, compared to the first quarter of 2024. Ryerson’s net leverage ratio as of the second quarter of 2024 was 3.2x, above the Company’s target leverage range of 0.5x – 2.0x, but still well below Ryerson’s prior 10-year average. Ryerson’s global liquidity, composed of cash and cash equivalents and availability on its revolving credit facilities, decreased to $585 million as of June 30, 2024, compared to $684 million as of March 31, 2024.

Shareholder Return Activity

Dividends. On July 30, 2024, the Board of Directors declared a quarterly cash dividend of $0.1875 per share of common stock, payable on September 19, 2024, to stockholders of record as of September 5, 2024, unchanged from the prior quarter. During the second quarter of 2024, Ryerson paid a quarterly dividend of $0.1875 per share, amounting to a cash return of approximately $6.4 million.

Share Repurchases and Authorization. Ryerson repurchased 647,330 shares for $14.0 million in the open market during the second quarter of 2024. Ryerson made these repurchases in accordance with its share repurchase authorization, which allows the Company to acquire up to an aggregate amount of $100.0 million of the Company’s common stock through April of 2025. As of June 30, 2024, $24.3 million of the $100.0 million remained under the existing authorization. On July 30, 2024, the Board of Directors approved a $50 million increase to the Company’s share repurchase authorization and extended the authorization to April 2026.

Outlook Commentary

For the third quarter of 2024, Ryerson expects customer shipments to decrease 2% to 4%, quarter-over-quarter. The Company anticipates third-quarter net sales to be in the range of $1.12 billion to $1.16 billion, with average selling prices decreasing 3% to 5%. LIFO income in the third quarter of 2024 is expected to be $12 million. We expect adjusted EBITDA, excluding LIFO in the range of $21 million to $25 million and earnings per diluted share in the range of $0.01 to $0.10.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter 2024 Major Product Metrics |

|

|

|

|

|

|

|

Net Sales (millions) |

|

|

Q2 2024 |

|

|

Q1 2024 |

|

|

|

Q2 2023 |

|

|

Quarter-over-quarter |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

$ |

656 |

|

$ |

645 |

|

|

$ |

683 |

|

|

1.7% |

|

(4.0)% |

|

Aluminum |

$ |

273 |

|

$ |

276 |

|

|

$ |

297 |

|

|

(1.1)% |

|

(8.1)% |

|

Stainless Steel |

$ |

277 |

|

$ |

297 |

|

|

$ |

338 |

|

|

(6.7)% |

|

(18.0)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Shipped (thousands) |

|

|

Q2 2024 |

|

|

Q1 2024 |

|

|

|

Q2 2023 |

|

|

Quarter-over-quarter |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

395 |

|

|

385 |

|

|

|

384 |

|

|

2.6% |

|

2.9% |

|

Aluminum |

|

52 |

|

|

50 |

|

|

|

51 |

|

|

4.0% |

|

2.0% |

|

Stainless Steel |

|

58 |

|

|

61 |

|

|

|

59 |

|

|

(4.9)% |

|

(1.7)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Selling Prices (per ton) |

|

|

Q2 2024 |

|

|

Q1 2024 |

|

|

|

Q2 2023 |

|

|

Quarter-over-quarter |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

$ |

|

1,661 |

|

$ |

|

1,675 |

|

|

$ |

|

1,779 |

|

|

(0.9)% |

|

(6.6)% |

|

Aluminum |

$ |

|

5,250 |

|

$ |

|

5,520 |

|

|

$ |

|

5,824 |

|

|

(4.9)% |

|

(9.8)% |

|

Stainless Steel |

$ |

|

4,776 |

|

$ |

|

4,869 |

|

|

$ |

|

5,729 |

|

|

(1.9)% |

|

(16.6)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Half 2024 Major Product Metrics |

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales (millions) |

|

|

|

|

2024 |

|

|

|

2023 |

|

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

$ |

|

1,301 |

|

|

$ |

|

1,375 |

|

|

(5.4)% |

|

Aluminum |

|

|

$ |

|

549 |

|

|

$ |

|

607 |

|

|

(9.6)% |

|

Stainless Steel |

|

$ |

|

574 |

|

|

$ |

|

716 |

|

|

(19.8)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Shipped (thousands) |

|

|

|

|

2024 |

|

|

|

2023 |

|

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

|

|

780 |

|

|

|

|

786 |

|

|

(0.8)% |

|

Aluminum |

|

|

|

102 |

|

|

|

103 |

|

|

(1.0)% |

|

Stainless Steel |

|

|

119 |

|

|

|

122 |

|

|

(2.5)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Selling Prices (per ton) |

|

|

|

|

2024 |

|

|

|

2023 |

|

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

$ |

|

1,668 |

|

|

$ |

|

1,749 |

|

|

(4.7)% |

|

Aluminum |

|

|

$ |

|

5,382 |

|

|

$ |

|

5,893 |

|

|

(8.7)% |

|

Stainless Steel |

|

$ |

|

4,824 |

|

|

$ |

|

5,869 |

|

|

(17.8)% |

|

Earnings Call Information

Ryerson will host a conference call to discuss second quarter 2024 financial results for the period ended June 30, 2024, on Wednesday, July 31, 2024, at 10 a.m. Eastern Time. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 4,400 employees and over 110 locations. Visit Ryerson at www.ryerson.com.

Manager – Investor Relations:

Pratham Dear

312.292.5033

investorinfo@ryerson.com

Notes:

1For EBITDA, Adjusted EBITDA and Adjusted EBITDA excluding LIFO please see Schedule 2

2 Diluted EPS is Diluted earnings per share

3Operating expenses are Warehousing, delivery, selling, general, and administrative expenses

4FIFO cost basis is inventory cost excluding LIFO

5Net debt is defined as long term debt plus short term debt less cash and cash equivalents and excludes restricted cash

Legal Disclaimer

The contents herein are provided for general information purposes only and do not constitute an offer to sell or buy, or a solicitation of an offer to buy, any security (“Security”) of the Company or its affiliates (“Ryerson”) in any jurisdiction. Ryerson does not intend to solicit, and is not soliciting, any action with respect to any Security or any other contractual relationship with Ryerson. Nothing in this release, individually or taken in the aggregate, constitutes an offer of securities for sale or buy, or a solicitation of an offer to buy, any Security in the United States, or to U.S. persons, or in any other jurisdiction in which such an offer or solicitation is unlawful.

Safe Harbor Provision

Certain statements made in this release and other written or oral statements made by or on behalf of the Company constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events; fluctuating metal prices; our indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; the influence of a single investor group over our policies and procedures; work stoppages; obligations under certain employee retirement benefit plans; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under “Risk Factors” in our most recent our annual report on Form 10-K and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Selected Income and Cash Flow Data - Unaudited |

|

(Dollars and Shares in Millions, except Per Share and Per Ton Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

First Six Months Ended |

|

|

|

Second |

|

|

First |

|

|

Second |

|

|

June 30, |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES |

|

$ |

1,225.5 |

|

|

$ |

1,239.2 |

|

|

$ |

1,343.5 |

|

|

$ |

2,464.7 |

|

|

$ |

2,749.6 |

|

Cost of materials sold |

|

|

1,002.0 |

|

|

|

1,021.6 |

|

|

|

1,082.6 |

|

|

|

2,023.6 |

|

|

|

2,224.5 |

|

Gross profit |

|

|

223.5 |

|

|

|

217.6 |

|

|

|

260.9 |

|

|

|

441.1 |

|

|

|

525.1 |

|

Warehousing, delivery, selling, general, and administrative |

|

|

199.0 |

|

|

|

216.8 |

|

|

|

202.6 |

|

|

|

415.8 |

|

|

|

396.8 |

|

Restructuring and other charges |

|

|

1.7 |

|

|

|

— |

|

|

|

— |

|

|

|

1.7 |

|

|

|

— |

|

OPERATING PROFIT |

|

|

22.8 |

|

|

|

0.8 |

|

|

|

58.3 |

|

|

|

23.6 |

|

|

|

128.3 |

|

Other income and (expense), net |

|

|

1.8 |

|

|

|

(0.2 |

) |

|

|

(0.3 |

) |

|

|

1.6 |

|

|

|

(0.4 |

) |

Interest and other expense on debt |

|

|

(11.3 |

) |

|

|

(10.1 |

) |

|

|

(8.3 |

) |

|

|

(21.4 |

) |

|

|

(15.9 |

) |

INCOME (LOSS) BEFORE INCOME TAXES |

|

|

13.3 |

|

|

|

(9.5 |

) |

|

|

49.7 |

|

|

|

3.8 |

|

|

|

112.0 |

|

Provision (benefit) for income taxes |

|

|

3.0 |

|

|

|

(2.1 |

) |

|

|

12.1 |

|

|

|

0.9 |

|

|

|

26.9 |

|

NET INCOME (LOSS) |

|

|

10.3 |

|

|

|

(7.4 |

) |

|

|

37.6 |

|

|

|

2.9 |

|

|

|

85.1 |

|

Less: Net income attributable to noncontrolling interest |

|

|

0.4 |

|

|

|

0.2 |

|

|

|

— |

|

|

|

0.6 |

|

|

|

0.2 |

|

NET INCOME (LOSS) ATTRIBUTABLE TO RYERSON HOLDING CORPORATION |

|

$ |

9.9 |

|

|

$ |

(7.6 |

) |

|

$ |

37.6 |

|

|

$ |

2.3 |

|

|

$ |

84.9 |

|

EARNINGS (LOSS) PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.29 |

|

|

$ |

(0.22 |

) |

|

$ |

1.07 |

|

|

$ |

0.07 |

|

|

$ |

2.38 |

|

Diluted |

|

$ |

0.29 |

|

|

$ |

(0.22 |

) |

|

$ |

1.06 |

|

|

$ |

0.07 |

|

|

$ |

2.33 |

|

Shares outstanding - basic |

|

|

34.2 |

|

|

|

34.0 |

|

|

|

35.0 |

|

|

|

34.1 |

|

|

|

35.7 |

|

Shares outstanding - diluted |

|

|

34.4 |

|

|

|

34.0 |

|

|

|

35.5 |

|

|

|

34.6 |

|

|

|

36.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per share |

|

$ |

0.1875 |

|

|

$ |

0.1875 |

|

|

$ |

0.180 |

|

|

$ |

0.375 |

|

|

$ |

0.350 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Data : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons shipped (000) |

|

|

508 |

|

|

|

497 |

|

|

|

496 |

|

|

|

1,005 |

|

|

|

1,015 |

|

Shipping days |

|

|

64 |

|

|

|

64 |

|

|

|

64 |

|

|

|

128 |

|

|

|

128 |

|

Average selling price/ton |

|

$ |

2,412 |

|

|

$ |

2,493 |

|

|

$ |

2,709 |

|

|

$ |

2,452 |

|

|

$ |

2,709 |

|

Gross profit/ton |

|

|

440 |

|

|

|

438 |

|

|

|

526 |

|

|

|

439 |

|

|

|

517 |

|

Operating profit/ton |

|

|

45 |

|

|

|

2 |

|

|

|

118 |

|

|

|

23 |

|

|

|

126 |

|

LIFO expense (income) per ton |

|

|

(20 |

) |

|

|

2 |

|

|

|

(18 |

) |

|

|

(9 |

) |

|

|

(5 |

) |

LIFO expense (income) |

|

|

(10.0 |

) |

|

|

1.0 |

|

|

|

(9.0 |

) |

|

|

(9.0 |

) |

|

|

(5.0 |

) |

Depreciation and amortization expense |

|

|

18.0 |

|

|

|

17.4 |

|

|

|

15.1 |

|

|

|

35.4 |

|

|

|

28.8 |

|

Cash flow provided by (used in) operating activities |

|

|

25.9 |

|

|

|

(47.8 |

) |

|

|

115.3 |

|

|

|

(21.9 |

) |

|

|

195.7 |

|

Capital expenditures |

|

|

(22.7 |

) |

|

|

(21.8 |

) |

|

|

(46.3 |

) |

|

|

(44.5 |

) |

|

|

(74.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Schedule 1 for Condensed Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

|

See Schedule 2 for EBITDA and Adjusted EBITDA reconciliation |

|

|

|

|

|

|

|

|

|

|

See Schedule 3 for Adjusted EPS reconciliation |

|

|

|

|

|

|

|

|

|

|

See Schedule 4 for Free Cash Flow reconciliation |

|

|

|

|

|

|

|

|

|

|

See Schedule 5 for Third Quarter 2024 Guidance reconciliation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 1 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Condensed Consolidated Balance Sheets |

|

(In millions, except shares) |

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

(unaudited) |

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

28.0 |

|

|

$ |

54.3 |

|

Restricted cash |

|

|

1.2 |

|

|

|

1.1 |

|

Receivables, less provisions of $3.2 at June 30, 2024 and $1.7 at December 31, 2023 |

|

|

529.0 |

|

|

|

467.7 |

|

Inventories |

|

|

744.1 |

|

|

|

782.5 |

|

Prepaid expenses and other current assets |

|

|

86.8 |

|

|

|

77.8 |

|

Total current assets |

|

|

1,389.1 |

|

|

|

1,383.4 |

|

Property, plant, and equipment, at cost |

|

|

1,098.8 |

|

|

|

1,071.5 |

|

Less: accumulated depreciation |

|

|

495.4 |

|

|

|

481.9 |

|

Property, plant, and equipment, net |

|

|

603.4 |

|

|

|

589.6 |

|

Operating lease assets |

|

|

351.9 |

|

|

|

349.4 |

|

Other intangible assets |

|

|

68.7 |

|

|

|

73.7 |

|

Goodwill |

|

|

161.0 |

|

|

|

157.8 |

|

Deferred charges and other assets |

|

|

17.1 |

|

|

|

15.7 |

|

Total assets |

|

$ |

2,591.2 |

|

|

$ |

2,569.6 |

|

Liabilities |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

439.3 |

|

|

$ |

463.4 |

|

Salaries, wages, and commissions |

|

|

38.8 |

|

|

|

51.9 |

|

Other accrued liabilities |

|

|

69.3 |

|

|

|

75.9 |

|

Short-term debt |

|

|

1.4 |

|

|

|

8.2 |

|

Current portion of operating lease liabilities |

|

|

30.2 |

|

|

|

30.5 |

|

Current portion of deferred employee benefits |

|

|

4.0 |

|

|

|

4.0 |

|

Total current liabilities |

|

|

583.0 |

|

|

|

633.9 |

|

Long-term debt |

|

|

524.0 |

|

|

|

428.3 |

|

Deferred employee benefits |

|

|

102.8 |

|

|

|

106.7 |

|

Noncurrent operating lease liabilities |

|

|

341.8 |

|

|

|

336.8 |

|

Deferred income taxes |

|

|

139.3 |

|

|

|

135.5 |

|

Other noncurrent liabilities |

|

|

13.9 |

|

|

|

13.9 |

|

Total liabilities |

|

|

1,704.8 |

|

|

|

1,655.1 |

|

Commitments and contingencies |

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Ryerson Holding Corporation stockholders' equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value; 7,000,000 shares authorized and no shares issued at June 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value; 100,000,000 shares authorized; 39,894,144 and 39,450,659 shares issued at June 30, 2024 and December 31, 2023, respectively |

|

|

0.4 |

|

|

|

0.4 |

|

Capital in excess of par value |

|

|

419.3 |

|

|

|

411.6 |

|

Retained earnings |

|

|

802.6 |

|

|

|

813.2 |

|

Treasury stock, at cost - Common stock of 6,201,965 shares at June 30, 2024 and 5,413,434 shares at December 31, 2023 |

|

|

(198.1 |

) |

|

|

(179.3 |

) |

Accumulated other comprehensive loss |

|

|

(146.3 |

) |

|

|

(140.0 |

) |

Total Ryerson Holding Corporation Stockholders' Equity |

|

|

877.9 |

|

|

|

905.9 |

|

Noncontrolling interest |

|

|

8.5 |

|

|

|

8.6 |

|

Total Equity |

|

|

886.4 |

|

|

|

914.5 |

|

Total Liabilities and Stockholders' Equity |

|

$ |

2,591.2 |

|

|

$ |

2,569.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 2 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Reconciliations of Net Income (Loss) Attributable to Ryerson Holding Corporation to EBITDA and Gross profit to Gross profit excluding LIFO |

|

(Dollars in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

First Six Months Ended |

|

|

|

Second |

|

|

First |

|

|

Second |

|

|

June 30, |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Ryerson Holding Corporation |

|

$ |

9.9 |

|

|

$ |

(7.6 |

) |

|

$ |

37.6 |

|

|

$ |

2.3 |

|

|

$ |

84.9 |

|

Interest and other expense on debt |

|

|

11.3 |

|

|

|

10.1 |

|

|

|

8.3 |

|

|

|

21.4 |

|

|

|

15.9 |

|

Provision (benefit) for income taxes |

|

|

3.0 |

|

|

|

(2.1 |

) |

|

|

12.1 |

|

|

|

0.9 |

|

|

|

26.9 |

|

Depreciation and amortization expense |

|

|

18.0 |

|

|

|

17.4 |

|

|

|

15.1 |

|

|

|

35.4 |

|

|

|

28.8 |

|

EBITDA |

|

$ |

42.2 |

|

|

$ |

17.8 |

|

|

$ |

73.1 |

|

|

$ |

60.0 |

|

|

$ |

156.5 |

|

Reorganization |

|

|

12.7 |

|

|

|

20.1 |

|

|

|

4.9 |

|

|

|

32.8 |

|

|

|

6.7 |

|

Pension settlement loss |

|

|

— |

|

|

|

2.2 |

|

|

|

— |

|

|

|

2.2 |

|

|

|

— |

|

Benefit plan curtailment gain |

|

|

— |

|

|

|

(0.3 |

) |

|

|

— |

|

|

|

(0.3 |

) |

|

|

— |

|

Foreign currency transaction (gains) losses |

|

|

(0.4 |

) |

|

|

(1.2 |

) |

|

|

1.3 |

|

|

|

(1.6 |

) |

|

|

1.2 |

|

Purchase consideration and other transaction costs (credits) |

|

|

(1.1 |

) |

|

|

0.1 |

|

|

|

0.4 |

|

|

|

(1.0 |

) |

|

|

0.7 |

|

Other adjustments |

|

|

(0.8 |

) |

|

|

0.5 |

|

|

|

(0.6 |

) |

|

|

(0.3 |

) |

|

|

0.1 |

|

Adjusted EBITDA |

|

$ |

52.6 |

|

|

$ |

39.2 |

|

|

$ |

79.1 |

|

|

$ |

91.8 |

|

|

$ |

165.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

52.6 |

|

|

$ |

39.2 |

|

|

$ |

79.1 |

|

|

$ |

91.8 |

|

|

$ |

165.2 |

|

LIFO expense (income) |

|

|

(10.0 |

) |

|

|

1.0 |

|

|

|

(9.0 |

) |

|

|

(9.0 |

) |

|

|

(5.0 |

) |

Adjusted EBITDA, excluding LIFO expense (income) |

|

$ |

42.6 |

|

|

$ |

40.2 |

|

|

$ |

70.1 |

|

|

$ |

82.8 |

|

|

$ |

160.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

1,225.5 |

|

|

$ |

1,239.2 |

|

|

$ |

1,343.5 |

|

|

$ |

2,464.7 |

|

|

$ |

2,749.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA, excluding LIFO expense (income), as a percentage of net sales |

|

|

3.5 |

% |

|

|

3.2 |

% |

|

|

5.2 |

% |

|

|

3.4 |

% |

|

|

5.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

$ |

223.5 |

|

|

$ |

217.6 |

|

|

$ |

260.9 |

|

|

$ |

441.1 |

|

|

$ |

525.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin |

|

|

18.2 |

% |

|

|

17.6 |

% |

|

|

19.4 |

% |

|

|

17.9 |

% |

|

|

19.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

$ |

223.5 |

|

|

$ |

217.6 |

|

|

$ |

260.9 |

|

|

$ |

441.1 |

|

|

$ |

525.1 |

|

LIFO expense (income) |

|

|

(10.0 |

) |

|

|

1.0 |

|

|

|

(9.0 |

) |

|

|

(9.0 |

) |

|

|

(5.0 |

) |

Gross profit, excluding LIFO expense (income) |

|

$ |

213.5 |

|

|

$ |

218.6 |

|

|

$ |

251.9 |

|

|

$ |

432.1 |

|

|

$ |

520.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin, excluding LIFO expense (income) |

|

|

17.4 |

% |

|

|

17.6 |

% |

|

|

18.7 |

% |

|

|

17.5 |

% |

|

|

18.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: EBITDA represents net income before interest and other expense on debt, provision for income taxes, depreciation, and amortization. Adjusted EBITDA gives further effect to, among other things, reorganization expenses, gain on sales of assets, pension settlement loss, benefit plan curtailment gain, and foreign currency transaction gains and losses. We believe that the presentation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), provides useful information to investors regarding our operational performance because they enhance an investor’s overall understanding of our core financial performance and provide a basis of comparison of results between current, past, and future periods. We also disclose the metric Adjusted EBITDA, excluding LIFO expense (income), to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), are three of the primary metrics management uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of our business without the effect of U.S. generally accepted accounting principles, or GAAP, expenses, revenues, and gains (losses) that are unrelated to the day to day performance of our business. We also establish compensation programs for our executive management and regional employees that are based upon the achievement of pre-established EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), targets. We also use EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), to benchmark our operating performance to that of our competitors. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. This release |

|

|

|

also presents gross margin, excluding LIFO expense (income), which is calculated as gross profit minus LIFO expense (income), divided by net sales. We have excluded LIFO expense from gross margin and Adjusted EBITDA as a percentage of net sales metrics in order to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories as we do. Our definitions of EBITDA, Adjusted EBITDA, Adjusted EBITDA, excluding LIFO expense (income), gross margin, excluding LIFO expense (income), and Adjusted EBITDA, excluding LIFO expense (income), as a percentage of sales may differ from that of other companies. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 3 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Reconciliation of Net Income (Loss) to Adjusted Net Income (Loss) and Adjusted Earnings (Loss) per Share |

|

(Dollars and Shares in Millions, Except Per Share Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

First Six Months Ended |

|

|

|

Second |

|

|

First |

|

|

Second |

|

|

June 30, |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Ryerson Holding Corporation |

|

$ |

9.9 |

|

|

$ |

(7.6 |

) |

|

$ |

37.6 |

|

|

$ |

2.3 |

|

|

$ |

84.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring and other charges |

|

|

1.7 |

|

|

|

— |

|

|

|

— |

|

|

|

1.7 |

|

|

|

— |

|

Pension settlement loss |

|

|

— |

|

|

|

2.2 |

|

|

|

— |

|

|

|

2.2 |

|

|

|

— |

|

Benefit plan curtailment gain |

|

|

— |

|

|

|

(0.3 |

) |

|

|

— |

|

|

|

(0.3 |

) |

|

|

— |

|

Benefit for income taxes |

|

|

(0.4 |

) |

|

|

(0.5 |

) |

|

|

— |

|

|

|

(0.9 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income (loss) attributable to Ryerson Holding Corporation |

|

$ |

11.2 |

|

|

$ |

(6.2 |

) |

|

$ |

37.6 |

|

|

$ |

5.0 |

|

|

$ |

84.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted earnings (loss) per share |

|

$ |

0.33 |

|

|

$ |

(0.18 |

) |

|

$ |

1.06 |

|

|

$ |

0.14 |

|

|

$ |

2.33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding - diluted |

|

|

34.4 |

|

|

|

34.0 |

|

|

|

35.5 |

|

|

|

34.6 |

|

|

|

36.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Adjusted net income (loss) and Adjusted earnings (loss) per share is presented to provide a means of comparison with periods that do not include similar adjustments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 4 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Cash Flow from Operations to Free Cash Flow Yield |

|

(Dollars in Millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

First Six Months Ended |

|

|

|

Second |

|

|

First |

|

|

Second |

|

|

June 30, |

|

|

|

Quarter |

|

|

Quarter |

|

|

Quarter |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating activities |

|

$ |

25.9 |

|

|

$ |

(47.8 |

) |

|

$ |

115.3 |

|

|

$ |

(21.9 |

) |

|

$ |

195.7 |

|

Capital expenditures |

|

|

(22.7 |

) |

|

|

(21.8 |

) |

|

|

(46.3 |

) |

|

|

(44.5 |

) |

|

|

(74.1 |

) |

Proceeds from sales of property, plant, and equipment |

|

|

0.1 |

|

|

|

1.4 |

|

|

|

0.1 |

|

|

|

1.5 |

|

|

|

0.1 |

|

Free cash flow |

|

$ |

3.3 |

|

|

$ |

(68.2 |

) |

|

$ |

69.1 |

|

|

$ |

(64.9 |

) |

|

$ |

121.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market capitalization |

|

$ |

657.0 |

|

|

$ |

1,150.1 |

|

|

$ |

1,491.8 |

|

|

$ |

657.0 |

|

|

$ |

1,491.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow yield |

|

|

0.5 |

% |

|

|

(5.9 |

%) |

|

|

4.6 |

% |

|

|

(9.9 |

%) |

|

|

8.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Market capitalization is calculated using June 30, 2024, March 31, 2024, and June 30, 2023 stock prices and shares outstanding. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 5 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Reconciliation of Third Quarter 2024 Net Income Attributable to Ryerson Holding Corporation to Adj. EBITDA, excl. LIFO Guidance |

|

(Dollars in Millions, except Per Share Data) |

|

|

|

Third Quarter 2024 |

|

|

|

Low |

|

|

High |

|

Net income attributable to Ryerson Holding Corporation |

|

$ |

- |

|

|

$ |

3 |

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$ |

0.01 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

Interest and other expense on debt |

|

|

10 |

|

|

|

10 |

|

Provision for income taxes |

|

|

- |

|

|

|

1 |

|

Depreciation and amortization expense |

|

|

18 |

|

|

|

18 |

|

EBITDA |

|

$ |

28 |

|

|

$ |

32 |

|

Adjustments |

|

|

5 |

|

|

|

5 |

|

Adjusted EBITDA |

|

$ |

33 |

|

|

$ |

37 |

|

LIFO income |

|

|

(12 |

) |

|

|

(12 |

) |

Adjusted EBITDA, excluding LIFO |

|

$ |

21 |

|

|

$ |

25 |

|

|

|

|

|

|

|

|

Note: See the note within Schedule 2 for a description of EBITDA and Adjusted EBITDA. |

|

|

|

|

|

|

Ryerson Quarterly Release Presentation Q2 2024 Exhibit 99.2

Important Information About Ryerson Holding Corporation These materials do not constitute an offer or solicitation to purchase or sell securities of Ryerson Holding Corporation (“Ryerson” or “the Company”) or its subsidiaries and no investment decision should be made based upon the information provided herein. Ryerson strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at https://ir.ryerson.com/financials/sec-filings/default.aspx. This site also provides additional information about Ryerson. Safe Harbor Provision Certain statements made in this release and other written or oral statements made by or on behalf of the Company constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events; fluctuating metal prices; our indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; the influence of a single investor group over our policies and procedures; work stoppages; obligations under certain employee retirement benefit plans; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under “Risk Factors” in our most recent annual report on Form 10-K for the year ended December 31, 2023, our quarterly report on Form 10-Q for the quarter ended June 30, 2024, and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise. Non-GAAP Measures Certain measures contained in these slides or the related presentation are not measures calculated in accordance with generally accepted accounting principles (“GAAP”). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnotes. A reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures is included in the Appendix.

10 Year View Since Ryerson IPO Net PP&E Book Value of Equity Pension Liability Net Debt2 Improved Operating Model Balance Sheet Transformation Improved Capital Allocation 1For EBITDA, Adjusted EBITDA and Adj EBITDA excluding LIFO please see Appendix; 10-year view represents Q3 2014 thru Q2 2024 as a proxy for the period since the Ryerson Initial Public Offering in August, 2014; 2Net debt is defined as long term debt plus short term debt less cash and cash equivalents and excludes restricted cash Adj. EBITDA ex. LIFO1 10-Year Total $2.9B Annual Average $295M Cash from Operations 10-Year Total $1.6B Annual Average $161M ▲$1.0B ▲$30/share ▼$660M ▼$115M ▲$170M 10-Year Total Investment Capex $525M Acquisitions $458M 10-Year Total Shareholder Return Dividends $64M Repurchase $181M Share Repurchases 2021-H2 2024 Shares Bought (6M) Shares at IPO 32M Shares at 6/24 34M ;

Increase through-the-cycle earnings and cash flow Earnings Power Increase 10-Year Total Annual Average Adj. EBITDA ex. LIFO1 $2.9B $295M Cash from Operations $1.6B $161M 1For EBITDA, Adjusted EBITDA and Adj EBITDA excluding LIFO please see Appendix; 10-year view represents Q3 2014 thru Q2 2024 as a proxy for the period since the Ryerson Initial Public Offering in August, 2014; the annual chart reflects full year 2014 data

Fixed asset portfolio Service Center Sqft = 9.4M1 Owned Real Estate Portfolio Valuation Estimated Fair Market Value2 $365M Net Book Value $184M 1As of 6/30/24 2This portfolio valuation is not based on any independent appraisals or third-party valuations of the fair market value (“FMV”) of the portfolio assets. Rather, the portfolio valuation assumes FMV based on internal estimates taking into consideration (1) third-party estimates, (2) prior sale-leaseback transactions, and (3) previous sales of similar assets, each of which involves highly subjective assessments or may no longer be current. The portfolio valuation should not be used as a substitute for an independent FMV valuation.

Reduction of net debt and legacy liabilities combined with improved operating model with average 10-year ex. LIFO EBITDA of $295M per year have driven substantial increase in our net book value of equity Equity value accretion 1June 2014 NBV/share reflects pro-forma amount that includes the 11M shares issued in the August 2014 IPO 1

Strong earnings and operating cash flow have afforded us the opportunity for a better-balanced allocation between reinvestments in the business and returns to shareholders Capital allocation Share Repurchases Shares Avg. Cost 2021 80K $22.39 2022 1.7M $29.39 2023 3.3M $35.00 H1 2024 0.7M $22.19 TOTAL 5.7M $31.63

Delivered Net Income attributable to Ryerson Holding Corporation of $9.9 million and Adjusted EBITDA1, excluding LIFO of $42.6 million Earned diluted EPS of $0.29 on $1.23 billion of revenue from 508,000 tons shipped and average selling price of $2,412 per ton Reduced operating expenses2 by $17.8 million, compared to the first quarter of 2024, as part of previously announced cost reductions. Annualized cost reduction expectations updated to savings of approximately $60 million Reduced inventory by $107.1 million on a FIFO cost basis3, compared to the first quarter of 2024 Returned $20.4 million to shareholders during the quarter, comprised of $14.0 million in share repurchases and $6.4 million in dividends Ended the quarter with debt of $525 million and net debt4 of $497 million as of June 30, 2024, compared to $497 million and $455 million, respectively, on March 31, 2024 Increased share repurchase authorization by $50 million and extended maturity to April 2026 Announced third quarter 2024 dividend of $0.1875 per share Q2 2024 Highlights 1For EBITDA, Adjusted EBITDA and Adj EBITDA excluding LIFO please see Appendix; 2Operating Expenses defined as Warehousing, delivery, selling, general, and administrative expenses; 3FIFO cost basis is inventory cost excluding LIFO;4Net Debt is defined as Long Term Debt plus Short-Term Debt less Cash and Cash Equivalents and excludes Restricted Cash

Macro & commodities 1Sources: Bloomberg: prices through June 30, 2024; Futures prices as of July 29, 2024; Bloomberg, US Industrial Production Index Month YoY Change; Bloomberg, U.S. Manufacturing PMI Commodity Prices Since Dec. 2017 U.S. Industrial Production Futures indicate pricing stabilizing; Macroeconomic indicators mixed to contractionary Futures

12023 Sales Mix by tons Excludes Other Industry Sectors which represent approximately 4% of Ryerson sales mix; Sales Mix based on 2023 results as disclosed in Ryerson’s Annual Report on Form 10-K for the year ended December 31, 2023 Metal Fab and Machine Shop Industrial Equipment Commercial Ground Transportation Food & Ag Consumer Durable Construction/Heavy Equipment HVAC Oil & Gas 2023 Sales Mix1 Commentary QoQ Volume 25% 17% 17% 9% 9% 8% 7% 4% Ryerson’s second quarter North American shipments reflected seasonal buying patterns as well as selective restocking customer demand from consumer and industrial manufacturing sectors Sequential end-market trends

Anticipate depressed conditions impacting Q3 volumes and pricing through a 2nd half cyclical bottoming 1Net Income attributable to Ryerson Holding Corporation; 2Diluted EPS of $0.05 represents the midpoint of our $0.01 - $0.10 guidance range. See Ryerson’s 8-K filed on July 30, 2024 Net Sales Net Income1 Adj. EBITDA, excl. LIFO $1.12 - 1.16B $0 – 3M $21 - 25M Second quarter revenue guidance of $1.12B to $1.16B assumes: Average Selling Prices decrease 3% to 5% Shipments decrease between 2% to 4% Diluted Earnings (loss) per Share Q3 2024 Guidance

1LTM Free Cash Flow Yield is calculated based on Last Twelve Months free cash flow divided by period-end market capitalization. LTM Free Cash Flow of $57.1M and market cap on 6/30/24 of $657.0 Capital Investment Expense Management Compared to Q1 2024 Inventory Days of Supply Cash Conversion Cycle 83 78 Asset Management Cash Flow Service Center modernization investments in new service centers, expanded service centers and value-added capex Second quarter cash flow generation driven by net income The Company’s cash conversion cycle increased sequentially due to an increase in days sales outstanding, partially offset by a decrease in inventory days of supply Cash from Operating activities LTM Free Cash Flow Yield1 $25.9 8.7% Q2 2024 Investment FY 2024E $23M $110M Expense Expense/Sales ($17.8M) -130bps Expenses decreased $17.8M, or 8.2%, compared to Q1 2024 driven by lower expenses from personnel, fixed and variable operations, and lower reorganization costs. financial and operating metrics

Liquidity remained strong and Net Leverage above target level A reconciliation of Net Debt as well as other non-GAAP financial measures to comparable GAAP measures is included in the Appendix. See Ryerson’s 8-K filed on July 30, 2024 Net Leverage of 3.2x in Q2 ’24 above target leverage range of 0.5x to 2.0x Global liquidity remained strong at $585M in Q2 ’24 Cash and Cash Equivalents Foreign Availability North American Availability Liquidity and leverage

Capital allocation plan 1LTM is Last Twelve Months LTM1 free cash flow generation $23M in Q2’24;� $110M in ’24E Modernization and and Value-Add Quarterly �dividend�of $0.1875 per share for Q3’24 Track record of successful acquisitions $14M repurchased in Q2’24; �Authorization extended to�2026 Supports key pillars of Capital Allocation CAPEX M&A DIVIDENDS BUYBACKS

shareholder returns $0.1875 per Share Return of capital to investors and $14.0M Share repurchases completed in Q2 2024 Q3 2024 Announced: Ryerson’s dividend is enabled by a transformed balance sheet and continued prioritization of shareholder returns as part of a balanced capital allocation strategy $0.1875 per Share Return of capital to investors

Q2 2024 key financial metrics 1 Net Income attributable to Ryerson Holding Corporation; A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in the Appendix. See Ryerson’s 8-K filed on July 30, 2024 Net Sales Gross Margin Net Income1 Diluted Income�per Share Debt $1.2B 18.2% $9.9M $0.29 $525M (1.1%) �QoQ +60 bps �QoQ +$17.5M �QoQ +$0.51 �QoQ +$28M �QoQ Tons Shipped Gross Margin, excl. LIFO Adj. EBITDA excl. LIFO Adjusted Diluted Income per Share Net Debt 508k 17.4% $42.6M $0.33 $497M +2.2% �QoQ -20 bps� QoQ +$2.4M� QoQ +$0.51� QoQ +42M� QoQ

Diversified (metals mix, ~40k customers, ~75k products) Availability, speed, ease, consistency Over 110 facilities Hundreds of “virtual” locations 24/7 E-Commerce Platform Relationship-centric customer experience Building the value chain of the future Intelligent Network 17

Reimagined e-commerce platform Investing in digitalization to improve customer experience 18

Appendix

University Park – New CS&W HQ 900,000 sq ft facility Significant automation and technological enhancements Investing IN the Business West Shelbyville Expansion State-of-the-art cut-to-length line (CTL) and automated storage and retrieval system for sheet products Centralia Pacific NW 214,000 sq ft facility Advanced processing capabilities for sheet, plate, and long products Portage Laser Cell Automated coil processing & laser cutting Atlanta Tube Laser Center Expanded tube processing facility SAP Conversion Converted 17 locations to SAP

Stronger capital structure allows for greater returns to shareholders Dividend payments 1EPS is Diluted EPS; 2Yield for 2023 is based on closing share price as of December 29, 2023, of $34.68. Yield for TTM Q2’24 is based on closing share price as of June 28, 2023, of $19.50. Dividend per Share 1 2 22

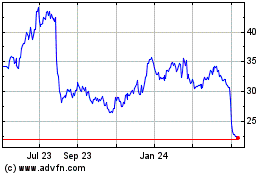

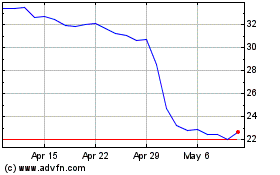

Quarterly financial highlights 1 Net Loss attributable to Ryerson Holding Corporation; A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix Average Selling Price Per Ton Gross Margin & Gross Margin, excl. LIFO Tons Sold (000’s) Adj. EBITDA excl. LIFO & Net Income (Loss) Margin % 1 23