Pitney Bowes Business Insight Debuts PERFORM.360 for Financial Institutions at BAI Retail Delivery Conference 2009

November 05 2009 - 8:00AM

Business Wire

Pitney Bowes Business Insight (PBBI), the leading global

provider of location and communication intelligence solutions,

today unveiled PERFORM.360™, an integrated portfolio of

applications that blends branch network design, performance

analytics and sales management tools to help financial services

institutions maximize market coverage, visualize opportunities and

optimize sales resource deployment. PBBI will demonstrate

PERFORM.360 at booth #1028 during the BAI Retail Delivery

Conference, taking place in Boston on November 3-5, 2009.

“Like many financial institutions, we rely on predictive

analytic tools to give us an advantage over our competition,” said

Kate Stackhouse, SVP and Director of Sales Integration at First

Citizens Bank. “We are particularly excited about Pitney Bowes

Business Insight’s PERFORM.360 because it was designed to empower

banks like us to better understand and provide service to our

customers and prospects, to be more agile in responding to market

changes, and ultimately, to improve our branch sales

performance—the end goal of all banks.”

Based on elite benchmarking, analysis and delivery optimization

capabilities, Pitney Bowes Business Insight gives financial

institutions the tools to enhance customer interactions across

multiple channels to them help acquire, develop, service and retain

their best customers.

At the branch level, for example, financial institutions need to

make branches conveniently accessible to customers, understand

customer needs, and appropriately staff branch locations to best

serve their customers. PERFORM.360 determines the true market

potential of each location and advises banks on how to set more

accurate, attainable goals. Using PBBI insight, banks can

repeatedly recreate successful business with optimum branch

staffing, locations and services.

By tailoring the PERFORM.360 toolset to its specific needs, each

institution can make a variety of intelligent decisions about

growth, retraction or re-investment in its branch network and

services. Sophisticated reporting capabilities allow management

teams to easily identify best to worst performing branches.

Financial services institutions can easily access PERFORM.360 via a

web-enabled portal. Its components include:

- Local Knowledge—Provides

a complete view of each branch’s customer base, trade area

characteristics, competition and performance metrics. This module

drives sales by significantly improving banks’ understanding of the

unique opportunities and competitive environment around each

branch.

- Network Analysis—Provides

easy access to hundreds of branch and trade area characteristics

through standard and customer reporting and graphing tools.

- Sales Assessment and Goal

Setting—Establishes objectives that are specific, measurable

and attainable—driven by PBBI's extensive understanding of

consumer behavior.

“Financial institutions face a specific set of opportunities and

unique environmental challenges at each branch,” said Bill Simmons,

Director of the Financial Services Practice for the Pitney Bowes

Business Insight Strategy & Analytics Portfolio. “To help focus

branch management attention on accurate performance goals, we

designed PERFORM.360 based on years of experience in benchmarking

performance across thousands of branches and analyzing millions of

customer account behaviors. Financial services industry analysts

can maximize branch performance by determining potential,

allocating appropriate resource levels and goals, ranking

performance on key metrics and empowering sales staff with

pertinent market information.”

Pitney Bowes Business Insight’s PERFORM.360 is available

immediately. Pricing is contingent on the scope of custom

predictive analytic services required. For more information, please

visit: http://go.pbinsight.com/NPM. Read the company’s Strategy

& Analytics blog here: http://analytics.pbbiblogs.com/.

About Pitney Bowes Business Insight

Pitney Bowes Business Insight (PBBI), a division of Pitney Bowes

Software Inc., provides a unique combination of location and

communication intelligence software, data and services that enable

organizations to make more informed decisions about customers,

competition and market expansion. Pitney Bowes Software is a

wholly-owned subsidiary of Pitney Bowes Inc. (NYSE – PBI). With the

industry’s most comprehensive set of solutions for maximizing the

value of customer data, PBBI provides the tools required to more

effectively locate, connect and communicate with customers in

today’s global markets. Leading organizations rely on PBBI

solutions to increase the accuracy and effectiveness of customer

information delivery and drive profitable growth. Visit

www.pbbusinessinsight.com and www.pb.com for more information.

Of Note

This press release contains forward-looking statements involving

risks and uncertainties. Any statement not a statement of

historical fact is a forward-looking statement, including without

limitation statements concerning demand for and benefits of Pitney

Bowes Business Insight products and integration of its products

with existing solutions. Actual results could differ materially

from those stated or implied in forward-looking statements due to a

number of factors, including those factors contained in the Pitney

Bowes Inc. 10-k statements filed with the Securities and Exchange

Commission under the heading “Risk Factors.” Pitney Bowes Business

Insight takes no responsibility to update any forward-looking

statements.

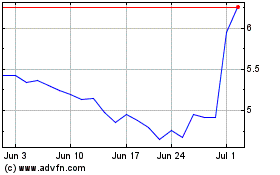

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

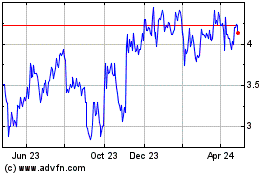

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024