Coughlin Stoia Geller Rudman & Robbins LLP Files Class Action Suit against Pitney Bowes Inc.

October 28 2009 - 4:57PM

Business Wire

Coughlin Stoia Geller Rudman & Robbins LLP (“Coughlin

Stoia”) (http://www.csgrr.com/cases/pitneybowes/) today announced

that a class action has been commenced on behalf of an

institutional investor in the United States District Court for the

District of Connecticut on behalf of purchasers of the common stock

of Pitney Bowes Inc. ("Pitney Bowes") (NYSE:PBI) between July 30,

2007 and October 29, 2007, inclusive (the “Class Period”), seeking

to pursue remedies under the Securities Exchange Act of 1934 (the

“Exchange Act”).

If you wish to serve as lead plaintiff, you must move the Court

no later than 60 days from today. If you wish to discuss this

action or have any questions concerning this notice or your rights

or interests, please contact plaintiff’s counsel, Samuel H. Rudman

or David A. Rosenfeld of Coughlin Stoia at 800/449-4900 or

619/231-1058, or via e-mail at djr@csgrr.com. If you are a member

of this Class, you can view a copy of the complaint as filed or

join this class action online at

http://www.csgrr.com/cases/pitneybowes/. Any member of the putative

class may move the Court to serve as lead plaintiff through counsel

of their choice, or may choose to do nothing and remain an absent

class member.

The complaint charges Pitney Bowes and certain officers of

Pitney Bowes with violations of the Exchange Act. Pitney Bowes

provides mail processing equipment and integrated mail solutions in

the United States and internationally.

The complaint alleges that, throughout the Class Period,

defendants made numerous positive statements regarding the

Company’s financial condition, business and prospects. The

complaint further alleges that these statements were inaccurate

statements of material fact when made because defendants failed to

disclose: (i) that the Company was experiencing a slowdown in sales

of equipment and software and supplies to the financial services

sector; (ii) that revenues in the Company’s U.S. mailing segment

had dramatically declined and were not performing according to

internal expectations; (iii) that the Company’s international

operations were not performing to internal expectations as market

liberalization and deregulation was causing customers to delay

purchasing decisions. For example, in France, a change in the

method of meter rentals was causing delayed purchasing decisions

and increased selling and marketing costs; and (iv) as a result of

the foregoing and other adverse undisclosed factors, there was no

reasonable basis for defendants’ positive statements about the

Company, its operations and earnings.

On October 29, 2007, Pitney Bowes held a conference call with

analysts and investors to discuss the Company’s earnings and

operations. During the conference call, defendants admitted that a

host of factors caused Pitney Bowes to drastically miss the

earnings they had promised. In response to the Company’s

announcement, the price of Pitney Bowes common stock declined from

$42.68 per share to $36.27 per share on extremely heavy trading

volume.

Plaintiff seeks to recover damages on behalf of all purchasers

of Pitney Bowes common stock during the Class Period (the “Class”).

The plaintiff is represented by Coughlin Stoia, which has expertise

in prosecuting investor class actions and extensive experience in

actions involving financial fraud.

Coughlin Stoia, a 190-lawyer firm with offices in San Diego, San

Francisco, Los Angeles, New York, Boca Raton, Washington, D.C.,

Philadelphia and Atlanta, is active in major litigations pending in

federal and state courts throughout the United States and has taken

a leading role in many important actions on behalf of defrauded

investors, consumers, and companies, as well as victims of human

rights violations. The Coughlin Stoia Web site

(http://www.csgrr.com) has more information about the firm.

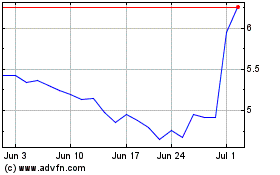

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

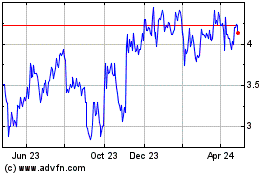

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024