Parsons to Acquire BCC Engineering

October 21 2024 - 6:30AM

Parsons Corporation (NYSE:PSN) announced today that it has entered

into a definitive agreement to acquire BCC Engineering, LLC (BCC),

one of Florida's leading transportation engineering firms, in an

all-cash transaction valued at $230 million.

BCC, a portfolio company of Trivest Partners, is a full-service

engineering firm that provides planning, design, and management

services for transportation, civil, and structural engineering

projects in Florida, Georgia, Texas, South Carolina, and Puerto

Rico. This acquisition strengthens Parsons’ position as an

infrastructure leader while expanding the company’s reach in the

Southeastern United States, an area where the Infrastructure

Investment and Jobs Act (IIJA) provided approximately $100 billion

in Federal Highway Administration formula dollars for fiscal years

2022-2026. The transaction is consistent with Parsons’ strategy of

acquiring high-growth companies with greater than 10% revenue

growth and adjusted EBITDA margins. BCC will be integrated into

Parsons’ North America Infrastructure business unit.

“Parsons’ acquisition of BCC represents another important

milestone in our mission to advance mobility solutions across North

America,” said Carey Smith, Parsons' chair, president, and chief

executive officer. “The addition of BCC’s talented team expands our

service offerings and furthers our impact during this

transformative era for infrastructure. Our collaboration will

enable us to drive progress, foster economic growth, and ultimately

create more connected and resilient infrastructure across the

nation. I am excited to welcome BCC into Parsons.”

Established in Miami, FL, in 1994, BCC is known for its

innovative, best-in-class solutions for some of Florida's largest

and most complex roadway and bridge projects. The company has

delivered over 100 major projects serving every district for the

Florida Department of Transportation and is one of the

fastest-growing transportation engineering firms in the southeast

U.S. BCC has also been consistently recognized as a top place to

work by the Sun Sentinel, and a Top 500 design firm by the

Engineering News Record (ENR).

“We are excited to become part of Parsons’ team,” said Jose

Muñoz, BCC’s president & CEO. “This acquisition marks a

significant milestone for both of our organizations and represents

a shared vision for the future of infrastructure in our

communities. Parsons is a leader in the digitization of design and

delivery of infrastructure, and this provides our team the

opportunity to be at the forefront of the industry. Together we’re

unlocking the potential of transportation infrastructure for our

customers and communities where we live and work.”

Parsons and BCC have worked closely for years on critical

infrastructure projects and, through collaboration and

client-focused strategy, will continue to unlock additional value

and impact for clients worldwide. The net transaction value of

$221m (including $9 million of transaction-related tax benefits)

represents approximately 13.0x BCC’s estimated 2025e EBITDA. For

2025, Parsons expects BCC to generate approximately $110 million of

gross revenue and be accretive to Parsons’ revenue growth and

adjusted EBITDA margins. The transaction is expected to close in

the next 30 days, subject to customary closing conditions. Parsons

was advised by BofA Securities and Jenner & Block, and Akerman

advised BCC.

About Parsons

Parsons (NYSE: PSN) is a leading disruptive technology provider

in the national security and global infrastructure markets, with

capabilities across cyber and intelligence, space and missile

defense, transportation, environmental remediation, urban

development, and critical infrastructure protection. Please visit

parsons.com and follow us on LinkedIn and Facebook to learn how

we're making an impact.

Forward-Looking Statements

This document contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements are based on our current expectations,

beliefs and assumptions, and are not guarantees of future

performance. Forward-looking statements are inherently subject to

uncertainties, risks, changes in circumstances, trends, and factors

that are difficult to predict, many of which are outside of our

control. Accordingly, actual performance, results, and events may

vary materially from those indicated in the forward-looking

statements, and you should not rely on the forward-looking

statements as predictions of future performance, results, or

events. Numerous factors could cause actual future performance,

results and events to differ materially from those indicated in the

forward-looking statements, including, among others: any issue that

compromises our relationships with the U.S. federal government or

its agencies or other state, local, or foreign governments or

agencies; any issues that damage our professional reputation;

changes in governmental priorities that shift expenditures away

from agencies or programs that we support; our dependence on

long-term government contracts, which are subject to the

government’s budgetary approval process; the size of our

addressable markets and the amount of government spending on

private contractors; failure by us or our employees to obtain and

maintain necessary security clearances or certifications; failure

to comply with numerous laws and regulations; changes in government

procurement, contract or other practices or the adoption by

governments of new laws, rules, regulations, and programs in a

manner adverse to us; the termination or nonrenewal of our

government contracts, particularly our contracts with the U.S.

federal government; our ability to compete effectively in the

competitive bidding process and delays, contract terminations, or

cancellations caused by competitors’ protests of major contract

awards received by us; our ability to generate revenue under

certain of our contracts; any inability to attract, train, or

retain employees with the requisite skills, experience, and

security clearances; the loss of members of senior management or

failure to develop new leaders; misconduct or other improper

activities from our employees or subcontractors; our ability to

realize the full value of our backlog and the timing of our receipt

of revenue under contracts included in backlog; changes in the mix

of our contracts and our ability to accurately estimate or

otherwise recover expenses, time and resources for our contracts;

changes in estimates used in recognizing revenue; internal system

or service failures and security breaches; and inherent

uncertainties and potential adverse developments in legal

proceedings, including litigation, audits, reviews, and

investigations, which may result in materially adverse judgments,

settlements, or other unfavorable outcomes. These factors are not

exhaustive and additional factors could adversely affect our

business and financial performance. For a discussion of additional

factors that could materially adversely affect our business and

financial performance, see the factors included under the caption

“Risk Factors” in our Registration Statement on Form S-1 and our

other filings with the Securities and Exchange Commission. All

forward-looking statements are based on currently available

information and speak only as of the date on which they are made.

We assume no obligation to update any forward-looking statement

made in this presentation that becomes untrue because of subsequent

events, new information or otherwise, except to the extent we are

required to do so in connection with our ongoing requirements under

federal securities laws.

Media Contact:Bryce

McDevitt+1.703.851.4425Bryce.McDevitt@parsons.com

Investor Relations Contact:Dave Spille+

1.571.655.8264Dave.Spille@parsons.us

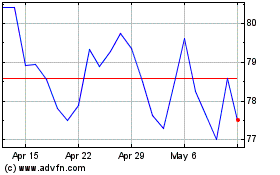

Parsons (NYSE:PSN)

Historical Stock Chart

From Nov 2024 to Dec 2024

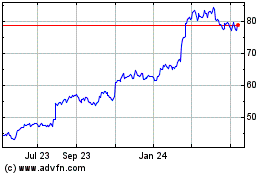

Parsons (NYSE:PSN)

Historical Stock Chart

From Dec 2023 to Dec 2024