Fast and Free Shipping, Free and Easy Returns,

Accurate Tracking and On-time Deliveries Top Online Shoppers’ Wish

Lists this Holiday Season

Pitney Bowes (NYSE: PBI), a global technology company that

provides commerce solutions in the areas of ecommerce, shipping,

mailing, data and financial services, today released the results of

its annual Online Shopping Study. Among the Study’s key findings:

60% of online shoppers in the US are dissatisfied with their

holiday shopping experiences, up four percentage points from last

year, and nearly double the number from just four years ago.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20191107005167/en/

Pitney Bowes Online Shopping Study 2019

(Graphic: Business Wire)

The Study also found that the more often you shop, the more

likely you are to be frustrated. Seventy-three percent of frequent

online shoppers (those who shop online daily, or weekly) and 74% of

millennials said they were disappointed in some aspect of the

post-purchase experience last holiday season.

The top three reasons for consumer frustration are: delayed

shipments; shipping costs; and inaccurate tracking.

“Despite the significant investments retailers and marketplaces

are making in the online shopping experience, consumers continue to

be disappointed, especially around the holidays,” said Lila Snyder,

EVP and President, Commerce Services at Pitney Bowes. “As an even

larger percentage of consumer spending is expected to shift online

this holiday season, retailers need to shift resources and

investments to areas like fast and free shipping, accurate tracking

and free and easy returns to keep up with consumer

expectations.”

Root Canals and Revenge

This year’s Study included a number of questions asking

consumers to associate an online shopping experience with an

emotion (“love it! / hate it.”), or a range of universally

enjoyable, or unpleasant experiences, such as “taking a vacation”

or “having a root canal.”

For example, 86% equated some aspect of a poor post-purchase

experience to “having a root canal,” especially these unpleasant

events:

- receiving a wrong or damaged item 72%

- taking too long to get a refund after returning an item

64%

- an inconvenient returns process 60%

- having to pay for shipping 47%

When a retailer puts a consumer through one of these unpleasant

experiences, they do so to the detriment of their brand. For the

second year in a row, nearly nine out of 10 consumers said that

they will make a complaint or take an action that could hurt a

brand’s reputation and bottom line following a bad post-purchase

experience. Among them, nearly one-third said a bad post-purchase

experience is cause for never shopping with the offending brand

again.

Fast and Free Shipping, and Free and Easy Returns

On the bright side, online shoppers did offer advice to

retailers and marketplaces about how they can improve the

post-purchase experience, particularly around fast and free

shipping, and free and easy returns.

Free shipping remains the number one loyalty driver an online

retailer can offer consumers. In fact, when given the choice

between “free” shipping or “fast” shipping” 80% choose “free,”

consistent with data collected in each of the past three years.

Free shipping was four times more likely to drive consumer loyalty

than any other feature that a retailer could offer.

In addition to fast and free shipping, consumers want a free and

easy returns process and fast refunds. On average, Amazon refunds

consumers 4.5 times faster than other brands.

Returns are on the rise and 51% of all online shoppers,

including 66% of millennials, now admit to “bracketing” –

purchasing multiple sizes, styles and colors of an item with the

intent to return what they don’t want.

Seventy-two percent said they “love” when a return label is

included in the package. Seventy percent said they “hate” paying

for return shipping even more than missing the returns period and

getting stuck with an unwanted item (61%).

“Returns seem to have become an unconscious behavior for some

frequent online shoppers,” said Snyder. “In response to our survey,

consumers said they return only 10% of their online purchases, but

in reality we know the number is much closer to 25%.”

Sixty-six percent of consumers said they “love” home pick-up for

returns. Home pick-up is three times more popular than carrier

drop-off and four times more popular than in-store drop-off. When

home pick-up of a return is not offered by a retailer, consumers

admit to compounding the delays by taking, on average, four more

days of what Snyder calls, “trunk time” to transport their item

from their home to the carrier, or store.

Cross-Border Shopping

The number of cross-border shoppers continues to grow in

countries like Australia, Canada, China, Mexico and UK. Of the

countries we surveyed, only the US saw a year-over-year decline in

the number of cross-border shoppers. Forty-six percent of online

shoppers in the US say they have made a cross-border purchase in

the past year, versus 49% the year prior.

Of the US consumers who do shop cross-border, nine out of 10

have purchased something from China. Expectations among

cross-border shoppers are not dissimilar to those of domestic

shoppers, but frustrations with late deliveries and inaccurate

tracking are higher, especially on items ordered from China.

Methodology: The 2019 Pitney Bowes Online Shopping Study is

based on survey results of more than 8,000 consumers globally.

Unless otherwise noted, the information in this press release is

based on survey results of more than 3,000 US consumers, ages 18

and up.

The Pitney Bowes Online Shopping Study is one of two annual

research reports the company conducts on behalf of its clients and

releases publicly. In October, the Company released its annual

Parcel Shipping Index which measures parcel volume and spend across

13 major markets globally. The Index found that annual parcel

volumes reached 87 billion in 2018 (17% year-over-year growth) and

are projected to reach 200 billion in 2025.

Pitney Bowes can help

Pitney Bowes supports retailers and other shippers in the areas

of fulfillment, delivery, returns and cross-border. In each of

these areas, the Company strives to be the service provider that’s

easiest to work with, by being more transparent and offering

simpler pricing with fewer and lower surcharges than others in the

market.

Services include:

- Fulfillment services with a nationwide network, automated

facilities and seamlessly integrated delivery and returns;

- Standard delivery of parcels through an extensive US domestic

network, leveraging the USPS® for final mile delivery;

- Cross-border delivery to 207 countries and territories with

bundled quoting and compliance services; and

- Standard domestic returns services that allow retailers to

offer free at-home pick-up, convenient drop-off options, and fast

refunds.

Pitney Bowes ranked as a top vendor in the International

Ecommerce Services, Fulfillment Services and Shipping Carrier

categories in Internet Retailer’s “2019 Leading Vendors to the Top

1000” E-Retailers report.

About Pitney Bowes

Pitney Bowes (NYSE: PBI) is a global technology company

providing commerce solutions that power billions of transactions.

Clients around the world, including 90 percent of the Fortune 500,

rely on the accuracy and precision delivered by Pitney Bowes

solutions, analytics, and APIs in the areas of ecommerce

fulfillment, shipping and returns; cross-border ecommerce; office

mailing and shipping; presort services; location data; customer

information and engagement software; services; and financing. For

nearly 100 years Pitney Bowes has been innovating and delivering

technologies that remove the complexity of getting commerce

transactions precisely right. For additional information visit

Pitney Bowes, the Craftsmen of Commerce, at

www.pitneybowes.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191107005167/en/

Brett Cody Pitney Bowes M +1 203 218 1187 brett.cody@pb.com

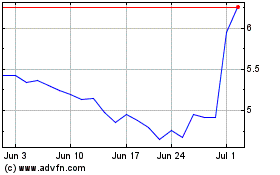

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2024 to Aug 2024

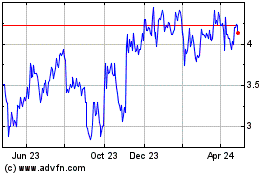

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Aug 2023 to Aug 2024