NORCAL Mutual Begins Solicitation of Policyholders in Proposed Demutualization

March 04 2021 - 4:15PM

Business Wire

The Board of Directors of NORCAL Mutual (“NORCAL”) has begun

solicitation of policyholders to vote on NORCAL’s plan to convert

from a mutual company to a stock company and to elect the form of

payment they wish to receive if the conversion occurs.

On February 20, 2020 ProAssurance Corporation (NYSE: PRA) and

the NORCAL Group announced the signing of a definitive agreement

under which NORCAL would become a part of ProAssurance in a $450

million transaction following its demutualization. The

demutualization and the acquisition agreement are mutually

contingent, and are subject to required regulatory and policyholder

approvals.

As part of this process, ProAssurance’s transfer agent

Computershare has mailed documentation and materials to NORCAL’s

eligible policyholders. Further, ProAssurance has begun

solicitation of policyholders who elect to receive NORCAL stock in

the conversion, asking them to respond to our tender offer and

agree to sell those shares to us on the terms of the offer.

Policyholders who elect NORCAL stock and tender it to ProAssurance

will receive their allocated share of the $450 million cash

transaction proceeds and will be eligible for a share of Contingent

Consideration in an amount of up to $150 million depending upon

development of NORCAL’s ultimate net losses between December 31,

2020 and December 31, 2023.

Eligible NORCAL policyholders may visit

https://norcalconversion.com using login credentials provided in

the documents mailed by Computershare, wherein they will be able to

cast their vote on NORCAL’s Plan of Conversion and elect their

desired form of payment.

The general public may visit https://www.norcal-group.com/pra

for copies of documents and more information about the proposed

transaction.

About ProAssurance

ProAssurance Corporation is an industry-leading specialty

insurer with extensive expertise in healthcare professional

liability, products liability for medical technology and life

sciences, legal professional liability, and workers’ compensation

insurance. ProAssurance Group is rated “A” (Excellent) by AM Best;

ProAssurance and its operating subsidiaries are rated “A-” (Strong)

by Fitch Ratings. For the latest on ProAssurance and its

industry-leading suite of products and services, cutting-edge risk

management and practice enhancement programs, follow @ProAssurance

on Twitter or LinkedIn. ProAssurance’s YouTube channel regularly

presents thought provoking, insightful videos that communicate

effective practice management, patient safety and risk management

strategies.

About NORCAL Group

The NORCAL Group of companies provide medical professional

liability insurance, risk management solutions and provider

wellness resources to physicians, healthcare extenders, medical

groups, hospitals, community clinics, and allied healthcare

facilities throughout the country. They share an AM Best “A-”

(Excellent) rating for their financial strength and stability.

NORCAL Group includes NORCAL Mutual Insurance Company and its

affiliated insurance companies.

Transaction Advisors

ProAssurance is being advised in this transaction by Goldman

Sachs & Co., LLC and the law firms of Burr & Forman, LLP

and Sidley Austin, LLP. NORCAL is being advised by Waller Helms

Advisors and the law firms of Mayer Brown, LLP, and McDermott Will

& Emery, LLP.

Caution Regarding Forward-Looking Statements

Statements in this news release that are not historical fact or

that convey our view of future business, events or trends are

specifically identified as forward-looking statements.

Forward-looking statements are based upon our estimates and

anticipation of future events and highlight certain risks and

uncertainties that could cause actual results to vary materially

from our expected results. We expressly claim the safe harbor

provisions of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, for any forward-looking statements in this news release.

Forward-looking statements represent our outlook only as of the

date of this news release. Except as required by law or regulation,

we do not undertake and specifically decline any obligation to

publicly release the result of any revisions that may be made to

any forward-looking statements to reflect events or circumstances

after the date of such statements or to reflect the occurrence of

anticipated or unanticipated events.

There are a number of risk factors that may cause outcomes that

differ from our expectations or projections. These are described in

detail in various documents filed by ProAssurance Corporation with

the Securities and Exchange Commission, such as current reports on

Form 8-K, and regular reports on Forms 10-Q and 10-K, particularly

in “Item 1A, Risk Factors.”

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210304005954/en/

Ken McEwen Manager, Investor Relations 800-282-6242 •

205-439-7903 • KenMcEwen@ProAssurance.com

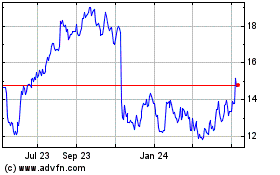

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Jan 2025 to Feb 2025

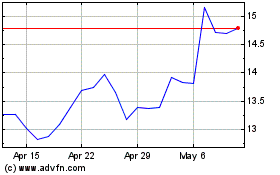

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Feb 2024 to Feb 2025