Business Equipment's Key Players -- Recap Before the Upcoming Earnings Releases

April 15 2010 - 8:34AM

Marketwired

www.rothmanresearch.com - The U.S. economy is slowly moving back on

track after what many describe as the worst financial calamity

since the end of the Second World War... that's 65 years ago. The

impact of the recession was felt globally, and many countries like

the U.S. are still finding recovery a paraplegic battle. There are

still hidden fears that 2010 could not be the end of the recession.

Whilst all the sectors have taken their share of beating, some more

than others, a few key players in the business equipment industry

kick-started the year on a positive financial note.

Xerox Corp. (NYSE: XRX) in late January delivered

unyielding operational results citing their cost-cutting

strategies. The company, however, saw a 3% decline in its 4th

quarter revenue as compared to the same quarter in 2008.

*Direct & free downloadable report on Xerox

Corp. is available by signing up now at

http://www.rothmanresearch.com/article/xrx/23431/Apr-15-2010.html

"Xerox is expected to announce its 2010 1st quarter earnings

release on April 23rd. I believe that we might see some mild

improvement as the company has done a great work on the

restructuring front which already proved crucial in its last

quarter readings. The economy is still recovering an inch at a

time, so we are not expecting revenue to be any better, but in a

$100 billion market, Xerox is already benefitting from a leadership

role in a number of its niche markets," commented Mathew Collier of

www.rothmanresearch.com. "Like many investors out there I remain

neutral on this play."

Another prominent player in this sphere that made the headlines

early this year is Pitney Bowes Inc. (NYSE:

PBI) when it released its fourth quarter and full year results for

2009 with a 33% surge in profits. Sales, however, were down. "In

challenging economic environments what makes a difference are cost

management and efficient-productivity. Pitney saw a 6% drop in

revenue but has been able to weather the worst by lowering

expenses," Mathew Collier observed. "Additionally, the company

recently maintained its quarterly cash dividend of 36.5 cents on

its common stock. We believe PBI will execute in line with the

benchmark, hence, we are taking a neutral stance on this stock at

this time."

*Complimentary downloadable research on Pitney

Bowes Inc. is accessible upon registration at

http://www.rothmanresearch.com/article/pbi/23432/Apr-15-2010.html

Pitney Bowes is due to report its 1st quarter earnings for 2010

on May 3rd.

* www.rothmanresearch.com is a source for investors seeking free

information on the business equipment industry; investors are

encouraged to sign up for free at

http://www.rothmanresearch.com/index.php?id=6&name=Register.

Companies looking for additional media or

advertising services can call Blue Chip IR at

1-917-267-8836.

About Rothman Research Rothman Research

brings independent company and sector research together, utilizing

top financial advisors and investment tactics to provide you with a

clear picture of investment opportunities.

For More Information Contact: Mathew Collier

info@rothmanresearch.com

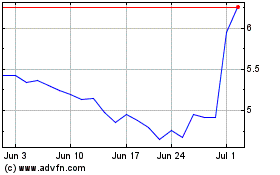

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

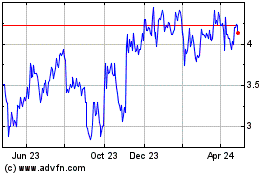

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024