UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 6)1

Pitney Bowes Inc.

(Name

of Issuer)

Common Stock, $1.00 par value per share

(Title of Class of Securities)

724479100

(CUSIP Number)

KURTIS J. WOLF

HESTIA CAPITAL MANAGEMENT, LLC

175 Brickyard Road, Suite 200

Adams Township, Pennsylvania 16046

(724) 687-7842

With a copy to:

ANDREW FREEDMAN

OLSHAN

FROME WOLOSKY LLP

1325

Avenue of the Americas

New

York, New York 10019

(212)

451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

January 31, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

HESTIA CAPITAL PARTNERS, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

5,572,261 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

5,572,261 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

5,572,261 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

3.2% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

HELIOS I, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

9,540,161 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

9,540,161 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

9,540,161 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

5.4% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

HESTIA CAPITAL PARTNERS GP, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF, OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

15,112,422 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

15,112,422 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

15,112,422 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

8.6% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

HESTIA CAPITAL MANAGEMENT, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF, OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

15,790,922 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

15,790,922 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

15,790,922 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

KURTIS J. WOLF |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF, OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

15,790,922 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

15,790,922 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

15,790,922 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

9.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

The following constitutes

Amendment No. 6 to the Schedule 13D filed by the undersigned (“Amendment No. 6”). This Amendment No. 6 amends the Schedule

13D as specifically set forth herein.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On January 31, 2024, the

Reporting Persons entered into a Cooperation Agreement (the “Cooperation Agreement”) with the Issuer. Pursuant to the Cooperation

Agreement, the Issuer agreed, among other things, (a) to increase the size of the Issuer’s Board of Directors (the “Board”)

from eight to ten directors, (b) to appoint William “Bill” Simon and Jill Sutton (the “New Directors”) to the

Board, effective as of February 1, 2024, (c) to nominate the New Directors for election to the Board at the Issuer’s 2024 annual

meeting of stockholders (the “2024 Annual Meeting”), (d) to not nominate any incumbent director serving on the Board as of

the date of the Cooperation Agreement other than Steve Brill, Sheila Stamps, Darrell Thomas, Katie A. May, Milena Alberti-Perez, Todd

Everett and Kurtis J. Wolf as directors of the Issuer at the 2024 Annual Meeting, and (e) to re-nominate the New Directors and Kurtis

J. Wolf as directors for re-election at the Issuer’s 2025 annual meeting of stockholders.

Pursuant to the Cooperation

Agreement, the Reporting Persons are subject to certain customary standstill restrictions (including with respect to nominating persons

for election to the Board, submitting any proposal for consideration at any stockholder meeting, and soliciting any proxy, consent or

other authority to vote from stockholders) from the date of the Cooperation Agreement until the date that is thirty (30) days prior to

the first day of the advance notice period for the submission by stockholders of director nominations for consideration at the Issuer’s

2026 annual meeting of stockholders (the “2026 Annual Meeting”) (such period, the “Cooperation Period”); provided,

however, that the Cooperation Period shall be extended until the date that is thirty (30) days prior to the first day of the advance notice

period for the submission by stockholders of director nominations for consideration at the Issuer’s 2027 annual meeting of stockholders

if (a) the Board agrees to re-nominate the New Directors for election at the 2026 Annual Meeting, (b) the Board agrees to re-nominate

Mr. Wolf for election at the 2026 Annual Meeting and Mr. Wolf agrees to such re-nomination, and (c) such re-nominations occur no later

than forty (40) days prior to the first day of the advance notice period for submission by stockholders of director nominations at the

2026 Annual Meeting. During the Cooperation Period, the Reporting Persons and the Issuer also agreed to certain mutual non-disparagement

provisions.

During the Cooperation

Period, the Reporting Persons also agreed to vote all of their Shares (a) in favor of the nominees for director recommended by the Board

and (b) in accordance with the Board’s recommendation with respect to any other matter presented to stockholders; provided, however,

that the Reporting Persons shall be permitted to vote in their sole discretion on any proposal of the Issuer in respect of any Extraordinary

Transaction (as defined the Cooperation Agreement) and in accordance with Institutional Shareholder Services, Inc. (“ISS”)

and Glass, Lewis & Co. LLC (“Glass Lewis”) if both ISS and Glass Lewis publish a voting recommendation that differs from

the Board’s recommendation with respect to any proposal (other than proposals related to director elections, removals or replacements,

the authorization of shares, or the issuance of equity in connection with employee compensation) submitted to stockholders during the

Cooperation Period. In addition, during the Cooperation Period, the Reporting Persons also agreed not to acquire beneficial ownership

of or economic exposure to more than 9.9% of the outstanding Shares.

The foregoing description

of the Cooperation Agreement does not purport to be complete and is qualified in its entirety by reference to the Cooperation Agreement,

which is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

On January 31, 2024, the

Reporting Persons and the Issuer entered into the Cooperation Agreement as defined and described in Item 4 above and attached as Exhibit

99.1 hereto.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibit:

| 99.1 | Cooperation Agreement, dated January 31, 2024. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: February 1, 2024

| |

Hestia Capital Partners, LP |

| |

|

| |

By: |

Hestia Capital Management, LLC,

its Investment Manager |

| |

|

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

Helios I, LP |

| |

|

| |

By: |

Hestia Capital Management, LLC,

its Investment Manager |

| |

|

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

Hestia Capital Partners GP, LLC |

| |

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

Hestia Capital Management, LLC |

| |

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

|

|

|

| |

/s/ Kurtis J. Wolf |

| |

Kurtis J. Wolf |

Exhibit 99.1

Execution Version

COOPERATION AGREEMENT

This Cooperation Agreement

(this “Agreement”), dated as of January 31, 2024 is by and between (i) Hestia Capital Partners, LP and each of

the persons set forth on Exhibit A (collectively, “Hestia Capital”) and (ii) Pitney Bowes Inc. (the “Company”).

Unless otherwise defined in this Agreement, capitalized terms shall have the meanings given to them in Section 7. In consideration

of and reliance upon the mutual covenants and agreements contained in this Agreement, and for other good and valuable consideration, the

receipt and sufficiency of which is hereby acknowledged, Hestia Capital and the Company agree as follows:

1.Board

Appointment and Nomination and Other Company Matters.

(a)The

Company agrees that, immediately following the execution of this Agreement, the Board of Directors of the Company (the “Board”)

and all applicable committees thereof (i) will take all necessary actions to increase the size of the Board from eight (8) to ten (10)

directors, and (ii) will, following its review of William “Bill” Simon and Jill Sutton (each a “New Director”

and together, the “New Directors”) in accordance with the Board’s internal procedures for the review of director

candidates, take all actions necessary to appoint each New Director as a Company director, effective as of February 1, 2024, with a term

expiring at the Company’s 2024 annual meeting of stockholders (the “2024 Annual Meeting”); provided, however,

that as a condition to such appointment of each New Director, each New Director will have fully completed and executed the Company’s

director candidate questionnaire (substantially in the form completed by the Company’s incumbent non-management directors), and

agreed to comply with all policies, procedures, codes, rules, standards, guidelines and confidentiality obligations applicable to all

of the Company’s directors (or any applicable subset thereof), to provide the information regarding himself or herself that is required

to be disclosed for candidates for directors and directors in a proxy statement and other periodic reports under the federal securities

laws of the United States of America and/or applicable New York Stock Exchange (“NYSE”) rules and regulations.

(b)The

Company agrees that:

(i)at

the 2024 Annual Meeting, the Board will nominate each New Director for election as a director of the Company (subject only to the approval

of each New Director to such nomination), together with, and for the same term as, the other persons included in the Company’s slate

of nominees for election as directors of the Company at the 2024 Annual Meeting in accordance with this Section 1(b);

(ii)the

Board will neither nominate nor recommend that the stockholders of the Company vote to elect any incumbent directors serving on the Board

as of the date of this Agreement other than Steve Brill, Sheila Stamps, Darrell Thomas, Katie A. May, Milena Alberti-Perez, Todd Everett,

and Kurtis J. Wolf as directors of the Company at the 2024 Annual Meeting;

(iii)the

Company will use its reasonable best efforts (which will include recommending stockholders vote for the New Directors and soliciting proxies

in support of the election of the New Directors) to obtain the election of the New Directors at the 2024 Annual Meeting in a manner no

less rigorous than the efforts used by the Company to obtain the election of any other independent director (as determined under the listing

rules of NYSE) nominee nominated by the Board to serve as a director on the Board at the 2024 Annual Meeting;

(iv)the

New Directors shall receive (A) the same benefits of director and officer insurance, and any indemnity and exculpation arrangements

available generally to the non-management directors on the Board, (B) compensation for his or her service as a director on the same

basis as the compensation received by other non-management directors on the Board, and (C) such other benefits on the same basis

as all other non-management directors on the Board; and

(v)at

the Company’s 2025 annual meeting of stockholders (the “2025 Annual Meeting”), the Board will re-nominate each

New Director and Mr. Wolf for election as a director of the Company (subject only to the approval of each New Director and Mr. Wolf to

such re-nomination), together with, and for the same term as, the other persons included in the Company’s slate of nominees for

election as directors of the Company at the 2025 Annual Meeting, and the Company will use its reasonable best efforts (which will include

recommending stockholders vote for the New Directors and Mr. Wolf, and soliciting proxies in support of the election of New Directors

and Mr. Wolf) to obtain the election of the New Directors and Mr. Wolf at the 2025 Annual Meeting in a manner no less rigorous than the

efforts used by the Company to obtain the election of any other independent director (as determined under the listing rules of NYSE) nominee

nominated by the Board to serve as a director on the Board at the 2025 Annual Meeting.

(c)If

any New Director is not appointed to the Board pursuant to Section 1(a) or following any appointment pursuant to Section 1(a)

is unable or unwilling to serve as a director and ceases to be a director, resigns as a director, is removed as a director, or for any

other reason fails to serve or is not serving as a director at any time prior to the expiration of the Cooperation Period (as defined

below, and such failure to be appointed to, or serve on, the Board, a “Director Absence”), then Hestia Capital shall

be entitled to propose, in consultation with the Company and as approved by the Board (such approval not to be unreasonably withheld,

conditioned or delayed), a substitute director candidate who has been interviewed, assessed, investigated and recommended by a nationally

recognized independent recruiting firm selected by Hestia Capital and who (i) qualifies as “independent” pursuant to NYSE

listing standards, (ii) has the relevant financial and business experience to be a director of the Company, and (iii) is independent of

Hestia Capital (for the avoidance of doubt, the nomination by Hestia Capital of such person to serve on the board of any other company

shall not, in and of itself, cause such person to fail to be deemed independent of Hestia Capital) (such substitute director candidate,

a “Replacement Director”), and the Board and all applicable committees thereof shall take such actions necessary to

appoint the Replacement Director to serve as a director of the Company; provided; however, that if at any such time of a

Director Absence Hestia Capital fails to beneficially own (as determined under Rule 13d-3 promulgated under the Exchange Act (as defined

below)) in the aggregate at least the Hestia Capital Minimum Ownership Amount, then any decision to replace such New Director, and any

process related to any such replacement, will be made by the Board in its sole discretion. Subject to NYSE rules and applicable law, upon

a Replacement Director’s appointment to the Board, the Board and all applicable committees of the Board shall take all necessary

actions to appoint such Replacement Director to any applicable committee of the Board of which the replaced director was a member immediately

prior to such director’s resignation or removal. Any Replacement Director designated pursuant to this Section 1(c) replacing

a New Director prior to the mailing of the Company’s definitive proxy statement for the 2024 Annual Meeting shall stand for election

at the 2024 Annual Meeting together with the other director nominees. Upon a Replacement Director’s appointment to the Board, such

Replacement Director shall be deemed to be a New Director for all purposes under this Agreement.

2.Cooperation.

(a)Hestia

Capital agrees that, during the Cooperation Period, neither it nor any of its agents, subsidiaries, Affiliates, Associates, successors,

assigns, officers, key employees or directors will encourage any other person to, in any way publicly criticize, disparage, call into

disrepute or otherwise defame or slander the Company or the Company’s subsidiaries, Affiliates, Associates, successors, assigns,

current or former officers, current or former directors, current or former employees, stockholders, agents or representatives or any of

the Company’s businesses, products or services, including, without limitation: (i) in any document or report filed with or

furnished to the Securities and Exchange Commission (the “SEC”) or any other governmental agency, (ii) in any

press release or other publicly available format or (iii) to any journalist or member of the media (including, without limitation,

in a television, radio, newspaper or magazine interview). Notwithstanding the foregoing, nothing in this Section 2(a) or elsewhere

in this Agreement shall prohibit Hestia Capital from making any statement or disclosure required under the federal securities laws or

other applicable laws (including, without limitation, to comply with any subpoena or other legal process from any governmental or regulatory

authority with competent jurisdiction over Hestia Capital) or stock exchange regulations, or from responding to any public statements

made by the Company of the nature described in this Section 2(a), if such statement by the Company was made in breach of this Agreement.

(b)The

Company agrees that, during the Cooperation Period, neither it nor any of its agents, subsidiaries, Affiliates, Associates, successors,

assigns, officers, key employees or directors will, or will knowingly encourage any other person to, in any way publicly criticize, disparage,

call into disrepute or otherwise defame or slander Hestia Capital or any of Hestia Capital’s subsidiaries, Affiliates, Associates,

successors, assigns, current or former officers, current or former directors, current or former employees, stockholders, agents or representatives,

or any of Hestia Capital’s businesses, products or services, including, without limitation: (i) in any document or report filed

with or furnished to the SEC or any other governmental agency, (ii) in any press release or other publicly available format or (iii) to

any journalist or member of the media (including, without limitation, in a television, radio, newspaper or magazine interview). Notwithstanding

the foregoing, nothing in this Section 2(b) or elsewhere in this Agreement shall prohibit the Company from making any statement

or disclosure required under the federal securities laws or other applicable laws (including, without limitation, to comply with any subpoena

or other legal process from any governmental or regulatory authority with competent jurisdiction over the Company) or stock exchange regulations,

or from responding to any public statements made by Hestia Capital of the nature described in this Section 2(b), if such statement

by Hestia Capital was made in breach of this Agreement.

(c)During

the Cooperation Period, Hestia Capital will cause all shares of common stock, par value $1 per share, of the Company (the “Company

Common Stock”) beneficially owned, directly or indirectly, by it, or by any of its controlled Affiliates or Associates, or any

other securities of the Company for which Hestia Capital, or any of its controlled Affiliates or Associates, has the right to vote, directly

or indirectly, to be present in person or by proxy for quorum purposes and to be voted at any meeting of stockholders or at any adjournments

or postponements thereof, whether such meeting is held at a physical location or virtually by means of remote communications, and to consent

in connection with any action by consent in lieu of a meeting, in each case in accordance with the Board’s recommendations with

respect to (i) the election, removal or replacement of any director and (ii) any other proposal to be submitted to the stockholders of

the Company by either the Company or any stockholder of the Company; provided, however, that Hestia Capital shall be permitted

to vote in its sole discretion on any proposal of the Company in respect of any Extraordinary Transaction; provided, further,

that in the event Institutional Shareholder Services, Inc. (“ISS”) and Glass, Lewis & Co. LLC (“Glass

Lewis”) publish a voting recommendation that differs from the Board’s recommendation with respect to any proposal (other

than proposals related to director elections, removals or replacements, the authorization of shares, or the issuance of equity in connection

with employee compensation) submitted to stockholders during the Cooperation Period, Hestia Capital and its controlled Affiliates and

Associates will be permitted to vote, or, if applicable, deliver consents or consent revocations with respect to, any shares beneficially

owned by Hestia Capital or its controlled Affiliates and Associates in accordance with such ISS and Glass Lewis recommendation.

(d)During

the Cooperation Period, except as otherwise provided in this Agreement, Hestia Capital will not, and it will cause its respective controlled

Affiliates and Associates to not, directly or indirectly, without the prior written consent of the Company:

(i)acquire,

seek or propose (publicly or otherwise) or agree to acquire (except by way of equity grants received as directors of the Company, stock

dividends or other distributions or offerings made available to holders of Company Common Stock generally on a pro rata basis or pursuant

to an Extraordinary Transaction), beneficial ownership, directly or indirectly and acting alone or in concert, whether by purchase, tender

or exchange offer, through the acquisition of control of another person, by joining a partnership, limited partnership, syndicate or other

group, or through swap or hedging transactions or otherwise, any securities of the Company, any rights decoupled from the underlying securities

of the Company, or any derivative securities, contracts or instruments in any way related to the price of shares of Company Common Stock

that would result in Hestia Capital (collectively with its controlled Affiliates and Associates) owning, controlling or otherwise having

any beneficial ownership interest in or aggregate economic exposure to more than 9.9% of the shares of Company Common Stock outstanding

at such time, including, without limitation, through the exercise of, or acquisition of, derivative securities;

(ii)seek

or propose (publicly or otherwise) to influence or control the management or policies of the Company (it being understood that Mr. Wolf’s

actions or service as a director of the Company shall not be deemed to be actions by Hestia Capital or its controlled Affiliates and Associates

seeking or proposing to influence or control the management or policies of the Company);

(iii)(A) request

(publicly or otherwise) a special meeting of the Company’s stockholders, (B) submit, participate in or be the proponent of,

any stockholder proposal to the Company, (C) seek representation on, or nominate any candidate to, the Board, or (D) seek (including,

without limitation, pursuing or encouraging any “withhold” or similar campaign) the removal of any member of the Board;

(iv)make

a request for any stockholder list or other Company books and records;

(v)make,

engage in, or in any way knowingly participate in, directly or indirectly, any “solicitation” of proxies (as such terms are

used in the proxy rules of the SEC, including, without limitation, engagement by use of or in coordination with a universal proxy card,

but without regard to the exclusion set forth in Rule 14A-1(1)(2)(iv) of the Exchange Act) or consents to vote, or seek to advise,

encourage or influence any person with respect to the voting of any securities of the Company or any securities convertible or exchangeable

into or exercisable for any such securities for the election of individuals to the Board or to approve stockholder proposals, or become

a “participant” in any contested “solicitation” for the election of directors with respect to the Company (as

such terms are defined or used under the Exchange Act) (other than a “solicitation” or acting as a “participant”

in support of all of the nominees of the Board at any stockholder meeting);

(vi)submit

(publicly or otherwise) a proposal or request for, offer of (with or without conditions), or knowingly take any action in support of a

proposal or request for, or offer of, any tender offer, exchange offer, merger, amalgamation, acquisition, recapitalization, consolidation,

sale or acquisition of material assets, liquidation, dissolution or other extraordinary transaction involving the Company or any of its

subsidiaries or joint ventures or any of their respective securities, any material change in the capitalization, stock repurchase programs

and practices, capital allocation programs and practices or dividend policy of the Company, any other material change in the Company’s

business or corporate structure, any modifications to the Company’s Restated Certificate of Incorporation (as may be amended, corrected,

or amended and restated from time to time) or the Company’s Amended and Restated By-laws (as may be amended, corrected, or amended

and restated from time to time), the delisting of a class of securities of the Company from any stock exchange or any action that would

result in a class of securities of the Company to become eligible for termination of registration pursuant to Section 12(g)(4) of

the Exchange Act, or take any action which would, or would reasonably be expected to, require public disclosure regarding any of the types

of matters set forth in this clause (vi);

(vii)knowingly

encourage, assist or enter into any discussions, negotiations, arrangements or understandings with any person not a party to this Agreement

(a “Third Party”) with respect to any of the foregoing, or otherwise form, join, or knowingly encourage, influence,

advise or in any way participate in any “group” (as such term is defined in Section 13(d)(3) of the Exchange Act) with

any person not a party to this Agreement (other than controlled Affiliates or Associates, so long as any such controlled Affiliate or

Associate agrees to be subject to, and bound by, the terms and conditions of this Agreement and, if required under the Exchange Act, files

a Schedule 13D or an amendment thereof, as applicable, within two (2) business days after disclosing that Hestia Capital has formed a

group with such controlled Affiliate or Associate) with respect to any securities of the Company or otherwise in any manner agree, attempt,

seek or propose to deposit any securities of the Company in any voting trust or similar arrangement, or subject any securities of the

Company to any agreement or arrangement with respect to the voting thereof (including, without limitation, by granting any proxy, consent

or other authority to vote), except as expressly set forth in this Agreement;

(viii)sell,

assign, or otherwise transfer or dispose of shares of Company Common Stock, or any rights decoupled from such shares, beneficially owned

by them, to any Third Party that, to Hestia Capital’s knowledge (after due inquiry, it being understood that such knowledge shall

be deemed to exist with respect to any publicly available information, including, but not limited to, information in documents filed with

the SEC), would result in such Third Party, together with its Affiliates and Associates, owning, controlling or otherwise having any beneficial

or other ownership interest of, in the aggregate, more than 4.9% of the shares of Company Common Stock outstanding at such time or would

increase the beneficial ownership interest of any Third Party who, collectively with its Affiliates and Associates, has a beneficial or

other ownership interest of, in the aggregate, more than 4.9% of the shares of Company Common Stock outstanding at such time, except for

Schedule 13G filers that are mutual funds, pension funds, index funds or investment fund managers with no known history of activism or

known plans to engage in activism;

(ix)make

any public disclosure, announcement or statement regarding any intent, purpose, plan or proposal with respect to the Board, the Company,

its management, policies, strategy, operations, financial results or affairs or any of its securities or assets or this Agreement that

is inconsistent with the provisions of this Agreement;

(x)institute,

solicit, knowingly encourage, assist or join, as a party, any litigation, arbitration or other proceedings against or involving the Company

or any of its current or former directors or officers (including, without limitation, derivative or class actions), other than (A) an

action to enforce the provisions of this Agreement instituted in accordance with and subject to Section 9, (B) making

counterclaims with respect to any proceeding initiated by, or on behalf of, the Company against Hestia Capital, or (C) responding

to or complying with a validly issued legal process that neither Hestia Capital nor any of its Affiliates initiated, encouraged or facilitated;

(xi)enter

into any discussions, negotiations, understandings or agreements (whether written or oral) with, or advise, finance, assist, seek to persuade

or knowingly encourage, any Third Party to take any action or make any statement with respect to any of the foregoing, or advise, assist,

knowingly encourage or seek to persuade any Third Party to take any action or make any statement with respect to any of the foregoing,

or otherwise take or cause any action or make any statement inconsistent with any of the foregoing; or

(xii)take

any action that could reasonably be expected to force the Company to make a public disclosure with respect to any of the foregoing.

(e)Hestia

Capital also agrees not to, and to cause its controlled Affiliates and Associates not to, request during the Cooperation Period that the

Company (or its directors, officers, employees or agents), directly or indirectly, amend or waive any provision of this Section 2

(including, without limitation, this sentence), publicly or in a manner that is intended to or would reasonably be expected to require

public disclosure of such request.

(f)The

Company and Hestia Capital hereby covenant not to assert, commence or maintain or assist any Third Party in asserting, commencing or maintaining

any claim, action or proceeding before any court, agency or other governmental authority (including, without limitation, the SEC) alleging

that any public filings, communications or soliciting materials made or delivered by the Company or Hestia Capital or their respective

Affiliates prior to the execution of this Agreement violates Rule 14a-9 under the Exchange Act, or contains any statement which,

at the time and in light of the circumstances under which it was made, was false or misleading with respect to a material fact, or omits

to state a material fact necessary to make the statements contained therein not false or misleading.

(g)Notwithstanding

anything set forth in this Agreement to the contrary, nothing in this Agreement shall prohibit or restrict Hestia Capital from (i) providing

its views privately to the Board or management on any matter or to privately request a waiver of any provision of this Agreement, provided

that such actions are not intended to and would not reasonably be expected to require public disclosure of such actions, (ii) taking

any action to the extent reasonably necessary to comply with any law, rule or regulation or any action required by any governmental or

regulatory authority or stock exchange that has jurisdiction over Hestia Capital or any of its Affiliates or Associates or (iii) privately

communicating to any of Hestia Capital’s potential investors or investors publicly available factual information regarding the Company

consistent with prior practice in Hestia Capital’s annual and quarterly investor letters.

(h)Nothing

in this Agreement shall limit in any respect the actions of any director of the Company in his or her capacity as such, recognizing that

such actions are subject to such director’s fiduciary duties to the Company and its stockholders (it being understood and agreed

that neither Hestia Capital nor any of its controlled Affiliates shall seek to do indirectly through any director or other party anything

that would be prohibited if done by Hestia Capital or its controlled Affiliates). Nothing in this Agreement shall prevent Hestia Capital

from freely voting its shares of Company Common Stock (except as otherwise provided in Section 2 hereto) or taking any actions

as specifically contemplated in this Agreement.

3.Public

Announcement.

(a)The

Company will announce this Agreement and the material terms hereof by means of a press release in substantially the form attached to this

Agreement as Exhibit B (the “Press Release”) promptly following the date of this Agreement.

(b)None

of Hestia Capital, or any of its respective controlled Affiliates or Associates will issue a press release or make or cause to be made

any other public statement or announcement in connection with this Agreement or the actions contemplated hereby, other than as mutually

agreed by the Company and Hestia Capital, except as set forth in Section 3(d) or as required by law or the rules of any stock exchange.

(c)The

Company shall file with the SEC a Current Report on Form 8-K reporting its entry into this Agreement and appending this Agreement and

the Press Release as exhibits thereto (the “Form 8-K”). The Form 8-K shall be consistent with the terms of this Agreement.

The Company shall provide Hestia Capital with a reasonable opportunity to review and comment on the Form 8-K prior to the filing with

the SEC and consider in good faith any such comments of Hestia Capital.

(d)No

later than two (2) business days following the date of this Agreement, Hestia Capital shall file with the SEC an amendment to that certain

Schedule 13D, in compliance with Section 13 of the Exchange Act, to report its entry into this Agreement (the “Hestia Capital

Schedule 13D Amendment”). The disclosures in the Hestia Capital 13D Amendment relating to this Agreement shall be consistent

with the terms of this Agreement. Hestia Capital shall provide the Company with a reasonable opportunity to review and comment on the

Hestia Capital Schedule 13D Amendment prior to it being filed with the SEC and consider in good faith any such comments of the Company.

4.Representations

and Warranties of the Company. The Company represents and warrants to Hestia Capital as follows: (a) the Company has the

power and authority to execute, deliver and carry out the terms and provisions of this Agreement and to consummate the transactions contemplated

by this Agreement, (b) this Agreement has been duly and validly authorized, executed and delivered by the Company, constitutes a

valid and binding obligation and agreement of the Company and is enforceable against the Company in accordance with its terms, except

as enforcement of this Agreement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance

or similar laws generally affecting the right of creditors and subject to general equity principles, and (c) the execution, delivery and

performance of this Agreement by the Company does not and will not (i) require the approval of the stockholders of the Company, (ii) violate

or conflict with any law, rule, regulation, order, judgment or decree applicable to the Company, or (iii) result in any breach or violation

of or constitute a default (or an event which with notice or lapse of time or both would constitute such a breach, violation or default)

under or pursuant to, or result in the loss of a material benefit under, or give any right of termination, amendment, acceleration or

cancellation of, any organizational document or material agreement to which the Company is a party or by which it is bound.

5.Representations

and Warranties of Hestia Capital. Hestia Capital represents and warrants to the Company as follows: (a) each member of

Hestia Capital has the power and authority to execute, deliver and carry out the terms and provisions of this Agreement and to consummate

the transactions contemplated by this Agreement, (b) this Agreement has been duly and validly authorized, executed and delivered

by each member of Hestia Capital, constitutes a valid and binding obligation and agreement of each member of Hestia Capital and is enforceable

against each member of Hestia Capital in accordance with its terms, except as enforcement of this Agreement may be limited by applicable

bankruptcy, insolvency, reorganization, moratorium, fraudulent conveyance or similar laws generally affecting the right of creditors and

subject to general equity principles, (c) as of the date of this Agreement, Hestia Capital beneficially owns 15,790,922 shares of

the Company Common Stock in the aggregate which represents approximately 9.0% of the issued and outstanding shares of the Company Common

Stock reported by the Company in its Quarterly Report on Form 10-Q, dated as of November 2, 2023, (d) Hestia Capital is not

and will not become party to any agreement, arrangement or understanding (whether written or oral) with any New Director with respect

to such person’s service as a director on the Board, and (e) the execution, delivery and performance of this Agreement by Hestia

Capital does not and will not (i) violate or conflict with any law, rule, regulation, order, judgment or decree applicable to Hestia Capital,

or (ii) result in any breach or violation of or constitute a default (or an event which with notice or lapse of time or both would constitute

such a breach, violation or default) under or pursuant to, or result in the loss of a material benefit under, or give any right of termination,

amendment, acceleration or cancellation of, any organizational document, agreement, contract, commitment, understanding or arrangement

to which such member is a party or by which it is bound.

6.No

Other Discussions or Arrangements. Hestia Capital represents and warrants that, as of the date of this Agreement, except as publicly

disclosed in its SEC filings, in this Agreement, or otherwise specifically disclosed to the Company in writing prior to the date of this

Agreement, (a) Hestia Capital does not own, of record or beneficially, any Company Common Stock or any securities convertible into,

or exchangeable or exercisable for, any Company Common Stock and (b) Hestia Capital has not entered into, directly or indirectly,

any agreements or understandings with any person with respect to any potential transaction involving the Company or the voting or disposition

of any securities of the Company.

7.Definitions.

For purposes of this Agreement:

(a)the

terms “Affiliate” and “Associate” have the respective meanings set forth in Rule 12b-2 promulgated by the

SEC under the Securities Exchange Act of 1934, as amended, and with the rules and regulations thereunder (the “Exchange Act”);

(b)the

terms “beneficial owner” and “beneficially own” have the same meanings as set forth in Rule 13d-3 promulgated

by the SEC under the Exchange Act;

(c)“Change

of Control” shall be deemed to have taken place if (i) any person is or becomes a beneficial owner, directly or indirectly,

of securities of the Company representing more than fifty percent (50%) of the equity interests and voting power of the Company’s

then-outstanding equity securities or (ii) the Company enters into a stock-for-stock transaction whereby immediately after the consummation

of the transaction the Company’s stockholders retain, directly or indirectly, less than fifty percent (50%) of the equity interests

and voting power of the surviving entity’s then-outstanding equity securities;

(d)“Extraordinary

Transaction” means any equity tender offer, equity exchange offer, merger, acquisition, joint venture, business combination, financing,

recapitalization, reorganization, restructuring, disposition, distribution, or other transaction with a Third Party that, in each case,

would result in a Change of Control of the Company, liquidation, dissolution or other extraordinary transaction involving a majority of

its equity securities or a majority of its assets (determined on a consolidated basis), and, for the avoidance of doubt, including, without

limitation, any such transaction with a Third Party that is submitted for a vote of the Company’s stockholders; and

(e)“Hestia

Capital Minimum Ownership Amount” means the lesser of (i) 5.0% of the then outstanding shares of Company Common Stock and (ii) 8,816,562

shares of Company Common Stock (subject to adjustment for stock splits, reclassifications, combinations and similar adjustments).

(f)The

terms “person” or “persons” mean any individual, corporation (including, without limitation, not-for-profit),

general or limited partnership, limited liability or unlimited liability company, joint venture, estate, trust, association, organization

or other entity of any kind, structure or nature.

8.Notices.

All notices, consents, requests, instructions, approvals and other communications provided for in this Agreement and all legal process

in regard to this Agreement will be in writing and will be deemed validly given, made or served, if (a) given by email, when such

email is sent to the email address set forth below and the appropriate confirmation of transmission is received or (b) if given by

any other means, when actually received during normal business hours at the address specified in this Section 8 (or to such other

address that may be designated by a party from time to time in accordance with this Section 8):

if to the Company:

Pitney Bowes Inc.

3001 Summer Street

Stamford, CT 06926

| Attention: | Executive Vice President, Chief Legal Officer and Corporate Secretary |

with a copy (which shall not constitute

notice) to:

Vinson & Elkins L.L.P.

1114 Avenue of the Americas, 32nd

Floor

New York, NY 10103

| Attention: | Lawrence S. Elbaum

C. Patrick Gadson |

if to Hestia Capital:

Hestia Capital Partners, LP

175 Brickyard Road, Suite 200

Adams Township, PA 16046

| Attention: | Kurtis J. Wolf (kwolf@hestiacapital.com) |

with a copy (which shall not constitute

notice) to:

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, NY 10019

| Attention: | Andrew Freedman

Ian Engoron |

9.Specific

Performance; Remedies.

(a)The

Company and Hestia Capital acknowledge and agree that irreparable injury to the other parties hereto would occur in the event any of the

provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached and that such injury

would not be adequately compensable by the remedies available at law (including, without limitation, the payment of money damages). It

is accordingly agreed that, in furtherance and not in limitation of Section 9(b), the Company and Hestia Capital will be entitled

to seek an injunction or injunctions to prevent breaches of this Agreement and to enforce specifically the terms and provisions of this

Agreement, in addition to any other remedy to which they are entitled at law or in equity. FURTHERMORE, EACH OF THE COMPANY AND HESTIA

CAPITAL (i) IRREVOCABLY WAIVES THE RIGHT TO TRIAL BY JURY AND (ii) AGREES TO WAIVE ANY BONDING REQUIREMENT UNDER ANY APPLICABLE

LAW, IN THE CASE ANY OTHER PARTY SEEKS TO ENFORCE THE TERMS BY WAY OF EQUITABLE RELIEF. THIS AGREEMENT WILL BE GOVERNED IN ALL RESPECTS,

INCLUDING, WITHOUT LIMITATION, VALIDITY, INTERPRETATION AND EFFECT, BY THE LAWS OF THE STATE OF DELAWARE WITHOUT GIVING EFFECT TO THE

CHOICE OF LAW PRINCIPLES OF SUCH STATE.

(b)Notwithstanding

any other Section in this Agreement and without limiting any other remedies the Company may have in law or equity, in the event that Hestia

Capital (or any controlled Affiliate or Associate of Hestia Capital) fails to perform or otherwise fulfill its obligations set forth in

Section 2 in any material respect, and has not remedied such failure or non-fulfillment if capable of being remedied or fulfilled

within five (5) business days following written notice from the Company of such failure or nonfulfillment, the Company will not be required

to perform or fulfill its obligations set forth in Section 1 or Section 2.

10.Severability.

If at any time subsequent to the date hereof, any provision of this Agreement is held by any court of competent jurisdiction to be illegal,

void or unenforceable, such provision will be of no force and effect, but the illegality or unenforceability of such provision will have

no effect upon the legality or enforceability of any other provision of this Agreement.

11.Term;

Termination. The term of this Agreement will commence on the date of this Agreement and shall continue until the date that

is thirty (30) days prior to the first day of the advance notice period for the submission by stockholders of director nominations for

consideration at the Company’s 2026 annual meeting of stockholders (the “2026 Annual Meeting”) (such period,

the “Cooperation Period”); provided, however, that the Cooperation Period shall be extended until the

date that is thirty (30) days prior to the first day of the advance notice period for the submission by stockholders of director nominations

for consideration at the Company’s 2027 annual meeting of stockholders if (a) the Board agrees to re-nominate the New Directors

for election at the 2026 Annual Meeting, (b) the Board agrees to re-nominate Mr. Wolf for election at the 2026 Annual Meeting and Mr.

Wolf agrees to such re-nomination, and (c) such re-nominations occur no later than forty (40) days prior to the first day of the advance

notice period for submission by stockholders of director nominations at the 2026 Annual Meeting; provided, further, that

either party may terminate this Agreement if the other party commits a material breach of its obligations under this Agreement (that if

capable of being cured) is not cured within five (5) business days after the non-breaching party’s receipt of written notice specifying

the material breach from the breaching party or, if impossible to cure within five (5) business days, which the breaching party has not

taken any substantive action to cure within such five (5) business day period. Notwithstanding the foregoing, the provisions of Section

11 through Section 16 shall survive the termination of this Agreement. Termination of this Agreement shall not relieve any

party from its responsibilities in respect of any breach of this Agreement prior to such termination.

12.Counterparts.

This Agreement may be executed in one or more counterparts and by scanned computer image (such as pdf), each of which will be deemed to

be an original copy of this Agreement, but all of which together shall be deemed to be one and the same agreement.

13.No

Third Party Beneficiaries. This Agreement is solely for the benefit of the Company and Hestia Capital and their respective

permitted assignees and is not enforceable by any other persons. No party to this Agreement may assign its rights or delegate its obligations

under this Agreement, whether by operation of law or otherwise, and any assignment in contravention hereof will be null and void; provided,

that each party may assign any of its rights and delegate any of its obligations hereunder to any person that acquires substantially all

of that party’s assets, whether by stock sale, merger, asset sale or otherwise.

14.No

Waiver. No failure or delay by either party in exercising any right or remedy hereunder will operate as a waiver thereof, nor

will any single or partial waiver thereof preclude any other or further exercise thereof or the exercise of any other right or remedy

hereunder.

15.Entire

Understanding. This Agreement contains the entire understanding of the parties with respect to the subject matter hereof and

supersedes any and all prior and contemporaneous agreements, memoranda, arrangements and understandings, both written and oral, between

the parties, or any of them, with respect to the subject matter of this Agreement. This Agreement may be amended only by an agreement

in writing executed by the Company and Hestia Capital.

16.Interpretation

and Construction. Each of the Company and Hestia Capital acknowledges that it has been represented by counsel of its choice

throughout all negotiations that have preceded the execution of this Agreement, and that it has executed the same with the advice of

said counsel. Each party and its counsel cooperated and participated in the drafting and preparation of this Agreement and the documents

referred to in this Agreement, and any and all drafts relating thereto exchanged among the parties will be deemed the work product of

all of the parties and may not be construed against any party by reason of its drafting or preparation. Accordingly, any rule of law

or any legal decision that would require interpretation of any ambiguities in this Agreement against any party that drafted or prepared

it is of no application and is hereby expressly waived by each of the Company and Hestia Capital, and any controversy over interpretations

of this Agreement will be decided without regard to events of drafting or preparation. In this Agreement, unless a clear contrary intention

appears, (a) the word “including” (in its various forms) means “including, without limitation;” (b) the words

“hereunder,” “hereof,” “herein,” “hereto” and words of similar import are references

in this Agreement as a whole and not to any particular provision of this Agreement; (c) the word “or” is not exclusive; (d)

references to “Sections” in this Agreement are references to Sections of this Agreement unless otherwise indicated; and (e)

whenever the context requires, the masculine gender shall include the feminine and neuter genders.

[Signature page follows]

IN WITNESS WHEREOF,

this Agreement has been duly executed and delivered by the duly authorized signatories of the parties as of the date hereof.

| |

PITNEY BOWES INC. |

| |

|

| |

By: |

/s/ Jason C. Dies |

| |

|

Name: |

Jason C. Dies |

| |

|

Title: |

Interim Chief Executive Officer |

| |

HESTIA CAPITAL PARTNERS, LP |

| |

|

| |

By: |

Hestia Capital Management, LLC,

its Investment Manager |

| |

|

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

HELIOS I, LP |

| |

|

| |

By: |

Hestia Capital Management, LLC,

its Investment Manager |

| |

|

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

HESTIA CAPITAL PARTNERS GP, LLC |

| |

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

HESTIA CAPITAL MANAGEMENT, LLC |

| |

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

KURTIS J. WOLF |

| |

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

[Signature Page to Cooperation Agreement]

Exhibit A

Hestia Capital Affiliates

1. Helios I, LP

2. Hestia Capital Partners GP, LLC

3. Hestia Capital Management, LLC

4. Kurtis J. Wolf

Exhibit B

Form of Press Release

[Attached]

Pitney Bowes Announces Continued Refreshment of its

Board of Directors

Chair Mary J. Guilfoile, Who Has Served With Distinction,

to Step Down Following the 2024 Annual Meeting

William S. Simon and Jill Sutton, Who Collectively

Possess Experience in Capital Allocation, Corporate Governance and Transformations, Have Been Added to the Board

STAMFORD, Conn., January 31, 2024 - Pitney Bowes Inc.

(NYSE: PBI) (“Pitney Bowes” or the “Company”), a global shipping and mailing company that provides technology,

logistics and financial services, today announced that Mary J. Guilfoile will step down as Chair and retire from the Board of Directors

(the “Board”) following the 2024 Annual Meeting of Stockholders (the “Annual Meeting”). The Board will elect a

new Chair following Ms. Guilfoile’s retirement. Additionally, the Company announced the addition of two highly qualified and independent

members – William S. Simon and Jill Sutton – to its Board, effective February 1, 2024. Mr. Simon and Ms. Sutton were selected

following a process that was supported by an independent, nationally-recognized search firm.

The Company’s slate of director candidates for

this year’s Annual Meeting is expected to include the following individuals:

Once the Company appoints its next permanent Chief

Executive Officer, that individual is expected to be added to the Board and become its tenth member.

Ms. Guilfoile, Chair of the Board, commented:

“It has been a privilege to lead the Board of

Pitney Bowes, a storied business with a more than 100-year history of change and innovation. The past year has been a particularly transformative

one in terms of adding several new directors, initiating a leadership transition and laying a foundation for enhanced value creation.

I have enjoyed working with our interim Chief Executive Officer, Jason Dies, who has been establishing a results-driven culture and taking

decisive steps to position the organization for long-term success. I look forward to working with management and the rest of the Board,

including our newest members, to build on this momentum between now and the Annual Meeting. I also want to take this opportunity to thank

the Company’s employees, customers, partners and investors for their confidence and trust during my time with Pitney Bowes.”

Ms. May, Chair of the Nominating and Governance Committee,

added:

“On behalf of all my fellow directors, I want

to thank Mary for her invaluable leadership during an important period for Pitney Bowes. She has overseen governance enhancements and

strategic actions that we expect will put the Company on stronger footing for years to come. Our entire Board also welcomes Bill and Jill,

who collectively bring significant experience in areas such as capital allocation, corporate governance and transformations.”

In conjunction with today’s announcement, the

Company has also entered into a cooperation agreement with Hestia Capital Management, LLC (collectively with its affiliates, “Hestia

Capital”).

Mr. Wolf, a member of the Board and the Founder and

Chief Investment Officer of Hestia Capital, concluded:

“I am pleased to have reached an agreement with

Pitney Bowes to solidify Hestia Capital’s long-term support for the Company’s Board and strategic direction. I also want to

thank Mary for her many contributions as Chair. Looking ahead, I am confident that this Board will deliver meaningful value-enhancing

results for shareholders, whom we represent, as well as for all of our other stakeholders.”

Additional information related to today’s announcements

and the agreement with Hestia can be found on a Form 8-K filed with the U.S. Securities and Exchange Commission.

New Director Biographies

William S. Simon

Mr. Simon is an experienced public company director

and former executive, with skills and perspectives that will be additive to Pitney Bowes’ Board. In addition to currently serving

as a director of Darden Restaurants, Inc. (NYSE: DRI) and Chairman of Hanesbrands Inc. (NYSE: HBI), Mr. Simon is an executive advisor

to the KKR & Co. investment firm and President of WSS Venture Holdings, LLC, a consulting and investment company. From 2010 to 2014,

Mr. Simon served as President and CEO of Walmart U.S. (NYSE: WMT). Before that, he was Chief Operating Officer of Walmart U.S. He joined

the company in 2006 as Executive Vice President of Professional Services and New Business Development. Prior to Walmart, Mr. Simon held

senior executive positions at Brinker International Inc. (NYSE: EAT), Diageo North America Inc. (NYSE: DEO) and Cadbury Schweppes plc.

Mr. Simon was also Secretary of the Florida Department of Management Services and served 25 years in the U.S. Navy and Naval Reserves.

He was previously a director of GameStop Corp. (NYSE: GME).

Jill Sutton

Ms. Sutton is a public company director

and former executive with extensive experience that will be additive to Pitney Bowes’ Board. Ms. Sutton served as Chief Legal Officer,

General Counsel and Corporate Secretary at United Natural Foods, Inc. (NYSE: UNFI) for over three years, where she developed the company’s

shareholder engagement program, was deeply involved in the Company’s ESG policies and programs, supported the realization of over

$150 million in synergies following UNFI’s acquisition of SuperValu, and helped to assure the Company’s supply chain remained

operational through the COVID-19 crisis. Prior to UNFI, Ms. Sutton served in senior legal positions at General Motors Company (NYSE: GM),

Tim Hortons and The Wendy’s Company (Nasdaq: WEN). She also currently serves as a director of Miller Industries, Inc. (NYSE: MLR)

and Potbelly Corp. (Nasdaq: PBPB). Ms. Sutton holds multiple degrees from The Ohio State University, including a J.D. and a Master’s

in Healthcare Administration.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a global shipping and mailing company that provides technology, logistics and financial services to more than

90 percent of the Fortune 500. Small business, retail, enterprise and government clients around the world rely on Pitney Bowes to reduce

the complexity of sending mail and parcels. For the latest news, corporate announcements and financial results visit https://www.pitneybowes.com/us/newsroom.html.

For additional information visit Pitney Bowes at www.pitneybowes.com.

This document contains “forward-looking statements”

about the Company’s expected or potential future business and financial performance. Forward-looking statements include, but are

not limited to, statements about the Company’s future progress, plans, market positioning and future events or conditions. Forward-looking

statements are not guarantees of future performance and involve risks and uncertainties that could cause actual results to differ materially

from those projected. Factors which could cause future financial performance to differ materially from expectations include, without limitation,

not realizing the anticipated benefits of our ongoing strategic initiatives, corporate cost optimization and related restructuring

efforts; declining physical mail volumes; changes in postal regulations or the operations and financial health of posts in the U.S.

or other major markets or changes to the broader postal or shipping markets; our ability to retain management and other employees; our

ability to continue to grow and manage unexpected fluctuations in volumes, gain additional economies of scale and improve profitability

within our Global Ecommerce segment; the loss of some of our larger clients in our Global Ecommerce and Presort Services segments; the

loss of, or significant changes to, United States Postal Service (USPS) commercial programs, or our contractual relationships with the

USPS or their performance under those contracts; the impacts on our cost of debt due to recent increases in interest rates and the potential

for future interest rate hikes; and other factors as more fully outlined in the Company's 2022 Form 10-K Annual Report and other reports

filed with the Securities and Exchange Commission during 2023. Pitney Bowes assumes no obligation to update any forward-looking statements

contained in this document as a result of new information, events or developments.

Contacts

For Media:

Kathleen Raymond

Head of Communications

203.351.7233

For Investors:

Phil Landler

VP, Investor Relations

203.351.6141

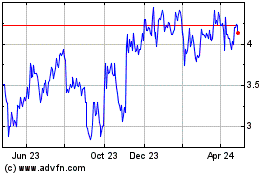

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

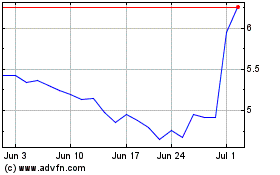

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Apr 2023 to Apr 2024