Pitney Bowes Inc. (NYSE:PBI) today reported third quarter 2009

financial results.

Revenue for the quarter was $1.36 billion compared with $1.55

billion in the prior year, a decline of 12 percent. A stronger

dollar reduced revenue by 2 percent year-over-year. Adjusted

earnings per diluted share from continuing operations was $0.55,

compared with $0.67 in the prior year. Earnings reflect the

negative impacts of $0.01 per diluted share associated with

currency and $0.01 per diluted share from incremental pension costs

when compared with the prior year.

On a Generally Accepted Accounting Principles (GAAP) basis,

earnings per diluted share was $0.50 compared with $0.47 for the

prior year. GAAP earnings per diluted share for this quarter

includes a $0.01 loss associated with discontinued operations and a

$0.04 charge for restructuring costs associated with our strategic

transformation initiatives.

Free cash flow was $223 million for the quarter while on a GAAP

basis the company generated $249 million in cash from operations.

Free cash flow benefited from lower capital expenditures and lower

levels of finance receivables. During the quarter the company paid

$75 million of dividends to common shareholders.

Year-to-date, the company has generated $666 million in free

cash flow and on a GAAP basis $732 million in cash from operations,

which was partially used to reduce debt by $298 million.

The company’s results for the quarter and year-to-date are

summarized below:

Third

Quarter Year-to-date Adjusted EPS

$0.55 $1.64

Restructuring ($0.04

) ($0.04 )

Tax Adjustments N/M

($0.06 )

GAAP EPS from Continuing Operations $0.51

$1.54

Discontinued Operations

($0.01 ) $0.03

GAAP EPS $0.50

$1.57

“We have been aggressively implementing a series of actions to

help mitigate the impact of a challenging business environment

characterized by ongoing economic pressures, depressed mail

volumes, and evolving customer behaviors,” noted Pitney Bowes

Chairman, President and CEO Murray D. Martin. “To enhance long-term

growth and value creation in this changing environment, we

introduced new solutions to the marketplace, we entered new

partnerships to deliver more value to our customers worldwide, and

we initiated a comprehensive program to transform our business

processes and operations.

“We also continued to take significant actions to reduce costs

and enhance productivity. The benefits from our earlier actions are

again visible in our sequential results as EBIT and EBIT margins

improved in 6 of our 7 business segments compared with the second

quarter 2009.

“We generated significant free cash flow and saw a sequential

improvement in our supplies and rental revenue streams, even as

equipment sales continued to be tempered by the economic

environment.

“We believe that our strategic transformation process will help

us navigate the current environment and enhance our positioning for

long-term growth when the economy rebounds. We are analyzing a wide

range of opportunities for process and operational improvements in

areas such as our global customer interactions and product

development processes.

“Currently, we are targeting annualized benefits, net of

investments, from our strategic transformation initiatives in the

range of at least $150 to $200 million on a pre-tax basis. We

expect the full benefit run rate to be achieved by 2012. The

restructuring charge in the current quarter represents costs

associated with initial actions identified as part of the

diagnostic phase of this project. Starting in the fourth quarter,

there will be additional ongoing costs associated with achieving

these benefits, and both the benefits and costs will be recognized

as different actions are approved and implemented.

“Based upon our results year-to-date and our expectations for

the remainder of the year, we are narrowing the range for adjusted

and GAAP earnings per diluted share. We now expect adjusted

earnings per diluted share will be in the range of $2.19 to $2.31

and GAAP earnings per diluted share will be in the range of $2.09

to $2.21. We are also increasing our guidance range for cash flow

and slightly reducing our revenue expectations.”

Business Segment Results

Mailstream Solutions revenue declined 12 percent on a

constant currency basis compared with the prior year. On a reported

basis, revenue declined 14 percent to $925 million and earnings

before interest and taxes (EBIT) declined 21 percent to $227

million compared with the prior year.

Within Mailstream Solutions:

U.S. Mailing revenue declined 12 percent to $491 million and

EBIT declined 19 percent to $178 million compared with the prior

year. Revenue declined by 4 percent and EBIT declined by 8 percent

compared with the second quarter. Sequential revenue comparisons

are negatively impacted by an increase in the number of customers

renewing leases on equipment rather than upgrading; absence of a

postal rate increase which generates sales; and, a seasonal impact

on the equipment sales cycle.

The company continued its focus on customer retention, as many

customers continued to take advantage of the option to extend

leases on existing equipment. The quarter’s revenue and EBIT also

reflect lower levels of high-margin financing revenue as a result

of reduced equipment sales in both the current and prior quarters.

In October the company continued to enhance its product line with

the launch of the new fully-featured mid-market DM475 mail and

metering solution.

International Mailing revenue declined 11 percent on a constant

currency basis compared with the prior year. On a reported basis,

revenue declined 17 percent to $225 million with more than 6 points

of this decline due to adverse currency impact, and EBIT declined

29 percent to $29 million when compared with the prior year.

Reported revenue increased by 3 percent, EBIT increased by 8

percent and EBIT margin improved by 60 basis points, when compared

with the second quarter of 2009.

Similar to the U.S., results have been impacted by lower

recurring revenue streams such as financing and supplies, as a

result of weak demand throughout the economic downturn. At the end

of the third quarter the company began to see signs of

stabilization of business trends in Canada, Asia Pacific, and parts

of Europe, despite generally weak economic conditions.

Worldwide Production Mail revenue declined 16 percent on a

constant currency basis compared with the prior year. On a reported

basis, revenue declined 18 percent to $126 million with 2 points of

the decline due to adverse currency impact. EBIT declined 50

percent to $11 million compared with the prior year. Reported

revenue declined 3 percent while EBIT increased 10 percent and EBIT

margin improved 110 basis points when compared with the second

quarter.

Production Mail again achieved sequential growth and margin

improvement in service revenue, despite lower equipment sales as a

result of customers around the world keeping existing equipment

longer than usual. One example of how the company is positioning

itself to provide incremental value to its customers is through a

partnership announced during the quarter with Hewlett Packard. The

company will sell Hewlett Packard’s digital high-speed color

printer as part of an integrated solution with Pitney Bowes’

inserting equipment.

Software revenue declined 9 percent on a constant currency basis

compared with the prior year. On a reported basis, revenue declined

13 percent to $82 million while EBIT increased 160 percent to $8

million, compared with the prior year. Reported revenue was

essentially flat and EBIT increased 58 percent compared with the

second quarter 2009. EBIT margin reached 10 percent in the quarter,

more than double the prior year.

The company has taken significant actions to integrate acquired

businesses, focus the product line and rebrand its software

offerings. Despite worldwide consolidation in the financial

services industry and weakness in the retail sector impacting

software sales, the company’s actions have resulted in substantial

EBIT margin improvements versus the prior year. This is expected to

benefit EBIT growth in the seasonally more significant fourth

quarter.

Mailstream Services revenue declined 6 percent on a

constant currency basis compared with the prior year. On a reported

basis, revenue declined 8 percent to $432 million and EBIT

increased 26 percent to $50 million compared with the prior

year.

Within Mailstream Services:

Management Services revenue declined 8 percent on a constant

currency basis compared with the prior year. On a reported basis,

revenue declined 10 percent to $259 million while EBIT improved 21

percent to $20 million compared with the prior year. Reported

revenue declined 2 percent and EBIT increased 21 percent compared

with the second quarter.

In the U.S., EBIT as a percentage of revenue remained above 10

percent, comparable to the first half of the year. The company has

implemented a more variable cost infrastructure that allows it to

align costs with changing volumes. This flexibility helped drive

EBIT improvements despite lower business activity. Outside the

U.S., the company instituted similar productivity enhancements that

have improved profitability despite lower print and transaction

volumes due to the economy. This will provide the international

operations with increased leverage as the economy improves and

revenue rebounds.

Mail Services revenue declined 3 percent on a constant currency

basis. On a reported basis, revenue declined 4 percent to $134

million while EBIT increased 49 percent to $23 million compared

with the prior year. Reported revenue declined 3 percent while EBIT

increased 6 percent and EBIT margin improved by 150 basis points

when compared with the second quarter of 2009.

Mail Services continues to capture significant new customers

even as mail volume per customer has declined as a result of

overall trends in mail volumes. The company achieved improved EBIT

margin contributions versus last year from the integration of mail

services sites acquired in 2008 and the ongoing automation and

productivity initiatives taken by the business.

Marketing Services revenue declined 6 percent to $39 million and

EBIT declined 8 percent to $7 million compared with the prior year.

Revenue increased 11 percent and EBIT increased 32 percent compared

with the second quarter of 2009, benefiting partially from a

seasonal increase in household moves during the summer.

On a year-over-year basis, revenue was negatively affected by

fewer household moves which resulted in the need for fewer change

of address kits. Ongoing production efficiencies resulted in EBIT

margin improvement on a sequential basis.

2009 Guidance

The company is modifying its 2009 annual guidance as

follows:

- The company is narrowing its

range for adjusted and GAAP earnings per diluted share from

continuing operations. The adjusted earnings per diluted share

range for 2009 is now $2.19 to $2.31. Adjusted earnings per diluted

share from continuing operations excludes an estimated 6 cents per

diluted share non-cash tax charge associated with out-of-the-money

stock options that was primarily recorded in the first half of

2009. Adjusted earnings per diluted share also excludes a $0.04 per

share restructuring charge recorded in the third quarter. The

company’s current 2009 expectations for diluted earnings per share

on a GAAP basis include the restructuring charges recorded in the

third quarter, but do not include any potential restructuring

charges in the fourth quarter. The company expects earnings per

diluted share from continuing operations on a GAAP basis for the

year will be in the range of $2.09 to $2.21.

- Revenue for the year is now

expected to decline by 5 to 8 percent on a constant currency basis

and 8 to 11 percent on a reported basis.

- Based on strong cash flow

performance year-to-date, the company is increasing its free cash

flow guidance for 2009 by $50 million to a range of $750 million to

$850 million.

The 2009 earnings guidance is summarized in the table below:

Full Year 2009

Adjusted EPS $2.19 to $2.31

Tax Adjustments

($0.06)

Restructuring ($0.04)

GAAP EPS from

Continuing Operations $2.09 to $2.21

Mr. Martin concluded, “We are committed to making the most of

the opportunities we have to transform the way we operate as a

global company so that we can build sustainable long-term value for

shareholders and customers. That is why we are excited about the

prospects of our strategic transformation initiative. The expected

improvements to our business practices, processes and operating

model will move us toward a more integrated global business with

enhanced go-to-market options and a flexible and variable cost

infrastructure.”

Management of Pitney Bowes will discuss the company’s results in

a broadcast over the Internet today at 5:00 p.m. EST. Instructions

for listening to the earnings results via the Web are available on

the Investor Relations page of the company’s web site at

www.pb.com/investorrelations.

Pitney Bowes is a $6.3 billion global technology leader whose

products, services and solutions deliver value within the

mailstream and beyond. For more information about the company, its

products, services and solutions, visit www.pitneybowes.com.

The company's financial results are reported in accordance with

generally accepted accounting principles (GAAP). However, earnings

per share, income from continuing operations, and free cash flow

results are adjusted to exclude the impact of special items such as

transformation initiatives, restructuring charges, tax adjustments,

accounting adjustments and write downs of assets. Although these

charges represent actual expenses to the company, these charges

might mask the periodic income and financial and operating trends

associated with our business. The use of free cash flow has

limitations. GAAP cash flow has the advantage of including all cash

available to the company after actual expenditures for all

purposes. Free cash flow permits a shareholder insight into the

amount of cash that management could have available for other

discretionary uses. It adjusts for long-term commitments such as

capital expenditures, as well as special items like cash used for

restructuring charges, unusual tax payments and contributions to

its pension funds. These items use cash that is not otherwise

available to the company and are important expenditures. Management

compensates for these limitations by using a combination of GAAP

cash flow and free cash flow in doing its planning.

EBIT excludes interest payments and taxes, both cash expenses to

the company, and as a result, has the effect of showing a greater

amount of earnings than net income. The company uses EBIT for

purposes of measuring the performance of its management team. The

interest rates and tax rates applicable to the company generally

are outside the control of management, and it can be useful to

judge performance independent of those variables. Financial results

on a constant currency basis exclude the impact of changes in

foreign currency exchange rates since the prior period under

comparison and are calculated using the average of the rates in

effect during that period. Constant currency measures are intended

to help investors better understand the underlying operational

performance of the business excluding the impacts of shifts in

currency exchange rates over the intervening period.

Pitney Bowes has provided a quantitative reconciliation to GAAP

in supplemental schedules. This information may also be found at

the company's web site www.pb.com/investorrelations in the

Investor Relations section.

This document contains “forward-looking statements” about our

expected future business and financial performance. Pitney Bowes

assumes no obligation to update any forward-looking statements

contained in this document as a result of new information or future

events or developments. For us forward-looking statements include,

but are not limited to, statements about possible transformation

initiatives; restructuring charges and our future revenue and

earnings guidance. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those projected. These risks and uncertainties include, but

are not limited to: the uncertain economic environment, including

adverse impacts on customer demand; changes in foreign currency

exchange rates; and changes in postal regulations, as more fully

outlined in the company's 2008 Form 10-K Annual Report and other

reports filed with the Securities and Exchange Commission.

Note: Consolidated statements of income; revenue and EBIT by

business segment; and reconciliation of GAAP to non-GAAP measures

for the three and nine months ended September 30, 2009 and 2008,

and consolidated balance sheets at September 30, 2009 and June 30,

2009 are attached.

Pitney Bowes Inc. Consolidated Statements of

Income

(Unaudited)

(Dollars in thousands, except

per share data) Three Months Ended September 30, Nine Months

Ended September 30, 2009 2008 2009 2008 Revenue: Equipment sales $

225,759 $ 296,520 $ 714,780 $ 910,883 Supplies 83,464 96,864

253,466 305,750 Software 87,295 100,092 254,401 314,617 Rentals

163,711 182,850 487,992 553,658 Financing 171,228 195,632 528,534

591,834 Support services 177,607 193,516 531,200 579,996 Business

services 447,756 482,199

1,344,493 1,452,978 Total revenue

1,356,820 1,547,673 4,114,866

4,709,716 Costs and expenses: Cost of

equipment sales 124,819 157,593 387,674 484,988 Cost of supplies

23,785 26,382 68,495 80,673 Cost of software 19,413 25,917 60,480

80,107 Cost of rentals 40,508 36,252 114,372 114,227 Financing

interest expense 23,975 27,702 73,865 85,630 Cost of support

services 100,541 113,581 300,090 343,507 Cost of business services

335,406 370,213 1,033,933 1,120,193 Selling, general and

administrative 435,931 484,650 1,317,410 1,491,154 Research and

development 45,052 53,008 138,623 156,176 Restructuring charges and

asset impairments 12,845 49,229 12,845 85,137 Other interest

expense 27,244 30,037 84,548 91,565 Interest income (668 )

(3,179 ) (3,153 ) (9,731 ) Total costs

and expenses 1,188,851 1,371,385

3,589,182 4,123,626 Income from

continuing operations before income taxes 167,969 176,288 525,684

586,090 Provision for income taxes 57,691

69,456 192,375 215,389

Income from continuing operations 110,278 106,832 333,309

370,701 Gain (loss) from discontinued operations, net of

income tax (2,429 ) (2,063 ) 5,296

(8,726 ) Net income before attribution of

noncontrolling interests 107,849 104,769 338,605 361,975

Less: Preferred stock dividends of

subsidiaries attributable to noncontrolling

interests

4,622 6,540 13,714

16,134 Pitney Bowes Inc. net income $ 103,227

$ 98,229 $ 324,891 $ 345,841

Amounts attributable to Pitney

Bowes Inc.common stockholders:

Income from continuing operations $ 105,656 $ 100,292 $ 319,595 $

354,567 Gain (loss) from discontinued operations (2,429 )

(2,063 ) 5,296 (8,726 ) Pitney

Bowes Inc. net income $ 103,227 $ 98,229 $ 324,891

$ 345,841

Basic earnings per share of common stock attributable to Pitney

Bowes Inc. common stockholders (1): Continuing operations $ 0.51 $

0.48 $ 1.55 $ 1.70

Discontinued operations

(0.01 ) (0.01 ) 0.03 (0.04 )

Net income $ 0.50 $ 0.47 $ 1.57 $ 1.65

Diluted earnings per share of common stock attributable to Pitney

Bowes Inc. common stockholders (1):

Continuing operations $ 0.51 $ 0.48 $ 1.54 $ 1.68 Discontinued

operations (0.01 ) (0.01 ) 0.03

(0.04 ) Net income $ 0.50 $ 0.47 $ 1.57

$ 1.64

Average common and potential

commonshares outstanding

207,643,504 208,655,671

207,198,120 210,586,568

(1) The sum of the earnings per

share amounts may not equal the totals above due to rounding.

Pitney Bowes Inc. Consolidated Balance Sheets

(Unaudited)

(Dollars in thousands, except

per share data)

Assets

09/30/09 06/30/09 Current assets: Cash and cash equivalents $

441,128 $ 445,262 Short-term investments 17,660 23,399 Accounts

receivable, less allowances: 09/09 $46,312 06/09 $46,647 772,077

796,119 Finance receivables, less allowances: 09/09 $43,333 06/09

$42,814 1,365,631 1,365,188 Inventories 176,626 171,267 Current

income taxes 73,386 91,465 Other current assets and prepayments

98,736 102,911 Total current

assets 2,945,244 2,995,611 Property, plant and equipment,

net 529,079 546,805 Rental property and equipment, net 374,021

365,852 Long-term finance receivables, less allowances: 09/09

$25,547 06/09 $25,091 1,370,460 1,382,681 Investment in leveraged

leases 231,088 212,235 Goodwill 2,294,594 2,276,151 Intangible

assets, net 319,040 341,612 Non-current income taxes 66,280 58,044

Other assets 414,215 389,188

Total assets $ 8,544,021 $ 8,568,179

Liabilities, noncontrolling interests and

stockholders' equity (deficit)

Current liabilities: Accounts payable and accrued liabilities $

1,693,697 $ 1,722,404 Current income taxes 112,908 103,042 Notes

payable and current portion of long-term obligations 170,783

292,869 Advance billings 452,380 491,073

Total current liabilities 2,429,768 2,609,388

Deferred taxes on income 366,721 320,842 Tax uncertainties and

other income tax liabilities 293,476 296,711 Long-term debt

4,218,646 4,209,129 Other non-current liabilities 783,750

788,244 Total liabilities

8,092,361 8,224,314 Noncontrolling

interests (Preferred stockholders' equity in subsidiaries) 374,165

374,165 Stockholders' equity (deficit): Cumulative preferred

stock, $50 par value, 4% convertible 4 7 Cumulative preference

stock, no par value, $2.12 convertible 876 969 Common stock, $1 par

value 323,338 323,338 Additional paid-in capital 251,273 249,312

Retained earnings 4,380,513 4,351,845 Accumulated other

comprehensive loss (461,550 ) (533,571 ) Treasury stock, at cost

(4,416,959 ) (4,422,200 ) Total Pitney Bowes

Inc. stockholders' equity (deficit) 77,495

(30,300 ) Total liabilities, noncontrolling interests and

stockholders' equity (deficit) $ 8,544,021 $ 8,568,179

Pitney Bowes Inc. Revenue and EBIT Business

Segments September 30, 2009

(Unaudited)

(Dollars in thousands)

Three Months

Ended September 30, % 2009 2008

Change

Revenue

U.S. Mailing $ 491,036 $ 558,038 (12 %) International

Mailing 224,681 271,727 (17 %) Production Mail 126,434 154,554 (18

%) Software 82,361 94,221 (13 %)

Mailstream Solutions 924,512 1,078,540

(14 %) Management Services 259,370 287,989 (10 %) Mail

Services 134,042 139,689 (4 %) Marketing Services 38,896

41,455 (6 %) Mailstream Services

432,308 469,133 (8 %)

Total

revenue $ 1,356,820 $

1,547,673 (12 %)

EBIT (1)

U.S. Mailing $ 178,066 $ 221,179 (19 %) International

Mailing 29,193 41,123 (29 %) Production Mail 11,494 23,183 (50 %)

Software 8,241 3,167 160 % Mailstream

Solutions 226,994 288,652 (21 %)

Management Services 19,517 16,064 21 % Mail Services 23,024 15,467

49 % Marketing Services 7,448 8,088 (8

%) Mailstream Services 49,989 39,619 26

%

Total EBIT $ 276,983 $

328,271 (16 %) Unallocated amounts:

Interest, net (50,551 ) (54,560 ) Corporate expense (45,618 )

(48,194 ) Restructuring charges and asset impairments

(12,845 ) (49,229 )

Income from continuing

operations before income taxes $ 167,969

$ 176,288

(1) Earnings before interest and

taxes (EBIT) excludes general corporate expenses and restructuring

charges and asset impairments.

Pitney Bowes Inc. Revenue and EBIT Business

Segments September 30, 2009

(Unaudited)

(Dollars in thousands)

Nine Months

Ended September 30, % 2009 2008

Change

Revenue

U.S. Mailing $ 1,517,377 $ 1,687,229 (10 %) International

Mailing 679,893 882,145 (23 %) Production Mail 366,000 439,358 (17

%) Software 240,559 296,134 (19 %)

Mailstream Solutions 2,803,829 3,304,866

(15 %) Management Services 789,635 891,078 (11 %)

Mail Services 413,891 399,875 4 % Marketing Services 107,511

113,897 (6 %) Mailstream Services

1,311,037 1,404,850 (7 %)

Total

revenue $ 4,114,866 $

4,709,716 (13 %)

EBIT (1)

U.S. Mailing $ 561,232 $ 663,469 (15 %) International

Mailing 87,201 142,520 (39 %) Production Mail 26,974 47,116 (43 %)

Software 16,064 15,962 1 % Mailstream

Solutions 691,471 869,067 (20 %)

Management Services 49,294 52,931 (7 %) Mail Services 63,322 49,836

27 % Marketing Services 17,323 15,558

11 % Mailstream Services 129,939 118,325

10 %

Total EBIT $ 821,410

$ 987,392 (17 %) Unallocated

amounts: Interest, net (155,260 ) (167,464 ) Corporate expense

(127,621 ) (148,701 ) Restructuring charges and asset impairments

(12,845 ) (85,137 )

Income from continuing

operations before income taxes $ 525,684

$ 586,090

(1) Earnings before interest and

taxes (EBIT) excludes general corporate expenses and restructuring

charges and asset impairments.

Pitney Bowes Inc. Reconciliation of Reported Consolidated

Results to Adjusted Results (Unaudited)

(Dollars in thousands, except per share data) Three Months

Ended September 30, Nine Months Ended September 30, 2009 2008 2009

2008 GAAP income from continuing operations after income

taxes, as reported $ 105,656 $ 100,292 $ 319,595 $ 354,567

Restructuring charges and asset impairments 8,300 39,117 8,300

61,862 Tax adjustment 216 - 12,204 6,480 MapInfo purchase

accounting - - -

322 Income from continuing operations after income taxes, as

adjusted $ 114,172 $ 139,409 $ 340,099 $

423,231 GAAP diluted earnings per share from

continuing operations, as reported $ 0.51 $ 0.48 $ 1.54 $ 1.68

Restructuring charges and asset impairments 0.04 0.19 0.04 0.29 Tax

adjustment 0.00 - 0.06 0.03 MapInfo purchase accounting -

- - 0.00 Diluted

earnings per share from continuing operations, as adjusted $ 0.55

$ 0.67 $ 1.64 $ 2.01 GAAP

net cash provided by operating activities, as reported $ 249,038 $

285,611 $ 732,424 $ 756,059 Capital expenditures (36,319 ) (54,632

) (126,509 ) (169,978 ) Restructuring payments and discontinued

operations 17,647 28,941 66,757 66,451 Reserve account deposits

(7,768 ) (1,835 ) (6,236 ) 16,617

Free cash flow, as adjusted $ 222,598 $

258,085 $ 666,436 $ 669,149 Note: The

sum of the earnings per share amounts may not equal the totals

above due to rounding.

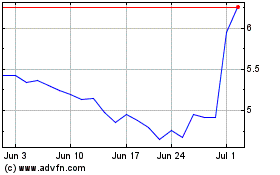

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

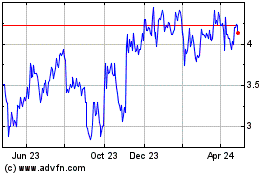

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024