Sales

Revenues

|

US$

million

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Diesel

|

17,480

|

10,241

|

70.7

|

|

Gasoline

|

8,148

|

4,518

|

80.3

|

|

Liquefied

petroleum gas (LPG)

|

3,327

|

2,461

|

35.2

|

|

Jet

fuel

|

1,456

|

1,113

|

30.8

|

|

Naphtha

|

1,219

|

1,364

|

(10.6)

|

|

Fuel

oil (including bunker fuel)

|

1,268

|

540

|

134.8

|

|

Other

oil by-products

|

3,080

|

1,915

|

60.8

|

|

Subtotal

Oil By-Products

|

35,978

|

22,152

|

62.4

|

|

Natural

gas

|

4,086

|

2,692

|

51.8

|

|

Renewables

and nitrogen products

|

34

|

45

|

(24.4)

|

|

Revenues

from non-exercised rights

|

200

|

368

|

(45.7)

|

|

Electricity

|

2,172

|

466

|

366.1

|

|

Services,

agency and others

|

648

|

594

|

9.1

|

|

Total

domestic market

|

43,118

|

26,317

|

63.8

|

|

Exports

|

16,103

|

12,308

|

30.8

|

|

Crude

oil

|

11,642

|

9,171

|

26.9

|

|

Fuel

oil (including bunker fuel)

|

3,624

|

2,551

|

42.1

|

|

Other

oil by-products and other products

|

837

|

586

|

42.8

|

|

Sales

abroad *

|

714

|

1,147

|

(37.8)

|

|

Total

foreign market

|

16,817

|

13,455

|

25.0

|

|

Total

|

59,935

|

39,772

|

50.7

|

|

* Sales

revenues from operations outside of Brazil, including trading and excluding exports.

|

|

|

|

Sales

revenues were US$ 59,935 million for the period Jan-Sep/2021, a 50.7% increase (US$ 20,163 million) when compared to US$ 39,772 million

for the period Jan-Sep/2020, mainly due to:

|

|

(i)

|

a

US$ 13,826 million increase in domestic oil product revenues, of which US$ 11,752 relates

to increase in average Brent prices, and US$ 2,074 relates to increase in volume; and

|

|

|

(ii)

|

a

US$ 2,471 million increase in crude oil revenues, of which US$ 4,037 million relates to increase

in average Brent prices, which was partially offset by US$ 1,566 million related to decrease

in volume.

|

Cost

of Sales

|

US$ million

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Raw

material, products for resale, materials and third-party services *

|

(13,505)

|

(9,487)

|

42.3

|

|

Depreciation,

depletion and amortization

|

(6,770)

|

(7,237)

|

(6.4)

|

|

Production

taxes

|

(7,962)

|

(4,386)

|

81.5

|

|

Employee

compensation

|

(1,475)

|

(1,701)

|

(13.3)

|

|

Total

|

(29,712)

|

(22,811)

|

30.3

|

* It includes

short-term leases and inventory turnover.

Cost

of sales was US$ 29,712 million for the period Jan-Sep/2021, an 30.3% increase (US$ 6,901 million) when compared to US$ 22,811 million

for the period Jan-Sep/2020, mainly due to:

|

|

•

|

higher

sales volumes of domestic oil by-products; and

|

|

|

•

|

higher

production taxes due to higher Brent prices.

|

Income

(Expenses)

|

US$ million

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Selling

expenses

|

(3,137)

|

(3,756)

|

(16.5)

|

|

General

and administrative expenses

|

(870)

|

(1,011)

|

(13.9)

|

|

Exploration

costs

|

(538)

|

(437)

|

23.1

|

|

Research

and development expenses

|

(415)

|

(255)

|

62.7

|

|

Other

taxes

|

(369)

|

(761)

|

(51.5)

|

|

Impairment

of assets

|

2,918

|

(13,358)

|

-

|

|

Other

income and expenses, net

|

(550)

|

(280)

|

96.4

|

|

Total

|

(2,961)

|

(19,858)

|

(85.1)

|

Selling

expenses were US$ 3,137 million for the period Jan-Sep/2021, a 16.5% decrease (US$ 619 million) compared to US$ 3,756 million for the

period Jan-Sep/2020, led by lower shipping costs and lower exported volume, partially offset by an increase in logistics expenses related

to natural gas, whose contracts were readjusted at the end of the last quarter of 2020.

General

and administrative expenses were US$ 870 million for the period Jan-Sep/2021, a 13.9% decrease (US$ 141 million) compared to US$

1,011 million for the period Jan-Sep/2020, mainly due to the depreciation of Brazilian reais against the US dollars, lower employee expenses

due to reduction of headcount, optimization and lower expenses with consulting services.

Impairment

reversal of US$ 2,918 million for the period Jan-Sep/2021 represent an increase of US$ 16,276 million over the expenses of US$ 13,358

million for the period Jan-Sep/2020, mainly due to brent price increase in the current period as compared to the prior period which had

resulted in a revision in the Brent price assumptions at the outbreak of the Covid-19 pandemic.

Net finance

income (expense)

|

US$

million

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Finance

income

|

555

|

406

|

36.7

|

|

Income

from investments and marketable securities (Government Bonds)

|

174

|

166

|

4.8

|

|

Other

income, net

|

381

|

240

|

58.8

|

|

Finance

expenses

|

(4,270)

|

(4,570)

|

(6.6)

|

|

Interest

on finance debt

|

(2,325)

|

(2,825)

|

(17.7)

|

|

Unwinding

of discount on lease liabilities

|

(895)

|

(994)

|

(10.0)

|

|

Discount

and premium on repurchase of debt securities

|

(1,098)

|

(783)

|

40.2

|

|

Capitalized

borrowing costs

|

747

|

707

|

5.7

|

|

Unwinding

of discount on the provision for decommissioning costs

|

(579)

|

(499)

|

16.0

|

|

Other

finance expenses and income, net

|

(120)

|

(176)

|

(31.8)

|

|

Foreign

exchange gains (losses) and indexation charges

|

(4,767)

|

(6,830)

|

(30.2)

|

|

Foreign

exchange gains (losses)

|

(1,956)

|

(5,127)

|

(61.8)

|

|

Reclassification

of hedge accounting to the Statement of Income

|

(3,339)

|

(3,586)

|

(6.9)

|

|

Recoverable

taxes inflation indexation income *

|

489

|

1,861

|

(73.7)

|

|

Other

foreign exchange gains (losses) and indexation charges, net

|

39

|

22

|

77.3

|

|

Total

|

(8,482)

|

(10,994)

|

(22.8)

|

* Includes

PIS and COFINS inflation indexation income - exclusion of ICMS (VAT tax) from the basis of calculation.

Net finance

expenses were US$ 8,482 million for the period Jan-Sep/2021, a 22.8% decrease (US$ 2,512 million) compared to the expense of US$ 10,994

million for the period Jan-Sep/2020, due a decrease in foreign exchange losses mainly due to fluctuations of the Brazilian real over

the US dollar (US$ 3,171 million), and lower interest on finance debt (US$ 500 million). This movement was partially offset by lower

inflation indexation income on recoverable taxes (US$ 1,372 million decrease), and higher premium on repurchase of debt securities (US$

315 million increase).

Income

tax expenses

Income

tax presented a US$ 5,970 million expense for the period Jan-Sep/2021, a US$ 9,869 million increase compared to a US$ 3,899 million net

benefit for the period Jan-Sep/2020, mainly due to the net income before income taxes in the period Jan-Sep/2021 compared to the loss

before income taxes in the comparative period.

Net Income

(loss) attributable to shareholders of Petrobras

Net income

(loss) attributable to shareholders of Petrobras presented a US$ 14,310 million net income for the period Jan-Sep/2021, a US$ 24,979

million increase compared to a US$ 10,669 million net loss for the period Jan-Sep/2020, mainly due to the impairment losses recognized

in Jan-Sep/2020, impairment reversal in Jan-Sep/2021, and business performance improvement, led by higher oil prices, increased margins

and sales volumes.

CAPITAL

EXPENDITURES (CAPEX)

Capital

expenditures, or CAPEX, based on the cost assumptions and financial methodology adopted in our strategic plans, which includes acquisition

of intangible assets and property, plant and equipment, investment in investees and other items that do not necessarily qualify as cash

flows used in investing activities, comprising geological and geophysical expenses, research and development expenses, pre-operating

charges, purchase of property, plant and equipment on credit and borrowing costs directly attributable to works in progress.

|

CAPEX

(US$ million)

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Exploration

and Production

|

5,030

|

5,038

|

(0.2)

|

|

Refining,

Transportation & Marketing

|

673

|

593

|

13.5

|

|

Gas

and Power

|

252

|

270

|

(6.7)

|

|

Corporate

and other businesses

|

186

|

108

|

72.2

|

|

Total

|

6,140

|

6,008

|

2.2

|

We

invested a total of US$ 6,140 million in the period Jan-Sep/2021, of which 81.9% was in the E&P segment, a 2.2% increase when

compared to our Capital Expenditures of US$ 6,008 million in the period Jan-Sep/2020. In line with our Strategic Plan, our Capital

Expenditures were primarily directed toward investment projects in which Management believes are most profitable, relating to oil and

gas production.

In

Jan-Sep/2021, investments in the E&P segment totaled US$ 5.0 billion, mainly concentrated on: (i) the development of ultra-deep

water production in the Santos Basin pre-salt complex (US$ 0.6 billion); (ii) development of new projects in deep water (US$ 0.1

billion); and (iii) exploratory investments (US$ 0.2 billion).

LIQUIDITY AND CAPITAL

RESOURCES

|

US$ million

|

Jan-Sep/2021

|

Jan-Sep/2020

|

|

Adjusted

Cash and Cash Equivalents at the beginning of period

|

12,384

|

8,265

|

|

Government

bonds and time deposits with maturities of more than 3 months at the beginning of period *

|

(659)

|

(888)

|

|

Cash

and cash equivalents at the beginning of period

|

11,725

|

7,377

|

|

Net

cash provided by operating activities

|

28,595

|

21,818

|

|

Acquisition

of PP&E and intangibles assets

|

(4,640)

|

(4,486)

|

|

Investments

in investees

|

(15)

|

(941)

|

|

Proceeds

from disposal of assets – (Divestments)

|

2,906

|

1,038

|

|

Financial

compensation for the Búzios co-participation agreement

|

2,938

|

-

|

|

Dividends

received

|

294

|

201

|

|

Divestment

(Investment) in marketable securities

|

117

|

(5)

|

|

Net

cash provided by (used in) investing activities

|

1,600

|

(4,193)

|

|

(=)

Net cash provided by operating and investing activities

|

30,195

|

17,625

|

|

Proceeds

from finance debt

|

1,754

|

15,897

|

|

Repayments

of finance debt

|

(22,360)

|

(22,256)

|

|

Net

change in finance debt

|

(20,606)

|

(6,359)

|

|

Repayment

of lease liability

|

(4,381)

|

(4,371)

|

|

Dividends

paid to shareholders of Petrobras

|

(5,828)

|

(1,020)

|

|

Dividends

paid to non-controlling interest

|

(75)

|

(38)

|

|

Investments

by non-controlling interest

|

(11)

|

(64)

|

|

Net

cash used in financing activities

|

(30,901)

|

(11,852)

|

|

Effect

of exchange rate changes on cash and cash equivalents

|

(94)

|

(446)

|

|

Cash

and cash equivalents at the end of period

|

10,925

|

12,704

|

|

Government

bonds and time deposits with maturities of more than 3 months at the end of period *

|

537

|

670

|

|

Adjusted

Cash and Cash Equivalents at the end of period

|

11,462

|

13,374

|

|

|

|

|

|

Reconciliation

of Free Cash Flow

|

|

|

|

Net

cash provided by operating activities

|

28,595

|

21,818

|

|

Acquisition

of PP&E and intangibles assets

|

(4,640)

|

(4,486)

|

|

Investments

in investees **

|

(15)

|

(941)

|

|

Free

Cash Flow

|

23,940

|

16,391

|

* Includes

short-term government bonds and time deposits and cash and cash equivalents of companies classified as held for sale.

**

In accordance with the Shareholders’ remuneration policy, the additions (reductions) in investments shall not be considered in

the calculation.

As

of September 30, 2021, the balance of Cash and cash equivalents was US$ 10,925 million and Adjusted Cash and Cash Equivalents totaled

US$ 11,462 million.

The

nine-month period ended September 30, 2021 had net cash provided by operating activities of US$ 28,595 million, proceeds from disposal

of assets (divestments) of US$ 2,906 million, financial compensation for the Búzios co-participation agreement of US$ 2,938

million and proceeds from financing of US$ 1,754 million. Those resources were allocated to debt prepayments and to amortizations

of principal and interest due in the period of US$ 22,360 million, repayment of lease liability of US$ 4,381 million and to

acquisition of PP&E and intangibles assets of US$ 4,640 million.

The

Company repaid several finance debts, in the amount of US$ 22,360 million notably: (i) prepayment of banking loans in the domestic and

international market totaling US$ 6,344 million; (ii) US$ 9,617 million to repurchase and withdraw global bonds previously issued by

the Company in the capital market, with net premium paid to bond holders amounting to US$ 1,095 million; and (iii) total prepayment of

US$ 593 million for loans from development agencies.

The

Company raised US$ 1,442 million through bonds issued in the international capital market (Global Notes) maturing in 2051.

CONSOLIDATED DEBT

|

Debt

(US$ million)

|

09.30.2021

|

12.31.2020

|

Change

(%)

|

|

Capital

Markets

|

22,213

|

30,137

|

(26.3)

|

|

Banking

Market

|

10,524

|

18,597

|

(43.4)

|

|

Development

banks

|

813

|

1,516

|

(46.4)

|

|

Export

Credit Agencies

|

2,972

|

3,424

|

(13.2)

|

|

Others

|

194

|

214

|

(9.3)

|

|

Finance

debt

|

36,716

|

53,888

|

(31.8)

|

|

Lease

liabilities

|

22,872

|

21,650

|

5.6

|

|

Gross

Debt

|

59,588

|

75,538

|

(21.1)

|

|

Adjusted

Cash and Cash Equivalents

|

11,456

|

12,370

|

(7.4)

|

|

Net

Debt

|

48,132

|

63,168

|

(23.8)

|

|

Leverage:

Net Debt/(Net Debt + Shareholders' Equity)

|

41%

|

51%

|

(19.6)

|

|

Average

interest rate (% p.a.)

|

6.0

|

5.9

|

1.7

|

|

Weighted

average maturity of outstanding debt (years)

|

13.50

|

11.71

|

15.3

|

The

cash flow generation and continuous liability management allowed a significant reduction in our indebtedness. Gross debt decreased 21.1%

(US$ 15,950 million) to US$ 59,588 million on September 30, 2021 from US$ 75,538 million on December 31, 2020. Gross debt

was lower than the US$ 60,000 target established for 2021 and 2022, mainly due to debt prepayments.

Net

debt was reduced by 23.8% (US$ 15,036 million), reaching US$ 48,132 million on September 30, 2021, compared to US$ 63,168 million on

December 31, 2020.

In

addition, our liability management strategy, which involved the issuance of new long-term debt and the payment of debt due in the shorter

term, helped increase the weighted average maturity of outstanding debt to 13.50 years as of September 30, 2021 from 11.71 years as of

December 31, 2020.

RECONCILIATION

OF LTM ADJUSTED EBITDA, GROSS DEBT/ LTM ADJUSTED EBITDA AND NET DEBT/LTM ADJUSTED EBITDA METRICS

LTM

Adjusted EBITDA reflects the sum of the last twelve months of Adjusted EBITDA, which is computed by using the EBITDA (net income before

net finance income (expense), income taxes, depreciation, depletion and amortization) adjusted by items not considered part of the Company’s

primary business, which include results in equity-accounted investments, reclassification of comprehensive income (loss) due to the disposal

of equity-accounted investments, results from disposal and write-offs of assets and on remeasurement of investment retained with loss

of control, impairment and results from co-participation agreements in bid areas.

LTM Adjusted

EBITDA represents an alternative to the company's operating cash generation. This measure is used to calculate the metrics Gross Debt/LTM

Adjusted EBITDA and Net Debt/LTM Adjusted EBITDA, to support management’s assessment of liquidity and leverage.

Adjusted

EBITDA

|

US$

million

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Net

income (loss)

|

14,310

|

(10,669)

|

-

|

|

Net

finance income (expense)

|

8,482

|

10,994

|

(22.8)

|

|

Income

taxes

|

5,970

|

(3,899)

|

-

|

|

Depreciation,

depletion and amortization

|

8,786

|

9,209

|

(4.6)

|

|

EBITDA

|

37,548

|

5,635

|

566.3

|

|

Results

in equity-accounted investments

|

(1,500)

|

677

|

-

|

|

Impairment

|

(2,918)

|

13,358

|

-

|

|

Reclassification

of comprehensive income (loss) due to the disposal of equity-accounted investments

|

41

|

43

|

(4.7)

|

|

Results

on disposal/write-offs of assets and on remeasurement of investment retained with loss of control

|

(225)

|

(133)

|

69.2

|

|

Results

from co-participation agreements in bid areas

|

(667)

|

-

|

-

|

|

Adjusted

EBITDA

|

32,279

|

19,580

|

64.9

|

LTM

Adjusted EBITDA

|

|

US$

million

|

|

|

Last

twelve months (LTM) at

|

|

|

|

|

|

|

09.30.2021

|

12.31.2020

|

4Q-2020

|

1Q-2021

|

2Q-2021

|

3Q-2021

|

|

Net income

(loss)

|

25,927

|

948

|

11,617

|

200

|

8,156

|

5,954

|

|

Net finance

(expense) income

|

7,118

|

9,630

|

(1,364)

|

5,639

|

(2,019)

|

4,862

|

|

Income

taxes

|

8,695

|

(1,174)

|

2,725

|

319

|

3,784

|

1,867

|

|

Depreciation,

depletion and amortization

|

11,022

|

11,445

|

2,236

|

2,856

|

2,822

|

3,108

|

|

EBITDA

|

52,762

|

20,849

|

15,214

|

9,014

|

12,743

|

15,791

|

|

Results

in equity-accounted investments

|

(1,518)

|

659

|

(18)

|

(183)

|

(1,026)

|

(291)

|

|

Impairment

|

(8,937)

|

7,339

|

(6,019)

|

90

|

90

|

(3,098)

|

|

Reclassification

of comprehensive income (loss) due to the disposal of equity-accounted investments

|

41

|

43

|

−

|

34

|

-

|

7

|

|

Results

on disposal/write-offs of assets and on remeasurement of investment retained with loss of control

|

(589)

|

(499)

|

(366)

|

(49)

|

(56)

|

(118)

|

|

Results

from co-participation agreements in bid areas

|

(667)

|

-

|

-

|

-

|

-

|

(667)

|

|

Adjusted

EBITDA

|

41,092

|

28,391

|

8,811

|

8,906

|

11,751

|

11,624

|

|

Income

taxes

|

(8,695)

|

1,174

|

(2,725)

|

(319)

|

(3,784)

|

(1,867)

|

|

Allowance

(reversals) for credit loss on trade and other receivables

|

6

|

144

|

20

|

(15)

|

11

|

(10)

|

|

Trade and

other receivables, net

|

(1,417)

|

1

|

70

|

(128)

|

(607)

|

(752)

|

|

Inventories

|

(2,182)

|

724

|

(18)

|

(1,973)

|

394

|

(585)

|

|

Trade payables

|

895

|

216

|

45

|

616

|

(276)

|

510

|

|

Deferred

income taxes, net

|

6,441

|

(1,743)

|

2,443

|

200

|

3,683

|

115

|

|

Taxes payable

|

4,742

|

2,914

|

1,237

|

977

|

1,367

|

1,161

|

|

Others

|

(5,215)

|

(2,931)

|

(2,811)

|

(1,020)

|

(1,716)

|

332

|

|

Net

cash provided by operating activities - OCF

|

35,667

|

28,890

|

7,072

|

7,244

|

10,823

|

10,528

|

Gross

Debt/LTM Adjusted EBITDA and Net Debt/LTM Adjusted EBITDA Metrics

The

Gross Debt/LTM Adjusted EBITDA ratio and Net debt/LTM Adjusted EBITDA ratio are important metrics that support our management in assessing

the liquidity and leverage of Petrobras Group. These ratios are important measures for management to assess the Company’s ability

to pay off its debt, mainly because Gross Debt became a Top Metric as identified in our Strategic Plan 2021-2025.

The

following table presents the reconciliation for those metrics to the most directly comparable measure derived from IFRS captions, which

is in this case the Gross Debt Net of Cash and Cash Equivalents/Net Cash provided by operating activities ratio:

|

|

US$

million

|

|

|

|

|

|

|

09.30.2021

|

12.31.2020

|

|

Cash and

cash equivalents

|

10,919

|

11,711

|

|

Government

securities and time deposits (maturity of more than three months)

|

537

|

659

|

|

Adjusted

Cash and Cash equivalents

|

11,456

|

12,370

|

|

Finance

debt

|

36,716

|

53,888

|

|

Lease liability

|

22,872

|

21,650

|

|

Current

and non-current debt - Gross Debt

|

59,588

|

75,538

|

|

Net

debt

|

48,132

|

63,168

|

|

Net

cash provided by operating activities - LTM OCF

|

35,667

|

28,890

|

|

Income

taxes

|

8,695

|

(1,174)

|

|

Allowance

(reversals) for impairment of trade and other receivables

|

(6)

|

(144)

|

|

Trade and

other receivables, net

|

1,417

|

(1)

|

|

Inventories

|

2,182

|

(724)

|

|

Trade payables

|

(895)

|

(216)

|

|

Deferred

income taxes, net

|

(6,441)

|

1,743

|

|

Taxes payable

|

(4,742)

|

(2,914)

|

|

Others

|

5,213

|

2,931

|

|

LTM

Adjusted EBITDA

|

41,090

|

28,391

|

|

Gross

debt net of cash and cash equivalents/LTM OCF ratio

|

1.36

|

2.21

|

|

Gross

debt/LTM Adjusted EBITDA ratio

|

1.45

|

2.66

|

|

Net

debt/LTM Adjusted EBITDA ratio

|

1.17

|

2.22

|

RESULTS

BY OPERATING BUSINESS SEGMENTS

Exploration

and Production (E&P)

Financial information

|

US$ million

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Sales

revenues

|

39,803

|

25,400

|

56.7

|

|

Gross

profit

|

22,661

|

11,331

|

100.0

|

|

Income

(Expenses)

|

2,728

|

(13,991)

|

-

|

|

Operating

income (loss)

|

25,389

|

(2,660)

|

-

|

|

Net

income (loss) attributable to the shareholders of Petrobras

|

16,847

|

(1,910)

|

-

|

|

Average

Brent crude (US$/bbl)

|

67.73

|

40.82

|

65.9

|

|

Sales

price – Brazil

|

|

|

|

|

Average

Crude oil (US$/bbl)

|

64.19

|

38.90

|

65.0

|

|

Production

taxes – Brazil

|

7,973

|

4,396

|

81.4

|

|

Royalties

|

4,080

|

2,448

|

66.7

|

|

Special

Participation

|

3,864

|

1,919

|

101.4

|

|

Retention

of areas

|

29

|

29

|

-

|

[1]

In the period

Jan-Sep/2021, the gross profit of E&P segment was US$ 22,661 million, an increase of 100.0% in relation to the period Jan-Sep/2020,

due to higher sales revenues, which reflect higher Brent prices.

The operating

income of US$25,389 million in the period Jan-Sep/2021 was mainly due to the increase in Brent prices and the lower expenses, reflecting

the reversal of impairment losses as a result of the revision of average short-term Brent price projections.

In the period

Jan-Sep/2021, the increase in production taxes was caused by the rise in Brent prices, in relation to the Jan-Sep/2020 period.

Operational information

|

Production

in thousand barrels of oil equivalent per day (mboed)

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Crude

oil, NGL and natural gas – Brazil

|

2,755

|

2,839

|

(3.0)

|

|

Crude

oil and NGL (mbbl/d)

|

2,231

|

2,310

|

(3.4)

|

|

Natural

gas (mboed)

|

524

|

529

|

(0.9)

|

|

Crude

oil, NGL and natural gas – Abroad

|

43

|

49

|

(12.2)

|

|

Total

(mboed)

|

2,798

|

2,888

|

(3.1)

|

Production

of crude oil, NGL and natural gas was 2,798 mboed in the period Jan-Sep/2021, representing a 3.1% reduction compared to Jan-Sep/2020,

due to platform hibernation in shallow water, divestments of fields concluded over 2020 and early 2021, in addition to the natural decline

in production, partially compensated by the start-up of the FPSO Carioca (Sépia field) and ramp up of platforms P-67 (Tupi field),

P-68 (Berbigão and Sururu field) and P-70 (Atapu field).

Refining, Transportation

and Marketing

Financial information

|

US$ million

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Sales

revenues

|

53,480

|

35,696

|

49.8

|

|

Gross

profit

|

6,632

|

2,527

|

162.4

|

|

Income

(Expenses)

|

(1,951)

|

(3,074)

|

(36.5)

|

|

Operating

income (loss)

|

4,681

|

(547)

|

-

|

|

Net

income attributable to the shareholders of Petrobras

|

3,972

|

(865)

|

-

|

|

Average

refining cost (US$ / barrel) – Brazil

|

1.64

|

1.78

|

(7.9)

|

|

Average

domestic basic oil products price (US$/bbl)

|

75.21

|

50.20

|

49.8

|

For

the period Jan-Sep/2021, Refining, Transportation and Marketing gross profit was US$ 4,105 million higher than in the period Jan-Sep/2020.

In Jan-Sep/2021 Brent prices appreciated which resulted in a higher gross profit margin as inventory was purchased at earlier, lower

prices. This effect was negative in Jan-Sep/2020 because of the strong reduction in Brent prices following the impact of the covid pandemic

on global demand.

The

operating income for the period Jan-Sep/2021 reflects higher gross profit and lower selling expenses, due to reduced international freight

prices and to reduced personnel expenses, due to the indemnity expenses related to the voluntary severance program recorded in 2020.

The

refining cost in the period Jan-Sep/2021 was US$ 1.64/bbl, 7.9% lower than in the period Jan-Sep/2020, due to the exchange rate variation

and to a reduction of personnel costs due to the indemnity expenses related to the voluntary severance program recorded in 2020.

Operational information

|

Thousand

barrels per day (mbbl/d)

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Total

production volume

|

1,832

|

1,805

|

1.5

|

|

Domestic

sales volume

|

1,792

|

1,630

|

9.9

|

|

Reference

feedstock

|

2,176

|

2,176

|

-

|

|

Refining

plants utilization factor (%)

|

81%

|

79%

|

2.5

|

|

Processed

feedstock (excluding NGL)

|

1,720

|

1,684

|

2.1

|

|

Processed

feedstock

|

1,758

|

1,730

|

1.6

|

|

Domestic

crude oil as % of total

|

92%

|

94%

|

(2.1)

|

Domestic

sales in the period Jan-Sep/2021 were 1,792 mbbl/d, an increase of 9.9% compared to Jan-Sep/2020, mainly due to the 21.2% growth in diesel

sales between periods due to the increase in demand for diesel following the economic recovery. Gasoline sales increased 18.7% between

the periods due to greater mobility in the period Jan-Sep/21 compared to the period Jan-Sep/2020, which included the start of the COVID-19

pandemic. Fuel oil sales increased by 67.6% driven by the increase in the thermoelectric demand.

Naphtha

had a 45.6 % reduction in sales volume in Jan-Sep/2021 compared to Jan-Sep/2020, due to the new contracts in force with Braskem, with

smaller committed amounts compared to the previous contract.

Total

production of oil products for the period Jan-Sep/2021 was 1,832 mbbl/d, 1.5% above Jan-Sep/2020. The main increases in volumes were

in diesel and gasoline production.

Processed

feedstock for the period Jan-Sep/2021 was 1,758 mbbl/d, with a utilization factor of 81%, 2.0% above Jan-Sep/2020.

Gas

and Power

Financial information

|

US$ million

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Sales

revenues

|

8,306

|

5,469

|

51.9

|

|

Gross

profit

|

2,648

|

2,753

|

(3.8)

|

|

Income

(expenses)

|

(2,183)

|

(1,840)

|

18.6

|

|

Operating

income (loss)

|

465

|

913

|

(49.1)

|

|

Net

income attributable to the shareholders of Petrobras

|

333

|

627

|

(46.9)

|

|

Average

natural gas sales price – Brazil (US$/bbl)

|

41.43

|

34.96

|

18.5

|

For

the period Jan-Sep/2021, the gross profit of the Gas and Power segment was US$ 2,648 million, a decrease of 3.8% when compared

to the period Jan-Sep/2020, mainly due to the increase in the gas acquisition costs, partially offset by higher power generation.

For

the period Jan-Sep/2021, the operating income was US$ 465 million, 49.1% lower than for the period Jan-Sep/2020, mainly due to lower

gross profit, higher sales expenses, despite the divestment made (remaining portion of NTS and sale of wind farms).

Operational information

|

|

Jan-Sep/2021

|

Jan-Sep/2020

|

Change

(%)

|

|

Sale

of Thermal Availability at Auction (ACR)- Average MW

|

2,458

|

2,404

|

2.2

|

|

Electricity

generation - average MW

|

3,383

|

1,192

|

183.8

|

|

National

gas delivered - million m³/day

|

43

|

45

|

(4.4)

|

|

Regasification

of liquefied natural gas - million m³/day

|

22

|

3

|

633.3

|

|

Import

of natural gas from Bolivia - million m³/day

|

20

|

17

|

17.6

|

|

Natural

gas sales - million m³/day

|

85

|

64

|

32.8

|

For

the period Jan-Sep/2021, the ACR sales increased by 2.2% when compared to the period Jan-Sep/2020, mainly due to the start of the new

contract for Ibirité Thermoelectric Power Plant (UTE Ibirité) in January 2021, whose sale took place in

the 2019 A-2 auction.

The

volume of electricity generation increased by 183.8% due to the decrease in the levels of hydroelectric plants reservoirs, which increases

the market demand for electricity from other sources, such as thermoelectric.

Higher

volume of natural gas sold to the thermoelectric sector, due to the increase in demand from our thermoelectric plants and other players,

resulted in higher need for supply through LNG regasification.

GLOSSARY

|

ACL

- Ambiente de Contratação Livre (Free contracting market) in the electricity system.

ACR

- Ambiente de Contratação Regulada (Regulated contracting market) in the electricity system.

Adjusted

Cash and Cash equivalents - Sum of cash and cash equivalents, government bonds and time deposits from highly rated financial institutions

abroad with maturities of more than 3 months from the date of acquisition, considering the expected realization of those financial investments

in the short-term. This measure is not defined under the International Financial Reporting Standards – IFRS and should not be considered

in isolation or as a substitute for cash and cash equivalents computed in accordance with IFRS. It may not be comparable to adjusted

cash and cash equivalents of other companies, however management believes that it is an appropriate supplemental measure to assess our

liquidity and supports leverage management.

Adjusted

EBITDA Net income plus net finance income (expense); income taxes; depreciation, depletion and amortization; results in equity-accounted

investments; impairment; reclassification of comprehensive income (loss) due to the disposal of equity-accounted investments; results

on disposal/write-offs of assets and on remeasurement of investment retained with loss of control; and results from co-participation

agreements in bid areas. Adjusted EBITDA is not a measure defined by IFRS and it is possible that it may not be comparable to similar

measures reported by other companies. However, management believes that it is an appropriate supplemental measure to assess our liquidity

and supports leverage management.

Adjusted

EBITDA Margin – Adjusted

EBITDA divided by Sales revenues.

ANP

- Brazilian National Petroleum, Natural Gas and Biofuels Agency.

Capital

Expenditures – Capital expenditures based on the cost assumptions and financial methodology adopted in our Business and Management

Plan, which include acquisition of PP&E, including expenses with leasing, intangibles assets, investment in investees and other items

that do not necessarily qualify as cash flows used in investing activities, primarily geological and geophysical expenses, research and

development expenses, pre-operating charges, purchase of property, plant and equipment on credit and borrowing costs directly attributable

to works in progress.

CTA

– Cumulative translation adjustment – The cumulative amount of exchange variation arising on translation of foreign operations

that is recognized in Shareholders’ Equity and will be transferred to profit or loss on the disposal of the investment.

EBITDA

- net income before net finance income (expense), income taxes, depreciation, depletion and amortization. EBITDA is not a measure

defined by IFRS and it is possible that it may not be comparable to similar measures reported by other companies. However, management

believes that it is an appropriate supplemental measure to assess our liquidity and supports leverage management.

Effect

of average cost in the Cost of Sales – In view of the average inventory term of 60 days, the crude oil and oil products international

prices movement, as well as foreign exchange effect over imports, production taxes and other factors that impact costs, do not entirely

influence the cost of sales in the current period, having their total effects only in the following period.

|

Free

Cash Flow - Net cash provided by operating activities less acquisition of PP&E, intangibles assets (except for signature bonus,

including the bidding for oil surplus of the Transfer of Rights Agreement, paid for obtaining concessions for exploration of crude oil

and natural gas) and investments in investees. Free cash flow is not defined under the IFRS and should not be considered in isolation

or as a substitute for cash and cash equivalents calculated in accordance with IFRS. It may not be comparable to free cash flow of other

companies. However, management believes that it is an appropriate supplemental measure to assess our liquidity and supports leverage

management.

Gross

Debt – Sum of current and non-current finance debt and lease liability, this measure is not defined under the IFRS. The global

adverse scenario encouraged the Company to revise its top metric relating to indebtedness, contained in the Strategic Plan 2020-2024,

replacing the Net debt / Adjusted EBITDA ratio with the Gross debt.

The

target approved for the Gross debt, in the scope of the Strategic Plan 2021-2025, is US$ 67 billion for 2021 and is US$ 60 billion

for 2022.

Leverage

– Ratio between the Net Debt and the sum of Net Debt and Shareholders’ Equity. Leverage is not a measure defined in the

IFRS and it is possible that it may not be comparable to similar measures reported by other companies, however management believes that

it is an appropriate supplemental measure to assess our liquidity.

Lifting

Cost - Crude oil and natural gas lifting cost indicator, which considers expenditures occurred in the period.

LTM

Adjusted EBITDA – Adjusted EBITDA for the last twelve months.

OCF

- Net Cash provided by (used in) operating activities (operating cash flow)

Operating

income (loss) - Net income (loss) before finance income (expense), results in equity-accounted investments and income taxes.

Net

Debt – Gross Debt less Adjusted Cash and Cash Equivalents. Net debt is not a measure defined in the IFRS and should not be

considered in isolation or as a substitute for total long-term debt calculated in accordance with IFRS. Our calculation of net debt may

not be comparable to the calculation of net debt by other companies. Management believes that net debt is an appropriate supplemental

measure that helps investors assess our liquidity and supports leverage management.

Results

by Business Segment – The information by the company's business segment is prepared based on available financial information

that is directly attributable to the segment or that can be allocated on a reasonable basis, being presented by business activities

used by the Executive Board to make resource allocation decisions and performance evaluation.

When

calculating segmented results, transactions with third parties, including jointly controlled and associated companies, and transfers

between business segments are considered. Transactions between business segments are valued at internal transfer prices calculated

based on methodologies that take into account market parameters, and these transactions are eliminated, outside the business segments,

for the purpose of reconciling the segmented information with the consolidated financial statements of the company.

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: November

26, 2021

PETRÓLEO

BRASILEIRO S.A–PETROBRAS

By: /s/ Rodrigo Araujo Alves

______________________________

Rodrigo

Araujo Alves

Chief

Financial Officer and Investor Relations Officer

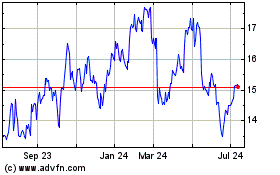

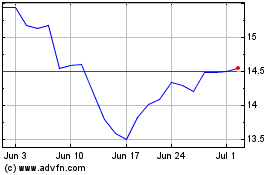

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Jan 2024 to Jan 2025