Adjusted earnings of $1.1 billion or $2.02 per

share

Highlights

- Strong earnings driven by improved

refining and marketing margins

- Record advantaged crude runs

- Chemicals impacted by unplanned

downtime

- Announced Dakota Access Pipeline and

Energy Transfer Crude Oil Pipeline joint ventures

- Returned $771 million of capital to

shareholders through dividends and share repurchases

Phillips 66 (NYSE: PSX), an energy manufacturing and logistics

company, announces third-quarter earnings of $1.2 billion, compared

with earnings of $863 million during the second quarter of 2014.

Adjusted earnings were $1.1 billion, an increase of $277 million

from the second quarter of 2014.

"Our operations ran well during the third quarter, capturing

strong margins in our refining and marketing businesses," said Greg

Garland, chairman and CEO of Phillips 66. "Chemicals earnings were

also strong despite the impact of unplanned downtime."

"We recently announced the Dakota Access Pipeline and Energy

Transfer Crude Oil Pipeline projects, which provide integration

opportunities with our Beaumont Terminal. We are executing our

Midstream growth strategy with increasing momentum," said

Garland.

Midstream

Midstream earnings were $115 million in the third quarter,

compared with earnings of $108 million in the second quarter of

2014.

Phillips 66’s Transportation business generated earnings of $58

million during the third quarter, in line with earnings of $60

million in the second quarter of 2014. Third-quarter earnings

related to the company’s equity investment in DCP Midstream, LLC

were $31 million, comparable with $33 million in the second quarter

of 2014.

Earnings from the NGL business were $26 million in the third

quarter, compared with $15 million in the second quarter of 2014.

The increase was primarily related to improved margins and higher

equity earnings from the ramp up of throughput volumes on the Sand

Hills and Southern Hills pipelines.

Chemicals

The Chemicals segment reflects Phillips 66's equity investment

in Chevron Phillips Chemical Company LLC (CPChem). Third-quarter

Chemicals earnings were $230 million and adjusted earnings were

$299 million. This compares with earnings of $324 million in the

second quarter of 2014.

During the third quarter, CPChem's Olefins and Polyolefins

(O&P) business contributed $254 million to Phillips 66's

Chemicals earnings. O&P's adjusted earnings contribution was

$259 million, compared with $310 million in the second quarter of

2014. The decrease was mainly due to an ethylene outage at CPChem's

Port Arthur plant from a localized fire in July. Global utilization

for O&P was 83 percent during the quarter.

CPChem's Specialties, Aromatics and Styrenics (SA&S)

business contributed a loss of $18 million to third-quarter

earnings, including asset impairments of $64 million. SA&S's

adjusted earnings contribution was $46 million during the third

quarter, an increase of $25 million from the second quarter of

2014, primarily driven by lower turnaround activity.

Refining

Refining recorded earnings of $558 million in the third quarter,

compared with earnings of $390 million in the second quarter of

2014. The increase was primarily attributable to improved realized

refining margins, which included capturing crude location

differentials. Margins improved, despite lower worldwide market

crack spreads, primarily due to higher clean product realizations.

Additionally, secondary product margins benefited from lower crude

oil prices.

During the quarter, a record 95 percent of the company's U.S.

crude slate was advantaged, compared with 93 percent in the second

quarter. Worldwide, Phillips 66’s refining utilization and clean

product yield were 94 percent and 84 percent, respectively, in the

third quarter of 2014.

Marketing and Specialties

Marketing and Specialties (M&S) third-quarter earnings were

$368 million and adjusted earnings were $259 million. This compares

with earnings of $162 million during the second quarter of

2014.

Earnings from Marketing and Other were $325 million in the third

quarter, which included the expected partial recognition of the

deferred gain from the sale of a power plant in July 2013. Adjusted

earnings were $216 million, an increase of $97 million compared

with earnings in the second quarter of 2014. The business benefited

from higher global marketing margins, primarily due to the steady

decline of product costs associated with falling crude oil prices

during the quarter. Third-quarter refined product exports were

129,000 barrels per day (BPD), a reduction from 181,000 BPD in the

second quarter of 2014, reflecting more favorable placement in the

domestic market.

Phillips 66’s Specialties businesses generated earnings of $43

million during the third quarter, in line with second-quarter 2014

earnings.

Corporate and Other

Corporate and Other costs were $91 million after-tax in the

third quarter, compared with $121 million in the second quarter of

2014. The decreased costs were mostly due to effective tax rate

changes, as well as timing of contributions and environmental

expenses.

The company's effective tax rate was 31 percent and its adjusted

effective tax rate was 33 percent for the third quarter, compared

with 36 percent in the second quarter of 2014.

Financial Position, Liquidity and Return of Capital

During the quarter, Phillips 66 generated $429 million of cash

from operations. Excluding $828 million of working capital changes,

operating cash flow was $1.3 billion. Working capital changes

mainly reflect the impact of temporary inventory builds during the

quarter. The company funded $1.5 billion in capital expenditures

and investments, primarily reflecting growth in its Midstream

segment.

Consistent with the company's commitment to return capital to

shareholders, Phillips 66 returned $771 million in the third

quarter through dividends and share repurchases. The company paid

$277 million in dividends and repurchased six million shares of

common stock for $494 million. Since August 2012, the company has

repurchased 66 million shares for $4.4 billion, as part of $7

billion in share repurchase authorizations. In addition, the

company received 17.4 million shares in exchange for its flow

improver business earlier this year. Phillips 66 ended the quarter

with 554 million shares outstanding.

As of Sept. 30, 2014, cash and cash equivalents were $3.1

billion and debt was $6.2 billion. The company's debt-to-capital

ratio was 22 percent. Additionally, Phillips 66 reported a

year-to-date annualized return on capital employed (ROCE) of 18

percent, and a year-to-date annualized adjusted ROCE of 14

percent.

Strategic Update

Phillips 66 is continuing to grow its more highly valued

businesses, while enhancing refining returns. The company's

Midstream segment is pursuing multiple growth opportunities to

further integrate its portfolio and benefit from increasing

production in North America.

Phillips 66 recently announced its participation in two joint

ventures to develop the Dakota Access Pipeline (DAPL) and Energy

Transfer Crude Oil Pipeline (ETCOP). Phillips 66 owns 25 percent

interests in both projects and its estimated share of construction

cost is approximately $1.2 billion. DAPL is expected to deliver

450,000 BPD of crude oil from the Bakken/Three Forks production

area in North Dakota to market centers in the Midwest. ETCOP will

provide crude oil transportation service from the Midwest to the

Gulf Coast, including Phillips 66's Beaumont Terminal. The DAPL and

ETCOP projects are expected to begin commercial operations in the

fourth quarter of 2016.

In support of its advantaged crude oil strategy, the company

ordered an additional 500 rail cars during the quarter and began

operations at its 75,000 BPD rail rack at the Bayway Refinery. The

30,000 BPD rail rack at the Ferndale Refinery is expected to begin

operations in the fourth quarter of 2014. In addition, Phillips 66

is constructing a rail-loading facility on land recently acquired

in North Dakota. The facility is expected to have up to 200,000 BPD

of capacity and further expand Phillips 66 and third-party access

to Bakken crude oil.

As recently announced, Phillips 66 Partners LP will acquire the

new rail-unloading facilities at Bayway and Ferndale, as well as

the Cross-Channel Connector Pipeline, from Phillips 66. The $340

million transaction is anticipated to close in early December

2014.

Construction continued on the Sweeny Fractionator One and

Freeport LPG Export Terminal, with startup expected in the second

half of 2015 and second half of 2016, respectively. The company

also plans to develop a second NGL fractionator and a crude and

condensate pipeline in Texas to meet growing demand for domestic

crude oil and global market demand for U.S.-supplied products. In

addition, the company is considering condensate processing options

to meet customer demand.

The proposed 110,000 BPD Sweeny Fractionator Two will be located

near the company’s Sweeny Refinery and Sweeny Fractionator One. The

planned crude and condensate pipeline will connect Eagle Ford

production to the Sweeny Refinery and Phillips 66’s terminal in

Freeport, Texas. The pipeline, including gathering systems, will

have an initial capacity of 200,000 BPD with the capability to

expand to over 400,000 BPD.

The pipeline and Sweeny Fractionator Two projects are currently

in the engineering design and permitting phase. Final investment

decision for both projects is anticipated in mid-2015, with startup

planned for late 2016 for the pipeline and 2017 for Sweeny

Fractionator Two.

CPChem is investing in domestic growth projects to realize the

benefits of low-cost petrochemical feedstocks in the U.S. Gulf

Coast (USGC). Construction continued on its world-scale USGC

Petrochemicals Project consisting of an ethane cracker and related

polyethylene facilities, with startup anticipated in 2017. In

addition, the ethylene production expansion project to add a tenth

furnace at CPChem's Sweeny facility is expected to start up in the

fourth quarter of 2014.

Later today, Phillips 66 Chairman and Chief Executive Officer

Greg Garland; President Tim Taylor; and Executive Vice President

and Chief Financial Officer Greg Maxwell will host a webcast at 11

a.m. EDT to discuss the company’s third-quarter performance and

provide an update on strategic growth projects. To listen to the

conference call and view related presentation materials, go to

www.phillips66.com/investors and click on "Events &

Presentations." For detailed supplemental information, go to

www.phillips66.com/supplemental.

Earnings

Millions of Dollars

2014 2013

SecondQuarter

ThirdQuarter

NineMonths

ThirdQuarter

NineMonths

Midstream $ 108 $ 115 $ 411 $ 147 $ 348 Chemicals 324 230 870 262

725 Refining 390 558 1,254 (30 ) 1,329 Marketing and Specialties

162 368 667 255 789 Corporate and Other (121 ) (91 ) (293 ) (113 )

(334 ) Discontinued Operations

-

-

706 14 43

Phillips

66 $ 863 $

1,180 $ 3,615 $

535 $ 2,900

Adjusted

Earnings

Millions of Dollars 2014 2013

SecondQuarter

ThirdQuarter

NineMonths

ThirdQuarter

NineMonths

Midstream $ 108 $ 115 $ 411 $ 147 $ 348 Chemicals 324 299 939 262

725 Refining 390 558 1,254 (30 ) 1,316 Marketing and Specialties

162 259 558 255 780 Corporate and Other (121 ) (91 )

(293 ) (113 ) (334 )

Phillips 66

$ 863 $ 1,140

$ 2,869 $ 521

$ 2,835

About Phillips 66

Built on more than 130 years of experience, Phillips 66 is a

growing energy manufacturing and logistics company with

high-performing Midstream, Chemicals, Refining, and Marketing and

Specialties businesses. This integrated portfolio enables Phillips

66 to capture opportunities in the changing energy landscape.

Headquartered in Houston, the company has 14,000 employees who are

committed to operating excellence and safety. Phillips 66 had $50

billion of assets as of Sept. 30, 2014. For more information, visit

www.phillips66.com or follow us on Twitter @Phillips66Co.

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE

"SAFE HARBOR" PROVISIONSOF THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

This news release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbors

created thereby. Words and phrases such as “is anticipated,” “is

estimated,” “is expected,” “is planned,” “is scheduled,” “is

targeted,” “believes,” “intends,” “objectives,” “projects,”

“strategies” and similar expressions are used to identify such

forward-looking statements. However, the absence of these words

does not mean that a statement is not forward-looking.

Forward-looking statements relating to Phillips 66’s operations

(including joint venture operations) are based on management’s

expectations, estimates and projections about the company, its

interests and the energy industry in general on the date this news

release was prepared. These statements are not guarantees of future

performance and involve certain risks, uncertainties and

assumptions that are difficult to predict. Therefore, actual

outcomes and results may differ materially from what is expressed

or forecast in such forward-looking statements. Factors that could

cause actual results or events to differ materially from those

described in the forward-looking statements include fluctuations in

crude oil, NGL, and natural gas prices, and refining and

petrochemical margins; unexpected changes in costs for

constructing, modifying or operating our facilities; unexpected

difficulties in manufacturing, refining or transporting our

products; lack of, or disruptions in, adequate and reliable

transportation for our crude oil, natural gas, NGL, and refined

products; potential liability from litigation or for remedial

actions, including removal and reclamation obligations under

environmental regulations; limited access to capital or

significantly higher cost of capital related to illiquidity or

uncertainty in the domestic or international financial markets; and

other economic, business, competitive and/or regulatory factors

affecting Phillips 66’s businesses generally as set forth in our

filings with the Securities and Exchange Commission. Phillips 66 is

under no obligation (and expressly disclaims any such obligation)

to update or alter its forward-looking statements, whether as a

result of new information, future events or otherwise.

Use of Non-GAAP Financial Information -- This news

release includes the terms adjusted earnings, adjusted earnings per

share, adjusted effective tax rate, operating cash flow excluding

working capital, and adjusted ROCE. These are non-GAAP financial

measures that are included to help facilitate comparisons of

company operating performance across periods.

References in the release to earnings refer to net income

attributable to Phillips 66.

Prior period results have been recast to reflect realignment of

certain businesses between segments and business lines. Within the

Midstream segment, certain NGL pipelines were moved from the

Transportation business to the NGL business. Sales commissions for

specialty coke, polypropylene and solvents businesses are recorded

in the M&S segment. Certain joint ventures, such as a base oil

business, were moved from the Refining segment to the M&S

segment.

Millions of Dollars

Except as Indicated

2014 2013 2Q

3Q Sep YTD 3Q Sep YTD

Reconciliation of Earnings to Adjusted Earnings

Consolidated Earnings $ 863 $

1,180 $ 3,615 $ 535 $

2,900 Adjustments: Gain on asset dispositions

-

(109 ) (109 )

-

(23

)

Impairments

-

69 69

-

-

Pending claims and settlements

-

-

-

-

(16

)

Exit of a business line

-

-

-

-

34 Tax law impacts

-

-

-

-

(17

)

Discontinued operations

-

-

(706 ) (14 ) (43

)

Adjusted earnings $ 863

$ 1,140 $ 2,869

$ 521 $ 2,835

Earnings per share of common stock (dollars)

$ 1.51 $ 2.09 $ 6.28

$ 0.87 $ 4.65 Adjusted

earnings per share of common stock (dollars) $

1.51 $ 2.02

$ 4.98 $ 0.85

$ 4.54 Chemicals

Earnings $ 324 $ 230 $

870 $ 262 $ 725 Adjustments:

Impairments

-

69 69

-

-

Adjusted earnings $ 324

$ 299 $ 939

$ 262 $ 725

Refining Earnings (loss) $

390 $ 558 $ 1,254 $

(30 ) $ 1,329 Adjustments: Tax law

impacts

-

-

-

-

(13

)

Adjusted earnings $ 390

$ 558 $ 1,254

$ (30 ) $ 1,316

Marketing and Specialties Earnings

$ 162 $ 368 $ 667

$ 255 $ 789 Adjustments: Gain on asset

dispositions

-

(109 ) (109 )

-

(23

)

Pending claims and settlements

-

-

-

-

(16

)

Exit of a business line

-

-

-

-

34 Tax law impacts

-

-

-

-

(4

)

Adjusted earnings $ 162

$ 259 $ 558

$ 255 $ 780

Millions ofDollars

3Q 2014 Cash Flows from Operating Activities

Net Cash Provided by Operating Activities, excluding

working capital $ 1,257 Changes in working

capital (828 )

Net Cash Provided by Operating

Activities $ 429

Millions ofDollars

2014 YTD Phillips 66 - ROCE Numerator Net

income $ 3,639 After-tax interest expense

126 GAAP ROCE earnings 3,765 Special items

(746 )

Adjusted ROCE earnings $

3,019 Denominator GAAP average

capital employed* $ 28,477 Discontinued

operations (96 )

Adjusted average capital

employed $ 28,381

Annualized Adjusted ROCE (percent) 14 %

Annualized GAAP ROCE (percent) 18

% *Total equity plus total debt.

Millions ofDollars

3Q 2014 Effective Tax Rates Income before

taxes $ 1,727 Special items (21 )

Adjusted income

before taxes $ 1,706

Provision for taxes $ 538 Special items 19

Adjusted provision for taxes $ 557

GAAP effective tax rate (percent) 31

% Adjusted effective tax rate (percent)

33 %

Phillips 66Dennis Nuss, 832-765-1850

(media)dennis.h.nuss@p66.comorRosy Zuklic, 832-765-2297

(investors)rosy.zuklic@p66.com

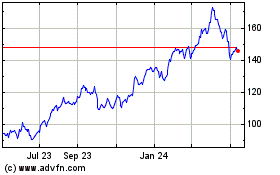

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Dec 2024 to Jan 2025

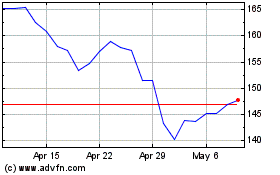

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Jan 2024 to Jan 2025