false

0001687221

0001687221

2024-02-07

2024-02-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 7, 2024

____________________________

REV Group, Inc.

(Exact name of Registrant as Specified in Its

Charter)

____________________________

| Delaware |

001-37999 |

26-3013415 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

245 South Executive

Drive, Suite 100

Brookfield, WI 53005

(Address of Principal Executive Offices)

(414) 290-0190

(Registrant’s Telephone Number, Including

Area Code)

Former Name or Former Address, if Changed Since

Last Report: Not Applicable

____________________________

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock ($0.001 Par Value) |

REVG |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

Amendment to Credit Facility

On February 7, 2024, REV Group, Inc. (the “Company”)

entered into an Amendment No. 2 (the “Amendment”) to its Credit Agreement (the “Agreement”) dated as of April

13, 2021, by and among the Company, as Borrower, certain subsidiaries of the Company, as other Loan Parties, the Lenders party thereto

and JPMorgan Bank N.A., as Administrative Agent.

Pursuant to the Amendment, the definition of Fixed

Charges under the Agreement was revised to exclude the special cash dividend that was previously disclosed in the Company’s Current

Reports on Form 8-K filed on January 29, 2024 and January 31, 2024.

The foregoing description is qualified in its entirety

by reference to the Amendment, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly

authorized.

| |

REV Group, Inc. |

| |

|

| |

|

|

| Date: February 8, 2024 |

By: |

/s/ Mark A. Skonieczny |

| |

|

Name: Mark A. Skonieczny |

| |

|

Title: President and Chief Executive Officer,

Interim Chief Financial Officer, and Director

(Principal Executive and Financial Officer) |

Exhibit 10.1

AMENDMENT

NO. 2 TO CREDIT AGREEMENT

This

AMENDMENT NO. 2 TO CREDIT AGREEMENT (this "Amendment") is entered into as of February 7, 2024 by and among REV GROUP,

INC., a Delaware corporation ("Borrower"), the Lenders party hereto (the "Lenders") and JPMORGAN CHASE

BANK, N.A., as administrative agent for the Lenders (in such capacity, "Administrative Agent").

W

I T N E S S E T H:

WHEREAS,

Borrower, the other Loan Parties party thereto, the Lenders party thereto and Administrative Agent are parties to that certain Credit

Agreement dated as of April 13, 2021 (as amended, restated, supplemented or otherwise modified to date and from time to time, including

hereby, the "Credit Agreement"; capitalized terms used herein but not otherwise defined shall have the meanings set

forth in the Credit Agreement);

WHEREAS,

Borrower has requested that Lenders agree to amend the Credit Agreement in certain respects; and

WHEREAS,

subject to the terms and conditions of this Amendment, the Lenders have agreed to amend the Credit Agreement as specified herein.

NOW

THEREFORE, in consideration of the mutual conditions and agreements set forth in the Credit Agreement and this Amendment, and other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1.

Amendments to Credit Agreement. Subject to the satisfaction of the conditions precedent set forth in Section

4 below, and in reliance on the representations and warranties set forth in Section 5 below, the Credit Agreement is hereby

amended as follows:

(a)

The definition of "Fixed Charges" set forth in Section 1.01 of the Credit Agreement is hereby amended and restated in

its entirety as follows:

"Fixed

Charges" means, for any period, without duplication, cash Interest Expense (excluding fees paid on the Effective Date), plus

scheduled principal payments (excluding (x) payments of Revolving Loans and (y) payments at maturity to purchase applicable Inventory

with respect to Indebtedness permitted by Section 6.01(i) or payments made with Refinancing Indebtedness permitted under Section 6.01(f))

on Indebtedness actually made, plus the Fixed Asset Amortization Amount, plus Restricted Payments paid in cash pursuant to Section 6.08(a)(iv)

(excluding the February 2024 Special Dividend), plus Capital Lease Obligation payments, all calculated for the Borrower and its Restricted

Subsidiaries on a consolidated basis in accordance with GAAP.

(b)

Section 1.01 of the Credit Agreement is hereby amended to add the following definition thereto in the appropriate alphabetical

order:

"February

2024 Special Dividend" means the special cash dividend on Equity Interests of the Borrower equal to $3.00 per share of common

stock, announced by the Borrower on January 29, 2024, payable on or about February 16, 2024, which will be in an aggregate amount not

to exceed $180,000,000.

2.

Continuing Effect. Except as expressly set forth in Section 1 of this Amendment, nothing in this Amendment

shall constitute a modification or alteration of the terms, conditions or covenants of the Credit Agreement or any other Loan Document,

or a waiver of any other terms or provisions thereof, and the Credit Agreement and the other Loan Documents shall remain unchanged and

shall continue in full force and effect, in each case as amended hereby.

3. Reaffirmation

and Confirmation; Agreement. Each Loan Party hereby ratifies, affirms, acknowledges and agrees that this Amendment, the Credit

Agreement, as modified hereby, and the other Loan Documents represent the valid, enforceable and collectible obligations of each Loan

Party, except as enforcement may be limited by equitable principles or by bankruptcy, insolvency, reorganization, moratorium, or similar

laws relating to or limiting creditors' rights generally, and further acknowledges, as of the date hereof, that there are no existing

claims, defenses, personal or otherwise, or rights of setoff whatsoever with respect to the Credit Agreement or any other Loan Document.

Each Loan Party hereby agrees that this Amendment in no way acts as a release or relinquishment of the Liens and rights securing payments

of the Obligations. The Liens and rights securing payment of the Obligations are hereby ratified and confirmed by each Loan Party in

all respects.

4.

Conditions to Effectiveness. The effectiveness of Section 1 of this Amendment is subject to the following

conditions precedent:

(a)

Administrative Agent shall have received a copy of this Amendment executed by Borrower, each of the other Loan Parties, Administrative

Agent and Lenders constituting the Required Lenders;

(b)

immediately

before and after giving effect to this Amendment, no Default or Event of Default shall have occurred and be continuing; and

(c)

Administrative Agent shall have received a consent fee for the account of each Lender that has returned an executed signature

page to this Amendment at or prior to 12:00 (noon), Chicago time, on February 7, 2024, equal to $2,500 for each such consenting Lender.

5. Representations and Warranties. To induce Administrative Agent and the Lenders to enter into this Amendment, each

Loan Party hereby represents and warrants to Administrative Agent and the Lenders that:

(a)

the execution, delivery and performance of this Amendment has been duly authorized by all requisite action on the part of such

Loan Party and this Amendment has been duly executed and delivered by such Loan Party;

(b)

immediately

before and after giving effect to this Amendment, each of the representations and warranties of the Loan Parties set forth in the Credit

Agreement, Security Agreement and each of the other Loan Documents are true and correct in all material respects (except that such materiality

qualifier shall not be applicable to any representations and warranties that already are qualified or modified by materiality in the

text thereof) as of the date hereof (except to the extent they relate to an earlier date, in which case they shall have been true and

correct in all material respects (except that such materiality qualifier shall not be applicable to any representations and warranties

that already are qualified or modified by materiality in the text thereof) as of such earlier date); and

(c)

immediately before and after giving effect to this Amendment, no Default or Event of Default has occurred and is continuing.

6. Cost and Expenses. Borrower agrees to pay all reasonable out-of-pocket expenses incurred by Administrative Agent

in connection with the preparation, negotiation, execution, delivery and administration of the Credit Agreement and each other Loan Document,

including without limitation this Amendment, and all other instruments or documents provided for therein or herein or delivered or to

be delivered hereunder or thereunder in connection herewith or therewith, in each case to the extent required by Section 9.03

of the Credit Agreement.

7.

Severability.

Any provision of this Amendment held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective

to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining

provisions thereof; and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in

any other jurisdiction.

8.

References. This Amendment is a Loan Document. Any reference to the Credit Agreement contained in any Loan Document

or any other document, instrument or agreement executed in connection with the Credit Agreement shall be deemed to be a reference to

the Credit Agreement as modified by this Amendment.

9.

Counterparts.

This Amendment may be executed in one or more counterparts, each of which shall constitute an original, but all of which taken together

shall be one and the same instrument. Delivery by telecopy or electronic portable document format (i.e., "pdf") transmission

of executed signature pages hereof from one party hereto to another party hereto shall be deemed to constitute due execution and delivery

by such party.

10.

Ratification. The terms and provisions set forth in this Amendment shall modify and supersede all inconsistent terms

and provisions of the Credit Agreement and shall not be deemed to be a consent to the modification or waiver of any other term or condition

of the Credit Agreement or any of the other Loan Documents. Except as expressly modified and superseded by this Amendment, the terms

and provisions of the Credit Agreement are ratified and confirmed and shall continue in full force and effect.

11.

Governing

Law. This Amendment shall be governed by and construed in accordance with the internal laws (and not the law of conflicts) of

the State of New York, but giving effect to federal laws applicable to national banks.

[Signature

pages follow]

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered by their respective duly authorized

officers on the date first written above.

| |

BORROWER: |

|

| |

|

|

| |

REV GROUP, INC. |

|

| |

|

|

| |

|

|

| |

By: |

/s/ Mark A. Skonieczny |

|

| |

Name: |

Mark A. Skonieczny |

|

| |

Title: |

Chief Executive Officer |

|

Signature Page to Amendment No. 2 to Credit Agreement

| |

GUARANTORS: |

| |

|

| |

AVERY TRANSPORT, INC. |

| |

CAPACITY OF TEXAS, INC. |

| |

COLLINS I HOLDING CORP. |

| |

COLLINS INDUSTRIES, INC. |

| |

DETROIT TRUCK MANUFACTURING, LLC |

| |

ELDORADO NATIONAL (CALIFORNIA), INC. |

| |

E-ONE, INC. |

| |

FERRARA FIRE APPARATUS, INC. |

| |

FERRARA FIRE APPARATUS HOLDING COMPANY, INC. |

| |

FFA ACQUISITION COMPANY, INC. |

| |

FFA HOLDCO, INC. |

| |

GOLDSHIELD FIBERGLASS, INC. |

| |

HALCORE GROUP, INC. |

| |

HORTON ENTERPRISES, INC. |

| |

KME HOLDINGS, LLC |

| |

KME RE HOLDINGS, LLC |

| |

KOVATCH MOBILE EQUIPMENT CORP. |

| |

LANCE CAMPER MFG. CORP. |

| |

MOBILE PRODUCTS, INC. |

| |

REV AMBULANCE GROUP ORLANDO, INC. |

| |

REV FINANCIAL SERVICES LLC |

| |

REV PARTS, LLC |

| |

REV RECREATION GROUP FUNDING, INC. |

| |

REV RECREATION GROUP, INC. |

| |

REV RENEGADE LLC |

| |

REV RENEGADE HOLDINGS CORP. |

| |

REV RTC, INC. |

| |

SPARTAN FIRE, LLC |

| |

SMEAL HOLDING, LLC |

| |

SMEAL SFA, LLC |

| |

SMEAL LTC, LLC |

| |

By: |

/s/ Mark A. Skonieczny |

|

| |

Name: |

Mark A. Skonieczny |

|

| |

Title: |

Chief Executive Officer |

|

Signature Page to Amendment No. 2 to Credit Agreement

| |

JPMORGAN CHASE BANK, N.A., as Administrative Agent and a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ John Morrone |

|

| |

Name: |

John Morrone |

|

| |

Title: |

Authorized Officer |

|

Signature Page to Amendment No. 2 to Credit Agreement

| |

BMO BANK N.A., f/k/a BMO Harris Bank, N.A. |

|

| |

as Joint Arranger, Joint Bookrunner, Co-Collateral Agent, Issuing Bank and a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Jared Price |

|

| |

Name: |

Jared Price |

|

| |

Title: |

Vice President |

|

| |

U.S. BANK NATIONAL ASSOCIATION, |

|

| |

as Joint Arranger, Joint Bookrunner, Syndication Agent and a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Thomas P. Chides |

|

| |

Name: |

Thomas P. Chides |

|

| |

Title: |

Vice President |

|

Signature Page to Amendment No. 2 to Credit Agreement

| |

CIBC BANK USA, |

|

| |

as Co-Documentation Agent and a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Peter B. Campbell |

|

| |

Name: |

Peter B. Campbell |

|

| |

Title: |

Managing Director |

|

Signature Page to Amendment No. 2 to Credit Agreement

| |

SUMITOMO MITSUI BANKING CORPORATION, |

|

| |

as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Robert Kowalewski |

|

| |

Name: |

Robert Kowalewski |

|

| |

Title: |

Executive Director |

|

Signature Page to Amendment No. 2 to Credit Agreement

| |

CITIZENS BANK, N.A., |

|

| |

as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Kenneth Wales |

|

| |

Name: |

Kenneth Wales |

|

| |

Title: |

Senior Vice President |

|

Signature Page to Amendment No. 2 to Credit Agreement

| |

WEBSTER BUSINESS CREDIT, a division of Webster Bank, N.A., as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Gordon Massave |

|

| |

Name: |

Gordon Massave |

|

| |

Title: |

Managing Director |

|

Signature Page to Amendment No. 2 to Credit Agreement

| |

FLAGSTAR BANK, N.A., |

|

| |

as a Lender |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ James DeSantis |

|

| |

Name: |

James DeSantis |

|

| |

Title: |

Vice President – Portfolio Manager |

|

Signature Page to Amendment No. 2 to Credit Agreement

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

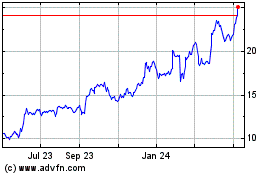

REV (NYSE:REVG)

Historical Stock Chart

From Dec 2024 to Jan 2025

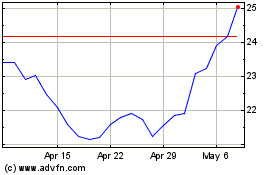

REV (NYSE:REVG)

Historical Stock Chart

From Jan 2024 to Jan 2025