Statement of Changes in Beneficial Ownership (4)

June 29 2021 - 10:07AM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

NORTON PIERCE |

2. Issuer Name and Ticker or Trading Symbol

ONEOK INC /NEW/

[

OKE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

President & CEO |

|

(Last)

(First)

(Middle)

100 W. 5TH ST. |

3. Date of Earliest Transaction

(MM/DD/YYYY)

6/28/2021 |

|

(Street)

TULSA, OK 74102

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| 2021 PSU Award | (1) | 6/28/2021 | | A | | 54113 | | (1) | (1) | Common Stock, par value $0.01 | 54113 | $55.44 | 54113 | D | |

| 2021 RSU Award | (2) | 6/28/2021 | | A | | 13528 | | (2) | (2) | Common Stock, par value $0.01 | 13528 | $55.44 | 13528 | D | |

| 2021-2 RSU Award | (3) | 6/28/2021 | | A | | 23828 | | (3) | (3) | Common Stock, par value $0.01 | 23828 | $55.44 | 23828 | D | |

| Explanation of Responses: |

| (1) | 54,113 Performance units awarded under the Issuers Equity Incentive Plan upon becoming the Issuers President and CEO, effective 6/28/2021. The award will vest on 2/17/2024, for a percentage (0%-200%) of the performance units awarded based upon the Issuers total shareholder return compared to total shareholder return of a selected peer group. During the 3-year vesting period, the award will be credited with dividend equivalents that will be paid out in shares of common stock at the time the underlying units vest and shares are issued. The award and credited dividend equivalents will be payable one share of the Issuers common stock for each vested performance unit, including additional performance units resulting from dividend equivalents. |

| (2) | 13,528 Restricted units awarded under the Issuers Equity Incentive Plan upon becoming the Issuers President and CEO, effective 6/28/2021. The award vests on 6/28/2024. During the 3-year vesting period, the award will be credited with dividend equivalents that will be paid out in shares of common stock at the time the underlying units vest and are issued. The award and credited dividend equivalents will be payable one share of the Issuers common stock for each vested restricted unit, including additional restricted units resulting from dividend equivalents. |

| (3) | 23,828 Restricted units awarded under the Issuers Equity Incentive Plan upon becoming the Issuers President and CEO, effective 6/28/2021. Half of the award will vest 6/28/2023, and the remaining half will vest on 6/28/2024. During the vesting period, the award will be credited with dividend equivalents that will be paid out in shares of common stock at the time the underlying units vest and are issued. The award and credited dividend equivalents will be payable one share of the Issuers common stock for each vested restricted unit, including additional restricted units resulting from dividend equivalents. |

Remarks:

The reporting person became President & CEO of ONEOK, Inc. on June 28, 2021. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

NORTON PIERCE

100 W. 5TH ST.

TULSA, OK 74102 | X |

| President & CEO |

|

Signatures

|

| /s/ Patrick W. Cipolla, Attorney-in-Fact for Pierce H. Norton II | | 6/28/2021 |

| **Signature of Reporting Person | Date |

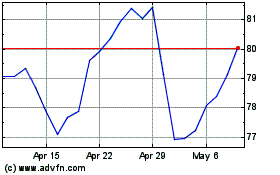

ONEOK (NYSE:OKE)

Historical Stock Chart

From Aug 2024 to Sep 2024

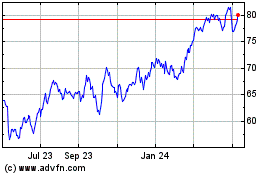

ONEOK (NYSE:OKE)

Historical Stock Chart

From Sep 2023 to Sep 2024