REV Group, Inc. Announces Proposed Secondary Offering of Common Stock and Concurrent Share Repurchase

February 13 2024 - 4:05PM

Business Wire

REV Group, Inc. (NYSE:REVG) announced today the commencement of

an underwritten public offering of 12,000,000 shares of common

stock by certain selling stockholders. In connection with the

offering, the selling stockholders intend to grant the underwriters

an option to purchase up to 1,800,000 additional shares of common

stock from the selling stockholders. REV Group is not selling any

shares of common stock in the offering, and REV Group will not

receive any proceeds from the offering by the selling stockholders.

The proposed offering is subject to market and other conditions, as

well as customary closing conditions.

Baird, Goldman Sachs & Co. LLC and Morgan Stanley are

serving as joint book-running managers for the proposed

offering.

Assuming the underwriters purchase 12,000,000 shares of REV

Group’s common stock, REV Group intends to purchase from the

underwriters 6,000,000 of the shares of its common stock that are

subject to the offering at a price per common share equal to the

price to be paid to the selling stockholders by the underwriters.

REV Group intends to fund the repurchase with cash on hand and

borrowings under its revolving credit agreement.

A registration statement on Form S-3 (File No. 333-276009)

relating to the shares of common stock of REV Group to be sold in

the proposed offering was declared effective by the Securities and

Exchange Commission (the “SEC”) on December 19, 2023. A preliminary

prospectus supplement and accompanying prospectus relating to and

describing the terms of the proposed offering have been filed with

the SEC and may be obtained by visiting EDGAR on the SEC’s website

at www.sec.gov or by contacting Baird, 777 East Wisconsin Avenue,

Milwaukee, WI 53202, Attention: Syndicate Department, Telephone:

800-792-2473, Email: syndicate@rwbaird.com, Goldman Sachs & Co.

LLC, 200 West Street, New York, NY 10282-2198, Attention:

Prospectus Department, Telephone: 866-471-2526, Email:

Prospectus-ny@ny.email.gs.com or Morgan Stanley & Co. LLC, 180

Varick Street, 2nd Floor, New York, NY 10014, Attn: Prospectus

Department. The final terms of the proposed offering will be

disclosed in a final prospectus supplement to be filed with the

SEC.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About REV Group

REV Group (REVG) is a leading designer, manufacturer and

distributor of specialty vehicles and related aftermarket parts and

services. We serve a diversified customer base, primarily in the

United States and Canada, through two segments: Specialty Vehicles

and Recreational Vehicles. We provide customized vehicle solutions

for applications, including essential needs for public services

(ambulances and fire apparatus), commercial infrastructure

(terminal trucks and industrial sweepers) and consumer leisure

(recreational vehicles). Our diverse portfolio is made up of

well-established principal vehicle brands, including many of the

most recognizable names within their industry. Several of our

brands pioneered their specialty vehicle product categories and

date back more than 50 years. REV Group trades on the NYSE under

the symbol REVG.

View source version on businesswire.com.

Source: REV Group, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240213362691/en/

REV Group, Inc. Drew Konop, 1-888-738-4037 (1-888-REVG-037)

investors@revgroup.com

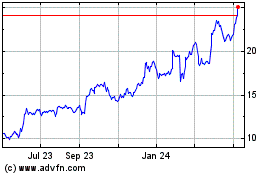

REV (NYSE:REVG)

Historical Stock Chart

From Dec 2024 to Jan 2025

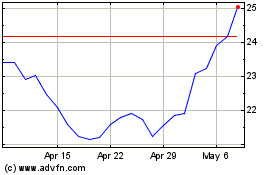

REV (NYSE:REVG)

Historical Stock Chart

From Jan 2024 to Jan 2025